Reports

Reports

The substation automation market’s growth is driven by the increasing demand for power, whether for smartphones or for cars, which creates an unsustainable burden on the electric grid. The combination of rise in demand for power, malicious threats aimed at disruption, and the complexity of the nation’s aging electric grid, it creates global demand for substation automation. Also, the good geopolitical supports drive the growth of substation automation industry across various regions.

Also, different types of energy sources such as solar energy, wind energy, and nuclear energy require stable substations, as these sources are less steady than the conventional stable power generation. Substation automation is the cutting-edge technology in electrical engineering. It aims at having an intelligent, interactive power distribution network.

Updating substation automation offers an opportunity to reduce operational and maintenance costs, increase plant productivity with the aid of enhanced schemes as well as condition monitoring for circuit breakers, power transformers, etc.

Hence, substation automation enhances electrical protection, performance and reliability, advanced disturbance, event recording capabilities, detailed electrical fault analysis, display of real-time substation information in a control center, remote switching and advanced supervisory control, increased electrical power network integrity and safety including advanced interlocking functions, and advanced automation functions such as intelligent load-shuffling. All these functionalities make electricity distribution burden-free and makes the fault detection and restoration faster.

Substation automation is an integral part of electrical system for generation, transmission, and distribution of electricity. Substations are the building blocks of any grid. Substations are used to receive electricity at high voltage from transmission and decrease the voltage to the appropriate level so that it can be used for local distribution.

With rapid urbanization people are more concerned about environment and sustainability. This automotive substation gives a regulatory framework to upgrade the developed and emerging economics. Countries like China, India, Japan are adopting substation automation to improve the grid reliability and enhance real-time system control.

Also, the integration of advanced technologies such as IoTs, AI, and advanced communication network is providing opportunities for innovative practices to enter emerging areas of the Substation Automation Market.

| Attribute | Detail |

|---|---|

| Substation Automation Market Drivers |

|

The need for sophisticated substation automation system increases significantly with the complexity of the electrical grids due to the increasing adoption of decentralized energy sources, electric vehicles, and the increase in renewable energy generation. Current power systems have incorporated intertwined networks with variable loads and bi-directional power flows that need to be managed in real-time. Traditional substations stand no chance to cope with that inefficiency.

Additionally, automated substations allow electrical grid for accurate control, proper interfacing, and rapid reaction. At the same time, critical infrastructure like the healthcare industry, data centers, manufacturing, and transportation—has increasing demand for power that is reliable and real-time data, which increases the need for power providers to reduce outages and improve system resiliency.

Automation of substations allows for real time and remote fault detection, control, and predictive maintenance, which, in combination, increases service reliability, reduces automation, and increases the overall system uptime.

Hence, the combination of the increasing complexity of the grid and the need for reliable, uninterrupted, and high-quality power boost the market growth of substation automation across the globe.

Existing substations require manual management, which can have huge cost impacts and productivity losses, especially during breakdowns. North America witnesses an increased emphasis on transmission and distribution investments for addressing aging and distressed infrastructure.

Thus, technological advancements play a crucial role in upgrading aging power infrastructure, thereby transforming conventional substations into smart, automated systems capable of meeting modern-day energy demands. Many existing substations were built decades ago and lack the digital capabilities needed for handling today’s complex and dynamic electrical grids.

Fertility treatment technologies such as in-vitro fertilization (IVF) and egg freezing are also improving and offering women better success rates with higher levels of personalized treatment. To sum up, the continued arrival of new and exciting solutions improves patient outcomes and creates increased interest for women seeking proactive healthcare.

These new advancements and adoption of intelligent electronic devices (IED) are increasing, as the device incorporates one or more processors with the capability to receive or send data/control from or to an external source (e.g., digital meters, digital relays, and controllers).

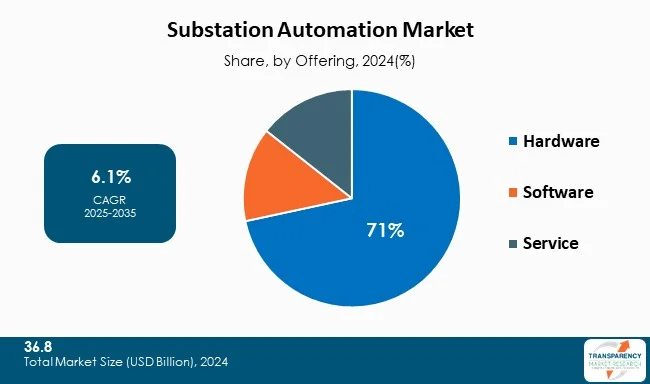

Hardware has the largest market share in substation automation market due to its use for components like digital relays, Intelligent Electronics Devices (IEDs), Programmable Logic Controllers (PLCs), Remote Terminal Units (RTUs, Communication network deceives, and Human-Machine Interface (HMIs)).

Additionally, the hardware segment is the prominent sector in the international substation automation industry. Key elements such as Intelligent Electronic Devices (IEDs), digital relays, and programmable logic controllers form the backbone to automate functions and improve monitoring within substations. Although software is increasing, the constant demand for physical hardware in power management, combined with constant innovation, guarantees the leading market share of the hardware segment. The reason behind the leading market share is also supplemented by the requirement for upgradation of aging infrastructure.

Also, the government initiative such as the partnership between East Japan Railway company (JR East) and Hitachi to create a fully digital substation by end of 2025 are adding to the growth.

| Attribute | Detail |

|---|---|

| Leading Region |

|

Asia Pacific leads the global substation automation market, thanks to a well-developed automation infrastructure and high levels of stakeholder awareness. The region's emphasis on rapid urbanization, industrialization 4.0, and integrating renewable sources such as solar and wind into national grids with advanced substation automation technologies puts the region on the top pedestal.

Countries like China, Japan, India are home to many of the world's largest smart grid infrastructure and renewable energy hubs who consistently release new technologies, to enhanced monitoring, predictive maintenance, and automation capabilities. Also, adoption of advanced technologies such as digital twins, AI-driven predictive maintenance and cloud-based solution, are help to feature real-time monitoring, fault detection and enhanced grid stability, in these countries that drives the market of substation automation.

