Reports

Reports

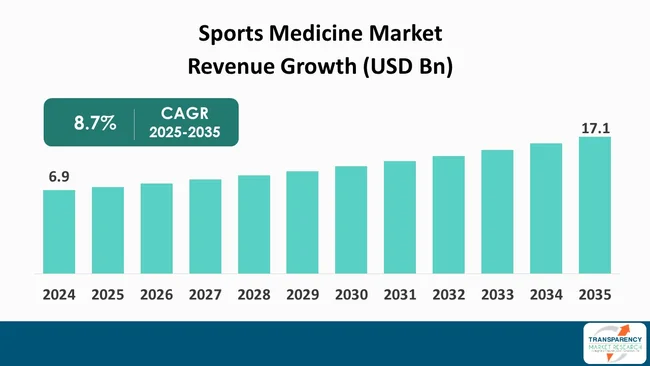

The global Sports Medicine market size was valued at US$ 6.9 billion in 2024 and is projected to reach US$ 17.1 billion by 2035, expanding at a CAGR of 8.7% from 2025 to 2035. The market growth is driven by increasing participation in sports and fitness activities and rising incidence of sports injuries

The sports medicine market is expected to expand on a significant note in the forecast period. This development is likely to be largely influenced by an increasing awareness of physical fitness among the individuals. Besides, the growing participation in sports and the other recreational activities will contribute to this upward curve.

The rationale behind this is that the need for medical services and products that are specially designed for the prevention, diagnosis, and treatment of sports-related injuries. Moreover, the frequency of sports injuries is the trigger for the need for medical services and products to prevent, diagnose, and treat sports-related injuries.

The upward trajectory is further supported by the major technological advancements, which have resulted in a rapid increase in treatment options, especially those involving minimally-invasive surgical techniques and the use of modern rehabilitation devices. Furthermore, the adoption of various digital health technologies including telemedicine and the use of wearable fitness tech have facilitated better patient monitoring and engagement. This, in turn, brings about a positive impact on the recovery process.

Furthermore, the growing emphasis on achieving an optimum sports performance is encouraging the participants in the sports market to consume sports nutrition products, supplements, and even seek the help of performance-enhancing therapies, thereby significantly increasing the market for sports medicine. It is therefore clear that as the idea of prevention and management of injuries becomes more popular among healthcare providers, sports organizations, and fitness enthusiasts, the market will blossom.

Sports medicine deals with the diagnosis, prevention, treatment, and rehabilitation of sports- and exercise-related injuries. It does involve a multidisciplinary approach, whereby the knowledge of different healthcare and medical fields such as physical therapy, orthopedics, nutrition, and psychology is combined.

The main objective of sports medicine professionals is to enhance the performance of the athlete and also maintain his/her safety and comfort, whether he/she is a professional or a recreational participant.

In order to be successful, sports medicine practitioners apply various methods such as physical therapy, and cutting-edge rehabilitation programs in order to match perfectly with the requirements of the athlete.

Of late, the growing emphasis on wellness and fitness, coupled with an increase in sports participation, has spurred the demand for sports medicine services. Wearable fitness devices and telemedicine have led to a complete reshaping of the sports medicine field, wherein all the latest injury prevention and recovery protocols are embraced.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

One of the main reasons for the increase in the sports medicine market is the growing trend in sports and fitness activities. As the world's health consciousness goes up, more number of people are taking part in different physical activities, etc. sports for fun or athletics for competition. The trend is evident in most youthful populations, mainly as they are open to adopting active lifestyles. On the other hand, the geriatric population is also in the picture as they realize the importance of physical activity in the process of keeping one’s health and vigor.

There is a rise in the number of sports-related injuries that accompany the rise in participation. In fact, the injuries range from scratches to serious conditions that require medication. Along with this, the demand for specialized sports medicine has also gone up, which include the services of prevention, diagnosis, cure, and rehabilitation of our body.

Another trend that has contributed to market expansion is the fact that fitness lovers and professional athletes keep appealing to the expertise of specialists in order to optimize their performance, and at the same time, to make sure that they are not going to get injured.

Therefore, more resources have been allocated on the aspects of preventive care, rehabilitation programs, and advanced training techniques. This is the moment for the market to expand enormously as the sports medicine professionals become the necessary part of the athlete’s success and wellness. To sum up, the increasing participation in the sports and fitness activities is not only the source of high demand in sports medicine services but also has the power to turn the market into one that embraces and fosters health and performance improvement as its major culture.

