Reports

Reports

Analysts’ Viewpoint on Market Scenario

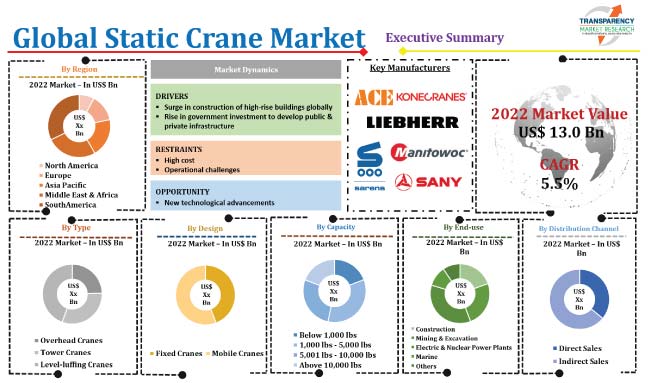

Rapid growth in urbanization and increase in construction activities across the globe are key factors that are driving the global static crane market size. Advancements in technology, such as connected devices and tools, telematics, smartphone apps, and smart controls, are augmenting market development. Rise in infrastructure activities is also a prominent factor fueling the demand for static tower cranes across the globe.

Introduction of the intelligent control technology, which includes safety features and programmable control systems, is enabling operators to control tower crane operations efficiently, thus reducing the number of accidents. Key players are focusing on using Artificial Intelligence (AI), connectivity sensors, and automation in cranes to gain lucrative static crane market opportunities.

Static cranes are permanent/semi-permanent structures fixed to the ground or buildings that lift and move loads along a fixed path. On the other hand, mobile cranes are mounted on pedals or wheels, and can be moved from one job site to another.

Static cranes are used for material handling in construction, mining, electric plant, and marine industries. These cranes are able to handle the toughest tasks on construction sites. Static cranes make construction work easier and help save considerable time. These cranes have become vital components of construction projects.

According to the static crane industry analysis, rapid urbanization and infrastructure development across the globe are driving the demand for static cranes. Construction of high-rise buildings has increased significantly in several countries such as Germany, the U.K., U.S., and India. This is projected to augment the static crane market value in the near future.

Distribution, warehousing, and manufacturing facilities are focusing on optimizing space for various activities due to steep real estate and rental costs. Heavy engineering equipment such as overhead cranes, gantry cranes, and girder cranes can all be integrated for higher stacking. This allows for greater utilization of vertical space and maximizes the volumetric area of a storage facility. Additionally, elimination of ground transportation reduces foot traffic in industrial workshops. The combined impact of these factors is expected to fuel the global static crane market share.

Government and private sector organizations across the globe are investing significantly in new commercial and residential buildings as well as public infrastructure projects. This is driving the global static crane industry. The global construction market is expected to reach around US$ 8.0 Trn by the end of 2030, according to the Institution of Civil Engineers, a London-based group that debates infrastructure and its environmental impact.

Rapid urbanization, especially in countries in Asia and Latin America, has created significant demand for residential infrastructure. This is anticipated to fuel the static crane market size in the next few years. Increase in regional and foreign direct investments is also augmenting market statistics.

Based on types of static cranes, the market has been segmented into overhead cranes, tower cranes, and level-luffing cranes.

The tower cranes segment is estimated to dominate the market during the forecast period. This can be ascribed to the growth in construction, shipbuilding, power, and utility industries across the globe. These cranes are also used extensively in large infrastructure projects.

Tower cranes have high load bearing capacity and work efficiently in harsh environmental conditions. These characteristics are further acting as market catalysts.

In terms of end-use, the static crane market has been divided into construction, mining & excavation, electric & nuclear power plants, marine, and others (industrial, railways, etc.).

Static crane market trends indicate that demand for these cranes is the largest in the construction industry. The construction industry faced a slowdown during the COVID-19 pandemic, which affected the sales of static cranes. However, the industry recovered, as COVID-19 cases subsided. Currently, the construction sector is growing at a steady rate across the globe, especially in Asia Pacific. This is projected to fuel market progress in the next few years.

Various government-backed construction projects are being carried out in China and India. For instance, in October 2021, governments of Dubai and India agreed to develop infrastructure projects, such as industrial parks, multi-purpose towers, logistics centers, medical colleges, and specialized hospitals, in the Indian state of Jammu and Kashmir. Thus, demand for static cranes is increasing in the construction industry, thereby leading to static crane market growth.

