Reports

Reports

Demographic transformation is amongst the primary drivers to the skincare serums market, as the aging population worldwide is building consistent demand for specific anti-aging treatments. As the consumers continue to seek effective solutions for specific skin concerns such as acne, aging, and hyperpigmentation, serums known for their high concentrations of active ingredients are becoming essential components of routine skincare regimen.

Additionally, formulation science advancements such as stabilized vitamin C, microencapsulation, and peptide delivery systems are allowing for higher potency with better tolerability, thereby rendering serums improved effectivity and versatility across ages and skin types.

The other important factors contributing toward expansion of the skincare serums market are the technological advancements in R&D and ingredient sourcing. Products are claimed and positioned clinically for demonstration with biotechnology-derived actives, such as growth factors, peptides, botanical bioactives, and strong stability platforms. Simultaneous improvements in manufacturing and supply-chain scalability have shared production barriers for high-concentration formulas, thereby enabling more widespread product commercialization. Retail and distribution innovations, particularly direct-to-consumer channels, rapid international rollouts, and subscription services have shortened time-to-market for niche serums so that specialty formats can reach consumers and professionals earlier.

Recent developments in the serum market have witnessed a paradigm shift toward the use of laboratory and biotechnically derived active ingredients (peptides, exosome inspired molecules and growth-factor blends), simplified high performance formulations and customization by skin diagnostics, and customized blends.

The market has evolved from disposable, single-use packs to refillable and concentrated bottles that reduce waste, promote sustainability, and packaging innovation. Compared to earlier times, social commerce and editorial approval continue to speed up niche launches and at the same time, brands focus on clinical endpoints such as measurable brightening, elasticity gains for differentiation.

Several companies engaged in the skincare serums market are now partnering with biotech firms, which specialize in creating unique active ingredients and launching clinical research results to validate their claims. Omni-channel subscription plans and curated regional product selections are becoming standard retail enhancement strategies, while eco-friendly scalable manufacturing of high-potency products is also in progress. Moreover, companies aim to cover several consumer segments simultaneously with luxury products in addition to budget-friendly offerings.

Serums represent a type of lightweight powerful formulation that delivers active components directly to skin layers. The correct application sequence for serums starts with post-cleansing use followed by moisturizing. Serums, like all skincare products, contain specific formulations that target particular skin issues including hydration needs and aging signs as well as acne problems and pigmentation concerns.

Serums possess light textures as they contain water or oil bases that use low molecular weight components to penetrate deeply into the skin. The proper order for using serums in one’s daily skincare routine is to apply them following cleansing, before moisturizing. All skin-types benefit from serums as they are easy to apply and provide desired effects without additional weight or residue.

Serums have a number of beneficial active ingredients. Frequently used active ingredients include hyaluronic acid along with vitamin C and niacinamide and peptides and retinol. Some of the commonly used actives are hyaluronic acid, vitamin C, niacinamide, peptides, and retinol.

The typical treatment results of serums include hydration, brightening, and anti-aging, but it will depend on the serum one chooses. The highly concentrated serums deliver precise doses of active ingredients that can quickly achieve significant changes in the texture, firmness, and luminosity of the skin faster than conventional skin care products.

Since serums can deliver these important ingredients deep in the skin, serums can be effective at improving the overall health and appearance of the skin and are an important addition to any skincare routine.

Each serum exists with individualized formulations, which address peculiar skin problems. Serums that hydrate work to fix dryness and strengthen skin barriers while brightening serums fight pigmentation problems and uneven skin tone and anti-aging serums work to reduce fine lines and achieve firmer skin.

Serum formulation developments have enhanced both - product stability and the ability to work with different skin types. Modern serum technology uses active ingredient encapsulation methods to protect components while increasing product longevity and minimizing skin sensitivity. The majority of these products have lightweight formulations that let people use multiple serums in their daily skincare routine. Serums function as adaptable solutions that provide precise results for various skincare routines.

| Attribute | Detail |

|---|---|

| Skincare Serums Market Drivers |

|

Growth in consumer consciousness is one of the most significant drivers to the skincare serums market, since the existing consumers are much more knowledgeable about ingredients, label claims, and skin wellness. The consumers are made aware of the benefits of active ingredients like vitamin C, hyaluronic acid, and peptides owing to the penetration of social media.

