Reports

Reports

Analysts’ Viewpoint

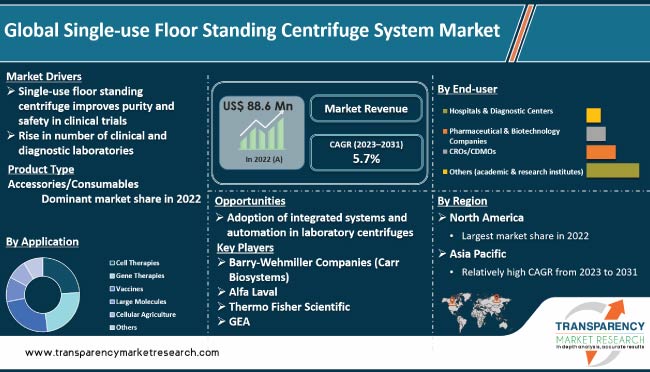

Single-use floor standing centrifuges are popular choice among researchers and biotech companies, as these offer convenience, reduced risk of contamination, and lower operational costs compared to their reusable counterparts. The global single-use floor standing centrifuge system market is expected to grow rapidly during the forecast period due to increase in demand for bioprocessing equipment and rise in demand for single-use systems. Growth of the biopharmaceutical industry is likely to propel market expansion.

Surge in demand for biopharmaceuticals and increase in need for efficient and reliable bioprocessing equipment offer lucrative opportunities for market players. Manufacturers are focusing on research & development of advanced single-use centrifuge systems in vaccine production. However, high cost of single-use floor standing centrifuges and limited availability of these systems in some regions are likely to restrain market progress.

A single-use floor standing centrifuge is a laboratory equipment used to separate particles of different densities in a suspension. Unlike traditional centrifuges that are made of metal and other durable materials, a single-use centrifuge is made of disposable plastic materials and is intended for one-time use. The single-use nature of this centrifuge makes it ideal for applications in biotechnology and life sciences, where the risk of cross-contamination is a major concern. This type of centrifuge features a compact design, making it easy to set up and operate in any laboratory.

Single-use floor standing centrifuge can accommodate a range of tube sizes and can be programmed to run at different speeds and for different durations, making it versatile for a number of separation applications. The digital control panel and user-friendly interface make it easy for users to set up and run the centrifuge, and the results can be viewed and stored digitally for later analysis. The single-use floor standing centrifuge offers several benefits over traditional centrifuges, including increased safety, reduced maintenance and cleaning requirements, and lower cost of ownership. Its disposable design eliminates the need for sterilization, making it ideal for usage in sensitive research environments. Furthermore, the single-use floor standing centrifuge can be discarded after use, reducing the risk of cross-contamination, and ensuring a higher level of biosecurity.

Single-use floor standing centrifuges are gaining traction in clinical trials due to the ability to enhance sample purity and safety. Traditional centrifuges are made of metal or plastic, and cleaned and reused multiple times, which increases the risk of cross-contamination between samples. Moreover, there is a chance that residual sample material could remain in the centrifuge and contaminate subsequent samples, leading to inaccurate results.

Single-use floor standing centrifuges eliminate the risk of cross-contamination between samples, as these are designed to be used only once. This eliminates the risk of residual sample material affecting subsequent samples. It also leads to a more accurate and consistent analysis of the samples processed in these centrifuges, which is critical in ensuring the validity of clinical trial results.

Usage of single-use floor standing centrifuges in clinical trials has improved overall research quality. Improved purity and safety of the samples processed in these centrifuges enhance the accuracy of the results, which helps researchers make better-informed decisions about patient care. This, in turn, leads to the development of more effective treatments and improved patient outcomes.

The global single-use floor standing centrifuge system market is expanding at a rapid pace due to rise in the number of clinical and diagnostic laboratories. Floor-standing centrifuges are designed for larger sample volumes, and are widely used in clinical and diagnostic laboratories. These are equipped with various features that make them ideal for applications such as blood separation and protein purification.

