Reports

Reports

The global sheet metal fabrication services market is being driven by a confluence of industrial demand and expanding technology. The industrial sector is being boosted by the growing volumetric need from industries such as automotive, aerospace, construction, electronics, and renewable energy.

The increase in volumetric demand encompasses growing urbanization and developing economies' efforts to invest in infrastructure. Most significant trends involve automation and smart manufacturing as fabricators are engaging CAD/CAM, robots, laser cutters, and an AI-enabled quoting tool to minimize lead times, increase accuracy, and improve flexibility.

Lightweight alloys such as aluminum and titanium are turning out to be more mainstream, especially for aerospace and automotive applications, attracting an increasing level of attention as they help to resolve applications more efficiently and sustainably. Sustainability has also become the epicenter, with metal manufacturers increasingly not only adding recycled metals but also putting energy-saving devices on machines, and are looking to adopt environmentally-friendly processes to respond to greater expectations from the public and society.

Although cost pressures arising from raw materials such as steel and aluminum remain at record levels, slowing down their profit margins, and at the same time, investing in automation and the authentic need for skilled labor demands even more capital investments, especially for SMEs.

Sheet metal fabrication services facilitate the process of taking flat metal like steel, stainless, aluminum alloys, and combining it with processes such as cutting, forming, joining, and finishing to create finished components. The characteristic services include laser/plasma/oxy cutting, CNC punching, bending and press-brake work, CNC folding, welding (MIG, TIG, robotic), stamping, CNC turret work, and sheet levelling and flattening.

Value-added services that exceed fabrication include kitting, value-added, or “sub-assemblies” that include fasteners or wiring, surface treatments (powder coat, anodizing, plating), precision machining of holes and threads, and integrated quality inspection (CMM, optical). Delivery models include high-volume contract manufacturing on behalf of OEMs, to on-demand prototyping and short-run customized batches on behalf of SMEs. A growing trend involves vendors packaging electronic services as part of their trio of instant quoting portals for CAD or DXF uploads that include nest-optimization to help minimize lead-times and scrap rates.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

Automation in sheet metal cutting, material handling, and bending is not merely a substitution for labor but fundamentally reshapes the decision of which parts are most profitable to manufacture in-house versus outsourcing. The adoption of advanced technologies such as fully automated punch-laser cells, automated coil-to-part lines, and integrated material storage with robotic handling significantly reduce per-part handling time while minimizing quality variability. This technology transition enables fabricators to manage complex nested runs and multi-operation assemblies efficiently, all while achieving competitive margins.

In addition, automation enhances flexibility with its lights-out production shifts, achieving better capacity utilization, especially in capital-intensive operations. In general, the economic trade-off is higher fixed but lower variable costs, and much improved on-time performance. Such advantages prove especially critical for OEMs that operate under strict tolerance requirements and high-mix production environments.

For instance, in TRUMPF’s 2024 launch of a fully automated punch-laser combination machine, integrated with automated sheet-material flow, the company positioned the innovation as a solution to improve both - productivity and energy efficiency for North American fabricators.

The movement towards lightweight and high-performance materials in manufacturing as a result of increasing environmental awareness, fuel-efficiency mandates, and performance mandates. The automotive, aerospace, and transportation industries are leading the charge on market growth, focusing on materials that are strong but less weighty. More and more popular are advanced high-strength steels (AHSS), aluminum alloys, magnesium, and composite-metal hybrids, which allow for reductions in component mass of 10-60% while maintaining safety performance. This is a direct relationship to improved energy efficiency and reduced carbon emissions as required by sustainability imperatives and regulations.

For instance, programs funded by the U.S. Department of Energy, especially the Vehicle Technologies Office, are making significant investments into third-generation AHSS and advanced aluminum alloys. Their target is to enable weight reductions of components up to 25 %, which directly impacts automaker design requirements. Fabricators are then forced to purchase new equipment, utilize specialized forming and joining processes, and improve material-handling and heat treatment processes. This phenomenon is a strong driver because it affects the upstream material producers and downstream OEMs, while providing stimulus for suppliers to continuously upgrade their technical and operational capabilities.

