Reports

Reports

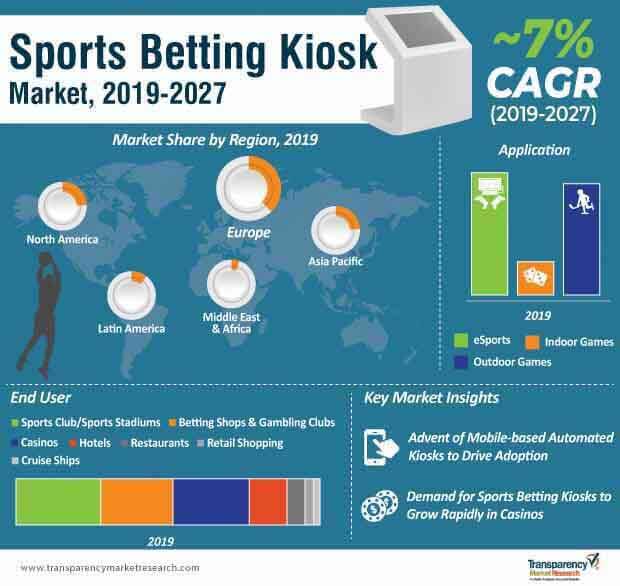

These are exciting times to be in the sports betting kiosk market, since more countries are legalizing sports betting, and as such, there is an increasing need to cater to a large consumer base across new markets. The impactful trend that has disrupted the sports betting kiosk industry is the spurt in the adoption of automated and self-service kiosk solutions at stadiums and sports clubs. With the drumbeat of digitization, market players are stepping up to incorporate digital signage in businesses, and, in turn, save on employing sales representatives. All in all, market players can look at an above-average CAGR of ~7% during the period of 2019-2027.

The sports betting kiosk market in Europe, with lenient betting laws, is projected to lead with a market share of ~38% in 2019, as consumers evince high interest in gambling activities, and continuous innovations being brought in by market players concentrated in the region. Another interesting finding of the report shows that, service providers prefer white-labeled kiosks over branded ones, as they look at lowering the per-unit cost of these kiosks. The sales of white-labeled sports betting kiosks are likely to advance at a CAGR of ~8%, while that of branded kiosks will register a CAGR of ~7% during 2019-2027.

High sales of sports betting kiosks are attributable to their increasing adoption at sports clubs, sports stadiums, betting shops, and gambling clubs, growing at a CAGR of ~8% over the course of the forecast period, followed by casinos. However, the popularity of gambling as a leisure activity is likely to turn restaurants, resorts, and hotels into lucrative end users.

As market players look at ways to gain marginal growth, some are poised to reap benefits from centralized record systems to save manual efforts and cut down their workforces. However, market players could possibly encounter a challenge while penetrating sports betting kiosks into end-user segments, given the high cost of installation. The cost-prohibitive nature of these kiosks further carries forward, as the maintenance requirements of these kiosks are high, on account of the frequent replacement of touchscreens.

The sports betting kiosk market remains highly consolidated, with leading players expanding territories of the entire industry. Leading players gain with the first-mover’s advantage through the development of customized and value-added sports betting kiosks. With their high exposure in numerous geographies, leading players can offer maintenance services to address issues arising in their unique solutions. For instance, in 2017, Kambi Group PLC announced the launch of a new online sports betting solution in Pennsylvania. This solution offers 24/7 sports betting services to wagers.

On top of that, as the integration of digital technology is integral to infiltrating in the consumer space, market players are staying abreast with technology to offer self service kiosks with features such as ticketing, centralized record systems, bet ticket scanning, and ease of self-betting, which gives traction to technological partnerships. For instance, in 2019, KIOSK Information Systems announced a technological partnership with Bitcoin ATM pioneer Bitshop, to offer next-gen Bitcoin ATM systems.

