Reports

Reports

Analysts’ Viewpoint

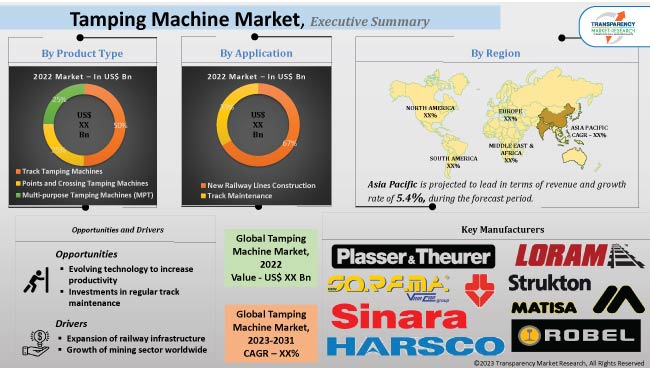

Tamping machines are specialized devices essential in maintaining railway tracks. Rise in the number of railway projects worldwide, and increase in efforts to maximize safety, upgrade the quality of existing railway systems, and prevent railway accidents are expected to drive the global tamping machine industry during the forecast period.

High capacity, sustainable and improved performance, ability to use electric and diesel engines, and digitization of the assistance system have revolutionized automation in machines, thus driving the tamping machine market size. According to tamping machine market insights, industry participants concentrate on raising the efficiency and quality of tamping equipment. Tamping machine market players extensively fund research and conduct frequent testing to gauge the performance of the machines.

A tamping machine or a tamper, is a self-propelled, rail tamping machine. The purpose of tamping machines is to pack the track ballast under railway tracks to level the tracks and roadbed and make them more durable.

Tamping machines are essential for use on concrete sleepers owing to their excessive weight (typically exceeding 250 kgs or 550 LB). They are fast, accurate, effective, and require less labor. Tamping machines are primarily used for packing ballast under the sleeper, for correction of alignment/lining, and correction of x-level and longitudinal level.

Recently designed large portable tamping machines include features such as lining and raising the rails along with their tamping function. The newest track maintenance equipment are powered by batteries as well as electrical energy from the contact wire. Recent advancements in tamping machines include technologies which keep local emissions of both pollutants and noise to a minimum on the work site. If there is no overhead contact line available for current collection, new tamping machines use a diesel-electric generator to supply electrical power.

Railway infrastructure refers to electrification, signaling and track maintenance, and track materials and equipment. Machines for tamping tracks are essential for keeping tracks in good condition. These sophisticated, high-priced tools are used in railway maintenance, on every railway track in the world.

As trains are essential for a low-carbon future, several businesses in Europe are developing new railway routes and services that may make transcontinental train journeys more appealing. One of the largest single expenditures made in the U.K., Crossrail, is the largest railway infrastructure project in Europe. As per a U.K. government report, the overall cost of the project is estimated at £18.6 Bn.

Construction Intelligence Centre (CIC) is currently tracking railway construction projects in Asia Pacific, which includes projects from the announced to execution stages with a total value of US$ 2.68 Trn. Market statistics indicate that China leads with a value of US$ 1.35 Trn, with the country’s highest value project being US$ 42.4 Bn, followed by India with US$ 342.4 Bn. Upgrades include 100% electrification of railways, development of existing lines, expansion of new lines, and introduction & eventually development of a large high-speed train network. Inadequate track maintenance can impede freight and passenger transportation. Track maintenance is important to keep trains running on time. In the early years of the railroad industry, track maintenance required a sizable crew of trackmen and was exceedingly exhaustive.

Tamping machine market demand is expected to grow at a steady pace during the forecast period owing to the rise in number of railway projects across the world. Significant financial investment is required to renovate existing rail networks and use it as a foundation for new rail projects, which is estimated to support the overall tamping machine industry growth.

The railroad tamping machine increases rail productivity by enabling flexible operations and integration along with track maintenance and construction of new tracks to move freight safely. The mining locomotive is scalable, making it cost effective in mines of varying sizes and grades.

