Reports

Reports

Analysts’ Viewpoint

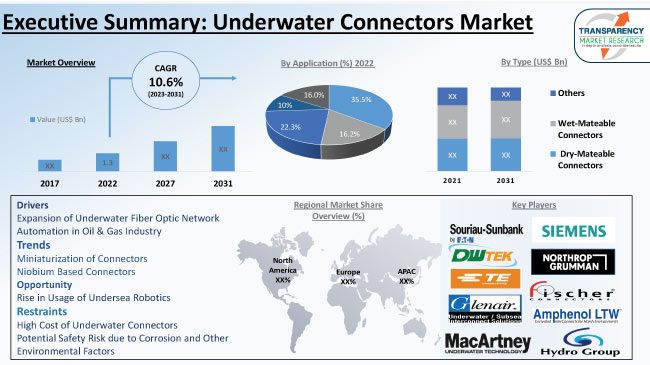

Maritime activities are expected to increase in the coming decades for both resource management and advancing defense and military and scientific knowledge. Growing number of underwater vehicles and increasing integration of technology in underwater equipment are helping cater to the increasing demand for underwater connectors. Wet-mateable connectors are likely to be extensively adopted due to extensive innovation and technological developments being carried out in these connectors.

Increased usage of remotely operated vehicles (ROVs) and autonomous underwater vehicles (AUVs) is also estimated to boost the global underwater connectors industry during the forecast period. Future prospects of the underwater connectors market in North America are highly promising owing to extensive use of underwater connectors in the exploration and production of oil & gas, as well as presence of key manufacturers of underwater vehicles for diverse applications and deep-see observation and research.

Underwater connectors are suitable for projects involving deep submersion in science and research. The military, government agencies, diving equipment manufacturers, producers of remotely operated vehicles (ROVs) and autonomous underwater vehicles (AUVs), oil and energy exploration equipment manufacturers are major consumers of marine connectors or aquatic connectors.

New product development, innovations, strategic alliances, and increasing investments in maritime research is anticipated to boost the global undersea connectors market demand during the forecast period.

More than 95% of the world's data, including phone calls, emails, and encrypted military secrets, is carried over kilometers of fiber optic cable that is buried at the bottom of the oceans. Significant rise in internet traffic volume has prompted some of the biggest corporations and technology firms in the world to invest in new subsea cable lines to address the demand for more bandwidth and faster connectivity.

Development of underwater systems depends heavily on the increasing data transfer and power capabilities. This new capability is smarter and can handle quicker data rates and increased bandwidth requirements. It also allows for the addition of more sensors while powering larger systems and multiple devices with a single input cable and connector.

Submarine or subsea communication networks comprise a network of underwater cables and other supporting infrastructure that allow for the long-distance transmission of voice and data communication signals beneath the surface of the ocean. The connectivity between continents and islands, as well as between offshore oil and gas facilities, depends on these networks. Thus, the transmission equipment is designed to facilitate the transfer of data over long distances and includes various components where underwater connectors plays a vital role. Therefore, expansion of network of fiber optic under the sea is expected to drive the underwater connectors market development in the next few years.

Autonomous underwater vehicles (AUVs) and remotely operated vehicles (ROVs) are being used to tackle myriad issues experienced by the marine industry. Technological advances in unmanned undersea vehicles (UUVs) and ROVs have also increased their applications within the military community. Thus increase in demand for undersea robotics is projected to propel the underwater connector market progress.

From 2021 to 2025, the US Navy is expected to spend US$ 1.9 Bn on UUVs. It spent US$ 941 Mn on USVs (unmanned surface vehicles) and UUVs in 2021.

For instance, Ocean Infinity announced plans to add six more autonomous underwater vehicles to its fleet in 2022. Ocean Infinity's remote operations infrastructure would make it possible for the new vehicles to be mobilized for international operations. The vessels will complement the company's current AUVs, which are rated to 6,000 meters of depth, and become a part of the Armada fleet of unscrewed and optionally-crewed vessels.

Underwater wet-mateable connections, which can be mated and de-mated underwater, have been widely used in numerous applications in the oil & gas industry, offshore renewable energy, and undersea observatories in order to reduce the cost and time of installation, maintenance, and reconfiguration.

Oil & gas exploration and production require a significant number of wet-mateable electrical connectors with high voltage rates that can work at depths of up to 3000 m. Ocean renewable energy farms also require high number of wet-mateable electrical connectors. Advancements in offshore wind energy, tidal stream energy, and ocean current energy generation systems are likely to fuel the underwater connectors market share held by the wet-mateable type connectors segment in the next few years.

According to analysis of the underwater connectors market report, demand for underwater connectors is majorly driven by industries such as oil and gas, marine services, and military and navy. The U.S. is home to prominent oil & gas and marine services industries. Furthermore, the country has a technologically advanced military and navy. Consequently, the U.S. contributes significantly to the underwater connector market growth in the region.

Europe witnesses a higher level of defense activities and the region is home to major players in the field of electronics. Therefore, Europe along with Asia Pacific is an emerging market for underwater connectors and these regions are likely to offer significant market opportunities in the next few years.

Leading manufacturers in the underwater connectors industry are focusing on the design and development of new connector designs, while demand for customized connectors is also high. They are following the latest underwater connectors market trends and investing significantly in the rapid development of new materials technologies such as niobium.