Analysts’ Viewpoint

Authors of the report foresee a propitious growth of the sports betting kiosk market during 2019-2027. As per their analysis, a spurt in the adoption of sports betting kiosks will be attributable to the legalization of betting in many regions. Investments made towards offering fully-automated ticketing services will create lucrative sales opportunities for market players, as compared to conventional methods that include longer wait times. Since high installation and maintenance costs displease service providers, and, in turn, lead to low adoption, market players can offer bundled maintenance services for a said duration, especially in new markets. Besides, market players can incorporate efficient malware-preventive software to curb instances of cyber threats.

Sports Betting Kiosk Market in Brief

Sports Betting Kiosk Market - Definition

Europe Sports Betting Kiosk Market

Key Growth Drivers of the Sports Betting Kiosk Market

Key Challenges Faced by Sports Betting Kiosk Market Players

Sports Betting Kiosk Market - Company Profile Snapshot

1. Preface

1.1. Market Scope

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Market Taxonomy - Segment Definitions

2.2. Research Methodology

2.2.1. List of Primary and Secondary Sources

2.3. Key Assumptions for Data Modeling

3. Executive Summary : Global Sports Betting Kiosk Market

4. Market Overview

4.1. Introduction

4.2. Global Market – Macro Economic Factors Overview

4.2.1. World GDP Indicator – For Top 20 Economies

4.2.2. Global ICT Spending (US$ Mn), 2013, 2018, 2023, 2027

4.3. Technology/Product Roadmap

4.4. Market Factor Analysis

4.4.1. Porter’s Five Forces Analysis

4.4.2. PESTEL Analysis

4.4.3. Value Chain Analysis

4.4.4. Market Dynamics (Growth Influencers)

4.4.4.1. Drivers

4.4.4.2. Restraints

4.4.4.3. Opportunities

4.4.4.4. Impact Analysis of Drivers & Restraints

4.5. Policies and Regulations – by Region

4.6. Digitization in Sport betting Industry

4.7. Adoption Analysis of Sports Betting Kiosk, by Sports Type

4.7.1. Horse Riding

4.7.2. Cricket

4.7.3. Football

4.7.4. Basketball

4.7.5. Others (Track Racing, Hockey, Baseball, etc.)

4.8. Global Sports Betting Kiosk Market Analysis and Forecast, 2012 - 2027

4.8.1. Market Revenue Analysis (US$ Mn)

4.8.1.1. Historic Growth Trends, 2012-2018

4.8.1.2. Forecast Trends, 2019-2027

4.9. Market Opportunity Analysis– By Region/ Country (North America/ Europe/ Asia Pacific/ Middle East & Africa/ South America)

