Reports

Reports

Analysts’ Viewpoint

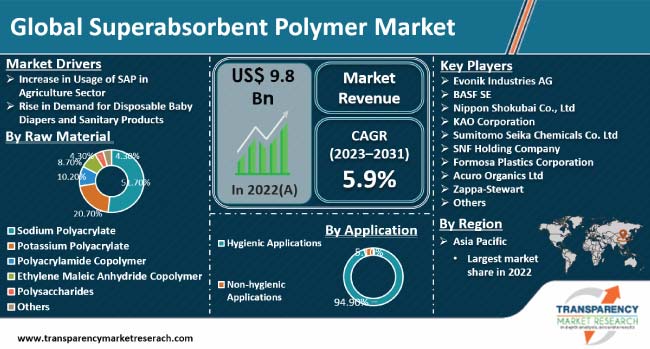

Surge in utilization of superabsorbent polymer in the agriculture sector, particularly for enhancing soil water retention and boosting crop yields, is a major factor driving the superabsorbent polymer industry growth across the globe. Additionally, rise in demand for diapers and hygiene products is propelling the superabsorbent polymer market demand.

Asia Pacific offers lucrative market growth opportunities to manufacturers, driven by expansion of agriculture and a rapid increase in population. However, for long-term commercial success, it is critical to address environmental issues and guarantee sustainable raw material procurement.

The market for superabsorbent polymers is also expected to rise significantly owing to a surge in demand for hygiene products and goods. According to the latest superabsorbent polymer market analysis, adapting to sustainable trends and emerging technologies are expected to play a critical role in the market's future direction.

The global superabsorbent polymer Industry is a dynamic and rapidly growing subset of the specialty chemicals industry as a whole. Superabsorbent polymers, or SAPs, are high-performance materials noted for their excellent water-absorbing characteristics. These polymers are widely used in various industries, including hygiene goods, agricultural, packaging, medical, and construction. Increase in demand for SAPs across diverse sectors is significantly driving the superabsorbent polymer market growth.

Rising demand for hygiene products including diapers, adult incontinence products, and feminine hygiene items, is also propelling the superabsorbent polymers market progress. Superabsorbent polymers are widely used in the agriculture sector to improve soil water retention and crop yields. Furthermore, continuing R&D activities are consistently broadening the possible uses of these flexible polymers.

Additionally, technical improvements and growing awareness about sustainability across various sectors throughout the world are projected to fuel the global superabsorbent polymer market development in the near future.

Expanding economies of Asia Pacific, the Middle East, and Africa provide considerable opportunities for super absorbent suppliers and manufacturers. Rapid expansion of the agriculture sector in several economies is prompting manufacturers to shifting their attention away from developed economies toward emerging ones. Agriculture improvements, notably in India, Brazil, and China, are expected to positively impact the forecasted demand for bio-based superabsorbent polymers in these countries in the near future.

SAPs improve soil quality, encourage water conservation, and provide drought resistance, producing an ideal environment for seeds to sprout and grow. They are eco-friendly, with outstanding water absorption and retention qualities. SAPs can be used with fertilizers, insecticides, and other agricultural chemicals to provide controlled release and increased efficacy. This protects groundwater, lowers soil nutrient loss, and improves the efficacy of agricultural inputs. Furthermore, SAPs play an important role in minimizing water depletion, runoff, and soil erosion, which contributes to their increasing demand in the agricultural sector.

SAPs show potential in managing soil parameters, particularly those governing plant nutrients and water. Consequently, increase in number of large-scale and long-term research that exploit the features of SAPs is projected to boost the superabsorbent polymers business growth in the near future. Polymer producers are also creating new business models, while raw material suppliers are looking for ways to counter the COVID-19 pandemic's disruptive influence on supply chain dynamics across industries.

