Reports

Reports

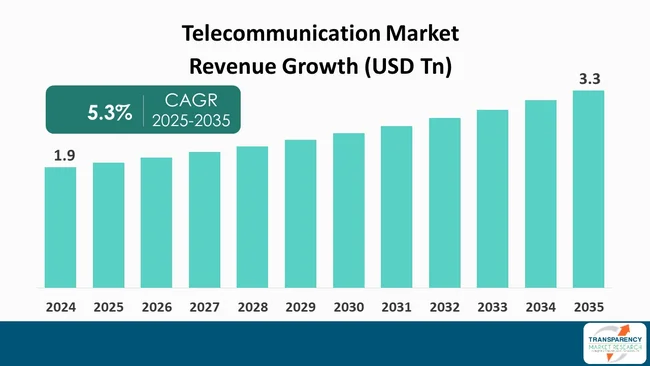

The global telecommunications market size was valued at US$ 1.9 Tn in 2024 and is projected to reach US$ 3.3 Tn by 2035, expanding at a CAGR of 5.3% from 2025 to 2035. The telecommunications market is expanding rapidly due to high consumption of mobile data usage, cloud services, and video streaming platforms have increased their data consumption rates. The spread of 5G technology creates a demand for fast internet access. This affects both individual users and business organizations.

The global telecommunication market is changing considerably, driven by the advent of new technologies, change in consumers’ demands, and the increase in digital connectivity. Moreover, the market is moving rapidly toward 5G, fiber optics, AI, and edge computing, which are all next-generation technologies.

The major changes are implemented as a direct result of these innovations to allow faster and lower latency services to both - consumer and enterprise segments. Meanwhile, telecom operators are dealing with issues, for instance - market saturation, strict regulations, and increased costs for the maintenance of network infrastructure.

Despite such negative elements, the telecommunication sector has a prominent future and growth aspects during the forecast period, particularly in the B2B market areas, digital infrastructure, and emerging economies. Analysts observe that the global telecommunication market is experiencing a change since the increase of data traffic is slowing down. This change has a positive effect on the free cash flow of telecom operators since their expenditure on capital are lower. However, it is anticipated that the development of Al and digital services will require the implementation of advanced infrastructure such as 5G and 6G be resumed.

The global telecommunication market serves a vital function of linking individuals, enterprises, and administrations electronically via voice, data, and video transmissions. The market covers diverse services such as mobile and land communication, broadband internet, satellite, and wireless technologies.

The market, fueled by technological advancement, higher mobile usage, and growing demand for high-speed connectivity, has changed to an essential element that enables digital transformation from various sectors. For instance, ITU estimates that approximately 5.5 billion people - or 68 % of the world’s population - are using the Internet as of 2024. The influx of 5G, IoT, and Al that are revolutionizing the communication infrastructure. Moreover, the increased use of cloud computing, remote working, and digital services has led to the growth of the telecom market, which is going to be a major trend in the next few years.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The major contributing factors to the expansion of the international telecommunication industry are the increased use of data and the extensive acceptance of mobile devices. As per the global assessment done by the International Telecommunications Union (ITU) in the year 2024, 68% of the global population has made Internet an indispensable part of their lives.

Moreover, streaming, social media, online gaming, and e-Commerce have become the primary activities of mobile users, and as a result, data traffic has gone through the roof. Such a move is forcing the telecom carriers to extend the capacity of their networks, and upgrade technology to 4G or 5G.

The increased demand for telecommunications services has compelled telecom providers to widen their networks, incorporate sophisticated technologies, and present new data plans that will satisfy the changing needs of the consumers. As a result, the sector is riding a positive uptrend, with the digital transformation being a major driver alongside the insatiable need for connectivity.

The introduction of new services and technology advancements have been the primary factors to boost the telecommunication market growth. 5G, fiber optic networks, and cloud-based communication platforms have not only made the connectivity faster but also more reliable and efficient. All these innovations are significantly enhancing the user experience, thereby contributing to the growth of the market. For instance, one of the main objectives of ETRI (Electronics and Telecommunications Research Institute) is to create a global standard for digital wallets that are personal, safe, and easy to use, and can store and provide access to IDs, loyalty cards, credit cards, etc., via mobile phones. Such a breakthrough is the leading move for a global digital authentication system revolution.

In addition, telecom companies are broadening their range of services, which may include mobile banking, streaming, and enterprise solutions, with the aim of satisfying the changing needs of customers. Given developments and new services are driving competition, thereby expanding market outreach and accelerating growth of telecommunications industry.

These changes are also allowing telecom organizations to simplify their processes and save money through the use of automation and Al-based solutions. In line with increasing customer demands, personalized and on-demand services are gaining importance as a key focus area. The implementation of advance technologies creates new possibilities in rural and deprived regions as well. The growth of this nature helps in bridging the digital gap and promoting the developmental inclusion. Thus, telecommunication remains a crucial player in the global digital transition.

