Reports

Reports

The T-cell engagers market growth is supported by robust market drivers linked to scientific and commercial enablers. Breakthroughs in platform engineering innovation including new bispecific scaffolds, half-life extension technologies, and modular formats have enhanced pharmacokinetics, manufacturability, and safety profiles of therapy candidates, further enhancing the potential to progress in the clinic.

Regulatory mechanisms providing faster review and adaptive trial designs decrease the time-to-market for high-potential participants, and result in higher transparency on chemistry, manufacturing, and controls expectations. Simultaneously, rising interest in venture capital, governments’ investments, and cross-industry collaborations are propelling translation of therapies from discovery to clinic, resulting in sustained investor interest in new T-cell engager programs.

Companies are investing in the development of biomarkers, setting up patient-support programs, and formulating new pricing and reimbursement strategies, with the help of mergers, acquisitions, and partnerships, which bring about the rapid gain of competences and expansion of therapeutic areas.

T-cell engagers belong to the drugs class of bispecific antibody therapies designed for linking T-cells to cancer cells. By simultaneously binding to a T-cell receptor and a tumor-associated antigen, such molecules activate T-cells for recognizing and eliminating cancer cells more effectively. This mechanism improves the body’s immune response against tumors, thereby making T-cell engagers one of the promising approaches in cancer treatment.

The first binding site of a T-cell engager is responsible for connection with CD3 receptor on T cells, while the second one, which is specific for cancer cells, targets tumor-associated antigens. By physical bridging between T cells and cancer cells, the T-cell engagers prompt cytotoxicity, which results in the release of granzymes and perforin that induce tumor cell apoptosis. Such a mechanism makes use of the native killing function of T cells, providing highly selective and potent treatment.

The mechanism of action of T-cell engagers differs from that of conventional monoclonal antibodies or checkpoint blockers. They circumvent peptide-MHC recognition and directly engage T-cells irrespective of their native antigen specificity. They are thus exceptionally versatile and effective even in immunocompromised hosts. In fact, T-cell engagers can activate polyclonal TCA without the need for ex-vivo manipulation or genetic alteration, like in the case of CAR-T cell therapy.

T-cell engagers, nevertheless, are being improved by new and advanced engineering methods, which are more effective and have more diverse therapeutic applications. The growth in protein design has allowed for the creation of bispecific molecules, which are more robust, have a longer lifespan, and have more remarkable tumor targeting abilities. Researchers are now working on multi-specific molecules that can target several tumor antigens simultaneously. These breakthroughs not only extend the reach of T-cell engagers but also make them highly adaptable tools that can be customized for different clinical applications of oncology.

Moreover, these improvements aim to expand the applicability of T-cell engagers to both - hematological cancers and solid tumors. The most advanced tactics consist of conditional activation systems that activate T-cells only at the tumor site and new delivery paths that facilitate penetration into the tissue. Collectively, the developments underscore the transformative potential of T-cell engagers, thereby positioning them as a pivotal innovation within the field of immuno-oncology.

| Attribute | Detail |

|---|---|

| T-cell Engagers Market Drivers |

|

The rising incidences of cancer is one of the key factors leading to the expansion of T-cell engagers market. While cancer cases have been increasing at an alarming rate worldwide, the effectiveness of traditional methods such as chemotherapy, radiation, and surgery has been questioned, especially in situations of advanced-stage or relapsed cancers. This growing challenge has overwhelmed the healthcare system to a point where it has had to plow capital into different types of immunotherapies, such as T-cell engagers, which are designed with highly specific methods for the destruction of cancer cells.

The growth of cancer cases has resulted in increased awareness among patients and doctors regarding the advanced immunotherapies that are available. The cancer burden, is thus consolidating these trends, thereby intensifying the features of the T-cell-engager value proposition and keeping on guiding their profile change as a therapeutic class. This situation has led researchers and pharmaceutical companies to turn to new treatment methods, which can provide better patient outcomes.

