Reports

Reports

With every aspect of human life becoming smarter and more intelligent, packaging is not too far behind. The perpetual rise in consumer expectations has been influencing a wide-range of industries to prioritize the upgrading process of their products as well as systems to offer an exceptional consumer experience, and the packaging sphere is no exception. As the adoption of flexible packaging is constantly on an upward swing, manufacturers of packaging films are emphasizing on developing new structures and composition to fulfil the increasingly demanding requirements of brand owners and consumers.

In view of this evolutionary landscape, new developments in the packaging industry in general, and the ultra-high barrier films market in particular, Transparency Market Research, in its new study, explores the tailwinds and headwinds of the ultra-high barrier films market, and brings to fore actionable insights to assist market stakeholders in critical decision-making.

No major advancements were made in the packaging industry until the introduction of plastic in the 1900s, which has brought a sea change to the industry. Rapid expansion of end-use industries, especially food & beverages, has been working in tandem with continuous developments of new packaging materials and barrier films, including those with high moisture barrier (HMB), high speed barrier (HSB), and ultra-high barrier (UHB). The demand for ultra-high barrier films thrived with the growing need for preserving, protecting, and extending the shelf life of processed food and sensitive products. In 2018, the global sales of ultra-high barrier films closed in on US$ 1.2 billion, and the number of manufacturers vying for a share of this lucrative market has been growing over the years.

Although ultra-high barrier films have been successful in fulfilling the consumer quest for convenience, rising intolerance for plastics and the cloud swirling around sustainability in recent years are putting manufactures to the test. In addition, strategic initiatives of market players are highly influenced by rapid advancements in the processed food industry and expansion of e-commerce sites as the modern sales channel.

As flexible packaging takes over traditionally-preferred rigid packaging of food and other products, manufacturers remain inclined towards the production of flexible and barrier films. While the industry-wide prevalence of different forms of plastics continues to work well with product development strategies in the ultra-high barrier films market, key manufacturers are shifting focus on the use of recyclable materials such as aluminum and aluminum oxide to address the rising concerns regarding the harmful impacts of plastic-filled oceans and surroundings.

The adoption of ultra-high barrier films continues to remain robust across different sectors of the food industry, and is further driven by the penetration of ready-to-eat meals in tune with a surge in the number of working individuals across the globe. With a notable rise in the number of quick service restaurants (QSRs) and their great efforts to deliver an on-the-go experience, manufacturers of ultra-high barrier films are focusing on leveraging the opportunities created across the spectrum of the food industry. Enhancing the barrier properties while minimizing the weight of the films also remains key focus areas of manufacturers.

Focus on Developing Countries

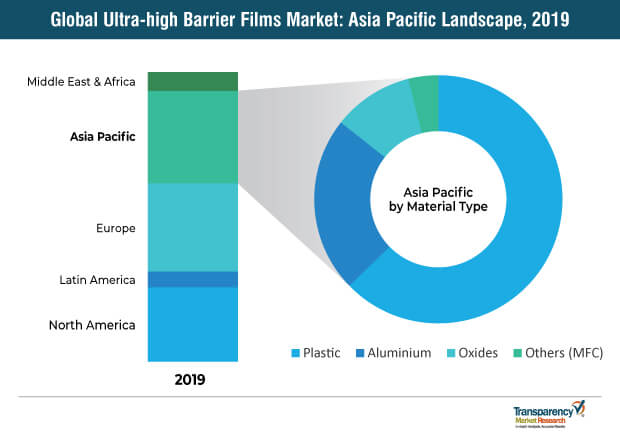

As the packaging industry is witnessing a paradigm shift towards the untapped markets in developing countries, where operating costs are relatively low, ultra-high barrier film manufacturers are eyeing the market opportunities in these countries. A transition from traditional markets to the purchasing of packaged consumer goods in Asia Pacific, led by China and India, accounts for a potential business prospect for key market players. In addition, a wave of small size packaging as opposed to large quantities emerging in the Middle East & African countries, due to reduced consumer spending capacity, is further influencing manufacturers to build effective strategies that align with these situations.

Innovations to Align with Technological Trends

Product innovations have also been forthcoming with the emergence of modern packaging techniques such as vacuum skin packaging (VSP) and modified atmosphere packaging (MAP) that use high barrier packaging materials. Additionally, considering the difficulty in recycling and disposing ultra-high barrier films, along with government regulations for enhancing environmental conservation practices, market players are launching products that meet the new standards set by the recycling community. These factors were put forward when Amcor Limited, a key ultra-high barrier films market player, launched its AmLite Ultra Recyclable, a high metal-free barrier laminate that significantly reduces the carbon footprint of packaging. Such strategic moves are likely to set the ball rolling and influence other stakeholders in the market.

The ultra-high barrier film market shows a high level of fragmentation, with global players such as Toray Plastics (America), Inc., Klöckner Pentaplast Europe GmbH & Co. KG, Amcor Limited, Sealed Air Corporation, and Mondi Group Plc. collectively accounting for 10-15% share of the market.

Taking the nature of the product into consideration, high-quality continues to be an influencing factor, and to acquire a strong position in the market, key players are focused on improving the product quality to retain their customers, while simultaneously increasing sales potential, internationally. The emergence of Asian countries as a lucrative market for packaging materials has also led to the realignment of these strategies.

Green initiatives also remain a key target area of manufacturers, as a change in government rules and regulations for environment, health, and safety pose as a potential threat to market growth. For instance, Toray Plastics (America) is notably engaged in zero-landfill, co-generation plants, and water & energy conservation.

The Analyst Viewpoint

Report authors feel that that the ultra-high barrier films market will continue to witness steady growth during the forecast period. Shifting demographic preferences, especially towards sustainability and reducing plastic usage, have brought significant transformation across a wide range of industries. Therefore, players in the ultra-high barrier films market will need to up their recycling processes and offer value-added products. Sensing the potential application of ultra-barrier films in pharmaceuticals, medical devices, and chemical industries, manufacturers will need to improve their operating efficiencies, and develop innovative films that deliver high oxygen and high moisture barrier properties.