The consumer demand for evidence-based products is fueling the growth of serums that offer clinically tested, visible results, and transparency of ingredient origin. Consumers increasingly seek detailed product information and demonstrated efficacy, and reward firms that offer science backing and educational content with products. It creates trust and loyalty that further fuels the serum consumption.

Also, consumers have become better informed and their needs for products have become more diverse as consumers now better understand the uniqueness of skin types and the need to treat skin with specific solutions. The brands, in turn, are producing serums for the specific needs of sensitive, oily, acne, and aging skin. This custom solution addresses not only product lines, but also increases business, trade, and brand, as consumers expect to find effective solutions specific to their skin care concerns.

The awareness movement has gained momentum through worldwide wellness patterns, which show that consumers view skincare as an essential element of their personal health maintenance. Serums match this approach by offering concentrated active ingredients that produce visible effects to consumers. The growing consumer interest in performance-driven products keeps serums as their primary choice for skincare investment.

Increasing disposable incomes are another major market driver to skincare serums, given that increased spending power leads consumers to spend on premium and niche skincare products.

The higher the incomes, the more likely consumers are to spend on remedial and preventative skincare and not maintenance. Serums, with the specificity of reacting to issues like wrinkles, pigmentation, and dryness, are considered as an investment in skin health for the long term. This is the mindset that generates repeat purchase and use of several serums in routines, creates demand for various product ranges.

Increasing income on the consumer side enables them to splurge on luxuries and try out international brands due to specialty retail chains and convenience shopping online. Premium-paying consumers are eager to try out new skincare ingredients introducing innovative active ingredients, dermatologist-recommended components, and green packaging. Such favorable consumer action reinforces and builds up the brands.

In addition, higher incomes drive aspirational spending, whereby skincare purchases reflect lifestyle and identity. Serums, positioned as refined and efficacious remedies, resonate well with the reputation-driven clientele who relate high-end beauty to assurance and health. Such readiness to invest in quality beauty further propels the growth of the serum segment.

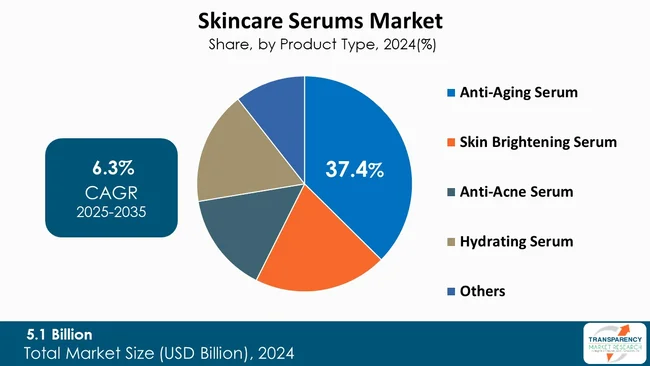

Anti-aging serums lead the skincare serums market as they are capable of tackling one of the most rampant concerns, which is aging. As the population of older people grows, increasing numbers of individuals are seeking for means of slowing down skin aging. This broad spectrum is created to address every skincare concern, ranging from anti-aging prevention to addressing individual concerns as witnessed with retinol serums, for moisturizing dry or damaged skin.

Their traction is also strengthened by significant clinical validation, as well as strong consumer confidence in their effectiveness. Anti-aging serums are also highly popular as younger consumers increasingly use them for prevention while older segments use them for repair to generate strong and long-term demand.

| Attribute | Detail |

|---|---|

| Leading Region |

|

As per the latest skincare serums market analysis, North America dominated in 2024. This could be credited to the region’s strong purchasing-consumer base, extensive distribution of premium skincare, and developed retail infrastructure. It is driven by an early adoption of dermatology-backed products and a preventive and corrective skin care philosophy, leading to sustained demand for anti-aging, moisturizing, and brightening serums.

Besides, North America holds the leading market position due to its innovation-led growth, where companies put strong investments in R&D, clinical validation, and marketing. Strong e-Commerce systems along with influencer-led consumer engagement and widespread product availability, further bolstering the region’s lead in the skincare serum market.