Hence, Asia Pacific's success in the global substation automation market is the result of heavy investments in infrastructure upgrading, the incorporation of renewable energy, and the use of digital solutions.

Key players operating in the substation automation market are investing in innovation, strategic partnerships, and technological advancements. They emphasize on improvement of imaging clarity and expansion of product portfolios, thereby ensuring sustained growth and leadership in the evolving healthcare landscape.

ABB, Siemens AG, Alstom, Cisco Systems, Inc., Cross Canyon Engineering, Eaton Corporation Plc., General Electric, Hitachi Energy Ltd, Ingeteam, Mitsubishi Electric Corporation, NISSI Engineering Solution Private Limited, NovaTech, LLC., SAE-IT SYSTEMS, Schneider Electric SE, Schweitzer Engineering Laboratories, Inc., Trilliant Inc., are the key players in substation automation market.

Each of these players has been profiled in the substation automation market research report based on parameters such as company overview, financial overview, SWOT Analysis, business overview.

| Attribute | Detail |

|---|---|

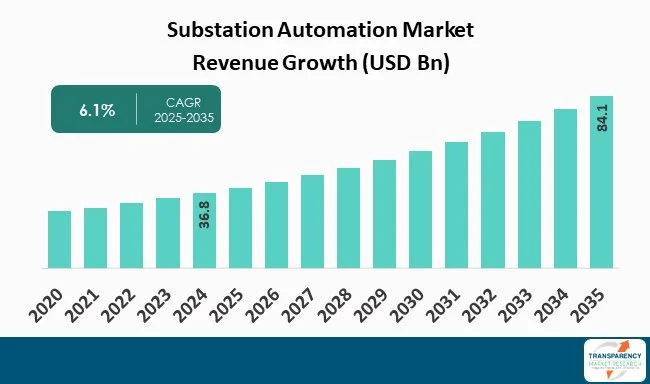

| Size in 2024 | US$ 36.8 Bn |

| Forecast Value in 2035 | US$ 84.1 Bn |

| CAGR | 6.1% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Substation Automation Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Offering

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global substation automation market was valued at US$ 36.8 Bn in 2024.

The global substation automation industry is projected to reach US$ 84.1 Bn by 2035.

Increasing grid complexity, and need for continuous power supply and technological advancements that upgrading the aging infrastructure are some of the factors driving the expansion of the substation automation market.

The CAGR is anticipated to be 6.1% from 2025 to 2035

Asia Pacific is expected to account for the largest share from 2025 to 2035

ABB, Siemens AG, Alstom, Cisco Systems, Inc., Cross Canyon Engineering, Eaton Corporation Plc., General Electric, Hitachi Energy Ltd, Ingeteam, Mitsubishi Electric Corporation, NISSI Engineering Solution Private Limited, NovaTech, LLC., SAE-IT SYSTEMS, Schneider Electric SE, Schweitzer Engineering Laboratories, Inc., and Trilliant Inc. among others

Table 01: Global Substation Automation Market Value (USD Billion) Forecast, by Offering, 2020 to 2035

Table 02: Global Substation Automation Market Value (USD Billion) Forecast, by Type, 2020 to 2035

Table 03: Global Substation Automation Market Value (USD Billion) Forecast, by Communication, 2020 to 2035

Table 04: Global Substation Automation Market Value (USD Billion) Forecast, by Installation, 2020 to 2035

Table 05: Global Substation Automation Market Value (USD Billion) Forecast, by End-use Industry, 2020 to 2035

Table 06: Global Substation Automation Market Value (USD Billion) Forecast, by Country/Sub-region, 2020 to 2035

Table 07: North America Substation Automation Market Value (USD Billion) Forecast, by Offering, 2020 to 2035

Table 08: North America Substation Automation Market Value (USD Billion) Forecast, by Type, 2020 to 2035

Table 09: North America Substation Automation Market Value (USD Billion) Forecast, by Communication, 2020 to 2035

Table 10: North America Substation Automation Market Value (USD Billion) Forecast, by Installation, 2020 to 2035

Table 11: North America Substation Automation Market Value (USD Billion) Forecast, by End-use Industry, 2020 to 2035

Table 12: North America Substation Automation Market Value (USD Billion) Forecast, by Country/Sub-region, 2020 to 2035

Table 13: U.S. Substation Automation Market Value (USD Billion) Forecast, by Offering, 2020 to 2035

Table 14: U.S. Substation Automation Market Value (USD Billion) Forecast, by Type, 2020 to 2035

Table 15: U.S. Substation Automation Market Value (USD Billion) Forecast, by Communication, 2020 to 2035

Table 16: U.S. Substation Automation Market Value (USD Billion) Forecast, by Installation, 2020 to 2035

Table 17: U.S. Substation Automation Market Value (USD Billion) Forecast, by End-use Industry, 2020 to 2035

Table 18: Canada Substation Automation Market Value (USD Billion) Forecast, by Offering, 2020 to 2035

Table 19: Canada Substation Automation Market Value (USD Billion) Forecast, by Type, 2020 to 2035

Table 20: Canada Substation Automation Market Value (USD Billion) Forecast, by Communication, 2020 to 2035

Table 21: Canada Substation Automation Market Value (USD Billion) Forecast, by Installation, 2020 to 2035

Table 22: Canada Substation Automation Market Value (USD Billion) Forecast, by End-use Industry, 2020 to 2035

Table 23: Europe Substation Automation Market Value (USD Billion) Forecast, by Offering, 2020 to 2035

Table 24: Europe Substation Automation Market Value (USD Billion) Forecast, by Type, 2020 to 2035

Table 25: Europe Substation Automation Market Value (USD Billion) Forecast, by Communication, 2020 to 2035

Table 26: Europe Substation Automation Market Value (USD Billion) Forecast, by Installation, 2020 to 2035

Table 27: Europe Substation Automation Market Value (USD Billion) Forecast, by End-use Industry, 2020 to 2035

Table 28: Europe Substation Automation Market Value (USD Billion) Forecast, by Country/Sub-region, 2020 to 2035

Table 29: Germany Substation Automation Market Value (USD Billion) Forecast, by Offering, 2020 to 2035

