Reports

Reports

Synthetic diamond market is growing robustly with increasing demand from the industrial, electronic, and jewelry sectors. Increasing demand for accurate cutting tools for the automobile and aerospace sectors, rise in applications in high-end electronics, and increasing demand for man-made diamonds in the jewelry market are expected to offset environmental and ethical concerns.

Synthetic diamonds are produced mainly by High Pressure High Temperature (HPHT) and Chemical Vapor Deposition (CVD) technologies, and are scalable and quality controllable. The end-users include heat sinks, semiconductors, optical devices, quantum computing, and high-end machining tools.

Key manufacturers are heavily investing in advanced CVD technologies, scaling up production capacities, and forging strategic partnerships in order to maintain consistency in supply and product innovation. Companies also focus on sustainability by reducing energy consumption in the production process and traceable supply chains. All in all, these initiatives are not only making the market competitive but also making man-made diamonds a viable and attractive alternative in industries.

Synthetic diamonds are created through sophisticated technology processes replicating the natural diamond-forming process. High Pressure High Temperature (HPHT) and Chemical Vapor Deposition (CVD) are the two prevailing processes employed. Synthetic diamonds have the same physical, chemical, and optical characteristics as natural diamonds and are therefore suitable for all applications.

They are applied for cutting, grinding, drilling, and polishing in industry due to their increased hardness. They are applied as heat spreaders and semiconductors in high-tech products in the electronics sector. They are being used more in the jewelry industry owing to their transparency and low price as a socially and ethically acceptable alternative to mined diamonds. They are creating consistent global demand in industries.

| Attribute | Detail |

|---|---|

| Drivers |

|

The synthetic diamond market is experiencing an active growth driven primarily through a growing number of applications in semiconductor and electrical devices. Wherever there is a demand for performance, miniaturization, and thermal efficiency, synthetic diamonds are starting to be recognized for their superior electrical insulation properties, high thermal conductivity and exceptional hardness.

In addition to offering superior heat dissipation, synthetic diamond also plays important roles in field emission displays, high-frequency transistors, and bits of quantum processor chips and where small amounts of heating or electron interference may cause catastrophic interference. They have chemically inert nature and broad bandgap, which allows them to work under harsh conditions and renders them suitable for space, aerospace, and military electronics.

Chip miniaturization and the new trend toward heterogeneous integration in semiconductor packaging further establish the demand for diamond-based substrates and heat spreaders.

With governments and tech firms from across the globe heavily investing in semiconductor technology and indigenous chip manufacturing capacity, artificial diamonds are becoming a strategic material. The market participants are installing additional chemical vapor deposition (CVD) capacities to meet this boom in demand.

Additionally, the focus on carbon footprint minimization in electronics manufacturing is in the interest of the new shift toward lab-created diamonds, given the fact that they are environmentally and ethically superior to their naturally mined counterparts. This shift, correspondingly, is not only accelerating the volume demand but also the product customization and innovation in synthetic diamond-based products. Henceforth, the synergy of growth in high-end electronics and thermal management requirements is significantly driving the synthetic diamond market.

Synthetic diamond industry is seeing robust growth with increasing demand in the industrial cutting, drilling, and polishing tool applications. The tools rely on synthetic diamonds since they are harder, more wear-resistance, and more thermally stable, which are most appropriate for cutting hard materials such as ceramics, composites, glass, and metals.

As manufacturing sectors such as automotive, aerospace, construction building, and electrical industry are further developing, hardness and precision in tooling operations are now required. Due to this, artificial diamond-tipped tools are now used in grinding, milling, sawing, and boring operations where cultured diamonds are too costly or of inconsistent quality.

The highest value of synthetic diamonds in industrial tools is that they are uniform and can be engineered to specific sizes, shapes, and crystal directions by employing High Pressure High Temperature (HPHT) or Chemical Vapor Deposition (CVD) technologies. This allows manufacturers to create highly specialized tools with optimized performance parameters for specialized applications.