4.9.1. By Region/Country

4.9.2. By Ownership

4.9.3. By Application

4.9.4. By End User

4.10. Competitive Scenario and Trends

4.10.1. Sports Betting Kiosk Market Concentration Rate

4.10.1.1. List of Emerging, Prominent and Leading Players

4.10.2. Mergers & Acquisitions, Expansions

4.11. Market Outlook

5. Global Sports Betting Kiosk Market Analysis And Forecast, By Ownership

5.1. Overview and Definition

5.2. Key Segment Analysis

5.3. Sports Betting Kiosk Market Size (US$ Mn) Forecast, By Ownership, 2017 - 2027

5.3.1. White labeled

5.3.2. Branded

6. Global Sports Betting Kiosk Market Analysis And Forecast, By Application

6.1. Overview and Definition

6.2. Key Segment Analysis

6.3. Sports Betting Kiosk Market Size (US$ Mn) Forecast, By Application, 2017 - 2027

6.3.1. eSports

6.3.2. Indoor Games

6.3.3. Outdoor Games

7. Global Sports Betting Kiosk Market Analysis And Forecast, By End User

7.1. Overview and Definition

7.2. Key Segment Analysis

7.3. Sports Betting Kiosk Market Size (US$ Mn) Forecast, By End User, 2017 - 2027

7.3.1. Sports Clubs / Sports Stadiums

7.3.2. Betting Shops & Gambling Clubs

7.3.3. Casinos

8. Global Sports Betting Kiosk Market Analysis and Forecast, by Region

8.1. Overview

8.2. Key Findings

8.3. Sports Betting Kiosk Market Size (US$ Mn) Forecast, by Region, 2017 - 2027

8.3.1. North America

8.3.2. Europe

8.3.3. Asia Pacific

8.3.4. Middle East & Africa

8.3.5. South America

9. North America Sports Betting Kiosk Market Analysis and Forecast

9.1. Key Findings

9.2. Sports Betting Kiosk Market Size (US$ Mn) Forecast, By Ownership, 2017 - 2027

9.2.1. White labeled

9.2.2. Branded

9.3. Sports Betting Kiosk Market Size (US$ Mn) Forecast, By Application, 2017 - 2027

9.3.1. eSports

9.3.2. Indoor Games

9.3.3. Outdoor Games

9.4. Sports Betting Kiosk Market Size (US$ Mn) Forecast, By End User, 2017 - 2027

9.4.1. Sports Clubs / Sports Stadiums

9.4.2. Betting Shops & Gambling Clubs

9.4.3. Casinos

9.5. Sports Betting Kiosk Market Size (US$ Mn) Forecast, By Country & Sub-region, 2017 - 2027

9.5.1. The U.S.

9.5.2. Canada

9.5.3. Rest of North America

10. Europe Sports Betting Kiosk Market Analysis and Forecast

10.1. Key Findings

10.2. Sports Betting Kiosk Market Size (US$ Mn) Forecast, By Ownership, 2017 - 2027

10.2.1. White labeled

10.2.2. Branded

10.3. Sports Betting Kiosk Market Size (US$ Mn) Forecast, By Application, 2017 - 2027

10.3.1. eSports

10.3.2. Indoor Games

10.3.3. Outdoor Games

10.4. Sports Betting Kiosk Market Size (US$ Mn) Forecast, By End User, 2017 - 2027

10.4.1. Sports Clubs / Sports Stadiums

10.4.2. Betting Shops & Gambling Clubs

10.4.3. Casinos

10.5. Sports Betting Kiosk Market Size (US$ Mn) Forecast, By Country & Sub-region, 2017 - 2027

10.5.1. Germany

10.5.2. France

10.5.3. U.K.

10.5.4. Italy

10.5.5. Netherlands

10.5.6. Rest of Europe

11. Asia Pacific Sports Betting Kiosk Market Analysis and Forecast

11.1. Key Findings

11.2. Sports Betting Kiosk Market Size (US$ Mn) Forecast, By Ownership, 2017 - 2027

11.2.1. White labeled

11.2.2. Branded

11.3. Sports Betting Kiosk Market Size (US$ Mn) Forecast, By Application, 2017 - 2027

11.3.1. eSports

11.3.2. Indoor Games

11.3.3. Outdoor Games

11.4. Sports Betting Kiosk Market Size (US$ Mn) Forecast, By End User, 2017 - 2027

11.4.1. Sports Clubs / Sports Stadiums

11.4.2. Betting Shops & Gambling Clubs

11.4.3. Casinos

11.5. Sports Betting Kiosk Market Size (US$ Mn) Forecast, By Country & Sub-region, 2017 - 2027

11.5.1. Japan

11.5.2. Australia

11.5.3. Philippines

11.5.4. Rest of Asia Pacific

12. Middle East & Africa (MEA) Sports Betting Kiosk Market Analysis and Forecast

12.1. Key Findings

12.2. Sports Betting Kiosk Market Size (US$ Mn) Forecast, By Ownership, 2017 - 2027

