Reports

Reports

Analysts’ Viewpoint on Market Scenario

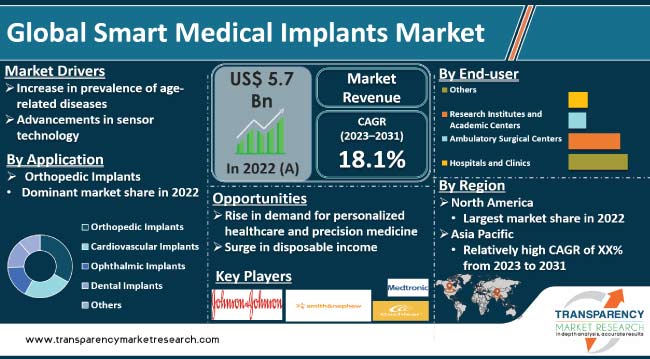

Increase in prevalence of age-related diseases is projected to fuel the smart medical implants market size in the next few years. Advancements in sensor technology are also expected to boost demand for smart medical implants during the forecast period.

Rise in demand for personalized healthcare and precision medicine and surge in disposable income are likely to offer lucrative opportunities to players in the global smart medical implants industry. Vendors are focusing on the development of advanced products to expand their product portfolio and increase their smart medical implants market share.

Smart medical implants are advanced devices designed to be placed within the human body for the monitoring and treatment of various medical conditions. They encompass a wide range of implantable devices that incorporate advanced technology to provide improved patient care and treatment outcomes.

Intelligent medical implants can be used in various medical fields, including cardiology, neurology, orthopedics, and diabetes management. They offer features such as real-time monitoring, data analysis, therapeutic adjustments, and wireless connectivity for seamless integration with healthcare systems. Advanced biomedical implants are equipped with various intelligent technologies, including sensors, microprocessors, and wireless connectivity, which enable them to perform specific functions and communicate with external devices or healthcare professionals.

According to the future analysis of the smart medical implants market, rise in incidence of chronic diseases, such as cardiovascular disorders, diabetes, orthopedic conditions, and neurological disorders, is anticipated to drive the demand for digital health implants in the near future. Rapid advancements in sensor technology, wireless connectivity, and data analytics are enhancing the capabilities of smart medical implants. This, in turn, is projected to spur the smart medical implants market growth in the next few years.

Surge in prevalence of age-related conditions is boosting demand for implantable medical devices. Smart medical implants help address the unique healthcare needs of elderly people by enabling continuous monitoring, early detection of complications, and personalized care. The shift toward precision medicine and personalized healthcare is augmenting the smart medical implants market development. Smart medical implants enable the collection of real-time patient data, which can be used to tailor treatment plans, optimize therapies, and thus improves patient outcomes.

COVID-19 pandemic has impacted the smart medical implants business through supply chain disruptions and a shift toward remote patient monitoring. Market expansion is likely to present opportunities for medical device manufacturers, healthcare providers, and investors to capitalize on the potential of smart medical implants and revolutionize patient care.

Advancements in sensor technology enable smart implants to gather real-time, accurate, and precise data, which is vital for effective monitoring, diagnosis, and treatment of medical conditions. In June 2022, researchers at the University of Pittsburgh Swanson School of Engineering reported the development of patient-specific 3D-printed smart metamaterial implants that serve as sensors to track spinal recovery. Hence, R&D in sensor technology is propelling the smart medical implants market statistics.

Sensor technology allows smart medical implants to continuously monitor various physiological parameters within the body, such as heart rate, blood pressure, glucose levels, or brain activity. Sensors provide detailed and accurate data that can be used by healthcare professionals for tailoring personalized treatment plans according to patient needs. The data collected and transmitted by implants is reliable and consistent, enabling healthcare professionals to make more accurate diagnosis and treatment decisions.

Advancements in sensor technology lead to the miniaturization of smart medical implants, thereby making them more comfortable for patients and allowing minimal invasive procedures. These advancements have paved the way for innovative solutions in patient care, augmenting the smart medical implants market progress.

According to the latest smart medical implants market trends, the orthopedic implants application segment held largest share in 2022. The trend is expected to continue during the forecast period. Orthopedic implants, such as smart joint replacements, spinal implants, and bone fixation devices, have seen advancements in recent years. These implants have been incorporated with smart technologies to enhance patient outcomes and improve the overall management of musculoskeletal conditions.