Moving freight securely, as efficiently and effectively as possible, 365 days a year is a top priority of the mining business and a market catalyst. Two main methods for moving supplies and machinery underground are track/rail systems and trackless systems. The primary function of a mining locomotive is long-distance ground and subsurface transportation. Underground locomotives are propelled by electric, compressed air, and seldom by gasoline motors. In Europe, diesel locomotives are often employed.

According to American Mine Services, there were approximately 13,000 active mines in the U.S. as of 2019, valued at US$ 61 Bn. A sharp increase in the use of metals, industrial minerals, and aggregates in Europe has been witnessed over the past ten years. Mining is a developing sector in the Middle East and North Africa (MENA). Gulf nations, in particular, plan to diversify their economies to lessen their reliance on oil and gas and provide jobs to their youth. India is the second largest producer of coal, with total 1,425 mines, which reported mineral production. Thus expansion of the mining sector is likely to boost market progress of tamping machines in the near future.

North America is expected to dominate the global market in the next few years. Tamping machine market performance in North America is expected to be highly positive, followed by Europe and Asia Pacific.

The tamping machine market share of Asia Pacific is anticipated to significantly expand during the forecast period. China and India, two of the world's developing economies, rely heavily on rail transportation. Some of the key aspects which are expected to influence tamping machine market growth in the region are steady expansion of the mining industry, rapid industrialization in emerging countries, increase in focus on improving the current rail infrastructure, and building new rail lines.

Key tamping machine manufacturers adopt strategies such as investments in R&D, product expansions, and mergers and acquisitions. Market analysis suggests product development as a key marketing strategy of top market players.

CRCC High-Tech Equipment Co., Ltd., Gemac Engineering Machinery Co Ltd, Harsco Corporation, Loram Maintenance of Way, Inc., MATISA MATÉRIEL INDUSTRIEL S.A., New Sorema Ferroviaria SpA, Plasser & Theurer, Robel Bahnbaumaschinen Gmbh, Strukton, and The Sinara Group are the prominent entities profiled in the tamping machine market report.

Key players have been profiled in the tamping machine market research based on parameters such as company overview, business strategies, financial overview, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 2.9 Bn |

|

Market Forecast Value in 2031 |

US$ 4.6 Bn |

|

Growth Rate (CAGR) |

5.4% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value & Thousand Units for Volume |

|

Market Analysis |

Includes cross segment analysis at regional as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Region Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 2.9 Bn in 2022

It is projected to expand at a CAGR of 5.4% from 2023 to 2031

Expansion in railway infrastructure and growth of the mining sector worldwide

Multi-purpose tamping machines (MPT) was the major segment in 2022

Asia Pacific is likely to be one of the lucrative regions in the next few years

CRCC High-Tech Equipment Co., Ltd., Gemac Engineering Machinery Co Ltd, Harsco Corporation, Loram Maintenance of Way, Inc., MATISA MATÉRIEL INDUSTRIEL S.A., New Sorema Ferroviaria SpA, Plasser & Theurer, Robel Bahnbaumaschinen Gmbh, Strukton, and The Sinara Group

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Technological Overview Analysis

5.5. Key Market Indicators

5.6. Raw Material Analysis

5.7. Porter’s Five Forces Analysis

5.8. Industry SWOT Analysis

5.9. Value Chain Analysis

5.10. Regulatory Framework

5.11. Global Tamping Machine Market Analysis and Forecast, 2017 - 2031

5.11.1. Market Value Projections (US$ Bn)

5.11.2. Market Volume Projections (Thousand Units)

6. Global Tamping Machine Market Analysis and Forecast, By Product Type

6.1. Tamping Machine Market Size (US$ Bn and Thousand Units) Forecast, By Product Type,2017 – 2031

6.1.1. Track Tamping Machines

6.1.2. Points and Crossing Tamping Machines

6.1.3. Multi-purpose Tamping Machines (MPT)

6.2. Incremental Opportunity, By Product Type

7. Global Tamping Machine Market Analysis and Forecast, By Application

7.1. Tamping Machine Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

7.1.1. New Railway Lines Construction

7.1.2. Track Maintenance

7.2. Incremental Opportunity, By Application

8. Global Tamping Machine Market Analysis and Forecast, By Region

8.1. Tamping Machine Market Size (US$ Bn and Thousand Units) Forecast, By Region, 2017 - 2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Incremental Opportunity, By Region