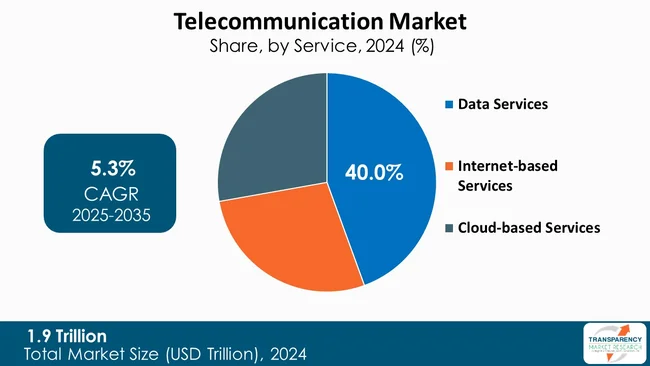

In terms of service segments, data service segment dominates the market with 40% of the overall share. Data Services is the leading segment in the telecommunication market, mainly arising from the need for high-speed connectivity, mobile internet usage, and data consumption.

Data services have become the fundamental offering of telecom operators due to the popularity of smartphones, streaming services, and cloud-based applications. Such services as mobile data, broadband internet, and high-speed fiber optics, which play a crucial role in satisfying the requirements of both - consumers and businesses that are the main trends of the market.

The increasing reliability on data has become the trend for almost all personal and professional activities, which include social media, video conferencing, online gaming, and cloud computing. As a result, data services have become the core offering of telecom companies. Data services have been pushed to the forefront as the shift to 5G technology has sped up the need for quicker and more reliable data connections. This has made the data services that were just the main revenue driver of the telecom providers, a strategic area from which they can distinguish themselves in the competitive market.

| Attribute | Detail |

|---|---|

| Leading Region |

|

According to the latest telecommunication market analysis, Asia Pacific held the largest share with 36.6%. This is mainly due to rapid technological innovation, large-scale infrastructure, and a huge consumer base. Among such countries are South Korea, China, and India which besides 5G roll out, have the highest mobile and digital services adoption.

The region is going on a massive expenditure spree with new technologies that include Al, IoT, and 6G, thereby leading the way for future telecommunications changes. With the strong backing of the government and a rapid demand for connectivity, the Asia-Pacific region is setting the trend for the global telecommunications sector.

For instance, China Telecom Research Institute and China Telecom Guangdong recently announced the world's first live-network test of optical-electrical synergy network architecture that is designed for future training and training-inference integration scenarios with clusters of more than 10,000 AI cards. Its high-quality DCN network provides inclusive computing power services for the whole province.

Verizon, Comcast Corporation, Deutsche Telekom AG, AT&T Intellectual Property, China Telecom Corporation Limited., SoftBank Corp, Charter Communications, Vodafone Idea Limited, Orange Business, RELIANCE INDUSTRIES LIMITED, KDDI CORPORATION, Telefónica S.A., stc, e&., British Telecommunications plc are some of the leading manufacturers operating in the global telecommunication market.

Each of these companies has been profiled in the telecommunication market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 1.9 Tn |

| Forecast Value in 2035 | More than US$ 3.3 Tn |

| CAGR | 5.3 % |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Tn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Service

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global telecommunication market was valued at US$ 1.9 Tn in 2024

The global telecommunication industry is projected to reach more than US$ 3.3 Tn by the end of 2035

Rising data consumption & mobile adoption and technological advancements & new services are some of the driving factor of telecommunication market.

The CAGR is anticipated to be 5.3% from 2025 to 2035

Verizon, Comcast Corporation, Deutsche Telekom AG, AT&T Intellectual Property, China Telecom Corporation Limited., SoftBank Corp, Vodafone Idea Limited, Orange Business, RELIANCE INDUSTRIES LIMITED, KDDI CORPORATION, Telefónica S.A., e&, British Telecommunications plc, and STC.

Table 01: Global Telecommunication Market Value (US$ Bn) Forecast, By Service, 2020 to 2035

Table 02: Global Telecommunication Market Value (US$ Bn) Forecast, By Transmission Type, 2020 to 2035

Table 03: Global Telecommunication Market Value (US$ Bn) Forecast, By End-User, 2020 to 2035

Table 04: Global Telecommunication Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 05: North America Telecommunication Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 06: North America Telecommunication Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 07: North America Telecommunication Market Value (US$ Bn) Forecast, by Transmission Type, 2020 to 2035

Table 08: North America Telecommunication Market Value (US$ Bn) Forecast, by End-User, 2020 to 2035

Table 09: U.S. Telecommunication Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 10: U.S. Telecommunication Market Value (US$ Bn) Forecast, by Transmission Type, 2020 to 2035

Table 11: U.S. Telecommunication Market Value (US$ Bn) Forecast, by End-User, 2020 to 2035

Table 12: Canada Telecommunication Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 13: Canada Telecommunication Market Value (US$ Bn) Forecast, by Transmission Type, 2020 to 2035

