Reports

Reports

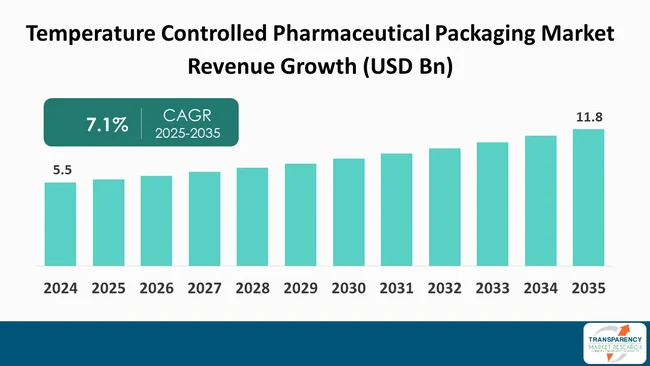

The global temperature controlled pharmaceutical packaging market size was valued at USD 5.5 billion in 2024 and is projected to reach USD 11.8 billion by 2035, expanding at a CAGR of 7.1 % from 2025 to 2035. The market will experience strong expansion throughout the forecast period because temperature-sensitive biologics, vaccines, and specialty drugs need exact thermal control for their storage and transportation. The market growth results from expanding worldwide pharmaceutical trade, improved cold chain logistics, and increasing regulatory requirements for product integrity maintenance.

Increased need for biologics, vaccines, and temperature-sensitive drugs is cited as a main reason for the expansion of the global temperature-controlled pharmaceutical packaging market. The advancements in packaging technologies including insulated containers, phase change materials, and smart packaging solutions act as the primary factors behind the great and efficient transport of temperature-sensitive products.

The expansion of the global pharmaceutical trade, with all the related regulatory requirements, has led to an ever-increasing demand for cold chain logistics. This demand, in turn, is driving the development of the market to even greater extents. Moreover, there is a growing interest and commitment in the market toward the implementation of new and creative solutions that focus on low energy consumption, improving the monitoring ability and assuring the sustainability of the packaging materials.

However, the market is facing challenges with high operational costs, complicated regulations, and possible spoilage of products or temperature changes during delivery. The need for safe, reasonably priced, and green temperature-controlled packaging solutions will most likely continue to be a major market trend, given the changes in the pharmaceutical sector.

Temperature controlled pharmaceutical packaging solutions are the ones that enable medicines to be kept within an indicated temperature range without any fluctuations in temperature. If a pharmaceutical company intends to retain the effectiveness of drugs, safety, and also ensure the sterility of temperature-sensitive drugs such as vaccines, biologics, and the other pharmaceutical products, these solutions are required as supporting pillars.

The global need for biologic treatments has steadily grown, and along with the ongoing trend pertaining to personalized medicine, the necessity of accurate temperature control during the supply chain process has turned out to be crucial. The said market involves various types of packaging that ensures the influx of specific temperature range such as insulated containers, refrigerated packaging, and temperature monitoring systems.

Due to strict regulations regarding drug safety, particularly in the area of cold chain logistics, there is a strong rise in the demand for the use of temperature-controlled pharmaceutical packaging. The advancements in packaging materials, technologies, and monitoring systems are progressively bringing about the desired quality and environmental benefits in these solutions. For instance, The European Medicine Agency outlines precise guidelines for the transportation and storage of temperature-sensitive drugs. These rules are particularly significant in the case of vaccines and biologics, as the agency requires utilization of packaging that is proven to be stable and does not lead to the deterioration of the product.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

One of the major factors leading to the increase of the temperature-controlled pharmaceutical packaging market is the biopharmaceutical sector that has developed at a rapid pace. The necessity of cold chain solutions becomes a major aspect when the sector expands and boosts the production of complicated and sensitive drugs, such as biologics, gene therapies, and personalized medicines.

For instance, U.S. FDA has been providing a strong support to the biopharmaceutical sector with the help of different initiatives that are intended to simplify the approval process for biologics and gene therapies. The FDA has launched the Biologics Control Act and the 21st Century Cures Act in recent years, which promote the innovation and permission of novel biopharmaceuticals.

