Reports

Reports

Increase in focus on sustainable industrial assets and surge in government regulations and landfill bans are some of the factors boosting market. The tire pyrolysis products market is expanding rapidly as industries seek eco-friendly and cost-effective solutions for fuel production, carbon black sourcing, and steel scrap applications. Tire pyrolysis products industry growth is supported by increased Industrial applications of pyrolysis oil from tires, governmental initiatives for green technologies, and advances in pyrolysis technology that increase the quality of the product and improve operational efficiency.

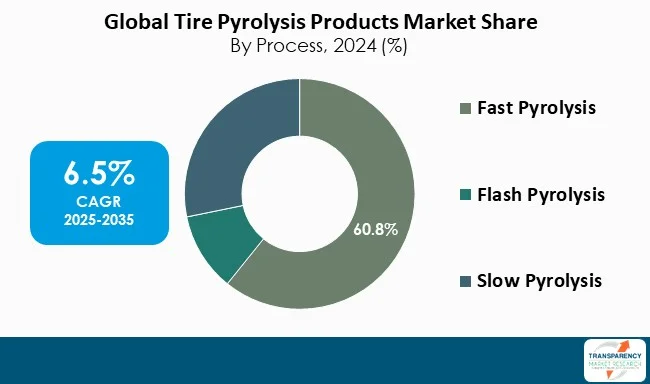

The industry’s growth continues to advance commercial developments based on low-carbon, high-performance materials driving market growth. Tire pyrolysis products market trends show that companies are in the process of commissioning new pyrolysis plants, so as to expand production and respond to the increasing demand for recovered materials. They are further doing their best to increase the efficiency of production, upgrade recycling technologies, and build effective supply chains, which are essential in response to the increasing demand for green materials.

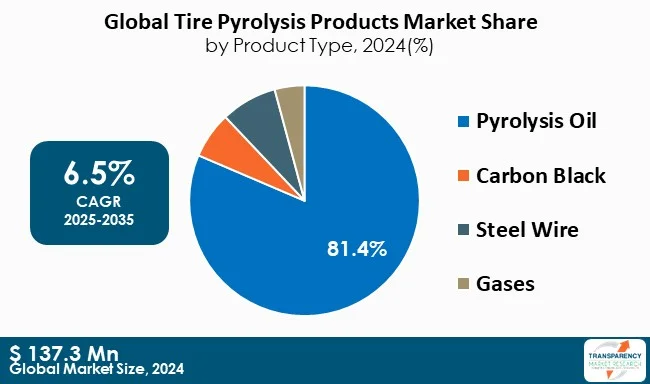

Tire pyrolysis implies a thermal decomposition of waste tires in an oxygen-free environment to generate valuable by-products that consist of pyrolysis oil and carbon black, and small quantities of steel wire, and combustible gases. Tire pyrolysis by-products have a broad range of uses across various industries including energy production, manufacturing, construction, and the automotive field.

Pyrolysis oil can be further processed for applications in fuel blending and as a chemical feedstock. Carbon black is also noticeably utilized in the production of rubber goods, inks, and paints. The recovered steel can be recycled, thereby contributing to resource recovery. Proper handling of waste tires through tire pyrolysis minimizes environmental pollution and promotes sustainability by offering alternative energy as well as raw material sources. This cutting-edge technology is necessary for promoting sustainability and improving the waste management sector.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

Tire pyrolysis drives significant growth in the market by generating waste tire conversion products, including pyrolysis oil, recovered carbon black (rCB), and scrap steel, which integrate seamlessly into industrial supply chains. As global interest in sustainability and circular economy principles rises, the tire pyrolysis products market share is expanding rapidly.

One billion end-of-life tires (ELTs) are discarded annually, causing immense environmental issues due to their non-biodegradable nature and toxic chemicals emitted during disposal or burning. Tire pyrolysis offers a green solution, effectively addressing these problems while producing useful products for industries worldwide.

Recovered carbon black has also become increasingly important across industries as a green substitute for virgin carbon black, thereby reducing carbon emissions and energy usage in production. Pyrolysis oil is used as a clean fuel in industrial boilers, cement kilns, and power generation facilities, as well as a petrochemical feedstock, further decreasing dependency on conventional fossil fuels. Pyrolysis also produces scrap steel that helps in satisfying worldwide construction and manufacturing needs for green materials.