In the oil and gas exploration sectors, synthetic diamonds are extensively employed in drill bits to achieve maximum penetration rates and minimize downtime, particularly in deep and abrasive rock formations. In the same way, in civil infrastructure construction, synthetic diamond tools form an essential component in cutting through reinforced concrete and rock in building and construction projects.

Growing high-performance manufacturing and demand for low-cost machining in the Asian-Pacific region, particularly China and India, is also driving the market. The countries are strengthening their industrial base, investing in equipment, and encouraging indigenous production through favorable policies, and all these are driving the demand for laboratory-created diamond tools. Sustainability and waste reduction concerns as well as downtime are also driving industries to move away from conventional tooling materials to longer-lived synthetic diamond ones. Thus, the increasing demand for high-precision, long-life, and efficient cutting, drilling, and polishing equipment is a major driver to the synthetic diamond market.

| Attribute | Detail |

|---|---|

| Leading Region |

|

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 | US$ 26.8 Bn |

| Market Forecast Value in 2035 | US$ 51.3 Bn |

| Growth Rate (CAGR) | 5.8% |

| Forecast Period | 2025–2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value and Mn Carat for Volume |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, Synthetic Diamond market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Product Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The synthetic diamond market was valued at US$ 26.8 Bn in 2024

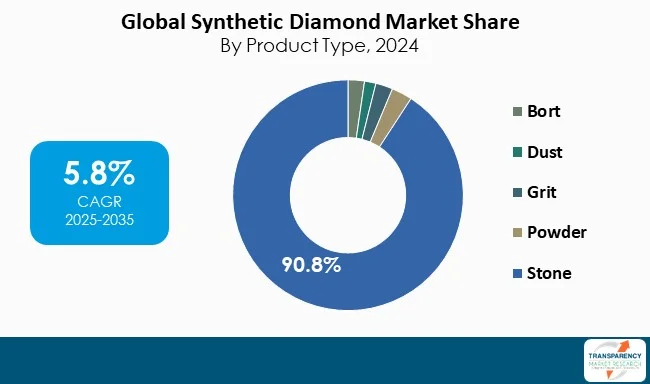

The synthetic diamond industry is expected to grow at a CAGR of 5.8% from 2025 to 2035

Escalating demand in electronics and growth in industrial cutting, drilling, and polishing tools

Stone was the largest product type segment and its value is anticipated to grow at a CAGR of 5.5% during the forecast period

Asia Pacific was the most lucrative region in 2024

Element Six (De Beers Group), Diamond Foundry, Sumitomo Electric Industries, ILJIN Diamond Co., Ltd., Henan Huanghe Whirlwind Co., Ltd., Henan Liliang Diamond Co., Ltd., Zhengzhou Sino‑Crystal Diamond Co., Ltd. are the major players in the synthetic diamond market

Table 1 Global Synthetic Diamond Market Volume (Mn Carat) Forecast, by Product Type, 2020 to 2035

Table 2 Global Synthetic Diamond Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 3 Global Synthetic Diamond Market Volume (Mn Carat) Forecast, by Type, 2020 to 2035

Table 4 Global Synthetic Diamond Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 5 Global Synthetic Diamond Market Volume (Mn Carat) Forecast, by Manufacturing Method, 2020 to 2035

Table 6 Global Synthetic Diamond Market Value (US$ Bn) Forecast, by Manufacturing Method, 2020 to 2035

Table 7 Global Synthetic Diamond Market Volume (Mn Carat) Forecast, by Application, 2020 to 2035

Table 8 Global Synthetic Diamond Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 9 Global Synthetic Diamond Market Volume (Mn Carat) Forecast, by Region, 2020 to 2035

Table 10 Global Synthetic Diamond Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 11 North America Synthetic Diamond Market Volume (Mn Carat) Forecast, by Product Type, 2020 to 2035

Table 12 North America Synthetic Diamond Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 13 North America Synthetic Diamond Market Volume (Mn Carat) Forecast, by Type, 2020 to 2035

Table 14 North America Synthetic Diamond Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 15 North America Synthetic Diamond Market Volume (Mn Carat) Forecast, by Manufacturing Method, 2020 to 2035

Table 16 North America Synthetic Diamond Market Value (US$ Bn) Forecast, by Manufacturing Method, 2020 to 2035