Key players operating in the underwater connectors business include AMETEK. Inc., Amissiontech Co.,Ltd., Amphenol Corporation, Eaton, Fischer Connectors SA, GISMA Steckverbinder GmbH, Hydro Group, MacArtney A/S, OTAQ Group, Siemens AG, TE Connectivity, Teledyne Technologies Incorporated.

| Attribute | Detail |

|---|---|

|

Market Size Value in 2021 |

US$ 1.3 Bn |

|

Market Forecast Value in 2031 |

US$ 3.1 Bn |

|

Growth Rate (CAGR) |

10.6% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2022 |

|

Quantitative Units |

US$ Bn for Value and Million Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 1.3 Bn in 2022

It is expected to expand at a CAGR of 10.6% by 2031

The global business is expected to reach a value of US$ 3.1 Bn in 2031

AMETEK. Inc., Amissiontech Co.,Ltd., Amphenol Corporation, Eaton, Fischer Connectors SA, GISMA Steckverbinder GmbH, Hydro Group, MacArtney A/S, OTAQ Group, Siemens AG, TE Connectivity, Teledyne Technologies Incorporated.

The U.S. accounted for 46.1% of underwater connectors demand in 2022

Wet-mateable and miniature underwater connectors recorded highest demand

North America region was more lucrative for manufacturers of underwater connectors

1. Preface

1.1. Market and Segments Definition

1.2. Market Taxonomy

1.3. Research Methodology

1.4. Assumption and Acronyms

2. Executive Summary

2.1. Global Underwater Connectors Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview - Global Subsea Devices Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter’s Five Forces Analysis