In terms of region, Asia Pacific dominates the global landscape. The region is driving the global demand for tower cranes owing to the surge in infrastructure activities and development of high-rise commercial and residential projects. For instance, the Government of Singapore has launched a large-scale infrastructure development program, which is driving the demand for tower cranes.

The global static crane market is moderately competitive, with the presence of a large number of players. Some of the companies are focusing on carving out a niche market for a specific demographic. The business has been benefiting from strong partnerships that place a high value on innovation. This has led to introduction of a series of tower cranes over the last few years.

ACE Equipment Company, Konecranes Oyj, Liebherr-International AG, Manitowoc Company, Inc., Raimondi SpA, SANY Global, Sarens n.v./s.a., Terex Corporation, XCMG Group, and Zoomlion Heavy Industry Science & Technology Co., Ltd. are prominent companies in the static crane market.

Each of these players has been profiled in the static crane market report based on parameters such as company overview, business strategies, financial overview, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Value in 2022 |

US$ 13.0 Bn |

|

Market Forecast Value in 2031 |

US$ 21.1 Bn |

|

Growth Rate (CAGR) |

5.5% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value and Units for Volume |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional levels. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 13.0 Bn in 2022

The CAGR is estimated to be 5.5% from 2023 to 2031

Increase in high-rise building activities across the globe and rise in government investment in public and private infrastructure projects

The tower cranes type segment accounted for the maximum share in 2022

Asia Pacific is likely to be one of the lucrative markets in the next few years

ACE Equipment Company, Konecranes Oyj, Liebherr-International AG, Manitowoc Company, Inc., Raimondi SpA, SANY Global, Sarens n.v./s.a., Terex Corporation, XCMG Group, and Zoomlion Heavy Industry Science & Technology Co., Ltd.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. Technological Roadmap