Table 30: Germany Substation Automation Market Value (USD Billion) Forecast, by Type, 2020 to 2035

Table 31: Germany Substation Automation Market Value (USD Billion) Forecast, by Communication, 2020 to 2035

Table 32: Germany Substation Automation Market Value (USD Billion) Forecast, by Installation, 2020 to 2035

Table 33: Germany Substation Automation Market Value (USD Billion) Forecast, by End-use Industry, 2020 to 2035

Table 34: U.K. Substation Automation Market Value (USD Billion) Forecast, by Offering, 2020 to 2035

Table 35: U.K. Substation Automation Market Value (USD Billion) Forecast, by Type, 2020 to 2035

Table 36: U.K. Substation Automation Market Value (USD Billion) Forecast, by Communication, 2020 to 2035

Table 37: U.K. Substation Automation Market Value (USD Billion) Forecast, by Installation, 2020 to 2035

Table 38: U.K. Substation Automation Market Value (USD Billion) Forecast, by End-use Industry, 2020 to 2035

Table 39: France Substation Automation Market Value (USD Billion) Forecast, by Offering, 2020 to 2035

Table 40: France Substation Automation Market Value (USD Billion) Forecast, by Type, 2020 to 2035

Table 41: France Substation Automation Market Value (USD Billion) Forecast, by Communication, 2020 to 2035

Table 42: France Substation Automation Market Value (USD Billion) Forecast, by Installation, 2020 to 2035

Table 43: France Substation Automation Market Value (USD Billion) Forecast, by End-use Industry, 2020 to 2035

Table 44: Italy Substation Automation Market Value (USD Billion) Forecast, by Offering, 2020 to 2035

Table 45: Italy Substation Automation Market Value (USD Billion) Forecast, by Type, 2020 to 2035

Table 46: Italy Substation Automation Market Value (USD Billion) Forecast, by Communication, 2020 to 2035

Table 47: Italy Substation Automation Market Value (USD Billion) Forecast, by Installation, 2020 to 2035

Table 48: Italy Substation Automation Market Value (USD Billion) Forecast, by End-use Industry, 2020 to 2035

Table 49: Spain Substation Automation Market Value (USD Billion) Forecast, by Offering, 2020 to 2035

Table 50: Spain Substation Automation Market Value (USD Billion) Forecast, by Type, 2020 to 2035

Table 51: Spain Substation Automation Market Value (USD Billion) Forecast, by Communication, 2020 to 2035

Table 52: Spain Substation Automation Market Value (USD Billion) Forecast, by Installation, 2020 to 2035

Table 53: Spain Substation Automation Market Value (USD Billion) Forecast, by End-use Industry, 2020 to 2035

Table 54: Switzerland Substation Automation Market Value (USD Billion) Forecast, by Offering, 2020 to 2035

Table 55: Switzerland Substation Automation Market Value (USD Billion) Forecast, by Type, 2020 to 2035

Table 56: Switzerland Substation Automation Market Value (USD Billion) Forecast, by Communication, 2020 to 2035

Table 57: Switzerland Substation Automation Market Value (USD Billion) Forecast, by Installation, 2020 to 2035

Table 58: Switzerland Substation Automation Market Value (USD Billion) Forecast, by End-use Industry, 2020 to 2035

Table 59: The Netherlands Substation Automation Market Value (USD Billion) Forecast, by Offering, 2020 to 2035

Table 60: The Netherlands Substation Automation Market Value (USD Billion) Forecast, by Type, 2020 to 2035

Table 61: The Netherlands Substation Automation Market Value (USD Billion) Forecast, by Communication, 2020 to 2035

Table 62: The Netherlands Substation Automation Market Value (USD Billion) Forecast, by Installation, 2020 to 2035

Table 63: The Netherlands Substation Automation Market Value (USD Billion) Forecast, by End-use Industry, 2020 to 2035

Table 64: Rest of Europe Substation Automation Market Value (USD Billion) Forecast, by Offering, 2020 to 2035

Table 65: Rest of Europe Substation Automation Market Value (USD Billion) Forecast, by Type, 2020 to 2035

Table 66: Rest of Europe Substation Automation Market Value (USD Billion) Forecast, by Communication, 2020 to 2035

Table 67: Rest of Europe Substation Automation Market Value (USD Billion) Forecast, by Installation, 2020 to 2035

Table 68: Rest of Europe Substation Automation Market Value (USD Billion) Forecast, by End-use Industry, 2020 to 2035

Table 69: Asia Pacific Substation Automation Market Value (USD Billion) Forecast, by Offering, 2020 to 2035

Table 70: Asia Pacific Substation Automation Market Value (USD Billion) Forecast, by Type, 2020 to 2035

Table 71: Asia Pacific Substation Automation Market Value (USD Billion) Forecast, by Communication, 2020 to 2035

Table 72: Asia Pacific Substation Automation Market Value (USD Billion) Forecast, by Installation, 2020 to 2035

Table 73: Asia Pacific Substation Automation Market Value (USD Billion) Forecast, by End-use Industry, 2020 to 2035

Table 74: Asia Pacific Substation Automation Market Value (USD Billion) Forecast, by Country/Sub-region, 2020 to 2035

Table 75: China Substation Automation Market Value (USD Billion) Forecast, by Offering, 2020 to 2035

Table 76: China Substation Automation Market Value (USD Billion) Forecast, by Type, 2020 to 2035

Table 77: China Substation Automation Market Value (USD Billion) Forecast, by Communication, 2020 to 2035

Table 78: China Substation Automation Market Value (USD Billion) Forecast, by Installation, 2020 to 2035

Table 79: China Substation Automation Market Value (USD Billion) Forecast, by End-use Industry, 2020 to 2035

Table 80: Japan Substation Automation Market Value (USD Billion) Forecast, by Offering, 2020 to 2035

Table 81: Japan Substation Automation Market Value (USD Billion) Forecast, by Type, 2020 to 2035

Table 82: Japan Substation Automation Market Value (USD Billion) Forecast, by Communication, 2020 to 2035

Table 83: Japan Substation Automation Market Value (USD Billion) Forecast, by Installation, 2020 to 2035