Orthopedic implants can be tailored according to individual patient needs. Smart technologies enable the customization of implant designs and dimensions, ensuring a better fit and alignment. Sensors within the implants can gather data on joint movements, forces, and pressures, enabling healthcare professionals to personalize treatment plans and rehabilitation strategies for each patient.

Smart orthopedic implants can transmit data wirelessly to healthcare providers, allowing for remote monitoring and analysis of patient progress. Smart implants can incorporate user interfaces or smartphone apps that provide patients with information on their progress, exercise recommendations, and reminders for medication or therapy adherence. Such advancements are boosting the demand for orthopedic implants worldwide.

According to the latest smart medical implants market analysis, the hospitals and clinics end-user segment held major share in 2022. Hospitals and clinics have advanced infrastructure and medical facilities that can support the integration of smart medical implants. They are home to specialized equipment, skilled healthcare professionals, and robust IT systems that effectively incorporate and manage smart implant technologies.

Hospitals and clinics offer specialized medical professionals who are well-versed in utilizing and managing advanced medical technologies. These experts, including surgeons, cardiologists, neurologists, and orthopedic specialists, are at the forefront of adopting smart medical implants.

According to the latest smart medical implants market forecast, North America is expected to hold largest share from 2023 to 2031. Presence of advanced healthcare infrastructure and technological expertise in medical devices are fueling the market dynamics of the region. Rise in prevalence of chronic diseases, such as cardiovascular disorders, diabetes, and orthopedic conditions, is also boosting market value in North America. Presence of major medical device manufacturers and surge in healthcare expenditure are propelling the development and adoption of smart medical implants in the region.

Rise in establishment of smart hospitals, clinics, and research centers and increase in disposable income are fueling market revenue in Asia Pacific.

Smart medical implant companies are adopting various growth strategies, such as product launches, mergers & acquisitions, partnerships, and collaborations, to broaden their customer base.

Medtronic, Abbott Laboratories, Boston Scientific Corporation, Johnson & Johnson, Siemens Healthineers, Smith & Nephew, Stryker Corporation, Zimmer Biomet, Cochlear Limited, Dexcom, St. Jude Medical (Abbott Laboratories), Edwards Lifesciences, Biotronik, Second Sight Medical Products, and Cyberonics (LivaNova) are key entities operating in this industry.

Major players have been profiled in the smart medical implants market report based on parameters such as company overview, financial overview, strategies, portfolio, segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 5.7 Bn |

|

Forecast Value in 2031 |

More than US$ 24.8 Bn |

|

Growth Rate (CAGR) |

18.1% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2022 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 5.7 Bn in 2022

It is projected to reach more than US$ 24.8 Bn by the end of 2031

It is anticipated to be 18.1% from 2023 to 2031

Increase in prevalence of age-related conditions and advancements in sensor technology

North America is expected to record the highest demand from 2023 to 2031

Medtronic, Abbott Laboratories, Boston Scientific Corporation, Johnson & Johnson, Siemens Healthineers, Smith & Nephew, Stryker Corporation, Zimmer Biomet, Cochlear Limited, Dexcom, St. Jude Medical (Abbott Laboratories), Edwards Lifesciences, Biotronik, Second Sight Medical Products, and Cyberonics (LivaNova)

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Smart Medical Implants Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Smart Medical Implants Market Analysis and Forecast, 2017-2031