The global Ultra-high Barrier Films market was estimated US$ 3 Bn in 2019, and is expected to increase at a CAGR of around 5.0% in terms of value throughout the forecast period.

Growing demand for ultra-high barrier films in the food end-use industry is expected to bolster the growth of the global ultra-high barrier films market during the forecast period of 2019-2027.

Some key players operating in the Ultra-high Barrier Films market include Cosmo Films Ltd., Jindal Poly Films Limited, Toray Plastics (America), Inc., Klöckner Pentaplast Europe GmbH & Co. KG, ProAmpac LLC, Treofan Group, Amcor Limited, Celplast Metallized Products Limited, Sealed Air Corporation, Mondi Group plc., Winpak Ltd., Coveris Holdings S.A., Taghleef Industries LLC, Ester Industries Ltd., and ACG Worldwide Private Limited, among others.

Food end-use segment is expected to drive the ultra-high barrier films market during the forecast period 2019–2027

Asia Pacific Expected To Remain A Lucrative Region In The Global Ultra-High Barrier Films Market, China is foreseen to remain prominent in terms of market share, while India is expected to be highly attractive in terms of growth rate of ultra-high barrier films during the forecast period.

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. Analysis and Recommendations

1.4. Wheel of Opportunity

2. Market Introduction

2.1. Market Definition

2.2. Market Taxonomy

3. Market Viewpoint

3.1. Parent Market Overview

3.1.1. Global Flexible Packaging Outlook

3.1.2. Global Rigid Packaging Outlook

3.2. Opportunity Analysis

4. Market Background

4.1. Global Economic Outlook

4.2. Global Packaging Industry Overview by Value & Volume

4.3. PESTLE Analysis for Key Countries

4.4. Porter’s Analysis

4.5. Macro-Economic Factors & Co-relation Analysis

4.6. Value Chain Analysis

4.7. Forecast Factors – Relevance & Impact

4.8. Flexible Packaging: Key Consumer Preferences Analysis

4.9. Market Dynamics

4.9.1. Drivers

4.9.2. Restraints

4.9.3. Opportunity

4.9.4. Trends

5. Market Forecast

5.1. Market Volume Projections

5.2. Pricing Analysis

5.3. Market Size Projections

5.3.1. Y-o-Y Projections

5.3.2. Absolute $ Opportunity Analysis

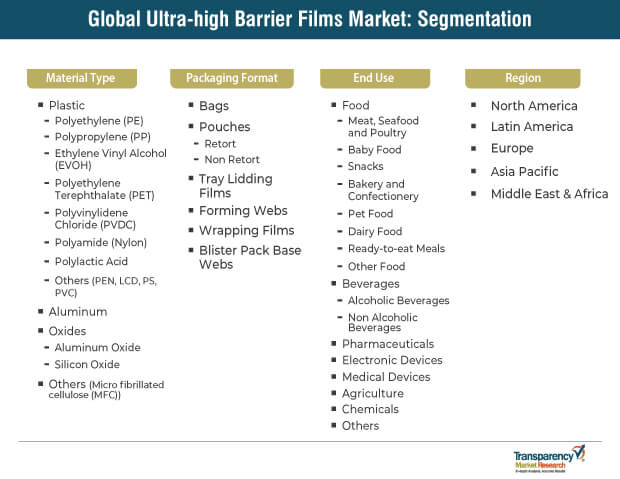

6. Global Ultra-high Barrier Films Market Analysis By Material Type

6.1. Introduction

6.1.1. Market Value Share Analysis By Material Type

6.1.2. Y-o-Y Growth Analysis By Material Type

6.2. Market Size (US$ Mn) and Volume (Tonnes) Historical (2014–2018) and Forecast (2019–2027) By Material Type

6.2.1. Plastic

6.2.1.1. Polyethylene (PE)

6.2.1.2. Polypropylene (PP)

6.2.1.3. Ethylene Vinyl Alcohol (EVOH)

6.2.1.4. Polyethylene Terephthalate (PET)

6.2.1.5. Polyvinylidene Chloride (PVDC)

6.2.1.6. Polyamide (Nylon)

6.2.1.7. Polylactic Acid

6.2.1.8. Others (PEN, LCD, PS, PVC)

6.2.2. Aluminum

6.2.3. Oxides

6.2.3.1. Aluminum Oxide

6.2.3.2. Silicon Oxide

6.2.4. Others (Micro fibrillated cellulose (MFC))

6.3. Market Attractiveness Analysis By Material Type

7. Global Ultra-high Barrier Films Market Analysis By Packaging Format

7.1. Introduction

7.1.1. Market Value Share Analysis By Packaging Format

7.1.2. Y-o-Y Growth Analysis By Packaging Format

7.2. Market Size (US$ Mn) and Volume (Tonnes) Historical (2014–2018) and Forecast (2019–2027) By Packaging Format

7.2.1. Bags

7.2.2. Pouches

7.2.2.1. Retort

7.2.2.2. Non Retort

7.2.3. Tray Lidding Films

7.2.4. Forming Webs

7.2.5. Wrapping Films

7.2.6. Blister Pack Base Webs

7.3. Market Attractiveness Analysis By Packaging Format

8. Global Ultra-high Barrier Films Market Analysis By End Use

8.1. Introduction

8.1.1. Market Value Share Analysis By End Use

8.1.2. Y-o-Y Growth Analysis By End Use

8.2. Market Size (US$ Mn) and Volume (Tonnes) Historical (2014–2018) and Forecast (2019–2027) By End Use

8.2.1. Food

8.2.1.1. Meat, Seafood and Poultry

8.2.1.2. Baby Food

8.2.1.3. Snacks

8.2.1.4. Bakery and Confectionery

8.2.1.5. Pet Food

8.2.1.6. Dairy Food

8.2.1.7. Ready to Eat Meals

8.2.1.8. Other Food

8.2.2. Beverages

8.2.2.1. Alcoholic Beverages

8.2.2.2. Non Alcoholic Beverages

8.2.3. Pharmaceuticals

8.2.4. Electronic Devices

8.2.5. Medical Devices

8.2.6. Agriculture

8.2.7. Chemicals

8.2.8. Others

8.3. Market Attractiveness Analysis By End Use

