Reports

Reports

The global thoracic endoscope market is likely to witness consistency. The major reasons behind this growth are the increased incidences of thoracic diseases, rising demand for minimally-invasive surgical procedures, and continuous progress in imaging and endoscopic technologies. The market will experience positive effects from new developments in high-definition imaging, and flexible endoscopes that work with AI-assisted diagnostic tools to improve both procedural accuracy and patient results.

The strict regulatory requirements and expensive device prices create obstacles, but analysts predict that rising awareness among healthcare providers, and patients, along with expanding market acceptance in developing countries will drive market growth. Moreover, reimbursement policies along with government initiatives that are facilitating early diagnosis and promoting minimally invasive procedures will have a positive impact on market adoption. The global thoracic endoscope market has a bright future and will experience gradual growth throughout the forecast period, due to ongoing research and development.

Additional factors that have contributed to this trend are the need for early diagnosis, reduction in duration of hospital stays, and patient's improvement. The demand for such equipment is especially high in healthcare systems with advanced technologies. However, the high costs of devices, and low accessibility in underdeveloped regions are restraining the market. The market outlook shows strong performance because hospitals, clinics, and specialty care centers worldwide continue to experience stable demand. The strategic partnerships and mergers and acquisitions among major players will create increased competition.

The thoracic endoscope market includes medical devices for visualizing, diagnosing, and conducting minimally-invasive operations in the thoracic cavity, such as the lungs, pleura, and mediastinum. Such endoscopes are the essential elements during thoracic operations and diagnostic interventions, thereby allowing additional precision, less surgical trauma, and quicker patient recovery in comparison with the conventional open procedures.

Over the years, the usage of minimally-invasive procedures has grown dramatically due to the progress in endoscopic imaging and instrumentation. The worldwide increase in incidences of thoracic diseases has led to rise in the need for thoracic endoscopes directing the market to a necessary part of the med-tech Industry that deals with the whole medical device sector. For instance, the U.S. Food and Drug Administration (FDA) has announced a class 1 recall of some Olympus Single-Use Guide Sheath Kits (models K-201, K-202, K-203, K-204) due to a safety issue: the radiopaque tip of the guide sheath can separate unintentionally during the procedure and get dropped into the patient, which could lead to severe injuries.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

One major factor that has been leading to the greater demand for thoracic endoscopic procedures is the rising incidence of chronic respiratory diseases that include lung cancer, chronic obstructive pulmonary disease (COPD), and the other pulmonary disorders. The use of endoscopes allows precise and early identification, minimally-invasive therapy, thus having a positive impact on patients' recovery and reducing the time of hospitalization. According to World Health Organization, Chronic obstructive pulmonary disease (COPD) is the fourth leading cause of death worldwide, causing 3.5 million deaths in 2021. Nearly 90% of COPD deaths aged 70 and below occur in low- and middle-income countries (LMIC).

Furthermore, the global cases of respiratory diseases are still on the rise. In order to improve accuracy and efficiency, medical practitioners are turning more and more to the use of high-end thoracic endoscopy tools. This trend is resulting in the expansion of the thoracic endoscope market.

One of the major reasons for the growth of the thoracic endoscopy market is the escalating need for minimally invasive surgeries (MIS). With the help of thoracic endoscopes, surgeons can now carry out complicated operations with less incision, minimal trauma to the patient, and less time for the recovery process than that of the conventional open surgeries.

Patient preference for less invasive treatments, progress in endoscopic technology, and the global uptake of MIS by hospitals and specialized clinics are all contributing to this trend. Healthcare systems aiming for optimization and better patient outcomes will still be the clients of thoracic endoscopy, which will be used not only for diagnosis but also for treatment. The use of thoracic endoscopy is overwhelmingly going to be more widespread as such systems make their way into the future.

The precision and safety of thoracic endoscopic procedures have been improved to a greater extent by continuous innovations in imaging, navigation, and instrumentation. The increasing demand for surgeon training programs and the opening of minimally-invasive surgery (MIS) equipment are the two factors that are helping the use of MIS to spread to hospitals across the globe. For instance, the European Union's Medical Device Regulation (EU) 2017/745), which came into effect in May 2021, has significantly changed the requirements for the authorization of medical devices, in particular the ones applied in endoscopy.

