Reports

Reports

Analysts’ Viewpoint

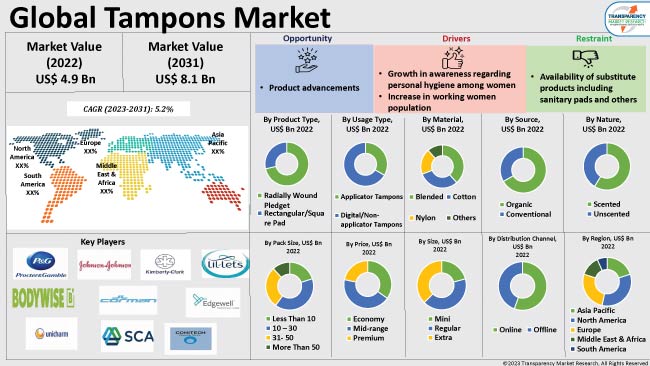

Increase in awareness about personal hygiene is a major factor contributing to the tampons industry growth. Moreover, rise in number of working women and their changing lifestyles are also augmenting the tampons market development. Growth in demand for safe, convenient, and easy-to-use solutions for women is boosting the sales of tampons across the globe.

Manufacturers of tampons are focusing on the development of innovative products based on technological advancements. They are introducing organic, eco-friendly, and scented tampons to gain value-grab opportunities in the market. However, increase in availability of substitute products, such as sanitary pads, is anticipated to hamper market progress during the forecast period.

A tampon is a menstrual device used to absorb blood and vaginal fluids while a woman is menstruating. Tampons are inserted inside the vaginal canal. Tampons are feminine products that are maintained in place by the vagina and expand, as they absorb menstrual blood when inserted properly.

Generally, tampons are manufactured by using various materials such as cotton, blended, nylon, and others. Different types of tampons are available in the market based on their shape and design.

Demand for tampons is driven by the need for women to maintain good menstrual hygiene and reduce the risk of infections. Increase in number of female population, rapid urbanization, and growth in consumer spending on personal hygiene care products are some of the factors fueling market expansion.

Rise in number of working women who can easily spend their money on high-quality personal care products is also contributing to market growth.

Increase in number of women who participate in sports, swimming, and other outdoor activities is augmenting tampons market demand. Tampons are more convenient and less visible than other menstrual products, such as sanitary pads, making them a popular choice for active women.

Tampons are popular choices for women, as they are compact, lightweight, and simple to use. The tampons market is constantly evolving with the emergence of innovative products. For instance, some tampons come with applicators, making them easier to use, while others are made from organic materials, catering to the growing demand for eco-friendly products.

Organic tampons are gaining traction among consumers across the globe. Manufacturers are currently developing tampons with better absorbency, comfort, and durability, which has increased their popularity among consumers.

Furthermore, technological advancements in tampons are creating lucrative opportunities for manufacturers. Tampons are also available in scented or unscented varieties.

Based on product type, the global industry has been bifurcated into radially wound pledget and rectangular/square pad. According to the tampons market forecast, the radially wound pledget product type segment is expected to dominate the global industry in the next few years.

Radially wound pledget tampons are cylindrical in shape and are made by wrapping layers of material around a central core. These tampons are designed to extend in all directions for optimal absorption.

Moreover, increase in need for mensuration hygiene and rise in demand for compact-size tampons are key factors that expected to boost the demand for radially wound pledget tampons in the near future.

Based on material, the global market has been segmented into cotton, blended, rayon, and others (synthetic fibers). The blended material segment is more likely to lead the global market during the forecast period.

Blended tampons are comfortable, safe, durable, and non-allergenic. Several manufacturers mix a blend of cotton and rayon fibers to create their tampons.

Moreover, tampons made of blended material are less expensive than those made of other materials that are available in the market. Thus, the demand for affordable and absorbent blended tampons is increasing worldwide.

North America is likely to dominate the global tampons market during the forecast period, owing to rise in awareness among women regarding personal hygiene and increase in disposable income. Demand for tampons is increasing in the U.S. due to the rise in number of product manufacturers in the country.

Furthermore, increase in spending capacity of women and product awareness are some of the major factors contributing to the tampons market growth in Asia Pacific. Asia Pacific is expected to be the fastest-growing market, in terms of CAGR, during the forecast period.

The global industry is fragmented, with the presence of many local and global players. These players control majority of the tampons market share. According to the tampons market research analysis, key players are implementing various strategies to gain revenue benefits. New product development is a major strategy adopted by these players.

Procter & Gamble Co., Johnson & Johnson Pvt.Ltd, Kimberly-Clark, Bodywise Ltd., Corman S.P.A, Edgewell Personal Care Company, Lil-lets Group Ltd, Unicharm Corporation, Svenska Cellulosa Aktiebolaget, and Cotton High Tech S.L. are the prominent tampons market leaders.

Key players have been profiled in the tampons market report based on various factors that include business segments, company overview, product portfolio, latest developments, financial overview, and business strategies.

|

Attribute |

Detail |

|

Market Value in 2022 (Base Year) |

US$ 4.9 Bn |

|

Market Value in 2031 |

US$ 8.1 Bn |

|

Growth Rate (CAGR) |

5.2% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Bn for Value and Million Units for Volume |

|

Market Analysis |

Global qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, regulatory analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and Brand analysis. |

|

Competition Landscape |

|

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

Tampons Market To Exceed Valuation Of US$ 8.3 Bn By 2031.

The global tampons market is estimated to expand at a CAGR of 5.9% during the forecast period.

The adoption of tampon is expected to increase due to surge in awareness towards importance of menstrual hygiene.

Based on geography, North America held the largest share of the tampons market as the behavior of consumers is changing, with consumers inclined toward buying new and advanced products.

