Reports

Reports

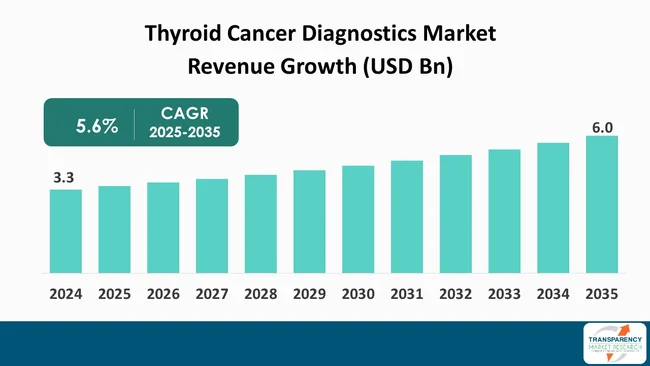

The global thyroid cancer diagnostics market size was valued at US$ 3.3 billion in 2024 and is projected to reach US$ 6.0 billion by 2035, expanding at a CAGR of 5.6% from 2025 to 2035. The market growth is driven by the rising prevalence of thyroid cancer, increasing public and government awareness through screening programs, and the advancement of diagnostic technologies.

The thyroid cancer diagnostics market is experiencing significant growth towing to the rising prevalence of thyroid cancer, increasing focus on early detection, and rising adoption of personalized medicine. Healthcare systems across the globe are investing in precision-based diagnostic techniques for better treatment outcomes. This is being reflected in the usage in molecular profiling, genomic testing, and risk stratification models for differentiating between malignant and benign thyroid nodules.

Besides, the growing awareness campaigns hosted by medical organizations has resulted in more number of diagnostic procedures being carried out, thus contributing to market growth in both - developed and emerging economies.

Similarly, the growing healthcare expenditure and expansion of diagnostic infrastructure, particularly in developing regions, is another aspect that bolsters thyroid cancer diagnostics market expansion. Besides, demand is further fueled by the increasing use of minimally-invasive diagnostic techniques, the need for quicker turnaround times, and the pursuit of cost-efficient testing. In addition, in several countries, favorable reimbursement policies are considerable factors contributing to the rising accessibility of thyroid cancer diagnostic tests.

One of the major trends in thyroid cancer diagnostics market is the broadening application of artificial intelligence (AI) and machine learning (ML) tools. Recently, AI image analysis and molecular interpretation systems have been successfully introduced to clinical workflows, thereby making it easier for pathologists to identify minute changes in ultrasound and cytology results.

Besides, the introduction of liquid biopsy and biomarker-based assays has a significant impact on the diagnostics field by providing means for non-invasive testing. The development of multiplex assays and companion diagnostics, which serve as a basis for selection of personalized treatment, is gaining traction.

Companies are emphasizing on research and development of genomic classifiers, multi-analyte assays, and next-generation sequencing panels that could lead to improved diagnostic performances characterize the competitive landscape of thyroid cancer diagnostics market. They are leveraging strategic partnerships with research institutes and hospitals in order to develop novel diagnostic biomarkers. The industry's move toward the use of digital pathology, cloud-based diagnostic platforms, and AI-integrated solutions exemplify the commitment of industries for accuracy and efficiency in thyroid cancer diagnosis and meet the evolving needs of healthcare providers and patients alike.

Thyroid cancer diagnostics is a comprehensive range of medical procedures and tests aimed for detecting, confirming, and characterizing malignant tumors in the thyroid gland. The thyroid, situated at the base of a person’s neck, does regulate metabolism through the production of hormones. As such, any abnormal growth of cells in this gland will eventually result in thyroid cancer. Diagnostics are necessary in differentiating between benign nodules and malignant nodules, thus ensuring interventions in treatment that are precise and in time.

Conventional ways of beginning with diagnosis include physical examination and ultrasound, which gives detailed information about the size, nature, and shape of these nodules in thyroid gland. Ultrasound-guided fine needle aspiration biopsy (FNAB) is often performed for cytotechnological examination and tissue sampling. Blood tests are taken to evaluate thyroid hormone levels and assess for the presence of malignant markers.

In addition to conventional methods, molecular testing has become an integral part of thyroid cancer diagnostics. Such tests include the study of genetic mutation and molecular markers like BRAF, RAS, and RET/PTC on different thyroid cancer subtypes. This enables precise diagnosis and guide personalized treatment approaches.