5. Global Underwater Connectors Market Analysis, by Type

5.1. Underwater Connectors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017-2031

5.1.1. Dry-Mateable Connectors

5.1.2. Wet-Mateable Connectors

5.1.3. Others

5.2. Market Attractiveness Analysis, By Type

6. Global Underwater Connectors Market Analysis, by Sealing

6.1. Underwater Connectors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Sealing, 2017-2031

6.1.1. Rubber-molded

6.1.2. Rigid shell

6.1.3. Fluid-filled

6.1.4. Inductive Couplings

6.2. Market Attractiveness Analysis, By Sealing

7. Global Underwater Connectors Market Analysis, by Connection

7.1. Underwater Connectors Market Size (US$ Mn) Analysis & Forecast, by Connection, 2017-2031

7.1.1. Electrical

7.1.2. Optical Fiber

7.1.3. Hybrid

7.2. Market Attractiveness Analysis, By Connection

8. Global Underwater Connectors Market Analysis, by Material

8.1. Underwater Connectors Market Size (US$ Mn) Analysis & Forecast, by Material, 2017-2031

8.1.1. Stainless Steel

8.1.2. Titanium

8.1.3. Polymer

8.2. Market Attractiveness Analysis, By Material

9. Global Underwater Connectors Market Analysis, by Application

9.1. Underwater Connectors Market Size (US$ Mn) Analysis & Forecast, by Application, 2017-2031

9.1.1. Oil & Gas Exploration

9.1.2. Offshore wind Energy

9.1.3. Submarine Systems

9.1.4. ROV/AUV

9.1.5. Underwater Communication Infrastructure

9.1.6. Underwater Observatories

9.1.7. Others

9.2. Market Attractiveness Analysis, By Application

10. Global Underwater Connectors Market Analysis, by End-use Industry

10.1. Underwater Connectors Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017-2031

10.1.1. Oil & gas

10.1.2. Military & Defense

10.1.3. IT & Telecommunication

10.1.4. Energy & Utility

10.1.5. Others

10.2. Market Attractiveness Analysis, By End-use Industry

11. Global Underwater Connectors Market Analysis and Forecast, by Region

11.1. Underwater Connectors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Region, 2017-2031

11.1.1. North America

11.1.2. Europe

11.1.3. Asia Pacific

11.1.4. Middle East & Africa

11.1.5. South America

11.2. Market Attractiveness Analysis, By Region

12. North America Underwater Connectors Market Analysis and Forecast

12.1. Market Snapshot

12.2. Underwater Connectors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017-2031

12.2.1. Dry-Mateable Connectors

12.2.2. Wet-Mateable Connectors

12.2.3. Others

12.3. Underwater Connectors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Sealing, 2017-2031

12.3.1. Rigid Shell

12.3.2. Inductive Coupling

12.3.3. Rubber Molded

12.3.4. Fluid Filled

12.4. Underwater Connectors Market Size (US$ Mn) Analysis & Forecast, by Connection, 2017-2031

12.4.1. Electrical

12.4.2. Optical Fiber

12.4.3. Hybrid

12.5. Underwater Connectors Market Size (US$ Mn) Analysis & Forecast, by Material, 2017-2031

12.5.1. Stainless Steel

12.5.2. Inconel

12.5.3. Titanium

12.6. Underwater Connectors Market Size (US$ Mn) Analysis & Forecast, by Application, 2017-2031

12.6.1. Oil & Gas Exploration

12.6.2. Offshore wind Energy

12.6.3. Submarine Systems

12.6.4. ROV/AUV

12.6.5. Underwater Communication Infrastructure

12.6.6. Underwater Observatories

12.6.7. Others

12.7. Underwater Connectors Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017-2031

12.7.1. Oil & gas

12.7.2. Military & Defense

12.7.3. IT & Telecommunication

12.7.4. Energy & Utility

12.7.5. Others

12.8. Underwater Connectors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

12.8.1. U.S.

12.8.2. Canada

12.8.3. Rest of North America

12.9. Market Attractiveness Analysis

12.9.1. By Type

12.9.2. By Material

12.9.3. By Connection

12.9.4. By Application

12.9.5. By End-use Industry

12.9.6. By Country/Sub-region

13. Europe Underwater Connectors Market Analysis and Forecast

13.1. Market Snapshot

13.2. Underwater Connectors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017-2031

13.2.1. Dry-Mateable Connectors

13.2.2. Wet-Mateable Connectors

13.2.3. Others

13.3. Underwater Connectors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Sealing, 2017-2031

13.3.1. Rigid Shell

13.3.2. Inductive Coupling

13.3.3. Rubber Molded

13.3.4. Fluid Filled

13.4. Underwater Connectors Market Size (US$ Mn) Analysis & Forecast, by Connection, 2017-2031

13.4.1. Electrical

13.4.2. Optical Fiber

13.4.3. Hybrid

13.5. Underwater Connectors Market Size (US$ Mn) Analysis & Forecast, by Material, 2017-2031

13.5.1. Stainless Steel

13.5.2. Inconel

13.5.3. Titanium

13.6. Underwater Connectors Market Size (US$ Mn) Analysis & Forecast, by Application, 2017-2031

13.6.1. Oil & Gas Exploration

13.6.2. Offshore wind Energy

13.6.3. Submarine Systems

13.6.4. ROV/AUV

13.6.5. Underwater Communication Infrastructure

13.6.6. Underwater Observatories

13.6.7. Others

13.7. Underwater Connectors Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017-2031

13.7.1. Oil & gas

13.7.2. Military & Defense

13.7.3. IT & Telecommunication

13.7.4. Energy & Utility

13.7.5. Others

13.8. Underwater Connectors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

13.8.1. The U.K.

13.8.2. Germany

13.8.3. France

13.8.4. Rest of Europe

13.9. Market Attractiveness Analysis

13.9.1. By Type

13.9.2. By Material

13.9.3. By Connection

13.9.4. By Application

13.9.5. By End-use Industry

13.9.6. By Country/Sub-region

14. Asia Pacific Underwater Connectors Market Analysis and Forecast

14.1. Market Snapshot

14.2. Underwater Connectors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017-2031

14.2.1. Dry-Mateable Connectors

14.2.2. Wet-Mateable Connectors

14.2.3. Others

14.3. Underwater Connectors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Sealing, 2017-2031