Key players operating in the global tampons market are Svenska Cellulosa Aktiebolaget (SCA), Bodywise (UK) Ltd, Corman SpA, Lil-Lets UK Limited, First Quality Enterprises Inc., Procter and Gamble Co., Johnson & Johnson Inc., Kimberly-Clark Corporation, Edgewell Personal Care Company, and Unicharm Corporation among others.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Raw Material Analysis

5.5. Key Market Indicators

5.6. Porter’s Five Forces Analysis

5.7. Industry SWOT Analysis

5.8. Value Chain Analysis

5.9. Global Tampons Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Value Projections (US$ Mn)

5.9.2. Market Volume Projections (Million Units)

6. Global Tampons Market Analysis and Forecast, by Product Type

6.1. Tampons Market Size (US$ Mn and Million Units) Forecast, by Product Type, 2017 - 2031

6.1.1. Radially Wound Pledget

6.1.2. Rectangular/Square Pad

6.2. Incremental Opportunity, by Product Type

7. Global Tampons Market Analysis and Forecast, by Usage Type

7.1. Tampons Market Size (US$ Mn and Million Units) Forecast, by Usage Type, 2017 - 2031

7.1.1. Applicator Tampons

7.1.2. Digital/Non-applicator Tampons

7.2. Incremental Opportunity, by Usage Type

8. Global Tampons Market Analysis and Forecast, by Material

8.1. Tampons Market Size (US$ Mn and Million Units) Forecast, by Material, 2017 - 2031

8.1.1. Cotton

8.1.2. Blended

8.1.3. Rayon

8.1.4. Others

8.2. Incremental Opportunity, by Material

9. Global Tampons Market Analysis and Forecast, by Source

9.1. Tampons Market Size (US$ Mn and Million Units) Forecast, by Source, 2017 - 2031

9.1.1. Organic

9.1.2. Conventional

9.2. Incremental Opportunity, by Source

10. Global Tampons Market Analysis and Forecast, by Nature

10.1. Tampons Market Size (US$ Mn and Million Units) Forecast, by Nature, 2017 - 2031

10.1.1. Scented

10.1.2. Unscented

10.2. Incremental Opportunity, by Nature

11. Global Tampons Market Analysis and Forecast, by Pack Size

11.1. Tampons Market Size (US$ Mn and Million Units) Forecast, by Pack Size, 2017 - 2031

11.1.1. Less Than 10

11.1.2. 10 - 30

11.1.3. 31- 50

11.1.4. More Than 50

11.2. Incremental Opportunity, by Pack Size

12. Global Tampons Market Analysis and Forecast, by Price

12.1. Tampons Market Size (US$ Mn and Million Units) Forecast, by Price, 2017 - 2031

12.1.1. Economy

12.1.2. Mid-range

12.1.3. Premium

12.2. Incremental Opportunity, by Price

13. Global Tampons Market Analysis and Forecast, by Size

13.1. Tampons Market Size (US$ Mn and Million Units) Forecast, by Size, 2017 - 2031

13.1.1. Mini

13.1.2. Regular

13.1.3. Extra

13.2. Incremental Opportunity, by Size

14. Global Tampons Market Analysis and Forecast, by Distribution Channel

14.1. Tampons Market Size (US$ Mn and Million Units) Forecast, by Distribution Channel, 2017 - 2031

14.1.1. Online

14.1.1.1. E-commerce Websites

14.1.1.2. Company-owned Websites

14.1.2. Offline

14.1.2.1. Hypermarkets & Supermarkets

14.1.2.2. Specialty Stores

14.1.2.3. Pharmaceutical & Drug Stores

14.1.2.4. Other Retail Stores

14.2. Incremental Opportunity, by Distribution Channel

15. Global Tampons Market Analysis and Forecast, by Region

15.1. Tampons Market Size (US$ Mn and Million Units) Forecast, by Region, 2017 - 2031

15.1.1. North America

15.1.2. Europe

15.1.3. Asia Pacific

15.1.4. Middle East & Africa

15.1.5. South America

15.2. Incremental Opportunity, by Region

16. North America Tampons Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Price Trend Analysis

16.2.1. Weighted Average Price

16.3. Key Trends Analysis

16.3.1. Demand Side Analysis

16.3.2. Supply Side Analysis

16.4. Brand Analysis

16.5. Consumer Buying Behavior Analysis

16.6. Tampons Market Size (US$ Mn and Million Units) Forecast, by Product Type, 2017 - 2031

16.6.1. Radially Wound Pledget

16.6.2. Rectangular/Square Pad

16.7. Tampons Market Size (US$ Mn and Million Units) Forecast, by Usage Type, 2017 - 2031

16.7.1. Applicator Tampons

16.7.2. Digital/Non-applicator Tampons

16.8. Tampons Market Size (US$ Mn and Million Units) Forecast, by Material, 2017 - 2031

16.8.1. Cotton

16.8.2. Blended

16.8.3. Rayon

16.8.4. Others

16.9. Tampons Market Size (US$ Mn and Million Units) Forecast, by Source, 2017 - 2031

16.9.1. Organic

16.9.2. Conventional

16.10. Tampons Market Size (US$ Mn and Million Units) Forecast, by Nature, 2017 - 2031

16.10.1. Scented

16.10.2. Unscented

16.11. Tampons Market Size (US$ Mn and Million Units) Forecast, by Pack Size, 2017 - 2031

16.11.1. Less Than 10

16.11.2. 10 - 30

16.11.3. 31- 50

16.11.4. More Than 50

16.12. Tampons Market Size (US$ Mn and Million Units) Forecast, by Price, 2017 - 2031

16.12.1. Economy

16.12.2. Mid-range

16.12.3. Premium

16.13. Tampons Market Size (US$ Mn and Million Units) Forecast, by Size, 2017- 2031

16.13.1. Mini

16.13.2. Regular

16.13.3. Extra

16.14. Tampons Market Size (US$ Mn and Million Units) Forecast, by Distribution Channel, 2017 - 2031

16.14.1. Online

16.14.1.1. E-commerce Websites

16.14.1.2. Company-owned Websites

16.14.2. Offline

16.14.2.1. Hypermarkets & Supermarkets

16.14.2.2. Specialty Stores

16.14.2.3. Pharmaceutical & Drug Stores

16.14.2.4. Other Retail Stores