Moreover, technology advancements in pyrolysis enhances efficiency, quality, and scalability, thus offering a competitive solution for both small-scale recycles and big industry players.

Tire pyrolysis market is boosted through the provision of a viable and sustainable solution to the increasing waste issue of end-of-life tires (ELTs). Thermal decomposition of the tires produces three valuable by-products: pyrolysis oil, recovered carbon black (rCB), and scrap steel. The products eliminate landfill-bound waste and considerably minimize the environmental footprint related to illegal tire disposal.

With more than a billion ELTs produced every year, inadequate disposal practices like landfilling or open burning contribute to land degradation, air pollution, and health hazards from harmful chemicals. Therefore, governments and environmental organizations worldwide are imposing stringent regulations to prevent these conventional modes of disposal, which promote the use of sustainable recycling technologies such as tire pyrolysis.

Moreover, regulatory frameworks in North America and Europe have implemented bans on tire dumping in landfills and offer financial incentives regarding adoption of advanced waste management systems. Extended Producer Responsibility (EPR) policies further support the market by encouraging manufacturers to invest in pyrolysis facilities, as they are responsible for the disposal of their products.

As majority of population becomes environmentally conscious, consumer pressure is inducing companies to turn to responsible and sustainable practices. This change has transformed tire pyrolysis technology into the central part of waste management programs. Car companies, manufacturing plants, and rubber companies are adopting pyrolysis technology to achieve critical environmental sustainability objectives increasingly. This large-scale adoption is accelerating tire pyrolysis product market growth, and it has established itself in the recycling and waste management sectors.

| Attribute | Detail |

|---|---|

| Leading Region | Asia Pacific |

According to the latest tire pyrolysis products market analysis, Asia Pacific held the largest share in 2023. Increased ELT generation, rising industrial demand, and technological advancements, shift toward sustainable raw materials, combined with government initiatives and growing awareness are some of the leading factors driving market expansion.

The Asia-Pacific’s market has some of the world's largest automotive markets, such as China, India, and Japan. As vehicle production and ownership continue to rise, so does the amount of waste tires. This growth in end-of-life tires (ELTs) requires an urgent need for environmentally-friendly disposal mechanisms, where tire pyrolysis has emerged as a principal technology to deal with waste in a most efficient manner. The increasing auto industry directly powers the demand for recovered carbon black (rCB) and pyrolysis oil, thereby fueling further market growth.

Governments in Asia are strengthening waste management regulations and pushing circular economy practices. China and India, for instance, have implemented rigorous landfill bans and enacted Extended Producer Responsibility (EPR) legislation requiring manufacturers to responsibly manage tire waste. Regulatory environment with incentives for sustainable waste management and carbon footprint minimization are fueling the transition to pyrolysis technologies, driving market growth.

Tire pyrolysis products market players, right from large multinational corporations to regional and small-scale operators, are investing in the development of new technology, increasing production capacities, and creating new products to satisfy the growing demand for sustainable waste handling systems.

Novum Energy Australia Pty Ltd, Entyr Limited, RCB Nanotehnologija d.o.o., Enespa AG, Niutech Environment Technology Corporation, Delta-Energy Group, City Circle Group (CCG), Black Bear Carbon B.V., Bolder Industries, DVA Renewable Energy JSC, Waverly Carbon Ltd, Scandinavian Enviro Systems AB, Reoil SP.o.o., Pyrum Innovations, Trident Fuels (Pty) Ltd, Alpha Carbone, New Energy Kft., Bridgestone Corporation, Green Rubber & Petroleum, Contec S.A., KGN Industries, and Vagmine Energies are some of the leading players operating in the tire pyrolysis products market.