The drugs of that type are normally maintained in strict temperature conditions during transportation or storage in order not to be changed in their stability and effectiveness. Consequently, shipping with temperature control is an indispensable part of the medical supply chain to guarantee safety of the drugs. The expansion of biopharmaceuticals, which are complicated in their production and are, in most cases, difficult to store, has led to the changes in their packaging, for example - temperature-controlled packaging, active cooling, and real-time temperature monitoring devices.

Biopharmaceutical Industry is booming to the extent of its vast expansion. Apart from their increased production capabilities, these firms are reaching out to broad international markets. Consequently, the demand for temperature control solutions that are both - safe and cost-efficient and compliant with regulations is on the rise. This stimulates the market development beyond the initial level. For instance, The National Medical Products Administration (NMPA) has implemented new cold chain standards that are meant to ease the distribution and storage of biologicals and any other drugs that require a particular temperature.

The meteoric rise of electronic commerce in the healthcare field has been a major factor in how the temperature-controlled pharmaceutical packaging market has been widened. The trend of selling medicines online and dispatching them directly to the consumers has led to an increase in the need for safe, effective, and tamper-proof transportation of drugs that are sensitive to temperature.

According to the World Health Organization (WHO), the role of e-Commerce in the supply of medicines worldwide, especially in markets, is considerable. The WHO acknowledges that for the growth in patients' preference for pharmaceutical services via the web stringent cold chain criteria should be implemented. This is aimed at drug safety during cross-border transport in which their efficacy at low temperatures is required to be maintained.

e-Commerce platforms are being utilized majorly for the distribution of biologics, vaccines, and the other drugs that are sensitive to temperature and require a controlled supply chain, temperature-wise. Temperature controlled transport equipment with extended use is one of the solutions meant to address these needs by pharmaceutical companies. Insulated packages, refrigerated containers, and temperature measuring devices are examples of these equipment. These steps are intended to ensure that medicines are kept at the required temperatures during the entire transportation cycle.

The demand for the temperature controlled pharmaceutical packaging market is still rising since consumers are changing their preferences and tending to choose the home-delivered pharmaceutical services that are convenient. The main focus of the pharmaceutical packaging market is maintaining product integrity and meeting regulatory standards through innovative cold chain solutions.

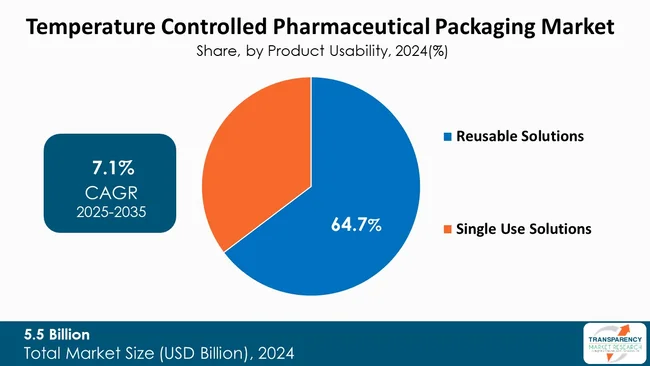

The reusable solutions dominate the global temperature controlled pharmaceutical packaging market with 64.7% market share. Reusable solutions are at the forefront of the temperature-controlled pharmaceutical packaging market, and the key factors leading this trend are the increasing emphasis on sustainability and cost reduction. In the long run, it has advantages with less waste and reduced operational costs, as the use of packaging for different transports such as insulated containers, pallet shippers, and active cooling devices is almost unlimited.

Large pharma companies and distributors are the primary users of these solutions. Such corporations usually have to regularly move large quantities of drugs that are sensitive to temperature. One smart way for businesses to combine the flow of their logistics with the need to comply with stringent rules set by the authorities for maintaining the integrity of the product is to put their money into robust, recyclable packaging.

