Reports

Reports

Global Technology Spending on Core Administration in Healthcare: Snapshot

The healthcare industry has witnessed a huge transformation from principally paper-based and manually-operated procedures to digitally-enabled connected processes and operations in the past few years. Factors such as growing government interventions to encourage technology-driven affordable healthcare services and improving healthcare infrastructure across developing countries have led to a vast rise in the money spent on making core administration in the healthcare sector technologically-rich and more effective. Moreover, rising patient-base across the globe and increasing healthcare spending will drive the need to outsource IT solutions for optimal healthcare management and a greater focus on core administrative operations.

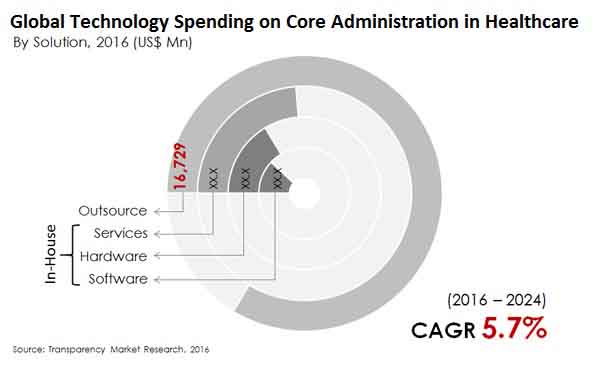

Transparency Market Research states that in terms of value, the global technology spending on core administration in healthcare will increase at a CAGR of over 5.7% during the period between 2016 and 2024.

Healthcare Payers Take Lion’s Share in Global Spending on Technology on Core Administration

On the basis of end users, the global technology spending on core administration in healthcare market is segmented into payers and providers. The payer segment is further divided into insurance companies, and government whereas the provider segment is further segmented into hospitals and other providers.

The payers segment accounted for the larger chunk of spending on core administration in healthcare, holding a nearly 88% of the overall market in 2015. The segment is also expected to remain the most lucrative end-user segment over the forecast period, with the segment expected to exhibit a 5.9% CAGR over the period between 2016 and 2024. The usage of a variety of data management and processing solutions for core administrative services such as fraud detection, claim management, and research and development has significantly increased across private and public insurance companies and government agencies in the past years.

The trend is expected to remain strong over the forecast period as well, with the payer end-use segment accounting for over 89% of the total spending on technology for core administration across the healthcare sector over the forecast period. Spending on technology for core administration across healthcare providers such as hospitals is expected to expand at a 4.4% CAGR from 2016 through 2024.

North America to Continue to Remain Leading Spender

Geographically, North America is the leading spender on technology for core administration in healthcare. Of the total funds devoted for making core administration technology-rich in the healthcare industry, over 50% were spent in North America. The region is expected to remain ahead of other regional markets in terms of technology spending the core administration in the healthcare sector over the forecast period as well. Factors such as rising scarcity of resources for undertaking patient-centric processes and the lack of technologically skilled healthcare staff for managing administrative processes will play a key role in highlighting the need for technological optimization of healthcare processes in the region.

North America is a steadily growing market, but will continue to account for a bigger stake compared to other regional markets, expanding at a 5.7% CAGR from 2016 through 2024. Asia Pacific will emerge as the most promising investment destination for technology in core administration for the healthcare industry over the said period. Technology spending in this area will swell at a promising 6.7% CAGR from 2016 to 2024 in Asia Pacific.

The region has emerged as the IT outsourcing destination due to growing public–private funding structures and low in-house expertise for healthcare IT. The robust and active medical tourism industry, rising spending power of the consumer on technologically advanced services, and rising international investments in the healthcare industry will continue to drive spending on technology in the Asia Pacific healthcare sector.

Some of the players in the global core administration system in healthcare are Plexis Healthcare Systems, DST Systems, Inc., HealthEdge Software, Inc., ikaSystems Corporation, TriZetto Corporation, Health Solutions Plus, Inc., Aldera Holdings, Inc., Wonderbox Technologies, UPP Technology, Inc., and HealthAxis Group, LLC.