Furthermore, recyclers and metal-service providers have started to produce annual sustainability reports that show recycled tonnage and processing efficiencies, which buyers are now considering in their supplier selections. To meet these expectations, many fabrication firms are forming alliances, mergers, or consolidations with recyclers/processors, thus obtaining access to cleaner feedstock and increasing their influence with OEM customers, and adapting to their upstream purchasing behaviors and new, longer-term contract procurement models.

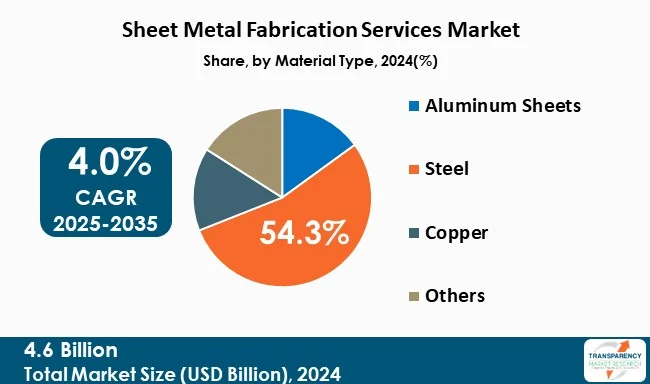

Steel is the dominant material in sheet metal fabrication services primarily due to its cost-performance ratio, easy access, mechanical properties, and supply chain. Due to steel's tensile strength, formability, and recyclability, it is the go-to for any load-bearing part, structural bracket, chassis, and HVAC component applications at the center of construction, automotive, and heavy machinery industries.

Global industry data, as stated by World Steel’s 2024 figures, show that steel production and consumption remain concentrated in regions with the major fabrication capacity, supporting fabricators that steel is the common source for large-volume programs. The combination of mechanical suitability, supply availability, and mature logistics explains steel’s dominant share among material-type segments in fabrication services.

| Attribute | Detail |

|---|---|

| Leading Region |

|

Asia-Pacific leads sheet metal fabrication activity due to manufacturing density, diversified end-markets, and a fast-growing domestic demand base. The region hosts huge clusters of home appliances, electronics, construction, telecom equipment, and increasingly EV component manufacturers - all major consumers of fabricated sheet parts. Local supply chains in China, India, Japan, South Korea, and Southeast Asia offer vertically integrated metal supply (rolling, coating), and assembly ecosystems, and component fabrication that shorten lead times and lower landed costs for OEMs.

The structural strengths sustain APAC’s dominance, where the scale and labor availability allow producers to support both high-volume runs and labor-intensive secondary operations, making the region attractive for both low-cost metalwork and complex assemblies. Furthermore, rapid adoption of automation by larger OEMs and machine tool vendors in APAC showroom launches, fairs such as regional trade shows, and factory rollouts. It is accelerating productivity, thereby effectively compressing the historical gap between APAC’s cost advantages and Western automation levels.

With Asia-Pacific’s structural strengths in manufacturing density, integrated supply chains, and rising automation, Jindal Stainless, in 2024, entered a joint venture in Indonesia to establish a 1.2 MTPA stainless steel melt shop. These ₹7 Bn (~US$ 84 Bn) investments increase its capacity by over 40% to 4.2 MTPA, reinforcing the region’s leadership in sheet metal fabrication through scale-driven and strategically localized production.

Mayville Engineering Company, Inc., Proto Labs, Inc., Xometry, Inc., KMF Group, O’Neal Manufacturing Services, All Metals Fabricating, Inc., BTD Manufacturing, Inc., Classic Sheet Metal, Inc., Dynamic Aerospace and Defense Group (Hydram Engineering), Ironform Corporation, Kapco Metal Stamping, Marlin Steel Wire Products LLC, Metcam, Inc., Moreng Metal Products, Inc., and Noble Industries, Inc. are some of the leading manufacturers operating in the global sheet metal fabrication services market.