Table 17 North America Synthetic Diamond Market Volume (Mn Carat) Forecast, by Application, 2020 to 2035

Table 18 North America Synthetic Diamond Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 19 North America Synthetic Diamond Market Volume (Mn Carat) Forecast, by Country, 2020 to 2035

Table 20 North America Synthetic Diamond Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 21 U.S. Synthetic Diamond Market Volume (Mn Carat) Forecast, by Product Type, 2020 to 2035

Table 22 U.S. Synthetic Diamond Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 23 U.S. Synthetic Diamond Market Volume (Mn Carat) Forecast, by Type, 2020 to 2035

Table 24 U.S. Synthetic Diamond Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 25 U.S. Synthetic Diamond Market Volume (Mn Carat) Forecast, by Manufacturing Method, 2020 to 2035

Table 26 U.S. Synthetic Diamond Market Value (US$ Bn) Forecast, by Manufacturing Method, 2020 to 2035

Table 27 U.S. Synthetic Diamond Market Volume (Mn Carat) Forecast, by Application, 2020 to 2035

Table 28 U.S. Synthetic Diamond Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 29 Canada Synthetic Diamond Market Volume (Mn Carat) Forecast, by Product Type, 2020 to 2035

Table 30 Canada Synthetic Diamond Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 31 Canada Synthetic Diamond Market Volume (Mn Carat) Forecast, by Type, 2020 to 2035

Table 32 Canada Synthetic Diamond Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 33 Canada Synthetic Diamond Market Volume (Mn Carat) Forecast, by Manufacturing Method, 2020 to 2035

Table 34 Canada Synthetic Diamond Market Value (US$ Bn) Forecast, by Manufacturing Method, 2020 to 2035

Table 35 Canada Synthetic Diamond Market Volume (Mn Carat) Forecast, by Application, 2020 to 2035

Table 36 Canada Synthetic Diamond Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 37 Europe Synthetic Diamond Market Volume (Mn Carat) Forecast, by Product Type, 2020 to 2035

Table 38 Europe Synthetic Diamond Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 39 Europe Synthetic Diamond Market Volume (Mn Carat) Forecast, by Type, 2020 to 2035

Table 40 Europe Synthetic Diamond Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 41 Europe Synthetic Diamond Market Volume (Mn Carat) Forecast, by Manufacturing Method, 2020 to 2035

Table 42 Europe Synthetic Diamond Market Value (US$ Bn) Forecast, by Manufacturing Method, 2020 to 2035

Table 43 Europe Synthetic Diamond Market Volume (Mn Carat) Forecast, by Application, 2020 to 2035

Table 44 Europe Synthetic Diamond Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 45 Europe Synthetic Diamond Market Volume (Mn Carat) Forecast, by Country and Sub-region, 2020 to 2035

Table 46 Europe Synthetic Diamond Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 47 Germany Synthetic Diamond Market Volume (Mn Carat) Forecast, by Product Type, 2020 to 2035

Table 48 Germany Synthetic Diamond Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 49 Germany Synthetic Diamond Market Volume (Mn Carat) Forecast, by Type, 2020 to 2035

Table 50 Germany Synthetic Diamond Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 51 Germany Synthetic Diamond Market Volume (Mn Carat) Forecast, by Manufacturing Method, 2020 to 2035

Table 52 Germany Synthetic Diamond Market Value (US$ Bn) Forecast, by Manufacturing Method, 2020 to 2035

Table 53 Germany Synthetic Diamond Market Volume (Mn Carat) Forecast, by Application, 2020 to 2035

Table 54 Germany Synthetic Diamond Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 55 France Synthetic Diamond Market Volume (Mn Carat) Forecast, by Product Type, 2020 to 2035

Table 56 France Synthetic Diamond Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 57 France Synthetic Diamond Market Volume (Mn Carat) Forecast, by Type, 2020 to 2035

Table 58 France Synthetic Diamond Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 59 France Synthetic Diamond Market Volume (Mn Carat) Forecast, by Manufacturing Method, 2020 to 2035

