Reports

Reports

Analysts’ Viewpoint on Surgical Navigation Systems Market Scenario

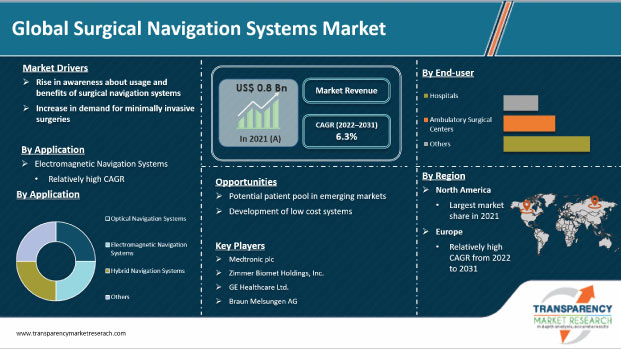

Millions of people across the world are affected by orthopedic, ENT, and neurological disorders. Efforts are being taken to spread awareness about these disorders among the general population. This has led to an increase in the number of surgeries performed across the globe. However, the COVID-19 pandemic resulted in delays in surgical procedures, thus hampering the market. Nevertheless, rise in adoption of minimally invasive surgeries and robot-navigated surgeries post the peak of the COVID-19 pandemic is expected to drive the demand for minimally invasive and non-invasive devices. Launch of new products by surgical navigation companies is also anticipated to propel the global market during the forecast period.

Surgical navigation systems assist surgeons in reaching the target anatomical position of the patient. Navigation in surgeries is often integrated with imaging systems such as computed tomography (CT) scanners and magnetic resonance imaging (MRI). Intraoperative navigation and imaging systems enable imaging of the navigation instrument touching the anatomical part of the patient’s body. Surgical navigation systems are primarily used to perform neurosurgeries, spinal surgeries, orthopedic surgeries, and ENT surgeries. Increase in adoption & easy availability of surgical navigation systems and rise in demand for minimally invasive non-surgical products across the globe are expected to drive the global market during the forecast period. Navigation assisted surgeries minimize the traumatic risk and enhance surgical precision. Demand for minimally invasive surgeries is increasing across the globe owing to advantages such as rapid wound healing, reduced hospital stay, and lesser pain. This, in turn, is driving the demand for surgical navigation systems.

Manufacturers are taking efforts to increase awareness about the usage and benefits of surgical navigation technology among healthcare professionals and patients. Surgical navigation system manufacturers in developed countries such as the U.S. have begun to reach out to local communities by offering Continual Medical Education (CME) classes. Apart from medical training and operation room assistance, key players in the market offer fee-per-use facilities, technical maintenance support, and 24X7 customer portal facilities in order to increase per unit sales of products in the surgical navigation systems market. This is expected to boost the uptake of surgical navigation systems across the globe.

Demand for minimally invasive procedures is increasing due to their benefits over open surgeries such as minimal bleeding, lesser postoperative infection chances, fewer complications, shorter hospital stay, and early recovery. These surgeries are performed with the help of robot-assisted navigation system-based techniques. Increase in patient preference for minimally invasive procedures is driving the demand for medical devices such as neurosurgery devices.

Surgical navigation systems have been widely used for minimally invasive surgeries in neurosurgery and orthopedic procedures. These techniques provide a faster recovery rate and are easy and precise to perform in comparison with traditional therapies and treatments. This has helped in the wide acceptance and adoption of medical surgical navigation systems in medical facilities and centers. Rise in trend of computer-assisted or robotic minimally invasive surgeries is also expected to augment the global market.

In terms of application, the global surgical navigation systems market has been classified into neurosurgery, orthopedic, ENT, and others. The orthopedic segment has been split into spine, knee, and hip. The orthopedic segment dominated the global market with around 38% share in 2021. The trend is likely to continue during the forecast period. The segment is driven by the rise in demand for minimally invasive orthopedic procedures to fix hip, knee, and spine injuries; and increase in adoption of orthopedic surgical navigation systems for knee procedures.

Based on technology, the global surgical navigation systems segment has been segregated into optical navigation systems, electromagnetic navigation systems, hybrid navigation systems, and others. The electromagnetic navigation systems segment dominated the global surgical navigation systems market, accounting for around 50% share in 2021. The segment is driven by the higher efficiency offered by electromagnetic technology in detecting instrument navigation in human anatomy. Electromagnetic navigation systems provide the ability to obtain tissue samples of lung masses.