Each of these companies have been profiled in the tire pyrolysis products market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

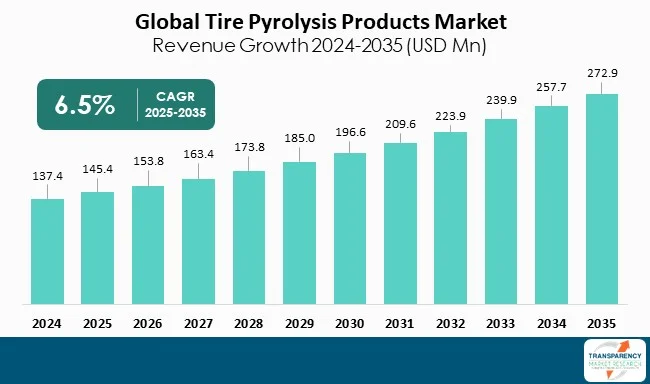

| Market Size Value in 2024 | US$ 137.3 Mn |

| Market Forecast Value in 2035 | US$ 269.6 Mn |

| Growth Rate (CAGR) | 6.5% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | Tons For Volume and US$ Mn For Value |

| Market Analysis | It includes cross segment analysis at Global as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Example: Electronic (PDF) + Excel |

| Market Segmentation | By Product by Application

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled (Potential Manufacturers) |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global tire pyrolysis products market was valued at US$ 137.3 Mn in 2024

The tire pyrolysis products industry is anticipated to grow at a CAGR of 6.5% from 2025 to 2035

Demand for advancing sustainability, circular economy initiatives, government policies, and landfill restrictions are the key drivers to the tire pyrolysis products market

Pyrolysis oil held the largest share under product segment in 2024

Asia Pacific was the leading region in 2024

Novum Energy Australia Pty Ltd, Enespa AG, City Circle Group (CCG), Black Bear Carbon B.V., Waverly Carbon Ltd, Scandinavian Enviro Systems AB, Pyrum Innovations, and Alpha Carbone

Table 1 Global Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Product by Application, 2020 to 2035

Table 2 Global Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020 to 2035

Table 3 Global Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Region, 2020 to 2035

Table 4 North America Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Product by Application, 2020 to 2035

Table 5 North America Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020 to 2035

Table 6 North America Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Country, 2020 to 2035

Table 7 U.S. Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Product by Application, 2020 to 2035

Table 8 U.S. Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020 to 2035

Table 9 Canada Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Product by Application, 2020 to 2035

Table 10 Canada Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020 to 2035

Table 11 Europe Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Product by Application, 2020 to 2035

Table 12 Europe Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020 to 2035

Table 13 Europe Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020 to 2035

Table 14 Germany Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Product by Application, 2020 to 2035

Table 15 Germany Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020 to 2035

Table 16 France Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Product by Application, 2020 to 2035

Table 17 France Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020 to 2035

Table 18 U.K. Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Product by Application, 2020 to 2035

Table 19 U.K. Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020 to 2035

Table 20 Italy Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Product by Application, 2020 to 2035

Table 21 Italy Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020 to 2035

Table 22 Spain Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Product by Application, 2020 to 2035

Table 23 Spain Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020 to 2035

Table 24 Russia & CIS Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Product by Application, 2020 to 2035

Table 25 Russia & CIS Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020 to 2035

Table 26 Rest of Europe Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Product by Application, 2020 to 2035

Table 27 Rest of Europe Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020 to 2035

Table 28 Asia Pacific Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Product by Application, 2020 to 2035

Table 29 Asia Pacific Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020 to 2035

Table 30 Asia Pacific Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020 to 2035

Table 31 China Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Product by Application 2020 to 2035

Table 32 China Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020 to 2035

Table 33 Japan Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Product by Application, 2020 to 2035

Table 34 Japan Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020 to 2035

Table 35 India Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Product by Application, 2020 to 2035

Table 36 India Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020 to 2035

Table 37 ASEAN Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Product by Application, 2020 to 2035

Table 38 ASEAN Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020 to 2035

Table 39 Rest of Asia Pacific Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Product by Application, 2020 to 2035

Table 40 Rest of Asia Pacific Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020 to 2035

Table 41 Latin America Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Product by Application, 2020 to 2035

Table 42 Latin America Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020 to 2035

Table 43 Latin America Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020 to 2035

Table 44 Brazil Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Product by Application, 2020 to 2035

Table 45 Brazil Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020 to 2035

Table 46 Mexico Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Product by Application, 2020 to 2035

Table 47 Mexico Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020 to 2035

Table 48 Rest of Latin America Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Product by Application, 2020 to 2035

Table 49 Rest of Latin America Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020 to 2035

Table 50 Middle East & Africa Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Product by Application, 2020 to 2035

Table 51 Middle East & Africa Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020 to 2035

Table 52 Middle East & Africa Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020 to 2035

Table 53 GCC Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Product by Application, 2020 to 2035

Table 54 GCC Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020 to 2035

Table 55 South Africa Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Product by Application, 2020 to 2035