9. North America Tamping Machine Market Analysis and Forecast

9.1. Regional Snapshot

9.2. Macroeconomic Overview

9.3. Brand Analysis

9.4. Price Trend Analysis

9.4.1. Weighted Average Price

9.5. Key Trends Analysis

9.5.1. Demand Side

9.5.2. Supplier Side

9.6. Tamping Machine Market Size (US$ Bn and Thousand Units) Forecast, By Product Type,2017 – 2031

9.6.1. Track Tamping Machines

9.6.2. Points and Crossing Tamping Machines

9.6.3. Multi-purpose Tamping Machines (MPT)

9.7. Tamping Machine Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

9.7.1. New Railway Lines Construction

9.7.2. Track Maintenance

9.8. Tamping Machine Market Size (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

9.8.1. U.S.

9.8.2. Canada

9.8.3. Rest of North America

9.9. Incremental Opportunity Analysis

10. Europe Tamping Machine Market Analysis and Forecast

10.1. Regional Snapshot

10.2. Macroeconomic Overview

10.3. Brand Analysis

10.4. Price Trend Analysis

10.4.1. Weighted Average Price

10.5. Key Trends Analysis

10.5.1. Demand Side

10.5.2. Supplier Side

10.6. Tamping Machine Market Size (US$ Bn and Thousand Units) Forecast, By Product Type,2017 – 2031

10.6.1. Track Tamping Machines

10.6.2. Points and Crossing Tamping Machines

10.6.3. Multi-purpose Tamping Machines (MPT)

10.7. Tamping Machine Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

10.7.1. New Railway Lines Construction

10.7.2. Track Maintenance

10.8. Tamping Machine Market Size (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

10.8.1. U.K.

10.8.2. Germany

10.8.3. France

10.8.4. Rest of Europe

10.9. Incremental Opportunity Analysis

11. Asia Pacific Tamping Machine Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Macroeconomic Overview

11.3. Brand Analysis

11.4. Key Trends Analysis

11.4.1. Demand Side

11.4.2. Supplier Side

11.5. Tamping Machine Market Size (US$ Bn and Thousand Units) Forecast, By Product Type,2017 – 2031

11.5.1. Track Tamping Machines

11.5.2. Points and Crossing Tamping Machines

11.5.3. Multi-purpose Tamping Machines (MPT)

11.6. Tamping Machine Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

11.6.1. New Railway Lines Construction

11.6.2. Track Maintenance

11.7. Tamping Machine Market Size (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

11.7.1. India

11.7.2. China

11.7.3. Japan

11.7.4. Rest of Asia Pacific

11.8. Incremental Opportunity Analysis

12. Middle East & South Africa Tamping Machine Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Macroeconomic Overview