16.15. Tampons Market Size (US$ Mn) (Million Units) Forecast, by Country/Sub-region, 2017 - 2027

16.15.1. The U.S.

16.15.2. Canada

16.15.3. Rest of North America

16.16. Incremental Opportunity Analysis

17. Europe Tampons Market Analysis and Forecast

17.1. Regional Snapshot

17.2. Price Trend Analysis

17.2.1. Weighted Average Price

17.3. Key Trends Analysis

17.3.1. Demand Side Analysis

17.3.2. Supply Side Analysis

17.4. Brand Analysis

17.5. Consumer Buying Behavior Analysis

17.6. Tampons Market Size (US$ Mn and Million Units) Forecast, by Product Type, 2017 - 2031

17.6.1. Radially Wound Pledget

17.6.2. Rectangular/Square Pad

17.7. Tampons Market Size (US$ Mn and Million Units) Forecast, by Usage Type, 2017 - 2031

17.7.1. Applicator Tampons

17.7.2. Digital/Non-applicator Tampons

17.8. Tampons Market Size (US$ Mn and Million Units) Forecast, by Material, 2017 - 2031

17.8.1. Cotton

17.8.2. Blended

17.8.3. Rayon

17.8.4. Others

17.9. Tampons Market Size (US$ Mn and Million Units) Forecast, by Source, 2017 - 2031

17.9.1. Organic

17.9.2. Conventional

17.10. Tampons Market Size (US$ Mn and Million Units) Forecast, by Nature, 2017 - 2031

17.10.1. Scented

17.10.2. Unscented

17.11. Tampons Market Size (US$ Mn and Million Units) Forecast, by Pack Size, 2017 - 2031

17.11.1. Less Than 10

17.11.2. 10 - 30

17.11.3. 31- 50

17.11.4. More Than 50

17.12. Tampons Market Size (US$ Mn and Million Units) Forecast, by Price, 2017 - 2031

17.12.1. Economy

17.12.2. Mid-range

17.12.3. Premium

17.13. Tampons Market Size (US$ Mn and Million Units) Forecast, by Size, 2017 - 2031

17.13.1. Mini

17.13.2. Regular

17.13.3. Extra

17.14. Tampons Market Size (US$ Mn and Million Units) Forecast, by Distribution Channel, 2017 - 2031

17.14.1. Online

17.14.1.1. E-commerce Websites

17.14.1.2. Company-owned Websites

17.14.2. Offline

17.14.2.1. Hypermarkets & Supermarkets

17.14.2.2. Specialty Stores

17.14.2.3. Pharmaceutical & Drug Stores

17.14.2.4. Other Retail Stores

17.15. Tampons Market Size (US$ Mn) (Million Units) Forecast, by Country/Sub-region, 2017 - 2031

17.15.1. U.K.

17.15.2. Germany

17.15.3. France

17.15.4. Rest of Europe

17.16. Incremental Opportunity Analysis

18. Asia Pacific Tampons Market Analysis and Forecast

18.1. Regional Snapshot

18.2. Price Trend Analysis

18.2.1. Weighted Average Price

18.3. Key Trends Analysis

18.3.1. Demand Side Analysis

18.3.2. Supply Side Analysis

18.4. Brand Analysis

18.5. Consumer Buying Behavior Analysis

18.6. Tampons Market Size (US$ Mn and Million Units) Forecast, by Product Type, 2017 - 2031

18.6.1. Radially Wound Pledget

18.6.2. Rectangular/Square Pad

18.7. Tampons Market Size (US$ Mn and Million Units) Forecast, by Usage Type, 2017 - 2031

18.7.1. Applicator Tampons

18.7.2. Digital/Non-applicator Tampons

18.8. Tampons Market Size (US$ Mn and Million Units) Forecast, by Material, 2017 - 2031

18.8.1. Cotton

18.8.2. Blended

18.8.3. Rayon

18.8.4. Others

18.9. Tampons Market Size (US$ Mn and Million Units) Forecast, by Source, 2017 - 2031

18.9.1. Organic

18.9.2. Conventional

18.10. Tampons Market Size (US$ Mn and Million Units) Forecast, by Nature, 2017 - 2031

18.10.1. Scented

18.10.2. Unscented

18.11. Tampons Market Size (US$ Mn and Million Units) Forecast, by Pack Size, 2017 - 2031

18.11.1. Less Than 10

18.11.2. 10 - 30

18.11.3. 31- 50

18.11.4. More Than 50

18.12. Tampons Market Size (US$ Mn and Million Units) Forecast, by Price, 2017 - 2031

18.12.1. Economy

18.12.2. Mid-range

18.12.3. Premium

18.13. Tampons Market Size (US$ Mn and Million Units) Forecast, by Size, 2017- 2031

18.13.1. Mini

18.13.2. Regular

18.13.3. Extra

18.14. Tampons Market Size (US$ Mn and Million Units) Forecast, by Distribution Channel, 2017 - 2031

18.14.1. Online

18.14.1.1. E-commerce Websites

18.14.1.2. Company-owned Websites

18.14.2. Offline

18.14.2.1. Hypermarkets & Supermarkets

18.14.2.2. Specialty Stores

18.14.2.3. Pharmaceutical & Drug Stores

18.14.2.4. Other Retail Stores

18.15. Tampons Market Size (US$ Mn) (Million Units) Forecast, by Country/Sub-region, 2017 - 2031

18.15.1. China

18.15.2. India

18.15.3. Japan

18.15.4. Rest of Asia Pacific

18.16. Incremental Opportunity Analysis

19. Middle East & Africa Tampons Market Analysis and Forecast

19.1. Regional Snapshot

19.2. Price Trend Analysis

19.2.1. Weighted Average Price

19.3. Key Trends Analysis

19.3.1. Demand Side Analysis

19.3.2. Supply Side Analysis

19.4. Brand Analysis

19.5. Consumer Buying Behavior Analysis

19.6. Tampons Market Size (US$ Mn and Million Units) Forecast, by Product Type, 2017 - 2031

19.6.1. Radially Wound Pledget

19.6.2. Rectangular/Square Pad

19.7. Tampons Market Size (US$ Mn and Million Units) Forecast, by Usage Type, 2017 - 2031

19.7.1. Applicator Tampons

19.7.2. Digital/Non-applicator Tampons

19.8. Tampons Market Size (US$ Mn and Million Units) Forecast, by Material, 2017 - 2031

19.8.1. Cotton

19.8.2. Blended

19.8.3. Rayon

19.8.4. Others

19.9. Tampons Market Size (US$ Mn and Million Units) Forecast, by Source, 2017 - 2031

19.9.1. Organic

19.9.2. Conventional

19.10. Tampons Market Size (US$ Mn and Million Units) Forecast, by Nature, 2017 - 2031

19.10.1. Scented

19.10.2. Unscented

