Reports

Reports

The temperature sensor market’s growth is driven by increased demand for consumer electronics, healthcare devices, and industrial revolution 4.0. Devices like smartphones, laptops, wearable, (smartwatches, fitness tracker), smart homes, VR headset, patient monitoring system are embedded by temperature sensors to manage battery life, overheating and performance.

Players in the industry are focused on diversifying their product mix to deliver innovative products and services to meet consumer need. Economies like China, India, Vietnam are hubs for the supply and production of semiconductors and electronics. The rapid industrialization in these areas is adopting wireless/monitoring system and digital sensors.

In addition, the rising adoption of wearables and smart health devices for fitness-conscious consumers are creating huge market demand for temperature sensors market. Temperature sensors are wireless, flexible, IoT enabled, have high accuracy, and require low-maintenance.

Safety concern and ease of lifestyle boost the demand for temperature sensor market. Key players in the market have invested in clinical collaborations, tourism collaborations, key launches, and health research to take the market forward. The market is evolving rapidly in a wide variety of ways fueled by ongoing innovation, increased fitness awareness, and overall evolving trends in the global market.

The temperature sensor market is a subset of semiconductor and electronics industry. It helps devices to monitor temperature to keep people safe and improve the quality of life. Several industries use temperature sensor devices for different objectives such as robotics and automation, food & beverages, healthcare and medical devices, etc.

Maintaining the temperature is crucial for any devices with regards to detecting the system, data, heating, and environment temperature. The increasing application of internet of things (IoT) is boosting the use of body-worn temperature sensors. Body-worn sensors are utilized to screen the condition of patients continuously. This also propels the temperature sensor market.

Currently, smartwatches with inbuilt temperature sensor are used to detect temperature as well as monitor heart rate. Rise in popularity of wearable clinical observing gadgets and smartwatches is boosting the interest for body-worn temperature sensors, which, in turn, is also propelling the temperature sensor market.

Technologies like Artificial Intelligence (AI) and Machine Learning (ML) plays a crucial role in transforming the market for temperature sensor. The massive growth of smart devices including electronics, wearables, and appliances create huge demand for automotive, consumer electronics, healthcare, and other industry.

Furthermore, rise in adoption of temperature sensors in automotive, healthcare, food & beverages and smart devices sectors to enhance device performance, maintain vehicle safety, and reduce emission is boosting the temperature sensor market.

| Attribute | Detail |

|---|---|

| Temperature Sensor Market Drivers |

|

The rise of comfort, reliability, and the other advanced features in vehicles is boosting the temperature sensor market. Demand for accurate temperature sensors is rising in smartwatches and fitness bands, Home appliances (microwaves, refrigerators, smart thermostats), patient monitoring (wearables, patches, implants), Incubators and sterilizers, battery temperature management. This is also driving the market.

Rise in awareness regarding fitness and remote patient monitoring surge the demand for temperature sensors market. For example- kinsa smart thermometer syncs with mobile app to detect fever trends and send temperature data to the smartphone or doctor. This helps patient at home to recover from illness.

The progressive growth of the Internet of Things (IoT) and smart devices are the main stimuli for the temperature sensor market. As systems become interconnected in homes, factories, transport networks, and critical infrastructure, there has been a significant increase in demand for monitoring the environment and collecting real-time data. Temperature sensors take on a pivotal role for these ecosystems to accurately monitor and track thermal wellbeing in a continuous manner to optimize safety for devices, energy consumption, and operating reliability. In smart homes, for instance, temperature sensors are a key component to regulate the systems for heating, ventilation, air conditioning, and energy savings and knowledge of comfort in the environment for occupants. Similarly, in an industrial IoT (Internet of Things) environment, temperature sensors are part of predictive maintenance to assist with avoiding the failure of equipment by noticing overheating or abnormal temperature change.

Automotive industry holds the largest market share in temperature sensors market due to the use of temperature sensors in contacted and non-contacted sensors, semiconductor-based, and high demand in electric vehicle (EVs). In automotives, temperature sensor plays a vital role in monitoring battery temperature, cabin climate control, and advanced driver assistance system (ADAS).

Also, in electric vehicles, the engine temperature is continuously monitored and regulated at a certain level to make the engine perform properly. This is also projected to boost the demand for temperature Sensor market.

| Attribute | Detail |

|---|---|

| Leading Region |

|

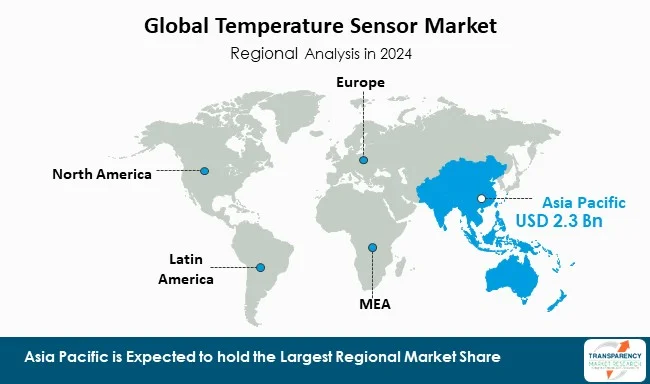

Asia Pacific leads the global market and is expected to maintain its dominance during the forecast period as well, as the region is presently the largest automotive and electronics manufacturer and witnesses robust demand for consumer devices such as portable healthcare electronics.

China is also home to many of the world's largest automotive and electronics companies, who consistently release new technologies including digital sensors and IoT-enabled sensors. Also, strong expansion of EVs manufacturing has increased the demand for temperature sensors.

India is also reporting progressive engagement with providers of smart industrial automation and consumer electronics. Demand for wearables and monitoring system devices are increasing in this area due to rapid urbanization.

Key players operating in the temperature sensor market are investing in strategic partnerships, innovation, and technological advancements. They focus on improving imaging clarity and expanding product portfolios, ensuring sustained growth and leadership in the evolving healthcare landscape.

Texas Instruments Incorporated, Amphenol Advanced Sensors, Analog Devices, Inc., Dwyer Instruments LTD, Emerson Electric Co., Honeywell International Inc., Infineon Technologies AG., Microchip Technology Inc., OMRON Corporation, ABB Lt, Robert Bosch GmbH., Semiconductor Components Industries, LLC, Siemens AG, STMicroelectronics, TDK Electronics AG, TE Connectivity Ltd., Yokogawa Electric Corporation are the key players in market.

Each of these players has been profiled in the temperature sensor market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

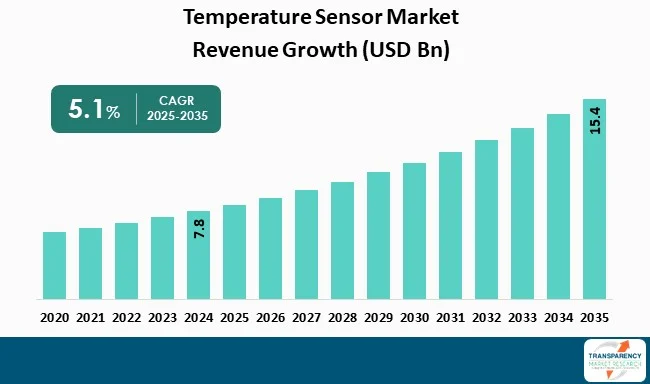

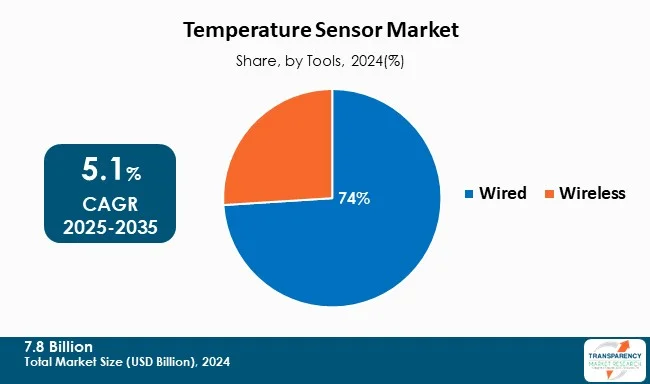

| Size in 2024 | US$ 7.8 Bn |

| Forecast Value in 2035 | US$ 15.4 Bn |

| CAGR | 5.1% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2024 |

| Quantitative Units | US$ Bn |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Product Type o Contact Temperature Sensors

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global temperature sensor market was valued at US$ 7.8 Bn in 2024

The global temperature sensor market is projected to reach US$ 15.4 Bn by the end of 2035

Increasing demand in consumer electronics, and medical devices and adoption across various industry verticals are some of the factors driving the expansion of temperature sensor market.