The development of next-generation sequencing, liquid biopsy, artificial intelligence-based imaging, and the other advanced diagnostic techniques is changing the landscape of early diagnosis of thyroid cancer. These techniques improve the accuracy of earlier diagnosis, reduce the need for surgery, and enable earlier intervention.

| Attribute | Detail |

|---|---|

| Thyroid Cancer Diagnostics Market Drivers |

|

The rising incidence of thyroid cancer is a significant driver to thyroid cancer diagnostics market. The increasing disease burden is propelling the demand for diagnostics that are accurate and efficient. Consequently, healthcare providers are installing new and improved diagnostics as well as molecular testing techniques to handle the upsurge of patients in a better manner.

Furthermore, the increasing rate of thyroid cancer has caused the authorities and the medical organizations to be more active in their screening and awareness programs. Such programs lead to the early detection of cases and the practice of going to the doctor regularly. As a result, the demand for diagnostic tools, imaging devices, and molecular tests has risen considerably in the areas of hospitals, diagnostic laboratories, and research institutes.

Besides, the massive increase in thyroid cancer cases has caused the mobilization of a lot of funds for research and development activities pertaining to more accurate and less invasive diagnostic technologies. The most recent technological advancements in this area include the use of next-generation sequencing (NGS) panels and genomic classifiers that help in distinguishing the benign from the malignant nodules.

The continuous improvement of diagnostic tests is significant growth factor for the thyroid cancer diagnostics market. Conventional procedures such as fine-needle aspiration biopsy and ultrasound have been replaced by new molecular and genetic testing techniques giving more precise results for thyroid nodules. These innovations let frontline healthcare professionals identify cancers at their earliest stage, thereby reducing the number of patients who undergo unnecessary surgeries and facilitating the selection of tailored, personalized treatment plans.

The merger of next-generation sequencing (NGS) and genomic classifiers has revolutionized the process of diagnosis in entirety. These methods make it possible to single out the specific genetic mutations and molecular markers that are related to different types of thyroid cancer.

By offering detailed diagnostic data, they contribute to distinction of patients according to their risk levels and selection of the correct treatment. This transition to precision diagnostics has a positive impact on the entire clinical decision-making process and on the treatment efficiency in general.

Moreover, development of state-of-the-art ultrasound and AI-assisted imaging analysis has remarkably aided in accurate detection and visualization capabilities. The deployment of robotic intelligence and pattern recognition algorithms to interpret imaging and cytology results is attracting adoption due to double benefits of fewer diagnostic errors and optimized workflow.

Furthermore, these innovations in technology enable collaborations among research institutions, diagnostic companies, and healthcare professionals. The acceptance of automated platforms, liquid biopsy assays, and integrated digital solutions is further allowing for enhanced scalability and accessibility. Together, these innovations are revolutionizing thyroid cancer diagnosis as a more accurate, non-invasive, and patient-centered approach hence, the further witnessing market penetration.

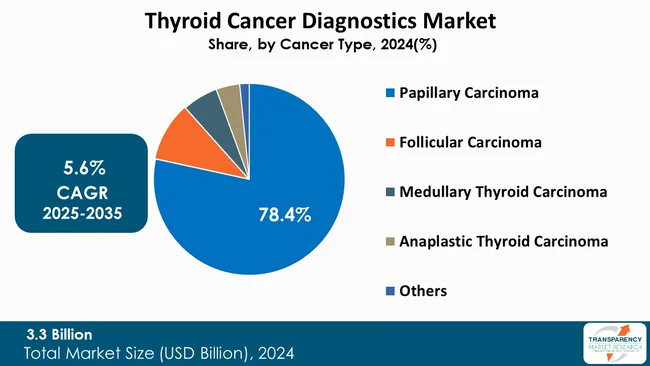

Since papillary carcinoma is the most frequently diagnosed form of thyroid cancer, it takes the largest share of the thyroid cancer diagnostics market. Due to its frequent occurrence, an increasingly wide range of diagnostic tools is used to detect and distinguish benign nodules, which are found frequently, including fine-needle aspiration biopsy, ultrasound imaging, and molecular assays.