In terms of end-user, the global surgical navigation systems market has been divided into hospitals, ambulatory surgical centers, and others. The hospitals segment held major share of around 52% of the global market in 2021. This trend is projected to continue during the forecast period. Increase in number of hospitals with advanced surgery techniques and growth in adoption of technologically advanced equipment are anticipated to drive the hospitals segment during the forecast period.

North America held the largest share of around 37% of the global surgical navigation systems market in 2021. Large share of the region can be ascribed to well-established health care facilities, favorable reimbursement policies, and early adoption of technologically advanced products for the management of surgical procedures. Europe accounted for around 28% share of the global market in 2021. The market in the region is expected to grow at a rapid pace during the forecast period due to the rise in prevalence and increase in incidence of ENT, neurology, and orthopedic disorders. The recent launch of surgery navigation systems with advanced technology and high per capita health care expenditure are propelling the market in Europe. Asia Pacific held a larger share of the global market than Latin America and Middle East & Africa in 2021. However, the market in Latin America is likely to grow at a faster pace than that in Middle East & Africa.

The market report concludes with the company profiles section, which includes key information about the leading players in the global market. Prominent players operating in the global surgical navigation systems market are Medtronic plc, Zimmer Biomet Holdings, Inc., Brainlab AG, GE Healthcare Ltd., Braun Melsungen AG, Fiagon GmbH (A Subsidiary of Fiagon AG), Stryker Corporation, Siemens Healthineers (a division of Siemens AG), and Amplitude Surgical.

Each of these players has been profiled in the surgical navigation systems market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 0.8 Bn |

|

Market Forecast Value in 2031 |

More than US$ 1.4 Bn |

|

Growth Rate (CAGR) |

6.3% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 0.8 Bn in 2021.

The global market is projected to reach more than US$ 1.4 Bn by 2031.

The global market is anticipated to grow at a CAGR of 6.3% from 2022 to 2031.

The orthopedic segment held more than 38% share of the global market in 2021.

North America is expected to account for major share of the global market during the forecast period.

Medtronic plc, Zimmer Biomet Holdings, Inc., Brainlab AG, GE Healthcare Ltd., and Braun Melsungen AG.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Surgical Navigation Systems Market

4. Market Overview

4.1. Introduction

4.1.1. Application Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Surgical Navigation Systems Market Analysis and Forecasts, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Technological Advancements

5.2. Price Analysis

5.3. Key Industry Events

5.4. COVID-19 Impact Analysis

6. Global Surgical Navigation Systems Market Analysis and Forecasts` Application

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Application, 2017–2031

6.3.1. Neurosurgery

6.3.2. Orthopedic

6.3.2.1. Spine

6.3.2.2. Knee

6.3.2.3. Hip

6.3.3. ENT

6.3.4. Others

6.4. Market Attractiveness Analysis, by Application

7. Global Surgical Navigation Systems Market Analysis and Forecasts, by Technology

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Technology, 2017–2031

7.3.1. Optical Navigation Systems

7.3.2. Electromagnetic Navigation Systems

7.3.3. Hybrid Navigation Systems

7.3.4. Others

7.4. Market Attractiveness Analysis, by Technology

8. Global Surgical Navigation Systems Market Analysis and Forecasts, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Hospitals

8.3.2. Ambulatory Surgical Centers

8.3.3. Others

8.4. Market Attractiveness Analysis, by End-user

9. Global Surgical Navigation Systems Market Analysis and Forecasts, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Surgical Navigation Systems Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Application, 2017–2031

10.2.1. Neurosurgery

10.2.2. Orthopedic

10.2.2.1. Spine

10.2.2.2. Knee

10.2.2.3. Hip

10.2.3. ENT

10.2.4. Others

10.3. Market Value Forecast, by Technology, 2017–2031

10.3.1. Optical Navigation Systems

10.3.2. Electromagnetic Navigation Systems

10.3.3. Hybrid Navigation Systems

10.3.4. Others

10.4. Market Value Forecast, by End-user, 2017–2031

10.4.1. Hospitals

10.4.2. Ambulatory Surgical Centers

10.4.3. Others

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Application

10.6.2. By Technology

10.6.3. By End-user

10.6.4. By Country

11. Europe Surgical Navigation Systems Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Application, 2017–2031

11.2.1. Neurosurgery

11.2.2. Orthopedic

11.2.2.1. Spine

11.2.2.2. Knee

11.2.2.3. Hip

11.2.3. ENT

11.2.4. Others

11.3. Market Value Forecast, by Technology, 2017–2031

11.3.1. Optical Navigation Systems

11.3.2. Electromagnetic Navigation Systems

11.3.3. Hybrid Navigation Systems

11.3.4. Others

11.4. Market Value Forecast, by End-user, 2017–2031

11.4.1. Hospitals

11.4.2. Ambulatory Surgical Centers

11.4.3. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Application

11.6.2. By Technology

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Surgical Navigation Systems Market Analysis and Forecast