Table 84: Japan Substation Automation Market Value (USD Billion) Forecast, by End-use Industry, 2020 to 2035

Table 85: India Substation Automation Market Value (USD Billion) Forecast, by Offering, 2020 to 2035

Table 86: India Substation Automation Market Value (USD Billion) Forecast, by Type, 2020 to 2035

Table 87: India Substation Automation Market Value (USD Billion) Forecast, by Communication, 2020 to 2035

Table 88: India Substation Automation Market Value (USD Billion) Forecast, by Installation, 2020 to 2035

Table 89: India Substation Automation Market Value (USD Billion) Forecast, by End-use Industry, 2020 to 2035

Table 90: South Korea Substation Automation Market Value (USD Billion) Forecast, by Offering, 2020 to 2035

Table 91: South Korea Substation Automation Market Value (USD Billion) Forecast, by Type, 2020 to 2035

Table 92: South Korea Substation Automation Market Value (USD Billion) Forecast, by Communication, 2020 to 2035

Table 93: South Korea Substation Automation Market Value (USD Billion) Forecast, by Installation, 2020 to 2035

Table 94: South Korea Substation Automation Market Value (USD Billion) Forecast, by End-use Industry, 2020 to 2035

Table 95: Australia and New Zealand Substation Automation Market Value (USD Billion) Forecast, by Offering, 2020 to 2035

Table 96: Australia and New Zealand Substation Automation Market Value (USD Billion) Forecast, by Type, 2020 to 2035

Table 97: Australia and New Zealand Substation Automation Market Value (USD Billion) Forecast, by Communication, 2020 to 2035

Table 98: Australia and New Zealand Substation Automation Market Value (USD Billion) Forecast, by Installation, 2020 to 2035

Table 99: Australia and New Zealand Substation Automation Market Value (USD Billion) Forecast, by End-use Industry, 2020 to 2035

Table 100: Rest of Asia Pacific Substation Automation Market Value (USD Billion) Forecast, by Offering, 2020 to 2035

Table 101: Rest of Asia Pacific Substation Automation Market Value (USD Billion) Forecast, by Type, 2020 to 2035

Table 102: Rest of Asia Pacific Substation Automation Market Value (USD Billion) Forecast, by Communication, 2020 to 2035

Table 103: Rest of Asia Pacific Substation Automation Market Value (USD Billion) Forecast, by Installation, 2020 to 2035

Table 104: Rest of Asia Pacific Substation Automation Market Value (USD Billion) Forecast, by End-use Industry, 2020 to 2035

Table 105: Latin America Substation Automation Market Value (USD Billion) Forecast, by Offering, 2020 to 2035

Table 106: Latin America Substation Automation Market Value (USD Billion) Forecast, by Type, 2020 to 2035

Table 107: Latin America Substation Automation Market Value (USD Billion) Forecast, by Communication, 2020 to 2035

Table 108: Latin America Substation Automation Market Value (USD Billion) Forecast, by Installation, 2020 to 2035

Table 109: Latin America Substation Automation Market Value (USD Billion) Forecast, by End-use Industry, 2020 to 2035

Table 110: Latin America Substation Automation Market Value (USD Billion) Forecast, by Country/Sub-region, 2020 to 2035

Table 111: Brazil Substation Automation Market Value (USD Billion) Forecast, by Offering, 2020 to 2035

Table 112: Brazil Substation Automation Market Value (USD Billion) Forecast, by Type, 2020 to 2035

Table 113: Brazil Substation Automation Market Value (USD Billion) Forecast, by Communication, 2020 to 2035

Table 114: Brazil Substation Automation Market Value (USD Billion) Forecast, by Installation, 2020 to 2035

Table 115: Brazil Substation Automation Market Value (USD Billion) Forecast, by End-use Industry, 2020 to 2035

Table 116: Mexico Substation Automation Market Value (USD Billion) Forecast, by Offering, 2020 to 2035

Table 117: Mexico Substation Automation Market Value (USD Billion) Forecast, by Type, 2020 to 2035

Table 118: Mexico Substation Automation Market Value (USD Billion) Forecast, by Communication, 2020 to 2035

Table 119: Mexico Substation Automation Market Value (USD Billion) Forecast, by Installation, 2020 to 2035

Table 120: Mexico Substation Automation Market Value (USD Billion) Forecast, by End-use Industry, 2020 to 2035

Table 121: Argentina Substation Automation Market Value (USD Billion) Forecast, by Offering, 2020 to 2035

Table 122: Argentina Substation Automation Market Value (USD Billion) Forecast, by Type, 2020 to 2035

Table 123: Argentina Substation Automation Market Value (USD Billion) Forecast, by Communication, 2020 to 2035

Table 124: Argentina Substation Automation Market Value (USD Billion) Forecast, by Installation, 2020 to 2035

Table 125: Argentina Substation Automation Market Value (USD Billion) Forecast, by End-use Industry, 2020 to 2035

Table 126: Rest of Latin America Substation Automation Market Value (USD Billion) Forecast, by Offering, 2020 to 2035

Table 127: Rest of Latin America Substation Automation Market Value (USD Billion) Forecast, by Type, 2020 to 2035

Table 128: Rest of Latin America Substation Automation Market Value (USD Billion) Forecast, by Communication, 2020 to 2035

Table 129: Rest of Latin America Substation Automation Market Value (USD Billion) Forecast, by Installation, 2020 to 2035

Table 130: Rest of Latin America Substation Automation Market Value (USD Billion) Forecast, by End-use Industry, 2020 to 2035

Table 131: Middle East and Africa Substation Automation Market Value (USD Billion) Forecast, by Offering, 2020 to 2035

Table 132: Middle East and Africa Substation Automation Market Value (USD Billion) Forecast, by Type, 2020 to 2035

Table 133: Middle East and Africa Substation Automation Market Value (USD Billion) Forecast, by Communication, 2020 to 2035

Table 134: Middle East and Africa Substation Automation Market Value (USD Billion) Forecast, by Installation, 2020 to 2035

Table 135: Middle East and Africa Substation Automation Market Value (USD Billion) Forecast, by End-use Industry, 2020 to 2035