For instance, the U.S. Environmental Protection Agency has been extremely influential in promoting the idea of waste reduction across all the sectors, pharmaceuticals being one of them. To support the green initiatives of drug corporations, the agency has not only given the resources but has also drawn the guidelines to facilitate their acceptance of the sustainable approach in packaging, specifically the change to reusable temperature-controlled packaging.

| Attribute | Detail |

|---|---|

| Leading Region |

|

North America holds the dominant market share (38.5%). The North American region is currently leading the global market for temperature controlled pharmaceutical packaging market. The U.S. and Canada's robust pharmaceutical manufacturing and distribution activities, together with their well-developed cold chain logistics network, are essentially the factors responsible for this supremacy in the market.

The major factor that contributes to the growing demand for temperature-controlled packaging solutions in North America is the rapid expansion of biopharmaceuticals’ manufacturing. Another factor is the increasing e-commerce usage within the pharmaceutical industry. Apart from these two, the existence of strict regulatory frameworks such as the FDA guidelines for cold chain management has accounted for the demand for such solutions.

For instance, the U.S. Department of Transportation has been funneling its funds into is the improvement of its infrastructure that is linked to the cold chain logistics sector. This is mainly to cater to the increasing pharmaceutical market, specifically for the production of biologics and vaccines. The Infrastructure Investment and Jobs Act has generously funded the upgrading of logistics hubs such as refrigerated warehouses and distribution centers all over the country.

Cardinal Health, Peli BioThermal LLC, Cencora, Inc., Intelsius, Cold Chain Technologies, Deutsche Post AG, Cryopak, FedEx, Cryoport Systems, LLC, Aeris Dynamics Pte Ltd., CSafe, Inmark - Life Sciences, McKesson Corporation, Sealed Air, SOFTBOX SYSTEMS (I) PVT. LIMITED and others are some of the leading manufacturers operating in the global temperature controlled pharmaceutical packaging market.

Each of these companies has been profiled in the temperature controlled pharmaceutical packaging market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 5.5 Bn |

| Forecast Value in 2035 | More than US$ 11.8 Bn |

| CAGR | 7.1 % |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Product Usability

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global temperature controlled pharmaceutical packaging market was valued at US$ 5.5 Bn in 2024

The global temperature controlled pharmaceutical packaging industry is projected to reach more than US$ 11.8 Bn by the end of 2035

Growth of biopharmaceutical sector & e-commerce growth in pharmaceuticals are some of the factors driving the expansion of temperature controlled pharmaceutical packaging market.

The CAGR is anticipated to be 7.1 % from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Cardinal Health, Peli BioThermal LLC, Cencora, Inc., Intelsius, Cold Chain Technologies, Deutsche Post AG, Cryopak, FedEx, Cryoport Systems, LLC, Aeris Dynamics Pte Ltd., CSafe, Inmark - Life Sciences, McKesson Corporation, Sealed Air, Softbox Systems (I) Pvt. Limited, and other prominent players

Table 01: Global Temperature Controlled Pharmaceutical Packaging Market Value (US$ Bn) Forecast, by Product Usability, 2020 to 2035

Table 02: Global Temperature Controlled Pharmaceutical Packaging Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 03: Global Temperature Controlled Pharmaceutical Packaging Market Value (US$ Bn) Forecast, By End User, 2020 to 2035

Table 04: Global Temperature Controlled Pharmaceutical Packaging Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 05: North America Temperature Controlled Pharmaceutical Packaging Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 06: North America Temperature Controlled Pharmaceutical Packaging Market Value (US$ Bn) Forecast, by Product Usability, 2020 to 2035

Table 07: North America Temperature Controlled Pharmaceutical Packaging Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 08: North America Temperature Controlled Pharmaceutical Packaging Market Value (US$ Bn) Forecast, by End User, 2020 to 2035

Table 09: Europe Temperature Controlled Pharmaceutical Packaging Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 10: Europe Temperature Controlled Pharmaceutical Packaging Market Value (US$ Bn) Forecast, by Product Usability, 2020 to 2035

Table 11: Europe Temperature Controlled Pharmaceutical Packaging Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 12: Europe Temperature Controlled Pharmaceutical Packaging Market Value (US$ Bn) Forecast, by End User, 2020 to 2035