The sports medicine market is being significantly driven by the increase in the number of sports injuries that have been rising steadily.

These injuries have led to an increase in the need for specialized services in sports medicine, a situation that is leading to a realignment of the healthcare sector. Providers are committing themselves to developing new options for treatment, rehabilitation, and even the practice of preventive medicine that is capable of supporting the athletes with a quick and safe return to their regular activities.

The emphasis on the correct and prompt treatment of sports injuries not only improves the recovery process but also helps in the prevention of various complications that might be a consequence of the injury.

Besides, understanding that sports injury issues have an influence on general health and performance is motivating athletes and fitness lovers to take professional advice.

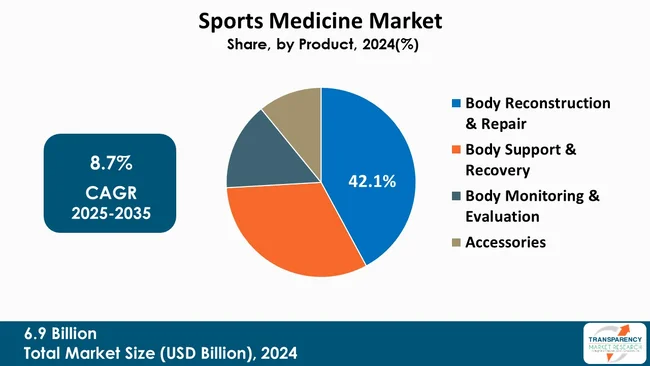

The body reconstruction and repair product segment is one of the major factors that are lead to growth in the sports medicine industry. The main reason for the increase in the number of surgical interventions is the rising number of sports-related injuries that require such operations as well as the need for advanced therapeutic solutions. The consequence is a skyrocketing demand for products that are developed to support recovery, cultivate healing, and reconstruct the lost function. The products in this sector are surgical implants, grafts, and biologics, which are those used in the reconstruction of tissues, ligaments, and bones that are injured.

One of the contributing factors to the increased use of body reconstruction products in sports medicine is the tremendous technological change in the materials and methods. These changes have allowed the production of highly advanced reconstruction products with improved biocompatibility, longevity, and efficiency. The creation of tissue that has been bioengineered and the use of new scaffolding materials for the injured part have changed the whole field of soft tissue injury repair, which, in turn, has resulted in the best possible outcome of patients’ health.

On top of that, the present-day concentration on minimally-invasive surgical techniques has led to the popularity of body reconstruction products. Those surgical methods are usually characterized by short recovery times and low risk of post-operative complications. This segment thus emerges as a major growth driver in the sports medicine market owing to the increasing injury rates, the development of reconstruction technologies, and the emphasis on recovery solutions, which together send a strong signal of commitment to athlete health and performance.

| Attribute | Detail |

|---|---|

| Leading Region |

|

The sports medicine market in North America is leading by a large margin due to several factors such as strong healthcare infrastructure, high sports activities and huge money being invested in research and development. The region comprises the world's top-rated sports organizations and institutions, which along with the demand of specialized medical services, promotes a culture of athletic excellence. The widespread Health and Fitness consciousness among the society has opened new avenues for participation in various sports, which has resulted in the occurrence of sports injuries and thereby necessitated professional care.

Moreover, North America is full of modern and high-tech medical equipment and is known for its out-of-the-box and successful treatment plans. This leading edge of technology in the treatment of injury entices the less number of days for recovery and good health return.

The region's major pharmaceutical and medical device companies, who are always working on the development of new products and services that meet the needs of sports professionals and individuals who lead an active life, are a major drivers to the growth of the market. On the other hand, the availability of sports medicine clinics and health centers that have been developed over a long period has given athletes the advantage of the necessary specialized care. The whole package of sports medicine in North America, being in line with its pledge toward the innovation and quality of care, makes it the leader of this market. Analysis of Key Players in Sports Medicine Market

Zimmer Biomet, Stryker, DePuy Synthes, Smith+Nephew, GE HealthCare, Star Sports Medicine Co., Ltd., Arthrex, Inc., Breg Inc., Mueller Sports Inc., KARL STORZ, Bauerfeind AG, Ossur, Cramer Products, RôG Sports Medicine, Biotek are the key players governing the global Sports Medicine Market.