Increase in demand for single-use floor standing centrifuges is driven by the need for cost-effective and efficient equipment in clinical and diagnostic laboratories. This trend is driving demand, especially in the clinical and diagnostic laboratory market. Multinational pathology chain Metropolis Healthcare has plans to expand its global presence with an investment of over US$ 46 Mn in the next four years. The company currently has 130 labs and 1,000 collection centers in India, Africa, Sri Lanka, and Mauritius, and aims to increase these to 250 labs and 2,000 collection centers by the end of 2023. Metropolis Healthcare also completed the acquisition of Chennai-based Hitech Diagnostic Centre (Hitech) along with its subsidiary Centralab Healthcare Services (Centralab) in October 2021 for US$ 7.7 Mn.

The number of clinical and diagnostic laboratories has increased significantly across the world in the last few years. This is ascribed to rise in the number of infectious diseases and need for rapid and accurate diagnostic procedures. This is projected to drive global the single-use floor standing centrifuge system market size in the next few years. The number of clinical and diagnostic laboratories has been increasing globally, particularly in developing countries, due to the growing demand for efficient and accurate medical diagnoses. According to the World Health Organization (WHO), there were around 5 million clinical laboratories globally in 2016.

In terms of product type, the accessories/consumables segment dominated the global single-use floor standing centrifuge system market in 2022. Demand for accessories and consumables is high, as these are required for proper functioning of a centrifuge. This includes items such as tubes, rotors, and other components that are necessary for the separation process. Surge in research activities using single-use floor standing centrifuges is expected to propel demand for accessories and consumables.

Accessories and consumables are disposable and typically need to be replaced after every use. Therefore, customers would have to make repeat purchases, which contributes to the growth of the segment. Equipment is a major investment, and accessories & consumables are often seen as a cost-effective option for customers. This is because these are much less expensive than the actual centrifuge equipment, making it easier for customers to purchase and use.

Based on application, cell therapies was the largest segment of the global single-use floor standing centrifuge system market in 2022. This is ascribed to increase in demand for cell therapies for treatment of various diseases, such as cancer, cardiovascular diseases, and neurological disorders. Usage of cell therapies has risen rapidly in the last few years due to advances in biotechnology and increase in understanding of cellular processes.

Cell therapies involve utilization of living cells to treat or cure diseases, and are considered one of the most promising areas in the field of biotechnology. Usage of cell therapies is expected to continue to rise in the next few years, as increasing number of treatments using this technology become available. The cell therapies segment is also driven by factors such as increase in demand for treatments for various diseases, rise in awareness about the benefits of cell therapies, and surge in investment in research & development. Furthermore, increase in number of biotech & pharmaceutical companies and rise in number of partnerships between these companies and academic institutions are expected to contribute to the growth of the cell therapies segment.

In terms of end-user, the hospitals & diagnostic centers segment dominated the global single-use floor standing centrifuge system market in 2022. Hospitals and diagnostic centers are at the forefront of healthcare delivery, and these require cutting-edge technology and equipment to diagnose and treat patients effectively. Single-use floor standing centrifuge is an essential tool in diagnostic procedures and is widely used in hospitals and diagnostic centers.

Growth of the in-vitro diagnostic (IVD) business is driving single-use floor standing centrifuge system market demand in hospitals and diagnostic centers. The IVD market is growing rapidly due to rise in prevalence of chronic diseases, such as diabetes and cancer, and the need for accurate and reliable diagnostic tests. Single-use floor standing centrifuge is a key tool in IVD tests.

As per single-use floor standing centrifuge system market analysis, North America is expected to be a major market for single-use floor standing centrifuges, driven by presence of a large number of pharmaceutical and biotechnology companies, research institutions, and hospitals. The region is home to a number of companies that manufacture and distribute single-use floor standing centrifuges. Presence of advanced healthcare infrastructure and well-established regulatory framework are the other factors bolstering market development in North America.

The single-use floor standing centrifuge system market growth in Asia Pacific is expected to be at a rapid pace in the near future. This is ascribed to increase in demand for these devices in countries such as China, India, and Japan. Growing population and increase in prevalence of chronic diseases are major drivers of the market in the region. Furthermore, growth of the pharmaceutical & biotechnology industries in Asia Pacific is driving the demand for single-use floor standing centrifuges in research & development. Surge in investment in healthcare infrastructure in the region is also expected to contribute to the growth of the market.