Each of these companies has been profiled in the sheet metal fabrication services market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

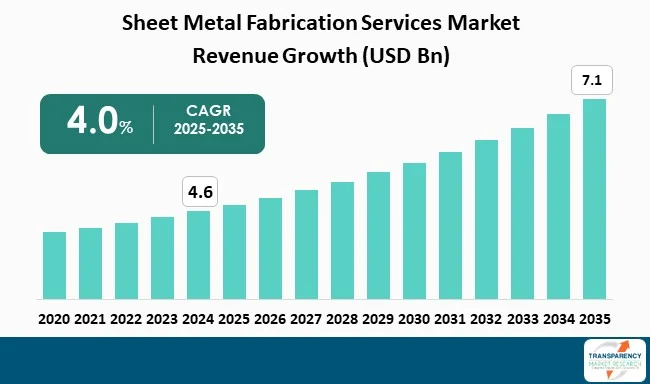

| Market Size Value in 2024 (Base Year) | US$ 4.6 Bn |

| Market Forecast Value in 2035 | US$ 7.11 Bn |

| Growth Rate (CAGR 2025 to 2035) | 4.0 % |

| Forecast Period | 2025 - 2035 |

| Historical data Available for | 2020 - 2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | Global qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape | Market Player Competition Dashboard and Revenue Share Analysis 2024 Company Profiles (Details Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview) |

| Format | Electronic (PDF) + Excel |

| Market Segmentation | By Fabrication Process

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

The global sheet metal fabrication services market was valued at US$ 4.6 Bn in 2024

The global sheet metal fabrication services industry is projected to reach at US$ 7.1 Bn by 2035

The role of advanced automation in sheet metal cutting, handling, and bending and rising adoption of lightweight and sustainable materials in automotive and aerospace are some of the factors driving the expansion of sheet metal fabrication services market.

The CAGR is anticipated to be 4.0% from 2025 to 2035

Mayville Engineering Company, Inc., Proto Labs, Inc., Xometry, Inc., KMF Group, O’Neal Manufacturing Services, All Metals Fabricating, Inc., BTD Manufacturing, Inc., Classic Sheet Metal, Inc., Dynamic Aerospace and Defense Group (Hydram Engineering), Ironform Corporation, Kapco Metal Stamping, Marlin Steel Wire Products LLC, Metcam, Inc., Moreng Metal Products, Inc. and Noble Industries, Inc.

Table 1: Global Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Fabrication Process

Table 2: Global Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Material Type

Table 3: Global Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 4: Global Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Region

Table 5: North America Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Fabrication Process

Table 6: North America Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Material Type

Table 7: North America Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 8: North America Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Country

Table 9: U.S. Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Fabrication Process

Table 10: U.S. Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Material Type

Table 11: U.S. Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 12: Canada Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Fabrication Process

Table 13: Canada Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Material Type

Table 14: Canada Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 15: Europe Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Fabrication Process

Table 16: Europe Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Material Type

Table 17: Europe Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 18: Europe Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Country

Table 19: U.K. Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Fabrication Process

Table 20: U.K. Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Material Type

Table 21: U.K. Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 22: Germany Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Fabrication Process

Table 23: Germany Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Material Type

Table 24: Germany Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 25: France Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Fabrication Process

Table 26: France Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Material Type

Table 27: France Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 28: Italy Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Fabrication Process

Table 29: Italy Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Material Type

Table 30: Italy Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 31: Spain Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Fabrication Process

Table 32: Spain Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Material Type

Table 33: Spain Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 34: The Netherlands Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Fabrication Process

Table 35: The Netherlands Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Material Type

Table 36: The Netherlands Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 37: Asia Pacific Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Fabrication Process

Table 38: Asia Pacific Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Material Type

Table 39: Asia Pacific Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 40: Asia Pacific Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Country

Table 41: China Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Fabrication Process

Table 42: China Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Material Type

Table 43: China Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 44: India Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Fabrication Process

Table 45: India Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Material Type

Table 46: India Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 47: Japan Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Fabrication Process

Table 48: Japan Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Material Type

Table 49: Japan Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 50: Australia Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Fabrication Process

Table 51: Australia Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Material Type

Table 52: Australia Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 53: South Korea Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Fabrication Process

Table 54: South Korea Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Material Type

Table 55: South Korea Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 56: ASEAN Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Fabrication Process

Table 57: ASEAN Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Material Type

Table 58: ASEAN Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 59: Middle East & Africa Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Fabrication Process

Table 60: Middle East & Africa Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Material Type

Table 61: Middle East & Africa Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 62: Middle East & Africa Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Country

Table 63: GCC Countries Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Fabrication Process

Table 64: GCC Countries Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Material Type

Table 65: GCC Countries Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 66: South Africa Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Fabrication Process

Table 67: South Africa Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Material Type

Table 68: South Africa Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 69: Latin America Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Fabrication Process