9. Global Ultra-high Barrier Films Market Analysis By Region

9.1. Introduction

9.1.1. Market Value Share Analysis By Region

9.1.2. Y-o-Y Growth Analysis By Region

9.2. Market Size (US$ Mn) and Volume (Tonnes) Historical (2014–2018) and Forecast (2019–2027) By Region

9.2.1. North America

9.2.2. Latin America

9.2.3. Europe

9.2.4. Asia Pacific (APAC)

9.2.5. Middle East & Africa (MEA)

9.3. Market Attractiveness Analysis By Region

10. North America Ultra-high Barrier Films Market Analysis

10.1. Introduction

10.2. Market Size (US$ Mn) and Volume (Tonnes) Historical (2014–2018) and Forecast (2019–2027) By Country

10.2.1. U.S.

10.2.2. Canada

10.3. Market Size (US$ Mn) and Volume (Tonnes) Historical (2014–2018) and Forecast (2019–2027) By Material Type

10.3.1. Plastic

10.3.1.1. Polyethylene (PE)

10.3.1.2. Polypropylene (PP)

10.3.1.3. Ethylene Vinyl Alcohol (EVOH)

10.3.1.4. Polyethylene Terephthalate (PET)

10.3.1.5. Polyvinylidene Chloride (PVDC)

10.3.1.6. Polyamide (Nylon)

10.3.1.7. Polylactic Acid

10.3.1.8. Others (PEN, LCD, PS, PVC)

10.3.2. Aluminum

10.3.3. Oxides

10.3.3.1. Aluminum Oxide

10.3.3.2. Silicon Oxide

10.3.4. Others (Micro fibrillated cellulose (MFC))

10.4. Market Size (US$ Mn) and Volume (Tonnes) Historical (2014–2018) and Forecast (2019–2027) By Packaging Format

10.4.1. Bags

10.4.2. Pouches

10.4.2.1. Retort

10.4.2.2. Non Retort

10.4.3. Tray Lidding Films

10.4.4. Forming Webs

10.4.5. Wrapping Films

10.4.6. Blister Pack Base Webs

10.5. Market Size (US$ Mn) and Volume (Tonnes) Historical (2014–2018) and Forecast (2019–2027) By End Use

10.5.1. Food

10.5.1.1. Meat, Seafood and Poultry

10.5.1.2. Baby Food

10.5.1.3. Snacks

10.5.1.4. Bakery and Confectionery

10.5.1.5. Pet Food

10.5.1.6. Dairy Food

10.5.1.7. Ready to Eat Meals

10.5.1.8. Other Food

10.5.2. Beverages

10.5.2.1. Alcoholic Beverages

10.5.2.2. Non Alcoholic Beverages

10.5.3. Pharmaceuticals

10.5.4. Electronic Devices

10.5.5. Medical Devices

10.5.6. Agriculture

10.5.7. Chemicals

10.5.8. Others

10.6. Drivers and Restraints – Impact Analysis

11. Latin America Ultra-high Barrier Films Market Analysis

11.1. Introduction

11.2. Market Size (US$ Mn) and Volume (Tonnes) Historical (2014–2018) and Forecast (2019–2027) By Country,

11.2.1. Brazil

11.2.2. Mexico

11.2.3. Argentina

11.2.4. Rest of Latin America

11.3. Market Size (US$ Mn) and Volume (Tonnes) Historical (2014–2018) and Forecast (2019–2027) By Material Type

11.3.1. Plastic

11.3.1.1. Polyethylene (PE)

11.3.1.2. Polypropylene (PP)

11.3.1.3. Ethylene Vinyl Alcohol (EVOH)

11.3.1.4. Polyethylene Terephthalate (PET)

11.3.1.5. Polyvinylidene Chloride (PVDC)

11.3.1.6. Polyamide (Nylon)

11.3.1.7. Polylactic Acid

11.3.1.8. Others (PEN, LCD, PS, PVC)

11.3.2. Aluminum

11.3.3. Oxides

11.3.3.1. Aluminum Oxide

11.3.3.2. Silicon Oxide

11.3.4. Others (Micro fibrillated cellulose (MFC))

11.4. Market Size (US$ Mn) and Volume (Tonnes) Historical (2014–2018) and Forecast (2019–2027) By Packaging Format

11.4.1. Bags

11.4.2. Pouches

11.4.2.1. Retort

11.4.2.2. Non Retort

11.4.3. Tray Lidding Films

11.4.4. Forming Webs

11.4.5. Wrapping Films

11.4.6. Blister Pack Base Webs

11.5. Market Size (US$ Mn) and Volume (Tonnes) Historical (2014–2018) and Forecast (2019–2027) By End Use

11.5.1. Food

11.5.1.1. Meat, Seafood and Poultry

11.5.1.2. Baby Food

11.5.1.3. Snacks

11.5.1.4. Bakery and Confectionery

11.5.1.5. Pet Food

11.5.1.6. Dairy Food

11.5.1.7. Ready to Eat Meals

11.5.1.8. Other Food

11.5.2. Beverages

11.5.2.1. Alcoholic Beverages

11.5.2.2. Non Alcoholic Beverages

11.5.3. Pharmaceuticals

11.5.4. Electronic Devices

11.5.5. Medical Devices

11.5.6. Agriculture

11.5.7. Chemicals

11.5.8. Others

11.6. Drivers and Restraints – Impact Analysis

12. Europe Ultra-high Barrier Films Market Analysis

12.1. Introduction

12.2. Pricing Analysis

12.3. Market Size (US$ Mn) and Volume (Tonnes) Historical (2014–2018) and Forecast (2019–2027) By Country,

12.3.1. Germany

12.3.2. Italy

12.3.3. France

12.3.4. U.K.

12.3.5. Spain

12.3.6. Benelux

12.3.7. Nordic

12.3.8. Russia

12.3.9. Poland

12.3.10. Rest of Europe

12.4. Market Size (US$ Mn) and Volume (Tonnes) Historical (2014–2018) and Forecast (2019–2027) By Material Type

12.4.1. Plastic

12.4.1.1. Polyethylene (PE)