12.2.1. White labeled

12.2.2. Branded

12.3. Sports Betting Kiosk Market Size (US$ Mn) Forecast, By Application, 2017 - 2027

12.3.1. eSports

12.3.2. Indoor Games

12.3.3. Outdoor Games

12.4. Sports Betting Kiosk Market Size (US$ Mn) Forecast, By End User, 2017 - 2027

12.4.1. Sports Clubs / Sports Stadiums

12.4.2. Betting Shops & Gambling Clubs

12.4.3. Casinos

12.5. Sports Betting Kiosk Market Size (US$ Mn) Forecast, By Country & Sub-region, 2017 – 2027

12.5.1. South Africa

12.5.2. Nigeria

12.5.3. Israel

12.5.4. Ghana

12.5.5. Rest of MEA

13. South America Sports Betting Kiosk Market Analysis and Forecast

13.1. Key Findings

13.2. Sports Betting Kiosk Market Size (US$ Mn) Forecast, By Ownership, 2017 - 2027

13.2.1. White labeled

13.2.2. Branded

13.3. Sports Betting Kiosk Market Size (US$ Mn) Forecast, By Application, 2017 - 2027

13.3.1. eSports

13.3.2. Indoor Games

13.3.3. Outdoor Games

13.4. Sports Betting Kiosk Market Size (US$ Mn) Forecast, By End User, 2017 - 2027

13.4.1. Sports Clubs / Sports Stadiums

13.4.2. Betting Shops & Gambling Clubs

13.4.3. Casinos

13.5. Sports Betting Kiosk Market Size (US$ Mn) Forecast, By Country & Sub-region, 2017 - 2027

13.5.1. Brazil

13.5.2. Argentina

13.5.3. Rest of South America

14. Competition Landscape

14.1. Market Player – Competition Matrix

14.2. Market Revenue Share Analysis (%), By Company (2018)

15. Company Profiles (Details – Basic Overview, Sales Area/Geographical Presence, Revenue, Key Developments, and Strategy)

15.1. JCM Global

15.1.1. Basic Overview

15.1.2. Sales Area/Geographical Presence

15.1.3. Revenue

15.1.4. Key Developments

15.1.5. Strategy

15.2. DB Solutions

15.2.1. Basic Overview

15.2.2. Sales Area/Geographical Presence

15.2.3. Revenue

15.2.4. Key Developments

15.2.5. Strategy

15.3. International Game Technology PLC

15.3.1. Basic Overview

15.3.2. Sales Area/Geographical Presence

15.3.3. Revenue

15.3.4. Key Developments

15.3.5. Strategy

15.4. ISI, LTD.

15.4.1. Basic Overview

15.4.2. Sales Area/Geographical Presence

15.4.3. Revenue

15.4.4. Key Developments

15.4.5. Strategy

15.5. Kambi Group PLC

15.5.1. Basic Overview

15.5.2. Sales Area/Geographical Presence

15.5.3. Revenue

15.5.4. Key Developments

15.5.5. Strategy

15.6. KIOSK Information Systems

15.6.1. Basic Overview

15.6.2. Sales Area/Geographical Presence

15.6.3. Revenue

15.6.4. Key Developments

15.6.5. Strategy

15.7. NOVOMATIC Sports Betting Solutions

15.7.1. Basic Overview

15.7.2. Sales Area/Geographical Presence

15.7.3. Revenue

15.7.4. Key Developments

15.7.5. Strategy

15.8. Olea Kiosks, Inc.

15.8.1. Basic Overview

15.8.2. Sales Area/Geographical Presence

15.8.3. Revenue

15.8.4. Key Developments

15.8.5. Strategy

15.9. SBTech Malta Limited

15.9.1. Basic Overview

15.9.2. Sales Area/Geographical Presence

15.9.3. Revenue

15.9.4. Key Developments

15.9.5. Strategy

15.10. SG Gaming

15.10.1. Basic Overview

15.10.2. Sales Area/Geographical Presence

15.10.3. Revenue

15.10.4. Key Developments

15.10.5. Strategy

16. Key Takeaways

List of Tables

Table 1: Mergers & Acquisitions, Expansions

Table 2: Global Sports Betting Kiosk Market Revenue Forecast (US$ Mn), by Ownership, 2017–2027

Table 3: Global Sports Betting Kiosk Market Volume Forecast (000' Units), by Ownership, 2017–2027

Table 4: Global Sports Betting Kiosk Market Revenue Forecast (US$ Mn), by Application, 2017–2027

Table 5: Global Sports Betting Kiosk Market Volume Forecast (000' Units), by Application, 2017–2027

Table 6: Global Sports Betting Kiosk Market Revenue Forecast (US$ Mn), by End User, 2017–2027

Table 7: Global Sports Betting Kiosk Market Volume Forecast (000' Units), by End User, 2017–2027