High Investment on Technology in the Healthcare Sector to Benefit Technology Spending on Core Administration in Healthcare Market

Over the next few years, the global demand for technology investment on healthcare core administration is projected to expand at a healthy pace. In recent years, the healthcare sector has undergone major changes, and a range of measures have been initiated to keep the industry afloat. Technology advances have assisted in the development of many countries' healthcare metrics. It is clear that advances in healthcare have resulted from a wide range of improvements in the sector's infrastructure, institutional structure, and technical environment. As disease rates rise, better administrative facilities are becoming increasingly important for managing large groups of patients. Clinics and hospitals are eager to implement hacks that are likely to assist them in successfully treating patients. This is a critical point for the growth of the global technology spending on core administration in healthcare market, thereby fuelling demand for the same in the years to come. The increasing healthcare spending and burgeoning population have necessitated a versatile IT infrastructure capable of managing the industry's operations, which is predicted to work in favor of the global technology spending on core administration in healthcare market in near future.

Shift from Volume-based Model to Value-based Model to Leave Positive Impact on the Market

The amount of information available about patients' wellbeing and other aspects of the healthcare industry is enormous. It is essential for health care industry to handle all of this information in order to better medical treatments and facilities. As a result, the requirement for IT outsourcing for data processing has arisen, and many healthcare centres choose to store their data at IT solution hubs. This has increased consumer demand and provided market participants with potential for advancement. In addition, there have been significant changes in the reimbursement policies for medical treatments, which necessitate a robust core administration. Consumers are more and more reliant on digital technology in the contemporary situation, which is also a trend in healthcare industry. The insurance companies are making every effort to persuade the healthcare industry to move from a volume model to a value-based model for reimbursement in a high price competition scenario. This is likely to expose healthcare providers to financial threats, pushing up demand for core administration. These factors are likely to work in favor of the global technology spending on core administration in healthcare market in years to come.

Technology spending on core administration in healthcare market was valued at US$25,900 mn in 2015 and is estimated to attain US$42,317 mn by 2024

Technology spending on core administration in healthcare market will increase at a CAGR of over 5.7% during the period between 2016 and 2024

Technology spending on core administration in healthcare market is driven by rising patient-base across the globe and increasing healthcare spending

North America dominates the technology spending on core administration in healthcare market and is expected to lead along the forecast period

key players in the global technology spending on core administration in healthcare market include Plexis Healthcare Systems, HealthEdge Software, Inc., DST Systems, Inc., ikaSystems Corporation, Health Solutions Plus, Inc., and TriZetto Corporation

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Technology Spending on Core Administration in Healthcare

4. Market Overview

4.1. Introduction

4.1.1. Solution Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Key Indicators

4.4. Key Industry Developments

4.5. Market Opportunity Map

4.6. Market Dynamics

4.6.1. Drivers

4.6.2. Restraints

4.6.3. Opportunity

4.7. Global Technology Spending on Core Administration in Healthcare Analysis and Forecasts, 2016–2024

4.7.1. Market Revenue Projections (US$ Mn)

4.8. Porter’s Five Force Analysis

4.9. Core Administration: Workflow

4.10.Market Outlook

5. Global Technology Spending on Core Administration in Healthcare Analysis and Forecasts, By Solution

5.1. Introduction & Definition

5.2. Key Findings / Developments

5.3. Key Trends

5.4. Market Value Forecast By Solution, 2016–2024

5.4.1. In-House

5.4.1.1. Hardware

5.4.1.2. Software

5.4.1.3. Services

5.4.2. Outsource

5.5. Solution Comparison Matrix

5.6. Market Attractiveness By Solution

6. Global Technology Spending on Core Administration in Healthcare Analysis and Forecasts, By End User

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast By End User, 2016–2024

6.3.1. Payer

6.3.1.1. Insurance Companies

6.3.1.2. Government

6.3.1.3. Others

6.3.2. Provider

6.3.2.1. Hospitals

6.3.2.2. Others

6.4. End User Comparison Matrix

6.5. Market Attractiveness By End User

7. Global Technology Spending on Core Administration in Healthcare Analysis and Forecasts, By Deployment

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast By Deployment, 2016–2024

7.3.1. Cloud-Based

7.3.2. On-Premise

7.4. Deployment Comparison Matrix

7.5. Market Attractiveness By Deployment

8. Global Technology Spending on Core Administration in Healthcare Analysis and Forecasts, By Region

8.1. Key Findings

8.2. Policies and Regulations

8.3. Market Value Forecast By Region

8.3.1. North America

8.3.2. Latin America

8.3.3. Asia Pacific

8.3.4. Europe

8.3.5. Middle East and Africa

8.4. Market Attractiveness By Country

9. North America Technology Spending on Core Administration in Healthcare Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.1.2. Policies and Regulations