4.4.1. Market Revenue Projections (US$ Bn)

5. Key Insights

5.1. Technological Advancements

5.2. Regulatory Scenario by Region/Globally

5.3. Insights on IoT Adoption and Application for Smart Healthcare

5.4. Opportunities and Challenges Associated with Smart Implants

5.5. Key Industry Events (Mergers & Acquisitions, Strategic Partnerships, Collaborations, etc.)

5.6. COVID-19 Impact Analysis

6. Global Smart Medical Implants Market Analysis and Forecast, by Application

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Application, 2017-2031

6.3.1. Orthopedic Implants

6.3.1.1. Smart Joint Implants

6.3.1.2. Smart Spinal Implants

6.3.1.3. Smart Bone Plates

6.3.1.4. Smart Orthopedic Screws

6.3.1.5. Others

6.3.2. Cardiovascular Implants

6.3.2.1. Smart Pacemakers

6.3.2.2. Smart Implantable Cardioverter-Defibrillators (ICDs)

6.3.2.3. Smart Cardiovascular Stents

6.3.2.4. Smart Cardiac Monitors

6.3.3. Ophthalmic Implants

6.3.3.1. Smart Intraocular Lenses (IOLs)

6.3.3.2. Smart Retinal Implants

6.3.3.3. Smart Glaucoma Implants

6.3.4. Dental Implants

6.3.4.1. Smart Prosthetic Teeth

6.3.4.2. Smart Dental Screws

6.3.4.3. Drug-eluting Dental Implants

6.3.4.4. Others

6.3.5. Others

6.4. Market Attractiveness Analysis, by Application

7. Global Smart Medical Implants Market Analysis and Forecast, by End-user

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by End-user, 2017-2031

7.3.1. Hospitals and Clinics

7.3.2. Ambulatory Surgical Centers

7.3.3. Research Institutes and Academic Centers

7.3.4. Others

7.4. Market Attractiveness Analysis, by End-user

8. Global Smart Medical Implants Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness Analysis, by Region

9. North America Smart Medical Implants Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Application, 2017-2031

9.2.1. Orthopedic Implants

9.2.1.1. Smart Joint Implants

9.2.1.2. Smart Spinal Implants

9.2.1.3. Smart Bone Plates

9.2.1.4. Smart Orthopedic Screws

9.2.1.5. Others

9.2.2. Cardiovascular Implants

9.2.2.1. Smart Pacemakers

9.2.2.2. Smart Implantable Cardioverter-Defibrillators (ICDs)

9.2.2.3. Smart Cardiovascular Stents

9.2.2.4. Smart Cardiac Monitors

9.2.3. Ophthalmic Implants

9.2.3.1. Smart Intraocular Lenses (IOLs)

9.2.3.2. Smart Retinal Implants

9.2.3.3. Smart Glaucoma Implants

9.2.4. Dental Implants

9.2.4.1. Smart Prosthetic Teeth

9.2.4.2. Smart Dental Screws

9.2.4.3. Drug-eluting Dental Implants

9.2.4.4. Others

9.2.5. Others

9.3. Market Value Forecast, by End-user, 2017-2031

9.3.1. Hospitals and Clinics

9.3.2. Ambulatory Surgical Centers

9.3.3. Research Institutes and Academic Centers

9.3.4. Others

9.4. Market Value Forecast, by Country, 2017-2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Application

9.5.2. By End-user

9.5.3. By Country

10. Europe Smart Medical Implants Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Application, 2017-2031

10.2.1. Orthopedic Implants

10.2.1.1. Smart Joint Implants

10.2.1.2. Smart Spinal Implants

10.2.1.3. Smart Bone Plates

10.2.1.4. Smart Orthopedic Screws

10.2.1.5. Others

10.2.2. Cardiovascular Implants

10.2.2.1. Smart Pacemakers

10.2.2.2. Smart Implantable Cardioverter-Defibrillators (ICDs)

10.2.2.3. Smart Cardiovascular Stents

10.2.2.4. Smart Cardiac Monitors

10.2.3. Ophthalmic Implants

10.2.3.1. Smart Intraocular Lenses (IOLs)

10.2.3.2. Smart Retinal Implants

10.2.3.3. Smart Glaucoma Implants

10.2.4. Dental Implants

10.2.4.1. Smart Prosthetic Teeth

10.2.4.2. Smart Dental Screws

10.2.4.3. Drug-eluting Dental Implants

10.2.4.4. Others

10.2.5. Others

10.3. Market Value Forecast, by End-user, 2017-2031

10.3.1. Hospitals and Clinics

10.3.2. Ambulatory Surgical Centers

10.3.3. Research Institutes and Academic Centers

10.3.4. Others