12.3. Brand Analysis

12.4. Price Trend Analysis

12.4.1. Weighted Average Price

12.5. Key Trends Analysis

12.5.1. Demand Side

12.5.2. Supplier Side

12.6. Tamping Machine Market Size (US$ Bn and Thousand Units) Forecast, By Product Type, 2017 – 2031

12.6.1. Track Tamping Machines

12.6.2. Points and Crossing Tamping Machines

12.6.3. Multi-purpose Tamping Machines (MPT)

12.7. Tamping Machine Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

12.7.1. New Railway Lines Construction

12.7.2. Track Maintenance

12.8. Tamping Machine Market Size (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

12.8.1. GCC

12.8.2. Rest of Middle East & Africa

12.9. Incremental Opportunity Analysis

13. South America Tamping Machine Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Macroeconomic Overview

13.3. Brand Analysis

13.4. Price Trend Analysis

13.4.1. Weighted Average Price

13.5. Key Trends Analysis

13.5.1. Demand Side

13.5.2. Supplier Side

13.6. Tamping Machine Market Size (US$ Bn and Thousand Units) Forecast, By Product Type, 2017 – 2031

13.6.1. Track Tamping Machines

13.6.2. Points and Crossing Tamping Machines

13.6.3. Multi-purpose Tamping Machines (MPT)

13.7. Tamping Machine Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

13.7.1. New Railway Lines Construction

13.7.2. Track Maintenance

13.8. Tamping Machine Market Size (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

13.8.1. Brazil

13.8.2. Rest of South America

13.9. Incremental Opportunity Analysis

14. Competition Landscape

14.1. Market Player – Competition Dashboard

14.2. Market Share Analysis (%), by Company, (2022)

14.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

14.3.1. CRCC High-Tech Equipment Co., Ltd.

14.3.1.1. Company Overview

14.3.1.2. Sales Area/Geographical Presence

14.3.1.3. Revenue

14.3.1.4. Strategy & Business Overview

14.3.2. Gemac Engineering Machinery Co Ltd

14.3.2.1. Company Overview

14.3.2.2. Sales Area/Geographical Presence

14.3.2.3. Revenue

14.3.2.4. Strategy & Business Overview

14.3.3. Harsco Corporation

14.3.3.1. Company Overview

14.3.3.2. Sales Area/Geographical Presence

14.3.3.3. Revenue

14.3.3.4. Strategy & Business Overview

14.3.4. Loram Maintenance of Way, Inc.

14.3.4.1. Company Overview

14.3.4.2. Sales Area/Geographical Presence

14.3.4.3. Revenue

14.3.4.4. Strategy & Business Overview

14.3.5. MATISA MATÉRIEL INDUSTRIEL S.A.

14.3.5.1. Company Overview

14.3.5.2. Sales Area/Geographical Presence

14.3.5.3. Revenue

14.3.5.4. Strategy & Business Overview

14.3.6. New Sorema Ferroviaria SpA

14.3.6.1. Company Overview

14.3.6.2. Sales Area/Geographical Presence

14.3.6.3. Revenue

14.3.6.4. Strategy & Business Overview

14.3.7. Plasser & Theurer

14.3.7.1. Company Overview

14.3.7.2. Sales Area/Geographical Presence

14.3.7.3. Revenue

14.3.7.4. Strategy & Business Overview

14.3.8. Robel Bahnbaumaschinen Gmbh

14.3.8.1. Company Overview

14.3.8.2. Sales Area/Geographical Presence

14.3.8.3. Revenue

14.3.8.4. Strategy & Business Overview

14.3.9. Strukton

14.3.9.1. Company Overview

14.3.9.2. Sales Area/Geographical Presence

14.3.9.3. Revenue

14.3.9.4. Strategy & Business Overview

14.3.10. The Sinara Group

14.3.10.1. Company Overview

14.3.10.2. Sales Area/Geographical Presence

14.3.10.3. Revenue

14.3.10.4. Strategy & Business Overview

15. Key Takeaways

15.1. Identification of Potential Market Spaces

15.1.1. By Product Type

15.1.2. By Application

15.1.3. By Region

15.2. Prevailing Market Risks

15.3. Understanding the Buying Process of Customers

15.4. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Tamping Machine Market Value (US$ Bn), by Product Type, 2017-2031

Table 2: Global Tamping Machine Market Volume (Thousand Units), by Product Type 2017-2031

Table 3: Global Tamping Machine Market Value (US$ Bn), by Application, 2017-2031

Table 4: Global Tamping Machine Market Volume (Thousand Units), by Application 2017-2031

Table 5: Global Tamping Machine Market Value (US$ Bn), by Region, 2017-2031

Table 6: Global Tamping Machine Market Volume (Thousand Units), by Region 2017-2031

Table 7: North America Tamping Machine Market Value (US$ Bn), by Product Type, 2017-2031