14.3.1. Rigid Shell

14.3.2. Inductive Coupling

14.3.3. Rubber Molded

14.3.4. Fluid Filled

14.4. Underwater Connectors Market Size (US$ Mn) Analysis & Forecast, by Connection, 2017-2031

14.4.1. Electrical

14.4.2. Optical Fiber

14.4.3. Hybrid

14.5. Underwater Connectors Market Size (US$ Mn) Analysis & Forecast, by Material, 2017-2031

14.5.1. Stainless Steel

14.5.2. Inconel

14.5.3. Titanium

14.6. Underwater Connectors Market Size (US$ Mn) Analysis & Forecast, by Application, 2017-2031

14.6.1. Oil & Gas Exploration

14.6.2. Offshore wind Energy

14.6.3. Submarine Systems

14.6.4. ROV/AUV

14.6.5. Underwater Communication Infrastructure

14.6.6. Underwater Observatories

14.6.7. Others

14.7. Underwater Connectors Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017-2031

14.7.1. Oil & gas

14.7.2. Military & Defense

14.7.3. IT & Telecommunication

14.7.4. Energy & Utility

14.7.5. Others

14.8. Underwater Connectors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

14.8.1. China

14.8.2. Japan

14.8.3. India

14.8.4. South Korea

14.8.5. ASEAN

14.8.6. Rest of Asia Pacific

14.9. Market Attractiveness Analysis

14.9.1. By Type

14.9.2. By Material

14.9.3. By Connection

14.9.4. By Application

14.9.5. By End-use Industry

14.9.6. By Country/Sub-region

15. Middle East & Africa Underwater Connectors Market Analysis and Forecast

15.1. Market Snapshot

15.2. Underwater Connectors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017-2031

15.2.1. Dry-Mateable Connectors

15.2.2. Wet-Mateable Connectors

15.2.3. Others

15.3. Underwater Connectors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Sealing, 2017-2031

15.3.1. Rigid Shell

15.3.2. Inductive Coupling

15.3.3. Rubber Molded

15.3.4. Fluid Filled

15.4. Underwater Connectors Market Size (US$ Mn) Analysis & Forecast, by Connection, 2017-2031

15.4.1. Electrical

15.4.2. Optical Fiber

15.4.3. Hybrid

15.5. Underwater Connectors Market Size (US$ Mn) Analysis & Forecast, by Material, 2017-2031

15.5.1. Stainless Steel

15.5.2. Inconel

15.5.3. Titanium

15.6. Underwater Connectors Market Size (US$ Mn) Analysis & Forecast, by Application, 2017-2031

15.6.1. Oil & Gas Exploration

15.6.2. Offshore wind Energy

15.6.3. Submarine Systems

15.6.4. ROV/AUV

15.6.5. Underwater Communication Infrastructure

15.6.6. Underwater Observatories

15.6.7. Others

15.7. Underwater Connectors Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017-2031

15.7.1. Oil & gas

15.7.2. Military & Defense

15.7.3. IT & Telecommunication

15.7.4. Energy & Utility

15.7.5. Others

15.8. Underwater Connectors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

15.8.1. GCC

15.8.2. South Africa

15.8.3. Rest of Middle East and Africa

15.9. Market Attractiveness Analysis

15.9.1. By Type

15.9.2. By Material

15.9.3. By Connection

15.9.4. By Application

15.9.5. By End-use Industry

15.9.6. By Country/Sub-region

16. South America Underwater Connectors Market Analysis and Forecast

16.1. Market Snapshot

16.2. Underwater Connectors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017-2031

16.2.1. Dry-Mateable Connectors

16.2.2. Wet-Mateable Connectors

16.2.3. Others

16.3. Underwater Connectors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Sealing, 2017-2031

16.3.1. Rigid Shell

16.3.2. Inductive Coupling

16.3.3. Rubber Molded

16.3.4. Fluid Filled

16.4. Underwater Connectors Market Size (US$ Mn) Analysis & Forecast, by Connection, 2017-2031

16.4.1. Electrical

16.4.2. Optical Fiber

16.4.3. Hybrid

16.5. Underwater Connectors Market Size (US$ Mn) Analysis & Forecast, by Material, 2017-2031

16.5.1. Stainless Steel

16.5.2. Inconel

16.5.3. Titanium

16.6. Underwater Connectors Market Size (US$ Mn) Analysis & Forecast, by Application, 2017-2031

16.6.1. Oil & Gas Exploration

16.6.2. Offshore wind Energy

16.6.3. Submarine Systems

16.6.4. ROV/AUV

16.6.5. Underwater Communication Infrastructure

16.6.6. Underwater Observatories

16.6.7. Others

16.7. Underwater Connectors Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017-2031

16.7.1. Oil & gas

16.7.2. Military & Defense

16.7.3. IT & Telecommunication

16.7.4. Energy & Utility

16.7.5. Others

16.8. Underwater Connectors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

16.8.1. Brazil

16.8.2. Rest of South America

16.9. Market Attractiveness Analysis

16.9.1. By Type

16.9.2. By Material

16.9.3. By Connection

16.9.4. By Application

16.9.5. By End-use Industry

16.9.6. By Country/Sub-region

17. Competition Assessment

17.1. Global Underwater Connectors Market Competition Matrix - a Dashboard View

17.1.1. Global Underwater Connectors Market Company Share Analysis, by Value (2022)

17.1.2. Technological Differentiator

18. Company Profiles (Global Manufacturers/Suppliers)

18.1. AMETEK.Inc.

18.1.1. Overview

18.1.2. Product Portfolio

18.1.3. Sales Footprint

18.1.4. Key Subsidiaries or Distributors

18.1.5. Strategy and Recent Developments

18.1.6. Key Financials

18.2. Amissiontech Co.,Ltd

18.2.1. Overview

18.2.2. Product Portfolio

18.2.3. Sales Footprint

18.2.4. Key Subsidiaries or Distributors

18.2.5. Strategy and Recent Developments

18.2.6. Key Financials

18.3. Amphenol Corporation

18.3.1. Overview

18.3.2. Product Portfolio

18.3.3. Sales Footprint

18.3.4. Key Subsidiaries or Distributors

18.3.5. Strategy and Recent Developments

18.3.6. Key Financials

18.4. Eaton

18.4.1. Overview

18.4.2. Product Portfolio

18.4.3. Sales Footprint

18.4.4. Key Subsidiaries or Distributors

18.4.5. Strategy and Recent Developments

18.4.6. Key Financials

18.5. Fischer Connectors SA

18.5.1. Overview

18.5.2. Product Portfolio

18.5.3. Sales Footprint

18.5.4. Key Subsidiaries or Distributors

18.5.5. Strategy and Recent Developments