Table 60 France Synthetic Diamond Market Value (US$ Bn) Forecast, by Manufacturing Method, 2020 to 2035

Table 61 France Synthetic Diamond Market Volume (Mn Carat) Forecast, by Application, 2020 to 2035

Table 62 France Synthetic Diamond Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 63 U.K. Synthetic Diamond Market Volume (Mn Carat) Forecast, by Product Type, 2020 to 2035

Table 64 U.K. Synthetic Diamond Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 65 U.K. Synthetic Diamond Market Volume (Mn Carat) Forecast, by Type, 2020 to 2035

Table 66 U.K. Synthetic Diamond Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 67 U.K. Synthetic Diamond Market Volume (Mn Carat) Forecast, by Manufacturing Method, 2020 to 2035

Table 68 U.K. Synthetic Diamond Market Value (US$ Bn) Forecast, by Manufacturing Method, 2020 to 2035

Table 69 U.K. Synthetic Diamond Market Volume (Mn Carat) Forecast, by Application, 2020 to 2035

Table 70 U.K. Synthetic Diamond Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 71 Italy Synthetic Diamond Market Volume (Mn Carat) Forecast, by Product Type, 2020 to 2035

Table 72 Italy Synthetic Diamond Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 73 Italy Synthetic Diamond Market Volume (Mn Carat) Forecast, by Type, 2020 to 2035

Table 74 Italy Synthetic Diamond Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 75 Italy Synthetic Diamond Market Volume (Mn Carat) Forecast, by Manufacturing Method, 2020 to 2035

Table 76 Italy Synthetic Diamond Market Value (US$ Bn) Forecast, by Manufacturing Method, 2020 to 2035

Table 77 Italy Synthetic Diamond Market Volume (Mn Carat) Forecast, by Application, 2020 to 2035

Table 78 Italy Synthetic Diamond Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 79 Spain Synthetic Diamond Market Volume (Mn Carat) Forecast, by Product Type, 2020 to 2035

Table 80 Spain Synthetic Diamond Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 81 Spain Synthetic Diamond Market Volume (Mn Carat) Forecast, by Type, 2020 to 2035

Table 82 Spain Synthetic Diamond Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 83 Spain Synthetic Diamond Market Volume (Mn Carat) Forecast, by Manufacturing Method, 2020 to 2035

Table 84 Spain Synthetic Diamond Market Value (US$ Bn) Forecast, by Manufacturing Method, 2020 to 2035

Table 85 Spain Synthetic Diamond Market Volume (Mn Carat) Forecast, by Application, 2020 to 2035

Table 86 Spain Synthetic Diamond Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 87 Rest of Europe Synthetic Diamond Market Volume (Mn Carat) Forecast, by Product Type, 2020 to 2035

Table 88 Rest of Europe Synthetic Diamond Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 89 Rest of Europe Synthetic Diamond Market Volume (Mn Carat) Forecast, by Type, 2020 to 2035

Table 90 Rest of Europe Synthetic Diamond Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 91 Rest of Europe Synthetic Diamond Market Volume (Mn Carat) Forecast, by Manufacturing Method, 2020 to 2035

Table 92 Rest of Europe Synthetic Diamond Market Value (US$ Bn) Forecast, by Manufacturing Method, 2020 to 2035

Table 93 Rest of Europe Synthetic Diamond Market Volume (Mn Carat) Forecast, by Application, 2020 to 2035

Table 94 Rest of Europe Synthetic Diamond Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 95 Asia Pacific Synthetic Diamond Market Volume (Mn Carat) Forecast, by Product Type, 2020 to 2035

Table 96 Asia Pacific Synthetic Diamond Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 97 Asia Pacific Synthetic Diamond Market Volume (Mn Carat) Forecast, by Type, 2020 to 2035

Table 98 Asia Pacific Synthetic Diamond Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 99 Asia Pacific Synthetic Diamond Market Volume (Mn Carat) Forecast, by Manufacturing Method, 2020 to 2035

Table 100 Asia Pacific Synthetic Diamond Market Value (US$ Bn) Forecast, by Manufacturing Method, 2020 to 2035