T-cell engagers represent an attractive solution as they involve the use of the patient's own immune system to track down and destroy the tumor cells. The core idea behind such therapies is direct T-cell stimulation to find the antigens that are cancer-specific and thus, to unleash a more targeted and potent effect than that of chemotherapies and radiotherapies. Additionally, the ability of T-cell engagers to target different kinds of cancers, such as hematological malignancies and solid tumors, is a factor that makes them more appealing in the market.

Advancements in immunotherapy and precision medicine are critical factors driving the growth of the T-cell engagers market, thereby necessitating a robust scientific and clinical basis for the targeted treatments. The checkpoint inhibitors and CAR-T cell therapies have underscored the potential of harnessing the immune system to combat cancer. These accomplishments have been significant in the development of novel approaches such as T-cell engagers, which direct T-cells to tumor-specific antigens.

These developments are further strengthened by precision medicine that allows for better selection of patients and personalization of therapy. The clinicians can identify patients who are best-suited for T-cell engager therapies with the help of advanced genomic profiling, molecular diagnostics, and use of biomarkers. This approach minimizes trial-and-error treatment strategies, thereby maximizing the response rates, which are crucial for clinical adoption.

Advancements in antibody technology and protein engineering have also significantly improved the functionality and versatility of T-cell engagers. New features such as multi-specific formats, longer half-life, and tumor microenvironment-responsive designs exemplify the synergy between precision medicine and immunotherapy. These innovations are the principal drivers behind the expansion of T-cell engagers' application across multiple types of cancer.

Moreover, the utilization of real-world evidence, sophisticated clinical trial approaches, and AI-based drug design is propelling faster drug development and allowing more informed decision-making. The precision medicine approach is the key to combination strategies that envisage the usage of T-cell engagers along with checkpoint inhibitors/targeted drugs to achieve the maximum therapeutic effect. The advent of immunotherapy and precision medicine has not only been instrumental in extending the eligibility criteria for T-cell engagement, but also been pivotal in establishing their position as a transformative therapy in cancer treatment.

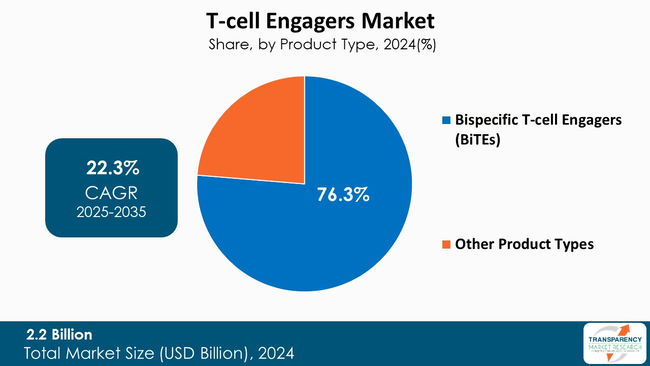

Bispecific T-cell engagers (BiTEs) capture majority of the market share in the T-cell engagers market, basically due to their clinically validated mechanism of action and established efficacy in treating the hematologic malignancies, thereby setting a high benchmark for all T-cell engagers. Since BiTEs engage simultaneously with CD3 on T-cells and tumor-associated antigens, they do redirect T-cells successfully for killing tumor cells without further modification or external activation. Their success in managing relapsed and refractory cancers has established a rigorous standard for the other T-cell engagers.