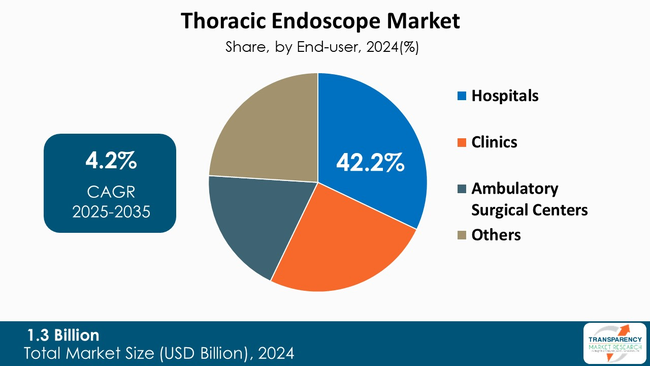

Regarding end-users, the hospitals are a leading segment with 42.2% of share in global thoracic endoscopic market. The segment of thoracic endoscope industry that caters to the hospitals is expected to hold a leading position as the hospitals are the places where majority of the minimally-invasive procedures, which are the chief cause of the demand for the endoscopes, are conducted.

In general, medical centers are equipped with the most advanced high-tech medical devices, staffed by professionals with high qualifications, and always have a large number of patients who need to undergo thoracic surgeries. The trend of relying on the endoscopic procedures is the main reason for the patient's preference for this category that has the advantages of less recovery time and fewer risks than the traditional surgeries.

Moreover, the advanced technology is always a pull factor for the medical organizations to take the step toward the adoption of the new devices that will ensure the patients' better treatment. Consequently, this leads to a higher need for thoracic endoscopes that have been trending in the same pattern as their demand in the market.

| Attribute | Detail |

|---|---|

| Leading Region |

|

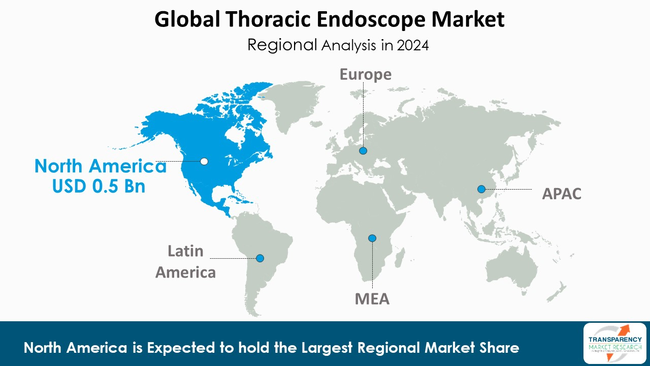

Currently, the thoracic endoscope market worldwide is led by the North American region with 40.3% of market share, which is credited to its advanced healthcare facilities, significant uptake of advanced medical technologies, and the substantial presence of top companies in the market. The region experiences the positive side of an increasing number of chronic respiratory diseases, the general approval of minimally-invasive surgical methods, and attractive refund policies that stimulate the utilization of the innovative diagnostic and therapeutic instruments.

Moreover, ongoing scientific research and inventive activities as well as favorable government measures and the clearance by the regulatory bodies, moves the market in North America for thoracic endoscopy to a higher position as the most dominant market worldwide. For instance, at Johns Hopkins, surgeons have an FDA-approved fluorescent imaging agent that can help them see those tiny lung nodules that were previously not visible during chest surgeries. With this auxiliary technology, the surgeon's ability to find tumors in minimally invasive thoracic procedures may be increased, thus, making the results better and decreasing the risk of complications.

Olympus, KARL STORZ, Boston Scientific Corporation, FUJIFILM, HOYA Corporation, Medtronic, STERIS, B. Braun SE, CONMED Corporation, Cook, Teleflex Incorporated, EndoMed Systems GmbH, Richard Wolf GmbH, Ambu A/S, Stryker are some of the leading manufacturers operating in the global Thoracic Endoscope market.

Each of these companies has been profiled in the thoracic endoscope market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

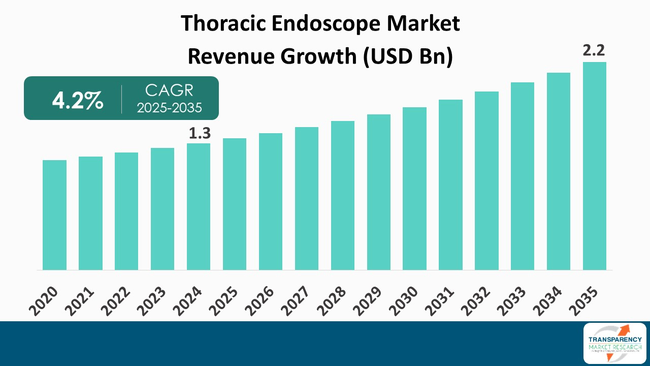

| Size in 2024 | US$ 1.3 Bn |

| Forecast Value in 2035 | More than US$ 2.2 Bn |

| CAGR | 4.2 % |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Product Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global thoracic endoscope market was valued at US$ 1.3 Bn in 2024

The global thoracic endoscope industry is projected to reach more than US$ 2.2 Bn by the end of 2035

Rising prevalence of chronic respiratory diseases and increasing demand for minimally invasive surgery (MIS) are factors driving growth

The CAGR is anticipated to be 4.2% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Olympus, KARL STORZ, Boston Scientific Corporation, FUJIFILM, HOYA Corporation, Medtronic, STERIS, B. Braun SE, CONMED Corporation, Cook, Teleflex Incorporated, EndoMed Systems GmbH, Richard Wolf GmbH, Ambu A/S, Stryker and other prominent players.

