Reports

Reports

Analyst Viewpoint

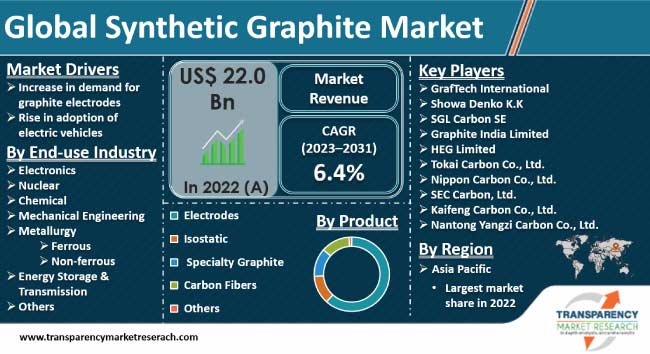

Increase in demand for graphite electrodes is boosting the synthetic graphite market value. Graphite electrodes are unique materials with properties such as high thermal shock resistance, chemical stability, and strong electrical conductivity. These properties make the electrodes crucial in the iron & steel production sector. Rise in demand for iron and steel from the growing construction sector is augmenting the synthetic graphite industry landscape.

Prominent players operating in the sector are investing significantly in advancements in graphite manufacturing and synthetic graphite production practices. Surge in adoption of electric vehicles is propelling the synthetic graphite market share. Electric vehicles primarily utilize lithium-ion batteries which have synthetic graphite electrodes acting as anodes. Synthetic graphite electrodes are also applied to boost energy density and reduce charging times.

Synthetic graphite is a unique material that is produced artificially under high temperatures by processing amorphous carbon. The material has a high percentage of pure carbon and can withstand severe temperatures and corrosion. Synthetic carbon is more expensive and resource-consuming to produce when compared to natural carbon but purer and predictable.

Synthetic graphite plays a critical role in several specialized industries such as metal fabrication, solar infrastructure, and lithium-ion batteries. A major application of the material is as an additive in the iron & steel sector to raise carbon. It is also used for energy storage, to produce ferroalloys, and in metal furnaces to melt iron and steel, thereby augmenting the synthetic graphite industry.

Graphite electrodes are temperature-resistant conductive materials made using synthetic graphite. They are utilized in steel refining and other smelting processes. Several properties of graphite electrodes, including potent thermal and electrical conductivity, chemical stability, high shock resistance, and high metal removal rate, make graphite electrodes necessary for high-quality iron and steel production.

According to the World Steel Association, global steel production reached 1885.4 million tons (MT) in 2022. China was the largest producer of steel in the world closely followed by India. Finished steel consumption per capita was 221.8 kg for the world while being 645.8 kg for China. India accounted for 86.7 kg per capita finished steel consumption in 2022. Expansion in the construction sector due to heightened infrastructural investment in emerging economies is boosting iron and steel production. Thus, rise in steel production is expected to spur the synthetic graphite market growth in the near future.

Governments in countries worldwide are promoting the adoption of Electric Vehicles (EVs) to help reduce global greenhouse gas emissions and meet climate change goals. Innovations in battery technology, government incentives, and a rise in environmental awareness are boosting the popularity of EVs. Hence, surge in adoption of EVs is augmenting the synthetic graphite market size.

Synthetic graphite is a critical component utilized in the production of lithium-ion batteries. It is applied as anodes, the negative electrode in Li-ion batteries. In electrical vehicles, it is used to increase the energy density and reduce charging times.

China is a major producer of EVs. It fosters a supply chain for manufacturing Li-ion batteries starting from the processing of minerals and other materials such as synthetic carbon or graphite. As per the National Blueprint for Lithium Batteries, China is projected to have 1,811 GWh of lithium cell production by 2025 while the global demand is estimated to increase sevenfold to 4.7 Terawatts-hours by 2030.

According to the latest synthetic graphite market analysis, Asia Pacific held the largest share in 2022. China is a major base for the artificial graphite market and high-performance graphite sector owing to the presence of a well-established chemical and iron & steel sector. Rise in adoption of electric vehicles in India and China is boosting demand for lithium-ion batteries, thereby propelling the market dynamics in Asia Pacific.