Furthermore, BiTEs have deep clinical development pipelines and ongoing molecular design innovation. Half-life extension, subcutaneous delivery, and safety maximization technologies are expanding their therapeutic application beyond hematologic cancers into the solid tumor setting. Their basic structure, as compared to more complicated multi-specifics, renders them perfect for large-scale manufacturability and global commercialization, securing their leadership in the T-cell engagers market.

| Attribute | Detail |

|---|---|

| Leading Region |

|

As per the latest T-cell engagers market analysis, North America dominated in 2024. The leading-edge research ecosystem, well-established healthcare infrastructure, and the supportive regulatory environment are the main contributors to the region’s dominance. The region boasts the presence of prestigious clinical research centers, academic institutions, and biotechnology hubs, thereby leading to cutting-edge immunotherapy innovations. Besides, efficient FDA routes such as breakthrough therapy and fast-track designations are enabling the development and approval of new T-cell engagers, thereby providing earlier access to innovative treatments.

The high healthcare expenditure coupled with large investment in oncology research have positioned North America as a global leader. Some of the main reasons for higher uptake include the existence of well-organized clinical trial networks, widespread application of precision medicine, and the increasing patient knowledge of cutting-edge immunotherapies. Cumulatively, these factors turn the region into a fertile ground for rapid T-cell engager therapy development, market release, and clinical use.

The companies engaged in T-cell engager market are revolving around innovations of platforms, strategic partnerships, and co-development agreements to speed up their pipelines for driving the T-cell engagers market growth. These firms invest heavily in advanced protein engineering, patient selection based on biomarkers, and new delivery methods. Additionally, companies also commit resources to global clinical expansion, manufacturing scalability, and the use of creative pricing strategies for facilitating adoption and market penetration.

F. Hoffmann-La Roche AG, Merck KGaA, Pfizer Inc., Amgen Inc., Boehringer Ingelheim International GmbH, AstraZeneca PLC, Johnson & Johnson Services, Inc., Regeneron Pharmaceuticals Inc., Takeda Pharmaceutical Company Limited, Immunocore Holdings plc, LAVA Therapeutics N.V., Candid Therapeutics, Inc., Clasp Therapeutics, CDR-Life Inc., and Adaptin Bio, Inc. are some of the leading players operating in the global market.

Each of these players has been profiled in the T-cell engagers market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

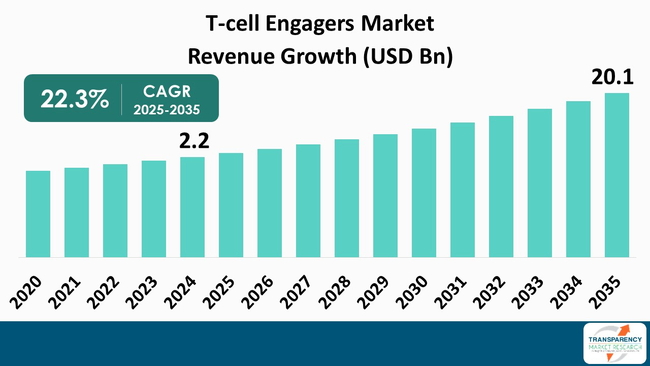

| Size in 2024 | US$ 2.2 Bn |

| Forecast Value in 2035 | US$ 20.1 Bn |

| CAGR | 22.3% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| T-cell Engagers Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Product Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global T-cell engagers market was valued at US$ 2.2 Bn in 2024

The global T-cell engagers industry is projected to reach more than US$ 20.1 Bn by the end of 2035

The rising prevalence of cancer, the shift toward precision and immuno-oncology therapies, advancements in antibody engineering, increased investment in R&D and clinical trials and the unmet clinical needs in treating both - hematologic and solid tumors are some of the factors driving the expansion of T-cell engagers market.

The CAGR is anticipated to be 22.3% from 2025 to 2035

F. Hoffmann-La Roche AG, Merck KGaA, Pfizer Inc., Amgen Inc., Boehringer Ingelheim International GmbH, AstraZeneca PLC, Johnson & Johnson Services, Inc., Regeneron Pharmaceuticals Inc., Takeda Pharmaceutical Company Limited, Immunocore Holdings plc, LAVA Therapeutics N.V., Candid Therapeutics, Inc., Clasp Therapeutics, CDR-Life Inc., and Adaptin Bio, Inc.