19.11. Tampons Market Size (US$ Mn and Million Units) Forecast, by Pack Size, 2017 - 2031

19.11.1. Less Than 10

19.11.2. 10 - 30

19.11.3. 31- 50

19.11.4. More Than 50

19.12. Tampons Market Size (US$ Mn and Million Units) Forecast, by Price, 2017 - 2031

19.12.1. Economy

19.12.2. Mid-range

19.12.3. Premium

19.13. Tampons Market Size (US$ Mn and Million Units) Forecast, by Size, 2017- 2031

19.13.1. Mini

19.13.2. Regular

19.13.3. Extra

19.14. Tampons Market Size (US$ Mn and Million Units) Forecast, by Distribution Channel, 2017 - 2031

19.14.1. Online

19.14.1.1. E-commerce Websites

19.14.1.2. Company-owned Websites

19.14.2. Offline

19.14.2.1. Hypermarkets & Supermarkets

19.14.2.2. Specialty Stores

19.14.2.3. Pharmaceutical & Drug Stores

19.14.2.4. Other Retail Stores

19.15. Tampons Market Size (US$ Mn) (Million Units) Forecast, by Country/Sub-region, 2017 - 2031

19.15.1. GCC

19.15.2. South Africa

19.15.3. Rest of Middle East & Africa

19.16. Incremental Opportunity Analysis

20. South America Tampons Market Analysis and Forecast

20.1. Regional Snapshot

20.2. Price Trend Analysis

20.2.1. Weighted Average Price

20.3. Key Trends Analysis

20.3.1. Demand Side Analysis

20.3.2. Supply Side Analysis

20.4. Brand Analysis

20.5. Consumer Buying Behavior Analysis

20.6. Tampons Market Size (US$ Mn and Million Units) Forecast, by Product Type, 2017 - 2031

20.6.1. Radially Wound Pledget

20.6.2. Rectangular/Square Pad

20.7. Tampons Market Size (US$ Mn and Million Units) Forecast, by Usage Type, 2017 - 2031

20.7.1. Applicator Tampons

20.7.2. Digital/Non-applicator Tampons

20.8. Tampons Market Size (US$ Mn and Million Units) Forecast, by Material, 2017 - 2031

20.8.1. Cotton

20.8.2. Blended

20.8.3. Rayon

20.8.4. Others

20.9. Tampons Market Size (US$ Mn and Million Units) Forecast, by Source, 2017 - 2031

20.9.1. Organic

20.9.2. Conventional

20.10. Tampons Market Size (US$ Mn and Million Units) Forecast, by Nature, 2017 - 2031

20.10.1. Scented

20.10.2. Unscented

20.11. Tampons Market Size (US$ Mn and Million Units) Forecast, by Pack Size, 2017 - 2031

20.11.1. Less Than 10

20.11.2. 10 - 30

20.11.3. 31- 50

20.11.4. More Than 50

20.12. Tampons Market Size (US$ Mn and Million Units) Forecast, by Price, 2017 - 2031

20.12.1. Economy

20.12.2. Mid-range

20.12.3. Premium

20.13. Tampons Market Size (US$ Mn and Million Units) Forecast, by Size, 2017- 2031

20.13.1. Mini

20.13.2. Regular

20.13.3. Extra

20.14. Tampons Market Size (US$ Mn and Million Units) Forecast, by Distribution Channel, 2017 - 2031

20.14.1. Online

20.14.1.1. E-commerce Websites

20.14.1.2. Company-owned Websites

20.14.2. Offline

20.14.2.1. Hypermarkets & Supermarkets

20.14.2.2. Specialty Stores

20.14.2.3. Pharmaceutical & Drug Stores

20.14.2.4. Other Retail Stores

20.15. Tampons Market Size (US$ Mn) (Million Units) Forecast, by Country/Sub-region, 2017 - 2031

20.15.1. Brazil

20.15.2. Rest of South America

20.16. Incremental Opportunity Analysis

21. Competition Landscape

21.1. Market Player - Competition Dashboard

21.2. Market Share Analysis - 2022 (%)

21.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

21.3.1. Procter & Gamble Co.

21.3.1.1. Company Overview

21.3.1.2. Sales Area/Geographical Presence

21.3.1.3. Revenue

21.3.1.4. Strategy & Business Overview

21.3.2. Johnson & Johnson Pvt.Ltd

21.3.2.1. Company Overview

21.3.2.2. Sales Area/Geographical Presence

21.3.2.3. Revenue

21.3.2.4. Strategy & Business Overview

21.3.3. Kimberly-Clark Corporation

21.3.3.1. Company Overview

21.3.3.2. Sales Area/Geographical Presence

21.3.3.3. Revenue

21.3.3.4. Strategy & Business Overview

21.3.4. Bodywise Ltd.

21.3.4.1. Company Overview

21.3.4.2. Sales Area/Geographical Presence

21.3.4.3. Revenue

21.3.4.4. Strategy & Business Overview

21.3.5. Corman S.P.A

21.3.5.1. Company Overview

21.3.5.2. Sales Area/Geographical Presence

21.3.5.3. Revenue

21.3.5.4. Strategy & Business Overview

21.3.6. Edgewell Personal Care Company

21.3.6.1. Company Overview

21.3.6.2. Sales Area/Geographical Presence

21.3.6.3. Revenue

21.3.6.4. Strategy & Business Overview

21.3.7. Lil-lets Group Ltd

21.3.7.1. Company Overview

21.3.7.2. Sales Area/Geographical Presence

21.3.7.3. Revenue

21.3.7.4. Strategy & Business Overview

21.3.8. Unicharm Corporation

21.3.8.1. Company Overview

21.3.8.2. Sales Area/Geographical Presence

21.3.8.3. Revenue

21.3.8.4. Strategy & Business Overview

21.3.9. Svenska Cellulosa Aktiebolaget

21.3.9.1. Company Overview

21.3.9.2. Sales Area/Geographical Presence

21.3.9.3. Revenue

21.3.9.4. Strategy & Business Overview

21.3.10. Cotton High Tech S.L.

21.3.10.1. Company Overview

21.3.10.2. Sales Area/Geographical Presence

21.3.10.3. Revenue

21.3.10.4. Strategy & Business Overview

22. Key Takeaways

22.1. Identification of Potential Market Spaces

22.1.1. Product Type

22.1.2. Usage Type

22.1.3. Material

22.1.4. Source

22.1.5. Nature

22.1.6. Pack Size

22.1.7. Price

22.1.8. Size

22.1.9. Distribution Channel

22.1.10. Region

22.2. Understanding the Procurement Process of End-users

22.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Tampons Market by Product Type, Million Units 2017-2031

