Reports

Reports

Analysts’ Viewpoint

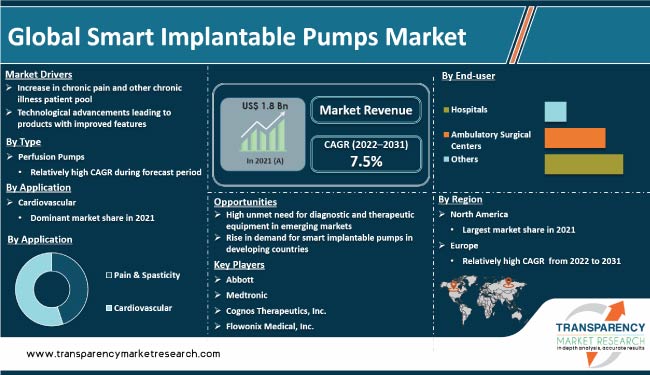

Smart implantable pumps are widely used to treat pain & spasticity, pulmonary arterial hypertension, and heart failure. Rise in admission of coronavirus patients in intensive care units (ICU) increased the demand for these pumps during the peak of the COVID-19 pandemic.

Technological advances in implantable pumps, such as less risky and more sophisticated products, are expected to drive the industry in the near future. Increase in government support in terms of reimbursement or investments in research activities is projected to be a major market trigger in the next few years.

Key companies are carrying out mechanical improvements in implantable drug pumps and technological advancements to fuel business expansion.

Smart implantable pumps are small medical devices that are used to administer medications in a consistent dose. Smart pumps are intended to notify a user when there is a risk of an adverse drug interaction or when the pump's parameters are set outside of specified safety limits.

Implantable pumps are made up of a reservoir, which is mounted subcutaneously and connected to the pump's intrathecal space via a catheter.

Implantable drug pump directs liquid medication to a specific area of the body via a thin flexible tube or a catheter. It delivers medication and nutrients in precise amounts.

The pump is available for treatment in all medical facilities. It is operated by professional medical practitioners who understand how to program the duration and rate of fluid delivery. Thus, rise in prevalence of chronic pain and spasticity is fueling industry growth.

Technological advancements have played a key role in driving the smart implantable pumps market in the past few years. The trend is expected to continue in the next few years.

Hence, manufacturers are focusing on developing innovative products to gain a competitive edge over other players. Introduction of advanced implantable pumps has reduced mortality as well as morbidity rates. This is propelling the demand for these pumps.

Smart implantable pumps have several advantages over traditional delivery systems (syringes/pens/syringes). These pumps manage the drug site, minimize possible side effects, and help improve the quality of life.

These devices are patient-friendly, as the associated regimen is usually less burdensome with safety measures than pills or injections. Therefore, advantages of these devices over conventional systems are likely to augment business development.

In terms of type, the global market has been bifurcated into perfusion pumps and micro pumps. The perfusion pumps segment accounted for the largest global smart implantable pumps market share in 2021.

Development of safe and efficacious perfusion systems, introduction of technically advanced implantable infusion pumps, and rise in adoption of these products are projected to propel the segment in the next few years.

Based on application, the global smart implantable pumps industry has been split into pain & spasticity and cardiovascular. Cardiovascular was the dominant segment in 2021 due to the rise in prevalence of cardiovascular diseases across the globe. Increase in incidence of heart failure and shortage of heart donors are expected to augment the segment during the forecast period.

In terms of end-user, the market segmentation entails hospitals, ambulatory surgical centers, and others. The hospitals segment held prominent global smart implantable pumps market share in 2021. Expanding base of hospitals and increase in number of hospital visits due to rise in prevalence of chronic illnesses such as pain and spasticity among hospitalized patients are the major factors driving the segment.

Furthermore, surge in preference for implantable infusion pumps and availability of different types of the device at hospitals are likely to fuel the segment during the forecast period.

North America is projected to be a highly attractive region for these devices during the forecast period. The market in the region is driven by large number of implantation procedures, high rate of adoption of new technologically advanced implantable medical devices, significant healthcare expenditure, and increase in research activities.

Europe is likely to record significant market progress during the forecast period. Rise in demand for smart pumps can be ascribed to the increase in incidence of chronic diseases and favorable reimbursement policies in the region.