Battery manufacturers in China are expected to produce 4,800 gigawatt-hours (GWh) of batteries by 2025. According to the U.S. Geological Survey, China accounts for about 65% of the overall graphite production in 2022.

As per the latest synthetic graphite market overview, the sector in North America is expected to grow at a steady pace during the forecast period. According to research done by Northwestern University, 63% of graphite produced domestically in the U.S. was synthetic graphite.

According to recent synthetic graphite market trends, prominent manufacturers are investing substantially in the development of synthetic graphite production techniques and high-performance synthetic graphite applications. Close collaborations within the market along with mergers and acquisitions are seen as key strategies to build a better product portfolio and maintain a strong stand in the sector.

GrafTech International, Showa Denko K.K, SGL Carbon SE, Graphite India Limited, HEG Limited, Tokai Carbon Co., Ltd., Nippon Carbon Co., Ltd., SEC Carbon, Ltd., Kaifeng Carbon Co., Ltd., and Nantong Yangzi Carbon Co., Ltd. are key synthetic graphite manufacturers operating in this market.

The synthetic graphite market report covers these companies in terms of various parameters such as company overview, business strategies, product portfolio, financial overview, and business segments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 22.0 Bn |

| Market Forecast Value in 2031 | US$ 38.3 Bn |

| Growth Rate (CAGR) | 6.4% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2021 |

| Quantitative Units | US$ Bn for Value and Tons for Volume |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 22.0 Bn in 2022

It is projected to advance at a CAGR of 6.4% from 2023 to 2031

Increase in demand for graphite electrodes and rise in adoption of electric vehicles

The electrodes product segment held the largest share in 2022

Asia Pacific was the leading region in 2022

W. R. Grace & Co.-Conn, LyondellBasell Industries Holdings B.V., Evonik Industries AG, INEOS, Mitsui Chemicals, Inc., Sinopec Catalyst Co., Ltd., Reliance Industries Limited, Toho Titanium Co., Ltd., and Renqiu Lihe Technology Co., Ltd.

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Synthetic Graphite Market Analysis and Forecast, 2020-2031

2.6.1. Global Synthetic Graphite Market Volume (Tons)

2.6.2. Global Synthetic Graphite Market Revenue (US$ Mn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Material Suppliers

2.9.2. List of Key Manufacturers

2.9.3. List of Key Suppliers

2.9.4. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on Supply Chain of Synthetic Graphite

3.2. Impact on Demand for Synthetic Graphite– Pre & Post Crisis

4. Production Output Analysis (Tons), 2022

4.1. North America

4.2. Europe

4.3. Asia Pacific

4.4. Latin America

4.5. Middle East & Africa

5. Impact of Current Geopolitical Scenario on Market

6. Price Trend Analysis and Forecast (US$/Tons), 2020-2031

6.1. Price Trend Analysis by Product

6.2. Price Trend Analysis by Region

7. Global Synthetic Graphite Market Analysis and Forecast, by Product, 2020–2031

7.1. Introduction and Definitions

7.2. Global Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

7.2.1. Electrodes

7.2.2. Isostatic

7.2.3. Specialty Graphite

7.2.4. Carbon Fibers

7.2.5. Others

7.3. Global Synthetic Graphite Market Attractiveness, by Product

8. Global Synthetic Graphite Market Analysis and Forecast, by End-use Industry, 2020–2031

8.1. Introduction and Definitions

8.2. Global Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

8.2.1. Electronics

8.2.2. Nuclear

8.2.3. Chemical

8.2.4. Mechanical Engineering

8.2.5. Metallurgy

8.2.5.1. Ferrous

8.2.5.2. Non-ferrous

8.2.6. Energy Storage & Transmission

8.2.7. Others

8.3. Global Synthetic Graphite Market Attractiveness, by End-use Industry

9. Global Synthetic Graphite Market Analysis and Forecast, by Region, 2020–2031

9.1. Key Findings

9.2. Global Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by Region, 2020–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Global Synthetic Graphite Market Attractiveness, by Region

