Reports

Reports

Analysts’ Viewpoint on Market Scenario

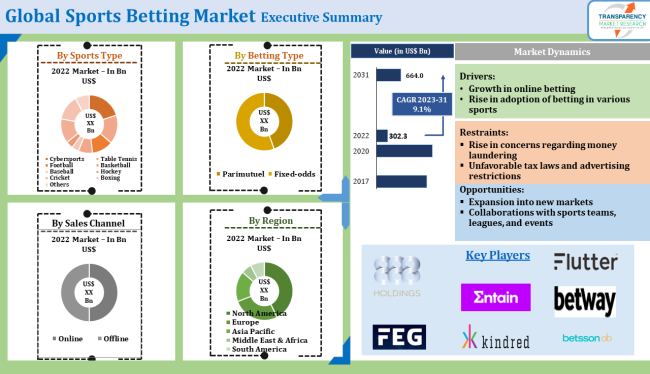

Growth in online betting and increase in in adoption of betting in various sports are expected to propel the sports betting market size during the forecast period. Online and live betting are gaining traction among users as they offer easy access to betting through smartphones and PCs.

However, rise in concerns regarding money laundering and unfavorable tax laws and advertising restrictions in many countries are projected to limit the sports betting market growth during the forecast period. Vendors in the global sports betting industry are collaborating with sports teams, leagues, and events to broaden their customer base. They are also expanding into new markets where demand for sports betting is growing.

Betting is the action of predicting an event by gambling money on the outcome of a race, game, or other unpredictable event. Parimutuel and fixed-odds are the two types of sports betting. Parimutuel betting, also known as pool betting, is a betting system in which all bets of a particular type are placed together in a pool. Instead of the bookmaker, the wager is placed against other bettors who have placed wagers on the same event. Fixed odds is a type of wagering against odds offered by a bookmaker or an individual or on a betting exchange. It involves betting on an event in which there is no fluctuation in the payout.

Sports betting has experienced massive growth after the introduction of internet. Previously, bettors had to go to an offline bookmaker to place bets. However, the number of bettors has increased significantly with the rise of online betting facilities and the ability to bet directly from home. Online betting and live streaming are gaining traction among gamblers as they offer the ability to place bets virtually on all types of sports in various countries. Hence, surge in online betting is propelling the sports betting market expansion.

Sports betting service providers are expanding their presence in many indoor and outdoor sports. Online bookmakers are offering various discounts, sign-up bonuses, and incentives for bettors. They are running regular promotions and providing live streaming services to increase their sports betting market share.

Increase in popularity of sports and surge in number of sports events are projected to boost demand for sports betting in the near future. Previously only a few sports, such as football and cricket, were the main sporting events that most people participated in. However, in recent years, other sports, including basketball, rugby, horse racing, boxing, hockey, and table tennis, are gaining popularity worldwide. The number of leagues in these sports, such as MLA, NBA, Premier League, and UEFA Championship, is increasing rapidly. Additionally, gambling is one of the fastest-growing industries worldwide. Most countries are legalizing sports betting. Technological advancements are further contributing to the sports betting market progress.

According to the latest sports betting market forecast, Asia Pacific is expected to hold largest share from 2023 to 2031. Rise in disposable income and surge in popularity of cricket and football are fueling the market dynamics of the region. Surge in adoption of smartphones and increase in penetration of internet are also boosting the sports betting market statistics in Asia Pacific.

The industry in North America, Europe, Middle East & Africa, and South Africa is anticipated to grow at a steady pace during the forecast period. Several sports betting companies are entering these markets through partnerships and sponsorships with sports teams, leagues, and events to broaden their market revenue.

Most firms are investing significantly in innovation along with blockchain and cryptocurrency integration to stay competitive in the market. They are also engaged in joint ventures and collaboration with different sports organizers and betting companies for business expansion. Major sports betting service providers are developing new sales channels through e-commerce websites to expand their market presence.