12.4.1.2. Polypropylene (PP)

12.4.1.3. Ethylene Vinyl Alcohol (EVOH)

12.4.1.4. Polyethylene Terephthalate (PET)

12.4.1.5. Polyvinylidene Chloride (PVDC)

12.4.1.6. Polyamide (Nylon)

12.4.1.7. Polylactic Acid

12.4.1.8. Others (PEN, LCD, PS, PVC)

12.4.2. Aluminum

12.4.3. Oxides

12.4.3.1. Aluminum Oxide

12.4.3.2. Silicon Oxide

12.4.4. Others (Micro fibrillated cellulose (MFC))

12.5. Market Size (US$ Mn) and Volume (Tonnes) Historical (2014–2018) and Forecast (2019–2027) By Packaging Format

12.5.1. Bags

12.5.2. Pouches

12.5.2.1. Retort

12.5.2.2. Non Retort

12.5.3. Tray Lidding Films

12.5.4. Forming Webs

12.5.5. Wrapping Films

12.5.6. Blister Pack Base Webs

12.6. Market Size (US$ Mn) and Volume (Tonnes) Historical (2014–2018) and Forecast (2019–2027) By End Use

12.6.1. Food

12.6.1.1. Meat, Seafood and Poultry

12.6.1.2. Baby Food

12.6.1.3. Snacks

12.6.1.4. Bakery and Confectionery

12.6.1.5. Pet Food

12.6.1.6. Dairy Food

12.6.1.7. Ready to Eat Meals

12.6.1.8. Other Food

12.6.2. Beverages

12.6.2.1. Alcoholic Beverages

12.6.2.2. Non Alcoholic Beverages

12.6.3. Pharmaceuticals

12.6.4. Electronic Devices

12.6.5. Medical Devices

12.6.6. Agriculture

12.6.7. Chemicals

12.6.8. Others

12.7. Drivers and Restraints – Impact Analysis

13. APAC Ultra-high Barrier Films Market Analysis

13.1. Introduction

13.2. Pricing Analysis

13.3. Market Size (US$ Mn) and Volume (Tonnes) Historical (2014–2018) and Forecast (2019–2027) By Country,

13.3.1. China

13.3.2. India

13.3.3. ASEAN Countries

13.3.4. Australia and New Zealand

13.3.5. Japan

13.3.6. Rest of APAC

13.4. Market Size (US$ Mn) and Volume (Tonnes) Historical (2014–2018) and Forecast (2019–2027) By Material Type

13.4.1. Plastic

13.4.1.1. Polyethylene (PE)

13.4.1.2. Polypropylene (PP)

13.4.1.3. Ethylene Vinyl Alcohol (EVOH)

13.4.1.4. Polyethylene Terephthalate (PET)

13.4.1.5. Polyvinylidene Chloride (PVDC)

13.4.1.6. Polyamide (Nylon)

13.4.1.7. Polylactic Acid

13.4.1.8. Others (PEN, LCD, PS, PVC)

13.4.2. Aluminum

13.4.3. Oxides

13.4.3.1. Aluminum Oxide

13.4.3.2. Silicon Oxide

13.4.4. Others (Micro fibrillated cellulose (MFC))

13.5. Market Size (US$ Mn) and Volume (Tonnes) Historical (2014–2018) and Forecast (2019–2027) By Packaging Format

13.5.1. Bags

13.5.2. Pouches

13.5.2.1. Retort

13.5.2.2. Non Retort

13.5.3. Tray Lidding Films

13.5.4. Forming Webs

13.5.5. Wrapping Films

13.5.6. Blister Pack Base Webs

13.6. Market Size (US$ Mn) and Volume (Tonnes) Historical (2014–2018) and Forecast (2019–2027) By End Use

13.6.1. Food

13.6.1.1. Meat, Seafood and Poultry

13.6.1.2. Baby Food

13.6.1.3. Snacks

13.6.1.4. Bakery and Confectionery

13.6.1.5. Pet Food

13.6.1.6. Dairy Food

13.6.1.7. Ready to Eat Meals

13.6.1.8. Other Food

13.6.2. Beverages

13.6.2.1. Alcoholic Beverages

13.6.2.2. Non Alcoholic Beverages

13.6.3. Pharmaceuticals

13.6.4. Electronic Devices

13.6.5. Medical Devices

13.6.6. Agriculture

13.6.7. Chemicals

13.6.8. Others

13.7. Drivers and Restraints – Impact Analysis

14. MEA Ultra-high Barrier Films Market Analysis

14.1. Introduction

14.2. Pricing Analysis

14.3. Market Size (US$ Mn) and Volume (Tonnes) Historical (2014–2018) and Forecast (2019–2027) By Country,

14.3.1. GCC Countries

14.3.2. North Africa

14.3.3. South Africa

14.3.4. Turkey

14.3.5. Rest of MEA

14.4. Market Size (US$ Mn) and Volume (Tonnes) Historical (2014–2018) and Forecast (2019–2027) By Material Type

14.4.1. Plastic

14.4.1.1. Polyethylene (PE)

14.4.1.2. Polypropylene (PP)

14.4.1.3. Ethylene Vinyl Alcohol (EVOH)

14.4.1.4. Polyethylene Terephthalate (PET)

14.4.1.5. Polyvinylidene Chloride (PVDC)

14.4.1.6. Polyamide (Nylon)

14.4.1.7. Polylactic Acid

14.4.1.8. Others (PEN, LCD, PS, PVC)

14.4.2. Aluminum

14.4.3. Oxides

14.4.3.1. Aluminum Oxide

14.4.3.2. Silicon Oxide

14.4.4. Others (Micro fibrillated cellulose (MFC))

14.5. Market Size (US$ Mn) and Volume (Tonnes) Historical (2014–2018) and Forecast (2019–2027) By Packaging Format

14.5.1. Bags

14.5.2. Pouches

14.5.2.1. Retort

14.5.2.2. Non Retort

14.5.3. Tray Lidding Films

14.5.4. Forming Webs

14.5.5. Wrapping Films

14.5.6. Blister Pack Base Webs

14.6. Market Size (US$ Mn) and Volume (Tonnes) Historical (2014–2018) and Forecast (2019–2027) By End Use

14.6.1. Food