The single-use floor standing centrifuge system market report includes vital information about the key manufacturers operating in the global market. Leading players are focusing on strategies such as product launches, divestiture, mergers & acquisitions (M&A), and partnerships to strengthen market position. Barry-Wehmiller Companies (Carr Biosystems), Alfa Laval, Thermo Fisher Scientific, GEA, and Sartorius AG are the prominent players operating in the market.

Key players in the market have been profiled in the report based on parameters such as company overview, financial overview, strategies, portfolio, segments, and recent developments.

|

Attribute |

Detail |

|

Size in 2022 |

US$ 88.6 Mn |

|

Forecast (Value) in 2031 |

More than US$ 143.6 Mn |

|

Compound Annual Growth Rate (CAGR) |

5.7% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2022 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 88.6 Mn in 2022.

It is projected to reach more than US$ 143.6 Mn by 2031.

The CAGR is anticipated to be 5.7% from 2022 to 2031.

Single-use floor standing centrifuge improves purity & safety in clinical trials and rise in number of clinical & diagnostic laboratories.

The accessories/consumables segment held leading share in 2022.

North America is expected to account for significant share during the forecast period.

Barry-Wehmiller Companies (Carr Biosystems), Alfa Laval, Thermo Fisher Scientific, GEA, and Sartorius AG.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Single-use Floor Standing Centrifuge System Market

4. Market Overview

4.1. Introduction

4.1.1. Product Type Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Single-use Floor Standing Centrifuge System Market Analysis and Forecast, 2017–31

5. Key Insights

5.1. Technological Advancements

5.2. Regulatory Scenario, by Region/Globally

5.3. Key Industry Events (mergers, acquisitions, collaborations, approvals, etc.)

5.4. COVID-19 Pandemic Impact on Industry (value chain and short- /mid- /long-term impact)

5.5. Single-use Centrifuge Disposables: Overview

5.6. Comparison: Single-use Centrifuge vs Non Single-use Centrifuge

5.7. Major Product Type Analysis

5.8. Significance of Single-use Centrifuge in Cellular Agriculture

5.9. Pricing Analysis of Single-use Centrifuge

5.10. Analysis of Competing Technologies for Single-use Centrifuge

6. Global Single-use Floor Standing Centrifuge System Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product Type, 2017–31

6.3.1. Accessories/Consumables

6.3.2. Equipment

6.4. Market Attractiveness Analysis, by Product Type

7. Global Single-use Floor Standing Centrifuge System Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Application, 2017–31

7.3.1. Cell Therapies

7.3.1.1. Autologous Cell Therapy

7.3.1.2. Allogenic Cell Therapy

7.3.2. Gene Therapies

7.3.3. Vaccines

7.3.3.1. Conjugated

7.3.3.2. Live-attenuated

7.3.3.3. Inactivated

7.3.3.4. Recombinant

7.3.3.5. mRNA

7.3.3.6. Others

7.3.4. Large Molecules

7.3.5. Cellular Agriculture

7.3.6. Others

7.4. Market Attractiveness Analysis, by Application

8. Global Single-use Floor Standing Centrifuge System Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2017–31

8.3.1. Hospitals & Diagnostic Centers

8.3.2. Pharmaceutical & Biotechnology Companies

8.3.3. CROs/CDMOs

8.3.4. Others

8.4. Market Attractiveness Analysis, by End-user

9. Global Single-use Floor Standing Centrifuge System Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Single-use Floor Standing Centrifuge System Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product Type, 2017–31

10.2.1. Accessories/Consumables

10.2.2. Equipment

10.3. Market Value Forecast, by Application, 2017–31

10.3.1. Cell Therapies

10.3.1.1. Autologous Cell Therapy

10.3.1.2. Allogenic Cell Therapy

10.3.2. Gene Therapies

10.3.3. Vaccines

10.3.3.1. Conjugated

10.3.3.2. Live-attenuated

10.3.3.3. Inactivated

10.3.3.4. Recombinant

10.3.3.5. mRNA

10.3.3.6. Others

10.3.4. Large Molecules

10.3.5. Cellular Agriculture

10.3.6. Others

10.4. Market Value Forecast, by End-user, 2017–31

10.4.1. Hospitals & Diagnostic Centers

10.4.2. Pharmaceutical & Biotechnology Companies

10.4.3. CROs/CDMOs

10.4.4. Others

10.5. Market Value Forecast, by Country, 2017–31

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product Type

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Single-use Floor Standing Centrifuge System Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product Type, 2017–31