888 Holdings plc., Betfred Ltd., Betsson AB, Fortuna Entertainment Group, Entain Holdings plc., Kindred Group, Flutter Entertainment plc, The Betway Group, and William Hill plc are key players in the sports betting market. Each of these players has been profiled in the sports betting market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 302.3 Bn |

| Market Forecast Value in 2031 | US$ 664.0 Bn |

| Growth Rate (CAGR) | 9.1% |

| Forecast Period | 2023-2031 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | Global qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Regions Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 302.3 Bn in 2022

It is projected to reach US$ 664.0 Bn by the end of 2031

Growth in online betting and rise in adoption of betting in various sports

The cybersport sports type segment held highest share in 2022

The region accounted for 34.0% market share in 2022

888 Holdings plc., Betfred Ltd., Betsson AB, Fortuna Entertainment Group, Entain Holdings plc., Kindred Group, Flutter Entertainment plc, The Betway Group, and William Hill plc

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.4.1. Overall Betting Industry Overview

5.5. Porter’s Five Forces Analysis

5.6. Value Chain Analysis

5.7. Industry SWOT Analysis

5.8. Technological Overview

5.9. Global Sports Betting Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Revenue Projection (US$ Bn)

6. Global Sports Betting Market Analysis and Forecast, By Sports Type

6.1. Global Sports Betting Market Size (US$ Bn) Forecast, By Sports Type, 2017 - 2031

6.1.1. Table Tennis

6.1.2. Cybersports

6.1.3. Football

6.1.4. Basketball

6.1.5. Baseball

6.1.6. Hockey

6.1.7. Cricket

6.1.8. Boxing

6.1.9. Others (Cycling, Auto Racing, etc.)

6.2. Incremental Opportunity, By Sports Type

7. Global Sports Betting Market Analysis and Forecast, By Betting Type

7.1. Global Sports Betting Market Size (US$ Bn) Forecast, By Betting Type, 2017 - 2031

7.1.1. Parimutuel

7.1.2. Fixed-odds

7.2. Incremental Opportunity, By Betting Type

8. Global Sports Betting Market Analysis and Forecast, By Sales Channel

8.1. Global Sports Betting Market Size (US$ Bn) Forecast, By Sales Channel, 2017 - 2031

8.1.1. Online

8.1.1.1. Desktops and Laptops

8.1.1.2. Tablets and Mobiles

8.1.2. Offline

8.2. Incremental Opportunity, By Sales Channel

9. Global Sports Betting Market Analysis and Forecast, by Region

9.1. Global Sports Betting Market Size (US$ Bn), by Region, 2017 - 2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East and Africa