Superabsorbent polymers may absorb up to 100 times their own weight in liquid and produce a gel that traps fluids in place. Super absorbent materials are frequently utilized in sanitary napkins and adult hygiene items, in addition to infant diapers. These polymers are added to the diaper in the form of an absorbent layer in the core, which aids in the absorption of liquid, which is subsequently turned into gel. This keeps the kid safe from rashes, which can be a serious issue.

Furthermore, population growth has resulted in an increase in birth rates. This has resulted to an increase in the use of infant diapers. Consequently, global demand for super absorbent gel is likely to increase significantly.

Expanding economies such as China and India witness a significant need for biodegradable super absorbent polymers in disposable infant diapers due to the high birth rates in these nations. In 2019, the fertility rate in Europe was 1.53 live births per woman, decreasing at a slower rate between 2000 and 2019. Furthermore, over 4.2 million infants were born in the EU in 2019

In India, the birth rate stood between 26 and 27 million per year. However, disposable infant diaper penetration is as low as 2% to 3%. These demographic patterns have a significant impact on the superabsorbent polymers industry.

Hygiene awareness initiatives undertaken by nonprofit organizations in developing countries are fueling the demand for superabsorbent polymers, particularly in rural areas. Furthermore, expansion of urban population and advancements in diaper quality are creating considerable superabsorbent polymer business opportunities for manufacturers.

Increased spending power of the middle-class population places a higher focus on hygienic goods, driving the demand for superabsorbent polymers even more. Consequently, consumer preferences are shaping the superabsorbent polymer market.

According to the region-wise analysis of the global superabsorbent polymers industry research report, Asia Pacific consistently emerges as the largest and most promising market for superabsorbent polymers. This hegemony is being driven by rising demand for personal care and agriculture products.

Notably, China one of the biggest consumer for personal hygiene products, and the country alone accounts for roughly half of worldwide SAP demand. These dynamics further underscore the region's significant superabsorbent polymer market share. India held the second-largest share in terms of demand for SAPs. Furthermore, growing number of end-use industries in the region is supporting R&D in the field of superabsorbent polymer, which in turn is propelling the superabsorbent market in Asia Pacific.

The superabsorbent polymer business in North America and Europe is also projected to grow at a reasonable pace during the forecast period. Expansion of the agriculture industry in developing economies is propelling the market in the region. Furthermore, growing per capita income and changing lifestyles in developing nations are also expected to drive superabsorbent polymer demand in the near future.

Key players in the superabsorbent polymer market are adopting various strategies to maintain their leading positions and extend their market presence. The superabsorbent polymer market landscape is robust, with prominent companies following the latest market trends in order to grab chances for expansion and innovation. Some of the notable companies operating in the global market include Evonik Industries AG, BASF SE, Nippon Shokubai Co., Ltd, KAO Corporation, Sumitomo Seika Chemicals Co. Ltd, SNF Holding Company, Formosa Plastics Corporation, Acuro Organics Ltd, and Zappa-Stewart.

Key players in the superabsorbent polymer market report have been profiled based on various parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 9.8 Bn |

| Forecast (Value) in 2031 | US$ 16.3 Bn |

| Growth Rate (CAGR) | 5.9% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2020-2022 |

| Quantitative Tons | US$ Bn for Value and Kilo Tons for Volume |

| Market Analysis | It includes segment analysis as well as regional level analysis. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces Analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global market was valued at US$ 9.8 Bn in 2022

It is expected to expand at a CAGR of 5.9% from 2023 to 2031

Increase in usage of superabsorbent polymer in agriculture sector and steady rise in demand for disposable baby diapers and sanitary products

In terms of raw material, the sodium polyacrylate segment held largest share in 2022

Asia Pacific was the most lucrative region in 2022

Evonik Industries AG, BASF SE, Nippon Shokubai Co., Ltd, KAO Corporation, Sumitomo Seika Chemicals Co. Ltd, SNF Holding Company, Formosa Plastics Corporation, Acuro Organics Ltd, Zappa-Stewart