Asia Pacific is likely to witness substantial market expansion in the next few years. Improvement in healthcare infrastructure, rise in awareness, and increase in purchasing power of the people are augmenting the market in the region.

Surge in patient base suffering from various chronic diseases due to changes in lifestyle is projected to drive market statistics in Asia Pacific during the forecast period.

The global market is fragmented, with the presence of large number leading players. Key players operating in the industry are Abbott, Baxter, Cognos Therapeutics, Inc., Flowonix Medical, Inc., Medtronic, Terumo Europe NV, Intarcia Therapeutics, Inc., Fresenius Kabi (Ivenix), and tricumed Medizintechnik GmbH.

These players are adopting growth strategies such as new product development, product launches, product approval, agreement, partnerships, and mergers to increase their market footprint.

The market report profiles leading players based on parameters such as company overview, financial overview, strategies, portfolio, segments, and recent developments.

|

Attribute |

Detail |

|

Size in 2021 |

US$ 1.8 Bn |

|

Forecast Value in 2031 |

More than US$ 3.8 Bn |

|

CAGR - 2022–2031 |

7.5% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

.Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

The market was valued at US$ 1.8 Bn in 2021

It is projected to reach more than US$ 3.8 Bn by 2031

The market grew at a CAGR of 9.5% from 2017 to 2021

The industry is anticipated to grow at a CAGR of 7.5% from 2022 to 2031

The perfusion pumps segment held more than 60.0% share in 2021

North America is expected to account for the largest share from 2022 to 2031

Abbott, Baxter, Cognos Therapeutics, Inc., Flowonix Medical, Inc., Medtronic, Terumo Europe NV, Intarcia Therapeutics, Inc., Fresenius Kabi (Ivenix), and Tricumed Medizintechnik GmbH.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Smart Implantable Pumps Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Smart Implantable Pumps Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Key Mergers & Acquisitions

5.2. Regulatory Scenario by Region/globally

5.3. Overview of Adjacent Market

5.4. Types of Drugs Delivered by Perfusion Pump and Micro Pump

5.5. Covid-19 Impact Analysis

6. Global Smart Implantable Pumps Market Analysis and Forecast, by Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Type, 2017–2031

6.3.1. Perfusion Pumps

6.3.2. Micro Pumps

6.4. Market Attractiveness Analysis, by Type

7. Global Smart Implantable Pumps Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Application, 2017–2031

7.3.1. Pain & Spasticity

7.3.2. Cardiovascular

7.4. Market Attractiveness Analysis, by Application

8. Global Smart Implantable Pumps Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Hospitals

8.3.2. Ambulatory Surgical Centers

8.3.3. Others

8.4. Market Attractiveness Analysis, by End-user

9. Global Smart Implantable Pumps Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Smart Implantable Pumps Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Type, 2017–2031

10.2.1. Perfusion Pumps

10.2.2. Micro Pumps

10.3. Market Value Forecast, by Application, 2017–2031

10.3.1. Pain & Spasticity

10.3.2. Cardiovascular

10.4. Market Value Forecast, by End-user, 2017–2031

10.4.1. Hospitals

10.4.2. Ambulatory Surgical Centers

10.4.3. Others

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Type

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Smart Implantable Pumps Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Type, 2017–2031

11.2.1. Perfusion Pumps

11.2.2. Micro Pumps

11.3. Market Value Forecast, by Application, 2017–2031

11.3.1. Pain & Spasticity

11.3.2. Cardiovascular

11.4. Market Value Forecast, by End-user, 2017–2031

11.4.1. Hospitals

11.4.2. Ambulatory Surgical Centers

11.4.3. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Type

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Smart Implantable Pumps Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Type, 2017–2031

12.2.1. Perfusion Pumps

12.2.2. Micro Pumps

12.3. Market Value Forecast, by Application, 2017–2031

12.3.1. Pain & Spasticity

12.3.2. Cardiovascular

12.4. Market Value Forecast, by End-user, 2017–2031

12.4.1. Hospitals

12.4.2. Ambulatory Surgical Centers

12.4.3. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Type

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Smart Implantable Pumps Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Type, 2017–2031

13.2.1. Perfusion Pumps

13.2.2. Micro Pumps

13.3. Market Value Forecast, by Application, 2017–2031

13.3.1. Pain & Spasticity

13.3.2. Cardiovascular

13.4. Market Value Forecast, by End-user, 2017–2031

13.4.1. Hospitals

13.4.2. Ambulatory Surgical Centers

13.4.3. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Type

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Smart Implantable Pumps Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Type, 2017–2031