14.6.1.1. Meat, Seafood and Poultry

14.6.1.2. Baby Food

14.6.1.3. Snacks

14.6.1.4. Bakery and Confectionery

14.6.1.5. Pet Food

14.6.1.6. Dairy Food

14.6.1.7. Ready to Eat Meals

14.6.1.8. Other Food

14.6.2. Beverages

14.6.2.1. Alcoholic Beverages

14.6.2.2. Non Alcoholic Beverages

14.6.3. Pharmaceuticals

14.6.4. Electronic Devices

14.6.5. Medical Devices

14.6.6. Agriculture

14.6.7. Chemicals

14.6.8. Others

14.7. Drivers and Restraints – Impact Analysis

15. Market Structure Analysis

15.1. Market Analysis by Tier of Companies

15.1.1. By Large, Medium and Small

15.2. Market Concentration

15.2.1. By Top 5 and by Top 10

15.3. Production Capacity Share Analysis

15.3.1. BY Large, Medium and Small

15.3.2. By Top 5 and Top 10

15.4. Market Share Analysis of Top 10 Players

15.5. Market Presence Analysis

16. Competition Analysis

16.1. Competition Dashboard

16.2. Competition Benchmarking

16.3. Profitability and Gross Margin Analysis By Competition

16.4. Competition Developments

16.5. Competition Deep pe

16.5.1. Cosmo Films Ltd.

16.5.1.1. Overview

16.5.1.2. Product Portfolio

16.5.1.3. Profitability

16.5.1.4. Production Footprint

16.5.1.5. Sales Footprint

16.5.1.6. Channel Footprint

16.5.1.7. Competition Benchmarking

16.5.1.8. Strategy

16.5.1.8.1. Marketing Strategy

16.5.1.8.2. Product Strategy

16.5.1.8.3. Channel Strategy

16.5.2. Jindal Poly Films Limited

16.5.2.1. Overview

16.5.2.2. Product Portfolio

16.5.2.3. Profitability

16.5.2.4. Production Footprint

16.5.2.5. Sales Footprint

16.5.2.6. Channel Footprint

16.5.2.7. Competition Benchmarking

16.5.2.8. Strategy

16.5.2.8.1. Marketing Strategy

16.5.2.8.2. Product Strategy

16.5.2.8.3. Channel Strategy

16.5.3. Toray Plastics (America), Inc.

16.5.3.1. Overview

16.5.3.2. Product Portfolio

16.5.3.3. Profitability

16.5.3.4. Production Footprint

16.5.3.5. Sales Footprint

16.5.3.6. Channel Footprint

16.5.3.7. Competition Benchmarking

16.5.3.8. Strategy

16.5.3.8.1. Marketing Strategy

16.5.3.8.2. Product Strategy

16.5.3.8.3. Channel Strategy

16.5.4. Klöckner Pentaplast Europe GmbH & Co. KG

16.5.4.1. Overview

16.5.4.2. Product Portfolio

16.5.4.3. Profitability

16.5.4.4. Production Footprint

16.5.4.5. Sales Footprint

16.5.4.6. Channel Footprint

16.5.4.7. Competition Benchmarking

16.5.4.8. Strategy

16.5.4.8.1. Marketing Strategy

16.5.4.8.2. Product Strategy

16.5.4.8.3. Channel Strategy

16.5.5. ProAmpac LLC

16.5.5.1. Overview

16.5.5.2. Product Portfolio

16.5.5.3. Profitability

16.5.5.4. Production Footprint

16.5.5.5. Sales Footprint

16.5.5.6. Channel Footprint

16.5.5.7. Competition Benchmarking

16.5.5.8. Strategy

16.5.5.8.1. Marketing Strategy

16.5.5.8.2. Product Strategy

16.5.5.8.3. Channel Strategy

16.5.6. Treofan Group

16.5.6.1. Overview

16.5.6.2. Product Portfolio

16.5.6.3. Profitability

16.5.6.4. Production Footprint

16.5.6.5. Sales Footprint

16.5.6.6. Channel Footprint

16.5.6.7. Competition Benchmarking

16.5.6.8. Strategy

16.5.6.8.1. Marketing Strategy

16.5.6.8.2. Product Strategy

16.5.6.8.3. Channel Strategy

16.5.7. Amcor Limited

16.5.7.1. Overview

16.5.7.2. Product Portfolio

16.5.7.3. Profitability

16.5.7.4. Production Footprint

16.5.7.5. Sales Footprint

16.5.7.6. Channel Footprint

16.5.7.7. Competition Benchmarking

16.5.7.8. Strategy

16.5.7.8.1. Marketing Strategy

16.5.7.8.2. Product Strategy

16.5.7.8.3. Channel Strategy

16.5.8. Celplast Metallized Products Limited

16.5.8.1. Overview

16.5.8.2. Product Portfolio

16.5.8.3. Profitability

16.5.8.4. Production Footprint

16.5.8.5. Sales Footprint

16.5.8.6. Channel Footprint

16.5.8.7. Competition Benchmarking

16.5.8.8. Strategy

16.5.8.8.1. Marketing Strategy

16.5.8.8.2. Product Strategy

16.5.8.8.3. Channel Strategy

16.5.9. Sealed Air Corporation

16.5.9.1. Overview

16.5.9.2. Product Portfolio

16.5.9.3. Profitability

16.5.9.4. Production Footprint

16.5.9.5. Sales Footprint

16.5.9.6. Channel Footprint

16.5.9.7. Competition Benchmarking

16.5.9.8. Strategy

16.5.9.8.1. Marketing Strategy

16.5.9.8.2. Product Strategy

16.5.9.8.3. Channel Strategy

16.5.10. Mondi Group plc.

16.5.10.1. Overview

16.5.10.2. Product Portfolio

16.5.10.3. Profitability

16.5.10.4. Production Footprint

16.5.10.5. Sales Footprint

16.5.10.6. Channel Footprint