9.1.3. Price Trend Analysis

9.2. Market Value Forecast By Solution, 2016–2024

9.2.1. In-House

9.2.1.1. Hardware

9.2.1.2. Software

9.2.1.3. Services

9.2.2. Outsource

9.3. Market Value Forecast By End User, 2016–2024

9.3.1. Payer

9.3.1.1. Insurance Companies

9.3.1.2. Government

9.3.1.3. Others

9.3.2. Provider

9.3.2.1. Hospitals

9.3.2.2. Others

9.4. Market Value Forecast By Deployment, 2016–2024

9.4.1. Cloud-Based

9.4.2. On-Premise

9.5. Market Value Forecast By Country, 2016–2024

9.5.1. US

9.5.2. Canada

9.6. Market Attractiveness Analysis

9.6.1. By Solution

9.6.2. By End User

9.6.3. By Deployment

9.6.4. By Country

10. Latin America Technology Spending on Core Administration in Healthcare Analysis and Forecast

10.1.Introduction

10.1.1. Key Findings

10.1.2. Policies and Regulations

10.1.3. Price Trend Analysis

10.2.Market Value Forecast By Solution, 2016–2024

10.2.1. In-House

10.2.1.1. Hardware

10.2.1.2. Software

10.2.1.3. Services

10.2.2. Outsource

10.3.Market Value Forecast By End User, 2016–2024

10.3.1. Payer

10.3.1.1. Insurance Companies

10.3.1.2. Government

10.3.1.3. Others

10.3.2. Provider

10.3.2.1. Hospitals

10.3.2.2. Others

10.4.Market Value Forecast By Deployment, 2016–2024

10.4.1. Cloud-Based

10.4.2. On-Premise

10.5.Market Value Forecast By Country, 2016–2024

10.5.1. Brazil

10.5.2. Mexico

10.5.3. Rest of Latin America

10.6. Market Attractiveness Analysis

10.6.1. By Solution

10.6.2. By End User

10.6.3. By Deployment

10.6.4. By Country

11. Asia Pacific Technology Spending on Core Administration in Healthcare Analysis and Forecast

11.1.Introduction

11.1.1. Key Findings

11.1.2. Policies and Regulations

11.1.3. Price Trend Analysis

11.2.Market Value Forecast By Solution, 2016–2024

11.2.1. In-House

11.2.1.1. Hardware

11.2.1.2. Software

11.2.1.3. Services

11.2.2. Outsource

11.3.Market Value Forecast By End User, 2016–2024

11.3.1. Payer

11.3.1.1. Insurance Companies

11.3.1.2. Government

11.3.1.3. Others

11.3.2. Provider

11.3.2.1. Hospitals

11.3.2.2. Others

11.4.Market Value Forecast By Deployment, 2016–2024

11.4.1. Cloud-Based

11.4.2. On-Premise

11.5.Market Value Forecast By Country, 2016–2024

11.5.1. Japan

11.5.2. China

11.5.3. India

11.5.4. Australia

11.5.5. New Zealand

11.5.6. Rest of Asia Pacific

11.6. Market Attractiveness Analysis

11.6.1. By Solution

11.6.2. By End User

11.6.3. By Deployment

11.6.4. By Country

12. Europe Technology Spending on Core Administration in Healthcare Analysis and Forecast

12.1.Introduction

12.1.1. Key Findings

12.1.2. Policies and Regulations

12.1.3. Price Trend Analysis

12.2.Market Value Forecast By Solution, 2016–2024

12.2.1. In-House

12.2.1.1. Hardware

12.2.1.2. Software

12.2.1.3. Services

12.2.2. Outsource

12.3.Market Value Forecast By End User, 2016–2024

12.3.1. Payer

12.3.1.1. Insurance Companies

12.3.1.2. Government

12.3.1.3. Others

12.3.2. Provider

12.3.2.1. Hospitals

12.3.2.2. Others

12.4.Market Value Forecast By Deployment, 2016–2024

12.4.1. Cloud-Based

12.4.2. On-Premise

12.5.Market Value Forecast By Country, 2016–2024

12.5.1. Germany

12.5.2. UK

12.5.3. France

12.5.4. Italy

12.5.5. Spain

12.5.6. Rest of Europe

12.6. Market Attractiveness Analysis

12.6.1. By Solution

12.6.2. By End User

12.6.3. By Deployment

12.6.4. By Country

13. Middle East and Africa Technology Spending on Core Administration in Healthcare Analysis and Forecast