Table 136: Middle East and Africa Substation Automation Market Value (USD Billion) Forecast, by Country/Sub-region, 2020 to 2035

Table 137: GCC Countries Substation Automation Market Value (USD Billion) Forecast, by Offering, 2020 to 2035

Table 138: GCC Countries Substation Automation Market Value (USD Billion) Forecast, by Type, 2020 to 2035

Table 139: GCC Countries Substation Automation Market Value (USD Billion) Forecast, by Communication, 2020 to 2035

Table 140: GCC Countries Substation Automation Market Value (USD Billion) Forecast, by Installation, 2020 to 2035

Table 141: GCC Countries Substation Automation Market Value (USD Billion) Forecast, by End-use Industry, 2020 to 2035

Table 142: South Africa Substation Automation Market Value (USD Billion) Forecast, by Offering, 2020 to 2035

Table 143: South Africa Substation Automation Market Value (USD Billion) Forecast, by Type, 2020 to 2035

Table 144: South Africa Substation Automation Market Value (USD Billion) Forecast, by Communication, 2020 to 2035

Table 145: South Africa Substation Automation Market Value (USD Billion) Forecast, by Installation, 2020 to 2035

Table 146: South Africa Substation Automation Market Value (USD Billion) Forecast, by End-use Industry, 2020 to 2035

Table 147: Rest of Middle East and Africa Substation Automation Market Value (USD Billion) Forecast, by Offering, 2020 to 2035

Table 148: Rest of Middle East and Africa Substation Automation Market Value (USD Billion) Forecast, by Type, 2020 to 2035

Table 149: Rest of Middle East and Africa Substation Automation Market Value (USD Billion) Forecast, by Communication, 2020 to 2035

Table 150: Rest of Middle East and Africa Substation Automation Market Value (USD Billion) Forecast, by Installation, 2020 to 2035

Table 151: Rest of Middle East and Africa Substation Automation Market Value (USD Billion) Forecast, by End-use Industry, 2020 to 2035

Figure 01: Global Substation Automation Market Value (USD Billion) Forecast, 2020 to 2035

Figure 02: Global Substation Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 03: Global Substation Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 04: Global Substation Automation Market Revenue (USD Billion), by Hardware, 2020 to 2035

Figure 05: Global Substation Automation Market Revenue (USD Billion), by Software, 2020 to 2035

Figure 06: Global Substation Automation Market Revenue (USD Billion), by Service, 2020 to 2035

Figure 07: Global Substation Automation Market Value Share Analysis, by Type, 2024 and 2035

Figure 08: Global Substation Automation Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 09: Global Substation Automation Market Revenue (USD Billion), by Transmission Substation, 2020 to 2035

Figure 10: Global Substation Automation Market Revenue (USD Billion), by Distribution Substations, 2020 to 2035

Figure 11: Global Substation Automation Market Value Share Analysis, by Communication, 2024 and 2035

Figure 12: Global Substation Automation Market Attractiveness Analysis, by Communication, 2025 to 2035

Figure 13: Global Substation Automation Market Revenue (USD Billion), by Wired, 2020 to 2035

Figure 14: Global Substation Automation Market Revenue (USD Billion), by Wireless, 2020 to 2035

Figure 15: Global Substation Automation Market Value Share Analysis, by Installation, 2024 and 2035

Figure 16: Global Substation Automation Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 17: Global Substation Automation Market Revenue (USD Billion), by New Installations, 2020 to 2035

Figure 18: Global Substation Automation Market Revenue (USD Billion), by Retrofit Installation, 2020 to 2035

Figure 19: Global Substation Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 20: Global Substation Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 21: Global Substation Automation Market Revenue (USD Billion), by Energy & Utility, 2020 to 2035

Figure 22: Global Substation Automation Market Revenue (USD Billion), by Oil and Gas, 2020 to 2035

Figure 23: Global Substation Automation Market Revenue (USD Billion), by Industrial Infrastructure, 2020 to 2035

Figure 24: Global Substation Automation Market Revenue (USD Billion), by Railway Infrastructure, 2020 to 2035

Figure 25: Global Substation Automation Market Revenue (USD Billion), by Others, 2020 to 2035

Figure 26: Global Substation Automation Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 27: Global Substation Automation Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 28: North America Substation Automation Market Value (USD Billion) Forecast, 2020 to 2035

Figure 29: North America Substation Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 30: North America Substation Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 31: North America Substation Automation Market Value Share Analysis, by Type, 2024 and 2035

Figure 32: North America Substation Automation Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 33: North America Substation Automation Market Value Share Analysis, by Communication, 2024 and 2035

Figure 34: North America Substation Automation Market Attractiveness Analysis, by Communication, 2025 to 2035

Figure 35: North America Substation Automation Market Value Share Analysis, by Installation, 2024 and 2035

Figure 36: North America Substation Automation Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 37: North America Substation Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 38: North America Substation Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 39: North America Substation Automation Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 40: North America Substation Automation Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 41: U.S. Substation Automation Market Value (USD Billion) Forecast, 2020 to 2035

Figure 42: U.S. Substation Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 43: U.S. Substation Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 44: U.S. Substation Automation Market Value Share Analysis, by Type, 2024 and 2035

Figure 45: U.S. Substation Automation Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 46: U.S. Substation Automation Market Value Share Analysis, by Communication, 2024 and 2035

Figure 47: U.S. Substation Automation Market Attractiveness Analysis, by Communication, 2025 to 2035

Figure 48: U.S. Substation Automation Market Value Share Analysis, by Installation, 2024 and 2035

Figure 49: U.S. Substation Automation Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 50: U.S. Substation Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 51: U.S. Substation Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 52: Canada Substation Automation Market Value (USD Billion) Forecast, 2020 to 2035

Figure 53: Canada Substation Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 54: Canada Substation Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 55: Canada Substation Automation Market Value Share Analysis, by Type, 2024 and 2035

Figure 56: Canada Substation Automation Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 57: Canada Substation Automation Market Value Share Analysis, by Communication, 2024 and 2035

Figure 58: Canada Substation Automation Market Attractiveness Analysis, by Communication, 2025 to 2035

Figure 59: Canada Substation Automation Market Value Share Analysis, by Installation, 2024 and 2035