14.2.1. Perfusion Pumps

14.2.2. Micro Pumps

14.3. Market Value Forecast, by Application, 2017–2031

14.3.1. Pain & Spasticity

14.3.2. Cardiovascular

14.4. Market Value Forecast, by End-user, 2017–2031

14.4.1. Hospitals

14.4.2. Ambulatory Surgical Centers

14.4.3. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Type

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2021

15.3. Company Profiles

15.3.1. Abbott

15.3.1.1. Company Overview

15.3.1.2. Product Portfolio

15.3.1.3. SWOT Analysis

15.3.1.4. Financial Overview

15.3.1.5. Strategic Overview

15.3.2. Baxter

15.3.2.1. Company Overview

15.3.2.2. Product Portfolio

15.3.2.3. SWOT Analysis

15.3.2.4. Financial Overview

15.3.2.5. Strategic Overview

15.3.3. Cognos Therapeutics, Inc.

15.3.3.1. Company Overview

15.3.3.2. Product Portfolio

15.3.3.3. SWOT Analysis

15.3.3.4. Financial Overview

15.3.3.5. Strategic Overview

15.3.4. Flowonix Medical, Inc.

15.3.4.1. Company Overview

15.3.4.2. Product Portfolio

15.3.4.3. SWOT Analysis

15.3.4.4. Financial Overview

15.3.4.5. Strategic Overview

15.3.5. Medtronic

15.3.5.1. Company Overview

15.3.5.2. Product Portfolio

15.3.5.3. SWOT Analysis

15.3.5.4. Financial Overview

15.3.5.5. Strategic Overview

15.3.6. Terumo Europe NV

15.3.6.1. Company Overview

15.3.6.2. Product Portfolio

15.3.6.3. SWOT Analysis

15.3.6.4. Financial Overview

15.3.6.5. Strategic Overview

15.3.7. Tricumed Medizintechnik GmbH

15.3.7.1. Company Overview

15.3.7.2. Product Portfolio

15.3.7.3. SWOT Analysis

15.3.7.4. Financial Overview

15.3.7.5. Strategic Overview

15.3.8. Intarcia Therapeutics, Inc.

15.3.8.1. Company Overview

15.3.8.2. Product Portfolio

15.3.8.3. SWOT Analysis

15.3.8.4. Financial Overview

15.3.8.5. Strategic Overview

15.3.9. Fresenius Kabi (Ivenix)

15.3.9.1. Company Overview

15.3.9.2. Product Portfolio

15.3.9.3. SWOT Analysis

15.3.9.4. Financial Overview

15.3.9.5. Strategic Overview

List of Tables

Table 01: Global Smart Implantable Pumps Market Value (US$ Mn) Forecast, by Type, 2017‒2031

Table 02: Smart Implantable Pumps Market Value (US$ Mn) Forecast, by 2017‒2031, by Perfusion Pumps

Table 03: Smart Implantable Pumps Market Value (US$ Mn) Forecast, by 2017‒2031, by Micro Pumps

Table 04: Global Smart Implantable Pumps Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 05: Global Smart Implantable Pumps Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 06: Global Smart Implantable Pumps Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 07: North America Smart Implantable Pumps Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 08: North America Smart Implantable Pumps Market Value (US$ Mn) Forecast, by Type, 2017‒2031

Table 09: North America Smart Implantable Pumps Market Value (US$ Mn) Forecast, by Perfusion Pumps, 2017‒2031

Table 10: North America Smart Implantable Pumps Market Value (US$ Mn) Forecast, by Micro Pumps, 2017‒2031

Table 11: North America Smart Implantable Pumps Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 12: North America Smart Implantable Pumps Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: Europe Smart Implantable Pumps Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Europe Smart Implantable Pumps Market Value (US$ Mn) Forecast, by Type, 2017‒2031

Table 15: Europe Smart Implantable Pumps Market Value (US$ Mn) Forecast, by Perfusion Pumps, 2017‒2031

Table 16: Europe Smart Implantable Pumps Market Value (US$ Mn) Forecast, by Micro Pumps, 2017‒2031