13.1.Introduction

13.1.1. Key Findings

13.1.2. Policies and Regulations

13.1.3. Price Trend Analysis

13.2.Market Value Forecast By Solution, 2016–2024

13.2.1. In-House

13.2.1.1. Hardware

13.2.1.2. Software

13.2.1.3. Services

13.2.2. Outsource

13.3.Market Value Forecast By End User, 2016–2024

13.3.1. Payer

13.3.1.1. Insurance Companies

13.3.1.2. Government

13.3.1.3. Others

13.3.2. Provider

13.3.2.1. Hospitals

13.3.2.2. Others

13.4.Market Value Forecast By Deployment, 2016–2024

13.4.1. Cloud-Based

13.4.2. On-Premise

13.5.Market Value Forecast By Country, 2016–2024

13.5.1. Saudi Arabia

13.5.2. UAE

13.5.3. RSA

13.5.4. Rest of Middle East and Africa

13.6. Market Attractiveness Analysis

13.6.1. By Solution

13.6.2. By End User

13.6.3. By Deployment

13.6.4. By Country

14. Competition Landscape

14.1.Market Player – Competition Matrix (By Tier and Size of companies)

14.2.Major Licenses and Contracts

14.3.Company Profiles (Details – Overview, Financials, Recent Developments, Strategy)

14.3.1. Plexis Healthcare Systems

14.3.1.1 Overview

14.3.1.2 Financials

14.3.1.3 SWOT Analysis

14.3.1.4 Strategic Overview

14.3.2. DST Systems, Inc.

14.3.2.1 Overview

14.3.2.2 Financials

14.3.2.3 SWOT Analysis

14.3.2.4 Strategic Overview

14.3.3. HealthEdge Software, Inc.

14.3.3.1 Overview

14.3.3.2 Financials

14.3.3.3 SWOT Analysis

14.3.3.4 Strategic Overview

14.3.4. ikaSystems Corporation

14.3.4.1 Overview

14.3.4.2 Financials

14.3.4.3 SWOT Analysis

14.3.4.4 Strategic Overview

14.3.5. TriZetto Corporation

14.3.5.1 Overview

14.3.5.2 Financials

14.3.5.3 SWOT Analysis

14.3.5.4 Strategic Overview

14.3.6. Health Solutions Plus, Inc.

14.3.6.1 Overview

14.3.6.2 Financials

14.3.6.3 SWOT Analysis

14.3.6.4 Strategic Overview

14.3.7. Aldera Holdings, Inc.

14.3.7.1 Overview

14.3.7.2 Financials

14.3.7.3 SWOT Analysis

14.3.7.4 Strategic Overview

14.3.8. Wonderbox Technologies

14.3.8.1 Overview

14.3.8.2 Financials

14.3.8.3 SWOT Analysis

14.3.8.4 Strategic Overview

14.3.9. HealthAxis Group, LLC.

14.3.9.1 Overview

14.3.9.2 Financials

14.3.9.3 SWOT Analysis

14.3.9.4 Strategic Overview

14.3.10. UPP Technology, Inc.

14.3.10.1 Overview

14.3.10.2 Financials

14.3.10.3 SWOT Analysis

14.3.10.4 Strategic Overview

List of Tables

Table 01: Global Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, By Solution, 2016–2024

Table 02: Global Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, By Solution (In-House), 2016–2024

Table 03: Global Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, By Deployment, 2016–2024

Table 04: Global Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, By End User, 2016–2024

Table 05: Global Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, By End User (Payer), 2016–2024

Table 06: Global Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, By End User (Provider), 2016–2024

Table 07: Global Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, By Region, 2016–2024

Table 08: North America Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, By Solution, 2016–2024

Table 09: North America Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, By Solution (In-House), 2016–2024

Table 10: North America Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, By Deployment 2016–2024

Table 11: North America Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, By End User 2016–2024