Table 13: Asia Pacific Temperature Controlled Pharmaceutical Packaging Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 14: Asia Pacific Temperature Controlled Pharmaceutical Packaging Market Value (US$ Bn) Forecast, by Product Usability, 2020 to 2035

Table 15: Asia Pacific Temperature Controlled Pharmaceutical Packaging Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 16: Asia Pacific Temperature Controlled Pharmaceutical Packaging Market Value (US$ Bn) Forecast, by End User, 2020 to 2035

Table 17: Latin America Temperature Controlled Pharmaceutical Packaging Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 18: Latin America Temperature Controlled Pharmaceutical Packaging Market Value (US$ Bn) Forecast, by Product Usability, 2020 to 2035

Table 19: Latin America Temperature Controlled Pharmaceutical Packaging Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 20: Latin America Temperature Controlled Pharmaceutical Packaging Market Value (US$ Bn) Forecast, by End User, 2020 to 2035

Table 21: Middle East and Africa Temperature Controlled Pharmaceutical Packaging Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 22: Middle East and Africa Temperature Controlled Pharmaceutical Packaging Market Value (US$ Bn) Forecast, by Product Usability, 2020 to 2035

Table 23: Middle East and Africa Temperature Controlled Pharmaceutical Packaging Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 24: Middle East and Africa Temperature Controlled Pharmaceutical Packaging Market Value (US$ Bn) Forecast, by End User, 2020 to 2035

Figure 01: Global Temperature Controlled Pharmaceutical Packaging Market Value Share Analysis, by Product Usability, 2024 and 2035

Figure 02: Global Temperature Controlled Pharmaceutical Packaging Market Attractiveness Analysis, by Product Usability, 2025 to 2035

Figure 03: Global Temperature Controlled Pharmaceutical Packaging Market Revenue (US$ Bn), by Reusable Solutions, 2020 to 2035

Figure 04: Global Temperature Controlled Pharmaceutical Packaging Market Revenue (US$ Bn), by Single Use Solutions, 2020 to 2035

Figure 05: Global Temperature Controlled Pharmaceutical Packaging Market Value Share Analysis, by Application, 2024 and 2035

Figure 06: Global Temperature Controlled Pharmaceutical Packaging Market Attractiveness Analysis, by Application, 2024 and 2035

Figure 07: Global Temperature Controlled Pharmaceutical Packaging Market Revenue (US$ Bn), by Temperature-Sensitive Pharmaceuticals, 2020 to 2035

Figure 08: Global Temperature Controlled Pharmaceutical Packaging Market Revenue (US$ Bn), by Vaccines, 2020 to 2035

Figure 09: Global Temperature Controlled Pharmaceutical Packaging Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 10: Global Temperature Controlled Pharmaceutical Packaging Market Value Share Analysis, by End User, 2024 and 2035

Figure 11: Global Temperature Controlled Pharmaceutical Packaging Market Attractiveness Analysis, by End User, 2024 and 2035

Figure 12: Global Temperature Controlled Pharmaceutical Packaging Market Revenue (US$ Bn), by Pharmaceutical Companies, 2025 to 2035

Figure 13: Global Temperature Controlled Pharmaceutical Packaging Market Revenue (US$ Bn), by Healthcare Facilities, 2020 to 2035

Figure 14: Global Temperature Controlled Pharmaceutical Packaging Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 15: Global Temperature Controlled Pharmaceutical Packaging Market Value Share Analysis, By Region, 2024 and 2035

Figure 16: Global Temperature Controlled Pharmaceutical Packaging Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 17: North America Temperature Controlled Pharmaceutical Packaging Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 18: North America Temperature Controlled Pharmaceutical Packaging Market Value Share Analysis, by Country, 2024 and 2035

Figure 19: North America Temperature Controlled Pharmaceutical Packaging Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 20: North America Temperature Controlled Pharmaceutical Packaging Market Value Share Analysis, by Product Usability, 2024 and 2035

Figure 21: North America Temperature Controlled Pharmaceutical Packaging Market Attractiveness Analysis, by Product Usability, 2025 to 2035

Figure 22: North America Temperature Controlled Pharmaceutical Packaging Market Value Share Analysis, by Application, 2024 and 2035