18.5.6. Key Financials

18.6. GISMA Steckverbinder GmbH

18.6.1. Overview

18.6.2. Product Portfolio

18.6.3. Sales Footprint

18.6.4. Key Subsidiaries or Distributors

18.6.5. Strategy and Recent Developments

18.6.6. Key Financials

18.7. Hydro Group

18.7.1. Overview

18.7.2. Product Portfolio

18.7.3. Sales Footprint

18.7.4. Key Subsidiaries or Distributors

18.7.5. Strategy and Recent Developments

18.7.6. Key Financials

18.8. MacArtney A/S

18.8.1. Overview

18.8.2. Product Portfolio

18.8.3. Sales Footprint

18.8.4. Key Subsidiaries or Distributors

18.8.5. Strategy and Recent Developments

18.8.6. Key Financials

18.9. OTAQ Group

18.9.1. Overview

18.9.2. Product Portfolio

18.9.3. Sales Footprint

18.9.4. Key Subsidiaries or Distributors

18.9.5. Strategy and Recent Developments

18.9.6. Key Financials

18.10. Siemens AG

18.10.1. Overview

18.10.2. Product Portfolio

18.10.3. Sales Footprint

18.10.4. Key Subsidiaries or Distributors

18.10.5. Strategy and Recent Developments

18.10.6. Key Financials

18.11. TE Connectivity

18.11.1. Overview

18.11.2. Product Portfolio

18.11.3. Sales Footprint

18.11.4. Key Subsidiaries or Distributors

18.11.5. Strategy and Recent Developments

18.11.6. Key Financials

18.12. Teledyne Technologies Incorporated

18.12.1. Overview

18.12.2. Product Portfolio

18.12.3. Sales Footprint

18.12.4. Key Subsidiaries or Distributors

18.12.5. Strategy and Recent Developments

18.12.6. Key Financials

18.13. Other Key Players

18.13.1. Overview

18.13.2. Product Portfolio

18.13.3. Sales Footprint

18.13.4. Key Subsidiaries or Distributors

18.13.5. Strategy and Recent Developments

18.13.6. Key Financials

19. Go to Market Strategy

19.1. Identification of Potential Market Spaces

19.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Underwater Connectors Market Value (US$ Mn) & Forecast, by Type, 2017-2031

Table 2: Global Underwater Connectors Market Volume (Million Units) & Forecast, by Type, 2017-2031

Table 3: Global Underwater Connectors Market Value (US$ Mn) & Forecast, by Sealing, 2017-2031

Table 4: Global Underwater Connectors Market Volume (Million Units) & Forecast, by Sealing, 2017-2031

Table 5: Global Underwater Connectors Market Value (US$ Mn) & Forecast, by Connection, 2017-2031

Table 6: Global Underwater Connectors Market Value (US$ Mn) & Forecast, by Material, 2017-2031

Table 7: Global Underwater Connectors Market Value (US$ Mn) & Forecast, by Applications, 2017-2033

Table 8: Global Underwater Connectors Market Value (US$ Mn) & Forecast, by End-use Industry, 2017-2033

Table 9: Global Underwater Connectors Market Value (US$ Mn) & Forecast, by Region, 2017-2031

Table 10: Global Underwater Connectors Market Volume (Million Units) & Forecast, by Region, 2017-2031

Table 11: North America Underwater Connectors Market Value (US$ Mn) & Forecast, by Type, 2017-2031

Table 12: North America Underwater Connectors Market Volume (Million Units) & Forecast, by Type, 2017-2031

Table 13: North America Underwater Connectors Market Value (US$ Mn) & Forecast, by Sealing, 2017-2031

Table 14: North America Underwater Connectors Market Volume (Million Units) & Forecast, by Sealing, 2017-2031

Table 15: North America Underwater Connectors Market Value (US$ Mn) & Forecast, by Connection, 2017-2031

Table 16: North America Underwater Connectors Market Value (US$ Mn) & Forecast, by Material, 2017-2031

Table 17: North America Underwater Connectors Market Value (US$ Mn) & Forecast, by Applications, 2017-2033

Table 18: North America Underwater Connectors Market Value (US$ Mn) & Forecast, by End-use Industry, 2017-2033

Table 19: North America Underwater Connectors Market Value (US$ Mn) & Forecast, by Country, 2017-2031

Table 20: North America Underwater Connectors Market Volume (Million Units) & Forecast, by Country, 2017-2031

Table 21: Europe Underwater Connectors Market Value (US$ Mn) & Forecast, by Type, 2017-2031

Table 22: Europe Underwater Connectors Market Volume (Million Units) & Forecast, by Type, 2017-2031

Table 23: Europe Underwater Connectors Market Value (US$ Mn) & Forecast, by Sealing, 2017-2031

Table 24: Europe Underwater Connectors Market Volume (Million Units) & Forecast, by Sealing, 2017-2031

Table 25: Europe Underwater Connectors Market Value (US$ Mn) & Forecast, by Connection, 2017-2031

Table 26: Europe Underwater Connectors Market Value (US$ Mn) & Forecast, by Material, 2017-2031

Table 27: Europe Underwater Connectors Market Value (US$ Mn) & Forecast, by Applications, 2017-2033

Table 28: Europe Underwater Connectors Market Value (US$ Mn) & Forecast, by End-use Industry, 2017-2033

Table 29: Europe Underwater Connectors Market Value (US$ Mn) & Forecast, by Country, 2017-2031

Table 30: Europe Underwater Connectors Market Volume (Million Units) & Forecast, by Country, 2017-2031

Table 31: Asia Pacific Underwater Connectors Market Value (US$ Mn) & Forecast, by Type, 2017-2031

Table 32: Asia Pacific Underwater Connectors Market Volume (Million Units) & Forecast, by Type, 2017-2031

Table 33: Asia Pacific Underwater Connectors Market Value (US$ Mn) & Forecast, by Sealing, 2017-2031

Table 34: Asia Pacific Underwater Connectors Market Volume (Million Units) & Forecast, by Sealing, 2017-2031

Table 35: Asia Pacific Underwater Connectors Market Value (US$ Mn) & Forecast, by Connection, 2017-2031

Table 36: Asia Pacific Underwater Connectors Market Value (US$ Mn) & Forecast, by Material, 2017-2031

Table 37: Asia Pacific Underwater Connectors Market Value (US$ Mn) & Forecast, by Applications, 2017-2033

Table 38: Asia Pacific Underwater Connectors Market Value (US$ Mn) & Forecast, by End-use Industry, 2017-2033

Table 39: Asia Pacific Underwater Connectors Market Value (US$ Mn) & Forecast, by Country, 2017-2031