13. 12.1.Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Application, 2017–2031

13.2.1. Neurosurgery

13.2.2. Orthopedic

13.2.2.1. Spine

13.2.2.2. Knee

13.2.2.3. Hip

13.2.3. ENT

13.2.4. Others

13.3. Market Value Forecast, by Technology, 2017–2031

13.3.1. Optical Navigation Systems

13.3.2. Electromagnetic Navigation Systems

13.3.3. Hybrid Navigation Systems

13.3.4. Others

13.4. Market Value Forecast, by End-user, 2017–2031

13.4.1. Hospitals

13.4.2. Ambulatory Surgical Centers

13.4.3. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. China

13.5.2. Japan

13.5.3. India

13.5.4. Australia & New Zealand

13.5.5. Rest of Asia Pacific

13.6. Market Attractiveness Analysis

13.6.1. By Application

13.6.2. By Technology

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Latin America Surgical Navigation Systems Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Application, 2017–2031

14.2.1. Neurosurgery

14.2.2. Orthopedic

14.2.2.1. Spine

14.2.2.2. Knee

14.2.2.3. Hip

14.2.3. ENT

14.2.4. Others

14.3. Market Value Forecast, by Technology, 2017–2031

14.3.1. Optical Navigation Systems

14.3.2. Electromagnetic Navigation Systems

14.3.3. Hybrid Navigation Systems

14.3.4. Others

14.4. Market Value Forecast, by End-user, 2017–2031

14.4.1. Hospitals

14.4.2. Ambulatory Surgical Centers

14.4.3. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. Brazil

14.5.2. Mexico

14.5.3. Rest of Latin America

14.6. Market Attractiveness Analysis

14.6.1. By Application

14.6.2. By Technology

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Middle East & Africa Surgical Navigation Systems Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Application, 2017–2031