Figure 60: Canada Substation Automation Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 61: Canada Substation Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 62: Canada Substation Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 63: Europe Substation Automation Market Value (USD Billion) Forecast, 2020 to 2035

Figure 64: Europe Substation Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 65: Europe Substation Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 66: Europe Substation Automation Market Value Share Analysis, by Type, 2024 and 2035

Figure 67: Europe Substation Automation Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 68: Europe Substation Automation Market Value Share Analysis, by Communication, 2024 and 2035

Figure 69: Europe Substation Automation Market Attractiveness Analysis, by Communication, 2025 to 2035

Figure 70: Europe Substation Automation Market Value Share Analysis, by Installation, 2024 and 2035

Figure 71: Europe Substation Automation Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 72: Europe Substation Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 73: Europe Substation Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 74: Europe Substation Automation Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 75: Europe Substation Automation Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 76: Germany Substation Automation Market Value (USD Billion) Forecast, 2020 to 2035

Figure 77: Germany Substation Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 78: Germany Substation Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 79: Germany Substation Automation Market Value Share Analysis, by Type, 2024 and 2035

Figure 80: Germany Substation Automation Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 81: Germany Substation Automation Market Value Share Analysis, by Communication, 2024 and 2035

Figure 82: Germany Substation Automation Market Attractiveness Analysis, by Communication, 2025 to 2035

Figure 83: Germany Substation Automation Market Value Share Analysis, by Installation, 2024 and 2035

Figure 84: Germany Substation Automation Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 85: Germany Substation Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 86: Germany Substation Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 87: U.K. Substation Automation Market Value (USD Billion) Forecast, 2020 to 2035

Figure 88: U.K. Substation Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 89: U.K. Substation Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 90: U.K. Substation Automation Market Value Share Analysis, by Type, 2024 and 2035

Figure 91: U.K. Substation Automation Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 92: U.K. Substation Automation Market Value Share Analysis, by Communication, 2024 and 2035

Figure 93: U.K. Substation Automation Market Attractiveness Analysis, by Communication, 2025 to 2035

Figure 94: U.K. Substation Automation Market Value Share Analysis, by Installation, 2024 and 2035

Figure 95: U.K. Substation Automation Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 96: U.K. Substation Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 97: U.K. Substation Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 98: France Substation Automation Market Value (USD Billion) Forecast, 2020 to 2035

Figure 99: France Substation Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 100: France Substation Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 101: France Substation Automation Market Value Share Analysis, by Type, 2024 and 2035

Figure 102: France Substation Automation Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 103: France Substation Automation Market Value Share Analysis, by Communication, 2024 and 2035

Figure 104: France Substation Automation Market Attractiveness Analysis, by Communication, 2025 to 2035

Figure 105: France Substation Automation Market Value Share Analysis, by Installation, 2024 and 2035

Figure 106: France Substation Automation Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 107: France Substation Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 108: France Substation Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 109: Italy Substation Automation Market Value (USD Billion) Forecast, 2020 to 2035

Figure 110: Italy Substation Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 111: Italy Substation Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 112: Italy Substation Automation Market Value Share Analysis, by Type, 2024 and 2035

Figure 113: Italy Substation Automation Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 114: Italy Substation Automation Market Value Share Analysis, by Communication, 2024 and 2035

Figure 115: Italy Substation Automation Market Attractiveness Analysis, by Communication, 2025 to 2035

Figure 116: Italy Substation Automation Market Value Share Analysis, by Installation, 2024 and 2035

Figure 117: Italy Substation Automation Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 118: Italy Substation Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 119: Italy Substation Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 120: Spain Substation Automation Market Value (USD Billion) Forecast, 2020 to 2035

Figure 121: Spain Substation Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 122: Spain Substation Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 123: Spain Substation Automation Market Value Share Analysis, by Type, 2024 and 2035

Figure 124: Spain Substation Automation Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 125: Spain Substation Automation Market Value Share Analysis, by Communication, 2024 and 2035

Figure 126: Spain Substation Automation Market Attractiveness Analysis, by Communication, 2025 to 2035

Figure 127: Spain Substation Automation Market Value Share Analysis, by Installation, 2024 and 2035

Figure 128: Spain Substation Automation Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 129: Spain Substation Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 130: Spain Substation Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 131: Switzerland Substation Automation Market Value (USD Billion) Forecast, 2020 to 2035

Figure 132: Switzerland Substation Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 133: Switzerland Substation Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 134: Switzerland Substation Automation Market Value Share Analysis, by Type, 2024 and 2035

Figure 135: Switzerland Substation Automation Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 136: Switzerland Substation Automation Market Value Share Analysis, by Communication, 2024 and 2035

Figure 137: Switzerland Substation Automation Market Attractiveness Analysis, by Communication, 2025 to 2035

Figure 138: Switzerland Substation Automation Market Value Share Analysis, by Installation, 2024 and 2035

Figure 139: Switzerland Substation Automation Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 140: Switzerland Substation Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 141: Switzerland Substation Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 142: The Netherlands Substation Automation Market Value (USD Billion) Forecast, 2020 to 2035

Figure 143: The Netherlands Substation Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 144: The Netherlands Substation Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 145: The Netherlands Substation Automation Market Value Share Analysis, by Type, 2024 and 2035

Figure 146: The Netherlands Substation Automation Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 147: The Netherlands Substation Automation Market Value Share Analysis, by Communication, 2024 and 2035

Figure 148: The Netherlands Substation Automation Market Attractiveness Analysis, by Communication, 2025 to 2035

Figure 149: The Netherlands Substation Automation Market Value Share Analysis, by Installation, 2024 and 2035

Figure 150: The Netherlands Substation Automation Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 151: The Netherlands Substation Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 152: The Netherlands Substation Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 153: Rest of Europe Substation Automation Market Value (USD Billion) Forecast, 2020 to 2035

Figure 154: Rest of Europe Substation Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 155: Rest of Europe Substation Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 156: Rest of Europe Substation Automation Market Value Share Analysis, by Type, 2024 and 2035

Figure 157: Rest of Europe Substation Automation Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 158: Rest of Europe Substation Automation Market Value Share Analysis, by Communication, 2024 and 2035

Figure 159: Rest of Europe Substation Automation Market Attractiveness Analysis, by Communication, 2025 to 2035