5.8. Global Static Crane Market Analysis and Forecast, 2017 - 2031

5.8.1. Market Value Projections (US$ Bn)

5.8.2. Market Volume Projections (Units)

6. Global Static Crane Market Analysis and Forecast, By Type

6.1. Global Static Crane Market Size (US$ Bn and Units), By Type, 2017 - 2031

6.1.1. Overhead Cranes

6.1.2. Tower Cranes

6.1.3. Level-luffing Cranes

6.2. Incremental Opportunity, By Type

7. Global Static Crane Market Analysis and Forecast, By Design

7.1. Global Static Crane Market Size (US$ Bn and Units), By Design, 2017 - 2031

7.1.1. Fixed Cranes

7.1.2. Mobile Cranes

7.2. Incremental Opportunity, By Design

8. Global Static Crane Market Analysis and Forecast, By Capacity

8.1. Global Static Crane Market Size (US$ Bn and Units), By Capacity, 2017 - 2031

8.1.1. Below 1,000 lbs

8.1.2. 1,000 lbs - 5,000 lbs

8.1.3. 5,001 lbs - 10,000 lbs

8.1.4. Above 10,000 lbs

8.2. Incremental Opportunity, By Capacity

9. Global Static Crane Market Analysis and Forecast, By End-use

9.1. Global Static Crane Market Size (US$ Bn and Units), By End-use, 2017 - 2031

9.1.1. Construction

9.1.2. Mining & Excavation

9.1.3. Electric & Nuclear Power Plants

9.1.4. Marine

9.1.5. Others

9.2. Incremental Opportunity, By End-use

10. Global Static Crane Market Analysis and Forecast, By Distribution Channel

10.1. Global Static Crane Market Size (US$ Bn and Units), By Distribution Channel, 2017 - 2031

10.1.1. Direct Sales

10.1.2. Indirect Sales

10.2. Incremental Opportunity, By Distribution Channel

11. Global Static Crane Market Analysis and Forecast, Region

11.1. Global Static Crane Market Size (US$ Bn and Units), By Region, 2017 - 2031

11.1.1. North America

11.1.2. Europe

11.1.3. Asia Pacific

11.1.4. Middle East & Africa

11.1.5. South America

11.2. Incremental Opportunity, By Region

12. North America Static Crane Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Supplier Analysis

12.3. Price Trend Analysis

12.3.1. Weighted Average Selling Price (US$)

12.4. Key Trends Analysis

12.4.1. Demand Side Analysis

12.4.2. Supply Side Analysis

12.5. Static Crane Market Size (US$ Bn and Units), By Type, 2017 - 2031

12.5.1. Overhead Cranes

12.5.2. Tower Cranes

12.5.3. Level-luffing Cranes

12.6. Static Crane Market Size (US$ Bn and Units), By Design, 2017 - 2031

12.6.1. Fixed Cranes

12.6.2. Mobile Cranes

12.7. Static Crane Market Size (US$ Bn and Units), By Capacity, 2017 - 2031

12.7.1. Below 1,000 lbs

12.7.2. 1,000 lbs - 5,000 lbs

12.7.3. 5,001 lbs - 10,000 lbs

12.7.4. Above 10,000 lbs

12.8. Static Crane Market Size (US$ Bn and Units), By End-use, 2017 - 2031

12.8.1. Construction

12.8.2. Mining & Excavation

12.8.3. Electric & Nuclear Power Plants

12.8.4. Marine

12.8.5. Others

12.9. Static Crane Market Size (US$ Bn and Units), By Distribution Channel, 2017 - 2031

12.9.1. Direct Sales

12.9.2. Indirect Sales

12.10. Static Crane Market Size (US$ Bn and Units), By Country/Sub-region, 2017 - 2031

12.10.1. U.S.

12.10.2. Canada

12.10.3. Rest of North America

12.11. Incremental Opportunity Analysis

13. Europe Static Crane Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Supplier Analysis

13.3. Price Trend Analysis

13.3.1. Weighted Average Selling Price (US$)

13.4. Key Trends Analysis

13.4.1. Demand Side Analysis

13.4.2. Supply Side Analysis

13.5. Static Crane Market Size (US$ Bn and Units), By Type, 2017 - 2031

13.5.1. Overhead Cranes

13.5.2. Tower Cranes

13.5.3. Level-luffing Cranes

13.6. Static Crane Market Size (US$ Bn and Units), By Design, 2017 - 2031

13.6.1. Fixed Cranes

13.6.2. Mobile Cranes

13.7. Static Crane Market Size (US$ Bn and Units), By Capacity, 2017 - 2031

13.7.1. Below 1,000 lbs

13.7.2. 1,000 lbs - 5,000 lbs

13.7.3. 5,001 lbs - 10,000 lbs

13.7.4. Above 10,000 lbs

13.8. Static Crane Market Size (US$ Bn and Units), By End-use, 2017 - 2031

13.8.1. Construction

13.8.2. Mining & Excavation

13.8.3. Electric & Nuclear Power Plants

13.8.4. Marine

13.8.5. Others

13.9. Static Crane Market Size (US$ Bn and Units), By Distribution Channel, 2017 - 2031

13.9.1. Direct Sales

13.9.2. Indirect Sales

13.10. Static Crane Market Size (US$ Bn and Units), By Country/Sub-region, 2017 - 2031