Table 12: North America Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, By, End User (Payer) 2016–2024

Table 13: North America Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, By End User (Provider) 2016–2024

Table 14: North America Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, By Country, 2016–2024

Table 15: Europe Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, By Solution, 2016–2024

Table 16: Europe Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, By Solution (In-House), 2016–2024

Table 17: Europe Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, By Deployment, 2016–2024

Table 18: Europe Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, By End User, 2016–2024

Table 19: Europe Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, By End User (Payer), 2016–2024

Table 20: Europe Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, By End User (Provider), 2016–2024

Table 21: Europe Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, By Country, 2016–2024

Table 22: Asia Pacific Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, By Solution, 2016–2024

Table 23: Asia Pacific Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, By Solution (In-House), 2016–2024

Table 24: Asia Pacific Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, By Deployment, 2016–2024

Table 25: Asia Pacific Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, By End User, 2016–2024

Table 26: Asia Pacific Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, By End User (Payer), 2016–2024

Table 27: Asia Pacific Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, By End User (Provider), 2016–2024

Table 28: Asia Pacific Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, By Country, 2016–2024

Table 29: Latin America Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, By Solution, 2016–2024

Table 30: Latin America Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, By Solution (In-House), 2016–2024

Table 31: Latin America Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, By Deployment, 2016–2024

Table 32: Latin America Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, By End User, 2016–2024

Table 33: Latin America Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, By End User (Payer), 2016–2024

Table 34: Latin America Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, By End User (Provider), 2016–2024

Table 35: Latin America Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, By Country, 2016–2024

Table 36: Middle East and Africa Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, By Solution, 2016–2024

Table 37: Middle East and Africa Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, By Solution (In-House), 2016–2024

Table 38: Middle East and Africa Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, By Deployment, 2016–2024

Table 39: Middle East and Africa Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, By End User, 2016–2024

Table 40: Middle East and Africa Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, By End User (Payer), 2016–2024

Table 41: Middle East and Africa Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, By End User (Provider), 2016–2024

Table 42: Middle East and Africa Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, By Country, 2016–2024

List of Figures

Figure 1: Global Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, 2016–2024

Figure 2: Global Technology Spending on Core Administration in Healthcare Value Share Analysis By Solutions, 2016 and 2024

Figure 3: Global Technology Spending on In-House Core Administration Solution in Healthcare Value (US$ Mn) and Y-o-Y Growth (%), 2016–2024

Figure 4: Global Technology Spending on Outsource Core Administration Solution in Healthcare Value (US$ Mn) and Y-o-Y Growth (%), 2016–2024

Figure 5: Global Technology Spending on Core Administration in Healthcare Attractiveness Analysis By Solution

Figure 6: Global Technology Spending on Hardware Value (US$ Mn) and Y-o-Y Growth (%), 2016–2024

Figure 7: Global Technology Spending on Software Value (US$ Mn) and Y-o-Y Growth (%), 2016–2024

Figure 8: Global Technology Spending on Services Value (US$ Mn) and Y-o-Y Growth (%), 2016–2024

Figure 9: Global Technology Spending on Core Administration in Healthcare Attractiveness Analysis By In-House Solutions

Figure 10: Global Technology Spending on Core Administration in Healthcare Value Share Analysis By Deployment, 2016 and 2024

Figure 11: Global Technology Spending on Cloud-Based Core Administration Deployment in Healthcare Value (US$ Mn) and Y-o-Y Growth (%), 2016–2024

Figure 12: Global Technology Spending on On-Premise Core Administration Deployment in Healthcare Value (US$ Mn) and Y-o-Y Growth (%), 2016–2024

Figure 13: Global Technology Spending on Core Administration in Healthcare Attractiveness Analysis By Deployment

Figure 14: Global Technology Spending on Core Administration in Healthcare Value Share Analysis By End User, 2016 and 2024

Figure 15: Global Technology Spending on Core Administration in Healthcare By Payer Value (US$ Mn) and Y-o-Y Growth (%), 2016–2024

Figure 16: Global Technology Spending on Core Administration in Healthcare By Provider Value (US$ Mn) and Y-o-Y Growth (%), 2016–2024

Figure 17: Global Technology Spending on Core Administration in Healthcare Attractiveness Analysis By End User

Figure 18: Global Technology Spending By Insurance Companies Value (US$ Mn) and Y-o-Y Growth (%), 2016–2024