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Superabsorbent Polymer Market Analysis and Forecast, 2023-2031

2.6.1. Superabsorbent Polymer Market Volume (Kilo Tons)

2.6.2. Superabsorbent Polymer Market Value (US$ Mn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Component Providers

2.9.2. List of Manufacturers

2.9.3. List of Dealer/Distributors

2.9.4. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on the Supply Chain of the Superabsorbent Polymer

3.2. Impact on the Demand of Superabsorbent Polymer - Pre & Post Crisis

4. Impact of Current Geopolitical Scenario on Market

5. Production Output Analysis (Tons)

5.1. North America

5.2. Europe

5.3. Asia Pacific

5.4. Latin America

5.5. Middle East and Africa

6. Price Trend Analysis and Forecast (US$/Ton), 2023-2031

6.1. Price Comparison Analysis by Region

7. Superabsorbent Polymer Market Analysis and Forecast, by Raw Material, 2023-2031

7.1. Introduction and Definitions

7.2. Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

7.2.1. Sodium Polyacrylate

7.2.2. Potassium Polyacrylate

7.2.3. Polyacrylamide Copolymer

7.2.4. Ethylene Maleic Anhydride Copolymer

7.2.5. Polysaccharides

7.2.6. Others

7.3. Superabsorbent Polymer Market Attractiveness, by Raw Material

8. Superabsorbent Polymer Market Analysis and Forecast, by Application, 2023-2031

8.1. Introduction and Definitions

8.2. Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

8.2.1. Hygienic Application

8.2.1.1. Diapers

8.2.1.2. Adult Diapers

8.2.1.3. Sanitary Products

8.2.2. Non-Hygienic Applications

8.2.2.1. Packaging

8.2.2.2. Medical & Healthcare

8.2.2.3. Agriculture

8.2.2.4. Construction

8.2.3. Others

8.3. Superabsorbent Polymer Market Attractiveness, by Application

9. Superabsorbent Polymer Market Analysis and Forecast, by Region, 2023-2031

9.1. Key Findings

9.2. Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Region, 2023-2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Superabsorbent Polymer Market Attractiveness, by Region