Figure 23: North America Temperature Controlled Pharmaceutical Packaging Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 24: North America Temperature Controlled Pharmaceutical Packaging Market Value Share Analysis, by End User, 2024 and 2035

Figure 25: North America Temperature Controlled Pharmaceutical Packaging Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 26: Europe Temperature Controlled Pharmaceutical Packaging Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 27: Europe Temperature Controlled Pharmaceutical Packaging Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 28: Europe Temperature Controlled Pharmaceutical Packaging Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 29: Europe Temperature Controlled Pharmaceutical Packaging Market Value Share Analysis, by Product Usability, 2024 and 2035

Figure 30: Europe Temperature Controlled Pharmaceutical Packaging Market Attractiveness Analysis, by Product Usability, 2025 to 2035

Figure 31: Europe Temperature Controlled Pharmaceutical Packaging Market Value Share Analysis, By Application, 2024 and 2035

Figure 32: Europe Temperature Controlled Pharmaceutical Packaging Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 33: Europe Temperature Controlled Pharmaceutical Packaging Market Value Share Analysis, by End User, 2024 and 2035

Figure 34: Europe Temperature Controlled Pharmaceutical Packaging Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 35: Asia Pacific Temperature Controlled Pharmaceutical Packaging Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 36: Asia Pacific Temperature Controlled Pharmaceutical Packaging Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 37: Asia Pacific Temperature Controlled Pharmaceutical Packaging Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 38: Asia Pacific Temperature Controlled Pharmaceutical Packaging Market Value Share Analysis, by Product Usability, 2024 and 2035

Figure 39: Asia Pacific Temperature Controlled Pharmaceutical Packaging Market Attractiveness Analysis, by Product Usability, 2025 to 2035

Figure 40: Asia Pacific Temperature Controlled Pharmaceutical Packaging Market Value Share Analysis, By Application, 2024 and 2035

Figure 41: Asia Pacific Temperature Controlled Pharmaceutical Packaging Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 42: Asia Pacific Temperature Controlled Pharmaceutical Packaging Market Value Share Analysis, by End User, 2024 and 2035

Figure 43: Asia Pacific Temperature Controlled Pharmaceutical Packaging Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 44: Latin America Temperature Controlled Pharmaceutical Packaging Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 45: Latin America Temperature Controlled Pharmaceutical Packaging Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 46: Latin America Temperature Controlled Pharmaceutical Packaging Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 47: Latin America Temperature Controlled Pharmaceutical Packaging Market Value Share Analysis, by Product Usability, 2024 and 2035

Figure 48: Latin America Temperature Controlled Pharmaceutical Packaging Market Attractiveness Analysis, by Product Usability, 2025 to 2035

Figure 49: Latin America Temperature Controlled Pharmaceutical Packaging Market Value Share Analysis, By Application, 2024 and 2035

Figure 50: Latin America Temperature Controlled Pharmaceutical Packaging Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 51: Latin America Temperature Controlled Pharmaceutical Packaging Market Value Share Analysis, by End User, 2024 and 2035

Figure 52: Latin America Temperature Controlled Pharmaceutical Packaging Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 53: Middle East & Africa Temperature Controlled Pharmaceutical Packaging Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 54: Middle East & Africa Temperature Controlled Pharmaceutical Packaging Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 55: Middle East & Africa Temperature Controlled Pharmaceutical Packaging Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 56: Middle East and Africa Temperature Controlled Pharmaceutical Packaging Market Value Share Analysis, by Product Usability, 2024 and 2035

Figure 57: Middle East and Africa Temperature Controlled Pharmaceutical Packaging Market Attractiveness Analysis, by Product Usability, 2025 to 2035

Figure 58: Middle East and Africa Temperature Controlled Pharmaceutical Packaging Market Value Share Analysis, by Application, 2024 and 2035

Figure 59: Middle East and Africa Temperature Controlled Pharmaceutical Packaging Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 60: Middle East and Africa Temperature Controlled Pharmaceutical Packaging Market Value Share Analysis, by End User, 2024 and 2035

Figure 61: Middle East and Africa Temperature Controlled Pharmaceutical Packaging Market Attractiveness Analysis, by End User, 2025 to 2035