11.2.1. Accessories/Consumables

11.2.2. Equipment

11.3. Market Value Forecast, by Application, 2017–31

11.3.1. Cell Therapies

11.3.1.1. Autologous Cell Therapy

11.3.1.2. Allogenic Cell Therapy

11.3.2. Gene Therapies

11.3.3. Vaccines

11.3.3.1. Conjugated

11.3.3.2. Live-attenuated

11.3.3.3. Inactivated

11.3.3.4. Recombinant

11.3.3.5. mRNA

11.3.3.6. Others

11.3.4. Large Molecules

11.3.5. Cellular Agriculture

11.3.6. Others

11.4. Market Value Forecast, by End-user, 2017–31

11.4.1. Hospitals & Diagnostic Centers

11.4.2. Pharmaceutical & Biotechnology Companies

11.4.3. CROs/CDMOs

11.4.4. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–31

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product Type

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Single-use Floor Standing Centrifuge System Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product Type, 2017–31

12.2.1. Accessories/Consumables

12.2.2. Equipment

12.3. Market Value Forecast, by Application, 2017–31

12.3.1. Cell Therapies

12.3.1.1. Autologous Cell Therapy

12.3.1.2. Allogenic Cell Therapy

12.3.2. Gene Therapies

12.3.3. Vaccines

12.3.3.1. Conjugated

12.3.3.2. Live-attenuated

12.3.3.3. Inactivated

12.3.3.4. Recombinant

12.3.3.5. mRNA

12.3.3.6. Others

12.3.4. Large Molecules

12.3.5. Cellular Agriculture

12.3.6. Others

12.4. Market Value Forecast, by End-user, 2017–31

12.4.1. Hospitals & Diagnostic Centers

12.4.2. Pharmaceutical & Biotechnology Companies

12.4.3. CROs/CDMOs

12.4.4. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017–31

12.5.1. China

12.5.2. Japan

12.5.3. South Korea

12.5.4. India

12.5.5. Australia & New Zealand

12.5.6. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product Type

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Single-use Floor Standing Centrifuge System Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product Type, 2017–31

13.2.1. Accessories/Consumables

13.2.2. Equipment

13.3. Market Value Forecast, by Application, 2017–31

13.3.1. Cell Therapies

13.3.1.1. Autologous Cell Therapy

13.3.1.2. Allogenic Cell Therapy

13.3.2. Gene Therapies

13.3.3. Vaccines

13.3.3.1. Conjugated

13.3.3.2. Live-attenuated

13.3.3.3. Inactivated

13.3.3.4. Recombinant

13.3.3.5. mRNA

13.3.3.6. Others

13.3.4. Large Molecules

13.3.5. Cellular Agriculture

13.3.6. Others

13.4. Market Value Forecast, by End-user, 2017–31

13.4.1. Hospitals & Diagnostic Centers

13.4.2. Pharmaceutical & Biotechnology Companies

13.4.3. CROs/CDMOs

13.4.4. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–31

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product Type

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Single-use Floor Standing Centrifuge System Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product Type, 2017–31

14.2.1. Accessories/Consumables

14.2.2. Equipment

14.3. Market Value Forecast, by Application, 2017–31

14.3.1. Cell Therapies

14.3.1.1. Autologous Cell Therapy

14.3.1.2. Allogenic Cell Therapy

14.3.2. Gene Therapies

14.3.3. Vaccines

14.3.3.1. Conjugated

14.3.3.2. Live-attenuated

14.3.3.3. Inactivated

14.3.3.4. Recombinant

14.3.3.5. mRNA

14.3.3.6. Others

14.3.4. Large Molecules

14.3.5. Cellular Agriculture

14.3.6. Others

14.4. Market Value Forecast, by End-user, 2017–31

14.4.1. Hospitals & Diagnostic Centers

14.4.2. Pharmaceutical & Biotechnology Companies

14.4.3. CROs/CDMOs

14.4.4. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017–31

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product Type

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2022

15.3. Company Profiles

15.3.1. Barry-Wehmiller Companies (Carr Biosystems)

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Type Portfolio

15.3.1.3. SWOT Analysis

15.3.1.4. Strategic Overview

15.3.2. Alfa Laval

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Type Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. Thermo Fisher Scientific