Market players leading the skincare serums market emphasize R&D on new actives, clinical proof to establish trust, and eco-friendly packaging to engage environmentally aware consumers. They utilize digital marketing, influencer partnerships, and customized skincare services, growing through e-commerce platforms and luxury retail collaborations in order to engage meaningfully with various consumer segments.

L’OREAL S.A., Estée Lauder Inc., Shiseido Co.,Ltd., Procter & Gamble, DECIEM Beauty Group Inc., SkinCeuticals, Kiehl’s, TATA HARPER SKINCARE, Dr. Dennis Gross Skincare LLC, Obagi Cosmeceuticals LLC, Murad, LLC, Drunk Elephant, Elizabeth Arden, LA PRAIRIE, Paula’s Choice, LLC, and GALDERMA are some of the leading players operating in the global skincare serums market.

Each of these players has been profiled in the skincare serums market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 5.1 Bn |

| Forecast Value in 2035 | US$ 9.9 Bn |

| CAGR | 6.3% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Skincare Serum Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Product Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global skincare serums market was valued at US$ 5.1 Bn in 2024

The global skincare serums industry is projected to reach more than US$ 9.9 Bn by the end of 2035

Growing anti-aging concerns, increased consumer awareness about specialized skincare needs, rising disposable incomes, the influence of social media and dermatologist endorsements, and the e-commerce growth are some of the factors driving the expansion of skincare serums market.

The CAGR is anticipated to be 6.3% from 2025 to 2035

L’OREAL S.A., Estée Lauder Inc., Shiseido Co., Ltd., Procter & Gamble, DECIEM Beauty Group Inc., SkinCeuticals, Kiehl’s, TATA HARPER SKINCARE, Dr. Dennis Gross Skincare LLC, Obagi Cosmeceuticals LLC, Murad, LLC, Drunk Elephant, Elizabeth Arden, LA PRAIRIE, Paula’s Choice, LLC, and GALDERMA

Table 01: Global Skincare Serums Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 02: Global Skincare Serums Market Value (US$ Bn) Forecast, By Skin Type, 2020 to 2035

Table 03: Global Skincare Serums Market Value (US$ Bn) Forecast, By Formulation, 2020 to 2035

Table 04: Global Skincare Serums Market Value (US$ Bn) Forecast, By Target Demographic, 2020 to 2035

Table 05: Global Skincare Serums Market Value (US$ Bn) Forecast, By Ingredients, 2020 to 2035

Table 06: Global Skincare Serums Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 07: Global Skincare Serums Market Value (US$ Bn) Forecast, By Online, 2020 to 2035

Table 08: Global Skincare Serums Market Value (US$ Bn) Forecast, By Offline, 2020 to 2035

Table 09: Global Skincare Serums Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 10: North America Skincare Serums Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 11: North America Skincare Serums Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 12: North America Skincare Serums Market Value (US$ Bn) Forecast, By Skin Type, 2020 to 2035

Table 13: North America Skincare Serums Market Value (US$ Bn) Forecast, By Formulation, 2020 to 2035

Table 14: North America Skincare Serums Market Value (US$ Bn) Forecast, By Target Demographic, 2020 to 2035

Table 15: North America Skincare Serums Market Value (US$ Bn) Forecast, By Ingredients, 2020 to 2035

Table 16: North America Skincare Serums Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 17: North America Skincare Serums Market Value (US$ Bn) Forecast, By Online, 2020 to 2035

Table 18: North America Skincare Serums Market Value (US$ Bn) Forecast, By Offline, 2020 to 2035

Table 19: Europe Skincare Serums Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 20: Europe Skincare Serums Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 21: Europe Skincare Serums Market Value (US$ Bn) Forecast, By Skin Type, 2020 to 2035

Table 22: Europe Skincare Serums Market Value (US$ Bn) Forecast, By Formulation, 2020 to 2035

Table 23: Europe Skincare Serums Market Value (US$ Bn) Forecast, By Target Demographic, 2020 to 2035

Table 24: Europe Skincare Serums Market Value (US$ Bn) Forecast, By Ingredients, 2020 to 2035

Table 25: Europe Skincare Serums Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 26: Europe Skincare Serums Market Value (US$ Bn) Forecast, By Online, 2020 to 2035

Table 27: Europe Skincare Serums Market Value (US$ Bn) Forecast, By Offline, 2020 to 2035