16.5.10.7. Competition Benchmarking

16.5.10.8. Strategy

16.5.10.8.1. Marketing Strategy

16.5.10.8.2. Product Strategy

16.5.10.8.3. Channel Strategy

16.5.11. Winpak Ltd.

16.5.11.1. Overview

16.5.11.2. Product Portfolio

16.5.11.3. Profitability

16.5.11.4. Production Footprint

16.5.11.5. Sales Footprint

16.5.11.6. Channel Footprint

16.5.11.7. Competition Benchmarking

16.5.11.8. Strategy

16.5.11.8.1. Marketing Strategy

16.5.11.8.2. Product Strategy

16.5.11.8.3. Channel Strategy

16.5.12. Coveris Holdings S.A.

16.5.12.1. Overview

16.5.12.2. Product Portfolio

16.5.12.3. Profitability

16.5.12.4. Production Footprint

16.5.12.5. Sales Footprint

16.5.12.6. Channel Footprint

16.5.12.7. Competition Benchmarking

16.5.12.8. Strategy

16.5.12.8.1. Marketing Strategy

16.5.12.8.2. Product Strategy

16.5.12.8.3. Channel Strategy

16.5.13. Taghleef Industries LLC

16.5.13.1. Overview

16.5.13.2. Product Portfolio

16.5.13.3. Profitability

16.5.13.4. Production Footprint

16.5.13.5. Sales Footprint

16.5.13.6. Channel Footprint

16.5.13.7. Competition Benchmarking

16.5.13.8. Strategy

16.5.13.8.1. Marketing Strategy

16.5.13.8.2. Product Strategy

16.5.13.8.3. Channel Strategy

16.5.14. Ester Industries Ltd.

16.5.14.1. Overview

16.5.14.2. Product Portfolio

16.5.14.3. Profitability

16.5.14.4. Production Footprint

16.5.14.5. Sales Footprint

16.5.14.6. Channel Footprint

16.5.14.7. Competition Benchmarking

16.5.14.8. Strategy

16.5.14.8.1. Marketing Strategy

16.5.14.8.2. Product Strategy

16.5.14.8.3. Channel Strategy

16.5.15. ACG Worldwide Private Limited

16.5.15.1. Overview

16.5.15.2. Product Portfolio

16.5.15.3. Profitability

16.5.15.4. Production Footprint

16.5.15.5. Sales Footprint

16.5.15.6. Channel Footprint

16.5.15.7. Competition Benchmarking

16.5.15.8. Strategy

16.5.15.8.1. Marketing Strategy

16.5.15.8.2. Product Strategy

16.5.15.8.3. Channel Strategy

17. Assumptions and Acronyms Used

18. Research Methodology

List of Tables

Table 01: Global Ultra-High Barrier Films Market Value (US$ Mn) 2014-2027, by Material Type (1/2)

Table 02: Global Ultra-High Barrier Films Market Value (US$ Mn) 2014-2027, by Material Type (2/2)

Table 03: Global Ultra-High Barrier Films Market Volume (‘000 Tonnes) 2014-2027, by Material Type (1/2)

Table 04: Global Ultra-High Barrier Films Market Volume (‘000 Tonnes) 2014-2027, by Material Type (2/2)

Table 05: Global Ultra-High Barrier Films Market Value (US$ Mn) 2014-2027, by Packaging Format

Table 06: Global Ultra-High Barrier Films Market Volume (‘000 Tonnes) 2014-2027, by Packaging Format

Table 07: Global Ultra-High Barrier Films Market Value (US$ Mn) 2014-2027, by End Use (1/2)

Table 08: Global Ultra-High Barrier Films Market Value (US$ Mn) 2014-2027, by End Use (2/2)

Table 09: Global Ultra-High Barrier Films Market Volume (‘000 Tonnes) 2014-2027, by End Use (1/2)

Table 10: Global Ultra-High Barrier Films Market Volume (‘000 Tonnes) 2014-2027, by End Use (2/2)

Table 11: Global Ultra-High Barrier Films Market Value (US$ Mn) 2014-2027, by Region

Table 12: Global Ultra-High Barrier Films Market Volume (‘000 Tonnes) 2014-2027, by Region

Table 13: North America Ultra-High Barrier Films Market Value (US$ Mn) 2014-2027, by Country

Table 14: North America Ultra-High Barrier Films Market Volume (‘000 Tonnes) 2014-2027, by Country

Table 15: North America Ultra-High Barrier Films Market Value (US$ Mn) 2014-2027, by Material Type (1/2)

Table 16: North America Ultra-High Barrier Films Market Value (US$ Mn) 2014-2027, by Material Type (2/2)

Table 17: North America Ultra-High Barrier Films Market Volume (‘000 Tonnes) 2014-2027, by Material Type (1/2)

Table 18: North America Ultra-High Barrier Films Market Volume (‘000 Tonnes) 2014-2027, by Material Type (2/2)

Table 19: North America Ultra-High Barrier Films Market Value (US$ Mn) 2014-2027, by Packaging Format

Table 20: North America Ultra-High Barrier Films Market Volume (‘000 Tonnes) 2014-2027, by Packaging Format

Table 21: North America Ultra-High Barrier Films Market Value (US$ Mn) 2014-2027, by End Use (1/2)

Table 22: North America Ultra-High Barrier Films Market Value (US$ Mn) 2014-2027, by End Use (2/2)

Table 23: North America Ultra-High Barrier Films Market Volume (‘000 Tonnes) 2014-2027, by End Use (1/2)