Table 2: Global Tampons Market by Product Type, US$ Mn, 2017-2031

Table 3: Global Tampons Market by Usage Type, Million Units 2017-2031

Table 4: Global Tampons Market by Usage Type, US$ Mn, 2017-2031

Table 5: Global Tampons Market by Material, Million Units 2017-2031

Table 6: Global Tampons Market by Material, US$ Mn, 2017-2031

Table 7: Global Tampons Market by Source, Million Units 2017-2031

Table 8: Global Tampons Market by Source, US$ Mn, 2017-2031

Table 9: Global Tampons Market by Nature, Million Units, 2017-2031

Table 10: Global Tampons Market by Nature, US$ Mn, 2017-2031

Table 11: Global Tampons Market by Pack Size, Million Units 2017-2031

Table 12: Global Tampons Market by Pack Size, US$ Mn, 2017-2031

Table 13: Global Tampons Market by Price, Million Units 2017-2031

Table 14: Global Tampons Market by Price, US$ Mn, 2017-2031

Table 15: Global Tampons Market by Size, Million Units 2017-2031

Table 16: Global Tampons Market by Size, US$ Mn, 2017-2031

Table 17: Global Tampons Market by Distribution Channel, Million Units, 2017-2031

Table 18: Global Tampons Market by Distribution Channel, US$ Mn, 2017-2031

Table 19: Global Tampons Market by Region, Million Units, 2017-2031

Table 20: Global Tampons Market by Region, US$ Mn, 2017-2031

Table 21: North America Tampons Market by Product Type, Million Units 2017-2031

Table 22: North America Tampons Market by Product Type, US$ Mn, 2017-2031

Table 23: North America Tampons Market by Usage Type, Million Units 2017-2031

Table 24: North America Tampons Market by Usage Type, US$ Mn, 2017-2031

Table 25: North America Tampons Market by Material, Million Units 2017-2031

Table 26: North America Tampons Market by Material, US$ Mn, 2017-2031

Table 27: North America Tampons Market by Source, Million Units 2017-2031

Table 28: North America Tampons Market by Source, US$ Mn, 2017-2031

Table 29: North America Tampons Market by Nature, Million Units, 2017-2031

Table 30: North America Tampons Market by Nature, US$ Mn, 2017-2031

Table 31: North America Tampons Market by Pack Size, Million Units 2017-2031

Table 32: North America Tampons Market by Pack Size, US$ Mn, 2017-2031

Table 33: North America Tampons Market by Price, Million Units 2017-2031

Table 34: North America Tampons Market by Price, US$ Mn, 2017-2031

Table 35: North America Tampons Market by Size, Million Units 2017-2031

Table 36: North America Tampons Market by Size, US$ Mn, 2017-2031

Table 37: North America Tampons Market by Distribution Channel, Million Units, 2017-2031

Table 38: North America Tampons Market by Distribution Channel, US$ Mn, 2017-2031

Table 39: Europe Tampons Market by Product Type, Million Units 2017-2031

Table 40: Europe Tampons Market by Product Type, US$ Mn, 2017-2031

Table 41: Europe Tampons Market by Usage Type, Million Units 2017-2031

Table 42: Europe Tampons Market by Usage Type, US$ Mn, 2017-2031

Table 43: Europe Tampons Market by Material, Million Units 2017-2031

Table 44: Europe Tampons Market by Material, US$ Mn, 2017-2031

Table 45: Europe Tampons Market by Source, Million Units 2017-2031

Table 46: Europe Tampons Market by Source, US$ Mn, 2017-2031

Table 47: Europe Tampons Market by Nature, Million Units, 2017-2031

Table 48: Europe Tampons Market by Nature, US$ Mn, 2017-2031

Table 49: Europe Tampons Market by Pack Size, Million Units 2017-2031

Table 50: Europe Tampons Market by Pack Size, US$ Mn, 2017-2031

Table 51: Europe Tampons Market by Price, Million Units 2017-2031

Table 52: Europe Tampons Market by Price, US$ Mn, 2017-2031

Table 53: Europe Tampons Market by Size, Million Units 2017-2031

Table 54: Europe Tampons Market by Size, US$ Mn, 2017-2031

Table 55: Europe Tampons Market by Distribution Channel, Million Units, 2017-2031

Table 56: Europe Tampons Market by Distribution Channel, US$ Mn, 2017-2031

Table 57: Asia Pacific Tampons Market by Product Type, Million Units 2017-2031

Table 58: Asia Pacific Tampons Market by Product Type, US$ Mn, 2017-2031

Table 59: Asia Pacific Tampons Market by Usage Type, Million Units 2017-2031

Table 60: Asia Pacific Tampons Market by Usage Type, US$ Mn, 2017-2031

Table 61: Asia Pacific Tampons Market by Material, Million Units 2017-2031

Table 62: Asia Pacific Tampons Market by Material, US$ Mn, 2017-2031

Table 63: Asia Pacific Tampons Market by Source, Million Units 2017-2031

Table 64: Asia Pacific Tampons Market by Source, US$ Mn, 2017-2031

Table 65: Asia Pacific Tampons Market by Nature, Million Units, 2017-2031

Table 66: Asia Pacific Tampons Market by Nature, US$ Mn, 2017-2031

Table 67: Asia Pacific Tampons Market by Pack Size, Million Units 2017-2031

Table 68: Asia Pacific Tampons Market by Pack Size, US$ Mn, 2017-2031

Table 69: Asia Pacific Tampons Market by Price, Million Units 2017-2031

Table 70: Asia Pacific Tampons Market by Price, US$ Mn, 2017-2031

Table 71: Asia Pacific Tampons Market by Size, Million Units 2017-2031

Table 72: Asia Pacific Tampons Market by Size, US$ Mn, 2017-2031

Table 73: Asia Pacific Tampons Market by Distribution Channel, Million Units, 2017-2031

Table 74: Asia Pacific Tampons Market by Distribution Channel, US$ Mn, 2017-2031

Table 75: Middle East & Africa Tampons Market by Product Type, Million Units 2017-2031

Table 76: Middle East & Africa Tampons Market by Product Type, US$ Mn, 2017-2031

Table 77: Middle East & Africa Tampons Market by Usage Type, Million Units 2017-2031

Table 78: Middle East & Africa Tampons Market by Usage Type, US$ Mn, 2017-2031

Table 79: Middle East & Africa Tampons Market by Material, Million Units 2017-2031

Table 80: Middle East & Africa Tampons Market by Material, US$ Mn, 2017-2031

Table 81: Middle East & Africa Tampons Market by Source, Million Units 2017-2031

Table 82: Middle East & Africa Tampons Market by Source, US$ Mn, 2017-2031

Table 83: Middle East & Africa Tampons Market by Nature, Million Units, 2017-2031