9.1.5. South America

9.2. Global Incremental Opportunity, by Region

10. North America Sports Betting Market Analysis and Forecast

10.1. Regional Snapshot

10.2. Key Trend Analysis

10.3. Demographic Overview

10.4. COVID-19 Impact Analysis

10.5. Brands Analysis

10.6. Consumer Buying Behavior Analysis

10.7. Sports Betting Market Size (US$ Bn) Forecast, By Sports Type, 2017 - 2031

10.7.1. Table Tennis

10.7.2. Cybersports

10.7.3. Football

10.7.4. Basketball

10.7.5. Baseball

10.7.6. Hockey

10.7.7. Cricket

10.7.8. Boxing

10.7.9. Others (Cycling, Auto Racing, etc.)

10.8. Sports Betting Market Size (US$ Bn) Forecast, By Betting Type, 2017 - 2031

10.8.1. Parimutuel

10.8.2. Fixed-odds

10.9. Sports Betting Market Size (US$ Bn) Forecast, By Sales Channel, 2017 - 2031

10.9.1. Online

10.9.1.1. Desktops and Laptops

10.9.1.2. Tablets and Mobiles

10.9.2. Offline

10.10. Sports Betting Market Size (US$ Bn), by Country, 2017 - 2031

10.10.1. U.S.

10.10.2. Canada

10.10.3. Rest of North America

10.11. Incremental Opportunity Analysis

11. Europe Sports Betting Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Key Trend Analysis

11.3. Demographic Overview

11.4. COVID-19 Impact Analysis

11.5. Brands Analysis

11.6. Consumer Buying Behavior Analysis

11.7. Sports Betting Market Size (US$ Bn) Forecast, By Sports Type, 2017 - 2031

11.7.1. Table Tennis

11.7.2. Cybersports

11.7.3. Football

11.7.4. Basketball

11.7.5. Baseball

11.7.6. Hockey

11.7.7. Cricket

11.7.8. Boxing

11.7.9. Others (Cycling, Auto Racing, etc.)

11.8. Sports Betting Market Size (US$ Bn) Forecast, By Betting Type, 2017 - 2031

11.8.1. Parimutuel

11.8.2. Fixed-odds

11.9. Sports Betting Market Size (US$ Bn) Forecast, By Sales Channel, 2017 - 2031

11.9.1. Online

11.9.1.1. Desktops and Laptops

11.9.1.2. Tablets and Mobiles

11.9.2. Offline

11.10. Sports Betting Market Size (US$ Bn), by Country, 2017 - 2031

11.10.1. Germany

11.10.2. France

11.10.3. U.K.

11.10.4. Rest of Europe

11.11. Incremental Opportunity Analysis

12. Asia Pacific Sports Betting Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Trend Analysis

12.3. Demographic Overview

12.4. COVID-19 Impact Analysis

12.5. Brands Analysis

12.6. Consumer Buying Behavior Analysis

12.7. Sports Betting Market Size (US$ Bn) Forecast, By Sports Type, 2017 - 2031

12.7.1. Table Tennis

12.7.2. Cybersports

12.7.3. Football

12.7.4. Basketball

12.7.5. Baseball

12.7.6. Hockey

12.7.7. Cricket

12.7.8. Boxing

12.7.9. Others (Cycling, Auto Racing, etc.)

12.8. Sports Betting Market Size (US$ Bn) Forecast, By Betting Type, 2017 - 2031

12.8.1. Parimutuel

12.8.2. Fixed-odds

12.9. Sports Betting Market Size (US$ Bn) Forecast, By Sales Channel, 2017 - 2031

12.9.1. Online

12.9.1.1. Desktops and Laptops

12.9.1.2. Tablets and Mobiles

12.9.2. Offline

12.10. Sports Betting Market Size (US$ Bn), by Country, 2017 - 2031

12.10.1. China

12.10.2. India

12.10.3. Japan

12.10.4. Southeast Asia

12.10.5. Rest of Asia Pacific

12.11. Incremental Opportunity Analysis

13. Middle East & Africa Sports Betting Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Trend Analysis

13.3. Demographic Overview

13.4. COVID-19 Impact Analysis

13.5. Brands Analysis

13.6. Consumer Buying Behavior Analysis

13.7. Sports Betting Market Size (US$ Bn) Forecast, By Sports Type, 2017 - 2031

13.7.1. Table Tennis

13.7.2. Cybersports

13.7.3. Football

13.7.4. Basketball

13.7.5. Baseball

13.7.6. Hockey

13.7.7. Cricket

13.7.8. Boxing

13.7.9. Others (Cycling, Auto Racing, etc.)

13.8. Sports Betting Market Size (US$ Bn) Forecast, By Betting Type, 2017 - 2031

13.8.1. Parimutuel

13.8.2. Fixed-odds