Table 14: Canada Telecommunication Market Value (US$ Bn) Forecast, by End-User, 2020 to 2035

Table 15: Europe Telecommunication Market Value (US$ Bn) Forecast, By Country/Sub-region, 2020-2035

Table 16: Europe Telecommunication Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 17: Europe Telecommunication Market Value (US$ Bn) Forecast, by Transmission Type, 2020 to 2035

Table 18: Europe Telecommunication Market Value (US$ Bn) Forecast, by End-User, 2020 to 2035

Table 19: Germany Telecommunication Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 20: Germany Telecommunication Market Value (US$ Bn) Forecast, by Transmission Type, 2020 to 2035

Table 21: Germany Telecommunication Market Value (US$ Bn) Forecast, by End-User, 2020 to 2035

Table 22: U.K. Telecommunication Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 23: U.K. Telecommunication Market Value (US$ Bn) Forecast, by Transmission Type, 2020 to 2035

Table 24: U.K. Telecommunication Market Value (US$ Bn) Forecast, by End-User, 2020 to 2035

Table 25: France Telecommunication Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 26: France Telecommunication Market Value (US$ Bn) Forecast, by Transmission Type, 2020 to 2035

Table 27: France Telecommunication Market Value (US$ Bn) Forecast, by End-User, 2020 to 2035

Table 28: Italy Telecommunication Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 29: Italy Telecommunication Market Value (US$ Bn) Forecast, by Transmission Type, 2020 to 2035

Table 30: Italy Telecommunication Market Value (US$ Bn) Forecast, by End-User, 2020 to 2035

Table 31: Spain Telecommunication Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 32: Spain Telecommunication Market Value (US$ Bn) Forecast, by Transmission Type, 2020 to 2035

Table 33: Spain Telecommunication Market Value (US$ Bn) Forecast, by End-User, 2020 to 2035

Table 34: The Netherlands Telecommunication Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 35: The Netherlands Telecommunication Market Value (US$ Bn) Forecast, by Transmission Type, 2020 to 2035

Table 36: The Netherlands Telecommunication Market Value (US$ Bn) Forecast, by End-User, 2020 to 2035

Table 37: Rest of Europe Telecommunication Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 38: Rest of Europe Telecommunication Market Value (US$ Bn) Forecast, by Transmission Type, 2020 to 2035

Table 39: Rest of Europe Telecommunication Market Value (US$ Bn) Forecast, by End-User, 2020 to 2035

Table 40: Asia Pacific Telecommunication Market Value (US$ Bn) Forecast, By Country/Sub-region, 2020-2035

Table 41: Asia Pacific Telecommunication Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 42: Asia Pacific Telecommunication Market Value (US$ Bn) Forecast, by Transmission Type, 2020 to 2035

Table 43: Asia Pacific Telecommunication Market Value (US$ Bn) Forecast, by End-User, 2020 to 2035

Table 44: China Telecommunication Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 45: China Telecommunication Market Value (US$ Bn) Forecast, by Transmission Type, 2020 to 2035

Table 46: China Telecommunication Market Value (US$ Bn) Forecast, by End-User, 2020 to 2035

Table 47: India Telecommunication Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 48: India Telecommunication Market Value (US$ Bn) Forecast, by Transmission Type, 2020 to 2035

Table 49: India Telecommunication Market Value (US$ Bn) Forecast, by End-User, 2020 to 2035

Table 50: Japan Telecommunication Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 51: Japan Telecommunication Market Value (US$ Bn) Forecast, by Transmission Type, 2020 to 2035

Table 52: Japan Telecommunication Market Value (US$ Bn) Forecast, by End-User, 2020 to 2035

Table 53: South Korea Telecommunication Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 54: South Korea Telecommunication Market Value (US$ Bn) Forecast, by Transmission Type, 2020 to 2035

Table 55: South Korea Telecommunication Market Value (US$ Bn) Forecast, by End-User, 2020 to 2035

Table 56: Australia Telecommunication Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 57: Australia Telecommunication Market Value (US$ Bn) Forecast, by Transmission Type, 2020 to 2035

Table 58: Australia Telecommunication Market Value (US$ Bn) Forecast, by End-User, 2020 to 2035

Table 59: ASEAN Telecommunication Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 60: ASEAN Telecommunication Market Value (US$ Bn) Forecast, by Transmission Type, 2020 to 2035

Table 61: ASEAN Telecommunication Market Value (US$ Bn) Forecast, by End-User, 2020 to 2035

Table 62: Rest of Asia Pacific Telecommunication Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 63: Rest of Asia Pacific Telecommunication Market Value (US$ Bn) Forecast, by Transmission Type, 2020 to 2035

Table 64: Rest of Asia Pacific Telecommunication Market Value (US$ Bn) Forecast, by End-User, 2020 to 2035

Table 65: Latin America Telecommunication Market Value (US$ Bn) Forecast, By Country/Sub-region, 2020-2035