Table 8: North America Tamping Machine Market Volume (Thousand Units), by Product Type 2017-2031

Table 9: North America Tamping Machine Market Value (US$ Bn), by Application, 2017-2031

Table 10: North America Tamping Machine Market Volume (Thousand Units), by Application 2017-2031

Table 11: North America Tamping Machine Market Value (US$ Bn), by Region, 2017-2031

Table 12: North America Tamping Machine Market Volume (Thousand Units), by Region 2017-2031

Table 13: Europe Tamping Machine Market Value (US$ Bn), by Product Type, 2017-2031

Table 14: Europe Tamping Machine Market Volume (Thousand Units), by Product Type 2017-2031

Table 15: Europe Tamping Machine Market Value (US$ Bn), by Application, 2017-2031

Table 16: Europe Tamping Machine Market Volume (Thousand Units), by Application 2017-2031

Table 17: Europe Tamping Machine Market Value (US$ Bn), by Region, 2017-2031

Table 18: Europe Tamping Machine Market Volume (Thousand Units), by Region 2017-2031

Table 19: Asia Pacific Tamping Machine Market Value (US$ Bn), by Product Type, 2017-2031

Table 20: Asia Pacific Tamping Machine Market Volume (Thousand Units), by Product Type 2017-2031

Table 21: Asia Pacific Tamping Machine Market Value (US$ Bn), by Application, 2017-2031

Table 22: Asia Pacific Tamping Machine Market Volume (Thousand Units), by Application 2017-2031

Table 23: Asia Pacific Tamping Machine Market Value (US$ Bn), by Region, 2017-2031

Table 24: Asia Pacific Tamping Machine Market Volume (Thousand Units), by Region 2017-2031

Table 25: Middle East & Africa Tamping Machine Market Value (US$ Bn), by Product Type, 2017-2031

Table 26: Middle East & Africa Tamping Machine Market Volume (Thousand Units), by Product Type 2017-2031

Table 27: Middle East & Africa Tamping Machine Market Value (US$ Bn), by Application, 2017-2031

Table 28: Middle East & Africa Tamping Machine Market Volume (Thousand Units), by Application 2017-2031

Table 29: Middle East & Africa Tamping Machine Market Value (US$ Bn), by Region, 2017-2031

Table 30: Middle East & Africa Tamping Machine Market Volume (Thousand Units), by Region 2017-2031

Table 31: South America Tamping Machine Market Value (US$ Bn), by Product Type, 2017-2031

Table 32: South America Tamping Machine Market Volume (Thousand Units), by Product Type 2017-2031

Table 33: South America Tamping Machine Market Value (US$ Bn), by Application, 2017-2031

Table 34: South America Tamping Machine Market Volume (Thousand Units), by Application 2017-2031

Table 35: South America Tamping Machine Market Value (US$ Bn), by Region, 2017-2031

Table 36: South America Tamping Machine Market Volume (Thousand Units), by Region 2017-2031

List of Figures

Figure 1: Global Tamping Machine Market Value (US$ Bn), by Product Type, 2017-2031

Figure 2: Global Tamping Machine Market Volume (Thousand Units), by Product Type 2017-2031

Figure 3: Global Tamping Machine Market Incremental Opportunity (US$ Bn), Forecast, by Product Type, 2023-2031

Figure 4: Global Tamping Machine Market Value (US$ Bn), by Application, 2017-2031

Figure 5: Global Tamping Machine Market Volume (Thousand Units), by Application 2017-2031

Figure 6: Global Tamping Machine Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 7: Global Tamping Machine Market Value (US$ Bn), by Region, 2017-2031

Figure 8: Global Tamping Machine Market Volume (Thousand Units), by Region 2017-2031

Figure 9: Global Tamping Machine Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 10: North America Tamping Machine Market Value (US$ Bn), by Product Type, 2017-2031

Figure 11: North America Tamping Machine Market Volume (Thousand Units), by Product Type 2017-2031