13.9. Sports Betting Market Size (US$ Bn) Forecast, By Sales Channel, 2017 - 2031

13.9.1. Online

13.9.1.1. Desktops and Laptops

13.9.1.2. Tablets and Mobiles

13.9.2. Offline

13.10. Sports Betting Market Size (US$ Bn), by Country, 2017 - 2031

13.10.1. GCC

13.10.2. South Africa

13.10.3. Rest of Middle East & Africa

13.11. Incremental Opportunity Analysis

14. South America Sports Betting Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Trend Analysis

14.3. Demographic Overview

14.4. COVID-19 Impact Analysis

14.5. Brands Analysis

14.6. Consumer Buying Behavior Analysis

14.7. Sports Betting Market Size (US$ Bn) Forecast, By Sports Type, 2017 - 2031

14.7.1. Table Tennis

14.7.2. Cybersports

14.7.3. Football

14.7.4. Basketball

14.7.5. Baseball

14.7.6. Hockey

14.7.7. Cricket

14.7.8. Boxing

14.7.9. Others (Cycling, Auto Racing, etc.)

14.8. Sports Betting Market Size (US$ Bn) Forecast, By Betting Type, 2017 - 2031

14.8.1. Parimutuel

14.8.2. Fixed-odds

14.9. Sports Betting Market Size (US$ Bn) Forecast, By Sales Channel, 2017 - 2031

14.9.1. Online

14.9.1.1. Desktops and Laptops

14.9.1.2. Tablets and Mobiles

14.9.2. Offline

14.10. Sports Betting Market Size (US$ Bn), by Country, 2017 - 2031

14.10.1. Brazil

14.10.2. Rest of South America

14.11. Incremental Opportunity Analysis

15. Competition Landscape

15.1. Market Player – Competition Dashboard

15.2. Market Revenue Share Analysis (%), (2020)

15.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

15.3.1. 888 Holdings plc.

15.3.1.1. Company Overview

15.3.1.2. Sales Area/Geographical Presence

15.3.1.3. Revenue

15.3.1.4. Strategy & Business Overview

15.3.2. Betfred Ltd.

15.3.2.1. Company Overview

15.3.2.2. Sales Area/Geographical Presence

15.3.2.3. Revenue

15.3.2.4. Strategy & Business Overview

15.3.3. BETSSON AB

15.3.3.1. Company Overview

15.3.3.2. Sales Area/Geographical Presence

15.3.3.3. Revenue

15.3.3.4. Strategy & Business Overview

15.3.4. Fortuna Entertainment Group

15.3.4.1. Company Overview

15.3.4.2. Sales Area/Geographical Presence

15.3.4.3. Revenue

15.3.4.4. Strategy & Business Overview

15.3.5. Entain plc

15.3.5.1. Company Overview

15.3.5.2. Sales Area/Geographical Presence

15.3.5.3. Revenue

15.3.5.4. Strategy & Business Overview

15.3.6. Kindred Group

15.3.6.1. Company Overview

15.3.6.2. Sales Area/Geographical Presence

15.3.6.3. Revenue

15.3.6.4. Strategy & Business Overview

15.3.7. Flutter Entertainment plc

15.3.7.1. Company Overview

15.3.7.2. Sales Area/Geographical Presence

15.3.7.3. Revenue

15.3.7.4. Strategy & Business Overview

15.3.8. The Betway Group

15.3.8.1. Company Overview

15.3.8.2. Sales Area/Geographical Presence

15.3.8.3. Revenue

15.3.8.4. Strategy & Business Overview

15.3.9. William Hill plc

15.3.9.1. Company Overview

15.3.9.2. Sales Area/Geographical Presence

15.3.9.3. Revenue

15.3.9.4. Strategy & Business Overview

16. Key Takeaways

16.1. Identification of Potential Market Spaces

16.1.1. By Sports Type

16.1.2. By Betting Type

16.1.3. By Sales Channel

16.1.4. By Region

16.2. Understanding Buying Process of Customers

16.3. Preferred Sales & Marketing Strategy

16.4. Prevailing Market Risk

List of Tables

Table 1: Global Sports Betting Market, By Sports Type, US$ Bn, 2017-2031

Table 2: Global Sports Betting Market, By Betting Type, US$ Bn, 2017-2031

Table 3: Global Sports Betting Market, By Sales Channel, US$ Bn, 2017-2031

Table 4: Global Sports Betting Market, By Region, US$ Bn, 2017-2031

Table 5: North America Sports Betting Market, By Sports Type, US$ Bn, 2017-2031

Table 6: North America Sports Betting Market, By Betting Type, US$ Bn, 2017-2031

Table 7: North America Sports Betting Market, By Sales Channel, US$ Bn, 2017-2031