10. North America Superabsorbent Polymer Market Analysis and Forecast, 2023-2031

10.1. Key Findings

10.2. North America Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

10.3. North America Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

10.4. North America Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country, 2023-2031

10.4.1. U.S. Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

10.4.2. U.S. Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

10.4.3. Canada Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

10.4.4. Canada Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

10.5. North America Superabsorbent Polymer Market Attractiveness Analysis

11. Europe Superabsorbent Polymer Market Analysis and Forecast, 2023-2031

11.1. Key Findings

11.2. Europe Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

11.3. Europe Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

11.4. Europe Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

11.4.1. Germany Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2023-2031

11.4.2. Germany Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

11.4.3. France Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

11.4.4. France Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

11.4.5. U.K. Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

11.4.6. U.K. Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

11.4.7. Italy Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

11.4.8. Italy Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

11.4.9. Russia & CIS Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

11.4.10. Russia & CIS Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

11.4.11. Rest of Europe Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

11.4.12. Rest of Europe Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

11.5. Europe Superabsorbent Polymer Market Attractiveness Analysis

12. Asia Pacific Superabsorbent Polymer Market Analysis and Forecast, 2023-2031

12.1. Key Findings

12.2. Asia Pacific Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Raw Material

12.3. Asia Pacific Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

12.4. Asia Pacific Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

12.4.1. China Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

12.4.2. China Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

12.4.3. Japan Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

12.4.4. Japan Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

12.4.5. India Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

12.4.6. India Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

12.4.7. ASEAN Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

12.4.8. ASEAN Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

12.4.9. Rest of Asia Pacific Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

12.4.10. Rest of Asia Pacific Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

12.5. Asia Pacific Superabsorbent Polymer Market Attractiveness Analysis

13. Latin America Superabsorbent Polymer Market Analysis and Forecast, 2023-2031

13.1. Key Findings

13.2. Latin America Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

13.3. Latin America Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

13.4. Latin America Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

13.4.1. Brazil Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

13.4.2. Brazil Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

13.4.3. Mexico Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

13.4.4. Mexico Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

13.4.5. Rest of Latin America Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

13.4.6. Rest of Latin America Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

13.5. Latin America Superabsorbent Polymer Market Attractiveness Analysis

14. Middle East & Africa Superabsorbent Polymer Market Analysis and Forecast, 2023-2031

14.1. Key Findings

14.2. Middle East & Africa Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

14.3. Middle East & Africa Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

14.4. Middle East & Africa Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

14.4.1. GCC Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

14.4.2. GCC Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

14.4.3. South Africa Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

14.4.4. South Africa Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application,2023-2031

14.4.5. Rest of Middle East & Africa Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

14.4.6. Rest of Middle East & Africa Superabsorbent Polymer Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

14.5. Middle East & Africa Superabsorbent Polymer Market Attractiveness Analysis

15. Competition Landscape

15.1. Market Players - Competition Matrix (by Tier and Size of Companies)

15.2. Market Share Analysis, 2021

15.3. Market Footprint Analysis

15.3.1. By Raw Material

15.3.2. By Application

15.4. Company Profiles

15.4.1. Evonik Industries AG

15.4.1.1. Company Revenue

15.4.1.2. Business Overview

15.4.1.3. Product Segments

15.4.1.4. Geographic Footprint

15.4.1.5. Production Type/Plant Details, etc. (*As Applicable)

15.4.1.6. Strategic Partnership, Coat Type Expansion, New Product Innovation, etc.

15.4.2. BASF SE

15.4.2.1. Company Revenue

15.4.2.2. Business Overview

15.4.2.3. Product Segments

15.4.2.4. Geographic Footprint

15.4.2.5. Production Type/Plant Details, etc. (*As Applicable)

15.4.2.6. Strategic Partnership, Coat Type Expansion, New Product Innovation, etc.

15.4.3. Nippon Shokubai Co., Ltd

15.4.3.1. Company Revenue

15.4.3.2. Business Overview

15.4.3.3. Product Segments

15.4.3.4. Geographic Footprint

15.4.3.5. Production Type/Plant Details, etc. (*As Applicable)

15.4.3.6. Strategic Partnership, Coat Type Expansion, New Product Innovation, etc.

15.4.4. KAO Corporation

15.4.4.1. Company Revenue

15.4.4.2. Business Overview

15.4.4.3. Product Segments

15.4.4.4. Geographic Footprint

15.4.4.5. Production Type/Plant Details, etc. (*As Applicable)

15.4.4.6. Strategic Partnership, Coat Type Expansion, New Product Innovation, etc.

15.4.5. Sumitomo Seika Chemicals Co. Ltd

15.4.5.1. Company Revenue

15.4.5.2. Business Overview

15.4.5.3. Product Segments

15.4.5.4. Geographic Footprint

15.4.5.5. Production Type/Plant Details, etc. (*As Applicable)

15.4.5.6. Strategic Partnership, Coat Type Expansion, New Product Innovation, etc.

15.4.6. SNF Holding Company

15.4.6.1. Company Revenue

15.4.6.2. Business Overview

15.4.6.3. Product Segments

15.4.6.4. Geographic Footprint

15.4.6.5. Production Type/Plant Details, etc. (*As Applicable)

15.4.6.6. Strategic Partnership, Coat Type Expansion, New Product Innovation, etc.

15.4.7. Formosa Plastics Corporation

15.4.7.1. Company Revenue

15.4.7.2. Business Overview

15.4.7.3. Product Segments

15.4.7.4. Geographic Footprint

15.4.7.5. Production Type/Plant Details, etc. (*As Applicable)

15.4.7.6. Strategic Partnership, Coat Type Expansion, New Product Innovation, etc.

15.4.8. Acuro Organics Ltd

15.4.8.1. Company Revenue

15.4.8.2. Business Overview

15.4.8.3. Product Segments

15.4.8.4. Geographic Footprint

15.4.8.5. Production Type/Plant Details, etc. (*As Applicable)

15.4.8.6. Strategic Partnership, Coat Type Expansion, New Product Innovation, etc.

15.4.9. Zappa-Stewart

15.4.9.1. Company Revenue

15.4.9.2. Business Overview

15.4.9.3. Product Segments

15.4.9.4. Geographic Footprint

15.4.9.5. Production Type/Plant Details, etc. (*As Applicable)