Table 40: Asia Pacific Underwater Connectors Market Volume (Million Units) & Forecast, by Country, 2017-2031

Table 41: Middle East & Africa Underwater Connectors Market Value (US$ Mn) & Forecast, by Type, 2017-2031

Table 42: Middle East & Africa Underwater Connectors Market Volume (Million Units) & Forecast, by Type, 2017-2031

Table 43: Middle East & Africa Underwater Connectors Market Value (US$ Mn) & Forecast, by Sealing, 2017-2031

Table 44: Middle East & Africa Underwater Connectors Market Volume (Million Units) & Forecast, by Sealing, 2017-2031

Table 45: Middle East & Africa Underwater Connectors Market Value (US$ Mn) & Forecast, by Connection, 2017-2031

Table 46: Middle East & Africa Underwater Connectors Market Value (US$ Mn) & Forecast, by Material, 2017-2031

Table 47: Middle East & Africa Underwater Connectors Market Value (US$ Mn) & Forecast, by Applications, 2017-2033

Table 48: Middle East & Africa Underwater Connectors Market Value (US$ Mn) & Forecast, by End-use Industry, 2017-2033

Table 49: Middle East & Africa Underwater Connectors Market Value (US$ Mn) & Forecast, by Country, 2017-2031

Table 50: Middle East & Africa Underwater Connectors Market Volume (Million Units) & Forecast, by Country, 2017-2031

Table 51: South America Underwater Connectors Market Value (US$ Mn) & Forecast, by Type, 2017-2031

Table 52: South America Underwater Connectors Market Volume (Million Units) & Forecast, by Type, 2017-2031

Table 53: South America Underwater Connectors Market Value (US$ Mn) & Forecast, by Sealing, 2017-2031

Table 54: South America Underwater Connectors Market Volume (Million Units) & Forecast, by Sealing, 2017-2031

Table 55: South America Underwater Connectors Market Value (US$ Mn) & Forecast, by Connection, 2017-2031

Table 56: South America Underwater Connectors Market Value (US$ Mn) & Forecast, by Material, 2017-2031

Table 57: South America Underwater Connectors Market Value (US$ Mn) & Forecast, by Applications, 2017-2033

Table 58: South America Underwater Connectors Market Value (US$ Mn) & Forecast, by End-use Industry, 2017-2033

Table 59: South America Underwater Connectors Market Value (US$ Mn) & Forecast, by Country, 2017-2031

Table 60: South America Underwater Connectors Market Volume (Million Units) & Forecast, by Country, 2017-2031

List of Figures

Figure 01: Global Underwater Connectors Market Value & Forecast, Value (US$ Mn), 2017‒2031

Figure 02: Global Underwater Connectors Market Value & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 03: Global Underwater Connectors Market Value & Forecast, Volume (Million Units), 2017‒2031

Figure 04: Global Underwater Connectors Market Value & Forecast, Y-O-Y, Volume (Million Units), 2017‒2031

Figure 05: Global Underwater Connectors Market Projections by Type, Value (US$ Mn), 2017‒2031

Figure 06: Global Underwater Connectors Market Share Analysis, by Type, 2021 and 2031

Figure 07: Global Underwater Connectors Market, Incremental Opportunity, by Type, 2021‒2031

Figure 08: Global Underwater Connectors Market Projections by Sealing, Value (US$ Mn), 2017‒2031

Figure 09: Global Underwater Connectors Market Share Analysis, by Sealing, 2021 and 2031

Figure 10: Global Underwater Connectors Market, Incremental Opportunity, by Sealing, 2021‒2031

Figure 11: Global Underwater Connectors Market Projections by Connection, Value (US$ Mn), 2017‒2031

Figure 12: Global Underwater Connectors Market Share Analysis, by Connection, 2021 and 2031

Figure 13: Global Underwater Connectors Market, Incremental Opportunity, by Connection, 2021‒2031

Figure 14: Global Underwater Connectors Market Projections by Material, Value (US$ Mn), 2017‒2031

Figure 15: Global Underwater Connectors Market Share Analysis, by Material, 2021 and 2031

Figure 16: Global Underwater Connectors Market, Incremental Opportunity, by Material, 2021‒2031

Figure 17: Global Underwater Connectors Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 18: Global Underwater Connectors Market Share Analysis, by Application, 2021 and 2031

Figure 19: Global Underwater Connectors Market, Incremental Opportunity, by Application, 2021‒2031

Figure 20: Global Underwater Connectors Market Projections by End User Industry, Value (US$ Mn), 2017‒2031

Figure 21: Global Underwater Connectors Market Share Analysis, by End User Industry, 2021 and 2031

Figure 22: Global Underwater Connectors Market, Incremental Opportunity, by End User Industry, 2021‒2031

Figure 23: Global Underwater Connectors Market Projections by Region, Value (US$ Mn), 2017‒2031

Figure 24: Global Underwater Connectors Market Share Analysis, by Region, 2021 and 2031

Figure 25: Global Underwater Connectors Market, Incremental Opportunity, by Region, 2021‒2031

Figure 26: North America Underwater Connectors Market Value & Forecast, Value (US$ Mn), 2017‒2031

Figure 27: North America Underwater Connectors Market Value & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 28: North America Underwater Connectors Market Value & Forecast, Volume (Million Units), 2017‒2031