Each of these players has been profiled in the market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 6.9 Bn |

| Forecast Value in 2035 | More than US$ 17.1 Bn |

| CAGR | 8.7% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Product

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 6.9 Bn in 2024

It is projected to cross US$ 17.1 Bn by the end of 2035

Increasing participation in sports and fitness activities and rising incidence of sports injuries

It is anticipated to grow at a CAGR of 8.7% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Zimmer Biomet, Stryker, DePuy Synthes, Smith+Nephew, GE HealthCare, Star Sports Medicine Co., Ltd., Arthrex, Inc., Breg Inc., Mueller Sports Inc., KARL STORZ, Bauerfeind AG, Ossur, Cramer Products, RôG Sports Medicine, Biotek, and others

Table 01: Global Sports Medicine Market Value (US$ Bn) Forecast, By Product, 2020 to 2035

Table 02: Global Sports Medicine Market Value (US$ Bn) Forecast, By Body Reconstruction & Repair, 2020 to 2035

Table 03: Global Sports Medicine Market Value (US$ Bn) Forecast, By Body Support & Recovery, 2020 to 2035

Table 04: Global Sports Medicine Market Value (US$ Bn) Forecast, By Body Monitoring & Evaluation, 2020 to 2035

Table 05: Global Sports Medicine Market Value (US$ Bn) Forecast, By Accessories, 2020 to 2035

Table 06: Global Sports Medicine Market Value (US$ Bn) Forecast, By Treatment Type, 2020 to 2035

Table 07: Global Sports Medicine Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 08: Global Sports Medicine Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 09: Global Sports Medicine Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 10: North America Sports Medicine Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 11: North America Sports Medicine Market Value (US$ Bn) Forecast, By Product, 2020 to 2035

Table 12: North America Sports Medicine Market Value (US$ Bn) Forecast, By Body Reconstruction & Repair, 2020 to 2035

Table 13: North America Sports Medicine Market Value (US$ Bn) Forecast, By Body Support & Recovery, 2020 to 2035

Table 14: North America Sports Medicine Market Value (US$ Bn) Forecast, By Body Monitoring & Evaluation, 2020 to 2035

Table 15: North America Sports Medicine Market Value (US$ Bn) Forecast, By Accessories, 2020 to 2035

Table 16: North America Sports Medicine Market Value (US$ Bn) Forecast, By Treatment Type, 2020 to 2035

Table 17: North America Sports Medicine Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 18: North America Sports Medicine Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 19: Europe Sports Medicine Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 20: Europe Sports Medicine Market Value (US$ Bn) Forecast, By Product, 2020 to 2035

Table 21: Europe Sports Medicine Market Value (US$ Bn) Forecast, By Body Reconstruction & Repair, 2020 to 2035

Table 22: Europe Sports Medicine Market Value (US$ Bn) Forecast, By Body Support & Recovery, 2020 to 2035

Table 23: Europe Sports Medicine Market Value (US$ Bn) Forecast, By Body Monitoring & Evaluation, 2020 to 2035

Table 24: Europe Sports Medicine Market Value (US$ Bn) Forecast, By Accessories, 2020 to 2035

Table 25: Europe Sports Medicine Market Value (US$ Bn) Forecast, By Treatment Type, 2020 to 2035

Table 26: Europe Sports Medicine Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 27: Europe Sports Medicine Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 28: Asia Pacific Sports Medicine Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 29: Asia Pacific Sports Medicine Market Value (US$ Bn) Forecast, By Product, 2020 to 2035

Table 30: Asia Pacific Sports Medicine Market Value (US$ Bn) Forecast, By Body Reconstruction & Repair, 2020 to 2035

Table 31: Asia Pacific Sports Medicine Market Value (US$ Bn) Forecast, By Body Support & Recovery, 2020 to 2035

Table 32: Asia Pacific Sports Medicine Market Value (US$ Bn) Forecast, By Body Monitoring & Evaluation, 2020 to 2035

Table 33: Asia Pacific Sports Medicine Market Value (US$ Bn) Forecast, By Accessories, 2020 to 2035

Table 34: Asia Pacific Sports Medicine Market Value (US$ Bn) Forecast, By Treatment Type, 2020 to 2035