13.10.1. EU-27

13.10.2. UK

13.10.3. Rest of Europe

13.11. Incremental Opportunity Analysis

14. Asia Pacific Static Crane Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Supplier Analysis

14.3. Price Trend Analysis

14.3.1. Weighted Average Selling Price (US$)

14.4. Key Trends Analysis

14.4.1. Demand Side Analysis

14.4.2. Supply Side Analysis

14.5. Static Crane Market Size (US$ Bn and Units), By Type, 2017 - 2031

14.5.1. Overhead Cranes

14.5.2. Tower Cranes

14.5.3. Level-luffing Cranes

14.6. Static Crane Market Size (US$ Bn and Units), By Design, 2017 - 2031

14.6.1. Fixed Cranes

14.6.2. Mobile Cranes

14.7. Static Crane Market Size (US$ Bn and Units), By Capacity, 2017 - 2031

14.7.1. Below 1,000 lbs

14.7.2. 1,000 lbs - 5,000 lbs

14.7.3. 5,001 lbs - 10,000 lbs

14.7.4. Above 10,000 lbs

14.8. Static Crane Market Size (US$ Bn and Units), By End-use, 2017 - 2031

14.8.1. Construction

14.8.2. Mining & Excavation

14.8.3. Electric & Nuclear Power Plants

14.8.4. Marine

14.8.5. Others

14.9. Static Crane Market Size (US$ Bn and Units), By Distribution Channel, 2017 - 2031

14.9.1. Direct Sales

14.9.2. Indirect Sales

14.10. Static Crane Market Size (US$ Bn and Units), By Country/Sub-region, 2017 - 2031

14.10.1. China

14.10.2. India

14.10.3. Japan

14.10.4. Rest of Asia Pacific

14.11. Incremental Opportunity Analysis

15. Middle East & Africa Static Crane Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Supplier Analysis

15.3. Price Trend Analysis

15.3.1. Weighted Average Selling Price (US$)

15.4. Key Trends Analysis

15.4.1. Demand Side Analysis

15.4.2. Supply Side Analysis

15.5. Static Crane Market Size (US$ Bn and Units), By Type, 2017 - 2031

15.5.1. Overhead Cranes

15.5.2. Tower Cranes

15.5.3. Level-luffing Cranes

15.6. Static Crane Market Size (US$ Bn and Units), By Design, 2017 - 2031

15.6.1. Fixed Cranes

15.6.2. Mobile Cranes

15.7. Static Crane Market Size (US$ Bn and Units), By Capacity, 2017 - 2031

15.7.1. Below 1,000 lbs

15.7.2. 1,000 lbs - 5,000 lbs

15.7.3. 5,001 lbs - 10,000 lbs

15.7.4. Above 10,000 lbs

15.8. Static Crane Market Size (US$ Bn and Units), By End-use, 2017 - 2031

15.8.1. Construction

15.8.2. Mining & Excavation

15.8.3. Electric & Nuclear Power Plants

15.8.4. Marine

15.8.5. Others

15.9. Static Crane Market Size (US$ Bn and Units), By Distribution Channel, 2017 - 2031

15.9.1. Direct Sales

15.9.2. Indirect Sales

15.10. Static Crane Market Size (US$ Bn and Units), By Country/Sub-region, 2017 - 2031

15.10.1. GCC

15.10.2. South Africa

15.10.3. Rest of Middle East & Africa

15.11. Incremental Opportunity Analysis

16. South America Static Crane Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Key Supplier Analysis

16.3. Price Trend Analysis

16.3.1. Weighted Average Selling Price (US$)

16.4. Key Trends Analysis

16.4.1. Demand Side Analysis

16.4.2. Supply Side Analysis

16.5. Static Crane Market Size (US$ Bn and Units), By Type, 2017 - 2031

16.5.1. Overhead Cranes

16.5.2. Tower Cranes

16.5.3. Level-luffing Cranes

16.6. Static Crane Market Size (US$ Bn and Units), By Design, 2017 - 2031

16.6.1. Fixed Cranes

16.6.2. Mobile Cranes

16.7. Static Crane Market Size (US$ Bn and Units), By Capacity, 2017 - 2031

16.7.1. Below 1,000 lbs

16.7.2. 1,000 lbs - 5,000 lbs

16.7.3. 5,001 lbs - 10,000 lbs

16.7.4. Above 10,000 lbs

16.8. Static Crane Market Size (US$ Bn and Units), By End-use, 2017 - 2031

16.8.1. Construction

16.8.2. Mining & Excavation

16.8.3. Electric & Nuclear Power Plants

16.8.4. Marine

16.8.5. Others

16.9. Static Crane Market Size (US$ Bn and Units), By Distribution Channel, 2017 - 2031

16.9.1. Direct Sales

16.9.2. Indirect Sales

16.10. Static Crane Market Size (US$ Bn and Units), By Country/Sub-region, 2017 - 2031

16.10.1. Brazil

16.10.2. Rest of South America

16.11. Incremental Opportunity Analysis

17. Competition Landscape

17.1. Market Player – Competition Dashboard

17.2. Market Share Analysis (%), 2022

17.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Financial/Revenue, Strategy & Business Overview, Sales Channel Analysis, Size Portfolio)