Figure 29: North America Underwater Connectors Market Value & Forecast, Y-O-Y, Volume (Million Units), 2017‒2031

Figure 30: North America Underwater Connectors Market Projections by Type, Value (US$ Mn), 2017‒2031

Figure 31: North America Underwater Connectors Market Share Analysis, by Type, 2021 and 2031

Figure 32: North America Underwater Connectors Market, Incremental Opportunity, by Type, 2021‒2031

Figure 33: North America Underwater Connectors Market Projections by Sealing, Value (US$ Mn), 2017‒2031

Figure 34: North America Underwater Connectors Market Share Analysis, by Sealing, 2021 and 2031

Figure 35: North America Underwater Connectors Market, Incremental Opportunity, by Sealing, 2021‒2031

Figure 36: North America Underwater Connectors Market Projections by Connection, Value (US$ Mn), 2017‒2031

Figure 37: North America Underwater Connectors Market Share Analysis, by Connection, 2021 and 2031

Figure 38: North America Underwater Connectors Market, Incremental Opportunity, by Connection, 2021‒2031

Figure 39: North America Underwater Connectors Market Projections by Material, Value (US$ Mn), 2017‒2031

Figure 40: North America Underwater Connectors Market Share Analysis, by Material, 2021 and 2031

Figure 41: North America Underwater Connectors Market, Incremental Opportunity, by Material, 2021‒2031

Figure 42: North America Underwater Connectors Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 43: North America Underwater Connectors Market Share Analysis, by Application, 2021 and 2031

Figure 44: North America Underwater Connectors Market, Incremental Opportunity, by Application, 2021‒2031

Figure 45: North America Underwater Connectors Market Projections by End User Industry, Value (US$ Mn), 2017‒2031

Figure 46: North America Underwater Connectors Market Share Analysis, by End User Industry, 2021 and 2031

Figure 47: North America Underwater Connectors Market, Incremental Opportunity, by End User Industry, 2021‒2031

Figure 48: North America Underwater Connectors Market Projections by Country and sub-region, Value (US$ Mn), 2017‒2031

Figure 49: North America Underwater Connectors Market Share Analysis, by Country and sub-region 2021 and 2031

Figure 50: North America Underwater Connectors Market, Incremental Opportunity, by Country and sub-region, 2021‒2031

Figure 51: Asia Pacific Underwater Connectors Market Value & Forecast, Value (US$ Mn), 2017‒2031

Figure 52: Asia Pacific Underwater Connectors Market Value & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 53: Asia Pacific Underwater Connectors Market Value & Forecast, Volume (Million Units), 2017‒2031

Figure 54: Asia Pacific Underwater Connectors Market Value & Forecast, Y-O-Y, Volume (Million Units), 2017‒2031

Figure 55: Asia Pacific Underwater Connectors Market Projections by Type, Value (US$ Mn), 2017‒2031

Figure 56: Asia Pacific Underwater Connectors Market Share Analysis, by Type, 2021 and 2031

Figure 57: Asia Pacific Underwater Connectors Market, Incremental Opportunity, by Type, 2021‒2031

Figure 58: Asia Pacific Underwater Connectors Market Projections by Sealing, Value (US$ Mn), 2017‒2031

Figure 59: Asia Pacific Underwater Connectors Market Share Analysis, by Sealing, 2021 and 2031

Figure 60: Asia Pacific Underwater Connectors Market, Incremental Opportunity, by Sealing, 2021‒2031

Figure 61: Asia Pacific Underwater Connectors Market Projections by Connection, Value (US$ Mn), 2017‒2031

Figure 62: Asia Pacific Underwater Connectors Market Share Analysis, by Connection, 2021 and 2031

Figure 63: Asia Pacific Underwater Connectors Market, Incremental Opportunity, by Connection, 2021‒2031

Figure 64: Asia Pacific Underwater Connectors Market Projections by Material, Value (US$ Mn), 2017‒2031

Figure 65: Asia Pacific Underwater Connectors Market Share Analysis, by Material, 2021 and 2031

Figure 66: Asia Pacific Underwater Connectors Market, Incremental Opportunity, by Material, 2021‒2031

Figure 67: Asia Pacific Underwater Connectors Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 68: Asia Pacific Underwater Connectors Market Share Analysis, by Application, 2021 and 2031

Figure 69: Asia Pacific Underwater Connectors Market, Incremental Opportunity, by Application, 2021‒2031

Figure 70: Asia Pacific Underwater Connectors Market Projections by End User Industry, Value (US$ Mn), 2017‒2031

Figure 71: Asia Pacific Underwater Connectors Market Share Analysis, by End User Industry, 2021 and 2031

Figure 72: Asia Pacific Underwater Connectors Market, Incremental Opportunity, by End User Industry, 2021‒2031

Figure 73: Asia Pacific Underwater Connectors Market Projections by Country and sub-region, Value (US$ Mn), 2017‒2031

Figure 74: Asia Pacific Underwater Connectors Market Share Analysis, by Country and sub-region 2021 and 2031

Figure 75: Asia Pacific Underwater Connectors Market, Incremental Opportunity, by Country and sub-region, 2021‒2031

Figure 76: Asia Pacific Underwater Connectors Market, Incremental Opportunity, by Country and sub-region, 2021‒2031

Figure 77: Middle East & Africa Underwater Connectors Market Value & Forecast, Value (US$ Mn), 2017‒2031