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Type Portfolio

15.3.3.3. SWOT Analysis

15.3.3.4. Strategic Overview

15.3.4. GEA

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Type Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. Sartorius AG

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Type Portfolio

15.3.5.3. Financial Overview

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

List of Tables

Table 1: Global overview of Single-use Floor Standing Centrifuge

Table 2: Regional overview of Single-use Floor Standing Centrifuge

Table 4: North America Overview of Single-use Floor Standing Centrifuge

Table 4: Asia Pacific overview of Single-use Floor Standing Centrifuge

Table 5: Global Single-use Floor Standing Centrifuge System Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 6: Global Single-use Floor Standing Centrifuge System Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 7: Global Single-use Floor Standing Centrifuge System Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 8: Global Single-use Floor Standing Centrifuge System Market Value (US$ Mn) Forecast, by Region, 2023–2031

Table 9: North America Single-use Floor Standing Centrifuge Value (US$ Mn) Forecast, by Country, 2023–2031

Table 10: North America Single-use Floor Standing Centrifuge Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 11: North America Single-use Floor Standing Centrifuge Value (US$ Mn) Forecast, by Application, 2023–2031

Table 12: North America Single-use Floor Standing Centrifuge Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 13: Europe Single-use Floor Standing Centrifuge Revenue (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 14: Europe Single-use Floor Standing Centrifuge Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 15: Europe Single-use Floor Standing Centrifuge Value (US$ Mn) Forecast, by Application, 2023–2031

Table 16: Europe Single-use Floor Standing Centrifuge Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 17: Asia Pacific Single-use Floor Standing Centrifuge Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 18: Asia Pacific Single-use Floor Standing Centrifuge Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 19: Asia Pacific Single-use Floor Standing Centrifuge Value (US$ Mn) Forecast, by Application, 2023–2031

Table 20: Asia Pacific Single-use Floor Standing Centrifuge Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 21: Latin America Single-use Floor Standing Centrifuge Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 22: Latin America Single-use Floor Standing Centrifuge Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 23: Latin America Single-use Floor Standing Centrifuge Value (US$ Mn) Forecast, by Application, 2023–2031

Table 24: Latin America Single-use Floor Standing Centrifuge Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 25: Middle East & Africa Single-use Floor Standing Centrifuge Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 26: Middle East & Africa Single-use Floor Standing Centrifuge Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 27: Middle East & Africa Single-use Floor Standing Centrifuge Value (US$ Mn) Forecast, by Application, 2023–2031

Table 28: Middle East & Africa Single-use Floor Standing Centrifuge Value (US$ Mn) Forecast, by End-user, 2023–2031

List of Figures

Figure 01: Global Single-use Floor Standing Centrifuge System Market Value (US$ Mn) Forecast, 2023–2031

Figure 02: Global Single-use Floor Standing Centrifuge System Market Value Share (%), by Product Type (2022)

Figure 03: Global Single-use Floor Standing Centrifuge System Market Value Share (%), by Application (2022)

Figure 04: Global Single-use Floor Standing Centrifuge System Market Value Share (%), by Region (2022)

Figure 05: Global Single-use Floor Standing Centrifuge System Market Value Share (%), by End-user (2022)

Figure 06: Global Single-use Floor Standing Centrifuge System Market Value Share (%), by Product Type, 2022 and 2031

Figure 07: Global Single-use Floor Standing Centrifuge System Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 08: Global Single-use Floor Standing Centrifuge System Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Accessories/Consumables, 2023–2031

Figure 09: Global Single-use Floor Standing Centrifuge System Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Equipment, 2023–2031

Figure 10: Global Single-use Floor Standing Centrifuge System Market Value Share (%), by Application, 2022 and 2031

Figure 11: Global Single-use Floor Standing Centrifuge System Market Attractiveness Analysis, by Application, 2023–2031