Table 01: Global T-cell Engagers Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 02: Global T-cell Engagers Market Value (US$ Bn) Forecast, By Mechanism of Action, 2020 to 2035

Table 03: Global T-cell Engagers Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 04: Global T-cell Engagers Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 05: Global T-cell Engagers Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 06: North America T-cell Engagers Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 07: North America T-cell Engagers Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 08: North America T-cell Engagers Market Value (US$ Bn) Forecast, By Mechanism of Action, 2020 to 2035

Table 09: North America T-cell Engagers Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 10: North America T-cell Engagers Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 11: Europe T-cell Engagers Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 12: Europe T-cell Engagers Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 13: Europe T-cell Engagers Market Value (US$ Bn) Forecast, By Mechanism of Action, 2020 to 2035

Table 14: Europe T-cell Engagers Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 15: Europe T-cell Engagers Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 16: Asia Pacific T-cell Engagers Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 17: Asia Pacific T-cell Engagers Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 18: Asia Pacific T-cell Engagers Market Value (US$ Bn) Forecast, By Mechanism of Action, 2020 to 2035

Table 19: Asia Pacific T-cell Engagers Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 20: Asia Pacific T-cell Engagers Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 21: Latin America T-cell Engagers Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 22: Latin America T-cell Engagers Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 23: Latin America T-cell Engagers Market Value (US$ Bn) Forecast, By Mechanism of Action, 2020 to 2035

Table 24: Latin America T-cell Engagers Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 25: Latin America T-cell Engagers Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 26: Middle East & Africa T-cell Engagers Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 27: Middle East & Africa T-cell Engagers Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 28: Middle East & Africa T-cell Engagers Market Value (US$ Bn) Forecast, By Mechanism of Action, 2020 to 2035

Table 29: Middle East & Africa T-cell Engagers Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 30: Middle East & Africa T-cell Engagers Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Figure 01: Global T-cell Engagers Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 02: Global T-cell Engagers Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 03: Global T-cell Engagers Market Revenue (US$ Bn), by Bispecific T-cell Engagers (BiTEs), 2020 to 2035

Figure 04: Global T-cell Engagers Market Revenue (US$ Bn), by Other Product Types, 2020 to 2035

Figure 05: Global T-cell Engagers Market Value Share Analysis, By Mechanism of Action, 2024 and 2035

Figure 06: Global T-cell Engagers Market Attractiveness Analysis, By Mechanism of Action, 2025 to 2035

Figure 07: Global T-cell Engagers Market Revenue (US$ Bn), by CD3-Targeting Engagers, 2020 to 2035

Figure 08: Global T-cell Engagers Market Revenue (US$ Bn), by CD19-Targeting Engagers, 2020 to 2035

Figure 09: Global T-cell Engagers Market Revenue (US$ Bn), by Other Target Antigens, 2020 to 2035

Figure 10: Global T-cell Engagers Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 11: Global T-cell Engagers Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 12: Global T-cell Engagers Market Revenue (US$ Bn), by Intravenous (IV) Administration, 2020 to 2035

Figure 13: Global T-cell Engagers Market Revenue (US$ Bn), by Subcutaneous Administration, 2020 to 2035

Figure 14: Global T-cell Engagers Market Revenue (US$ Bn), by Other Routes of Administration, 2020 to 2035

Figure 15: Global T-cell Engagers Market Value Share Analysis, By End-user, 2024 and 2035

Figure 16: Global T-cell Engagers Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 17: Global T-cell Engagers Market Revenue (US$ Bn), by Hospitals, 2020 to 2035

Figure 18: Global T-cell Engagers Market Revenue (US$ Bn), by Oncology Clinics, 2020 to 2035

Figure 19: Global T-cell Engagers Market Revenue (US$ Bn), by Academic and Research Centers, 2020 to 2035