Figure 78: Middle East & Africa Underwater Connectors Market Value & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 79: Middle East & Africa Underwater Connectors Market Value & Forecast, Volume (Million Units), 2017‒2031

Figure 80: Middle East & Africa Underwater Connectors Market Value & Forecast, Y-O-Y, Volume (Million Units), 2017‒2031

Figure 81: Middle East & Africa Underwater Connectors Market Projections by Type, Value (US$ Mn), 2017‒2031

Figure 82: Middle East & Africa Underwater Connectors Market Share Analysis, by Type, 2021 and 2031

Figure 83: Middle East & Africa Underwater Connectors Market, Incremental Opportunity, by Type, 2021‒2031

Figure 84: Middle East & Africa Underwater Connectors Market Projections by Sealing, Value (US$ Mn), 2017‒2031

Figure 85: Middle East & Africa Underwater Connectors Market Share Analysis, by Sealing, 2021 and 2031

Figure 86: Middle East & Africa Underwater Connectors Market, Incremental Opportunity, by Sealing, 2021‒2031

Figure 87: Middle East & Africa Underwater Connectors Market Projections by Connection, Value (US$ Mn), 2017‒2031

Figure 88: Middle East & Africa Underwater Connectors Market Share Analysis, by Connection, 2021 and 2031

Figure 89: Middle East & Africa Underwater Connectors Market, Incremental Opportunity, by Connection, 2021‒2031

Figure 90: Middle East & Africa Underwater Connectors Market Projections by Material, Value (US$ Mn), 2017‒2031

Figure 91: Middle East & Africa Underwater Connectors Market Share Analysis, by Material, 2021 and 2031

Figure 92: Middle East & Africa Underwater Connectors Market, Incremental Opportunity, by Material, 2021‒2031

Figure 93: Middle East & Africa Underwater Connectors Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 94: Middle East & Africa Underwater Connectors Market Share Analysis, by Application, 2021 and 2031

Figure 95: Middle East & Africa Underwater Connectors Market, Incremental Opportunity, by Application, 2021‒2031

Figure 96: Middle East & Africa Underwater Connectors Market Projections by End User Industry, Value (US$ Mn), 2017‒2031

Figure 97: Middle East & Africa Underwater Connectors Market Share Analysis, by End User Industry, 2021 and 2031

Figure 98: Middle East & Africa Underwater Connectors Market, Incremental Opportunity, by End User Industry, 2021‒2031

Figure 99: Middle East & Africa Underwater Connectors Market Projections by Country and sub-region, Value (US$ Mn), 2017‒2031

Figure 100: Middle East & Africa Underwater Connectors Market Share Analysis, by Country and sub-region 2021 and 2031

Figure 101: Middle East & Africa Underwater Connectors Market, Incremental Opportunity, by Country and sub-region, 2021‒2031

Figure 102: South America Underwater Connectors Market Value & Forecast, Value (US$ Mn), 2017‒2031

Figure 103: South America Underwater Connectors Market Value & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 104: South America Underwater Connectors Market Value & Forecast, Volume (Million Units), 2017‒2031

Figure 105: South America Underwater Connectors Market Value & Forecast, Y-O-Y, Volume (Million Units), 2017‒2031

Figure 106: South America Underwater Connectors Market Projections by Type, Value (US$ Mn), 2017‒2031

Figure 107: South America Underwater Connectors Market Share Analysis, by Type, 2021 and 2031

Figure 108: South America Underwater Connectors Market, Incremental Opportunity, by Type, 2021‒2031

Figure 109: South America Underwater Connectors Market Projections by Sealing, Value (US$ Mn), 2017‒2031

Figure 110: South America Underwater Connectors Market Share Analysis, by Sealing, 2021 and 2031

Figure 111: South America Underwater Connectors Market, Incremental Opportunity, by Sealing, 2021‒2031

Figure 112: South America Underwater Connectors Market Projections by Connection, Value (US$ Mn), 2017‒2031

Figure 113: South America Underwater Connectors Market Share Analysis, by Connection, 2021 and 2031

Figure 114: South America Underwater Connectors Market, Incremental Opportunity, by Connection, 2021‒2031

Figure 115: South America Underwater Connectors Market Projections by Material, Value (US$ Mn), 2017‒2031

Figure 116: South America Underwater Connectors Market Share Analysis, by Material, 2021 and 2031

Figure 117: South America Underwater Connectors Market, Incremental Opportunity, by Material, 2021‒2031

Figure 118: South America Underwater Connectors Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 119: South America Underwater Connectors Market Share Analysis, by Application, 2021 and 2031

Figure 120: South America Underwater Connectors Market, Incremental Opportunity, by Application, 2021‒2031

Figure 121: South America Underwater Connectors Market Projections by End User Industry, Value (US$ Mn), 2017‒2031

Figure 122: South America Underwater Connectors Market Share Analysis, by End User Industry, 2021 and 2031

Figure 123: South America Underwater Connectors Market, Incremental Opportunity, by End User Industry, 2021‒2031

Figure 124: South America Underwater Connectors Market Projections by Country and sub-region, Value (US$ Mn), 2017‒2031

Figure 125: South America Underwater Connectors Market Share Analysis, by Country and sub-region 2021 and 2031

Figure 126: South America Underwater Connectors Market, Incremental Opportunity, by Country and sub-region, 2021‒2031