Figure 12: Global Single-use Floor Standing Centrifuge System Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Cell Therapies, 2023–2031

Figure 13: Global Single-use Floor Standing Centrifuge System Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Gene Therapies, 2023–2031

Figure 14: Global Single-use Floor Standing Centrifuge System Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Others, 2023–2031

Figure 15: Global Single-use Floor Standing Centrifuge System Market Value Share Analysis (%), by End-user, 2022 and 2031

Figure 16: Global Single-use Floor Standing Centrifuge System Market Attractiveness Analysis, by End-user, 2023–2031

Figure 17: Global Single-use Floor Standing Centrifuge System Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Hospitals & Diagnostic Centers, 2023–2031

Figure 18: Global Single-use Floor Standing Centrifuge System Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Pharmaceutical & Biotechnology Companies, 2023–2031

Figure 19: Global Single-use Floor Standing Centrifuge System Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by CROs/CDMOs, 2023–2031

Figure 20: Global Single-use Floor Standing Centrifuge System Market Value Share (%), by Region, 2022 and 2031

Figure 21: Global Single-use Floor Standing Centrifuge System Market Attractiveness Analysis, by Region, 2023–2031

Figure 22: North America Single-use Floor Standing Centrifuge Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2023–2031

Figure 23: North America Single-use Floor Standing Centrifuge Value Share, by Country, 2022 and 2031

Figure 24: North America Single-use Floor Standing Centrifuge Attractiveness Analysis, by Country, 2022-2031

Figure 25: North America Single-use Floor Standing Centrifuge Value Share Analysis (%), by Product Type, 2022 and 2031

Figure 26: North America Single-use Floor Standing Centrifuge Attractiveness Analysis, by Product Type, 2023–2031

Figure 27: North America Single-use Floor Standing Centrifuge Value Share (%), by Application, 2022 and 2031

Figure 28: North America Single-use Floor Standing Centrifuge Attractiveness Analysis, by Application, 2023–2031

Figure 29: North America Single-use Floor Standing Centrifuge Value Share (%), by End-user, 2022 and 2031

Figure 30: North America Single-use Floor Standing Centrifuge Attractiveness Analysis, by End-user, 2023–2031

Figure 31: Europe Single-use Floor Standing Centrifuge Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2023–2031

Figure 32: Europe Single-use Floor Standing Centrifuge Value Share, by Country/Sub-region, 2022 and 2031

Figure 33: Europe Single-use Floor Standing Centrifuge Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 34: Europe Single-use Floor Standing Centrifuge Value Share (%), by Product Type, 2022 and 2031

Figure 35: Europe Single-use Floor Standing Centrifuge Attractiveness Analysis, by Product Type, 2023–2031

Figure 36: Europe Single-use Floor Standing Centrifuge Value Share (%), by Application, 2022 and 2031

Figure 37: Europe Single-use Floor Standing Centrifuge Attractiveness Analysis, by Application, 2023–2031

Figure 38: Europe Single-use Floor Standing Centrifuge Value Share (%), by End-user, 2022 and 2031

Figure 39: Europe Single-use Floor Standing Centrifuge Attractiveness Analysis, by End-user, 2023–2031

Figure 40: Asia Pacific Single-use Floor Standing Centrifuge Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2023–2031

Figure 41: Asia Pacific Single-use Floor Standing Centrifuge Value Share, by Country/Sub-region, 2022 and 2031

Figure 42: Asia Pacific Single-use Floor Standing Centrifuge Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 43: Asia Pacific Single-use Floor Standing Centrifuge Value Share Analysis (%), by Product Type, 2022 and 2031

Figure 44: Asia Pacific Single-use Floor Standing Centrifuge Attractiveness Analysis, by Product Type, 2023–2031

Figure 45: Asia Pacific Single-use Floor Standing Centrifuge Value Share (%), by Application, 2022 and 2031

Figure 46: Asia Pacific Single-use Floor Standing Centrifuge Attractiveness Analysis, by Application, 2023–2031

Figure 47: Asia Pacific Single-use Floor Standing Centrifuge Value Share (%), by End-user, 2022 and 2031