Table 84: Middle East & Africa Tampons Market by Nature, US$ Mn, 2017-2031

Table 85: Middle East & Africa Tampons Market by Pack Size, Million Units 2017-2031

Table 86: Middle East & Africa Tampons Market by Pack Size, US$ Mn, 2017-2031

Table 87: Middle East & Africa Tampons Market by Price, Million Units 2017-2031

Table 88: Middle East & Africa Tampons Market by Price, US$ Mn, 2017-2031

Table 89: Middle East & Africa Tampons Market by Size, Million Units 2017-2031

Table 90: Middle East & Africa Tampons Market by Size, US$ Mn, 2017-2031

Table 91: Middle East & Africa Tampons Market by Distribution Channel, Million Units, 2017-2031

Table 92: Middle East & Africa Tampons Market by Distribution Channel, US$ Mn, 2017-2031

Table 93: South America Tampons Market by Product Type, Million Units 2017-2031

Table 94: South America Tampons Market by Product Type, US$ Mn, 2017-2031

Table 95: South America Tampons Market by Usage Type, Million Units 2017-2031

Table 96: South America Tampons Market by Usage Type, US$ Mn, 2017-2031

Table 97: South America Tampons Market by Material, Million Units 2017-2031

Table 98: South America Tampons Market by Material, US$ Mn, 2017-2031

Table 99: South America Tampons Market by Source, Million Units 2017-2031

Table 100: South America Tampons Market by Source, US$ Mn, 2017-2031

Table 101: South America Tampons Market by Nature, Million Units, 2017-2031

Table 102: South America Tampons Market by Nature, US$ Mn, 2017-2031

Table 103: South America Tampons Market by Pack Size, Million Units 2017-2031

Table 104: South America Tampons Market by Pack Size, US$ Mn, 2017-2031

Table 105: South America Tampons Market by Price, Million Units 2017-2031

Table 106: South America Tampons Market by Price, US$ Mn, 2017-2031

Table 107: South America Tampons Market by Size, Million Units 2017-2031

Table 108: South America Tampons Market by Size, US$ Mn, 2017-2031

Table 109: South America Tampons Market by Distribution Channel, Million Units, 2017-2031

Table 110: South America Tampons Market by Distribution Channel, US$ Mn, 2017-2031

List of Figures

Figure 1: Global Tampons Market Projections, by Product Type, Million Units, 2017-2031

Figure 2: Global Tampons Market Projections, by Product Type, US$ Mn, 2017-2031

Figure 3: Global Tampons Market, Incremental Opportunity, by Product Type, US$ Mn, 2023 -2031

Figure 4: Global Tampons Market Projections, by Usage Type, Million Units, 2017-2031

Figure 5: Global Tampons Market Projections, by Usage Type, US$ Mn, 2017-2031

Figure 6: Global Tampons Market, Incremental Opportunity, by Usage Type, US$ Mn, 2023 -2031

Figure 7: Global Tampons Market Projections, by Material, Million Units, 2017-2031

Figure 8: Global Tampons Market Projections, by Material, US$ Mn, 2017-2031

Figure 9: Global Tampons Market, Incremental Opportunity, by Material, US$ Mn, 2023 -2031

Figure 10: Global Tampons Market Projections, by Source, Million Units, 2017-2031

Figure 11: Global Tampons Market Projections, by Source, US$ Mn, 2017-2031

Figure 12: Global Tampons Market, Incremental Opportunity, by Source, US$ Mn, 2023 -2031

Figure 13: Global Tampons Market Projections, by Nature, Million Units, 2017-2031

Figure 14: Global Tampons Market Projections, by Nature, US$ Mn, 2017-2031

Figure 15: Global Tampons Market, Incremental Opportunity, by Nature, US$ Mn, 2023 -2031

Figure 16: Global Tampons Market Projections, by Pack Size, Million Units, 2017-2031

Figure 17: Global Tampons Market Projections, by Pack Size, US$ Mn, 2017-2031

Figure 18: Global Tampons Market, Incremental Opportunity, by Pack Size, US$ Mn, 2023 -2031

Figure 19: Global Tampons Market Projections, by Price, Million Units, 2017-2031

Figure 20: Global Tampons Market Projections, by Price, US$ Mn, 2017-2031

Figure 21: Global Tampons Market, Incremental Opportunity, by Price, US$ Mn, 2023 -2031

Figure 22: Global Tampons Market Projections, by Size, Million Units, 2017-2031

Figure 23: Global Tampons Market Projections, by Size, US$ Mn, 2017-2031

Figure 24: Global Tampons Market, Incremental Opportunity, by Size, US$ Mn, 2023 -2031

Figure 25: Global Tampons Market Projections, by Distribution Channel, Million Units, 2017-2031

Figure 26: Global Tampons Market Projections, by Distribution Channel, US$ Mn, 2017-2031

Figure 27: Global Tampons Market, Incremental Opportunity, by Distribution Channel, US$ Mn, 2023 -2031

Figure 28: Global Tampons Market Projections, by Region, Million Units, 2017-2031

Figure 29: Global Tampons Market Projections, by Region, US$ Mn, 2017-2031

Figure 30: Global Tampons Market, Incremental Opportunity, by Region, US$ Mn, 2023 -2031

Figure 31: North America Tampons Market Projections, by Product Type, Million Units, 2017-2031

Figure 32: North America Tampons Market Projections, by Product Type, US$ Mn, 2017-2031

Figure 33: North America Tampons Market, Incremental Opportunity, by Product Type, US$ Mn, 2023 -2031

Figure 34: North America Tampons Market Projections, by Usage Type, Million Units, 2017-2031

Figure 35: North America Tampons Market Projections, by Usage Type, US$ Mn, 2017-2031

Figure 36: North America Tampons Market, Incremental Opportunity, by Usage Type, US$ Mn, 2023 -2031

Figure 37: North America Tampons Market Projections, by Material, Million Units, 2017-2031

Figure 38: North America Tampons Market Projections, by Material, US$ Mn, 2017-2031

Figure 39: North America Tampons Market, Incremental Opportunity, by Material, US$ Mn, 2023 -2031

Figure 40: North America Tampons Market Projections, by Source, Million Units, 2017-2031

Figure 41: North America Tampons Market Projections, by Source, US$ Mn, 2017-2031

Figure 42: North America Tampons Market, Incremental Opportunity, by Source, US$ Mn, 2023 -2031

Figure 43: North America Tampons Market Projections, by Nature, Million Units, 2017-2031