Figure 19: Global Technology Spending By Government Value (US$ Mn) and Y-o-Y Growth (%), 2016–2024

Figure 20: Global Technology Spending By Others Value (US$ Mn) and Y-o-Y Growth (%), 2016–2024

Figure 21: Global Technology Spending on Core Administration in Healthcare Attractiveness Analysis By Payer

Figure 22: Global Technology Spending By Hospital Value (US$ Mn) and Y-o-Y Growth (%), 2016–2024

Figure 23: Global Technology Spending By Others Value (US$ Mn) and Y-o-Y Growth (%), 2016–2024

Figure 24: Global Technology Spending on Core Administration in Healthcare Attractiveness Analysis By Provider

Figure 25: Global Technology Spending on Core Administration in Healthcare Value Share Analysis By Region, 2016 and 2024

Figure 26: Global Technology Spending on Core Administration in Healthcare Attractiveness Analysis, By Region

Figure 27: North America Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, 2016–2024

Figure 28: North America Technology Spending on Core Administration in Healthcare Attractiveness Analysis By Country

Figure 29: North America Technology Spending on Core Administration in Healthcare Value Share Analysis By Solution, 2016 and 2024

Figure 30: North America Technology Spending on Core Administration in Healthcare Value Share Analysis By Deployment, 2016 and 2024

Figure 31: North America Technology Spending on Core Administration in Healthcare Value Share Analysis By End User, 2016 and 2024

Figure 32: North America Technology Spending on Core Administration in Healthcare Value Share Analysis By Country, 2016 and 2024

Figure 33: U.S. Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, 2016–2024

Figure 34: U.S. Technology Spending on Core Administration in Healthcare Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 35: Canada Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, 2016–2024

Figure 36: Canada Technology Spending on Core Administration in Healthcare Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 37: North America Technology Spending on Core Administration in Healthcare Attractiveness Analysis by Solution

Figure 38: North America Technology Spending on Core Administration in Healthcare Attractiveness Analysis by Deployment

Figure 39: North America Technology Spending on Core Administration in Healthcare Attractiveness Analysis by End User

Figure 40: Europe Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, 2016–2024

Figure 41: Europe Technology Spending on Core Administration in Healthcare Attractiveness Analysis By Country

Figure 42: Europe Technology Spending on Core Administration in Healthcare Value Share Analysis By Solution, 2016 and 2024

Figure 43: Europe Technology Spending on Core Administration in Healthcare Value Share Analysis By Deployment, 2016 and 2024

Figure 44: Europe Technology Spending on Core Administration in Healthcare Value Share Analysis By End User, 2016 and 2024

Figure 45: Europe Technology Spending on Core Administration in Healthcare Value Share Analysis By Country, 2016 and 2024

Figure 46: Germany Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, 2016–2024

Figure 47: Germany Technology Spending on Core Administration in Healthcare Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 48: UK Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, 2016–2024

Figure 49: UK Technology Spending on Core Administration in Healthcare Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 50: France Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, 2016–2024

Figure 51: France Technology Spending on Core Administration in Healthcare Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 52: Italy Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, 2016–2024

Figure 53: Italy Technology Spending on Core Administration in Healthcare Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 54: Spain Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, 2016–2024

Figure 55: Spain Technology Spending on Core Administration in Healthcare Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 56: Rest of Europe Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, 2016–2024

Figure 57: Rest of Europe Technology Spending on Core Administration in Healthcare Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 58: Europe Technology Spending on Core Administration in Healthcare Attractiveness Analysis by Solution

Figure 59: Europe Technology Spending on Core Administration in Healthcare Attractiveness Analysis by Deployment

Figure 60: Europe Technology Spending on Core Administration in Healthcare Attractiveness Analysis by End User

Figure 61: Asia Pacific Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, 2016–2024

Figure 62: Asia Pacific Technology Spending on Core Administration in Healthcare Attractiveness Analysis By Country

Figure 63: Asia Pacific Technology Spending on Core Administration in Healthcare Value Share Analysis By Solution, 2016 and 2024

Figure 64: Asia Pacific Core Administration in Healthcare Value Share Analysis By Deployment, 2016 and 2024

Figure 65: Asia Pacific Core Administration in Healthcare Value Share Analysis By End User, 2016 and 2024