Table 17: Europe Smart Implantable Pumps Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 18: Europe Smart Implantable Pumps Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 19: Asia Pacific Smart Implantable Pumps Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 20: Asia Pacific Smart Implantable Pumps Market Value (US$ Mn) Forecast, by Type, 2017‒2031

Table 21: Asia Pacific Smart Implantable Pumps Market Value (US$ Mn) Forecast, by Perfusion Pumps, 2017‒2031

Table 22: Asia Pacific Smart Implantable Pumps Market Value (US$ Mn) Forecast, by Micro Pumps, 2017‒2031

Table 23: Asia Pacific Smart Implantable Pumps Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 24: Asia Pacific Smart Implantable Pumps Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 25: Latin America Smart Implantable Pumps Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 26: Latin America Smart Implantable Pumps Market Value (US$ Mn) Forecast, by Type, 2017‒2031

Table 27: Latin America Smart Implantable Pumps Market Value (US$ Mn) Forecast, by Perfusion Pumps, 2017‒2031

Table 28: Latin America Smart Implantable Pumps Market Value (US$ Mn) Forecast, by Micro Pumps, 2017‒2031

Table 29: Latin America Smart Implantable Pumps Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 30: Latin America Smart Implantable Pumps Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 31: Middle East & Africa Smart Implantable Pumps Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 32: Middle East & Africa Smart Implantable Pumps Market Value (US$ Mn) Forecast, by Type, 2017‒2031

Table 33: Middle East & Africa Smart Implantable Pumps Market Value (US$ Mn) Forecast, by Perfusion Pumps, 2017‒2031

Table 34: Middle East & Africa Smart Implantable Pumps Market Value (US$ Mn) Forecast, by Micro Pumps, 2017‒2031

Table 35: Middle East & Africa Smart Implantable Pumps Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 36: Middle East & Africa Smart Implantable Pumps Market Value (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Smart Implantable Pumps Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Smart Implantable Pumps Market Value Share, by Type, 2021

Figure 03: Smart Implantable Pumps Market Value Share, by Application, 2021

Figure 04: Smart Implantable Pumps Market Value Share, by End-user 2021

Figure 05: Global Smart Implantable Pumps Market Value Share Analysis, by Type, 2021 and 2031

Figure 06: Global Smart Implantable Pumps Market Attractiveness Analysis, by Type, 2022–2031

Figure 07: Global Smart Implantable Pumps Market Value (US$ Mn), by Perfusion Pumps, 2017‒2031

Figure 08: Global Smart Implantable Pumps Market Value (US$ Mn), by Micro Pumps, 2017‒2031

Figure 09: Global Smart Implantable Pumps Market Value Share Analysis, by Application, 2021 and 2031

Figure 10: Global Smart Implantable Pumps Market Attractiveness Analysis, by Application, 2022–2031

Figure 11: Global Smart Implantable Pumps Market Revenue (US$ Mn), by Pain & Spasticity, 2017–2031

Figure 12: Global Smart Implantable Pumps Market Revenue (US$ Mn), by Cardiovascular, 2017–2031

Figure 13: Global Smart Implantable Pumps Market Value Share Analysis, by End-user 2021 and 2031

Figure 14: Global Smart Implantable Pumps Market Attractiveness Analysis, by End-user 2022–2031

Figure 15: Global Smart Implantable Pumps Market Revenue (US$ Mn), by Hospital, 2017–2031

Figure 16: Global Smart Implantable Pumps Market Revenue (US$ Mn), by Ambulatory Surgical Centers, 2017–2031

Figure 17: Global Smart Implantable Pumps Market Revenue (US$ Mn), by Others, 2017–2031

Figure 18: Global Smart Implantable Pumps Market Value Share Analysis, by Region, 2021 and 2031

Figure 19: Global Smart Implantable Pumps Market Attractiveness Analysis, by Region, 2022–2031

Figure 20: North America Smart Implantable Pumps Market Value (US$ Mn) Forecast, 2017–2031

Figure 21: North America Smart Implantable Pumps Market Value Share Analysis, by Country, 2021 and 2031

Figure 22: North America Smart Implantable Pumps Market Attractiveness Analysis, by Country, 2022–2031

Figure 23: North America Smart Implantable Pumps Market Value Share Analysis, by Type, 2021 and 2031

Figure 24: North America Smart Implantable Pumps Market Attractiveness Analysis, by Type, 2022–2031