10. North America Synthetic Graphite Market Analysis and Forecast, 2020–2031

10.1. Key Findings

10.2. North America Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

10.3. North America Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

10.4. North America Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by Country, 2020–2031

10.4.1. U.S. Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

10.4.2. U.S. Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

10.4.3. Canada Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

10.4.4. Canada Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

10.5. North America Synthetic Graphite Market Attractiveness Analysis

11. Europe Synthetic Graphite Market Analysis and Forecast, 2020–2031

11.1. Key Findings

11.2. Europe Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

11.3. Europe Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

11.4. Europe Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

11.4.1. Germany Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

11.4.2. Germany Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

11.4.3. France Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

11.4.4. France Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

11.4.5. U.K. Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

11.4.6. U.K. Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

11.4.7. Italy Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

11.4.8. Italy Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

11.4.9. Russia & CIS Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

11.4.10. Russia & CIS Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

11.4.11. Rest of Europe Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

11.4.12. Rest of Europe Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

11.5. Europe Synthetic Graphite Market Attractiveness Analysis

12. Asia Pacific Synthetic Graphite Market Analysis and Forecast, 2020–2031

12.1. Key Findings

12.2. Asia Pacific Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by Product

12.3. Asia Pacific Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

12.4. Asia Pacific Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

12.4.1. China Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

12.4.2. China Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

12.4.3. Japan Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

12.4.4. Japan Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

12.4.5. India Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

12.4.6. India Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

12.4.7. ASEAN Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

12.4.8. ASEAN Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

12.4.9. Rest of Asia Pacific Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

12.4.10. Rest of Asia Pacific Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

12.5. Asia Pacific Synthetic Graphite Market Attractiveness Analysis

13. Latin America Synthetic Graphite Market Analysis and Forecast, 2020–2031

13.1. Key Findings

13.2. Latin America Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

13.3. Latin America Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

13.4. Latin America Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

13.4.1. Brazil Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

13.4.2. Brazil Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

13.4.3. Mexico Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

13.4.4. Mexico Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

13.4.5. Rest of Latin America Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

13.4.6. Rest of Latin America Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

13.5. Latin America Synthetic Graphite Market Attractiveness Analysis

14. Middle East & Africa Synthetic Graphite Market Analysis and Forecast, 2020–2031

14.1. Key Findings

14.2. Middle East & Africa Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

14.3. Middle East & Africa Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

14.4. Middle East & Africa Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

14.4.1. GCC Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

14.4.2. GCC Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

14.4.3. South Africa Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

14.4.4. South Africa Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

14.4.5. Rest of Middle East & Africa Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

14.4.6. Rest of Middle East & Africa Synthetic Graphite Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

14.5. Middle East & Africa Synthetic Graphite Market Attractiveness Analysis

15. Competition Landscape

15.1. Global Synthetic Graphite Market Company Share Analysis, 2022

15.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

15.2.1. GrafTech International

15.2.1.1. Company Revenue

15.2.1.2. Business Overview

15.2.1.3. Product Segments

15.2.1.4. Geographic Footprint

15.2.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.2. Showa Denko K.K

15.2.2.1. Company Revenue

15.2.2.2. Business Overview

15.2.2.3. Product Segments

15.2.2.4. Geographic Footprint

15.2.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.3. SGL Carbon SE

15.2.3.1. Company Revenue

15.2.3.2. Business Overview

15.2.3.3. Product Segments

15.2.3.4. Geographic Footprint

15.2.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.4. Graphite India Limited

15.2.4.1. Company Revenue

15.2.4.2. Business Overview

15.2.4.3. Product Segments

15.2.4.4. Geographic Footprint

15.2.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.5. HEG Limited

15.2.5.1. Company Revenue

15.2.5.2. Business Overview

15.2.5.3. Product Segments

15.2.5.4. Geographic Footprint

15.2.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.6. Tokai Carbon Co., Ltd.

15.2.6.1. Company Revenue

15.2.6.2. Business Overview

15.2.6.3. Product Segments

15.2.6.4. Geographic Footprint

15.2.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.7. Nippon Carbon Co., Ltd.