Table 56 South Africa Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020 to 2035

Table 57 Rest of Middle East & Africa Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Product by Application, 2020 to 2035

Table 58 Rest of Middle East & Africa Tire Pyrolysis Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Process, 2020 to 2035

Figure 1 Global Tire Pyrolysis Products Market Value Share Analysis, by Product by Application, 2024, 2027, and 2035

Figure 2 Global Tire Pyrolysis Products Market Attractiveness, by Product by Application

Figure 3 Global Tire Pyrolysis Products Market Value Share Analysis, by Process, 2024, 2027, and 2035

Figure 4 Global Tire Pyrolysis Products Market Attractiveness, by Process

Figure 5 Global Tire Pyrolysis Products Market Value Share Analysis, by Region, 2024, 2027, and 2035

Figure 6 Global Tire Pyrolysis Products Market Attractiveness, by Region

Figure 7 North America Tire Pyrolysis Products Market Value Share Analysis, by Product by Application, 2024, 2027, and 2035

Figure 8 North America Tire Pyrolysis Products Market Attractiveness, by Product by Application

Figure 9 North America Tire Pyrolysis Products Market Value Share Analysis, by Process, 2024, 2027, and 2035

Figure 10 North America Tire Pyrolysis Products Market Attractiveness, by Process

Figure 11 North America Tire Pyrolysis Products Market Value Share Analysis, by Country, 2024, 2027, and 2035

Figure 12 North America Tire Pyrolysis Products Market Attractiveness, by Country

Figure 13 Europe Tire Pyrolysis Products Market Value Share Analysis, by Product by Application, 2024, 2027, and 2035

Figure 14 Europe Tire Pyrolysis Products Market Attractiveness, by Product by Application

Figure 15 Europe Tire Pyrolysis Products Market Value Share Analysis, by Process, 2024, 2027, and 2035

Figure 16 Europe Tire Pyrolysis Products Market Attractiveness, by Process

Figure 17 Europe Tire Pyrolysis Products Market Value Share Analysis, by Country, 2024, 2027, and 2035

Figure 18 Europe Tire Pyrolysis Products Market Attractiveness, by Country and Sub-region

Figure 19 Asia Pacific Tire Pyrolysis Products Market Value Share Analysis, by Product by Application, 2024, 2027, and 2035

Figure 20 Asia Pacific Tire Pyrolysis Products Market Attractiveness, by Product by Application

Figure 21 Asia Pacific Tire Pyrolysis Products Market Value Share Analysis, by Process, 2024, 2027, and 2035

Figure 22 Asia Pacific Tire Pyrolysis Products Market Attractiveness, by Process

Figure 23 Asia Pacific Tire Pyrolysis Products Market Value Share Analysis, by Country, 2024, 2027, and 2035

Figure 24 Asia Pacific Tire Pyrolysis Products Market Attractiveness, by Country and Sub-region

Figure 25 Latin America Tire Pyrolysis Products Market Value Share Analysis, by Product by Application, 2024, 2027, and 2035

Figure 26 Latin America Tire Pyrolysis Products Market Attractiveness, by Product by Application

Figure 27 Latin America Tire Pyrolysis Products Market Value Share Analysis, by Process, 2024, 2027, and 2035

Figure 28 Latin America Tire Pyrolysis Products Market Attractiveness, by Process

Figure 29 Latin America Tire Pyrolysis Products Market Value Share Analysis, by Country, 2024, 2027, and 2035

Figure 30 Latin America Tire Pyrolysis Products Market Attractiveness, by Country and Sub-region

Figure 31 Middle East & Africa Tire Pyrolysis Products Market Value Share Analysis, by Product by Application, 2024, 2027, and 2035

Figure 32 Middle East & Africa Tire Pyrolysis Products Market Attractiveness, by Product by Application

Figure 33 Middle East & Africa Tire Pyrolysis Products Market Value Share Analysis, by Process, 2024, 2027, and 2035

Figure 34 Middle East & Africa Tire Pyrolysis Products Market Attractiveness, by Process

Figure 35 Middle East & Africa Tire Pyrolysis Products Market Value Share Analysis, by Country, 2024, 2027, and 2035

Figure 36 Middle East & Africa Tire Pyrolysis Products Market Attractiveness, by Country and Sub-region