17.3.1. ACE Equipment Company

17.3.1.1. Company Overview

17.3.1.2. Sales Area/Geographical Presence

17.3.1.3. Financial/Revenue

17.3.1.4. Strategy & Business Overview

17.3.1.5. Sales Channel Analysis

17.3.1.6. Size Portfolio

17.3.2. Konecranes Oyj

17.3.2.1. Company Overview

17.3.2.2. Sales Area/Geographical Presence

17.3.2.3. Financial/Revenue

17.3.2.4. Strategy & Business Overview

17.3.2.5. Sales Channel Analysis

17.3.2.6. Size Portfolio

17.3.3. Liebherr-International AG

17.3.3.1. Company Overview

17.3.3.2. Sales Area/Geographical Presence

17.3.3.3. Financial/Revenue

17.3.3.4. Strategy & Business Overview

17.3.3.5. Sales Channel Analysis

17.3.3.6. Size Portfolio

17.3.4. Manitowoc Company, Inc.

17.3.4.1. Company Overview

17.3.4.2. Sales Area/Geographical Presence

17.3.4.3. Financial/Revenue

17.3.4.4. Strategy & Business Overview

17.3.4.5. Sales Channel Analysis

17.3.4.6. Size Portfolio

17.3.5. Raimondi SpA

17.3.5.1. Company Overview

17.3.5.2. Sales Area/Geographical Presence

17.3.5.3. Financial/Revenue

17.3.5.4. Strategy & Business Overview

17.3.5.5. Sales Channel Analysis

17.3.5.6. Size Portfolio

17.3.6. SANY Global

17.3.6.1. Company Overview

17.3.6.2. Sales Area/Geographical Presence

17.3.6.3. Financial/Revenue

17.3.6.4. Strategy & Business Overview

17.3.6.5. Sales Channel Analysis

17.3.6.6. Size Portfolio

17.3.7. Sarens n.v./s.a.

17.3.7.1. Company Overview

17.3.7.2. Sales Area/Geographical Presence

17.3.7.3. Financial/Revenue

17.3.7.4. Strategy & Business Overview

17.3.7.5. Sales Channel Analysis

17.3.7.6. Size Portfolio

17.3.8. Terex Corporation

17.3.8.1. Company Overview

17.3.8.2. Sales Area/Geographical Presence

17.3.8.3. Financial/Revenue

17.3.8.4. Strategy & Business Overview

17.3.8.5. Sales Channel Analysis

17.3.8.6. Size Portfolio

17.3.9. XCMG Group

17.3.9.1. Company Overview

17.3.9.2. Sales Area/Geographical Presence

17.3.9.3. Financial/Revenue

17.3.9.4. Strategy & Business Overview

17.3.9.5. Sales Channel Analysis

17.3.9.6. Size Portfolio

17.3.10. Zoomlion Heavy Industry Science & Technology Co., Ltd.

17.3.10.1. Company Overview

17.3.10.2. Sales Area/Geographical Presence

17.3.10.3. Financial/Revenue

17.3.10.4. Strategy & Business Overview

17.3.10.5. Sales Channel Analysis

17.3.10.6. Size Portfolio

18. Key Takeaways

18.1. Identification of Potential Market Spaces

18.1.1. Type

18.1.2. Design

18.1.3. Capacity

18.1.4. End-use

18.1.5. Distribution Channel

18.1.6. Geography

18.2. Understanding the Buying Process of Customers

18.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Static Crane Market, By Type, Units, 2017-2031

Table 2: Global Static Crane Market, By Type, US$ Bn, 2017-2031

Table 3: Global Static Crane Market, By Capacity, Units, 2017-2031

Table 4: Global Static Crane Market, By Capacity, US$ Bn, 2017-2031

Table 5: Global Static Crane Market, By End-use, Units, 2017-2031

Table 6: Global Static Crane Market, By End-use, US$ Bn, 2017-2031

Table 7: Global Static Crane Market, By Distribution Channel, Units, 2017-2031

Table 8: Global Static Crane Market, By Distribution Channel, US$ Bn, 2017-2031

Table 9: Global Static Crane Market, By Region, Units, 2017-2031

Table 10: Global Static Crane Market, By Region, US$ Bn, 2017-2031

Table 11: North America Static Crane Market, By Type, Units, 2017-2031

Table 12: North America Static Crane Market, By Type, US$ Bn, 2017-2031

Table 13: North America Static Crane Market, By Capacity, Units, 2017-2031

Table 14: North America Static Crane Market, By Capacity, US$ Bn, 2017-2031

Table 15: North America Static Crane Market, By End-use, Units, 2017-2031

Table 16: North America Static Crane Market, By End-use, US$ Bn, 2017-2031

Table 17: North America Static Crane Market, By Distribution Channel, Units, 2017-2031