Figure 160: Rest of Europe Substation Automation Market Value Share Analysis, by Installation, 2024 and 2035

Figure 161: Rest of Europe Substation Automation Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 162: Rest of Europe Substation Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 163: Rest of Europe Substation Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 164: Asia Pacific Substation Automation Market Value (USD Billion) Forecast, 2020 to 2035

Figure 165: Asia Pacific Substation Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 166: Asia Pacific Substation Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 167: Asia Pacific Substation Automation Market Value Share Analysis, by Type, 2024 and 2035

Figure 168: Asia Pacific Substation Automation Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 169: Asia Pacific Substation Automation Market Value Share Analysis, by Communication, 2024 and 2035

Figure 170: Asia Pacific Substation Automation Market Attractiveness Analysis, by Communication, 2025 to 2035

Figure 171: Asia Pacific Substation Automation Market Value Share Analysis, by Installation, 2024 and 2035

Figure 172: Asia Pacific Substation Automation Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 173: Asia Pacific Substation Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 174: Asia Pacific Substation Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 175: Asia Pacific Substation Automation Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 176: Asia Pacific Substation Automation Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 177: China Substation Automation Market Value (USD Billion) Forecast, 2020 to 2035

Figure 178: China Substation Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 179: China Substation Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 180: China Substation Automation Market Value Share Analysis, by Type, 2024 and 2035

Figure 181: China Substation Automation Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 182: China Substation Automation Market Value Share Analysis, by Communication, 2024 and 2035

Figure 183: China Substation Automation Market Attractiveness Analysis, by Communication, 2025 to 2035

Figure 184: China Substation Automation Market Value Share Analysis, by Installation, 2024 and 2035

Figure 185: China Substation Automation Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 186: China Substation Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 187: China Substation Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 188: Japan Substation Automation Market Value (USD Billion) Forecast, 2020 to 2035

Figure 189: Japan Substation Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 190: Japan Substation Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 191: Japan Substation Automation Market Value Share Analysis, by Type, 2024 and 2035

Figure 192: Japan Substation Automation Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 193: Japan Substation Automation Market Value Share Analysis, by Communication, 2024 and 2035

Figure 194: Japan Substation Automation Market Attractiveness Analysis, by Communication, 2025 to 2035

Figure 195: Japan Substation Automation Market Value Share Analysis, by Installation, 2024 and 2035

Figure 196: Japan Substation Automation Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 197: Japan Substation Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 198: Japan Substation Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 199: India Substation Automation Market Value (USD Billion) Forecast, 2020 to 2035

Figure 200: India Substation Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 201: India Substation Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 202: India Substation Automation Market Value Share Analysis, by Type, 2024 and 2035

Figure 203: India Substation Automation Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 204: India Substation Automation Market Value Share Analysis, by Communication, 2024 and 2035

Figure 205: India Substation Automation Market Attractiveness Analysis, by Communication, 2025 to 2035

Figure 206: India Substation Automation Market Value Share Analysis, by Installation, 2024 and 2035

Figure 207: India Substation Automation Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 208: India Substation Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 209: India Substation Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 210: South Korea Substation Automation Market Value (USD Billion) Forecast, 2020 to 2035

Figure 211: South Korea Substation Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 212: South Korea Substation Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 213: South Korea Substation Automation Market Value Share Analysis, by Type, 2024 and 2035

Figure 214: South Korea Substation Automation Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 215: South Korea Substation Automation Market Value Share Analysis, by Communication, 2024 and 2035

Figure 216: South Korea Substation Automation Market Attractiveness Analysis, by Communication, 2025 to 2035

Figure 217: South Korea Substation Automation Market Value Share Analysis, by Installation, 2024 and 2035

Figure 218: South Korea Substation Automation Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 219: South Korea Substation Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 220: South Korea Substation Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 221: Australia and New Zealand Substation Automation Market Value (USD Billion) Forecast, 2020 to 2035

Figure 222: Australia and New Zealand Substation Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 223: Australia and New Zealand Substation Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 224: Australia and New Zealand Substation Automation Market Value Share Analysis, by Type, 2024 and 2035

Figure 225: Australia and New Zealand Substation Automation Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 226: Australia and New Zealand Substation Automation Market Value Share Analysis, by Communication, 2024 and 2035

Figure 227: Australia and New Zealand Substation Automation Market Attractiveness Analysis, by Communication, 2025 to 2035

Figure 228: Australia and New Zealand Substation Automation Market Value Share Analysis, by Installation, 2024 and 2035

Figure 229: Australia and New Zealand Substation Automation Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 230: Australia and New Zealand Substation Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 231: Australia and New Zealand Substation Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 232: Rest of Asia Pacific Substation Automation Market Value (USD Billion) Forecast, 2020 to 2035

Figure 233: Rest of Asia Pacific Substation Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 234: Rest of Asia Pacific Substation Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 235: Rest of Asia Pacific Substation Automation Market Value Share Analysis, by Type, 2024 and 2035

Figure 236: Rest of Asia Pacific Substation Automation Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 237: Rest of Asia Pacific Substation Automation Market Value Share Analysis, by Communication, 2024 and 2035

Figure 238: Rest of Asia Pacific Substation Automation Market Attractiveness Analysis, by Communication, 2025 to 2035

Figure 239: Rest of Asia Pacific Substation Automation Market Value Share Analysis, by Installation, 2024 and 2035

Figure 240: Rest of Asia Pacific Substation Automation Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 241: Rest of Asia Pacific Substation Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 242: Rest of Asia Pacific Substation Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 243: Latin America Substation Automation Market Value (USD Billion) Forecast, 2020 to 2035

Figure 244: Latin America Substation Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 245: Latin America Substation Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 246: Latin America Substation Automation Market Value Share Analysis, by Type, 2024 and 2035

Figure 247: Latin America Substation Automation Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 248: Latin America Substation Automation Market Value Share Analysis, by Communication, 2024 and 2035

Figure 249: Latin America Substation Automation Market Attractiveness Analysis, by Communication, 2025 to 2035

Figure 250: Latin America Substation Automation Market Value Share Analysis, by Installation, 2024 and 2035

Figure 251: Latin America Substation Automation Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 252: Latin America Substation Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 253: Latin America Substation Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 254: Latin America Substation Automation Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 255: Latin America Substation Automation Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 256: Brazil Substation Automation Market Value (USD Billion) Forecast, 2020 to 2035