15.4.9.6. Strategic Partnership, Coat Type Expansion, New Product Innovation, etc.

16. Primary Research: Key Insights

17. Appendix

List of Tables

Table 1: Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Raw Material, 2023-2031

Table 2: Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 3: Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 4: Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 5: Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Region, 2023-2031

Table 6: Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Region, 2023-2031

Table 7: North America Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Raw Material, 2023-2031

Table 8: North America Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 9: North America Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 10: North America Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 11: North America Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Country, 2023-2031

Table 12: North America Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Country, 2023-2031

Table 13: U.S. Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Raw Material, 2023-2031

Table 14: U.S. Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 15: U.S. Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 16: U.S. Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 17: Canada Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Raw Material, 2023-2031

Table 18: Canada Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 19: Canada Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 20: Canada Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 21: Europe Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Raw Material, 2023-2031

Table 22: Europe Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 23: Europe Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 24: Europe Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 25: Europe Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023-2031

Table 26: Europe Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

Table 27: Germany Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Raw Material, 2023-2031

Table 28: Germany Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 29: Germany Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 30: Germany Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 31: France Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Raw Material, 2023-2031

Table 32: France Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 33: France Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 34: France Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 35: U.K. Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Raw Material, 2023-2031

Table 36: U.K. Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 37: U.K. Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 38: U.K. Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 39: Italy Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Raw Material, 2023-2031

Table 40: Italy Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 41: Italy Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 42: Italy Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 43: Spain Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Raw Material, 2023-2031

Table 44: Spain Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 45: Spain Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 46: Spain Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 47: Russia & CIS Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Raw Material, 2023-2031

Table 48: Russia & CIS Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 49: Russia & CIS Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 50: Russia & CIS Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 51: Rest of Europe Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Raw Material, 2023-2031

Table 52: Rest of Europe Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 53: Rest of Europe Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 54: Rest of Europe Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 55: Asia Pacific Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Raw Material, 2023-2031

Table 56: Asia Pacific Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 57: Asia Pacific Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 58: Asia Pacific Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 59: Asia Pacific Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023-2031

Table 60: Asia Pacific Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

Table 61: China Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Raw Material, 2023-2031

Table 62: China Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Raw Material 2023-2031

Table 63: China Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 64: China Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 65: Japan Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Raw Material, 2023-2031

Table 66: Japan Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 67: Japan Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 68: Japan Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 69: India Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Raw Material, 2023-2031

Table 70: India Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 71: India Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 72: India Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 73: ASEAN Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Raw Material, 2023-2031

Table 74: ASEAN Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 75: ASEAN Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 76: ASEAN Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 77: Rest of Asia Pacific Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Raw Material, 2023-2031

Table 78: Rest of Asia Pacific Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 79: Rest of Asia Pacific Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 80: Rest of Asia Pacific Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 81: Latin America Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Raw Material, 2023-2031

Table 82: Latin America Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 83: Latin America Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 84: Latin America Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 85: Latin America Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023-2031

Table 86: Latin America Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

Table 87: Brazil Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Raw Material, 2023-2031

Table 88: Brazil Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 89: Brazil Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 90: Brazil Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 91: Mexico Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Raw Material, 2023-2031

Table 92: Mexico Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 93: Mexico Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 94: Mexico Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 95: Rest of Latin America Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Raw Material, 2023-2031

Table 96: Rest of Latin America Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 97: Rest of Latin America Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 98: Rest of Latin America Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 99: Middle East & Africa Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Raw Material, 2023-2031