Table 35: Asia Pacific Sports Medicine Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 36: Asia Pacific Sports Medicine Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 37: Latin America Sports Medicine Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 38: Latin America Sports Medicine Market Value (US$ Bn) Forecast, By Product, 2020 to 2035

Table 39: Latin America Sports Medicine Market Value (US$ Bn) Forecast, By Body Reconstruction & Repair, 2020 to 2035

Table 40: Latin America Sports Medicine Market Value (US$ Bn) Forecast, By Body Support & Recovery, 2020 to 2035

Table 41: Latin America Sports Medicine Market Value (US$ Bn) Forecast, By Body Monitoring & Evaluation, 2020 to 2035

Table 42: Latin America Sports Medicine Market Value (US$ Bn) Forecast, By Accessories, 2020 to 2035

Table 43: Latin America Sports Medicine Market Value (US$ Bn) Forecast, By Treatment Type, 2020 to 2035

Table 44: Latin America Sports Medicine Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 45: Latin America Sports Medicine Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 46: Middle East & Africa Sports Medicine Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 47: Middle East & Africa Sports Medicine Market Value (US$ Bn) Forecast, By Product, 2020 to 2035

Table 48: Middle East & Africa Sports Medicine Market Value (US$ Bn) Forecast, By Body Reconstruction & Repair, 2020 to 2035

Table 49: Middle East & Africa Sports Medicine Market Value (US$ Bn) Forecast, By Body Support & Recovery, 2020 to 2035

Table 50: Middle East & Africa Sports Medicine Market Value (US$ Bn) Forecast, By Body Monitoring & Evaluation, 2020 to 2035

Table 51: Middle East & Africa Sports Medicine Market Value (US$ Bn) Forecast, By Accessories, 2020 to 2035

Table 52: Middle East & Africa Sports Medicine Market Value (US$ Bn) Forecast, By Treatment Type, 2020 to 2035

Table 53: Middle East & Africa Sports Medicine Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 54: Middle East & Africa Sports Medicine Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Figure 01: Global Sports Medicine Market Value Share Analysis, By Product, 2024 and 2035

Figure 02: Global Sports Medicine Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 03: Global Sports Medicine Market Revenue (US$ Bn), by Body Reconstruction & Repair, 2020 to 2035

Figure 04: Global Sports Medicine Market Revenue (US$ Bn), by Body Support & Recovery, 2020 to 2035

Figure 05: Global Sports Medicine Market Revenue (US$ Bn), by Body Monitoring & Evaluation, 2020 to 2035

Figure 06: Global Sports Medicine Market Revenue (US$ Bn), by Accessories, 2020 to 2035

Figure 07: Global Sports Medicine Market Value Share Analysis, By Treatment Type, 2024 and 2035

Figure 08: Global Sports Medicine Market Attractiveness Analysis, By Treatment Type, 2025 to 2035

Figure 09: Global Sports Medicine Market Revenue (US$ Bn), by Active Treatment, 2020 to 2035

Figure 10: Global Sports Medicine Market Revenue (US$ Bn), by Passive Treatment, 2020 to 2035

Figure 11: Global Sports Medicine Market Value Share Analysis, By Application, 2024 and 2035

Figure 12: Global Sports Medicine Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 13: Global Sports Medicine Market Revenue (US$ Bn), by Knee Injuries, 2020 to 2035

Figure 14: Global Sports Medicine Market Revenue (US$ Bn), by Shoulder Injuries, 2020 to 2035

Figure 15: Global Sports Medicine Market Revenue (US$ Bn), by Foot and Ankle Injuries, 2020 to 2035

Figure 16: Global Sports Medicine Market Revenue (US$ Bn), by Hip and Groin Injuries, 2020 to 2035

Figure 17: Global Sports Medicine Market Revenue (US$ Bn), by Elbow and Wrist Injuries, 2020 to 2035

Figure 18: Global Sports Medicine Market Revenue (US$ Bn), by Back and Spine Injuries, 2020 to 2035

Figure 19: Global Sports Medicine Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 20: Global Sports Medicine Market Value Share Analysis, By End-user, 2024 and 2035

Figure 21: Global Sports Medicine Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 22: Global Sports Medicine Market Revenue (US$ Bn), by Hospitals, 2020 to 2035

Figure 23: Global Sports Medicine Market Revenue (US$ Bn), by Orthopedic Specialty Clinics, 2020 to 2035