Figure 12: North America Tamping Machine Market Incremental Opportunity (US$ Bn), Forecast, by Product Type, 2023-2031

Figure 13: North America Tamping Machine Market Value (US$ Bn), by Application, 2017-2031

Figure 14: North America Tamping Machine Market Volume (Thousand Units), by Application 2017-2031

Figure 15: North America Tamping Machine Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 16: North America Tamping Machine Market Value (US$ Bn), by Region, 2017-2031

Figure 17: North America Tamping Machine Market Volume (Thousand Units), by Region 2017-2031

Figure 18: North America Tamping Machine Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 19: Europe Tamping Machine Market Value (US$ Bn), by Product Type, 2017-2031

Figure 20: Europe Tamping Machine Market Volume (Thousand Units), by Product Type 2017-2031

Figure 21: Europe Tamping Machine Market Incremental Opportunity (US$ Bn), Forecast, by Product Type, 2023-2031

Figure 22: Europe Tamping Machine Market Value (US$ Bn), by Application, 2017-2031

Figure 23: Europe Tamping Machine Market Volume (Thousand Units), by Application 2017-2031

Figure 24: Europe Tamping Machine Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 25: Europe Tamping Machine Market Value (US$ Bn), by Region, 2017-2031

Figure 26: Europe Tamping Machine Market Volume (Thousand Units), by Region 2017-2031

Figure 27: Europe Tamping Machine Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 28: Asia Pacific Tamping Machine Market Value (US$ Bn), by Product Type, 2017-2031

Figure 29: Asia Pacific Tamping Machine Market Volume (Thousand Units), by Product Type 2017-2031

Figure 30: Asia Pacific Tamping Machine Market Incremental Opportunity (US$ Bn), Forecast, by Product Type, 2023-2031

Figure 31: Asia Pacific Tamping Machine Market Value (US$ Bn), by Application, 2017-2031

Figure 32: Asia Pacific Tamping Machine Market Volume (Thousand Units), by Application 2017-2031

Figure 33: Asia Pacific Tamping Machine Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 34: Asia Pacific Tamping Machine Market Value (US$ Bn), by Region, 2017-2031

Figure 35: Asia Pacific Tamping Machine Market Volume (Thousand Units), by Region 2017-2031

Figure 36: Asia Pacific Tamping Machine Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 37: Middle East & Africa Tamping Machine Market Value (US$ Bn), by Product Type, 2017-2031

Figure 38: Middle East & Africa Tamping Machine Market Volume (Thousand Units), by Product Type 2017-2031

Figure 39: Middle East & Africa Tamping Machine Market Incremental Opportunity (US$ Bn), Forecast, by Product Type, 2023-2031

Figure 40: Middle East & Africa Tamping Machine Market Value (US$ Bn), by Application, 2017-2031

Figure 41: Middle East & Africa Tamping Machine Market Volume (Thousand Units), by Application 2017-2031

Figure 42: Middle East & Africa Tamping Machine Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 43: Middle East & Africa Tamping Machine Market Value (US$ Bn), by Region, 2017-2031

Figure 44: Middle East & Africa Tamping Machine Market Volume (Thousand Units), by Region 2017-2031

Figure 45: Middle East & Africa Tamping Machine Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 46: South America Tamping Machine Market Value (US$ Bn), by Product Type, 2017-2031

Figure 47: South America Tamping Machine Market Volume (Thousand Units), by Product Type 2017-2031

Figure 48: South America Tamping Machine Market Incremental Opportunity (US$ Bn), Forecast, by Product Type, 2023-2031

Figure 49: South America Tamping Machine Market Value (US$ Bn), by Application, 2017-2031

Figure 50: South America Tamping Machine Market Volume (Thousand Units), by Application 2017-2031

Figure 51: South America Tamping Machine Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 52: South America Tamping Machine Market Value (US$ Bn), by Region, 2017-2031

Figure 53: South America Tamping Machine Market Volume (Thousand Units), by Region 2017-2031

Figure 54: South America Tamping Machine Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031