Table 8: Global Sports Betting Kiosk Market Revenue Forecast (US$ Mn), by Region, 2017–2027

Table 9: Global Sports Betting Kiosk Market Volume Forecast (000' Units), by Region, 2017–2027

Table 10: North America Sports Betting Kiosk Market Revenue Forecast (US$ Mn), by Ownership, 2017–2027

Table 11: North America Sports Betting Kiosk Market Volume Forecast (000' Units), by Ownership, 2017–2027

Table 12: North America Sports Betting Kiosk Market Revenue Forecast (US$ Mn), by Application, 2017–2027

Table 13: North America Sports Betting Kiosk Market Volume Forecast (000' Units), by Application, 2017–2027

Table 14: North America Sports Betting Kiosk Market Revenue Forecast (US$ Mn), by End User, 2017–2027

Table 15: North America Sports Betting Kiosk Market Volume Forecast (000' Units), by End User, 2017–2027

Table 16: North America Sports Betting Kiosk Market Revenue Forecast (US$ Mn), by Country, 2017–2027

Table 17: North America Sports Betting Kiosk Market Volume Forecast (000' Units), by Country, 2017–2027

Table 18: Europe Sports Betting Kiosk Market Revenue Forecast (US$ Mn), by Ownership, 2017–2027

Table 19: Europe Sports Betting Kiosk Market Volume Forecast (000' Units), by Ownership, 2017–2027

Table 20: Europe Sports Betting Kiosk Market Revenue Forecast (US$ Mn), by Application, 2017–2027

Table 21: Europe Sports Betting Kiosk Market Volume Forecast (000' Units), by Application, 2017–2027

Table 22: Europe Sports Betting Kiosk Market Revenue Forecast (US$ Mn), by End User, 2017–2027

Table 23: Europe Sports Betting Kiosk Market Volume Forecast (000' Units), by End User, 2017–2027

Table 24: Europe Sports Betting Kiosk Market Revenue Forecast (US$ Mn), by Country, 2017–2027

Table 25: Europe Sports Betting Kiosk Market Volume Forecast (000' Units), by Country, 2017–2027

Table 26: Asia Pacific Sports Betting Kiosk Market Revenue Forecast (US$ Mn), by Ownership, 2017–2027

Table 27: Asia Pacific Sports Betting Kiosk Market Volume Forecast (000' Units), by Ownership, 2017–2027

Table 28: Asia Pacific Sports Betting Kiosk Market Revenue Forecast (US$ Mn), by Application, 2017–2027

Table 29: Asia Pacific Sports Betting Kiosk Market Volume Forecast (000' Units), by Application, 2017–2027

Table 30: Asia Pacific Sports Betting Kiosk Market Revenue Forecast (US$ Mn), by End User, 2017–2027

Table 31: Asia Pacific Sports Betting Kiosk Market Volume Forecast (000' Units), by End User, 2017–2027

Table 32: Asia Pacific Sports Betting Kiosk Market Revenue Forecast (US$ Mn), by Country, 2017–2027

Table 33: Asia Pacific Sports Betting Kiosk Market Volume Forecast (000' Units), by Country, 2017–2027

Table 34: Middle East & Africa Sports Betting Kiosk Market Revenue Forecast (US$ Mn), by Ownership, 2017–2027

Table 35: Middle East & Africa Sports Betting Kiosk Market Volume Forecast (000' Units), by Ownership, 2017–2027

Table 36: Middle East & Africa Sports Betting Kiosk Market Revenue Forecast (US$ Mn), by Application, 2017–2027

Table 37: Middle East & Africa Sports Betting Kiosk Market Volume Forecast (000' Units), by Application, 2017–2027

Table 38: Middle East & Africa Sports Betting Kiosk Market Revenue Forecast (US$ Mn), by End User, 2017–2027

Table 39: Middle East & Africa Sports Betting Kiosk Market Volume Forecast (000' Units), by End User, 2017–2027

Table 40: Middle East & Africa Sports Betting Kiosk Market Revenue Forecast (US$ Mn), by Country, 2017–2027