Table 24: North America Ultra-High Barrier Films Market Volume (‘000 Tonnes) 2014-2027, by End Use (2/2)

Table 25: Latin America Ultra-High Barrier Films Market Value (US$ Mn) 2014-2027, by Country

Table 26: Latin America Ultra-High Barrier Films Market Volume (‘000 Tonnes) 2014-2027, by Country

Table 27: Latin America Ultra-High Barrier Films Market Value (US$ Mn) 2014-2027, by Material Type (1/2)

Table 28: Latin America Ultra-High Barrier Films Market Value (US$ Mn) 2014-2027, by Material Type (2/2)

Table 29: Latin America Ultra-High Barrier Films Market Volume (‘000 Tonnes) 2014-2027, by Material Type (1/2)

Table 30: Latin America Ultra-High Barrier Films Market Volume (‘000 Tonnes) 2014-2027, by Material Type (2/2)

Table 31: Latin America Ultra-High Barrier Films Market Value (US$ Mn) 2014-2027, by Packaging Format

Table 32: Latin America Ultra-High Barrier Films Market Volume (‘000 Tonnes) 2014-2027, by Packaging Format

Table 33: Latin America Ultra-High Barrier Films Market Value (US$ Mn) 2014-2027, by End Use (1/2)

Table 34: Latin America Ultra-High Barrier Films Market Value (US$ Mn) 2014-2027, by End Use (2/2)

Table 35: Latin America Ultra-High Barrier Films Market Volume (‘000 Tonnes) 2014-2027, by End Use (1/2)

Table 36: Latin America Ultra-High Barrier Films Market Volume (‘000 Tonnes) 2014-2027, by End Use (2/2)

Table 37: Europe Ultra-High Barrier Films Market Value (US$ Mn) 2014-2027, by Country

Table 38: Europe Ultra-High Barrier Films Market Volume (‘000 Tonnes) 2014-2027, by Country

Table 39: Europe Ultra-High Barrier Films Market Value (US$ Mn) 2014-2027, by Material Type (1/2)

Table 40: Europe Ultra-High Barrier Films Market Value (US$ Mn) 2014-2027, by Material Type (2/2)

Table 41: Europe Ultra-High Barrier Films Market Volume (‘000 Tonnes) 2014-2027, by Material Type (1/2)

Table 42: Europe Ultra-High Barrier Films Market Volume (‘000 Tonnes) 2014-2027, by Material Type (2/2)

Table 43: Europe Ultra-High Barrier Films Market Value (US$ Mn) 2014-2027, by Packaging Format

Table 44: Europe Ultra-High Barrier Films Market Volume (‘000 Tonnes) 2014-2027, by Packaging Format

Table 45: Europe Ultra-High Barrier Films Market Value (US$ Mn) 2014-2027, by End Use (1/2)

Table 46: Europe Ultra-High Barrier Films Market Value (US$ Mn) 2014-2027, by End Use (2/2)

Table 47: Europe Ultra-High Barrier Films Market Volume (‘000 Tonnes) 2014-2027, by End Use (1/2)

Table 48: North America Ultra-High Barrier Films Market Volume (‘000 Tonnes) 2014-2027, by End Use (2/2)

Table 49: Asia Pacific Ultra-High Barrier Films Market Value (US$ Mn) 2014-2027, by Country

Table 50: Asia Pacific Ultra-High Barrier Films Market Volume (‘000 Tonnes) 2014-2027, by Country

Table 51: Asia Pacific Ultra-High Barrier Films Market Value (US$ Mn) 2014-2027, by Material Type (1/2)

Table 52: Asia Pacific Ultra-High Barrier Films Market Value (US$ Mn) 2014-2027, by Material Type (2/2)

Table 53: Asia Pacific Ultra-High Barrier Films Market Volume (‘000 Tonnes) 2014-2027, by Material Type (1/2)

Table 54: Asia Pacific Ultra-High Barrier Films Market Volume (‘000 Tonnes) 2014-2027, by Material Type (2/2)

Table 55: Asia Pacific Ultra-High Barrier Films Market Value (US$ Mn) 2014-2027, by Packaging Format

Table 56: Asia Pacific Ultra-High Barrier Films Market Volume (‘000 Tonnes) 2014-2027, by Packaging Format

Table 57: Asia Pacific Ultra-High Barrier Films Market Value (US$ Mn) 2014-2027, by End Use (1/2)

Table 58: Asia Pacific Ultra-High Barrier Films Market Value (US$ Mn) 2014-2027, by End Use (2/2)

Table 59: Asia Pacific Ultra-High Barrier Films Market Volume (‘000 Tonnes) 2014-2027, by End Use (1/2)

Table 60: Asia Pacific Ultra-High Barrier Films Market Volume (‘000 Tonnes) 2014-2027, by End Use (2/2)

Table 61: Middle East & Africa Ultra-High Barrier Films Market Value (US$ Mn) 2014-2027, by Country

Table 62: Middle East & Africa Ultra-High Barrier Films Market Volume (‘000 Tonnes) 2014-2027, by Country

Table 63: Middle East & Africa Ultra-High Barrier Films Market Value (US$ Mn) 2014-2027, by Material Type (1/2)

Table 64: Middle East & Africa Ultra-High Barrier Films Market Value (US$ Mn) 2014-2027, by Material Type (2/2)

Table 65: Middle East & Africa Ultra-High Barrier Films Market Volume (‘000 Tonnes) 2014-2027, by Material Type (1/2)

Table 66: Middle East & Africa Ultra-High Barrier Films Market Volume (‘000 Tonnes) 2014-2027, by Material Type (2/2)

Table 67: Middle East & Africa Ultra-High Barrier Films Market Value (US$ Mn) 2014-2027, by Packaging Format

Table 68: Middle East & Africa Ultra-High Barrier Films Market Volume (‘000 Tonnes) 2014-2027, by Packaging Format

Table 69: Middle East & Africa Ultra-High Barrier Films Market Value (US$ Mn) 2014-2027, by End Use (1/2)