The CAGR is anticipated to be 5.1% from 2025 to 2035

Asia Pacific is expected to account for the largest share from 2025 to 2035

Texas Instruments Incorporated, Amphenol Advanced Sensors, Analog Devices, Inc., Dwyer Instruments LTD, Emerson Electric Co., Honeywell International Inc., Infineon Technologies AG., Microchip Technology Inc., OMRON Corporation, ABB Lt, Robert Bosch GmbH, onsemi, Siemens AG, STMicroelectronics, TDK Electronics AG, TE Connectivity Ltd., Yokogawa Electric Corporation and Others

Table 01: Global Temperature Sensor Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 02: Global Temperature Sensor Market Volume (Units) Forecast, by Product Type, 2020 to 2035

Table 03: Global Temperature Sensor Market Volume (Units) Forecast, by Contact Temperature Sensors, 2020 to 2035

Table 04: Global Temperature Sensor Market Volume (Units) Forecast, by Non-Contact Temperature Sensors, 2020 to 2035

Table 05: Global Temperature Sensor Market Value (US$ Bn) Forecast, by Output Type, 2020 to 2035

Table 06: Global Temperature Sensor Market Volume (Units) Forecast, by Output Type, 2020 to 2035

Table 07: Global Temperature Sensor Market Value (US$ Bn) Forecast, by Connectivity Type, 2020 to 2035

Table 08: Global Temperature Sensor Market Volume (Units) Forecast, by Connectivity Type, 2020 to 2035

Table 09: Global Temperature Sensor Market Value (US$ Bn) Forecast, by End-use industry, 2020 to 2035

Table 10: Global Temperature Sensor Market Volume (Units) Forecast, by End-use industry, 2020 to 2035

Table 11: Global Temperature Sensor Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 12: Global Temperature Sensor Market Volume (Units) Forecast, by Region, 2020 to 2035

Table 13: North America Temperature Sensor Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 14: North America Temperature Sensor Market Volume (Units) Forecast, by Country, 2020 to 2035

Table 15: North America Temperature Sensor Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 16: North America Temperature Sensor Market Volume (Units) Forecast, by Product Type, 2020 to 2035

Table 17: North America Temperature Sensor Market Value (US$ Bn) Forecast, by Output Type, 2020 to 2035

Table 18: North America Temperature Sensor Market Volume (Units) Forecast, by Output Type, 2020 to 2035

Table 19: North America Temperature Sensor Market Value (US$ Bn) Forecast, by Connectivity Type, 2020 to 2035

Table 20: North America Temperature Sensor Market Volume (Units) Forecast, by Connectivity Type, 2020 to 2035

Table 21: North America Temperature Sensor Market Value (US$ Bn) Forecast, by End-use industry, 2020 to 2035

Table 22: North America Temperature Sensor Market Volume (Units) Forecast, by End-use industry, 2020 to 2035

Table 23: U.S. Temperature Sensor Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 24: U.S. Temperature Sensor Market Volume (Units) Forecast, by Product Type, 2020 to 2035

Table 25: U.S. Temperature Sensor Market Value (US$ Bn) Forecast, by Output Type, 2020 to 2035

Table 26: U.S. Temperature Sensor Market Volume (Units) Forecast, by Output Type, 2020 to 2035

Table 27: U.S. Temperature Sensor Market Value (US$ Bn) Forecast, by Connectivity Type, 2020 to 2035

Table 28: U.S. Temperature Sensor Market Volume (Units) Forecast, by Connectivity Type, 2020 to 2035

Table 29: U.S. Temperature Sensor Market Value (US$ Bn) Forecast, by End-use industry, 2020 to 2035

Table 30: U.S. Temperature Sensor Market Volume (Units) Forecast, by End-use industry, 2020 to 2035

Table 31: Canada Temperature Sensor Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 32: Canada Temperature Sensor Market Volume (Units) Forecast, by Product Type, 2020 to 2035

Table 33: Canada Temperature Sensor Market Value (US$ Bn) Forecast, by Output Type, 2020 to 2035

Table 34: Canada Temperature Sensor Market Volume (Units) Forecast, by Output Type, 2020 to 2035

Table 35: Canada Temperature Sensor Market Value (US$ Bn) Forecast, by Connectivity Type, 2020 to 2035

Table 36: Canada Temperature Sensor Market Volume (Units) Forecast, by Connectivity Type, 2020 to 2035

Table 37: Canada Temperature Sensor Market Value (US$ Bn) Forecast, by End-use industry, 2020 to 2035

Table 38: Canada Temperature Sensor Market Volume (Units) Forecast, by End-use industry, 2020 to 2035

Table 39: Europe Temperature Sensor Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 40: Europe Temperature Sensor Market Volume (Units) Forecast, by Country/Sub-region, 2020 to 2035

Table 41: Europe Temperature Sensor Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 42: Europe Temperature Sensor Market Volume (Units) Forecast, by Product Type, 2020 to 2035

Table 43: Europe Temperature Sensor Market Value (US$ Bn) Forecast, by Output Type, 2020 to 2035

Table 44: Europe Temperature Sensor Market Volume (Units) Forecast, by Output Type, 2020 to 2035

Table 45: Europe Temperature Sensor Market Value (US$ Bn) Forecast, by Connectivity Type, 2020 to 2035

Table 46: Europe Temperature Sensor Market Volume (Units) Forecast, by Connectivity Type, 2020 to 2035

Table 47: Europe Temperature Sensor Market Value (US$ Bn) Forecast, by End-use industry, 2020 to 2035

Table 48: Europe Temperature Sensor Market Volume (Units) Forecast, by End-use industry, 2020 to 2035

Table 49: Germany Temperature Sensor Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 50: Germany Temperature Sensor Market Volume (Units) Forecast, by Product Type, 2020 to 2035

Table 51: Germany Temperature Sensor Market Value (US$ Bn) Forecast, by Output Type, 2020 to 2035

Table 52: Germany Temperature Sensor Market Volume (Units) Forecast, by Output Type, 2020 to 2035

Table 53: Germany Temperature Sensor Market Value (US$ Bn) Forecast, by Connectivity Type, 2020 to 2035

Table 54: Germany Temperature Sensor Market Volume (Units) Forecast, by Connectivity Type, 2020 to 2035

Table 55: Germany Temperature Sensor Market Value (US$ Bn) Forecast, by End-use industry, 2020 to 2035

Table 56: Germany Temperature Sensor Market Volume (Units) Forecast, by End-use industry, 2020 to 2035

Table 57: U.K Temperature Sensor Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 58: U.K Temperature Sensor Market Volume (Units) Forecast, by Product Type, 2020 to 2035

Table 59: U.K Temperature Sensor Market Value (US$ Bn) Forecast, by Output Type, 2020 to 2035

Table 60: U.K Temperature Sensor Market Volume (Units) Forecast, by Output Type, 2020 to 2035

Table 61: U.K Temperature Sensor Market Value (US$ Bn) Forecast, by Connectivity Type, 2020 to 2035

Table 62: U.K Temperature Sensor Market Volume (Units) Forecast, by Connectivity Type, 2020 to 2035