10.4. Market Value Forecast, by Country/Sub-region, 2017-2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Italy

10.4.5. Spain

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Application

10.5.2. By End-user

10.5.3. By Country/Sub-region

11. Asia Pacific Smart Medical Implants Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Application, 2017-2031

11.2.1. Orthopedic Implants

11.2.1.1. Smart Joint Implants

11.2.1.2. Smart Spinal Implants

11.2.1.3. Smart Bone Plates

11.2.1.4. Smart Orthopedic Screws

11.2.1.5. Others

11.2.2. Cardiovascular Implants

11.2.2.1. Smart Pacemakers

11.2.2.2. Smart Implantable Cardioverter-Defibrillators (ICDs)

11.2.2.3. Smart Cardiovascular Stents

11.2.2.4. Smart Cardiac Monitors

11.2.3. Ophthalmic Implants

11.2.3.1. Smart Intraocular Lenses (IOLs)

11.2.3.2. Smart Retinal Implants

11.2.3.3. Smart Glaucoma Implants

11.2.4. Dental Implants

11.2.4.1. Smart Prosthetic Teeth

11.2.4.2. Smart Dental Screws

11.2.4.3. Drug-eluting Dental Implants

11.2.4.4. Others

11.2.5. Others

11.3. Market Value Forecast, by End-user, 2017-2031

11.3.1. Hospitals and Clinics

11.3.2. Ambulatory Surgical Centers

11.3.3. Research Institutes and Academic Centers

11.3.4. Others

11.4. Market Value Forecast, by Country/Sub-region, 2017-2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Application

11.5.2. By End-user

11.5.3. By Country/Sub-region

12. Latin America Smart Medical Implants Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Application, 2017-2031

12.2.1. Orthopedic Implants

12.2.1.1. Smart Joint Implants

12.2.1.2. Smart Spinal Implants

12.2.1.3. Smart Bone Plates

12.2.1.4. Smart Orthopedic Screws

12.2.1.5. Others

12.2.2. Cardiovascular Implants

12.2.2.1. Smart Pacemakers

12.2.2.2. Smart Implantable Cardioverter-Defibrillators (ICDs)

12.2.2.3. Smart Cardiovascular Stents

12.2.2.4. Smart Cardiac Monitors

12.2.3. Ophthalmic Implants

12.2.3.1. Smart Intraocular Lenses (IOLs)

12.2.3.2. Smart Retinal Implants

12.2.3.3. Smart Glaucoma Implants

12.2.4. Dental Implants

12.2.4.1. Smart Prosthetic Teeth

12.2.4.2. Smart Dental Screws

12.2.4.3. Drug-eluting Dental Implants

12.2.4.4. Others

12.2.5. Others

12.3. Market Value Forecast, by End-user, 2017-2031

12.3.1. Hospitals and Clinics

12.3.2. Ambulatory Surgical Centers

12.3.3. Research Institutes and Academic Centers

12.3.4. Others

12.4. Market Value Forecast, by Country/Sub-region, 2017-2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Application

12.5.2. By End-user

12.5.3. By Country/Sub-region

13. Middle East & Africa Smart Medical Implants Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Application, 2017-2031

13.2.1. Orthopedic Implants

13.2.1.1. Smart Joint Implants

13.2.1.2. Smart Spinal Implants

13.2.1.3. Smart Bone Plates

13.2.1.4. Smart Orthopedic Screws

13.2.1.5. Others

13.2.2. Cardiovascular Implants

13.2.2.1. Smart Pacemakers

13.2.2.2. Smart Implantable Cardioverter-Defibrillators (ICDs)

13.2.2.3. Smart Cardiovascular Stents

13.2.2.4. Smart Cardiac Monitors

13.2.3. Ophthalmic Implants

13.2.3.1. Smart Intraocular Lenses (IOLs)

13.2.3.2. Smart Retinal Implants

13.2.3.3. Smart Glaucoma Implants

13.2.4. Dental Implants

13.2.4.1. Smart Prosthetic Teeth

13.2.4.2. Smart Dental Screws

13.2.4.3. Drug-eluting Dental Implants

13.2.4.4. Others

13.2.5. Others

13.3. Market Value Forecast, by End-user, 2017-2031

13.3.1. Hospitals and Clinics

13.3.2. Ambulatory Surgical Centers

13.3.3. Research Institutes and Academic Centers

13.3.4. Others

13.4. Market Value Forecast, by Country/Sub-region, 2017-2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Application

13.5.2. By End-user

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player - Competition Matrix (By Tier and Size of Companies)