15.2.7.1. Company Revenue

15.2.7.2. Business Overview

15.2.7.3. Product Segments

15.2.7.4. Geographic Footprint

15.2.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.8. SEC Carbon, Ltd.

15.2.8.1. Company Revenue

15.2.8.2. Business Overview

15.2.8.3. Product Segments

15.2.8.4. Geographic Footprint

15.2.8.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.9. Kaifeng Carbon Co., Ltd.

15.2.9.1. Company Revenue

15.2.9.2. Business Overview

15.2.9.3. Product Segments

15.2.9.4. Geographic Footprint

15.2.9.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.9.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.10. Nantong Yangzi Carbon Co., Ltd.

15.2.10.1. Company Revenue

15.2.10.2. Business Overview

15.2.10.3. Product Segments

15.2.10.4. Geographic Footprint

15.2.10.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.10.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

16. Primary Research: Key Insights

17. Appendix

List of Tables

Table 1: Global Synthetic Graphite Market Volume (Tons) Forecast, by Product, 2020–2031

Table 2: Global Synthetic Graphite Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 3: Global Synthetic Graphite Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 4: Global Synthetic Graphite Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 5: Global Synthetic Graphite Market Volume (Tons) Forecast, by Region, 2020–2031

Table 6: Global Synthetic Graphite Market Value (US$ Mn) Forecast, by Region, 2020–2031

Table 7: North America Synthetic Graphite Market Volume (Tons) Forecast, by Product, 2020–2031

Table 8: North America Synthetic Graphite Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 9: North America Synthetic Graphite Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 10: North America Synthetic Graphite Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 11: North America Synthetic Graphite Market Volume (Tons) Forecast, by Country, 2020–2031

Table 12: North America Synthetic Graphite Market Value (US$ Mn) Forecast, by Country, 2020–2031

Table 13: U.S. Synthetic Graphite Market Volume (Tons) Forecast, by Product, 2020–2031

Table 14: U.S. Synthetic Graphite Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 15: U.S. Synthetic Graphite Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 16: U.S. Synthetic Graphite Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 17: Canada Synthetic Graphite Market Volume (Tons) Forecast, by Product, 2020–2031

Table 18: Canada Synthetic Graphite Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 19: Canada Synthetic Graphite Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 20: Canada Synthetic Graphite Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 21: Europe Synthetic Graphite Market Volume (Tons) Forecast, by Product, 2020–2031

Table 22: Europe Synthetic Graphite Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 23: Europe Synthetic Graphite Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 24: Europe Synthetic Graphite Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 25: Europe Synthetic Graphite Market Volume (Tons) Forecast, by Country and Sub-region, 2020–2031

Table 26: Europe Synthetic Graphite Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 27: Germany Synthetic Graphite Market Volume (Tons) Forecast, by Product, 2020–2031

Table 28: Germany Synthetic Graphite Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 29: Germany Synthetic Graphite Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 30: Germany Synthetic Graphite Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 31: France Synthetic Graphite Market Volume (Tons) Forecast, by Product, 2020–2031

Table 32: France Synthetic Graphite Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 33: France Synthetic Graphite Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 34: France Synthetic Graphite Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 35: U.K. Synthetic Graphite Market Volume (Tons) Forecast, by Product, 2020–2031

Table 36: U.K. Synthetic Graphite Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 37: U.K. Synthetic Graphite Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 38: U.K. Synthetic Graphite Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 39: Italy Synthetic Graphite Market Volume (Tons) Forecast, by Product, 2020–2031

Table 40: Italy Synthetic Graphite Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 41: Italy Synthetic Graphite Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 42: Italy Synthetic Graphite Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 43: Spain Synthetic Graphite Market Volume (Tons) Forecast, by Product, 2020–2031

Table 44: Spain Synthetic Graphite Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 45: Spain Synthetic Graphite Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 46: Spain Synthetic Graphite Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 47: Russia & CIS Synthetic Graphite Market Volume (Tons) Forecast, by Product, 2020–2031