Table 70: Middle East & Africa Ultra-High Barrier Films Market Value (US$ Mn) 2014-2027, by End Use (2/2)

Table 71: Middle East & Africa Ultra-High Barrier Films Market Volume (‘000 Tonnes) 2014-2027, by End Use (1/2)

Table 72: Middle East & Africa Ultra-High Barrier Films Market Volume (‘000 Tonnes) 2014-2027, by End Use (2/2)

List of Figures

Figure 01: Global Ultra-High Barrier Films Market Y-o-Y growth, by Material Type 2019-2027

Figure 02: Global Ultra-High Barrier Films Market Attractiveness Analysis, by Material Type 2019-2027

Figure 03: Global Ultra-High Barrier Films Market Y-o-Y growth, by Packaging Format 2019-2027

Figure 04: Global Ultra-High Barrier Films Market Attractiveness Analysis, by Packaging Format 2019-2027

Figure 05: Global Ultra-High Barrier Films Market Y-o-Y growth, by End Use 2019-2027

Figure 06: Global Ultra-High Barrier Films Market Attractiveness Analysis, by End Use 2019-2027

Figure 07: Global Ultra-High Barrier Films Market Y-o-Y growth, by Region 2019-2027

Figure 08: Global Ultra-High Barrier Films Market Attractiveness Analysis, by Region 2019-2027

Figure 09: North America Ultra-High Barrier Films Market Value Share Analysis, by Country, 2019-2027

Figure 10: North America Ultra-High Barrier Films Market Attractiveness Analysis, by Country, 2019-2027

Figure 11: North America Ultra-High Barrier Films Market Y-o-Y growth, by Material Type 2019-2027

Figure 12: North America Ultra-High Barrier Films Market Attractiveness Analysis, by Material Type 2019-2027

Figure 13: North America Ultra-High Barrier Films Market Y-o-Y growth, by Packaging Format 2019-2027

Figure 14: North America Ultra-High Barrier Films Market Attractiveness Analysis, by Packaging Format 2019-2027

Figure 15: North America Ultra-High Barrier Films Market Y-o-Y growth, by End Use 2019-2027

Figure 16: North America Ultra-High Barrier Films Market Attractiveness Analysis, by End Use 2019-2027

Figure 17: Latin America Ultra-High Barrier Films Market Value Share Analysis, by Country, 2019-2027

Figure 18: Latin America Ultra-High Barrier Films Market Attractiveness Analysis, by Country, 2019-2027

Figure 19: Latin America Ultra-High Barrier Films Market Y-o-Y growth, by Material Type 2019-2027

Figure 20: Latin America Ultra-High Barrier Films Market Attractiveness Analysis, by Material Type 2019-2027

Figure 21: Latin America Ultra-High Barrier Films Market Y-o-Y growth, by Packaging Format 2019-2027

Figure 22: Latin America Ultra-High Barrier Films Market Attractiveness Analysis, by Packaging Format 2019-2027

Figure 23: Latin America Ultra-High Barrier Films Market Y-o-Y growth, by End Use 2019-2027

Figure 24: Latin America Ultra-High Barrier Films Market Attractiveness Analysis, by End Use 2019-2027

Figure 25: Europe Ultra-High Barrier Films Market Value Share Analysis, by Country, 2019-2027

Figure 26: Europe Ultra-High Barrier Films Market Attractiveness Analysis, by Country, 2019-2027

Figure 27: Europe Ultra-High Barrier Films Market Y-o-Y growth, by Material Type 2019-2027

Figure 28: Europe Ultra-High Barrier Films Market Attractiveness Analysis, by Material Type 2019-2027

Figure 29: Europe Ultra-High Barrier Films Market Y-o-Y growth, by Packaging Format 2019-2027

Figure 30: Europe Ultra-High Barrier Films Market Attractiveness Analysis, by Packaging Format 2019-2027

Figure 31: Europe Ultra-High Barrier Films Market Y-o-Y growth, by End Use 2019-2027

Figure 32: Europe Ultra-High Barrier Films Market Attractiveness Analysis, by End Use 2019-2027

Figure 33: Asia Pacific Ultra-High Barrier Films Market Value Share Analysis, by Country, 2019-2027

Figure 34: Asia Pacific Ultra-High Barrier Films Market Attractiveness Analysis, by Country, 2019-2027

Figure 35: Asia Pacific Ultra-High Barrier Films Market Y-o-Y growth, by Material Type 2019-2027

Figure 36: Asia Pacific Ultra-High Barrier Films Market Attractiveness Analysis, by Material Type 2019-2027

Figure 37: Asia Pacific Ultra-High Barrier Films Market Y-o-Y growth, by Packaging Format 2019-2027

Figure 38: Asia Pacific Ultra-High Barrier Films Market Attractiveness Analysis, by Packaging Format 2019-2027

Figure 39: Asia Pacific Ultra-High Barrier Films Market Y-o-Y growth, by End Use 2019-2027

Figure 40: Asia Pacific Ultra-High Barrier Films Market Attractiveness Analysis, by End Use 2019-2027

Figure 41: Middle East & Africa Ultra-High Barrier Films Market Value Share Analysis, by Country, 2019-2027

Figure 42: Middle East & Africa Ultra-High Barrier Films Market Attractiveness Analysis, by Country, 2019-2027

Figure 43: Middle East & Africa Ultra-High Barrier Films Market Y-o-Y growth, by Material Type 2019-2027

Figure 44: Middle East & Africa Ultra-High Barrier Films Market Attractiveness Analysis, by Material Type 2019-2027

Figure 45: Middle East & Africa Ultra-High Barrier Films Market Y-o-Y growth, by Packaging Format 2019-2027

Figure 46: Middle East & Africa Ultra-High Barrier Films Market Attractiveness Analysis, by Packaging Format 2019-2027

Figure 47: Middle East & Africa Ultra-High Barrier Films Market Y-o-Y growth, by End Use 2019-2027

Figure 48: Middle East & Africa Ultra-High Barrier Films Market Attractiveness Analysis, by End Use 2019-2027