14.2. Market Share Analysis, by Company (2022)

14.3. Company Profiles

14.3.1. Medtronic

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Product Portfolio

14.3.1.3. Financial Overview

14.3.1.4. SWOT Analysis

14.3.1.5. Strategic Overview

14.3.2. Abbott Laboratories

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Product Portfolio

14.3.2.3. Financial Overview

14.3.2.4. SWOT Analysis

14.3.2.5. Strategic Overview

14.3.3. Boston Scientific Corporation

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Product Portfolio

14.3.3.3. Financial Overview

14.3.3.4. SWOT Analysis

14.3.3.5. Strategic Overview

14.3.4. Johnson & Johnson

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Product Portfolio

14.3.4.3. Financial Overview

14.3.4.4. SWOT Analysis

14.3.4.5. Strategic Overview

14.3.5. Siemens Healthineers

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Product Portfolio

14.3.5.3. Financial Overview

14.3.5.4. SWOT Analysis

14.3.5.5. Strategic Overview

14.3.6. Smith & Nephew

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Product Portfolio

14.3.6.3. Financial Overview

14.3.6.4. SWOT Analysis

14.3.6.5. Strategic Overview

14.3.7. Stryker Corporation

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Product Portfolio

14.3.7.3. Financial Overview

14.3.7.4. SWOT Analysis

14.3.7.5. Strategic Overview

14.3.8. Zimmer Biomet

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Product Portfolio

14.3.8.3. Financial Overview

14.3.8.4. SWOT Analysis

14.3.8.5. Strategic Overview

14.3.9. Cochlear Limited

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Product Portfolio

14.3.9.3. Financial Overview

14.3.9.4. SWOT Analysis

14.3.9.5. Strategic Overview

14.3.10. Dexcom

14.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.10.2. Product Portfolio

14.3.10.3. Financial Overview

14.3.10.4. SWOT Analysis

14.3.10.5. Strategic Overview

14.3.11. St. Jude Medical (Abbott Laboratories)

14.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.11.2. Product Portfolio

14.3.11.3. Financial Overview

14.3.11.4. SWOT Analysis

14.3.11.5. Strategic Overview

14.3.12. Edwards Lifesciences

14.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.12.2. Product Portfolio

14.3.12.3. Financial Overview

14.3.12.4. SWOT Analysis

14.3.12.5. Strategic Overview

14.3.13. Biotronik

14.3.13.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.13.2. Product Portfolio

14.3.13.3. Financial Overview

14.3.13.4. SWOT Analysis

14.3.13.5. Strategic Overview

14.3.14. Second Sight Medical Products

14.3.14.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.14.2. Product Portfolio

14.3.14.3. Financial Overview

14.3.14.4. SWOT Analysis

14.3.14.5. Strategic Overview

14.3.15. Cyberonics (LivaNova)

14.3.15.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.15.2. Product Portfolio

14.3.15.3. Financial Overview

14.3.15.4. SWOT Analysis

14.3.15.5. Strategic Overview

List of Tables

Table 01: Global Smart Medical Implants Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 02: Global Smart Medical Implants Market Value (US$ Bn) Forecast, by Orthopedic Implants, 2017-2031

Table 03: Global Smart Medical Implants Market Value (US$ Bn) Forecast, by Cardiovascular Implants, 2017-2031

Table 04: Global Smart Medical Implants Market Value (US$ Bn) Forecast, by Ophthalmic Implants, 2017-2031

Table 05: Global Smart Medical Implants Market Value (US$ Bn) Forecast, by Dental Implants, 2017-2031

Table 06: Global Smart Medical Implants Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Table 07: Global Smart Medical Implants Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 08: North America Smart Medical Implants Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Table 09: North America Smart Medical Implants Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 10: North America Smart Medical Implants Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Table 11: Europe Smart Medical Implants Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Table 12: Europe Smart Medical Implants Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 13: Europe Smart Medical Implants Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Table 14: Asia Pacific Smart Medical Implants Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Table 15: Asia Pacific Smart Medical Implants Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 16: Asia Pacific Smart Medical Implants Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Table 17: Latin America Smart Medical Implants Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Table 18: Latin America Smart Medical Implants Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 19: Latin America Smart Medical Implants Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Table 20: Middle East & Africa Smart Medical Implants Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Table 21: Middle East & Africa Smart Medical Implants Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 22: Middle East & Africa Smart Medical Implants Market Value (US$ Bn) Forecast, by End-user, 2017-2031

List of Figures

Figure 01: Global Smart Medical Implants Market Value Share Analysis, by Application, 2022 and 2031

Figure 02: Global Smart Medical Implants Market Attractiveness Analysis, Application, 2023-2031

Figure 03: Global Smart Medical Implants Market Value (US$ Bn) Forecast, by Orthopedic Implants, 2017-2031

Figure 04: Global Smart Medical Implants Market Revenue (US$ Bn), by Cardiovascular Implants, 2017-2031