Table 101 Asia Pacific Synthetic Diamond Market Volume (Mn Carat) Forecast, by Application, 2020 to 2035

Table 102 Asia Pacific Synthetic Diamond Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 103 Asia Pacific Synthetic Diamond Market Volume (Mn Carat) Forecast, by Country and Sub-region, 2020 to 2035

Table 104 Asia Pacific Synthetic Diamond Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 105 China Synthetic Diamond Market Volume (Mn Carat) Forecast, by Product Type, 2020 to 2035

Table 106 China Synthetic Diamond Market Value (US$ Bn) Forecast, by Product Type 2020 to 2035

Table 107 China Synthetic Diamond Market Volume (Mn Carat) Forecast, by Type, 2020 to 2035

Table 108 China Synthetic Diamond Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 109 China Synthetic Diamond Market Volume (Mn Carat) Forecast, by Manufacturing Method, 2020 to 2035

Table 110 China Synthetic Diamond Market Value (US$ Bn) Forecast, by Manufacturing Method, 2020 to 2035

Table 111 China Synthetic Diamond Market Volume (Mn Carat) Forecast, by Application, 2020 to 2035

Table 112 China Synthetic Diamond Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 113 Japan Synthetic Diamond Market Volume (Mn Carat) Forecast, by Product Type, 2020 to 2035

Table 114 Japan Synthetic Diamond Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 115 Japan Synthetic Diamond Market Volume (Mn Carat) Forecast, by Type, 2020 to 2035

Table 116 Japan Synthetic Diamond Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 117 Japan Synthetic Diamond Market Volume (Mn Carat) Forecast, by Manufacturing Method, 2020 to 2035

Table 118 Japan Synthetic Diamond Market Value (US$ Bn) Forecast, by Manufacturing Method, 2020 to 2035

Table 119 Japan Synthetic Diamond Market Volume (Mn Carat) Forecast, by Application, 2020 to 2035

Table 120 Japan Synthetic Diamond Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 121 India Synthetic Diamond Market Volume (Mn Carat) Forecast, by Product Type, 2020 to 2035

Table 122 India Synthetic Diamond Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 123 India Synthetic Diamond Market Volume (Mn Carat) Forecast, by Type, 2020 to 2035

Table 124 India Synthetic Diamond Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 125 India Synthetic Diamond Market Volume (Mn Carat) Forecast, by Manufacturing Method, 2020 to 2035

Table 126 India Synthetic Diamond Market Value (US$ Bn) Forecast, by Manufacturing Method, 2020 to 2035

Table 127 India Synthetic Diamond Market Volume (Mn Carat) Forecast, by Application, 2020 to 2035

Table 128 India Synthetic Diamond Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 129 ASEAN Synthetic Diamond Market Volume (Mn Carat) Forecast, by Product Type, 2020 to 2035

Table 130 ASEAN Synthetic Diamond Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 131 ASEAN Synthetic Diamond Market Volume (Mn Carat) Forecast, by Type, 2020 to 2035

Table 132 ASEAN Synthetic Diamond Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 133 ASEAN Synthetic Diamond Market Volume (Mn Carat) Forecast, by Manufacturing Method, 2020 to 2035

Table 134 ASEAN Synthetic Diamond Market Value (US$ Bn) Forecast, by Manufacturing Method, 2020 to 2035

Table 135 ASEAN Synthetic Diamond Market Volume (Mn Carat) Forecast, by Application, 2020 to 2035

Table 136 ASEAN Synthetic Diamond Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 137 Rest of Asia Pacific Synthetic Diamond Market Volume (Mn Carat) Forecast, by Product Type, 2020 to 2035

Table 138 Rest of Asia Pacific Synthetic Diamond Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 139 Rest of Asia Pacific Synthetic Diamond Market Volume (Mn Carat) Forecast, by Type, 2020 to 2035

Table 140 Rest of Asia Pacific Synthetic Diamond Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 141 Rest of Asia Pacific Synthetic Diamond Market Volume (Mn Carat) Forecast, by Manufacturing Method, 2020 to 2035

Table 142 Rest of Asia Pacific Synthetic Diamond Market Value (US$ Bn) Forecast, by Manufacturing Method, 2020 to 2035