Table 41: Middle East & Africa Sports Betting Kiosk Market Volume Forecast (000' Units), by Country, 2017–2027

Table 42: South America Sports Betting Kiosk Market Revenue Forecast (US$ Mn), by Ownership, 2017–2027

Table 43: South America Sports Betting Kiosk Market Volume Forecast (000' Units), by Ownership, 2017–2027

Table 44: South America Sports Betting Kiosk Market Revenue Forecast (US$ Mn), by Application, 2017–2027

Table 45: South America Sports Betting Kiosk Market Volume Forecast (000' Units), by Application, 2017–2027

Table 46: South America Sports Betting Kiosk Market Revenue Forecast (US$ Mn), by End User, 2017–2027

Table 47: South America Sports Betting Kiosk Market Volume Forecast (000' Units), by End User, 2017–2027

Table 48: South America Sports Betting Kiosk Market Revenue Forecast (US$ Mn), by Country, 2017–2027

Table 49: South America Sports Betting Kiosk Market Volume Forecast (000' Units), by Country, 2017–2027

List of Figures

Figure 1: Global Sports Betting Kiosk Market Size (US$ Mn) Forecast, 2017 – 2027

Figure 2: Global Sports Betting Kiosk Market Value (US$ Mn) Opportunity Assessment, by Region, 2019E

Figure 3: Global Sports Betting Kiosk Market Value (US$ Mn) Opportunity Assessment, by Region, 2027F

Figure 4: GDP (US$ Bn), Top Countries (2014 – 2019)

Figure 5: Top Economies GDP Landscape, 2018

Figure 7: Global ICT Spending (US$ Bn), Regional Contribution, 2019E

Figure 6: Global ICT Spending (%), by Region, 2019E

Figure 8: Global ICT Spending (US$ Bn), Spending Type Contribution, 2019E

Figure 9: Global ICT Spending (%), by Type, 2019E

Figure 10: Adoption Analysis of Sports Betting Kiosk by Sports Type (2018)

Figure 11: Global Sport Betting Kiosk Market Revenue (US$ Mn) and Y-o-Y Growth (Value %) Forecast, 2017 - 2027

Figure 12: Global Sport Betting Kiosk Market Revenue Opportunity (US$ Mn) Forecast, 2017 - 2027

Figure 13: Global Sport Betting Kiosk Market Volume (000’ Units) and Y-o-Y Growth (Value %) Forecast, 2019 - 2027

Figure 14: Global Sport Betting Kiosk Market Volume Opportunity (000’ Units) Forecast, 2017 - 2027

Figure 15: Global Sport Betting Kiosk Market Revenue (US$ Mn) and Y-o-Y Growth (Value %) Historic Trends, 2012 - 2018

Figure 16: Global Sport Betting Kiosk Market Revenue Opportunity (US$ Mn) Historic Trends, 2012 - 2018

Figure 17: Global Market Opportunity Assessment, by Ownership

Figure 18: Global Market Opportunity Assessment, by Application

Figure 19: Global Market Opportunity Assessment, by End User

Figure 20: Global Market Opportunity Assessment, by Region

Figure 21: Four Firm Concentration Ratio Analysis (2018)

Figure 23: Global Sports Betting Kiosk Market, Application CAGR (%) (2019 – 2027)

Figure 25: Global Sports Betting Kiosk Market, by Region CAGR (%) (2019 – 2027)

Figure 22: Global Sports Betting Kiosk Market, Ownership CAGR (%) (2019 – 2027)

Figure 24: Global Sports Betting Kiosk Market, End User CAGR (%) (2019 – 2027)

Figure 26: Global Sports Betting Kiosk Market Share Analysis, by Ownership (2019)

Figure 27: Global Sports Betting Kiosk Market Share Analysis, by Ownership (2027)

Figure 28: Global Sports Betting Kiosk Market Share Analysis, by Application (2019)

Figure 29: Global Sports Betting Kiosk Market Share Analysis, by Application (2027)

Figure 30: Global Sports Betting Kiosk Market Share Analysis, by End User (2019)

Figure 31: Global Sports Betting Kiosk Market Share Analysis, by End User (2027)