Table 18: North America Static Crane Market, By Distribution Channel, US$ Bn, 2017-2031

Table 19: North America Static Crane Market, By Country, Units, 2017-2031

Table 20: North America Static Crane Market, By Country, US$ Bn, 2017-2031

Table 21: Europe Static Crane Market, By Type, Units, 2017-2031

Table 22: Europe Static Crane Market, By Type, US$ Bn, 2017-2031

Table 23: Europe Static Crane Market, By Capacity, Units, 2017-2031

Table 24: Europe Static Crane Market, By Capacity, US$ Bn, 2017-2031

Table 25: Europe Static Crane Market, By End-use, Units, 2017-2031

Table 26: Europe Static Crane Market, By End-use, US$ Bn, 2017-2031

Table 27: Europe Static Crane Market, By Distribution Channel, Units, 2017-2031

Table 28: Europe Static Crane Market, By Distribution Channel, US$ Bn, 2017-2031

Table 29: Europe Static Crane Market, By Country, Units, 2017-2031

Table 30: Europe Static Crane Market, By Country, US$ Bn, 2017-2031

Table 31: Asia Pacific Static Crane Market, By Type, Units, 2017-2031

Table 32: Asia Pacific Static Crane Market, By Type, US$ Bn, 2017-2031

Table 33: Asia Pacific Static Crane Market, By Capacity, Units, 2017-2031

Table 34: Asia Pacific Static Crane Market, By Capacity, US$ Bn, 2017-2031

Table 35: Asia Pacific Static Crane Market, By End-use, Units, 2017-2031

Table 36: Asia Pacific Static Crane Market, By End-use, US$ Bn, 2017-2031

Table 37: Asia Pacific Static Crane Market, By Distribution Channel, Units, 2017-2031

Table 38: Asia Pacific Static Crane Market, By Distribution Channel, US$ Bn, 2017-2031

Table 39: Asia Pacific Static Crane Market, By Country, Units, 2017-2031

Table 40: Asia Pacific Static Crane Market, By Country, US$ Bn, 2017-2031

Table 41: Middle East & Africa Static Crane Market, By Type, Units, 2017-2031

Table 42: Middle East & Africa Static Crane Market, By Type, US$ Bn, 2017-2031

Table 43: Middle East & Africa Static Crane Market, By Capacity, Units, 2017-2031

Table 44: Middle East & Africa Static Crane Market, By Capacity, US$ Bn, 2017-2031

Table 45: Middle East & Africa Static Crane Market, By End-use, Units, 2017-2031

Table 46: Middle East & Africa Static Crane Market, By End-use, US$ Bn, 2017-2031

Table 47: Middle East & Africa Static Crane Market, By Distribution Channel, Units, 2017-2031

Table 48: Middle East & Africa Static Crane Market, By Distribution Channel, US$ Bn, 2017-2031

Table 49: Middle East & Africa Static Crane Market, By Country, Units, 2017-2031

Table 50: Middle East & Africa Static Crane Market, By Country, US$ Bn, 2017-2031

Table 51: South America Static Crane Market, By Type, Units, 2017-2031

Table 52: South America Static Crane Market, By Type, US$ Bn, 2017-2031

Table 53: South America Static Crane Market, By Capacity, Units, 2017-2031

Table 54: South America Static Crane Market, By Capacity, US$ Bn, 2017-2031

Table 55: South America Static Crane Market, By End-use, Units, 2017-2031

Table 56: South America Static Crane Market, By End-use, US$ Bn, 2017-2031

Table 57: South America Static Crane Market, By Distribution Channel, Units, 2017-2031

Table 58: South America Static Crane Market, By Distribution Channel, US$ Bn, 2017-2031

Table 59: South America Static Crane Market, By Country, Units, 2017-2031

Table 60: South America Static Crane Market, By Country, US$ Bn, 2017-2031

List of Figures

Figure 1: Global Static Crane Market, By Type, Units, 2017-2031

Figure 2: Global Static Crane Market, By Type, US$ Bn, 2017-2031

Figure 3: Global Static Crane Market Incremental Opportunity, By Type, US$ Bn, 2017-2031