Table 66: Latin America Telecommunication Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 67: Latin America Telecommunication Market Value (US$ Bn) Forecast, by Transmission Type, 2020 to 2035

Table 68: Latin America Telecommunication Market Value (US$ Bn) Forecast, by End-User, 2020 to 2035

Table 69: Brazil Telecommunication Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 70: Brazil Telecommunication Market Value (US$ Bn) Forecast, by Transmission Type, 2020 to 2035

Table 71: Brazil Telecommunication Market Value (US$ Bn) Forecast, by End-User, 2020 to 2035

Table 72: Mexico Telecommunication Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 73: Mexico Telecommunication Market Value (US$ Bn) Forecast, by Transmission Type, 2020 to 2035

Table 74: Mexico Telecommunication Market Value (US$ Bn) Forecast, by End-User, 2020 to 2035

Table 75: Argentina Telecommunication Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 76: Argentina Telecommunication Market Value (US$ Bn) Forecast, by Transmission Type, 2020 to 2035

Table 77: Argentina Telecommunication Market Value (US$ Bn) Forecast, by End-User, 2020 to 2035

Table 78: Rest of Latin America Telecommunication Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 79: Rest of Latin America Telecommunication Market Value (US$ Bn) Forecast, by Transmission Type, 2020 to 2035

Table 80: Rest of Latin America Telecommunication Market Value (US$ Bn) Forecast, by End-User, 2020 to 2035

Table 81: Middle East and Africa Telecommunication Market Value (US$ Bn) Forecast, By Country/Sub-region, 2020-2035

Table 82: Middle East and Africa Telecommunication Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 83: Middle East and Africa Telecommunication Market Value (US$ Bn) Forecast, by Transmission Type, 2020 to 2035

Table 84: Middle East and Africa Telecommunication Market Value (US$ Bn) Forecast, by End-User, 2020 to 2035

Table 85: GCC Countries Telecommunication Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 86: GCC Countries Telecommunication Market Value (US$ Bn) Forecast, by Transmission Type, 2020 to 2035

Table 87: GCC Countries Telecommunication Market Value (US$ Bn) Forecast, by End-User, 2020 to 2035

Table 88: South Africa Telecommunication Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 89: South Africa Telecommunication Market Value (US$ Bn) Forecast, by Transmission Type, 2020 to 2035

Table 90: South Africa Telecommunication Market Value (US$ Bn) Forecast, by End-User, 2020 to 2035

Table 91: Rest of Middle East Telecommunication Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 92: Rest of Middle East Telecommunication Market Value (US$ Bn) Forecast, by Transmission Type, 2020 to 2035

Table 93: Rest of Middle East Telecommunication Market Value (US$ Bn) Forecast, by End-User, 2020 to 2035

Figure 01: Global Telecommunication Market Value Share Analysis, by Service, 2024 and 2035

Figure 02: Global Telecommunication Market Attractiveness Analysis, by Service, 2025 to 2035

Figure 03: Global Telecommunication Market Revenue (US$ Bn), by Data Services, 2020 to 2035

Figure 04: Global Telecommunication Market Revenue (US$ Bn), by Internet-Based Services, 2020 to 2035

Figure 05: Global Telecommunication Market Revenue (US$ Bn), by Cloud-Based Services, 2020 to 2035

Figure 06: Global Telecommunication Market Value Share Analysis, by Transmission Type, 2024 and 2035

Figure 07: Global Telecommunication Market Attractiveness Analysis, by Transmission Type, 2025 to 2035

Figure 08: Global Telecommunication Market Revenue (US$ Bn), by Wired, 2020 to 2035

Figure 09: Global Telecommunication Market Revenue (US$ Bn), by Wireless, 2020 to 2035

Figure 10: Global Telecommunication Market Value Share Analysis, by End-User, 2024 and 2035

Figure 11: Global Telecommunication Market Attractiveness Analysis, by End-User, 2024 and 2035

Figure 12: Global Telecommunication Market Revenue (US$ Bn), by Residential, 2025 to 2035

Figure 13: Global Telecommunication Market Revenue (US$ Bn), by Commercial/Business, 2020 to 2035

Figure 14: Global Telecommunication Market Revenue (US$ Bn), by Industrial, 2020 to 2035

Figure 15: Global Telecommunication Market Revenue (US$ Bn), by Healthcare, 2020 to 2035

Figure 16: Global Telecommunication Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 17: Global Telecommunication Market Value Share Analysis, By Region, 2024 and 2035

Figure 18: Global Telecommunication Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 19: North America Telecommunication Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 20: North America Telecommunication Market Value Share Analysis, by Country, 2024 and 2035

Figure 21: North America Telecommunication Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 22: North America Telecommunication Market Value Share Analysis, by Service, 2025 to 2035

Figure 23: North America Telecommunication Market Attractiveness Analysis, by Service, 2025 to 2035

Figure 24: North America Telecommunication Market Value Share Analysis, by Transmission Type, 2024 and 2035

Figure 25: North America Telecommunication Market Attractiveness Analysis, by Transmission Type, 2025 to 2035