Table 63: U.K Temperature Sensor Market Value (US$ Bn) Forecast, by End-use industry, 2020 to 2035

Table 64: U.K Temperature Sensor Market Volume (Units) Forecast, by End-use industry, 2020 to 2035

Table 65: France Temperature Sensor Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 66: France Temperature Sensor Market Volume (Units) Forecast, by Product Type, 2020 to 2035

Table 67: France Temperature Sensor Market Value (US$ Bn) Forecast, by Output Type, 2020 to 2035

Table 68: France Temperature Sensor Market Volume (Units) Forecast, by Output Type, 2020 to 2035

Table 69: France Temperature Sensor Market Value (US$ Bn) Forecast, by Connectivity Type, 2020 to 2035

Table 70: France Temperature Sensor Market Volume (Units) Forecast, by Connectivity Type, 2020 to 2035

Table 71: France Temperature Sensor Market Value (US$ Bn) Forecast, by End-use industry, 2020 to 2035

Table 72: France Temperature Sensor Market Volume (Units) Forecast, by End-use industry, 2020 to 2035

Table 73: Italy Temperature Sensor Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 74: Italy Temperature Sensor Market Volume (Units) Forecast, by Product Type, 2020 to 2035

Table 75: Italy Temperature Sensor Market Value (US$ Bn) Forecast, by Output Type, 2020 to 2035

Table 76: Italy Temperature Sensor Market Volume (Units) Forecast, by Output Type, 2020 to 2035

Table 77: Italy Temperature Sensor Market Value (US$ Bn) Forecast, by Connectivity Type, 2020 to 2035

Table 78: Italy Temperature Sensor Market Volume (Units) Forecast, by Connectivity Type, 2020 to 2035

Table 79: Italy Temperature Sensor Market Value (US$ Bn) Forecast, by End-use industry, 2020 to 2035

Table 80: Italy Temperature Sensor Market Volume (Units) Forecast, by End-use industry, 2020 to 2035

Table 81: Spain Temperature Sensor Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 82: Spain Temperature Sensor Market Volume (Units) Forecast, by Product Type, 2020 to 2035

Table 83: Spain Temperature Sensor Market Value (US$ Bn) Forecast, by Output Type, 2020 to 2035

Table 84: Spain Temperature Sensor Market Volume (Units) Forecast, by Output Type, 2020 to 2035

Table 85: Spain Temperature Sensor Market Value (US$ Bn) Forecast, by Connectivity Type, 2020 to 2035

Table 86: Spain Temperature Sensor Market Volume (Units) Forecast, by Connectivity Type, 2020 to 2035

Table 87: Spain Temperature Sensor Market Value (US$ Bn) Forecast, by End-use industry, 2020 to 2035

Table 88: Spain Temperature Sensor Market Volume (Units) Forecast, by End-use industry, 2020 to 2035

Table 89: Switzerland Temperature Sensor Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 90: Switzerland Temperature Sensor Market Volume (Units) Forecast, by Product Type, 2020 to 2035

Table 91: Switzerland Temperature Sensor Market Value (US$ Bn) Forecast, by Output Type, 2020 to 2035

Table 92: Switzerland Temperature Sensor Market Volume (Units) Forecast, by Output Type, 2020 to 2035

Table 93: Switzerland Temperature Sensor Market Value (US$ Bn) Forecast, by Connectivity Type, 2020 to 2035

Table 94: Switzerland Temperature Sensor Market Volume (Units) Forecast, by Connectivity Type, 2020 to 2035

Table 95: Switzerland Temperature Sensor Market Value (US$ Bn) Forecast, by End-use industry, 2020 to 2035

Table 96: Switzerland Temperature Sensor Market Volume (Units) Forecast, by End-use industry, 2020 to 2035

Table 97: The Netherlands Temperature Sensor Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 98: The Netherlands Temperature Sensor Market Volume (Units) Forecast, by Product Type, 2020 to 2035

Table 99: The Netherlands Temperature Sensor Market Value (US$ Bn) Forecast, by Output Type, 2020 to 2035

Table 100: The Netherlands Temperature Sensor Market Volume (Units) Forecast, by Output Type, 2020 to 2035

Table 101: The Netherlands Temperature Sensor Market Value (US$ Bn) Forecast, by Connectivity Type, 2020 to 2035

Table 102: The Netherlands Temperature Sensor Market Volume (Units) Forecast, by Connectivity Type, 2020 to 2035

Table 103: The Netherlands Temperature Sensor Market Value (US$ Bn) Forecast, by End-use industry, 2020 to 2035

Table 104: The Netherlands Temperature Sensor Market Volume (Units) Forecast, by End-use industry, 2020 to 2035

Table 105: Rest of Europe Temperature Sensor Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 106: Rest of Europe Temperature Sensor Market Volume (Units) Forecast, by Product Type, 2020 to 2035

Table 107: Rest of Europe Temperature Sensor Market Value (US$ Bn) Forecast, by Output Type, 2020 to 2035

Table 108: Rest of Europe Temperature Sensor Market Volume (Units) Forecast, by Output Type, 2020 to 2035

Table 109: Rest of Europe Temperature Sensor Market Value (US$ Bn) Forecast, by Connectivity Type, 2020 to 2035

Table 110: Rest of Europe Temperature Sensor Market Volume (Units) Forecast, by Connectivity Type, 2020 to 2035

Table 111: Rest of Europe Temperature Sensor Market Value (US$ Bn) Forecast, by End-use industry, 2020 to 2035

Table 112: Rest of Europe Temperature Sensor Market Volume (Units) Forecast, by End-use industry, 2020 to 2035

Table 113: Asia Pacific Temperature Sensor Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 114: Asia Pacific Temperature Sensor Market Volume (Units) Forecast, by Country/Sub-region, 2020 to 2035

Table 115: Asia Pacific Temperature Sensor Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 116: Asia Pacific Temperature Sensor Market Volume (Units) Forecast, by Product Type, 2020 to 2035

Table 117: Asia Pacific Temperature Sensor Market Value (US$ Bn) Forecast, by Output Type, 2020 to 2035

Table 118: Asia Pacific Temperature Sensor Market Volume (Units) Forecast, by Output Type, 2020 to 2035

Table 119: Asia Pacific Temperature Sensor Market Value (US$ Bn) Forecast, by Connectivity Type, 2020 to 2035

Table 120: Asia Pacific Temperature Sensor Market Volume (Units) Forecast, by Connectivity Type, 2020 to 2035

Table 121: Asia Pacific Temperature Sensor Market Value (US$ Bn) Forecast, by End-use industry, 2020 to 2035

Table 122: Asia Pacific Temperature Sensor Market Volume (Units) Forecast, by End-use industry, 2020 to 2035

Table 123: China Temperature Sensor Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 124: China Temperature Sensor Market Volume (Units) Forecast, by Product Type, 2020 to 2035

Table 125: China Temperature Sensor Market Value (US$ Bn) Forecast, by Output Type, 2020 to 2035

Table 126: China Temperature Sensor Market Volume (Units) Forecast, by Output Type, 2020 to 2035

Table 127: China Temperature Sensor Market Value (US$ Bn) Forecast, by Connectivity Type, 2020 to 2035

Table 128: China Temperature Sensor Market Volume (Units) Forecast, by Connectivity Type, 2020 to 2035

Table 129: China Temperature Sensor Market Value (US$ Bn) Forecast, by End-use industry, 2020 to 2035

Table 130: China Temperature Sensor Market Volume (Units) Forecast, by End-use industry, 2020 to 2035

Table 131: India Temperature Sensor Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 132: India Temperature Sensor Market Volume (Units) Forecast, by Product Type, 2020 to 2035

Table 133: India Temperature Sensor Market Value (US$ Bn) Forecast, by Output Type, 2020 to 2035

Table 134: India Temperature Sensor Market Volume (Units) Forecast, by Output Type, 2020 to 2035

Table 135: India Temperature Sensor Market Value (US$ Bn) Forecast, by Connectivity Type, 2020 to 2035