Table 143 Rest of Asia Pacific Synthetic Diamond Market Volume (Mn Carat) Forecast, by Application, 2020 to 2035

Table 144 Rest of Asia Pacific Synthetic Diamond Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 145 Latin America Synthetic Diamond Market Volume (Mn Carat) Forecast, by Product Type, 2020 to 2035

Table 146 Latin America Synthetic Diamond Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 147 Latin America Synthetic Diamond Market Volume (Mn Carat) Forecast, by Type, 2020 to 2035

Table 148 Latin America Synthetic Diamond Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 149 Latin America Synthetic Diamond Market Volume (Mn Carat) Forecast, by Manufacturing Method, 2020 to 2035

Table 150 Latin America Synthetic Diamond Market Value (US$ Bn) Forecast, by Manufacturing Method, 2020 to 2035

Table 151 Latin America Synthetic Diamond Market Volume (Mn Carat) Forecast, by Application, 2020 to 2035

Table 152 Latin America Synthetic Diamond Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 153 Latin America Synthetic Diamond Market Volume (Mn Carat) Forecast, by Country and Sub-region, 2020 to 2035

Table 154 Latin America Synthetic Diamond Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 155 Brazil Synthetic Diamond Market Volume (Mn Carat) Forecast, by Product Type, 2020 to 2035

Table 156 Brazil Synthetic Diamond Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 157 Brazil Synthetic Diamond Market Volume (Mn Carat) Forecast, by Type, 2020 to 2035

Table 158 Brazil Synthetic Diamond Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 159 Brazil Synthetic Diamond Market Volume (Mn Carat) Forecast, by Manufacturing Method, 2020 to 2035

Table 160 Brazil Synthetic Diamond Market Value (US$ Bn) Forecast, by Manufacturing Method, 2020 to 2035

Table 161 Brazil Synthetic Diamond Market Volume (Mn Carat) Forecast, by Application, 2020 to 2035

Table 162 Brazil Synthetic Diamond Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 163 Mexico Synthetic Diamond Market Volume (Mn Carat) Forecast, by Product Type, 2020 to 2035

Table 164 Mexico Synthetic Diamond Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 165 Mexico Synthetic Diamond Market Volume (Mn Carat) Forecast, by Type, 2020 to 2035

Table 166 Mexico Synthetic Diamond Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 167 Mexico Synthetic Diamond Market Volume (Mn Carat) Forecast, by Manufacturing Method, 2020 to 2035

Table 168 Mexico Synthetic Diamond Market Value (US$ Bn) Forecast, by Manufacturing Method, 2020 to 2035

Table 169 Mexico Synthetic Diamond Market Volume (Mn Carat) Forecast, by Application, 2020 to 2035

Table 170 Mexico Synthetic Diamond Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 171 Rest of Latin America Synthetic Diamond Market Volume (Mn Carat) Forecast, by Product Type, 2020 to 2035

Table 172 Rest of Latin America Synthetic Diamond Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 173 Rest of Latin America Synthetic Diamond Market Volume (Mn Carat) Forecast, by Type, 2020 to 2035

Table 174 Rest of Latin America Synthetic Diamond Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 175 Rest of Latin America Synthetic Diamond Market Volume (Mn Carat) Forecast, by Manufacturing Method, 2020 to 2035

Table 176 Rest of Latin America Synthetic Diamond Market Value (US$ Bn) Forecast, by Manufacturing Method, 2020 to 2035

Table 177 Rest of Latin America Synthetic Diamond Market Volume (Mn Carat) Forecast, by Application, 2020 to 2035

Table 178 Rest of Latin America Synthetic Diamond Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 179 Middle East & Africa Synthetic Diamond Market Volume (Mn Carat) Forecast, by Product Type, 2020 to 2035

Table 180 Middle East & Africa Synthetic Diamond Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 181 Middle East & Africa Synthetic Diamond Market Volume (Mn Carat) Forecast, by Type, 2020 to 2035

Table 182 Middle East & Africa Synthetic Diamond Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 183 Middle East & Africa Synthetic Diamond Market Volume (Mn Carat) Forecast, by Manufacturing Method, 2020 to 2035