Table 8: North America Sports Betting Market, By Country, US$ Bn, 2017-2031

Table 9: Europe Sports Betting Market, By Sports Type, US$ Bn, 2017-2031

Table 10: Europe Sports Betting Market, By Betting Type, US$ Bn, 2017-2031

Table 11: Europe Sports Betting Market, By Sales Channel, US$ Bn, 2017-2031

Table 12: Europe Sports Betting Market, By Country, US$ Bn, 2017-2031

Table 13: Asia Pacific Sports Betting Market, By Sports Type, US$ Bn, 2017-2031

Table 14: Asia Pacific Sports Betting Market, By Betting Type, US$ Bn, 2017-2031

Table 15: Asia Pacific Sports Betting Market, By Sales Channel, US$ Bn, 2017-2031

Table 16: Asia Pacific Sports Betting Market, By Country, US$ Bn, 2017-2031

Table 17: Middle East & Africa Sports Betting Market, By Sports Type, US$ Bn, 2017-2031

Table 18: Middle East & Africa Sports Betting Market, By Betting Type, US$ Bn, 2017-2031

Table 19: Middle East & Africa Sports Betting Market, By Sales Channel, US$ Bn, 2017-2031

Table 20: Middle East & Africa Sports Betting Market, By Country, US$ Bn, 2017-2031

Table 21: South America Sports Betting Market, By Sports Type, US$ Bn, 2017-2031

Table 22: South America Sports Betting Market, By Betting Type, US$ Bn, 2017-2031

Table 23: South America Sports Betting Market, By Sales Channel, US$ Bn, 2017-2031

Table 24: South America Sports Betting Market, By Country, US$ Bn, 2017-2031

List of Figures

Figure 1: Global Sports Betting Market Projections by Sports Type, US$ Bn, 2017-2031

Figure 2: Global Sports Betting Market, Incremental Opportunity, by Sports Type, US$ Bn, 2017-2031

Figure 3: Global Sports Betting Market Projections by Betting Type, US$ Bn, 2017-2031

Figure 4: Global Sports Betting Market, Incremental Opportunity, by Betting Type, US$ Bn, 2017-2031

Figure 5: Global Sports Betting Market Projections by Sales Channel, US$ Bn, 2017-2031

Figure 6: Global Sports Betting Market, Incremental Opportunity, by Sales Channel, US$ Bn, 2017-2031

Figure 7: Global Sports Betting Market Projections by Region, US$ Bn, 2017-2031

Figure 8: Global Sports Betting Market, Incremental Opportunity, by Region, US$ Bn, 2017-2031

Figure 9: North America Sports Betting Market Projections by Sports Type, US$ Bn, 2017-2031

Figure 10: North America Sports Betting Market, Incremental Opportunity, by Sports Type, US$ Bn, 2017-2031

Figure 11: North America Sports Betting Market Projections by Betting Type, US$ Bn, 2017-2031

Figure 12: North America Sports Betting Market, Incremental Opportunity, by Betting Type, US$ Bn, 2017-2031

Figure 13: North America Sports Betting Market Projections by Sales Channel, US$ Bn, 2017-2031

Figure 14: North America Sports Betting Market, Incremental Opportunity, by Sales Channel, US$ Bn, 2017-2031

Figure 15: North America Sports Betting Market Projections by Country, US$ Bn, 2017-2031