Table 136: India Temperature Sensor Market Volume (Units) Forecast, by Connectivity Type, 2020 to 2035

Table 137: India Temperature Sensor Market Value (US$ Bn) Forecast, by End-use industry, 2020 to 2035

Table 138: India Temperature Sensor Market Volume (Units) Forecast, by End-use industry, 2020 to 2035

Table 139: Japan Temperature Sensor Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 140: Japan Temperature Sensor Market Volume (Units) Forecast, by Product Type, 2020 to 2035

Table 141: Japan Temperature Sensor Market Value (US$ Bn) Forecast, by Output Type, 2020 to 2035

Table 142: Japan Temperature Sensor Market Volume (Units) Forecast, by Output Type, 2020 to 2035

Table 143: Japan Temperature Sensor Market Value (US$ Bn) Forecast, by Connectivity Type, 2020 to 2035

Table 144: Japan Temperature Sensor Market Volume (Units) Forecast, by Connectivity Type, 2020 to 2035

Table 145: Japan Temperature Sensor Market Value (US$ Bn) Forecast, by End-use industry, 2020 to 2035

Table 146: Japan Temperature Sensor Market Volume (Units) Forecast, by End-use industry, 2020 to 2035

Table 147: South Korea Temperature Sensor Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 148: South Korea Temperature Sensor Market Volume (Units) Forecast, by Product Type, 2020 to 2035

Table 149: South Korea Temperature Sensor Market Value (US$ Bn) Forecast, by Output Type, 2020 to 2035

Table 150: South Korea Temperature Sensor Market Volume (Units) Forecast, by Output Type, 2020 to 2035

Table 151: South Korea Temperature Sensor Market Value (US$ Bn) Forecast, by Connectivity Type, 2020 to 2035

Table 152: South Korea Temperature Sensor Market Volume (Units) Forecast, by Connectivity Type, 2020 to 2035

Table 153: South Korea Temperature Sensor Market Value (US$ Bn) Forecast, by End-use industry, 2020 to 2035

Table 154: South Korea Temperature Sensor Market Volume (Units) Forecast, by End-use industry, 2020 to 2035

Table 155: Australia and New Zealand Temperature Sensor Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 156: Australia and New Zealand Temperature Sensor Market Volume (Units) Forecast, by Product Type, 2020 to 2035

Table 157: Australia and New Zealand Temperature Sensor Market Value (US$ Bn) Forecast, by Output Type, 2020 to 2035

Table 158: Australia and New Zealand Temperature Sensor Market Volume (Units) Forecast, by Output Type, 2020 to 2035

Table 159: Australia and New Zealand Temperature Sensor Market Value (US$ Bn) Forecast, by Connectivity Type, 2020 to 2035

Table 160: Australia and New Zealand Temperature Sensor Market Volume (Units) Forecast, by Connectivity Type, 2020 to 2035

Table 161: Australia and New Zealand Temperature Sensor Market Value (US$ Bn) Forecast, by End-use industry, 2020 to 2035

Table 162: Australia and New Zealand Temperature Sensor Market Volume (Units) Forecast, by End-use industry, 2020 to 2035

Table 163: Rest of Asia Pacific Temperature Sensor Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 164: Rest of Asia Pacific Temperature Sensor Market Volume (Units) Forecast, by Product Type, 2020 to 2035

Table 165: Rest of Asia Pacific Temperature Sensor Market Value (US$ Bn) Forecast, by Output Type, 2020 to 2035

Table 166: Rest of Asia Pacific Temperature Sensor Market Volume (Units) Forecast, by Output Type, 2020 to 2035

Table 167: Rest of Asia Pacific Temperature Sensor Market Value (US$ Bn) Forecast, by Connectivity Type, 2020 to 2035

Table 168: Rest of Asia Pacific Temperature Sensor Market Volume (Units) Forecast, by Connectivity Type, 2020 to 2035

Table 169: Rest of Asia Pacific Temperature Sensor Market Value (US$ Bn) Forecast, by End-use industry, 2020 to 2035

Table 170: Rest of Asia Pacific Temperature Sensor Market Volume (Units) Forecast, by End-use industry, 2020 to 2035

Table 171: Latin America Temperature Sensor Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 172: Latin America Temperature Sensor Market Volume (Units) Forecast, by Country/Sub-region, 2020 to 2035

Table 173: Latin America Temperature Sensor Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 174: Latin America Temperature Sensor Market Volume (Units) Forecast, by Product Type, 2020 to 2035

Table 175: Latin America Temperature Sensor Market Value (US$ Bn) Forecast, by Output Type, 2020 to 2035

Table 176: Latin America Temperature Sensor Market Volume (Units) Forecast, by Output Type, 2020 to 2035

Table 177: Latin America Temperature Sensor Market Value (US$ Bn) Forecast, by Connectivity Type, 2020 to 2035

Table 178: Latin America Temperature Sensor Market Volume (Units) Forecast, by Connectivity Type, 2020 to 2035

Table 179: Latin America Temperature Sensor Market Value (US$ Bn) Forecast, by End-use industry, 2020 to 2035

Table 180: Latin America Temperature Sensor Market Volume (Units) Forecast, by End-use industry, 2020 to 2035

Table 181: Brazil Temperature Sensor Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 182: Brazil Temperature Sensor Market Volume (Units) Forecast, by Product Type, 2020 to 2035

Table 183: Brazil Temperature Sensor Market Value (US$ Bn) Forecast, by Output Type, 2020 to 2035

Table 184: Brazil Temperature Sensor Market Volume (Units) Forecast, by Output Type, 2020 to 2035

Table 185: Brazil Temperature Sensor Market Value (US$ Bn) Forecast, by Connectivity Type, 2020 to 2035

Table 186: Brazil Temperature Sensor Market Volume (Units) Forecast, by Connectivity Type, 2020 to 2035

Table 187: Brazil Temperature Sensor Market Value (US$ Bn) Forecast, by End-use industry, 2020 to 2035

Table 188: Brazil Temperature Sensor Market Volume (Units) Forecast, by End-use industry, 2020 to 2035

Table 189: Mexico Temperature Sensor Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 190: Mexico Temperature Sensor Market Volume (Units) Forecast, by Product Type, 2020 to 2035

Table 191: Mexico Temperature Sensor Market Value (US$ Bn) Forecast, by Output Type, 2020 to 2035

Table 192: Mexico Temperature Sensor Market Volume (Units) Forecast, by Output Type, 2020 to 2035

Table 193: Mexico Temperature Sensor Market Value (US$ Bn) Forecast, by Connectivity Type, 2020 to 2035

Table 194: Mexico Temperature Sensor Market Volume (Units) Forecast, by Connectivity Type, 2020 to 2035

Table 195: Mexico Temperature Sensor Market Value (US$ Bn) Forecast, by End-use industry, 2020 to 2035

Table 196: Mexico Temperature Sensor Market Volume (Units) Forecast, by End-use industry, 2020 to 2035

Table 197: Argentina Temperature Sensor Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 198: Argentina Temperature Sensor Market Volume (Units) Forecast, by Product Type, 2020 to 2035

Table 199: Argentina Temperature Sensor Market Value (US$ Bn) Forecast, by Output Type, 2020 to 2035

Table 200: Argentina Temperature Sensor Market Volume (Units) Forecast, by Output Type, 2020 to 2035

Table 201: Argentina Temperature Sensor Market Value (US$ Bn) Forecast, by Connectivity Type, 2020 to 2035

Table 202: Argentina Temperature Sensor Market Volume (Units) Forecast, by Connectivity Type, 2020 to 2035

Table 203: Argentina Temperature Sensor Market Value (US$ Bn) Forecast, by End-use industry, 2020 to 2035

Table 204: Argentina Temperature Sensor Market Volume (Units) Forecast, by End-use industry, 2020 to 2035