Figure 05: Global Smart Medical Implants Market Revenue (US$ Bn), by Ophthalmic Implants, 2017-2031

Figure 06: Global Smart Medical Implants Market Revenue (US$ Bn), by Dental Implants, 2017-2031

Figure 07: Global Smart Medical Implants Market Revenue (US$ Bn), by Others, 2017-2031

Figure 08: Global Smart Medical Implants Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Figure 09: Global Smart Medical Implants Market Attractiveness Analysis, by End-user, 2023-2031

Figure 10: Global Smart Medical Implants Market Revenue (US$ Bn), by Hospitals and Clinics, 2017-2031

Figure 11: Global Smart Medical Implants Market Revenue (US$ Bn), by Ambulatory Surgical Centers, 2017-2031

Figure 12: Global Smart Medical Implants Market Revenue (US$ Bn), by Research Institutes and Academic Centers, 2017-2031

Figure 13: Global Smart Medical Implants Market Revenue (US$ Bn), by Others, 2017-2031

Figure 14: Global Smart Medical Implants Market Attractiveness Analysis, by Region, 2023-2031

Figure 15: North America Smart Medical Implants Market Value (US$ Bn) Forecast, 2017-2031

Figure 16: North America Smart Medical Implants Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 17: North America Smart Medical Implants Market Value Share Analysis, by Application, 2022 and 2031

Figure 18: North America Smart Medical Implants Market Attractiveness Analysis, Application, 2023-2031

Figure 19: North America Smart Medical Implants Market Value Share Analysis, by End-user, 2022 and 2031

Figure 20: North America Smart Medical Implants Market Attractiveness Analysis, End-user, 2023-2031

Figure 21: Europe Smart Medical Implants Market Value (US$ Bn) Forecast, 2017-2031

Figure 22: Europe Smart Medical Implants Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 23: Europe Smart Medical Implants Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 24: Europe Smart Medical Implants Market Value Share Analysis, by Application, 2022 and 2031

Figure 25: Europe Smart Medical Implants Market Attractiveness Analysis, Application, 2023-2031

Figure 26: Europe Smart Medical Implants Market Value Share Analysis, by End-user, 2022 and 2031

Figure 27: Europe Smart Medical Implants Market Attractiveness Analysis, by End-user, 2023-2031

Figure 28: Asia Pacific Smart Medical Implants Market Value (US$ Bn) Forecast, 2017-2031

Figure 29: Asia Pacific Smart Medical Implants Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 30: Asia Pacific Smart Medical Implants Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 31: Asia Pacific Smart Medical Implants Market Value Share Analysis, by Application, 2022 and 2031

Figure 32: Asia Pacific Smart Medical Implants Market Attractiveness Analysis, Application, 2023-2031

Figure 33: Asia Pacific Smart Medical Implants Market Value Share Analysis, by End-user, 2022 and 2031

Figure 34: Asia Pacific Smart Medical Implants Market Attractiveness Analysis, by End-user, 2023-2031

Figure 35: Latin America Smart Medical Implants Market Value (US$ Bn) Forecast, 2017-2031

Figure 36: Latin America Smart Medical Implants Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 37: Latin America Smart Medical Implants Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 38: Latin America Smart Medical Implants Market Value Share Analysis, by Application, 2022 and 2031

Figure 39: Latin America Smart Medical Implants Market Attractiveness Analysis, Application, 2023-2031

Figure 40: Latin America Smart Medical Implants Market Value Share Analysis, by End-user, 2022 and 2031

Figure 41: Latin America Smart Medical Implants Market Attractiveness Analysis, End-user, 2023-2031

Figure 42: Middle East & Africa Smart Medical Implants Market Value (US$ Bn) Forecast, 2017-2031

Figure 43: Middle East & Africa Smart Medical Implants Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 44: Middle East & Africa Smart Medical Implants Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 45: Middle East & Africa Smart Medical Implants Market Value Share Analysis, by Application, 2022 and 2031

Figure 46: Middle East & Africa Smart Medical Implants Market Attractiveness Analysis, Application, 2023-2031

Figure 47: Middle East & Africa Smart Medical Implants Market Value Share Analysis, by End-user, 2022 and 2031

Figure 48: Middle East & Africa Smart Medical Implants Market Attractiveness Analysis, End-user, 2023-2031

Figure 49: Global Smart Medical Implants Market Share Analysis, by Company 2022