Figure 26: North America Telecommunication Market Value Share Analysis, by End-User, 2024 and 2035

Figure 27: North America Telecommunication Market Attractiveness Analysis, by End-User, 2025 to 2035

Figure 28: U.S. Telecommunication Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 29: U.S. Telecommunication Market Value Share Analysis, by Service, 2025 to 2035

Figure 30: U.S. Telecommunication Market Attractiveness Analysis, by Service, 2025 to 2035

Figure 31: U.S. Telecommunication Market Value Share Analysis, by Transmission Type, 2024 and 2035

Figure 32: U.S. Telecommunication Market Attractiveness Analysis, by Transmission Type, 2025 to 2035

Figure 33: U.S. Telecommunication Market Value Share Analysis, by End-User, 2024 and 2035

Figure 34: U.S. Telecommunication Market Attractiveness Analysis, by End-User, 2025 to 2035

Figure 35: Canada Telecommunication Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 36: Canada Telecommunication Market Attractiveness Analysis, by Service, 2025 to 2035

Figure 37: Canada Telecommunication Market Attractiveness Analysis, by Service, 2025 to 2035

Figure 38: Canada Telecommunication Market Value Share Analysis, by Transmission Type, 2024 and 2035

Figure 39: Canada Telecommunication Market Attractiveness Analysis, by Transmission Type, 2025 to 2035

Figure 40: Canada Telecommunication Market Value Share Analysis, by End-User, 2024 and 2035

Figure 41: Canada Telecommunication Market Attractiveness Analysis, by End-User, 2025 to 2035

Figure 42: Europe Telecommunication Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 43: Europe Telecommunication Market Value Share Analysis, By Country/Sub-region, 2024 and 2035

Figure 44: Europe Telecommunication Market Attractiveness Analysis, By Country/Sub-region, 2025 to 2035

Figure 45: Europe Telecommunication Market Value Share Analysis, by Service, 2024 and 2035

Figure 46: Europe Telecommunication Market Attractiveness Analysis, by Service, 2025 to 2035

Figure 47: Europe Telecommunication Market Value Share Analysis, By Transmission Type, 2024 and 2035

Figure 48: Europe Telecommunication Market Attractiveness Analysis, By Transmission Type, 2025 to 2035

Figure 49: Europe Telecommunication Market Value Share Analysis, by End-User, 2024 and 2035

Figure 50: Europe Telecommunication Market Attractiveness Analysis, by End-User, 2025 to 2035

Figure 51: Germany Telecommunication Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 52: Germany Telecommunication Market Value Share Analysis, by Service, 2024 and 2035

Figure 53: Germany Telecommunication Market Attractiveness Analysis, by Service, 2025 to 2035

Figure 54: Germany Telecommunication Market Value Share Analysis, By Transmission Type, 2024 and 2035

Figure 55: Germany Telecommunication Market Attractiveness Analysis, By Transmission Type, 2025 to 2035

Figure 56: Germany Telecommunication Market Value Share Analysis, by End-User, 2024 and 2035

Figure 57: Germany Telecommunication Market Attractiveness Analysis, by End-User, 2025 to 2035

Figure 58: U.K. Telecommunication Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 59: U.K. Telecommunication Market Value Share Analysis, by Service, 2024 and 2035

Figure 60: U.K. Telecommunication Market Attractiveness Analysis, by Service, 2025 to 2035

Figure 61: U.K. Telecommunication Market Value Share Analysis, By Transmission Type, 2024 and 2035

Figure 62: U.K. Telecommunication Market Attractiveness Analysis, By Transmission Type, 2025 to 2035

Figure 63: U.K. Telecommunication Market Value Share Analysis, by End-User, 2024 and 2035

Figure 64: U.K. Telecommunication Market Attractiveness Analysis, by End-User, 2025 to 2035

Figure 65: France Telecommunication Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 66: France Telecommunication Market Value Share Analysis, by Service, 2024 and 2035

Figure 67: France Telecommunication Market Attractiveness Analysis, by Service, 2025 to 2035

Figure 68: France Telecommunication Market Value Share Analysis, By Transmission Type, 2024 and 2035

Figure 69: France Telecommunication Market Attractiveness Analysis, By Transmission Type, 2025 to 2035

Figure 70: France Telecommunication Market Value Share Analysis, by End-User, 2024 and 2035

Figure 71: France Telecommunication Market Attractiveness Analysis, by End-User, 2025 to 2035

Figure 72: Italy Telecommunication Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 73: Italy Telecommunication Market Value Share Analysis, by Service, 2024 and 2035

Figure 74: Italy Telecommunication Market Attractiveness Analysis, by Service, 2025 to 2035

Figure 75: Italy Telecommunication Market Value Share Analysis, By Transmission Type, 2024 and 2035

Figure 76: Italy Telecommunication Market Attractiveness Analysis, By Transmission Type, 2025 to 2035

Figure 77: Italy Telecommunication Market Value Share Analysis, by End-User, 2024 and 2035