Table 205: Rest of Latin America Temperature Sensor Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 206: Rest of Latin America Temperature Sensor Market Volume (Units) Forecast, by Product Type, 2020 to 2035

Table 207: Rest of Latin America Temperature Sensor Market Value (US$ Bn) Forecast, by Output Type, 2020 to 2035

Table 208: Rest of Latin America Temperature Sensor Market Volume (Units) Forecast, by Output Type, 2020 to 2035

Table 209: Rest of Latin America Temperature Sensor Market Value (US$ Bn) Forecast, by Connectivity Type, 2020 to 2035

Table 210: Rest of Latin America Temperature Sensor Market Volume (Units) Forecast, by Connectivity Type, 2020 to 2035

Table 211: Rest of Latin America Temperature Sensor Market Value (US$ Bn) Forecast, by End-use industry, 2020 to 2035

Table 212: Rest of Latin America Temperature Sensor Market Volume (Units) Forecast, by End-use industry, 2020 to 2035

Table 213: Middle East and Africa Temperature Sensor Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 214: Middle East and Africa Temperature Sensor Market Volume (Units) Forecast, by Country/Sub-region, 2020 to 2035

Table 215: Middle East and Africa Temperature Sensor Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 216: Middle East and Africa Temperature Sensor Market Volume (Units) Forecast, by Product Type, 2020 to 2035

Table 217: Middle East and Africa Temperature Sensor Market Value (US$ Bn) Forecast, by Output Type, 2020 to 2035

Table 218: Middle East and Africa Temperature Sensor Market Volume (Units) Forecast, by Output Type, 2020 to 2035

Table 219: Middle East and Africa Temperature Sensor Market Value (US$ Bn) Forecast, by Connectivity Type, 2020 to 2035

Table 220: Middle East and Africa Temperature Sensor Market Volume (Units) Forecast, by Connectivity Type, 2020 to 2035

Table 221: Middle East and Africa Temperature Sensor Market Value (US$ Bn) Forecast, by End-use industry, 2020 to 2035

Table 222: Middle East and Africa Temperature Sensor Market Volume (Units) Forecast, by End-use industry, 2020 to 2035

Table 223: GCC Countries Temperature Sensor Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 224: GCC Countries Temperature Sensor Market Volume (Units) Forecast, by Product Type, 2020 to 2035

Table 225: GCC Countries Temperature Sensor Market Value (US$ Bn) Forecast, by Output Type, 2020 to 2035

Table 226: GCC Countries Temperature Sensor Market Volume (Units) Forecast, by Output Type, 2020 to 2035

Table 227: GCC Countries Temperature Sensor Market Value (US$ Bn) Forecast, by Connectivity Type, 2020 to 2035

Table 228: GCC Countries Temperature Sensor Market Volume (Units) Forecast, by Connectivity Type, 2020 to 2035

Table 229: GCC Countries Temperature Sensor Market Value (US$ Bn) Forecast, by End-use industry, 2020 to 2035

Table 230: GCC Countries Temperature Sensor Market Volume (Units) Forecast, by End-use industry, 2020 to 2035

Table 231: South Africa Temperature Sensor Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 232: South Africa Temperature Sensor Market Volume (Units) Forecast, by Product Type, 2020 to 2035

Table 233: South Africa Temperature Sensor Market Value (US$ Bn) Forecast, by Output Type, 2020 to 2035

Table 234: South Africa Temperature Sensor Market Volume (Units) Forecast, by Output Type, 2020 to 2035

Table 235: South Africa Temperature Sensor Market Value (US$ Bn) Forecast, by Connectivity Type, 2020 to 2035

Table 236: South Africa Temperature Sensor Market Volume (Units) Forecast, by Connectivity Type, 2020 to 2035

Table 237: South Africa Temperature Sensor Market Value (US$ Bn) Forecast, by End-use industry, 2020 to 2035

Table 238: South Africa Temperature Sensor Market Volume (Units) Forecast, by End-use industry, 2020 to 2035

Table 239: Rest of Middle East and Africa Temperature Sensor Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 240: Rest of Middle East and Africa Temperature Sensor Market Volume (Units) Forecast, by Product Type, 2020 to 2035

Table 241: Rest of Middle East and Africa Temperature Sensor Market Value (US$ Bn) Forecast, by Output Type, 2020 to 2035

Table 242: Rest of Middle East and Africa Temperature Sensor Market Volume (Units) Forecast, by Output Type, 2020 to 2035

Table 243: Rest of Middle East and Africa Temperature Sensor Market Value (US$ Bn) Forecast, by Connectivity Type, 2020 to 2035

Table 244: Rest of Middle East and Africa Temperature Sensor Market Volume (Units) Forecast, by Connectivity Type, 2020 to 2035

Table 245: Rest of Middle East and Africa Temperature Sensor Market Value (US$ Bn) Forecast, by End-use industry, 2020 to 2035

Table 246: Rest of Middle East and Africa Temperature Sensor Market Volume (Units) Forecast, by End-use industry, 2020 to 2035

Figure 01: Global Temperature Sensor Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 02: Global Temperature Sensor Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 03: Global Temperature Sensor Market Revenue (US$ Bn), by Contact Temperature Sensors, 2025 to 2035

Figure 04: Global Temperature Sensor Market Revenue (US$ Bn), by Non-Contact Temperature Sensors, 2025 to 2035

Figure 05: Global Temperature Sensor Market Value Share Analysis, by Output Type, 2024 and 2035

Figure 06: Global Temperature Sensor Market Attractiveness Analysis, by Output Type, 2025 to 2035

Figure 07: Global Temperature Sensor Market Revenue (US$ Bn), by Analog, 2025 to 2035

Figure 08: Global Temperature Sensor Market Revenue (US$ Bn), by Digital, 2025 to 2035

Figure 09: Global Temperature Sensor Market Value Share Analysis, by Connectivity Type, 2024 and 2035

Figure 10: Global Temperature Sensor Market Attractiveness Analysis, by Connectivity Type, 2025 to 2035

Figure 11: Global Temperature Sensor Market Revenue (US$ Bn), by Wired, 2025 to 2035

Figure 12: Global Temperature Sensor Market Revenue (US$ Bn), by Wireless, 2025 to 2035

Figure 13: Global Temperature Sensor Market Value Share Analysis, by End-use industry, 2024 and 2035

Figure 14: Global Temperature Sensor Market Attractiveness Analysis, by End-use industry, 2025 to 2035

Figure 15: Global Temperature Sensor Market Revenue (US$ Bn), by Automotive and Transportation, 2025 to 2035

Figure 16: Global Temperature Sensor Market Revenue (US$ Bn), by Aerospace & Defense, 2025 to 2035

Figure 17: Global Temperature Sensor Market Revenue (US$ Bn), by Energy & Utility, 2025 to 2035

Figure 18: Global Temperature Sensor Market Revenue (US$ Bn), by Chemicals, 2025 to 2035

Figure 19: Global Temperature Sensor Market Revenue (US$ Bn), by Oil & Gas, 2025 to 2035

Figure 20: Global Temperature Sensor Market Revenue (US$ Bn), by Healthcare, 2025 to 2035

Figure 21: Global Temperature Sensor Market Revenue (US$ Bn), by Building and Construction, 2025 to 2035

Figure 22: Global Temperature Sensor Market Revenue (US$ Bn), by Consumer Electronics, 2025 to 2035

Figure 23: Global Temperature Sensor Market Revenue (US$ Bn), by Food & Beverages, 2025 to 2035

Figure 24: Global Temperature Sensor Market Revenue (US$ Bn), by Others, 2025 to 2035

Figure 25: Global Temperature Sensor Market Value Share Analysis, by Region, 2024 and 2035

Figure 26: Global Temperature Sensor Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 27: North America Temperature Sensor Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 28: North America Temperature Sensor Market Value Share Analysis, by Country, 2024 and 2035

Figure 29: North America Temperature Sensor Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 30: North America Temperature Sensor Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 31: North America Temperature Sensor Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 32: North America Temperature Sensor Market Value Share Analysis, by Output Type, 2024 and 2035