Moreover, papillary carcinoma is frequently associated with particular genetic alterations, for example, BRAF and RET/PTC rearrangements, which are accurately identified by advanced molecular diagnostics. The increased implementation of next-generation sequencing and targeted genomic testing is a key factor for strengthening the diagnostic attention of this subtype, thereby contributing to its market dominance.

| Attribute | Detail |

|---|---|

| Leading Region |

|

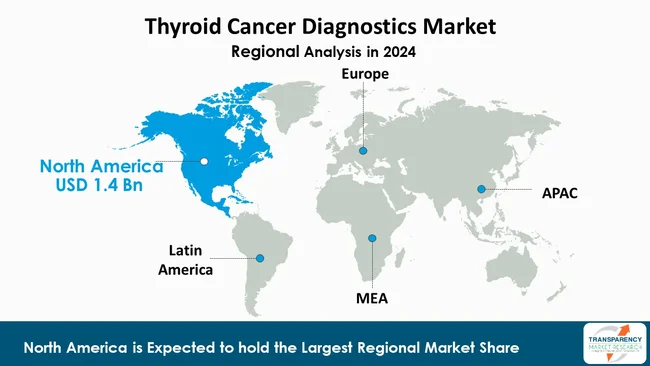

As per the latest thyroid cancer diagnostics market analysis, North America dominated in 2024, capturing a market share of 41.8%. This is primarily attributable to the region’s well-established healthcare infrastructure, presence of a large number of leading diagnostic companies, and high adoption of innovative testing technologies.

Precision diagnostic tools like molecular assays and next-generation sequencing are some of the advanced technologies beneficial for this region. Besides, there is also a strong demand for well-established screening programs, high awareness of thyroid disorders, and easy access to precision diagnostic tools.

In addition, the market growth is supported by a number of factors such as favorable reimbursement policies, increase in healthcare expenditure, and a high rate of early detection of diseases. Research initiatives, clinical collaborations, and the regulatory approval of new diagnostic solutions are some of the factors, which reinstates the position of North America in the global market.

Companies operating in the thyroid cancer diagnostics market are emphasizing collaborative initiatives with universities, enhancing product lines with new proprietary diagnostic technology, and investing in AI-enabled technology.

GE HealthCare, Siemens Healthineers AG, Koninklijke Philips N.V, CANON MEDICAL SYSTEMS CORPORATION, FUJIFILM Holdings Corporation, Samsung Medison Co., Ltd., Abbott, Novus Biologicals, Agilent Technologies, Inc., Beckman Coulter, Inc. (Danaher Corporation), CTK Biotech, Inc., Cosmic Scientific Technologies, F. Hoffmann-La Roche Ltd, DiaSorin S.p.A., Sonic Healthcare Limited, and Meridian Bioscience Inc. are some of the leading players operating in the global market.

Each of these players has been profiled in the thyroid cancer diagnostics industry research report based on parameters such as financial overview, company overview, business strategies, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 3.3 Bn |

| Forecast Value in 2035 | US$ 6.0 Bn |

| CAGR | 5.6% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Thyroid Cancer Diagnostics Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Cancer Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global thyroid cancer diagnostics market was valued at US$ 3.3 Bn in 2024

The global thyroid cancer diagnostics industry is projected to reach more than US$ 6.0 Bn by the end of 2035

The rising prevalence of thyroid cancer, increasing public and government awareness through screening programs, and the advancement of diagnostic technologies such as AI-enable imaging and molecular testing are some of the factors driving the expansion of thyroid cancer diagnostics market.

The CAGR is anticipated to be 5.6% from 2025 to 2035

GE HealthCare, Siemens Healthineers AG, Koninklijke Philips N.V, CANON MEDICAL SYSTEMS CORPORATION, FUJIFILM Holdings Corporation, Samsung Medison Co., Ltd., Abbott, Novus Biologicals, Agilent Technologies, Inc., Beckman Coulter, Inc. (Danaher Corporation), CTK Biotech, Inc., Cosmic Scientific Technologies, F. Hoffmann-La Roche Ltd, DiaSorin S.p.A., Sonic Healthcare Limited, and Meridian Bioscience Inc.

Table 01: Global Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, By Cancer Type, 2020 to 2035

Table 02: Global Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, By Diagnostic Test Type, 2020 to 2035

Table 03: Global Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, By Imaging, 2020 to 2035

Table 04: Global Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, By Blood Tests, 2020 to 2035

Table 05: Global Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, By Genetic Marker Tests, 2020 to 2035

Table 06: Global Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 07: Global Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 08: North America Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 09: North America Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, By Cancer Type, 2020 to 2035

Table 10: North America Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, By Diagnostic Test Type, 2020 to 2035

Table 11: North America Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, By Imaging, 2020 to 2035

Table 12: North America Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, By Blood Tests, 2020 to 2035

Table 13: North America Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, By Genetic Marker Tests, 2020 to 2035