Figure 4: Global Static Crane Market, By Capacity, Units, 2017-2031

Figure 5: Global Static Crane Market, By Capacity, US$ Bn, 2017-2031

Figure 6: Global Static Crane Market Incremental Opportunity, By Capacity, US$ Bn, 2017-2031

Figure 7: Global Static Crane Market, By End-use, Units, 2017-2031

Figure 8: Global Static Crane Market, By End-use, US$ Bn, 2017-2031

Figure 9: Global Static Crane Market Incremental Opportunity, By End-use, US$ Bn, 2017-2031

Figure 10: Global Static Crane Market, By Distribution Channel, Units, 2017-2031

Figure 11: Global Static Crane Market, By Distribution Channel, US$ Bn, 2017-2031

Figure 12: Global Static Crane Market Incremental Opportunity, By Distribution Channel, US$ Bn, 2017-2031

Figure 13: Global Static Crane Market, By Region, Units, 2017-2031

Figure 14: Global Static Crane Market, By Region, US$ Bn, 2017-2031

Figure 15: Global Static Crane Market Incremental Opportunity, By Region, US$ Bn, 2017-2031

Figure 16: North America Static Crane Market, By Type, Units, 2017-2031

Figure 17: North America Static Crane Market, By Type, US$ Bn, 2017-2031

Figure 18: North America Static Crane Market Incremental Opportunity, By Type, US$ Bn, 2017-2031

Figure 19: North America Static Crane Market, By Capacity, Units, 2017-2031

Figure 20: North America Static Crane Market, By Capacity, US$ Bn, 2017-2031

Figure 21: North America Static Crane Market Incremental Opportunity, By Capacity, US$ Bn, 2017-2031

Figure 22: North America Static Crane Market, By End-use, Units, 2017-2031

Figure 23: North America Static Crane Market, By End-use, US$ Bn, 2017-2031

Figure 24: North America Static Crane Market Incremental Opportunity, By End-use, US$ Bn, 2017-2031

Figure 25: North America Static Crane Market, By Distribution Channel, Units, 2017-2031

Figure 26: North America Static Crane Market, By Distribution Channel, US$ Bn, 2017-2031

Figure 27: North America Static Crane Market Incremental Opportunity, By Distribution Channel, US$ Bn, 2017-2031

Figure 28: North America Static Crane Market, By Country, Units, 2017-2031

Figure 29: North America Static Crane Market, By Country, US$ Bn, 2017-2031

Figure 30: North America Static Crane Market Incremental Opportunity, By Country, US$ Bn, 2017-2031

Figure 31: Europe Static Crane Market, By Type, Units, 2017-2031

Figure 32: Europe Static Crane Market, By Type, US$ Bn, 2017-2031

Figure 33: Europe Static Crane Market Incremental Opportunity, By Type, US$ Bn, 2017-2031

Figure 34: Europe Static Crane Market, By Capacity, Units, 2017-2031

Figure 35: Europe Static Crane Market, By Capacity, US$ Bn, 2017-2031

Figure 36: Europe Static Crane Market Incremental Opportunity, By Capacity, US$ Bn, 2017-2031

Figure 37: Europe Static Crane Market, By End-use, Units, 2017-2031

Figure 38: Europe Static Crane Market, By End-use, US$ Bn, 2017-2031

Figure 39: Europe Static Crane Market Incremental Opportunity, By End-use, US$ Bn, 2017-2031

Figure 40: Europe Static Crane Market, By Distribution Channel, Units, 2017-2031

Figure 41: Europe Static Crane Market, By Distribution Channel, US$ Bn, 2017-2031

Figure 42: Europe Static Crane Market Incremental Opportunity, By Distribution Channel, US$ Bn, 2017-2031

Figure 43: Europe Static Crane Market, By Country, Units, 2017-2031

Figure 44: Europe Static Crane Market, By Country, US$ Bn, 2017-2031

Figure 45: Europe Static Crane Market Incremental Opportunity, By Country, US$ Bn, 2017-2031

Figure 46: Asia Pacific Static Crane Market, By Type, Units, 2017-2031

Figure 47: Asia Pacific Static Crane Market, By Type, US$ Bn, 2017-2031

Figure 48: Asia Pacific Static Crane Market Incremental Opportunity, By Type, US$ Bn, 2017-2031