15.2.1. Neurosurgery

15.2.2. Orthopedic

15.2.2.1. Spine

15.2.2.2. Knee

15.2.2.3. Hip

15.2.3. ENT

15.2.4. Others

15.3. Market Value Forecast, by Technology, 2017–2031

15.3.1. Optical Navigation Systems

15.3.2. Electromagnetic Navigation Systems

15.3.3. Hybrid Navigation Systems

15.3.4. Others

15.4. Market Value Forecast, by End-user, 2017–2031

15.4.1. Hospitals

15.4.2. Ambulatory Surgical Centers

15.4.3. Others

15.5. Market Value Forecast, by Country/Sub-region, 2017–2031

15.5.1. GCC Countries

15.5.2. South Africa

15.5.3. Rest of Middle East & Africa

15.6. Market Attractiveness Analysis

15.6.1. By Application

15.6.2. By Technology

15.6.3. By End-user

15.6.4. By Country/Sub-region

16. Competition Landscape

16.1. Market Player - Competition Matrix (by tier and size of companies)

16.2. Market Share Analysis, by Company, 2021

16.3. Company Profiles

16.3.1. Medtronic plc

16.3.1.1. Company overview

16.3.1.2. Financial overview

16.3.1.3. Business strategies

16.3.1.4. SWOT analysis

16.3.1.5. Recent developments

16.3.2. Zimmer Biomet Holdings, Inc.

16.3.2.1. Company overview

16.3.2.2. Financial overview

16.3.2.3. Business strategies

16.3.2.4. SWOT analysis

16.3.2.5. Recent developments

16.3.3. Brainlab AG

16.3.3.1. Company overview

16.3.3.2. Financial overview

16.3.3.3. Business strategies

16.3.3.4. SWOT analysis

16.3.3.5. Recent developments

16.3.4. GE Healthcare Ltd.

16.3.4.1. Company overview

16.3.4.2. Financial overview

16.3.4.3. Business strategies

16.3.4.4. SWOT analysis

16.3.4.5. Recent developments

16.3.5. Braun Melsungen AG

16.3.5.1. Company overview

16.3.5.2. Financial overview

16.3.5.3. Business strategies

16.3.5.4. SWOT analysis

16.3.5.5. Recent developments

16.3.6. Fiagon GmbH (subsidiary of Fiagon AG)

16.3.6.1. Company overview

16.3.6.2. Financial overview

16.3.6.3. Business strategies

16.3.6.4. SWOT analysis

16.3.6.5. Recent developments

16.3.7. Stryker Corporation

16.3.7.1. Company overview

16.3.7.2. Financial overview

16.3.7.3. Business strategies

16.3.7.4. SWOT analysis

16.3.7.5. Recent developments

16.3.8. Siemens Healthineers (division of Siemens AG)

16.3.8.1. Company overview

16.3.8.2. Financial overview

16.3.8.3. Business strategies

16.3.8.4. SWOT analysis

16.3.8.5. Recent developments

16.3.9. Amplitude Surgical

16.3.9.1. Company overview

16.3.9.2. Financial overview

16.3.9.3. Business strategies

16.3.9.4. SWOT analysis

16.3.9.5. Recent developments

List of Tables

Table 01: Global Surgical Navigation System Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 02: Global Surgical Navigation System Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Table 03: Global Surgical Navigation System Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 04: Global Surgical Navigation System Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Surgical Navigation System Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America Surgical Navigation System Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 07: North America Surgical Navigation System Market (US$ Mn) Forecast, by Technology, 2017–2031

Table 08: North America Surgical Navigation System Market (US$ Mn) Forecast, by End-user, 2017–2031

Table 09: Europe Surgical Navigation System Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Europe Surgical Navigation System Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 11: Europe Surgical Navigation System Market (US$ Mn) Forecast, by Technology, 2017–2031

Table 12: Europe Surgical Navigation System Market (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: Asia Pacific Surgical Navigation System Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific Surgical Navigation System Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 15: Asia Pacific Surgical Navigation System Market Value (US$ Mn) Forecast, by Technology, 2017–2031

Table 16: Asia Pacific Surgical Navigation System Market (US$ Mn) Forecast, by End-user, 2017–2031

Table 17: Latin America Surgical Navigation System Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 18: Latin America Surgical Navigation System Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 19: Latin America Surgical Navigation System Market (US$ Mn) Forecast, by Technology, 2017–2031

Table 20: Latin America Surgical Navigation System Market (US$ Mn) Forecast, by End-user, 2017–2031

Table 21: Middle East and Africa Surgical Navigation System Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Middle East and Africa Surgical Navigation System Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 23: Middle East and Africa Surgical Navigation System Market (US$ Mn) Forecast, by Technology, 2017–2031

Table 24: Middle East and Africa Surgical Navigation System Market (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Surgical Navigation System market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Surgical Navigation System Market Value Share Analysis, by Application, 2021 and 2031

Figure 03: Global Surgical Navigation System Market Attractiveness Analysis, by Application, 2022–2031

Figure 04: Global Surgical Navigation System Market Value (US$ Mn) Forecast, by Neurosurgery, 2017–2031

Figure 05: Global Surgical Navigation System Market Value (US$ Mn) Forecast, by Orthopedic, 2017–2031

Figure 06: Global Surgical Navigation System Market Value (US$ Mn) Forecast, by ENT, 2017–2031

Figure 07: Global Surgical Navigation System Market Value (US$ Mn) Forecast, by Others, 2017–2031

Figure 08: Global Surgical Navigation System Market Value Share Analysis, by Technology, 2021 and 2031

Figure 09: Global Surgical Navigation System Market Attractiveness Analysis, by Technology, 2022–2031

Figure 10: Global Surgical Navigation System Market Value (US$ Mn) Forecast, by Optical Navigation Systems, 2017–2031

Figure 11: Global Surgical Navigation System Market Value (US$ Mn) Forecast, by Electromagnetic Navigation Systems, 2017–2031

Figure 12: Global Surgical Navigation System Market Value (US$ Mn) Forecast, by Hybrid Navigation Systems, 2017–2031

Figure 13: Global Surgical Navigation System Market Value (US$ Mn) Forecast, Others, 2017–2031

Figure 14: Global Surgical Navigation System Market Value Share Analysis, by End-user, 2021 and 2031

Figure 15: Global Surgical Navigation System Market Attractiveness Analysis, by End-user, 2022–2031

Figure 16: Global Surgical Navigation System Market Value (US$ Mn) Forecast, Hospitals, 2017–2031

Figure 17: Global Surgical Navigation System Market Value (US$ Mn) Forecast, Ambulatory Surgical Centers, 2017–2031

Figure 18: Global Surgical Navigation System Market Value (US$ Mn) Forecast, Others, 2017–2031

Figure 19: Global Surgical Navigation System Market Value Share Analysis, by Region, 2021 and 2031

Figure 20: Global Surgical Navigation System Market Attractiveness Analysis, by Region, 2022–2031