Table 14: North America Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 15: Europe Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 16: Europe Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, By Cancer Type, 2020 to 2035

Table 17: Europe Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, By Diagnostic Test Type, 2020 to 2035

Table 18: Europe Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, By Imaging, 2020 to 2035

Table 19: Europe Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, By Blood Tests, 2020 to 2035

Table 20: Europe Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, By Genetic Marker Tests, 2020 to 2035

Table 21: Europe Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 22: Asia Pacific Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 23: Asia Pacific Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, By Cancer Type, 2020 to 2035

Table 24: Asia Pacific Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, By Diagnostic Test Type, 2020 to 2035

Table 25: Asia Pacific Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, By Imaging, 2020 to 2035

Table 26: Asia Pacific Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, By Blood Tests, 2020 to 2035

Table 27: Asia Pacific Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, By Genetic Marker Tests, 2020 to 2035

Table 28: Asia Pacific Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 29: Latin America Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 30: Latin America Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, By Cancer Type, 2020 to 2035

Table 31: Latin America Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, By Diagnostic Test Type, 2020 to 2035

Table 32: Latin America Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, By Imaging, 2020 to 2035

Table 33: Latin America Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, By Blood Tests, 2020 to 2035

Table 34: Latin America Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, By Genetic Marker Tests, 2020 to 2035

Table 35: Latin America Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 36: Europe Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 37: Europe Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, By Cancer Type, 2020 to 2035

Table 38: Europe Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, By Diagnostic Test Type, 2020 to 2035

Table 39: Europe Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, By Imaging, 2020 to 2035

Table 40: Europe Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, By Blood Tests, 2020 to 2035

Table 41: Europe Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, By Genetic Marker Tests, 2020 to 2035

Table 42: Europe Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Figure 01: Global Thyroid Cancer Diagnostics Market Value Share Analysis, By Cancer Type, 2024 and 2035

Figure 02: Global Thyroid Cancer Diagnostics Market Attractiveness Analysis, By Cancer Type, 2025 to 2035

Figure 03: Global Thyroid Cancer Diagnostics Market Revenue (US$ Bn), by Papillary Carcinoma, 2020 to 2035

Figure 04: Global Thyroid Cancer Diagnostics Market Revenue (US$ Bn), by Follicular Carcinoma, 2020 to 2035

Figure 05: Global Thyroid Cancer Diagnostics Market Revenue (US$ Bn), by Medullary Thyroid Carcinoma, 2020 to 2035

Figure 06: Global Thyroid Cancer Diagnostics Market Revenue (US$ Bn), by Anaplastic Thyroid Carcinoma, 2020 to 2035

Figure 07: Global Thyroid Cancer Diagnostics Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 08: Global Thyroid Cancer Diagnostics Market Value Share Analysis, By Diagnostic Test Type, 2024 and 2035

Figure 08: Global Thyroid Cancer Diagnostics Market Attractiveness Analysis, By Diagnostic Test Type, 2025 to 2035

Figure 09: Global Thyroid Cancer Diagnostics Market Revenue (US$ Bn), by Imaging, 2020 to 2035

Figure 10: Global Thyroid Cancer Diagnostics Market Revenue (US$ Bn), by Blood Tests, 2020 to 2035

Figure 11: Global Thyroid Cancer Diagnostics Market Revenue (US$ Bn), by Genetic Marker Tests, 2020 to 2035

Figure 12: Global Thyroid Cancer Diagnostics Market Revenue (US$ Bn), by Biopsy, 2020 to 2035

Figure 13: Global Thyroid Cancer Diagnostics Market Value Share Analysis, By End-user, 2024 and 2035

Figure 14: Global Thyroid Cancer Diagnostics Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 15: Global Thyroid Cancer Diagnostics Market Revenue (US$ Bn), by Hospital Laboratories, 2020 to 2035

Figure 16: Global Thyroid Cancer Diagnostics Market Revenue (US$ Bn), by Diagnostic Centers, 2020 to 2035

Figure 17: Global Thyroid Cancer Diagnostics Market Revenue (US$ Bn), by Academic and Research Institutes, 2020 to 2035

Figure 18: Global Thyroid Cancer Diagnostics Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 20: Global Thyroid Cancer Diagnostics Market Value Share Analysis, By Region, 2024 and 2035

Figure 21: Global Thyroid Cancer Diagnostics Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 22: North America Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 23: North America Thyroid Cancer Diagnostics Market Value Share Analysis, by Country, 2024 and 2035