Figure 49: Asia Pacific Static Crane Market, By Capacity, Units, 2017-2031

Figure 50: Asia Pacific Static Crane Market, By Capacity, US$ Bn, 2017-2031

Figure 51: Asia Pacific Static Crane Market Incremental Opportunity, By Capacity, US$ Bn, 2017-2031

Figure 52: Asia Pacific Static Crane Market, By End-use, Units, 2017-2031

Figure 53: Asia Pacific Static Crane Market, By End-use, US$ Bn, 2017-2031

Figure 54: Asia Pacific Static Crane Market Incremental Opportunity, By End-use, US$ Bn, 2017-2031

Figure 55: Asia Pacific Static Crane Market, By Distribution Channel, Units, 2017-2031

Figure 56: Asia Pacific Static Crane Market, By Distribution Channel, US$ Bn, 2017-2031

Figure 57: Asia Pacific Static Crane Market Incremental Opportunity, By Distribution Channel, US$ Bn, 2017-2031

Figure 58: Asia Pacific Static Crane Market, By Country, Units, 2017-2031

Figure 59: Asia Pacific Static Crane Market, By Country, US$ Bn, 2017-2031

Figure 60: Asia Pacific Static Crane Market Incremental Opportunity, By Country, US$ Bn, 2017-2031

Figure 61: Middle East & Africa Static Crane Market, By Type, Units, 2017-2031

Figure 62: Middle East & Africa Static Crane Market, By Type, US$ Bn, 2017-2031

Figure 63: Middle East & Africa Static Crane Market Incremental Opportunity, By Type, US$ Bn, 2017-2031

Figure 64: Middle East & Africa Static Crane Market, By Capacity, Units, 2017-2031

Figure 65: Middle East & Africa Static Crane Market, By Capacity, US$ Bn, 2017-2031

Figure 66: Middle East & Africa Static Crane Market Incremental Opportunity, By Capacity, US$ Bn, 2017-2031

Figure 67: Middle East & Africa Static Crane Market, By End-use, Units, 2017-2031

Figure 68: Middle East & Africa Static Crane Market, By End-use, US$ Bn, 2017-2031

Figure 69: Middle East & Africa Static Crane Market Incremental Opportunity, By End-use, US$ Bn, 2017-2031

Figure 70: Middle East & Africa Static Crane Market, By Distribution Channel, Units, 2017-2031

Figure 71: Middle East & Africa Static Crane Market, By Distribution Channel, US$ Bn, 2017-2031

Figure 72: Middle East & Africa Static Crane Market Incremental Opportunity, By Distribution Channel, US$ Bn, 2017-2031

Figure 73: Middle East & Africa Static Crane Market, By Country, Units, 2017-2031

Figure 74: Middle East & Africa Static Crane Market, By Country, US$ Bn, 2017-2031

Figure 75: Middle East & Africa Static Crane Market Incremental Opportunity, By Country, US$ Bn, 2017-2031

Figure 76: South America Static Crane Market, By Type, Units, 2017-2031

Figure 77: South America Static Crane Market, By Type, US$ Bn, 2017-2031

Figure 78: South America Static Crane Market Incremental Opportunity, By Type, US$ Bn, 2017-2031

Figure 79: South America Static Crane Market, By Capacity, Units, 2017-2031

Figure 80: South America Static Crane Market, By Capacity, US$ Bn, 2017-2031

Figure 81: South America Static Crane Market Incremental Opportunity, By Capacity, US$ Bn, 2017-2031

Figure 82: South America Static Crane Market, By End-use, Units, 2017-2031

Figure 83: South America Static Crane Market, By End-use, US$ Bn, 2017-2031

Figure 84: South America Static Crane Market Incremental Opportunity, By End-use, US$ Bn, 2017-2031

Figure 85: South America Static Crane Market, By Distribution Channel, Units, 2017-2031

Figure 86: South America Static Crane Market, By Distribution Channel, US$ Bn, 2017-2031

Figure 87: South America Static Crane Market Incremental Opportunity, By Distribution Channel, US$ Bn, 2017-2031

Figure 88: South America Static Crane Market, By Country, Units, 2017-2031

Figure 89: South America Static Crane Market, By Country, US$ Bn, 2017-2031

Figure 90: South America Static Crane Market Incremental Opportunity, By Country, US$ Bn, 2017-2031