Figure 25: North America Smart Implantable Pumps Market Value Share Analysis, by Application, 2021 and 2031

Figure 26: North America Smart Implantable Pumps Market Attractiveness Analysis, by Application, 2022–2031

Figure 27: North America Smart Implantable Pumps Market Value Share Analysis, by End-user 2021 and 2031

Figure 28: North America Smart Implantable Pumps Market Attractiveness Analysis, by End-user 2022–2031

Figure 29: Europe Smart Implantable Pumps Market Value (US$ Mn) Forecast, 2017–2031

Figure 30: Europe Smart Implantable Pumps Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 31: Europe Smart Implantable Pumps Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 32: Europe Smart Implantable Pumps Market Value Share Analysis, by Type, 2021 and 2031

Figure 33: Europe Smart Implantable Pumps Market Attractiveness Analysis, by Type, 2022–2031

Figure 34: Europe Smart Implantable Pumps Market Value Share Analysis, by Application, 2021 and 2031

Figure 35: Europe Smart Implantable Pumps Market Attractiveness Analysis, by Application, 2022–2031

Figure 36: Europe Smart Implantable Pumps Market Value Share Analysis, by End-user 2021 and 2031

Figure 37: Europe Smart Implantable Pumps Market Attractiveness Analysis, by End-user 2022–2031

Figure 38: Asia Pacific Smart Implantable Pumps Market Value (US$ Mn) Forecast, 2017–2031

Figure 39: Asia Pacific Smart Implantable Pumps Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 40: Asia Pacific Smart Implantable Pumps Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 41: Asia Pacific Smart Implantable Pumps Market Value Share Analysis, by Type, 2021 and 2031

Figure 42: Asia Pacific Smart Implantable Pumps Market Attractiveness Analysis, by Type, 2022–2031

Figure 43: Asia Pacific Smart Implantable Pumps Market Value Share Analysis, by Application, 2021 and 2031

Figure 44: Asia Pacific Smart Implantable Pumps Market Value Share Analysis, by End-user 2021 and 2031

Figure 45: Asia Pacific Smart Implantable Pumps Market Attractiveness Analysis, by End-user 2022–2031

Figure 46: Asia Pacific Smart Implantable Pumps Market Attractiveness Analysis, by Application, 2022–2031

Figure 47: Latin America Smart Implantable Pumps Market Value (US$ Mn) Forecast, 2017–2031

Figure 48: Latin America Smart Implantable Pumps Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 49: Latin America Smart Implantable Pumps Market Attractiveness Analysis, by Country/Sub-region, 2021-2031

Figure 50: Latin America Smart Implantable Pumps Market Value Share Analysis, by Type, 2021 and 2031

Figure 51: Latin America Smart Implantable Pumps Market Attractiveness Analysis, by Type, 2022–2031

Figure 52: Latin America Smart Implantable Pumps Market Value Share Analysis, by Application, 2021 and 2031

Figure 53: Latin America Smart Implantable Pumps Market Attractiveness Analysis, by Application, 2022–2031

Figure 54: Latin America Smart Implantable Pumps Market Value Share Analysis, by End-user 2022–2031

Figure 55: Latin America Smart Implantable Pumps Market Attractiveness Analysis, by End-user, 2022–2031

Figure 56: Middle East & Africa Smart Implantable Pumps Market Value (US$ Mn) Forecast, 2017–2031

Figure 57: Middle East & Africa Smart Implantable Pumps Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 58: Middle East & Africa Smart Implantable Pumps Market Attractiveness Analysis, by Country/Sub-region, 2021-2031

Figure 59: Middle East & Africa Smart Implantable Pumps Market Value Share Analysis, by Type, 2021 and 2031

Figure 60: Middle East & Africa Smart Implantable Pumps Market Attractiveness Analysis, by Type, 2022–2031

Figure 61: Middle East & Africa Smart Implantable Pumps Market Value Share Analysis, by Application, 2021 and 2031

Figure 62: Middle East & Africa Smart Implantable Pumps Market Attractiveness Analysis, by Application, 2022–2031

Figure 63: Middle East & Africa Smart Implantable Pumps Market Value Share Analysis, by End-user 2022–2031

Figure 64: Middle East & Africa Smart Implantable Pumps Market Attractiveness Analysis, by End-user, 2022–2031

Figure 65: Company Share Analysis, 2021