Figure 24: North America Thyroid Cancer Diagnostics Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 25: North America Thyroid Cancer Diagnostics Market Value Share Analysis, By Cancer Type, 2024 and 2035

Figure 26: North America Thyroid Cancer Diagnostics Market Attractiveness Analysis, By Cancer Type, 2025 to 2035

Figure 27: North America Thyroid Cancer Diagnostics Market Value Share Analysis, By Diagnostic Test Type, 2024 and 2035

Figure 28: North America Thyroid Cancer Diagnostics Market Attractiveness Analysis, By Diagnostic Test Type, 2025 to 2035

Figure 29: North America Thyroid Cancer Diagnostics Market Value Share Analysis, By End-user, 2024 and 2035

Figure 30: North America Thyroid Cancer Diagnostics Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 31: Europe Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 32: Europe Thyroid Cancer Diagnostics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 33: Europe Thyroid Cancer Diagnostics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 34: Europe Thyroid Cancer Diagnostics Market Value Share Analysis, By Cancer Type, 2024 and 2035

Figure 35: Europe Thyroid Cancer Diagnostics Market Attractiveness Analysis, By Cancer Type, 2025 to 2035

Figure 36: Europe Thyroid Cancer Diagnostics Market Value Share Analysis, By Diagnostic Test Type, 2024 and 2035

Figure 37: Europe Thyroid Cancer Diagnostics Market Attractiveness Analysis, By Diagnostic Test Type, 2025 to 2035

Figure 38: Europe Thyroid Cancer Diagnostics Market Value Share Analysis, By End-user, 2024 and 2035

Figure 39: Europe Thyroid Cancer Diagnostics Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 40: Asia Pacific Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 41: Asia Pacific Thyroid Cancer Diagnostics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 42: Asia Pacific Thyroid Cancer Diagnostics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 43: Asia Pacific Thyroid Cancer Diagnostics Market Value Share Analysis, By Cancer Type, 2024 and 2035

Figure 44: Asia Pacific Thyroid Cancer Diagnostics Market Attractiveness Analysis, By Cancer Type, 2025 to 2035

Figure 45: Asia Pacific Thyroid Cancer Diagnostics Market Value Share Analysis, By Diagnostic Test Type, 2024 and 2035

Figure 46: Asia Pacific Thyroid Cancer Diagnostics Market Attractiveness Analysis, By Diagnostic Test Type, 2025 to 2035

Figure 47: Asia Pacific Thyroid Cancer Diagnostics Market Value Share Analysis, By End-user, 2024 and 2035

Figure 48: Asia Pacific Thyroid Cancer Diagnostics Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 49: Latin America Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 50: Latin America Thyroid Cancer Diagnostics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 51: Latin America Thyroid Cancer Diagnostics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 52: Latin America Thyroid Cancer Diagnostics Market Value Share Analysis, By Cancer Type, 2024 and 2035

Figure 53: Latin America Thyroid Cancer Diagnostics Market Attractiveness Analysis, By Cancer Type, 2025 to 2035

Figure 54: Latin America Thyroid Cancer Diagnostics Market Value Share Analysis, By Diagnostic Test Type, 2024 and 2035

Figure 55: Latin America Thyroid Cancer Diagnostics Market Attractiveness Analysis, By Diagnostic Test Type, 2025 to 2035

Figure 56: Latin America Thyroid Cancer Diagnostics Market Value Share Analysis, By End-user, 2024 and 2035

Figure 57: Latin America Thyroid Cancer Diagnostics Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 58: Middle East & Africa Thyroid Cancer Diagnostics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 59: Middle East & Africa Thyroid Cancer Diagnostics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 60: Middle East & Africa Thyroid Cancer Diagnostics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 61: Middle East & Africa Thyroid Cancer Diagnostics Market Value Share Analysis, By Cancer Type, 2024 and 2035

Figure 62: Middle East & Africa Thyroid Cancer Diagnostics Market Attractiveness Analysis, By Cancer Type, 2025 to 2035

Figure 63: Middle East & Africa Thyroid Cancer Diagnostics Market Value Share Analysis, By Diagnostic Test Type, 2024 and 2035

Figure 64: Middle East & Africa Thyroid Cancer Diagnostics Market Attractiveness Analysis, By Diagnostic Test Type, 2025 to 2035

Figure 65: Middle East & Africa Thyroid Cancer Diagnostics Market Value Share Analysis, By End-user, 2024 and 2035

Figure 66: Middle East & Africa Thyroid Cancer Diagnostics Market Attractiveness Analysis, By End-user, 2025 to 2035