Figure 33: North America Temperature Sensor Market Attractiveness Analysis, by Output Type, 2025 to 2035

Figure 34: North America Temperature Sensor Market Value Share Analysis, by Connectivity Type, 2024 and 2035

Figure 35: North America Temperature Sensor Market Attractiveness Analysis, by Connectivity Type, 2025 to 2035

Figure 36: North America Temperature Sensor Market Value Share Analysis, by End-use industry, 2024 and 2035

Figure 37: North America Temperature Sensor Market Attractiveness Analysis, by End-use industry, 2025 to 2035

Figure 38: U.S. Temperature Sensor Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 39: U.S. Temperature Sensor Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 40: U.S. Temperature Sensor Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 41: U.S. Temperature Sensor Market Value Share Analysis, by Output Type, 2024 and 2035

Figure 42: U.S. Temperature Sensor Market Attractiveness Analysis, by Output Type, 2025 to 2035

Figure 43: U.S. Temperature Sensor Market Value Share Analysis, by Connectivity Type, 2024 and 2035

Figure 44: U.S. Temperature Sensor Market Attractiveness Analysis, by Connectivity Type, 2025 to 2035

Figure 45: U.S. Temperature Sensor Market Value Share Analysis, by End-use industry, 2024 and 2035

Figure 46: U.S. Temperature Sensor Market Attractiveness Analysis, by End-use industry, 2025 to 2035

Figure 47: Canada Temperature Sensor Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 48: Canada Temperature Sensor Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 49: Canada Temperature Sensor Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 50: Canada Temperature Sensor Market Value Share Analysis, by Output Type, 2024 and 2035

Figure 51: Canada Temperature Sensor Market Attractiveness Analysis, by Output Type, 2025 to 2035

Figure 52: Canada Temperature Sensor Market Value Share Analysis, by Connectivity Type, 2024 and 2035

Figure 53: Canada Temperature Sensor Market Attractiveness Analysis, by Connectivity Type, 2025 to 2035

Figure 54: Canada Temperature Sensor Market Value Share Analysis, by End-use industry, 2024 and 2035

Figure 55: Canada Temperature Sensor Market Attractiveness Analysis, by End-use industry, 2025 to 2035

Figure 56: Europe Temperature Sensor Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 57: Europe Temperature Sensor Market Value Share Analysis, by Country, 2024 and 2035

Figure 58: Europe Temperature Sensor Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 59: Europe Temperature Sensor Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 60: Europe Temperature Sensor Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 61: Europe Temperature Sensor Market Value Share Analysis, by Output Type, 2024 and 2035

Figure 62: Europe Temperature Sensor Market Attractiveness Analysis, by Output Type, 2025 to 2035

Figure 63: Europe Temperature Sensor Market Value Share Analysis, by Connectivity Type, 2024 and 2035

Figure 64: Europe Temperature Sensor Market Attractiveness Analysis, by Connectivity Type, 2025 to 2035

Figure 65: Europe Temperature Sensor Market Value Share Analysis, by End-use industry, 2024 and 2035

Figure 66: Europe Temperature Sensor Market Attractiveness Analysis, by End-use industry, 2025 to 2035

Figure 67: Germany Temperature Sensor Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 68: Germany Temperature Sensor Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 69: Germany Temperature Sensor Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 70: Germany Temperature Sensor Market Value Share Analysis, by Output Type, 2024 and 2035

Figure 71: Germany Temperature Sensor Market Attractiveness Analysis, by Output Type, 2025 to 2035

Figure 72: Germany Temperature Sensor Market Value Share Analysis, by Connectivity Type, 2024 and 2035

Figure 73: Germany Temperature Sensor Market Attractiveness Analysis, by Connectivity Type, 2025 to 2035

Figure 74: Germany Temperature Sensor Market Value Share Analysis, by End-use industry, 2024 and 2035

Figure 75: Germany Temperature Sensor Market Attractiveness Analysis, by End-use industry, 2025 to 2035

Figure 76: U.K Temperature Sensor Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 77: U.K Temperature Sensor Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 78: U.K Temperature Sensor Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 79: U.K Temperature Sensor Market Value Share Analysis, by Output Type, 2024 and 2035

Figure 80: U.K Temperature Sensor Market Attractiveness Analysis, by Output Type, 2025 to 2035

Figure 81: U.K Temperature Sensor Market Value Share Analysis, by Connectivity Type, 2024 and 2035

Figure 82: U.K Temperature Sensor Market Attractiveness Analysis, by Connectivity Type, 2025 to 2035

Figure 83: U.K Temperature Sensor Market Value Share Analysis, by End-use industry, 2024 and 2035

Figure 84: U.K Temperature Sensor Market Attractiveness Analysis, by End-use industry, 2025 to 2035

Figure 85: France Temperature Sensor Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 86: France Temperature Sensor Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 87: France Temperature Sensor Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 88: France Temperature Sensor Market Value Share Analysis, by Output Type, 2024 and 2035

Figure 89: France Temperature Sensor Market Attractiveness Analysis, by Output Type, 2025 to 2035

Figure 90: France Temperature Sensor Market Value Share Analysis, by Connectivity Type, 2024 and 2035

Figure 91: France Temperature Sensor Market Attractiveness Analysis, by Connectivity Type, 2025 to 2035

Figure 92: France Temperature Sensor Market Value Share Analysis, by End-use industry, 2024 and 2035

Figure 93: France Temperature Sensor Market Attractiveness Analysis, by End-use industry, 2025 to 2035

Figure 94: Italy Temperature Sensor Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 95: Italy Temperature Sensor Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 96: Italy Temperature Sensor Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 97: Italy Temperature Sensor Market Value Share Analysis, by Output Type, 2024 and 2035

Figure 98: Italy Temperature Sensor Market Attractiveness Analysis, by Output Type, 2025 to 2035

Figure 99: Italy Temperature Sensor Market Value Share Analysis, by Connectivity Type, 2024 and 2035

Figure 100: Italy Temperature Sensor Market Attractiveness Analysis, by Connectivity Type, 2025 to 2035

Figure 101: Italy Temperature Sensor Market Value Share Analysis, by End-use industry, 2024 and 2035

Figure 102: Italy Temperature Sensor Market Attractiveness Analysis, by End-use industry, 2025 to 2035

Figure 103: Spain Temperature Sensor Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 104: Spain Temperature Sensor Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 105: Spain Temperature Sensor Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 106: Spain Temperature Sensor Market Value Share Analysis, by Output Type, 2024 and 2035

Figure 107: Spain Temperature Sensor Market Attractiveness Analysis, by Output Type, 2025 to 2035

Figure 108: Spain Temperature Sensor Market Value Share Analysis, by Connectivity Type, 2024 and 2035

Figure 109: Spain Temperature Sensor Market Attractiveness Analysis, by Connectivity Type, 2025 to 2035

Figure 110: Spain Temperature Sensor Market Value Share Analysis, by End-use industry, 2024 and 2035

Figure 111: Spain Temperature Sensor Market Attractiveness Analysis, by End-use industry, 2025 to 2035

Figure 112: Switzerland Temperature Sensor Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 113: Switzerland Temperature Sensor Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 114: Switzerland Temperature Sensor Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 115: Switzerland Temperature Sensor Market Value Share Analysis, by Output Type, 2024 and 2035

Figure 116: Switzerland Temperature Sensor Market Attractiveness Analysis, by Output Type, 2025 to 2035

Figure 117: Switzerland Temperature Sensor Market Value Share Analysis, by Connectivity Type, 2024 and 2035

Figure 118: Switzerland Temperature Sensor Market Attractiveness Analysis, by Connectivity Type, 2025 to 2035

Figure 119: Switzerland Temperature Sensor Market Value Share Analysis, by End-use industry, 2024 and 2035

Figure 120: Switzerland Temperature Sensor Market Attractiveness Analysis, by End-use industry, 2025 to 2035