Table 28: Asia Pacific Skincare Serums Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 29: Asia Pacific Skincare Serums Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 30: Asia Pacific Skincare Serums Market Value (US$ Bn) Forecast, By Skin Type, 2020 to 2035

Table 31: Asia Pacific Skincare Serums Market Value (US$ Bn) Forecast, By Formulation, 2020 to 2035

Table 32: Asia Pacific Skincare Serums Market Value (US$ Bn) Forecast, By Target Demographic, 2020 to 2035

Table 33: Asia Pacific Skincare Serums Market Value (US$ Bn) Forecast, By Ingredients, 2020 to 2035

Table 34: Asia Pacific Skincare Serums Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 35: Asia Pacific Skincare Serums Market Value (US$ Bn) Forecast, By Online, 2020 to 2035

Table 36: Asia Pacific Skincare Serums Market Value (US$ Bn) Forecast, By Offline, 2020 to 2035

Table 37: Latin America Skincare Serums Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 38: Latin America Skincare Serums Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 39: Latin America Skincare Serums Market Value (US$ Bn) Forecast, By Skin Type, 2020 to 2035

Table 40: Latin America Skincare Serums Market Value (US$ Bn) Forecast, By Formulation, 2020 to 2035

Table 41: Latin America Skincare Serums Market Value (US$ Bn) Forecast, By Target Demographic, 2020 to 2035

Table 42: Latin America Skincare Serums Market Value (US$ Bn) Forecast, By Ingredients, 2020 to 2035

Table 43: Latin America Skincare Serums Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 44: Latin America Skincare Serums Market Value (US$ Bn) Forecast, By Online, 2020 to 2035

Table 45: Latin America Skincare Serums Market Value (US$ Bn) Forecast, By Offline, 2020 to 2035

Table 46: Middle East & Africa Skincare Serums Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 47: Middle East & Africa Skincare Serums Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 48: Middle East & Africa Skincare Serums Market Value (US$ Bn) Forecast, By Skin Type, 2020 to 2035

Table 49: Middle East & Africa Skincare Serums Market Value (US$ Bn) Forecast, By Formulation, 2020 to 2035

Table 50: Middle East & Africa Skincare Serums Market Value (US$ Bn) Forecast, By Target Demographic, 2020 to 2035

Table 51: Middle East & Africa Skincare Serums Market Value (US$ Bn) Forecast, By Ingredients, 2020 to 2035

Table 52: Middle East & Africa Skincare Serums Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 53: Middle East & Africa Skincare Serums Market Value (US$ Bn) Forecast, By Online, 2020 to 2035

Table 54: Middle East & Africa Skincare Serums Market Value (US$ Bn) Forecast, By Offline, 2020 to 2035

Figure 01: Global Skincare Serums Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 02: Global Skincare Serums Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 03: Global Skincare Serums Market Revenue (US$ Bn), by Anti-Aging Serum, 2020 to 2035

Figure 04: Global Skincare Serums Market Revenue (US$ Bn), by Skin Brightening Serum, 2020 to 2035

Figure 05: Global Skincare Serums Market Revenue (US$ Bn), by Anti-Acne Serum, 2020 to 2035

Figure 06: Global Skincare Serums Market Revenue (US$ Bn), by Hydrating Serum, 2020 to 2035

Figure 07: Global Skincare Serums Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 08: Global Skincare Serums Market Value Share Analysis, By Skin Type, 2024 and 2035

Figure 09: Global Skincare Serums Market Attractiveness Analysis, By Skin Type, 2025 to 2035

Figure 10: Global Skincare Serums Market Revenue (US$ Bn), by Dry Skin, 2020 to 2035

Figure 11: Global Skincare Serums Market Revenue (US$ Bn), by Sensitive Skin, 2020 to 2035

Figure 12: Global Skincare Serums Market Revenue (US$ Bn), by Oily Skin, 2020 to 2035

Figure 13: Global Skincare Serums Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 14: Global Skincare Serums Market Value Share Analysis, By Formulation, 2024 and 2035

Figure 15: Global Skincare Serums Market Attractiveness Analysis, By Formulation, 2025 to 2035

Figure 16: Global Skincare Serums Market Revenue (US$ Bn), by Oil-based Serum, 2020 to 2035