Figure 257: Brazil Substation Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 258: Brazil Substation Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 259: Brazil Substation Automation Market Value Share Analysis, by Type, 2024 and 2035

Figure 260: Brazil Substation Automation Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 261: Brazil Substation Automation Market Value Share Analysis, by Communication, 2024 and 2035

Figure 262: Brazil Substation Automation Market Attractiveness Analysis, by Communication, 2025 to 2035

Figure 263: Brazil Substation Automation Market Value Share Analysis, by Installation, 2024 and 2035

Figure 264: Brazil Substation Automation Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 265: Brazil Substation Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 266: Brazil Substation Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 267: Mexico Substation Automation Market Value (USD Billion) Forecast, 2020 to 2035

Figure 268: Mexico Substation Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 269: Mexico Substation Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 270: Mexico Substation Automation Market Value Share Analysis, by Type, 2024 and 2035

Figure 271: Mexico Substation Automation Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 272: Mexico Substation Automation Market Value Share Analysis, by Communication, 2024 and 2035

Figure 273: Mexico Substation Automation Market Attractiveness Analysis, by Communication, 2025 to 2035

Figure 274: Mexico Substation Automation Market Value Share Analysis, by Installation, 2024 and 2035

Figure 275: Mexico Substation Automation Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 276: Mexico Substation Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 277: Mexico Substation Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 278: Argentina Substation Automation Market Value (USD Billion) Forecast, 2020 to 2035

Figure 279: Argentina Substation Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 280: Argentina Substation Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 281: Argentina Substation Automation Market Value Share Analysis, by Type, 2024 and 2035

Figure 282: Argentina Substation Automation Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 283: Argentina Substation Automation Market Value Share Analysis, by Communication, 2024 and 2035

Figure 284: Argentina Substation Automation Market Attractiveness Analysis, by Communication, 2025 to 2035

Figure 285: Argentina Substation Automation Market Value Share Analysis, by Installation, 2024 and 2035

Figure 286: Argentina Substation Automation Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 287: Argentina Substation Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 288: Argentina Substation Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 289: Rest of Latin America Substation Automation Market Value (USD Billion) Forecast, 2020 to 2035

Figure 290: Rest of Latin America Substation Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 291: Rest of Latin America Substation Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 292: Rest of Latin America Substation Automation Market Value Share Analysis, by Type, 2024 and 2035

Figure 293: Rest of Latin America Substation Automation Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 294: Rest of Latin America Substation Automation Market Value Share Analysis, by Communication, 2024 and 2035

Figure 295: Rest of Latin America Substation Automation Market Attractiveness Analysis, by Communication, 2025 to 2035

Figure 296: Rest of Latin America Substation Automation Market Value Share Analysis, by Installation, 2024 and 2035

Figure 297: Rest of Latin America Substation Automation Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 298: Rest of Latin America Substation Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 299: Rest of Latin America Substation Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 300: Middle East and Africa Substation Automation Market Value (USD Billion) Forecast, 2020 to 2035

Figure 301: Middle East and Africa Substation Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 302: Middle East and Africa Substation Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 303: Middle East and Africa Substation Automation Market Value Share Analysis, by Type, 2024 and 2035

Figure 304: Middle East and Africa Substation Automation Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 305: Middle East and Africa Substation Automation Market Value Share Analysis, by Communication, 2024 and 2035

Figure 306: Middle East and Africa Substation Automation Market Attractiveness Analysis, by Communication, 2025 to 2035

Figure 307: Middle East and Africa Substation Automation Market Value Share Analysis, by Installation, 2024 and 2035

Figure 308: Middle East and Africa Substation Automation Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 309: Middle East and Africa Substation Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 310: Middle East and Africa Substation Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 311: Middle East and Africa Substation Automation Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 312: Middle East and Africa Substation Automation Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 313: GCC Countries Substation Automation Market Value (USD Billion) Forecast, 2020 to 2035

Figure 314: GCC Countries Substation Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 315: GCC Countries Substation Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 316: GCC Countries Substation Automation Market Value Share Analysis, by Type, 2024 and 2035

Figure 317: GCC Countries Substation Automation Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 318: GCC Countries Substation Automation Market Value Share Analysis, by Communication, 2024 and 2035

Figure 319: GCC Countries Substation Automation Market Attractiveness Analysis, by Communication, 2025 to 2035

Figure 320: GCC Countries Substation Automation Market Value Share Analysis, by Installation, 2024 and 2035

Figure 321: GCC Countries Substation Automation Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 322: GCC Countries Substation Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 323: GCC Countries Substation Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 324: South Africa Substation Automation Market Value (USD Billion) Forecast, 2020 to 2035

Figure 325: South Africa Substation Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 326: South Africa Substation Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 327: South Africa Substation Automation Market Value Share Analysis, by Type, 2024 and 2035

Figure 328: South Africa Substation Automation Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 329: South Africa Substation Automation Market Value Share Analysis, by Communication, 2024 and 2035

Figure 330: South Africa Substation Automation Market Attractiveness Analysis, by Communication, 2025 to 2035

Figure 331: South Africa Substation Automation Market Value Share Analysis, by Installation, 2024 and 2035

Figure 332: South Africa Substation Automation Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 333: South Africa Substation Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 334: South Africa Substation Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 335: Rest of Middle East and Africa Substation Automation Market Value (USD Billion) Forecast, 2020 to 2035

Figure 336: Rest of Middle East and Africa Substation Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 337: Rest of Middle East and Africa Substation Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 338: Rest of Middle East and Africa Substation Automation Market Value Share Analysis, by Type, 2024 and 2035

Figure 339: Rest of Middle East and Africa Substation Automation Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 340: Rest of Middle East and Africa Substation Automation Market Value Share Analysis, by Communication, 2024 and 2035

Figure 341: Rest of Middle East and Africa Substation Automation Market Attractiveness Analysis, by Communication, 2025 to 2035

Figure 342: Rest of Middle East and Africa Substation Automation Market Value Share Analysis, by Installation, 2024 and 2035

Figure 343: Rest of Middle East and Africa Substation Automation Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 344: Rest of Middle East and Africa Substation Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 345: Rest of Middle East and Africa Substation Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035