Figure 78: Italy Telecommunication Market Attractiveness Analysis, by End-User, 2025 to 2035

Figure 79: Spain Telecommunication Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 80: Spain Telecommunication Market Value Share Analysis, by Service, 2024 and 2035

Figure 81: Spain Telecommunication Market Attractiveness Analysis, by Service, 2025 to 2035

Figure 82: Spain Telecommunication Market Value Share Analysis, By Transmission Type, 2024 and 2035

Figure 83: Spain Telecommunication Market Attractiveness Analysis, By Transmission Type, 2025 to 2035

Figure 84: Spain Telecommunication Market Value Share Analysis, by End-User, 2024 and 2035

Figure 85: Spain Telecommunication Market Attractiveness Analysis, by End-User, 2025 to 2035

Figure 86: The Netherlands Telecommunication Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 87: The Netherlands Telecommunication Market Value Share Analysis, by Service, 2024 and 2035

Figure 88: The Netherlands Telecommunication Market Attractiveness Analysis, by Service, 2025 to 2035

Figure 89: The Netherlands Telecommunication Market Value Share Analysis, By Transmission Type, 2024 and 2035

Figure 90: The Netherlands Telecommunication Market Attractiveness Analysis, By Transmission Type, 2025 to 2035

Figure 91: The Netherlands Telecommunication Market Value Share Analysis, by End-User, 2024 and 2035

Figure 92: The Netherlands Telecommunication Market Attractiveness Analysis, by End-User, 2025 to 2035

Figure 93: Rest of Europe Telecommunication Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 94: Rest of Europe Telecommunication Market Value Share Analysis, by Service, 2024 and 2035

Figure 95: Rest of Europe Telecommunication Market Attractiveness Analysis, by Service, 2025 to 2035

Figure 96: Rest of Europe Telecommunication Market Value Share Analysis, By Transmission Type, 2024 and 2035

Figure 97: Rest of Europe Telecommunication Market Attractiveness Analysis, By Transmission Type, 2025 to 2035

Figure 98: Rest of Europe Telecommunication Market Value Share Analysis, by End-User, 2024 and 2035

Figure 99: Rest of Europe Telecommunication Market Attractiveness Analysis, by End-User, 2025 to 2035

Figure 100: Asia Pacific Telecommunication Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 101: Asia Pacific Telecommunication Market Value Share Analysis, By Country/Sub-region, 2024 and 2035

Figure 102: Asia Pacific Telecommunication Market Attractiveness Analysis, By Country/Sub-region, 2025 to 2035

Figure 103: Asia Pacific Telecommunication Market Value Share Analysis, by Service, 2024 and 2035

Figure 104: Asia Pacific Telecommunication Market Attractiveness Analysis, by Service, 2025 to 2035

Figure 105: Asia Pacific Telecommunication Market Value Share Analysis, By Transmission Type, 2024 and 2035

Figure 106: Asia Pacific Telecommunication Market Attractiveness Analysis, By Transmission Type, 2025 to 2035

Figure 107: Asia Pacific Telecommunication Market Value Share Analysis, by End-User, 2024 and 2035

Figure 108: Asia Pacific Telecommunication Market Attractiveness Analysis, by End-User, 2025 to 2035

Figure 109: China Telecommunication Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 110: China Telecommunication Market Value Share Analysis, by Service, 2024 and 2035

Figure 111: China Telecommunication Market Attractiveness Analysis, by Service, 2025 to 2035

Figure 112: China Telecommunication Market Value Share Analysis, By Transmission Type, 2024 and 2035

Figure 113: China Telecommunication Market Attractiveness Analysis, By Transmission Type, 2025 to 2035

Figure 114: China Telecommunication Market Value Share Analysis, by End-User, 2024 and 2035

Figure 115: China Telecommunication Market Attractiveness Analysis, by End-User, 2025 to 2035

Figure 116: India Telecommunication Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 117: India Telecommunication Market Value Share Analysis, by Service, 2024 and 2035

Figure 118: India Telecommunication Market Attractiveness Analysis, by Service, 2025 to 2035

Figure 119: India Telecommunication Market Value Share Analysis, By Transmission Type, 2024 and 2035

Figure 120: India Telecommunication Market Attractiveness Analysis, By Transmission Type, 2025 to 2035

Figure 121: India Telecommunication Market Value Share Analysis, by End-User, 2024 and 2035

Figure 122: India Telecommunication Market Attractiveness Analysis, by End-User, 2025 to 2035

Figure 123: Japan Telecommunication Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 124: Japan Telecommunication Market Value Share Analysis, by Service, 2024 and 2035

Figure 125: Japan Telecommunication Market Attractiveness Analysis, by Service, 2025 to 2035

Figure 126: Japan Telecommunication Market Value Share Analysis, By Transmission Type, 2024 and 2035

Figure 127: Japan Telecommunication Market Attractiveness Analysis, By Transmission Type, 2025 to 2035