Table 100: Middle East & Africa Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 101: Middle East & Africa Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 102: Middle East & Africa Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 103: Middle East & Africa Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023-2031

Table 104: Middle East & Africa Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

Table 105: GCC Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Raw Material, 2023-2031

Table 106: GCC Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 107: GCC Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 108: GCC Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 109: South Africa Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Raw Material, 2023-2031

Table 110: South Africa Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 111: South Africa Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 112: South Africa Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 113: Rest of Middle East & Africa Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Raw Material, 2023-2031

Table 114: Rest of Middle East & Africa Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 115: Rest of Middle East & Africa Superabsorbent Polymer Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 116: Rest of Middle East & Africa Superabsorbent Polymer Market Value (US$ Mn) Forecast, by Application, 2023-2031

List of Figures

Figure 1: Superabsorbent Polymer Market Volume Share Analysis, by Raw Material, 2022, 2027, and 2031

Figure 2: Superabsorbent Polymer Market Attractiveness, by Raw Material

Figure 3: Superabsorbent Polymer Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 4: Superabsorbent Polymer Market Attractiveness, by Application

Figure 5: Superabsorbent Polymer Market Volume Share Analysis, by Region, 2022, 2027, and 2031

Figure 6: Superabsorbent Polymer Market Attractiveness, by Region

Figure 7: North America Superabsorbent Polymer Market Volume Share Analysis, by Raw Material, 2022, 2027, and 2031

Figure 8: North America Superabsorbent Polymer Market Attractiveness, by Raw Material

Figure 9: North America Superabsorbent Polymer Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 10: North America Superabsorbent Polymer Market Attractiveness, by Application

Figure 11: North America Superabsorbent Polymer Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 12: North America Superabsorbent Polymer Market Attractiveness, by Country and Sub-region

Figure 13: Europe Superabsorbent Polymer Market Volume Share Analysis, by Raw Material, 2022, 2027, and 2031

Figure 14: Europe Superabsorbent Polymer Market Attractiveness, by Raw Material

Figure 15: Europe Superabsorbent Polymer Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 16: Europe Superabsorbent Polymer Market Attractiveness, by Application

Figure 17: Europe Superabsorbent Polymer Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 18: Europe Superabsorbent Polymer Market Attractiveness, by Country and Sub-region

Figure 19: Asia Pacific Superabsorbent Polymer Market Volume Share Analysis, by Raw Material, 2022, 2027, and 2031

Figure 20: Asia Pacific Superabsorbent Polymer Market Attractiveness, by Raw Material

Figure 21: Asia Pacific Superabsorbent Polymer Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 22: Asia Pacific Superabsorbent Polymer Market Attractiveness, by Application

Figure 23: Asia Pacific Superabsorbent Polymer Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 24: Asia Pacific Superabsorbent Polymer Market Attractiveness, by Country and Sub-region

Figure 25: Latin America Superabsorbent Polymer Market Volume Share Analysis, by Raw Material, 2022, 2027, and 2031

Figure 26: Latin America Superabsorbent Polymer Market Attractiveness, by Raw Material

Figure 27: Latin America Superabsorbent Polymer Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 28: Latin America Superabsorbent Polymer Market Attractiveness, by Application

Figure 29: Latin America Superabsorbent Polymer Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 30: Latin America Superabsorbent Polymer Market Attractiveness, by Country and Sub-region

Figure 31: Middle East & Africa Superabsorbent Polymer Market Volume Share Analysis, by Raw Material, 2022, 2027, and 2031

Figure 32: Middle East & Africa Superabsorbent Polymer Market Attractiveness, by Raw Material

Figure 33: Middle East & Africa Superabsorbent Polymer Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 34: Middle East & Africa Superabsorbent Polymer Market Attractiveness, by Application

Figure 35: Middle East & Africa Superabsorbent Polymer Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 36: Middle East & Africa Superabsorbent Polymer Market Attractiveness, by Country and Sub-region