Table 48: Russia & CIS Synthetic Graphite Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 49: Russia & CIS Synthetic Graphite Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 50: Russia & CIS Synthetic Graphite Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 51: Rest of Europe Synthetic Graphite Market Volume (Tons) Forecast, by Product, 2020–2031

Table 52: Rest of Europe Synthetic Graphite Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 53: Rest of Europe Synthetic Graphite Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 54: Rest of Europe Synthetic Graphite Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 55: Asia Pacific Synthetic Graphite Market Volume (Tons) Forecast, by Product, 2020–2031

Table 56: Asia Pacific Synthetic Graphite Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 57: Asia Pacific Synthetic Graphite Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 58: Asia Pacific Synthetic Graphite Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 59: Asia Pacific Synthetic Graphite Market Volume (Tons) Forecast, by Country and Sub-region, 2020–2031

Table 60: Asia Pacific Synthetic Graphite Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 61: China Synthetic Graphite Market Volume (Tons) Forecast, by Product, 2020–2031

Table 62: China Synthetic Graphite Market Value (US$ Mn) Forecast, by Product 2020–2031

Table 63: China Synthetic Graphite Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 64: China Synthetic Graphite Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 65: Japan Synthetic Graphite Market Volume (Tons) Forecast, by Product, 2020–2031

Table 66: Japan Synthetic Graphite Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 67: Japan Synthetic Graphite Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 68: Japan Synthetic Graphite Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 69: India Synthetic Graphite Market Volume (Tons) Forecast, by Product, 2020–2031

Table 70: India Synthetic Graphite Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 71: India Synthetic Graphite Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 72: India Synthetic Graphite Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 73: ASEAN Synthetic Graphite Market Volume (Tons) Forecast, by Product, 2020–2031

Table 74: ASEAN Synthetic Graphite Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 75: ASEAN Synthetic Graphite Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 76: ASEAN Synthetic Graphite Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 77: Rest of Asia Pacific Synthetic Graphite Market Volume (Tons) Forecast, by Product, 2020–2031

Table 78: Rest of Asia Pacific Synthetic Graphite Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 79: Rest of Asia Pacific Synthetic Graphite Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 80: Rest of Asia Pacific Synthetic Graphite Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 81: Latin America Synthetic Graphite Market Volume (Tons) Forecast, by Product, 2020–2031

Table 82: Latin America Synthetic Graphite Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 83: Latin America Synthetic Graphite Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 84: Latin America Synthetic Graphite Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 85: Latin America Synthetic Graphite Market Volume (Tons) Forecast, by Country and Sub-region, 2020–2031

Table 86: Latin America Synthetic Graphite Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 87: Brazil Synthetic Graphite Market Volume (Tons) Forecast, by Product, 2020–2031

Table 88: Brazil Synthetic Graphite Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 89: Brazil Synthetic Graphite Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 90: Brazil Synthetic Graphite Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 91: Mexico Synthetic Graphite Market Volume (Tons) Forecast, by Product, 2020–2031

Table 92: Mexico Synthetic Graphite Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 93: Mexico Synthetic Graphite Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 94: Mexico Synthetic Graphite Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 95: Rest of Latin America Synthetic Graphite Market Volume (Tons) Forecast, by Product, 2020–2031

Table 96: Rest of Latin America Synthetic Graphite Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 97: Rest of Latin America Synthetic Graphite Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 98: Rest of Latin America Synthetic Graphite Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 99: Middle East & Africa Synthetic Graphite Market Volume (Tons) Forecast, by Product, 2020–2031

Table 100: Middle East & Africa Synthetic Graphite Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 101: Middle East & Africa Synthetic Graphite Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 102: Middle East & Africa Synthetic Graphite Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 103: Middle East & Africa Synthetic Graphite Market Volume (Tons) Forecast, by Country and Sub-region, 2020–2031

Table 104: Middle East & Africa Synthetic Graphite Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 105: GCC Synthetic Graphite Market Volume (Tons) Forecast, by Product, 2020–2031

Table 106: GCC Synthetic Graphite Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 107: GCC Synthetic Graphite Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 108: GCC Synthetic Graphite Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 109: South Africa Synthetic Graphite Market Volume (Tons) Forecast, by Product, 2020–2031