Figure 32: North America Sports Betting Kiosk Market Share Analysis, by Region (2019)

Figure 33: North America Sports Betting Kiosk Market Share Analysis, by Region (2027)

Figure 34: North America Sports Betting Kiosk Market Share Analysis, by Ownership (2019)

Figure 35: North America Sports Betting Kiosk Market Share Analysis, by Ownership (2027)

Figure 36: North America Sports Betting Kiosk Market Share Analysis, by Application (2019)

Figure 37: North America Sports Betting Kiosk Market Share Analysis, by Application (2027)

Figure 38: North America Sports Betting Kiosk Market Share Analysis, by End User (2019)

Figure 39: North America Sports Betting Kiosk Market Share Analysis, by End User (2027)

Figure 40: North America Sports Betting Kiosk Market Share Analysis, by Country (2019)

Figure 41: North America Sports Betting Kiosk Market Share Analysis, by Country (2027)

Figure 42: Europe Sports Betting Kiosk Market Share Analysis, by Ownership (2019)

Figure 43: Europe Sports Betting Kiosk Market Share Analysis, by Ownership (2027)

Figure 44: Europe Sports Betting Kiosk Market Share Analysis, by Application (2019)

Figure 45: Europe Sports Betting Kiosk Market Share Analysis, by Application (2027)

Figure 46: Europe Sports Betting Kiosk Market Share Analysis, by End User (2019)

Figure 47: Europe Sports Betting Kiosk Market Share Analysis, by End User (2027)

Figure 48: Europe Sports Betting Kiosk Market Share Analysis, by Country (2019)

Figure 49: Europe Sports Betting Kiosk Market Share Analysis, by Country (2027)

Figure 50: Asia Pacific Sports Betting Kiosk Market Share Analysis, by Ownership (2019)

Figure 51: Asia Pacific Sports Betting Kiosk Market Share Analysis, by Ownership (2027)

Figure 52: Asia Pacific Sports Betting Kiosk Market Share Analysis, by Application (2019)

Figure 53: Asia Pacific Sports Betting Kiosk Market Share Analysis, by Application (2027)

Figure 54: Asia Pacific Sports Betting Kiosk Market Share Analysis, by End User (2019)

Figure 55: Asia Pacific Sports Betting Kiosk Market Share Analysis, by End User (2027)

Figure 56: Asia Pacific Sports Betting Kiosk Market Share Analysis, by Country (2019)

Figure 57: Asia Pacific Sports Betting Kiosk Market Share Analysis, by Country (2027)

Figure 58: Middle East & Africa Sports Betting Kiosk Market Share Analysis, by Ownership (2019)

Figure 59: Middle East & Africa Sports Betting Kiosk Market Share Analysis, by Ownership (2027)

Figure 60: Middle East & Africa Sports Betting Kiosk Market Share Analysis, by Application (2019)

Figure 61: Middle East & Africa Sports Betting Kiosk Market Share Analysis, by Application (2027)

Figure 62: Middle East & Africa Sports Betting Kiosk Market Share Analysis, by End User (2019)

Figure 63: Middle East & Africa Sports Betting Kiosk Market Share Analysis, by End User (2027)

Figure 64: Middle East & Africa Sports Betting Kiosk Market Share Analysis, by Country (2019)

Figure 65: Middle East & Africa Sports Betting Kiosk Market Share Analysis, by Country (2027)

Figure 66: South America Sports Betting Kiosk Market Share Analysis, by Ownership (2019)

Figure 67: South America Sports Betting Kiosk Market Share Analysis, by Ownership (2027)

Figure 68: South America Sports Betting Kiosk Market Share Analysis, by Application (2019)

Figure 69: South America Sports Betting Kiosk Market Share Analysis, by Application (2027)

Figure 70: South America Sports Betting Kiosk Market Share Analysis, by End User (2019)

Figure 71: South America Sports Betting Kiosk Market Share Analysis, by End User (2027)

Figure 72: South America Sports Betting Kiosk Market Share Analysis, by Country (2019)

Figure 73: South America Sports Betting Kiosk Market Share Analysis, by Country (2027)