Figure 66: Asia Pacific Technology Spending on Core Administration in Healthcare Value Share Analysis By Country, 2016 and 2024

Figure 67: China Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, 2016–2024

Figure 68: China Technology Spending on Core Administration in Healthcare Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 69: Japan Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, 2016–2024

Figure 70: Japan Technology Spending on Core Administration in Healthcare Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 71: India Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, 2016–2024

Figure 72: India Technology Spending on Core Administration in Healthcare Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 73: Australia Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, 2016–2024

Figure 74: Australia Technology Spending on Core Administration in Healthcare Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 75: New Zealand Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, 2016–2024

Figure 76: New Zealand Technology Spending on Core Administration in Healthcare Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 77: Rest of Asia Pacific Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, 2016–2024

Figure 78: Rest of Asia Pacific Technology Spending on Core Administration in Healthcare Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 79: Asia Pacific Technology Spending on Core Administration in Healthcare Attractiveness Analysis by Solution

Figure 80: Asia Pacific Technology Spending on Core Administration in Healthcare Attractiveness Analysis by Deployment

Figure 81: Asia Pacific Technology Spending on Core Administration in Healthcare Attractiveness Analysis by End User

Figure 82: Latin America Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, 2016–2024

Figure 83: Latin America Technology Spending on Core Administration in Healthcare Attractiveness Analysis By Country

Figure 84: Latin America Technology Spending on Core Administration in Healthcare Value Share Analysis By Solution, 2016 and 2024

Figure 85: Latin America Technology Spending on Core Administration in Healthcare Value Share Analysis By Deployment, 2016 and 2024

Figure 86: Latin America Technology Spending on Core Administration in Healthcare Value Share Analysis By End User, 2016 and 2024

Figure 87: Latin America Technology Spending on Core Administration in Healthcare Value Share Analysis By Country, 2016 and 2024

Figure 88: Brazil Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, 2016–2024

Figure 89: Brazil Technology Spending on Core Administration in Healthcare Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 90: Mexico Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, 2016–2024

Figure 91: Mexico Technology Spending on Core Administration in Healthcare Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 92: Rest of LATAM Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, 2016–2024

Figure 93: Rest of LATAM Technology Spending on Core Administration in Healthcare Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 94: Latin America Technology Spending on Core Administration in Healthcare Attractiveness Analysis by Solution

Figure 95: Latin America Technology Spending on Core Administration in Healthcare Attractiveness Analysis by Deployment

Figure 96: Latin America Technology Spending on Core Administration in Healthcare Attractiveness Analysis by End User

Figure 97: Middle East and Africa Technology Spending on Core Administration in Healthcare (US$ Mn Forecast, 2016–2024

Figure 98: Middle East and Africa Technology Spending on Core Administration in Healthcare Attractiveness Analysis By Country

Figure 99: Middle East and Africa Technology Spending on Core Administration in Healthcare Value Share Analysis By Solution, 2016 and 2024

Figure 100: Middle East and Africa Technology Spending on Core Administration in Healthcare Value Share Analysis By Deployment, 2016 and 2024

Figure 101: Middle East and Africa Technology Spending on Core Administration in Healthcare Value Share Analysis By End User, 2016 and 2024

Figure 102: Middle East and Africa Technology Spending on Core Administration in Healthcare Value Share Analysis By Country, 2016 and 2024

Figure 103: Saudi Arabia Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, 2016–2024

Figure 104: Saudi Arabia Technology Spending on Core Administration in Healthcare Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 105: UAE Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, 2016–2024

Figure 106: UAE Technology Spending on Core Administration in Healthcare Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 107: RSA Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, 2016–2024

Figure 108: RSA Technology Spending on Core Administration in Healthcare Absolute $ Opportunity (US$ Mn), 2016-2024

Figure 109: Rest of Middle East and Africa Technology Spending on Core Administration in Healthcare (US$ Mn) Forecast, 2016–2024

Figure 110: Rest of Middle East and Africa Technology Spending on Core Administration in Healthcare Absolute $ Opportunity (US$ Mn), 2016-202

Figure 111: Middle East & Africa Technology Spending on Core Administration in Healthcare Attractiveness Analysis by Solution

Figure 112: Middle East & Africa Technology Spending on Core Administration in Healthcare Attractiveness Analysis by Deployment

Figure 113: Middle East & Africa Technology Spending on Core Administration in Healthcare Attractiveness Analysis by End User