Figure 24: Global Sports Medicine Market Revenue (US$ Bn), by Ambulatory Surgical Centers (ASCs), 2020 to 2035

Figure 25: Global Sports Medicine Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 26: Global Sports Medicine Market Value Share Analysis, By Region, 2024 and 2035

Figure 27: Global Sports Medicine Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 28: North America Sports Medicine Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 29: North America Sports Medicine Market Value Share Analysis, by Country, 2024 and 2035

Figure 30: North America Sports Medicine Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 31: North America Sports Medicine Market Value Share Analysis, By Product, 2024 and 2035

Figure 32: North America Sports Medicine Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 33: North America Sports Medicine Market Value Share Analysis, By Treatment Type, 2024 and 2035

Figure 34: North America Sports Medicine Market Attractiveness Analysis, By Treatment Type, 2025 to 2035

Figure 35: North America Sports Medicine Market Value Share Analysis, By Application, 2024 and 2035

Figure 36: North America Sports Medicine Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 37: North America Sports Medicine Market Value Share Analysis, By End-user, 2024 and 2035

Figure 38: North America Sports Medicine Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 39: Europe Sports Medicine Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 40: Europe Sports Medicine Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 41: Europe Sports Medicine Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 42: Europe Sports Medicine Market Value Share Analysis, By Product, 2024 and 2035

Figure 43: Europe Sports Medicine Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 44: Europe Sports Medicine Market Value Share Analysis, By Treatment Type, 2024 and 2035

Figure 45: Europe Sports Medicine Market Attractiveness Analysis, By Treatment Type, 2025 to 2035

Figure 46: Europe Sports Medicine Market Value Share Analysis, By Application, 2024 and 2035

Figure 47: Europe Sports Medicine Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 48: Europe Sports Medicine Market Value Share Analysis, By End-user, 2024 and 2035

Figure 49: Europe Sports Medicine Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 50: Asia Pacific Sports Medicine Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 51: Asia Pacific Sports Medicine Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 52: Asia Pacific Sports Medicine Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 53: Asia Pacific Sports Medicine Market Value Share Analysis, By Product, 2024 and 2035

Figure 54: Asia Pacific Sports Medicine Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 55: Asia Pacific Sports Medicine Market Value Share Analysis, By Treatment Type, 2024 and 2035

Figure 56: Asia Pacific Sports Medicine Market Attractiveness Analysis, By Treatment Type, 2025 to 2035

Figure 57: Asia Pacific Sports Medicine Market Value Share Analysis, By Application, 2024 and 2035

Figure 58: Asia Pacific Sports Medicine Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 59: Asia Pacific Sports Medicine Market Value Share Analysis, By End-user, 2024 and 2035

Figure 60: Asia Pacific Sports Medicine Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 61: Latin America Sports Medicine Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 62: Latin America Sports Medicine Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 63: Latin America Sports Medicine Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 64: Latin America Sports Medicine Market Value Share Analysis, By Product, 2024 and 2035

Figure 65: Latin America Sports Medicine Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 66: Latin America Sports Medicine Market Value Share Analysis, By Treatment Type, 2024 and 2035

Figure 67: Latin America Sports Medicine Market Attractiveness Analysis, By Treatment Type, 2025 to 2035

Figure 68: Latin America Sports Medicine Market Value Share Analysis, By Application, 2024 and 2035

Figure 69: Latin America Sports Medicine Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 70: Latin America Sports Medicine Market Value Share Analysis, By End-user, 2024 and 2035

Figure 71: Latin America Sports Medicine Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 72: Middle East & Africa Sports Medicine Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 73: Middle East & Africa Sports Medicine Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 74: Middle East & Africa Sports Medicine Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 75: Middle East & Africa Sports Medicine Market Value Share Analysis, By Product, 2024 and 2035

Figure 76: Middle East & Africa Sports Medicine Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 77: Middle East & Africa Sports Medicine Market Value Share Analysis, By Treatment Type, 2024 and 2035

Figure 78: Middle East & Africa Sports Medicine Market Attractiveness Analysis, By Treatment Type, 2025 to 2035

Figure 79: Middle East & Africa Sports Medicine Market Value Share Analysis, By Application, 2024 and 2035

Figure 80: Middle East & Africa Sports Medicine Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 81: Middle East & Africa Sports Medicine Market Value Share Analysis, By End-user, 2024 and 2035

Figure 82: Middle East & Africa Sports Medicine Market Attractiveness Analysis, By End-user, 2025 to 2035