Table 184 Middle East & Africa Synthetic Diamond Market Value (US$ Bn) Forecast, by Manufacturing Method, 2020 to 2035

Table 185 Middle East & Africa Synthetic Diamond Market Volume (Mn Carat) Forecast, by Application, 2020 to 2035

Table 186 Middle East & Africa Synthetic Diamond Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 187 Middle East & Africa Synthetic Diamond Market Volume (Mn Carat) Forecast, by Country and Sub-region, 2020 to 2035

Table 188 Middle East & Africa Synthetic Diamond Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 189 GCC Synthetic Diamond Market Volume (Mn Carat) Forecast, by Product Type, 2020 to 2035

Table 190 GCC Synthetic Diamond Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 191 GCC Synthetic Diamond Market Volume (Mn Carat) Forecast, by Type, 2020 to 2035

Table 192 GCC Synthetic Diamond Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 193 GCC Synthetic Diamond Market Volume (Mn Carat) Forecast, by Manufacturing Method, 2020 to 2035

Table 194 GCC Synthetic Diamond Market Value (US$ Bn) Forecast, by Manufacturing Method, 2020 to 2035

Table 195 GCC Synthetic Diamond Market Volume (Mn Carat) Forecast, by Application, 2020 to 2035

Table 196 GCC Synthetic Diamond Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 197 South Africa Synthetic Diamond Market Volume (Mn Carat) Forecast, by Product Type, 2020 to 2035

Table 198 South Africa Synthetic Diamond Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 199 South Africa Synthetic Diamond Market Volume (Mn Carat) Forecast, by Type, 2020 to 2035

Table 200 South Africa Synthetic Diamond Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 201 South Africa Synthetic Diamond Market Volume (Mn Carat) Forecast, by Manufacturing Method, 2020 to 2035

Table 202 South Africa Synthetic Diamond Market Value (US$ Bn) Forecast, by Manufacturing Method, 2020 to 2035

Table 203 South Africa Synthetic Diamond Market Volume (Mn Carat) Forecast, by Application, 2020 to 2035

Table 204 South Africa Synthetic Diamond Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 205 Rest of Middle East & Africa Synthetic Diamond Market Volume (Mn Carat) Forecast, by Product Type, 2020 to 2035

Table 206 Rest of Middle East & Africa Synthetic Diamond Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 207 Rest of Middle East & Africa Synthetic Diamond Market Volume (Mn Carat) Forecast, by Type, 2020 to 2035

Table 208 Rest of Middle East & Africa Synthetic Diamond Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 209 Rest of Middle East & Africa Synthetic Diamond Market Volume (Mn Carat) Forecast, by Manufacturing Method, 2020 to 2035

Table 210 Rest of Middle East & Africa Synthetic Diamond Market Value (US$ Bn) Forecast, by Manufacturing Method, 2020 to 2035

Table 211 Rest of Middle East & Africa Synthetic Diamond Market Volume (Mn Carat) Forecast, by Application, 2020 to 2035

Table 212 Rest of Middle East & Africa Synthetic Diamond Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Figure 1 Global Synthetic Diamond Market Volume Share Analysis, by Product Type, 2024, 2028, and 2035

Figure 2 Global Synthetic Diamond Market Attractiveness, by Product Type

Figure 3 Global Synthetic Diamond Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 4 Global Synthetic Diamond Market Attractiveness, by Type

Figure 5 Global Synthetic Diamond Market Volume Share Analysis, by Manufacturing Method, 2024, 2028, and 2035

Figure 6 Global Synthetic Diamond Market Attractiveness, by Manufacturing Method

Figure 7 Global Synthetic Diamond Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 8 Global Synthetic Diamond Market Attractiveness, by Application

Figure 9 Global Synthetic Diamond Market Volume Share Analysis, by Region, 2024, 2028, and 2035

Figure 10 Global Synthetic Diamond Market Attractiveness, by Region

Figure 11 North America Synthetic Diamond Market Volume Share Analysis, by Product Type, 2024, 2028, and 2035