Figure 128: Japan Telecommunication Market Value Share Analysis, by End-User, 2024 and 2035

Figure 129: Japan Telecommunication Market Attractiveness Analysis, by End-User, 2025 to 2035

Figure 130: South Korea Telecommunication Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 131: South Korea Telecommunication Market Value Share Analysis, by Service, 2024 and 2035

Figure 132: South Korea Telecommunication Market Attractiveness Analysis, by Service, 2025 to 2035

Figure 133: South Korea Telecommunication Market Value Share Analysis, By Transmission Type, 2024 and 2035

Figure 134: South Korea Telecommunication Market Attractiveness Analysis, By Transmission Type, 2025 to 2035

Figure 135: South Korea Telecommunication Market Value Share Analysis, by End-User, 2024 and 2035

Figure 136: South Korea Telecommunication Market Attractiveness Analysis, by End-User, 2025 to 2035

Figure 137: Australia Telecommunication Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 138: Australia Telecommunication Market Value Share Analysis, by Service, 2024 and 2035

Figure 139: Australia Telecommunication Market Attractiveness Analysis, by Service, 2025 to 2035

Figure 140: Australia Telecommunication Market Value Share Analysis, By Transmission Type, 2024 and 2035

Figure 141: Australia Telecommunication Market Attractiveness Analysis, By Transmission Type, 2025 to 2035

Figure 142: Australia Telecommunication Market Value Share Analysis, by End-User, 2024 and 2035

Figure 143: Australia Telecommunication Market Attractiveness Analysis, by End-User, 2025 to 2035

Figure 144: ASEAN Telecommunication Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 145: ASEAN Telecommunication Market Value Share Analysis, by Service, 2024 and 2035

Figure 146: ASEAN Telecommunication Market Attractiveness Analysis, by Service, 2025 to 2035

Figure 147: ASEAN Telecommunication Market Value Share Analysis, By Transmission Type, 2024 and 2035

Figure 148: ASEAN Telecommunication Market Attractiveness Analysis, By Transmission Type, 2025 to 2035

Figure 149: ASEAN Telecommunication Market Value Share Analysis, by End-User, 2024 and 2035

Figure 150: ASEAN Telecommunication Market Attractiveness Analysis, by End-User, 2025 to 2035

Figure 151: Rest of Asia Pacific Telecommunication Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 152: Rest of Asia Pacific Telecommunication Market Value Share Analysis, by Service, 2024 and 2035

Figure 153: Rest of Asia Pacific Telecommunication Market Attractiveness Analysis, by Service, 2025 to 2035

Figure 154: Rest of Asia Pacific Telecommunication Market Value Share Analysis, By Transmission Type, 2024 and 2035

Figure 155: Rest of Asia Pacific Telecommunication Market Attractiveness Analysis, By Transmission Type, 2025 to 2035

Figure 156: Rest of Asia Pacific Telecommunication Market Value Share Analysis, by End-User, 2024 and 2035

Figure 157: Rest of Asia Pacific Telecommunication Market Attractiveness Analysis, by End-User, 2025 to 2035

Figure 158: Latin America Telecommunication Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 159: Latin America Telecommunication Market Value Share Analysis, By Country/Sub-region, 2024 and 2035

Figure 160: Latin America Telecommunication Market Attractiveness Analysis, By Country/Sub-region, 2025 to 2035

Figure 161: Latin America Telecommunication Market Value Share Analysis, by Service, 2024 and 2035

Figure 162: Latin America Telecommunication Market Attractiveness Analysis, by Service, 2025 to 2035

Figure 163: Latin America Telecommunication Market Value Share Analysis, By Transmission Type, 2024 and 2035

Figure 164: Latin America Telecommunication Market Attractiveness Analysis, By Transmission Type, 2025 to 2035

Figure 165: Latin America Telecommunication Market Value Share Analysis, by End-User, 2024 and 2035

Figure 166: Latin America Telecommunication Market Attractiveness Analysis, by End-User, 2025 to 2035

Figure 167: Brazil Telecommunication Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 168: Brazil Telecommunication Market Value Share Analysis, by Service, 2024 and 2035

Figure 169: Brazil Telecommunication Market Attractiveness Analysis, by Service, 2025 to 2035

Figure 170: Brazil Telecommunication Market Value Share Analysis, By Transmission Type, 2024 and 2035

Figure 171: Brazil Telecommunication Market Attractiveness Analysis, By Transmission Type, 2025 to 2035

Figure 172: Brazil Telecommunication Market Value Share Analysis, by End-User, 2024 and 2035

Figure 173: Brazil Telecommunication Market Attractiveness Analysis, by End-User, 2025 to 2035

Figure 174: Mexico Telecommunication Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 175: Mexico Telecommunication Market Value Share Analysis, by Service, 2024 and 2035

Figure 176: Mexico Telecommunication Market Attractiveness Analysis, by Service, 2025 to 2035

Figure 177: Mexico Telecommunication Market Value Share Analysis, By Transmission Type, 2024 and 2035