Figure 16: North America Sports Betting Market, Incremental Opportunity, by Country, US$ Bn, 2017-2031

Figure 17: Europe Sports Betting Market Projections by Sports Type, US$ Bn, 2017-2031

Figure 18: Europe Sports Betting Market, Incremental Opportunity, by Sports Type, US$ Bn, 2017-2031

Figure 19: Europe Sports Betting Market Projections by Betting Type, US$ Bn, 2017-2031

Figure 20: Europe Sports Betting Market, Incremental Opportunity, by Betting Type, US$ Bn, 2017-2031

Figure 21: Europe Sports Betting Market Projections by Sales Channel, US$ Bn, 2017-2031

Figure 22: Europe Sports Betting Market, Incremental Opportunity, by Sales Channel, US$ Bn, 2017-2031

Figure 23: Europe Sports Betting Market Projections by Country, US$ Bn, 2017-2031

Figure 24: Europe Sports Betting Market, Incremental Opportunity, by Country, US$ Bn, 2017-2031

Figure 25: Asia Pacific Sports Betting Market Projections by Sports Type, US$ Bn, 2017-2031

Figure 26: Asia Pacific Sports Betting Market, Incremental Opportunity, by Sports Type, US$ Bn, 2017-2031

Figure 27: Asia Pacific Sports Betting Market Projections by Betting Type, US$ Bn, 2017-2031

Figure 28: Asia Pacific Sports Betting Market, Incremental Opportunity, by Betting Type, US$ Bn, 2017-2031

Figure 29: Asia Pacific Sports Betting Market Projections by Sales Channel, US$ Bn, 2017-2031

Figure 30: Asia Pacific Sports Betting Market, Incremental Opportunity, by Sales Channel, US$ Bn, 2017-2031

Figure 31: Asia Pacific Sports Betting Market Projections by Country, US$ Bn, 2017-2031

Figure 32: Asia Pacific Sports Betting Market, Incremental Opportunity, by Country, US$ Bn, 2017-2031

Figure 33: Middle East & Africa Sports Betting Market Projections by Sports Type, US$ Bn, 2017-2031

Figure 34: Middle East & Africa Sports Betting Market, Incremental Opportunity, by Sports Type, US$ Bn, 2017-2031

Figure 35: Middle East & Africa Sports Betting Market Projections by Betting Type, US$ Bn, 2017-2031

Figure 36: Middle East & Africa Sports Betting Market, Incremental Opportunity, by Betting Type, US$ Bn, 2017-2031

Figure 37: Middle East & Africa Sports Betting Market Projections by Sales Channel, US$ Bn, 2017-2031

Figure 38: Middle East & Africa Sports Betting Market, Incremental Opportunity, by Sales Channel, US$ Bn, 2017-2031

Figure 39: Middle East & Africa Sports Betting Market Projections by Country, US$ Bn, 2017-2031

Figure 40: Middle East & Africa Sports Betting Market, Incremental Opportunity, by Country, US$ Bn, 2017-2031

Figure 41: South America Sports Betting Market Projections by Sports Type, US$ Bn, 2017-2031

Figure 42: South America Sports Betting Market, Incremental Opportunity, by Sports Type, US$ Bn, 2017-2031

Figure 43: South America Sports Betting Market Projections by Betting Type, US$ Bn, 2017-2031

Figure 44: South America Sports Betting Market, Incremental Opportunity, by Betting Type, US$ Bn, 2017-2031

Figure 45: South America Sports Betting Market Projections by Sales Channel, US$ Bn, 2017-2031

Figure 46: South America Sports Betting Market, Incremental Opportunity, by Sales Channel, US$ Bn, 2017-2031

Figure 47: South America Sports Betting Market Projections by Country, US$ Bn, 2017-2031

Figure 48: South America Sports Betting Market, Incremental Opportunity, by Country, US$ Bn, 2017-2031