Figure 44: North America Tampons Market Projections, by Nature, US$ Mn, 2017-2031

Figure 45: North America Tampons Market, Incremental Opportunity, by Nature, US$ Mn, 2023 -2031

Figure 46: North America Tampons Market Projections, by Pack Size, Million Units, 2017-2031

Figure 47: North America Tampons Market Projections, by Pack Size, US$ Mn, 2017-2031

Figure 48: North America Tampons Market, Incremental Opportunity, by Pack Size, US$ Mn, 2023 -2031

Figure 49: North America Tampons Market Projections, by Price, Million Units, 2017-2031

Figure 50: North America Tampons Market Projections, by Price, US$ Mn, 2017-2031

Figure 51: North America Tampons Market, Incremental Opportunity, by Price, US$ Mn, 2023 -2031

Figure 52: North America Tampons Market Projections, by Size, Million Units, 2017-2031

Figure 53: North America Tampons Market Projections, by Size, US$ Mn, 2017-2031

Figure 54: North America Tampons Market, Incremental Opportunity, by Size, US$ Mn, 2023 -2031

Figure 55: North America Tampons Market Projections, by Distribution Channel, Million Units, 2017-2031

Figure 56: North America Tampons Market Projections, by Distribution Channel, US$ Mn, 2017-2031

Figure 57: North America Tampons Market, Incremental Opportunity, by Distribution Channel, US$ Mn, 2023 -2031

Figure 58: Europe Tampons Market Projections, by Product Type, Million Units, 2017-2031

Figure 59: Europe Tampons Market Projections, by Product Type, US$ Mn, 2017-2031

Figure 60: Europe Tampons Market, Incremental Opportunity, by Product Type, US$ Mn, 2023 -2031

Figure 61: Europe Tampons Market Projections, by Usage Type, Million Units, 2017-2031

Figure 62: Europe Tampons Market Projections, by Usage Type, US$ Mn, 2017-2031

Figure 63: Europe Tampons Market, Incremental Opportunity, by Usage Type, US$ Mn, 2023 -2031

Figure 64: Europe Tampons Market Projections, by Material, Million Units, 2017-2031

Figure 65: Europe Tampons Market Projections, by Material, US$ Mn, 2017-2031

Figure 66: Europe Tampons Market, Incremental Opportunity, by Material, US$ Mn, 2023 -2031

Figure 67: Europe Tampons Market Projections, by Source, Million Units, 2017-2031

Figure 68: Europe Tampons Market Projections, by Source, US$ Mn, 2017-2031

Figure 69: Europe Tampons Market, Incremental Opportunity, by Source, US$ Mn, 2023 -2031

Figure 70: Europe Tampons Market Projections, by Nature, Million Units, 2017-2031

Figure 71: Europe Tampons Market Projections, by Nature, US$ Mn, 2017-2031

Figure 72: Europe Tampons Market, Incremental Opportunity, by Nature, US$ Mn, 2023 -2031

Figure 73: Europe Tampons Market Projections, by Pack Size, Million Units, 2017-2031

Figure 74: Europe Tampons Market Projections, by Pack Size, US$ Mn, 2017-2031

Figure 75: Europe Tampons Market, Incremental Opportunity, by Pack Size, US$ Mn, 2023 -2031

Figure 76: Europe Tampons Market Projections, by Price, Million Units, 2017-2031

Figure 77: Europe Tampons Market Projections, by Price, US$ Mn, 2017-2031

Figure 78: Europe Tampons Market, Incremental Opportunity, by Price, US$ Mn, 2023 -2031

Figure 79: Europe Tampons Market Projections, by Size, Million Units, 2017-2031

Figure 80: Europe Tampons Market Projections, by Size, US$ Mn, 2017-2031

Figure 81: Europe Tampons Market, Incremental Opportunity, by Size, US$ Mn, 2023 -2031

Figure 82: Europe Tampons Market Projections, by Distribution Channel, Million Units, 2017-2031

Figure 83: Europe Tampons Market Projections, by Distribution Channel, US$ Mn, 2017-2031

Figure 84: Europe Tampons Market, Incremental Opportunity, by Distribution Channel, US$ Mn, 2023 -2031

Figure 85: Asia Pacific Tampons Market Projections, by Product Type, Million Units, 2017-2031

Figure 86: Asia Pacific Tampons Market Projections, by Product Type, US$ Mn, 2017-2031

Figure 87: Asia Pacific Tampons Market, Incremental Opportunity, by Product Type, US$ Mn, 2023 -2031

Figure 88: Asia Pacific Tampons Market Projections, by Usage Type, Million Units, 2017-2031

Figure 89: Asia Pacific Tampons Market Projections, by Usage Type, US$ Mn, 2017-2031

Figure 90: Asia Pacific Tampons Market, Incremental Opportunity, by Usage Type, US$ Mn, 2023 -2031

Figure 91: Asia Pacific Tampons Market Projections, by Material, Million Units, 2017-2031

Figure 92: Asia Pacific Tampons Market Projections, by Material, US$ Mn, 2017-2031

Figure 93: Asia Pacific Tampons Market, Incremental Opportunity, by Material, US$ Mn, 2023 -2031

Figure 94: Asia Pacific Tampons Market Projections, by Source, Million Units, 2017-2031

Figure 95: Asia Pacific Tampons Market Projections, by Source, US$ Mn, 2017-2031

Figure 96: Asia Pacific Tampons Market, Incremental Opportunity, by Source, US$ Mn, 2023 -2031

Figure 97: Asia Pacific Tampons Market Projections, by Nature, Million Units, 2017-2031

Figure 98: Asia Pacific Tampons Market Projections, by Nature, US$ Mn, 2017-2031

Figure 99: Asia Pacific Tampons Market, Incremental Opportunity, by Nature, US$ Mn, 2023 -2031

Figure 100: Asia Pacific Tampons Market Projections, by Pack Size, Million Units, 2017-2031

Figure 101: Asia Pacific Tampons Market Projections, by Pack Size, US$ Mn, 2017-2031

Figure 102: Asia Pacific Tampons Market, Incremental Opportunity, by Pack Size, US$ Mn, 2023 -2031

Figure 103: Asia Pacific Tampons Market Projections, by Price, Million Units, 2017-2031

Figure 104: Asia Pacific Tampons Market Projections, by Price, US$ Mn, 2017-2031

Figure 105: Asia Pacific Tampons Market, Incremental Opportunity, by Price, US$ Mn, 2023 -2031