Figure 12 North America Synthetic Diamond Market Attractiveness, by Product Type

Figure 13 North America Synthetic Diamond Market Attractiveness, by Product Type

Figure 14 North America Synthetic Diamond Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 15 North America Synthetic Diamond Market Attractiveness, by Type

Figure 16 North America Synthetic Diamond Market Volume Share Analysis, by Manufacturing Method, 2024, 2028, and 2035

Figure 17 North America Synthetic Diamond Market Attractiveness, by Manufacturing Method

Figure 18 North America Synthetic Diamond Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 19 North America Synthetic Diamond Market Attractiveness, by Application

Figure 20 North America Synthetic Diamond Market Attractiveness, by Country and Sub-region

Figure 21 Europe Synthetic Diamond Market Volume Share Analysis, by Product Type, 2024, 2028, and 2035

Figure 22 Europe Synthetic Diamond Market Attractiveness, by Product Type

Figure 23 Europe Synthetic Diamond Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 24 Europe Synthetic Diamond Market Attractiveness, by Type

Figure 25 Europe Synthetic Diamond Market Volume Share Analysis, by Manufacturing Method, 2024, 2028, and 2035

Figure 26 Europe Synthetic Diamond Market Attractiveness, by Manufacturing Method

Figure 27 Europe Synthetic Diamond Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 28 Europe Synthetic Diamond Market Attractiveness, by Application

Figure 29 Europe Synthetic Diamond Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 30 Europe Synthetic Diamond Market Attractiveness, by Country and Sub-region

Figure 31 Asia Pacific Synthetic Diamond Market Volume Share Analysis, by Product Type, 2024, 2028, and 2035

Figure 32 Asia Pacific Synthetic Diamond Market Attractiveness, by Product Type

Figure 33 Asia Pacific Synthetic Diamond Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 34 Asia Pacific Synthetic Diamond Market Attractiveness, by Type

Figure 35 Asia Pacific Synthetic Diamond Market Volume Share Analysis, by Manufacturing Method, 2024, 2028, and 2035

Figure 36 Asia Pacific Synthetic Diamond Market Attractiveness, by Manufacturing Method

Figure 37 Asia Pacific Synthetic Diamond Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 38 Asia Pacific Synthetic Diamond Market Attractiveness, by Application

Figure 39 Asia Pacific Synthetic Diamond Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 40 Asia Pacific Synthetic Diamond Market Attractiveness, by Country and Sub-region

Figure 41 Latin America Synthetic Diamond Market Volume Share Analysis, by Product Type, 2024, 2028, and 2035

Figure 42 Latin America Synthetic Diamond Market Attractiveness, by Product Type

Figure 43 Latin America Synthetic Diamond Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 44 Latin America Synthetic Diamond Market Attractiveness, by Type

Figure 45 Latin America Synthetic Diamond Market Volume Share Analysis, by Manufacturing Method, 2024, 2028, and 2035

Figure 46 Latin America Synthetic Diamond Market Attractiveness, by Manufacturing Method

Figure 47 Latin America Synthetic Diamond Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 48 Latin America Synthetic Diamond Market Attractiveness, by Application

Figure 49 Latin America Synthetic Diamond Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 50 Latin America Synthetic Diamond Market Attractiveness, by Country and Sub-region

Figure 51 Middle East & Africa Synthetic Diamond Market Volume Share Analysis, by Product Type, 2024, 2028, and 2035

Figure 52 Middle East & Africa Synthetic Diamond Market Attractiveness, by Product Type

Figure 53 Middle East & Africa Synthetic Diamond Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 54 Middle East & Africa Synthetic Diamond Market Attractiveness, by Type

Figure 55 Middle East & Africa Synthetic Diamond Market Volume Share Analysis, by Manufacturing Method, 2024, 2028, and 2035

Figure 56 Middle East & Africa Synthetic Diamond Market Attractiveness, by Manufacturing Method

Figure 57 Middle East & Africa Synthetic Diamond Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 58 Middle East & Africa Synthetic Diamond Market Attractiveness, by Application

Figure 59 Middle East & Africa Synthetic Diamond Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 60 Middle East & Africa Synthetic Diamond Market Attractiveness, by Count