Figure 21: North America Surgical Navigation System Market Value (US$ Mn) Forecast, 2017–2031

Figure 22: North America Surgical Navigation System Market Value Share Analysis, by Country, 2021 and 2031

Figure 23: North America Surgical Navigation System Market Attractiveness Analysis, by Country, 2022–2031

Figure 24: North America Surgical Navigation System Market Value Share Analysis, by Application, 2021 and 2031

Figure 25: North America Surgical Navigation System Market Attractiveness Analysis, by Application, 2022–2031

Figure 26: North America Surgical Navigation System Market Value Share Analysis, by Technology, 2021 and 2031

Figure 27: North America Surgical Navigation System Market Attractiveness Analysis, by Technology, 2022–2031

Figure 28: North America Surgical Navigation System Market Value Share Analysis, by End-user, 2021 and 2031

Figure 29: North America Surgical Navigation System Market Attractiveness Analysis, by End-user, 2022–2031

Figure 30: Europe Surgical Navigation System Market Value (US$ Mn) Forecast, 2017–2031

Figure 31: Europe Surgical Navigation System Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 32: Europe Surgical Navigation System Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 33: Europe Surgical Navigation System Market Value Share Analysis, by Application, 2021 and 2031

Figure 34: Europe Surgical Navigation System Market Attractiveness Analysis, by Application, 2022–2031

Figure 35: Europe Surgical Navigation System Market Value Share Analysis, by Technology, 2021 and 2031

Figure 36: Europe Surgical Navigation System Market Attractiveness Analysis, by Technology, 2022–2031

Figure 37: Europe Surgical Navigation System Market Value Share Analysis, by End-user, 2021 and 2031

Figure 38: Europe Surgical Navigation System Market Attractiveness Analysis, by End-user, 2022–2031

Figure 39: Asia Pacific Surgical Navigation System Market Value (US$ Mn) Forecast, 2017–2031

Figure 40: Asia Pacific Surgical Navigation System Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 41: Asia Pacific Surgical Navigation System Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 42: Asia Pacific Surgical Navigation System Market Value Share Analysis, by Application, 2021 and 2031

Figure 43: Asia Pacific Surgical Navigation System Market Attractiveness Analysis, by Application, 2022–2031

Figure 44: Asia Pacific Surgical Navigation System Market Value Share Analysis, by Technology, 2021 and 2031

Figure 45: Asia Pacific Surgical Navigation System Market Attractiveness Analysis, by Technology, 2022–2031

Figure 46: Asia Pacific Surgical Navigation System Market Value Share Analysis, by End-user, 2021 and 2031

Figure 47: Asia Pacific Surgical Navigation System Market Attractiveness Analysis, by End-user, 2022–2031

Figure 48: Latin America Surgical Navigation System Market Value (US$ Mn) Forecast, 2017–2031

Figure 49: Latin America Surgical Navigation System Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 50: Latin America Surgical Navigation System Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 51: Latin America Surgical Navigation System Market Value Share Analysis, by Application, 2021 and 2031

Figure 52: Latin America Surgical Navigation System Market Attractiveness Analysis, by Application, 2022–2031

Figure 53: Latin America Surgical Navigation System Market Value Share Analysis, by Technology, 2021 and 2031

Figure 54: Latin America Surgical Navigation System Market Attractiveness Analysis, by Technology, 2022–2031

Figure 55: Latin America Surgical Navigation System Market Value Share Analysis, by End-user, 2021 and 2031

Figure 56: Latin America Surgical Navigation System Market Attractiveness Analysis, by End-user, 2022–2031

Figure 57: Middle East and Africa Surgical Navigation System Market Value (US$ Mn) Forecast, 2017–2031

Figure 58: Middle East and Africa Surgical Navigation System Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 59: Middle East and Africa Surgical Navigation System Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 60: Middle East and Africa Surgical Navigation System Market Value Share Analysis, by Application, 2021 and 2031

Figure 61: Middle East and Africa Surgical Navigation System Market Attractiveness Analysis, by Application, 2022–2031

Figure 62: Middle East and Africa Surgical Navigation System Market Value Share Analysis, by Technology, 2021 and 2031

Figure 63: Middle East and Africa Surgical Navigation System Market Attractiveness Analysis, by Technology, 2022–2031

Figure 64: Middle East and Africa Surgical Navigation System Market Value Share Analysis, by End-user, 2021 and 2031

Figure 65: Middle East and Africa Surgical Navigation System Market Attractiveness Analysis, by End-user, 2022–2031