Figure 178: Mexico Telecommunication Market Attractiveness Analysis, By Transmission Type, 2025 to 2035

Figure 179: Mexico Telecommunication Market Value Share Analysis, by End-User, 2024 and 2035

Figure 180: Mexico Telecommunication Market Attractiveness Analysis, by End-User, 2025 to 2035

Figure 181: Argentina Telecommunication Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 182: Argentina Telecommunication Market Value Share Analysis, by Service, 2024 and 2035

Figure 183: Argentina Telecommunication Market Attractiveness Analysis, by Service, 2025 to 2035

Figure 184: Argentina Telecommunication Market Value Share Analysis, By Transmission Type, 2024 and 2035

Figure 185: Argentina Telecommunication Market Attractiveness Analysis, By Transmission Type, 2025 to 2035

Figure 186: Argentina Telecommunication Market Value Share Analysis, by End-User, 2024 and 2035

Figure 187: Argentina Telecommunication Market Attractiveness Analysis, by End-User, 2025 to 2035

Figure 188: Rest of Latin America Telecommunication Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 189: Rest of Latin America Telecommunication Market Value Share Analysis, by Service, 2024 and 2035

Figure 190: Rest of Latin America Telecommunication Market Attractiveness Analysis, by Service, 2025 to 2035

Figure 191: Rest of Latin America Telecommunication Market Value Share Analysis, By Transmission Type, 2024 and 2035

Figure 192: Rest of Latin America Telecommunication Market Attractiveness Analysis, By Transmission Type, 2025 to 2035

Figure 193: Rest of Latin America Telecommunication Market Value Share Analysis, by End-User, 2024 and 2035

Figure 194: Rest of Latin America Telecommunication Market Attractiveness Analysis, by End-User, 2025 to 2035

Figure 195: Middle East and Africa Telecommunication Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 196: Middle East and Africa Telecommunication Market Value Share Analysis, By Country/Sub-region, 2024 and 2035

Figure 197: Middle East and Africa Telecommunication Market Attractiveness Analysis, By Country/Sub-region, 2025 to 2035

Figure 198: Middle East and Africa Telecommunication Market Value Share Analysis, by Service, 2024 and 2035

Figure 199: Middle East and Africa Telecommunication Market Attractiveness Analysis, by Service, 2025 to 2035

Figure 200: Middle East and Africa Telecommunication Market Value Share Analysis, by Transmission Type, 2024 and 2035

Figure 201: Middle East and Africa Telecommunication Market Attractiveness Analysis, By Transmission Type, 2025 to 2035

Figure 202: Middle East and Africa Telecommunication Market Value Share Analysis, by End-User, 2024 and 2035

Figure 203: Middle East and Africa Telecommunication Market Attractiveness Analysis, by End-User, 2025 to 2035

Figure 204: GCC Countries Telecommunication Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 205: GCC Countries Telecommunication Market Value Share Analysis, by Service, 2024 and 2035

Figure 206: GCC Countries Telecommunication Market Attractiveness Analysis, by Service, 2025 to 2035

Figure 207: GCC Countries Telecommunication Market Value Share Analysis, by Transmission Type, 2024 and 2035

Figure 208: GCC Countries Telecommunication Market Attractiveness Analysis, By Transmission Type, 2025 to 2035

Figure 209: GCC Countries Telecommunication Market Value Share Analysis, by End-User, 2024 and 2035

Figure 210: GCC Countries Telecommunication Market Attractiveness Analysis, by End-User, 2025 to 2035

Figure 211: South Africa Telecommunication Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 212: South Africa Telecommunication Market Value Share Analysis, by Service, 2024 and 2035

Figure 213: South Africa Telecommunication Market Attractiveness Analysis, by Service, 2025 to 2035

Figure 214: South Africa Telecommunication Market Value Share Analysis, by Transmission Type, 2024 and 2035

Figure 215: South Africa Telecommunication Market Attractiveness Analysis, By Transmission Type, 2025 to 2035

Figure 216: South Africa Telecommunication Market Value Share Analysis, by End-User, 2024 and 2035

Figure 217: South Africa Telecommunication Market Attractiveness Analysis, by End-User, 2025 to 2035

Figure 218: Rest of Middle East Telecommunication Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 219: Rest of Middle East Telecommunication Market Value Share Analysis, by Service, 2024 and 2035

Figure 220: Rest of Middle East Telecommunication Market Attractiveness Analysis, by Service, 2025 to 2035

Figure 221: Rest of Middle East Telecommunication Market Value Share Analysis, by Transmission Type, 2024 and 2035

Figure 222: Rest of Middle East Telecommunication Market Attractiveness Analysis, By Transmission Type, 2025 to 2035

Figure 223: Rest of Middle East Telecommunication Market Value Share Analysis, by End-User, 2024 and 2035

Figure 224: Rest of Middle East Telecommunication Market Attractiveness Analysis, by End-User, 2025 to 2035