Figure 48: Asia Pacific Single-use Floor Standing Centrifuge Attractiveness Analysis, by End-user, 2023–2031

Figure 49: Latin America Single-use Floor Standing Centrifuge Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2023–2031

Figure 50: Latin America Single-use Floor Standing Centrifuge Value Share, by Country/Sub-region, 2022 and 2031

Figure 51: Latin America Single-use Floor Standing Centrifuge Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 52: Latin America Single-use Floor Standing Centrifuge Value Share Analysis (%), by Product Type, 2022 and 2031

Figure 53: Latin America Single-use Floor Standing Centrifuge Attractiveness Analysis, by Product Type, 2023–2031

Figure 54: Latin America Single-use Floor Standing Centrifuge Value Share (%), by Application, 2022 and 2031

Figure 55: Latin America Single-use Floor Standing Centrifuge Attractiveness Analysis, by Application, 2023–2031

Figure 56: Latin America Single-use Floor Standing Centrifuge Value Share (%), by End-user, 2022 and 2031

Figure 57: Latin America Single-use Floor Standing Centrifuge Attractiveness Analysis, by End-user, 2023–2031

Figure 58: Middle East & Africa Single-use Floor Standing Centrifuge Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2023–2031

Figure 59: Middle East & Africa Single-use Floor Standing Centrifuge Value Share, by Country/Sub-region, 2022 and 2031

Figure 60: Middle East & Africa Single-use Floor Standing Centrifuge Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 61: Middle East & Africa Single-use Floor Standing Centrifuge Value Share Analysis (%), by Product Type, 2022 and 2031

Figure 62: Middle East & Africa Single-use Floor Standing Centrifuge Attractiveness Analysis, by Product Type, 2023–2031

Figure 63: Middle East & Africa Single-use Floor Standing Centrifuge Value Share (%), by Application, 2022 and 2031

Figure 64: Middle East & Africa Single-use Floor Standing Centrifuge Attractiveness Analysis, by Application, 2023–2031

Figure 65: Middle East & Africa Single-use Floor Standing Centrifuge Value Share (%), by End-user, 2022 and 2031

Figure 66: Middle East & Africa Single-use Floor Standing Centrifuge Attractiveness Analysis, by End-user, 2023–2031

Figure 67: Medtronic Revenue (US$ Bn) and Y-o-Y Growth (%), 2018–2021

Figure 68: Medtronic R&D Intensity and Sales & Marketing Intensity - Company Level, 2017–2021

Figure 69: Medtronic Breakdown of Net Sales, by Region, 2021

Figure 70: Medtronic Breakdown of Net Sales, by Business Segment, 2021

Figure 71: NuVasive Revenue (US$ Mn) and Y-o-Y Growth (%), 2017–2021

Figure 72: NuVasive R&D Intensity and Sales & Marketing Intensity (%), 2018–2021

Figure 73: NuVasive Breakdown of Net Sales, by Product Type Line, 2021

Figure 74: NuVasive Breakdown of Net Sales, by Region, 2021

Figure 75: Globus Medical, Inc. Innovative Fusion segment (Globus Medical, Inc.) Revenue (US$ Mn) & Y-o-Y Growth (%), 2017–2021

Figure 76: Globus Medical, Inc. R&D Investment (US$ Mn), 2018-2021

Figure 77: Globus Medical, Inc. Breakdown of Net Sales, by Segment, 2021

Figure 78: Globus Medical, Inc. Breakdown of Net Sales, by Region, 2021

Figure 79: RTI Surgical Inc. Innovative Fusion segment (Globus Medical, Inc.) Revenue (US$ Mn) & Y-o-Y Growth (%), 2018–2021

Figure 80: RTI Surgical Inc. R&D Investment (US$ Mn), 2017–2021

Figure 81: RTI Surgical Inc. Breakdown of Net Sales, by Segment, 2021

Figure 82: RTI Surgical Inc. Breakdown of Net Sales, by Region, 2021

Figure 83: Zimmer Biomet, Breakdown of Net Sales (%), by Region

Figure 84: Zimmer Biomet, Breakdown of Net Sales (%), by Segment

Figure 85: Zimmer Biomet, Revenue (US$ Mn) & Y-o-Y Growth (%), 2017–2021