Figure 17: Global Skincare Serums Market Revenue (US$ Bn), by Water-based Serum, 2020 to 2035

Figure 18: Global Skincare Serums Market Revenue (US$ Bn), by Gel-based Serum, 2020 to 2035

Figure 19: Global Skincare Serums Market Revenue (US$ Bn), by Emulsion Serum, 2020 to 2035

Figure 20: Global Skincare Serums Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 21: Global Skincare Serums Market Value Share Analysis, By Target Demographic, 2024 and 2035

Figure 22: Global Skincare Serums Market Attractiveness Analysis, By Target Demographic, 2025 to 2035

Figure 23: Global Skincare Serums Market Revenue (US$ Bn), by Female, 2020 to 2035

Figure 24: Global Skincare Serums Market Revenue (US$ Bn), by Male, 2020 to 2035

Figure 25: Global Skincare Serums Market Value Share Analysis, By Ingredients, 2024 and 2035

Figure 26: Global Skincare Serums Market Attractiveness Analysis, By Ingredients, 2025 to 2035

Figure 27: Global Skincare Serums Market Revenue (US$ Bn), by Hyaluronic Acid, 2020 to 2035

Figure 28: Global Skincare Serums Market Revenue (US$ Bn), by Vitamin C, 2020 to 2035

Figure 29: Global Skincare Serums Market Revenue (US$ Bn), by Retinol (Vitamin A), 2020 to 2035

Figure 30: Global Skincare Serums Market Revenue (US$ Bn), by Alpha Hydroxy Acids (AHAs), 2020 to 2035

Figure 31: Global Skincare Serums Market Revenue (US$ Bn), by Vitamin E, 2020 to 2035

Figure 32: Global Skincare Serums Market Revenue (US$ Bn), by DMAE (Dimethylaminoethanol), 2020 to 2035

Figure 33: Global Skincare Serums Market Revenue (US$ Bn), by Peptides, 2020 to 2035

Figure 34: Global Skincare Serums Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 35: Global Skincare Serums Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 36: Global Skincare Serums Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 37: Global Skincare Serums Market Revenue (US$ Bn), by Online, 2020 to 2035

Figure 38: Global Skincare Serums Market Revenue (US$ Bn), by Offline, 2020 to 2035

Figure 39: Global Skincare Serums Market Value Share Analysis, By Region, 2024 and 2035

Figure 40: Global Skincare Serums Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 41: North America Skincare Serums Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 42: North America Skincare Serums Market Value Share Analysis, by Country, 2024 and 2035

Figure 43: North America Skincare Serums Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 44: North America Skincare Serums Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 45: North America Skincare Serums Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 46: North America Skincare Serums Market Value Share Analysis, By Skin Type, 2024 and 2035

Figure 47: North America Skincare Serums Market Attractiveness Analysis, By Skin Type, 2025 to 2035

Figure 48: North America Skincare Serums Market Value Share Analysis, By Formulation, 2024 and 2035

Figure 49: North America Skincare Serums Market Attractiveness Analysis, By Formulation, 2025 to 2035

Figure 50: North America Skincare Serums Market Value Share Analysis, By Target Demographic, 2024 and 2035

Figure 51: North America Skincare Serums Market Attractiveness Analysis, By Target Demographic, 2025 to 2035

Figure 52: North America Skincare Serums Market Value Share Analysis, By Ingredients, 2024 and 2035

Figure 53: North America Skincare Serums Market Attractiveness Analysis, By Ingredients, 2025 to 2035

Figure 54: North America Skincare Serums Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 55: North America Skincare Serums Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 56: Europe Skincare Serums Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 57: Europe Skincare Serums Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 58: Europe Skincare Serums Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 59: Europe Skincare Serums Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 60: Europe Skincare Serums Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 61: Europe Skincare Serums Market Value Share Analysis, By Skin Type, 2024 and 2035

Figure 62: Europe Skincare Serums Market Attractiveness Analysis, By Skin Type, 2025 to 2035

Figure 63: Europe Skincare Serums Market Value Share Analysis, By Formulation, 2024 and 2035

Figure 64: Europe Skincare Serums Market Attractiveness Analysis, By Formulation, 2025 to 2035

Figure 65: Europe Skincare Serums Market Value Share Analysis, By Target Demographic, 2024 and 2035