Figure 106: Asia Pacific Tampons Market Projections, by Size, Million Units, 2017-2031

Figure 107: Asia Pacific Tampons Market Projections, by Size, US$ Mn, 2017-2031

Figure 108: Asia Pacific Tampons Market, Incremental Opportunity, by Size, US$ Mn, 2023 -2031

Figure 109: Asia Pacific Tampons Market Projections, by Distribution Channel, Million Units, 2017-2031

Figure 110: Asia Pacific Tampons Market Projections, by Distribution Channel, US$ Mn, 2017-2031

Figure 111: Asia Pacific Tampons Market, Incremental Opportunity, by Distribution Channel, US$ Mn, 2023 -2031

Figure 112: Middle East & Africa Tampons Market Projections, by Product Type, Million Units, 2017-2031

Figure 113: Middle East & Africa Tampons Market Projections, by Product Type, US$ Mn, 2017-2031

Figure 114: Middle East & Africa Tampons Market, Incremental Opportunity, by Product Type, US$ Mn, 2023 -2031

Figure 115: Middle East & Africa Tampons Market Projections, by Usage Type, Million Units, 2017-2031

Figure 116: Middle East & Africa Tampons Market Projections, by Usage Type, US$ Mn, 2017-2031

Figure 117: Middle East & Africa Tampons Market, Incremental Opportunity, by Usage Type, US$ Mn, 2023 -2031

Figure 118: Middle East & Africa Tampons Market Projections, by Material, Million Units, 2017-2031

Figure 119: Middle East & Africa Tampons Market Projections, by Material, US$ Mn, 2017-2031

Figure 120: Middle East & Africa Tampons Market, Incremental Opportunity, by Material, US$ Mn, 2023 -2031

Figure 121: Middle East & Africa Tampons Market Projections, by Source, Million Units, 2017-2031

Figure 122: Middle East & Africa Tampons Market Projections, by Source, US$ Mn, 2017-2031

Figure 123: Middle East & Africa Tampons Market, Incremental Opportunity, by Source, US$ Mn, 2023 -2031

Figure 124: Middle East & Africa Tampons Market Projections, by Nature, Million Units, 2017-2031

Figure 125: Middle East & Africa Tampons Market Projections, by Nature, US$ Mn, 2017-2031

Figure 126: Middle East & Africa Tampons Market, Incremental Opportunity, by Nature, US$ Mn, 2023 -2031

Figure 127: Middle East & Africa Tampons Market Projections, by Pack Size, Million Units, 2017-2031

Figure 128: Middle East & Africa Tampons Market Projections, by Pack Size, US$ Mn, 2017-2031

Figure 129: Middle East & Africa Tampons Market, Incremental Opportunity, by Pack Size, US$ Mn, 2023 -2031

Figure 130: Middle East & Africa Tampons Market Projections, by Price, Million Units, 2017-2031

Figure 131: Middle East & Africa Tampons Market Projections, by Price, US$ Mn, 2017-2031

Figure 132: Middle East & Africa Tampons Market, Incremental Opportunity, by Price, US$ Mn, 2023 -2031

Figure 133: Middle East & Africa Tampons Market Projections, by Size, Million Units, 2017-2031

Figure 134: Middle East & Africa Tampons Market Projections, by Size, US$ Mn, 2017-2031

Figure 135: Middle East & Africa Tampons Market, Incremental Opportunity, by Size, US$ Mn, 2023 -2031

Figure 136: Middle East & Africa Tampons Market Projections, by Distribution Channel, Million Units, 2017-2031

Figure 137: Middle East & Africa Tampons Market Projections, by Distribution Channel, US$ Mn, 2017-2031

Figure 138: Middle East & Africa Tampons Market, Incremental Opportunity, by Distribution Channel, US$ Mn, 2023 -2031

Figure 139: South America Tampons Market Projections, by Product Type, Million Units, 2017-2031

Figure 140: South America Tampons Market Projections, by Product Type, US$ Mn, 2017-2031

Figure 141: South America Tampons Market, Incremental Opportunity, by Product Type, US$ Mn, 2023 -2031

Figure 142: South America Tampons Market Projections, by Usage Type, Million Units, 2017-2031

Figure 143: South America Tampons Market Projections, by Usage Type, US$ Mn, 2017-2031

Figure 144: South America Tampons Market, Incremental Opportunity, by Usage Type, US$ Mn, 2023 -2031

Figure 145: South America Tampons Market Projections, by Material, Million Units, 2017-2031

Figure 146: South America Tampons Market Projections, by Material, US$ Mn, 2017-2031

Figure 147: South America Tampons Market, Incremental Opportunity, by Material, US$ Mn, 2023 -2031

Figure 148: South America Tampons Market Projections, by Source, Million Units, 2017-2031

Figure 149: South America Tampons Market Projections, by Source, US$ Mn, 2017-2031

Figure 150: South America Tampons Market, Incremental Opportunity, by Source, US$ Mn, 2023 -2031

Figure 151: South America Tampons Market Projections, by Nature, Million Units, 2017-2031

Figure 152: South America Tampons Market Projections, by Nature, US$ Mn, 2017-2031

Figure 153: South America Tampons Market, Incremental Opportunity, by Nature, US$ Mn, 2023 -2031

Figure 154: South America Tampons Market Projections, by Pack Size, Million Units, 2017-2031

Figure 155: South America Tampons Market Projections, by Pack Size, US$ Mn, 2017-2031

Figure 156: South America Tampons Market, Incremental Opportunity, by Pack Size, US$ Mn, 2023 -2031

Figure 157: South America Tampons Market Projections, by Price, Million Units, 2017-2031

Figure 158: South America Tampons Market Projections, by Price, US$ Mn, 2017-2031

Figure 159: South America Tampons Market, Incremental Opportunity, by Price, US$ Mn, 2023 -2031

Figure 160: South America Tampons Market Projections, by Size, Million Units, 2017-2031

Figure 161: South America Tampons Market Projections, by Size, US$ Mn, 2017-2031

Figure 162: South America Tampons Market, Incremental Opportunity, by Size, US$ Mn, 2023 -2031

Figure 163: South America Tampons Market Projections, by Distribution Channel, Million Units, 2017-2031

Figure 164: South America Tampons Market Projections, by Distribution Channel, US$ Mn, 2017-2031

Figure 165: South America Tampons Market, Incremental Opportunity, by Distribution Channel, US$ Mn, 2023 -2031