Figure 121: The Netherlands Temperature Sensor Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 122: The Netherlands Temperature Sensor Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 123: The Netherlands Temperature Sensor Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 124: The Netherlands Temperature Sensor Market Value Share Analysis, by Output Type, 2024 and 2035

Figure 125: The Netherlands Temperature Sensor Market Attractiveness Analysis, by Output Type, 2025 to 2035

Figure 126: The Netherlands Temperature Sensor Market Value Share Analysis, by Connectivity Type, 2024 and 2035

Figure 127: The Netherlands Temperature Sensor Market Attractiveness Analysis, by Connectivity Type, 2025 to 2035

Figure 128: The Netherlands Temperature Sensor Market Value Share Analysis, by End-use industry, 2024 and 2035

Figure 129: The Netherlands Temperature Sensor Market Attractiveness Analysis, by End-use industry, 2025 to 2035

Figure 130: Rest of Europe Temperature Sensor Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 131: Rest of Europe Temperature Sensor Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 132: Rest of Europe Temperature Sensor Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 133: Rest of Europe Temperature Sensor Market Value Share Analysis, by Output Type, 2024 and 2035

Figure 134: Rest of Europe Temperature Sensor Market Attractiveness Analysis, by Output Type, 2025 to 2035

Figure 135: Rest of Europe Temperature Sensor Market Value Share Analysis, by Connectivity Type, 2024 and 2035

Figure 136: Rest of Europe Temperature Sensor Market Attractiveness Analysis, by Connectivity Type, 2025 to 2035

Figure 137: Rest of Europe Temperature Sensor Market Value Share Analysis, by End-use industry, 2024 and 2035

Figure 138: Rest of Europe Temperature Sensor Market Attractiveness Analysis, by End-use industry, 2025 to 2035

Figure 139: Asia Pacific Temperature Sensor Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 140: Asia Pacific Temperature Sensor Market Value Share Analysis, by Country, 2024 and 2035

Figure 141: Asia Pacific Temperature Sensor Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 142: Asia Pacific Temperature Sensor Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 143: Asia Pacific Temperature Sensor Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 144: Asia Pacific Temperature Sensor Market Value Share Analysis, by Output Type, 2024 and 2035

Figure 145: Asia Pacific Temperature Sensor Market Attractiveness Analysis, by Output Type, 2025 to 2035

Figure 146: Asia Pacific Temperature Sensor Market Value Share Analysis, by Connectivity Type, 2024 and 2035

Figure 147: Asia Pacific Temperature Sensor Market Attractiveness Analysis, by Connectivity Type, 2025 to 2035

Figure 148: Asia Pacific Temperature Sensor Market Value Share Analysis, by End-use industry, 2024 and 2035

Figure 149: Asia Pacific Temperature Sensor Market Attractiveness Analysis, by End-use industry, 2025 to 2035

Figure 150: China Temperature Sensor Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 151: China Temperature Sensor Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 152: China Temperature Sensor Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 153: China Temperature Sensor Market Value Share Analysis, by Output Type, 2024 and 2035

Figure 154: China Temperature Sensor Market Attractiveness Analysis, by Output Type, 2025 to 2035

Figure 155: China Temperature Sensor Market Value Share Analysis, by Connectivity Type, 2024 and 2035

Figure 156: China Temperature Sensor Market Attractiveness Analysis, by Connectivity Type, 2025 to 2035

Figure 157: China Temperature Sensor Market Value Share Analysis, by End-use industry, 2024 and 2035

Figure 158: China Temperature Sensor Market Attractiveness Analysis, by End-use industry, 2025 to 2035

Figure 159: India Temperature Sensor Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 160: India Temperature Sensor Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 161: India Temperature Sensor Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 162: India Temperature Sensor Market Value Share Analysis, by Output Type, 2024 and 2035

Figure 163: India Temperature Sensor Market Attractiveness Analysis, by Output Type, 2025 to 2035

Figure 164: India Temperature Sensor Market Value Share Analysis, by Connectivity Type, 2024 and 2035

Figure 165: India Temperature Sensor Market Attractiveness Analysis, by Connectivity Type, 2025 to 2035

Figure 166: India Temperature Sensor Market Value Share Analysis, by End-use industry, 2024 and 2035

Figure 167: India Temperature Sensor Market Attractiveness Analysis, by End-use industry, 2025 to 2035

Figure 168: Japan Temperature Sensor Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 169: Japan Temperature Sensor Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 170: Japan Temperature Sensor Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 171: Japan Temperature Sensor Market Value Share Analysis, by Output Type, 2024 and 2035

Figure 172: Japan Temperature Sensor Market Attractiveness Analysis, by Output Type, 2025 to 2035

Figure 173: Japan Temperature Sensor Market Value Share Analysis, by Connectivity Type, 2024 and 2035

Figure 174: Japan Temperature Sensor Market Attractiveness Analysis, by Connectivity Type, 2025 to 2035

Figure 175: Japan Temperature Sensor Market Value Share Analysis, by End-use industry, 2024 and 2035

Figure 176: Japan Temperature Sensor Market Attractiveness Analysis, by End-use industry, 2025 to 2035

Figure 177: South Korea Temperature Sensor Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 178: South Korea Temperature Sensor Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 179: South Korea Temperature Sensor Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 180: South Korea Temperature Sensor Market Value Share Analysis, by Output Type, 2024 and 2035

Figure 181: South Korea Temperature Sensor Market Attractiveness Analysis, by Output Type, 2025 to 2035

Figure 182: South Korea Temperature Sensor Market Value Share Analysis, by Connectivity Type, 2024 and 2035

Figure 183: South Korea Temperature Sensor Market Attractiveness Analysis, by Connectivity Type, 2025 to 2035

Figure 184: South Korea Temperature Sensor Market Value Share Analysis, by End-use industry, 2024 and 2035

Figure 185: South Korea Temperature Sensor Market Attractiveness Analysis, by End-use industry, 2025 to 2035

Figure 186: Australia & New Zealand Temperature Sensor Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 187: Australia & New Zealand Temperature Sensor Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 188: Australia & New Zealand Temperature Sensor Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 189: Australia & New Zealand Temperature Sensor Market Value Share Analysis, by Output Type, 2024 and 2035

Figure 190: Australia & New Zealand Temperature Sensor Market Attractiveness Analysis, by Output Type, 2025 to 2035

Figure 191: Australia & New Zealand Temperature Sensor Market Value Share Analysis, by Connectivity Type, 2024 and 2035

Figure 192: Australia & New Zealand Temperature Sensor Market Attractiveness Analysis, by Connectivity Type, 2025 to 2035

Figure 193: Australia & New Zealand Temperature Sensor Market Value Share Analysis, by End-use industry, 2024 and 2035

Figure 194: Australia & New Zealand Temperature Sensor Market Attractiveness Analysis, by End-use industry, 2025 to 2035

Figure 195: Rest of Asia Pacific Temperature Sensor Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 196: Rest of Asia Pacific Temperature Sensor Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 197: Rest of Asia Pacific Temperature Sensor Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 198: Rest of Asia Pacific Temperature Sensor Market Value Share Analysis, by Output Type, 2024 and 2035

Figure 199: Rest of Asia Pacific Temperature Sensor Market Attractiveness Analysis, by Output Type, 2025 to 2035

Figure 200: Rest of Asia Pacific Temperature Sensor Market Value Share Analysis, by Connectivity Type, 2024 and 2035

Figure 201: Rest of Asia Pacific Temperature Sensor Market Attractiveness Analysis, by Connectivity Type, 2025 to 2035

Figure 202: Rest of Asia Pacific Temperature Sensor Market Value Share Analysis, by End-use industry, 2024 and 2035

Figure 203: Rest of Asia Pacific Temperature Sensor Market Attractiveness Analysis, by End-use industry, 2025 to 2035

Figure 204: Latin America Temperature Sensor Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 205: Latin America Temperature Sensor Market Value Share Analysis, by Country, 2024 and 2035