Figure 20: Global T-cell Engagers Market Revenue (US$ Bn), by Other End-users, 2020 to 2035

Figure 21: Global T-cell Engagers Market Value Share Analysis, By Region, 2024 and 2035

Figure 22: Global T-cell Engagers Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 23: North America T-cell Engagers Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 24: North America T-cell Engagers Market Value Share Analysis, by Country, 2024 and 2035

Figure 25: North America T-cell Engagers Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 26: North America T-cell Engagers Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 27: North America T-cell Engagers Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 28: North America T-cell Engagers Market Value Share Analysis, By Mechanism of Action, 2024 and 2035

Figure 29: North America T-cell Engagers Market Attractiveness Analysis, By Mechanism of Action, 2025 to 2035

Figure 30: North America T-cell Engagers Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 31: North America T-cell Engagers Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 32: North America T-cell Engagers Market Value Share Analysis, By End-user, 2024 and 2035

Figure 33: North America T-cell Engagers Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 34: Europe T-cell Engagers Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 35: Europe T-cell Engagers Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 36: Europe T-cell Engagers Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 37: Europe T-cell Engagers Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 38: Europe T-cell Engagers Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 39: Europe T-cell Engagers Market Value Share Analysis, By Mechanism of Action, 2024 and 2035

Figure 40: Europe T-cell Engagers Market Attractiveness Analysis, By Mechanism of Action, 2025 to 2035

Figure 41: Europe T-cell Engagers Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 42: Europe T-cell Engagers Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 43: Europe T-cell Engagers Market Value Share Analysis, By End-user, 2024 and 2035

Figure 44: Europe T-cell Engagers Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 45: Asia Pacific T-cell Engagers Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 46: Asia Pacific T-cell Engagers Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 47: Asia Pacific T-cell Engagers Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 48: Asia Pacific T-cell Engagers Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 49: Asia Pacific T-cell Engagers Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 50: Asia Pacific T-cell Engagers Market Value Share Analysis, By Mechanism of Action, 2024 and 2035

Figure 51: Asia Pacific T-cell Engagers Market Attractiveness Analysis, By Mechanism of Action, 2025 to 2035

Figure 52: Asia Pacific T-cell Engagers Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 53: Asia Pacific T-cell Engagers Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 54: Asia Pacific T-cell Engagers Market Value Share Analysis, By End-user, 2024 and 2035

Figure 55: Asia Pacific T-cell Engagers Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 56: Latin America T-cell Engagers Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 57: Latin America T-cell Engagers Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 58: Latin America T-cell Engagers Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 59: Latin America T-cell Engagers Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 60: Latin America T-cell Engagers Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 61: Latin America T-cell Engagers Market Value Share Analysis, By Mechanism of Action, 2024 and 2035

Figure 62: Latin America T-cell Engagers Market Attractiveness Analysis, By Mechanism of Action, 2025 to 2035

Figure 63: Latin America T-cell Engagers Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 64: Latin America T-cell Engagers Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 65: Latin America T-cell Engagers Market Value Share Analysis, By End-user, 2024 and 2035

Figure 66: Latin America T-cell Engagers Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 67: Middle East & Africa T-cell Engagers Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 68: Middle East & Africa T-cell Engagers Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 69: Middle East & Africa T-cell Engagers Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 70: Middle East & Africa T-cell Engagers Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 71: Middle East & Africa T-cell Engagers Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 72: Middle East & Africa T-cell Engagers Market Value Share Analysis, By Mechanism of Action, 2024 and 2035

Figure 73: Middle East & Africa T-cell Engagers Market Attractiveness Analysis, By Mechanism of Action, 2025 to 2035

Figure 74: Middle East & Africa T-cell Engagers Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 75: Middle East & Africa T-cell Engagers Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 76: Middle East & Africa T-cell Engagers Market Value Share Analysis, By End-user, 2024 and 2035

Figure 77: Middle East & Africa T-cell Engagers Market Attractiveness Analysis, By End-user, 2025 to 2035