Figure 66: Europe Skincare Serums Market Attractiveness Analysis, By Target Demographic, 2025 to 2035

Figure 67: Europe Skincare Serums Market Value Share Analysis, By Ingredients, 2024 and 2035

Figure 68: Europe Skincare Serums Market Attractiveness Analysis, By Ingredients, 2025 to 2035

Figure 69: Europe Skincare Serums Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 70: Europe Skincare Serums Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 71: Asia Pacific Skincare Serums Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 72: Asia Pacific Skincare Serums Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 73: Asia Pacific Skincare Serums Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 74: Asia Pacific Skincare Serums Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 75: Asia Pacific Skincare Serums Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 76: Asia Pacific Skincare Serums Market Value Share Analysis, By Skin Type, 2024 and 2035

Figure 77: Asia Pacific Skincare Serums Market Attractiveness Analysis, By Skin Type, 2025 to 2035

Figure 78: Asia Pacific Skincare Serums Market Value Share Analysis, By Formulation, 2024 and 2035

Figure 79: Asia Pacific Skincare Serums Market Attractiveness Analysis, By Formulation, 2025 to 2035

Figure 80: Asia Pacific Skincare Serums Market Value Share Analysis, By Target Demographic, 2024 and 2035

Figure 81: Asia Pacific Skincare Serums Market Attractiveness Analysis, By Target Demographic, 2025 to 2035

Figure 82: Asia Pacific Skincare Serums Market Value Share Analysis, By Ingredients, 2024 and 2035

Figure 83: Asia Pacific Skincare Serums Market Attractiveness Analysis, By Ingredients, 2025 to 2035

Figure 84: Asia Pacific Skincare Serums Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 85: Asia Pacific Skincare Serums Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 86: Latin America Skincare Serums Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 87: Latin America Skincare Serums Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 88: Latin America Skincare Serums Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 89: Latin America Skincare Serums Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 90: Latin America Skincare Serums Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 91: Latin America Skincare Serums Market Value Share Analysis, By Skin Type, 2024 and 2035

Figure 92: Latin America Skincare Serums Market Attractiveness Analysis, By Skin Type, 2025 to 2035

Figure 93: Latin America Skincare Serums Market Value Share Analysis, By Formulation, 2024 and 2035

Figure 94: Latin America Skincare Serums Market Attractiveness Analysis, By Formulation, 2025 to 2035

Figure 95: Latin America Skincare Serums Market Value Share Analysis, By Target Demographic, 2024 and 2035

Figure 96: Latin America Skincare Serums Market Attractiveness Analysis, By Target Demographic, 2025 to 2035

Figure 97: Latin America Skincare Serums Market Value Share Analysis, By Ingredients, 2024 and 2035

Figure 98: Latin America Skincare Serums Market Attractiveness Analysis, By Ingredients, 2025 to 2035

Figure 99: Latin America Skincare Serums Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 100: Latin America Skincare Serums Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 101: Middle East & Africa Skincare Serums Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 102: Middle East & Africa Skincare Serums Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 103: Middle East & Africa Skincare Serums Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 104: Middle East & Africa Skincare Serums Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 105: Middle East & Africa Skincare Serums Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 106: Middle East & Africa Skincare Serums Market Value Share Analysis, By Skin Type, 2024 and 2035

Figure 107: Middle East & Africa Skincare Serums Market Attractiveness Analysis, By Skin Type, 2025 to 2035

Figure 108: Middle East & Africa Skincare Serums Market Value Share Analysis, By Formulation, 2024 and 2035

Figure 109: Middle East & Africa Skincare Serums Market Attractiveness Analysis, By Formulation, 2025 to 2035

Figure 110: Middle East & Africa Skincare Serums Market Value Share Analysis, By Target Demographic, 2024 and 2035

Figure 111: Middle East & Africa Skincare Serums Market Attractiveness Analysis, By Target Demographic, 2025 to 2035

Figure 112: Middle East & Africa Skincare Serums Market Value Share Analysis, By Ingredients, 2024 and 2035

Figure 113: Middle East & Africa Skincare Serums Market Attractiveness Analysis, By Ingredients, 2025 to 2035

Figure 114: Middle East & Africa Skincare Serums Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 115: Middle East & Africa Skincare Serums Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035