Figure 206: Latin America Temperature Sensor Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 207: Latin America Temperature Sensor Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 208: Latin America Temperature Sensor Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 209: Latin America Temperature Sensor Market Value Share Analysis, by Output Type, 2024 and 2035

Figure 210: Latin America Temperature Sensor Market Attractiveness Analysis, by Output Type, 2025 to 2035

Figure 211: Latin America Temperature Sensor Market Value Share Analysis, by Connectivity Type, 2024 and 2035

Figure 212: Latin America Temperature Sensor Market Attractiveness Analysis, by Connectivity Type, 2025 to 2035

Figure 213: Latin America Temperature Sensor Market Value Share Analysis, by End-use industry, 2024 and 2035

Figure 214: Latin America Temperature Sensor Market Attractiveness Analysis, by End-use industry, 2025 to 2035

Figure 215: Brazil Temperature Sensor Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 216: Brazil Temperature Sensor Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 217: Brazil Temperature Sensor Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 218: Brazil Temperature Sensor Market Value Share Analysis, by Output Type, 2024 and 2035

Figure 219: Brazil Temperature Sensor Market Attractiveness Analysis, by Output Type, 2025 to 2035

Figure 220: Brazil Temperature Sensor Market Value Share Analysis, by Connectivity Type, 2024 and 2035

Figure 221: Brazil Temperature Sensor Market Attractiveness Analysis, by Connectivity Type, 2025 to 2035

Figure 222: Brazil Temperature Sensor Market Value Share Analysis, by End-use industry, 2024 and 2035

Figure 223: Brazil Temperature Sensor Market Attractiveness Analysis, by End-use industry, 2025 to 2035

Figure 224: Mexico Temperature Sensor Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 225: Mexico Temperature Sensor Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 226: Mexico Temperature Sensor Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 227: Mexico Temperature Sensor Market Value Share Analysis, by Output Type, 2024 and 2035

Figure 228: Mexico Temperature Sensor Market Attractiveness Analysis, by Output Type, 2025 to 2035

Figure 229: Mexico Temperature Sensor Market Value Share Analysis, by Connectivity Type, 2024 and 2035

Figure 230: Mexico Temperature Sensor Market Attractiveness Analysis, by Connectivity Type, 2025 to 2035

Figure 231: Mexico Temperature Sensor Market Value Share Analysis, by End-use industry, 2024 and 2035

Figure 232: Mexico Temperature Sensor Market Attractiveness Analysis, by End-use industry, 2025 to 2035

Figure 233: Argentina Temperature Sensor Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 234: Argentina Temperature Sensor Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 235: Argentina Temperature Sensor Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 236: Argentina Temperature Sensor Market Value Share Analysis, by Output Type, 2024 and 2035

Figure 237: Argentina Temperature Sensor Market Attractiveness Analysis, by Output Type, 2025 to 2035

Figure 238: Argentina Temperature Sensor Market Value Share Analysis, by Connectivity Type, 2024 and 2035

Figure 239: Argentina Temperature Sensor Market Attractiveness Analysis, by Connectivity Type, 2025 to 2035

Figure 240: Argentina Temperature Sensor Market Value Share Analysis, by End-use industry, 2024 and 2035

Figure 241: Argentina Temperature Sensor Market Attractiveness Analysis, by End-use industry, 2025 to 2035

Figure 242: Rest of Latin America Temperature Sensor Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 243: Rest of Latin America Temperature Sensor Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 244: Rest of Latin America Temperature Sensor Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 245: Rest of Latin America Temperature Sensor Market Value Share Analysis, by Output Type, 2024 and 2035

Figure 246: Rest of Latin America Temperature Sensor Market Attractiveness Analysis, by Output Type, 2025 to 2035

Figure 247: Rest of Latin America Temperature Sensor Market Value Share Analysis, by Connectivity Type, 2024 and 2035

Figure 248: Rest of Latin America Temperature Sensor Market Attractiveness Analysis, by Connectivity Type, 2025 to 2035

Figure 249: Rest of Latin America Temperature Sensor Market Value Share Analysis, by End-use industry, 2024 and 2035

Figure 250: Rest of Latin America Temperature Sensor Market Attractiveness Analysis, by End-use industry, 2025 to 2035

Figure 251: Middle East and Africa Temperature Sensor Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 252: Middle East and Africa Temperature Sensor Market Value Share Analysis, by Country, 2024 and 2035

Figure 253: Middle East and Africa Temperature Sensor Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 254: Middle East and Africa Temperature Sensor Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 255: Middle East and Africa Temperature Sensor Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 256: Middle East and Africa Temperature Sensor Market Value Share Analysis, by Output Type, 2024 and 2035

Figure 257: Middle East and Africa Temperature Sensor Market Attractiveness Analysis, by Output Type, 2025 to 2035

Figure 258: Middle East and Africa Temperature Sensor Market Value Share Analysis, by Connectivity Type, 2024 and 2035

Figure 259: Middle East and Africa Temperature Sensor Market Attractiveness Analysis, by Connectivity Type, 2025 to 2035

Figure 260: Middle East and Africa Temperature Sensor Market Value Share Analysis, by End-use industry, 2024 and 2035

Figure 261: Middle East and Africa Temperature Sensor Market Attractiveness Analysis, by End-use industry, 2025 to 2035

Figure 262: GCC Countries Temperature Sensor Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 263: GCC Countries Temperature Sensor Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 264: GCC Countries Temperature Sensor Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 265: GCC Countries Temperature Sensor Market Value Share Analysis, by Output Type, 2024 and 2035

Figure 266: GCC Countries Temperature Sensor Market Attractiveness Analysis, by Output Type, 2025 to 2035

Figure 267: GCC Countries Temperature Sensor Market Value Share Analysis, by Connectivity Type, 2024 and 2035

Figure 268: GCC Countries Temperature Sensor Market Attractiveness Analysis, by Connectivity Type, 2025 to 2035

Figure 269: GCC Countries Temperature Sensor Market Value Share Analysis, by End-use industry, 2024 and 2035

Figure 270: GCC Countries Temperature Sensor Market Attractiveness Analysis, by End-use industry, 2025 to 2035

Figure 271: South Africa Temperature Sensor Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 272: South Africa Temperature Sensor Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 273: South Africa Temperature Sensor Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 274: South Africa Temperature Sensor Market Value Share Analysis, by Output Type, 2024 and 2035

Figure 275: South Africa Temperature Sensor Market Attractiveness Analysis, by Output Type, 2025 to 2035

Figure 276: South Africa Temperature Sensor Market Value Share Analysis, by Connectivity Type, 2024 and 2035

Figure 277: South Africa Temperature Sensor Market Attractiveness Analysis, by Connectivity Type, 2025 to 2035

Figure 278: South Africa Temperature Sensor Market Value Share Analysis, by End-use industry, 2024 and 2035

Figure 279: South Africa Temperature Sensor Market Attractiveness Analysis, by End-use industry, 2025 to 2035

Figure 280: Rest of Middle East and Africa Temperature Sensor Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 281: Rest of Middle East and Africa Temperature Sensor Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 282: Rest of Middle East and Africa Temperature Sensor Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 283: Rest of Middle East and Africa Temperature Sensor Market Value Share Analysis, by Output Type, 2024 and 2035

Figure 284: Rest of Middle East and Africa Temperature Sensor Market Attractiveness Analysis, by Output Type, 2025 to 2035

Figure 285: Rest of Middle East and Africa Temperature Sensor Market Value Share Analysis, by Connectivity Type, 2024 and 2035

Figure 286: Rest of Middle East and Africa Temperature Sensor Market Attractiveness Analysis, by Connectivity Type, 2025 to 2035

Figure 287: Rest of Middle East and Africa Temperature Sensor Market Value Share Analysis, by End-use industry, 2024 and 2035

Figure 288: Rest of Middle East and Africa Temperature Sensor Market Attractiveness Analysis, by End-use industry, 2025 to 2035