Table 110: South Africa Synthetic Graphite Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 111: South Africa Synthetic Graphite Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 112: South Africa Synthetic Graphite Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 113: Rest of Middle East & Africa Synthetic Graphite Market Volume (Tons) Forecast, by Product, 2020–2031

Table 114: Rest of Middle East & Africa Synthetic Graphite Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 115: Rest of Middle East & Africa Synthetic Graphite Market Volume (Tons) Forecast, by End-use Industry, 2020–2031

Table 116: Rest of Middle East & Africa Synthetic Graphite Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

List of Figures

Figure 1: Global Synthetic Graphite Market Volume Share Analysis, by Product, 2022, 2027, and 2031

Figure 2: Global Synthetic Graphite Market Attractiveness, by Product

Figure 3: Global Synthetic Graphite Market Volume Share Analysis, by End-use Industry, 2022, 2027, and 2031

Figure 4: Global Synthetic Graphite Market Attractiveness, by End-use Industry

Figure 5: Global Synthetic Graphite Market Volume Share Analysis, by Region, 2022, 2027, and 2031

Figure 6: Global Synthetic Graphite Market Attractiveness, by Region

Figure 7: North America Synthetic Graphite Market Volume Share Analysis, by Product, 2022, 2027, and 2031

Figure 8: North America Synthetic Graphite Market Attractiveness, by Product

Figure 9: North America Synthetic Graphite Market Volume Share Analysis, by End-use Industry, 2022, 2027, and 2031

Figure 10: North America Synthetic Graphite Market Attractiveness, by End-use Industry

Figure 11: North America Synthetic Graphite Market Volume Share Analysis, by Country, 2022, 2027, and 2031

Figure 12: North America Synthetic Graphite Market Attractiveness, by Country

Figure 13: Europe Synthetic Graphite Market Volume Share Analysis, by Product, 2022, 2027, and 2031

Figure 14: Europe Synthetic Graphite Market Attractiveness, by Product

Figure 15: Europe Synthetic Graphite Market Volume Share Analysis, by End-use Industry, 2022, 2027, and 2031

Figure 16: Europe Synthetic Graphite Market Attractiveness, by End-use Industry

Figure 17: Europe Synthetic Graphite Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 18: Europe Synthetic Graphite Market Attractiveness, by Country and Sub-region

Figure 19: Asia Pacific Synthetic Graphite Market Volume Share Analysis, by Product, 2022, 2027, and 2031

Figure 20: Asia Pacific Synthetic Graphite Market Attractiveness, by Product

Figure 21: Asia Pacific Synthetic Graphite Market Volume Share Analysis, by End-use Industry, 2022, 2027, and 2031

Figure 22: Asia Pacific Synthetic Graphite Market Attractiveness, by End-use Industry

Figure 23: Asia Pacific Synthetic Graphite Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 24: Asia Pacific Synthetic Graphite Market Attractiveness, by Country and Sub-region

Figure 25: Latin America Synthetic Graphite Market Volume Share Analysis, by Product, 2022, 2027, and 2031

Figure 26: Latin America Synthetic Graphite Market Attractiveness, by Product

Figure 27: Latin America Synthetic Graphite Market Volume Share Analysis, by End-use Industry, 2022, 2027, and 2031

Figure 28: Latin America Synthetic Graphite Market Attractiveness, by End-use Industry

Figure 29: Latin America Synthetic Graphite Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 30: Latin America Synthetic Graphite Market Attractiveness, by Country and Sub-region

Figure 31: Middle East & Africa Synthetic Graphite Market Volume Share Analysis, by Product, 2022, 2027, and 2031

Figure 32: Middle East & Africa Synthetic Graphite Market Attractiveness, by Product

Figure 33: Middle East & Africa Synthetic Graphite Market Volume Share Analysis, by End-use Industry, 2022, 2027, and 2031

Figure 34: Middle East & Africa Synthetic Graphite Market Attractiveness, by End-use Industry

Figure 35: Middle East & Africa Synthetic Graphite Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 36: Middle East & Africa Synthetic Graphite Market Attractiveness, by Country and Sub-region