Table 01: Global Thoracic Endoscope Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 02: Global Thoracic Endoscope Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 03: Global Thoracic Endoscope Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 04: North America Thoracic Endoscope Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 05: North America Thoracic Endoscope Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 06: North America Thoracic Endoscope Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 07: Europe Thoracic Endoscope Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 08: Europe Thoracic Endoscope Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 09: Europe Thoracic Endoscope Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 10: Asia Pacific Thoracic Endoscope Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 11: Asia Pacific Thoracic Endoscope Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 12: Asia Pacific Thoracic Endoscope Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 13: Latin America Thoracic Endoscope Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 14: Latin America Thoracic Endoscope Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 15: Latin America Thoracic Endoscope Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 16: Middle East and Africa Thoracic Endoscope Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 17: Middle East and Africa Thoracic Endoscope Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 18: Middle East and Africa Thoracic Endoscope Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Figure 01: Global Thoracic Endoscope Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 02: Global Thoracic Endoscope Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 03: Global Thoracic Endoscope Market Revenue (US$ Bn), by Rigid Endoscopes, 2020 to 2035

Figure 04: Global Thoracic Endoscope Market Revenue (US$ Bn), by Flexible Endoscopes, 2020 to 2035

Figure 05: Global Thoracic Endoscope Market Value Share Analysis, by End-user, 2024 and 2035

Figure 06: Global Thoracic Endoscope Market Attractiveness Analysis, by End-user, 2024 and 2035

Figure 07: Global Thoracic Endoscope Market Revenue (US$ Bn), by Hospitals, 2025 to 2035

Figure 08: Global Thoracic Endoscope Market Revenue (US$ Bn), by Clinics, 2020 to 2035

Figure 09: Global Thoracic Endoscope Market Revenue (US$ Bn), by Ambulatory surgical centers, 2020 to 2035

Figure 10: Global Thoracic Endoscope Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 11: Global Thoracic Endoscope Market Value Share Analysis, By Region, 2024 and 2035

Figure 12: Global Thoracic Endoscope Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 13: North America Thoracic Endoscope Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 14: North America Thoracic Endoscope Market Value Share Analysis, by Country, 2024 and 2035

Figure 15: North America Thoracic Endoscope Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 16: North America Thoracic Endoscope Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 17: North America Thoracic Endoscope Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 18: North America Thoracic Endoscope Market Value Share Analysis, by End-user, 2024 and 2035

Figure 19: North America Thoracic Endoscope Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 20: Europe Thoracic Endoscope Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 21: Europe Thoracic Endoscope Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 22: Europe Thoracic Endoscope Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 23: Europe Thoracic Endoscope Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 24: Europe Thoracic Endoscope Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 25: Europe Thoracic Endoscope Market Value Share Analysis, by End-user, 2024 and 2035

Figure 26: Europe Thoracic Endoscope Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 27: Asia Pacific Thoracic Endoscope Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 28: Asia Pacific Thoracic Endoscope Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 29: Asia Pacific Thoracic Endoscope Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 30: Asia Pacific Thoracic Endoscope Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 31: Asia Pacific Thoracic Endoscope Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 32: Asia Pacific Thoracic Endoscope Market Value Share Analysis, by End-user, 2024 and 2035

Figure 33: Asia Pacific Thoracic Endoscope Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 34: Latin America Thoracic Endoscope Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 35: Latin America Thoracic Endoscope Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 36: Latin America Thoracic Endoscope Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 37: Latin America Thoracic Endoscope Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 38: Latin America Thoracic Endoscope Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 39: Latin America Thoracic Endoscope Market Value Share Analysis, by End-user, 2024 and 2035

Figure 40: Latin America Thoracic Endoscope Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 41: Middle East and Africa Data Thoracic Endoscope Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 42: Middle East and Africa Data Thoracic Endoscope Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 43: Middle East and Africa Data Thoracic Endoscope Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 44: Middle East and Africa Thoracic Endoscope Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 45: Middle East and Africa Thoracic Endoscope Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 46: Middle East and Africa Thoracic Endoscope Market Value Share Analysis, by End-user, 2024 and 2035

Figure 47: Middle East and Africa Thoracic Endoscope Market Attractiveness Analysis, by End-user, 2025 to 2035