Table 70: Latin America Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Material Type

Table 71: Latin America Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 72: Latin America Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Country

Table 73: Brazil Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Fabrication Process

Table 74: Brazil Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Material Type

Table 75: Brazil Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 76: Argentina Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Fabrication Process

Table 77: Argentina Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Material Type

Table 78: Argentina Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Table 79: Mexico Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Fabrication Process

Table 80: Mexico Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By Material Type

Table 81: Mexico Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, 2020 to 2035 By End-use Industry

Figure 1: Global Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Fabrication Process 2020 to 2035

Figure 2: Global Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Fabrication Process 2025 to 2035

Figure 3: Global Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Material Type 2020 to 2035

Figure 4: Global Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Material Type 2025 to 2035

Figure 5: Global Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 6: Global Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 7: Global Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Region 2020 to 2035

Figure 8: Global Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Region 2025 to 2035

Figure 9: North America Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Fabrication Process 2020 to 2035

Figure 10: North America Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Fabrication Process 2025 to 2035

Figure 11: North America Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Material Type 2020 to 2035

Figure 12: North America Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Material Type 2025 to 2035

Figure 13: North America Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 14: North America Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 15: North America Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 16: North America Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 17: U.S. Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Fabrication Process 2020 to 2035

Figure 18: U.S. Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Fabrication Process 2025 to 2035

Figure 19: U.S. Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Material Type 2020 to 2035

Figure 20: U.S. Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Material Type 2025 to 2035

Figure 21: U.S. Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 22: U.S. Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 23: Canada Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Fabrication Process 2020 to 2035

Figure 24: Canada Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Fabrication Process 2025 to 2035

Figure 25: Canada Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Material Type 2020 to 2035

Figure 26: Canada Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Material Type 2025 to 2035

Figure 27: Canada Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 28: Canada Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 29: Europe Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Fabrication Process 2020 to 2035

Figure 30: Europe Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Fabrication Process 2025 to 2035

Figure 31: Europe Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Material Type 2020 to 2035

Figure 32: Europe Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Material Type 2025 to 2035

Figure 33: Europe Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 34: Europe Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 35: Europe Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 36: Europe Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 37: U.K. Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Fabrication Process 2020 to 2035

Figure 38: U.K. Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Fabrication Process 2025 to 2035

Figure 39: U.K. Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Material Type 2020 to 2035

Figure 40: U.K. Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Material Type 2025 to 2035

Figure 41: U.K. Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 42: U.K. Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 43: Germany Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Fabrication Process 2020 to 2035

Figure 44: Germany Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Fabrication Process 2025 to 2035

Figure 45: Germany Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Material Type 2020 to 2035

Figure 46: Germany Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Material Type 2025 to 2035

Figure 47: Germany Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 48: Germany Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 49: France Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Fabrication Process 2020 to 2035

Figure 50: France Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Fabrication Process 2025 to 2035

Figure 51: France Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Material Type 2020 to 2035

Figure 52: France Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Material Type 2025 to 2035

Figure 53: France Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 54: France Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 55: Italy Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Fabrication Process 2020 to 2035

Figure 56: Italy Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Fabrication Process 2025 to 2035

Figure 57: Italy Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Material Type 2020 to 2035

Figure 58: Italy Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Material Type 2025 to 2035

Figure 59: Italy Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 60: Italy Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 61: Spain Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Fabrication Process 2020 to 2035

Figure 62: Spain Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Fabrication Process 2025 to 2035

Figure 63: Spain Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Material Type 2020 to 2035

Figure 64: Spain Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Material Type 2025 to 2035

Figure 65: Spain Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 66: Spain Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 67: The Netherlands Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Fabrication Process 2020 to 2035

Figure 68: The Netherlands Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Fabrication Process 2025 to 2035

Figure 69: The Netherlands Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Material Type 2020 to 2035

Figure 70: The Netherlands Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Material Type 2025 to 2035

Figure 71: The Netherlands Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 72: The Netherlands Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 73: Asia Pacific Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Fabrication Process 2020 to 2035

Figure 74: Asia Pacific Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Fabrication Process 2025 to 2035

Figure 75: Asia Pacific Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Material Type 2020 to 2035

Figure 76: Asia Pacific Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Material Type 2025 to 2035

Figure 77: Asia Pacific Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 78: Asia Pacific Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 79: Asia Pacific Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 80: Asia Pacific Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 81: China Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Fabrication Process 2020 to 2035

Figure 82: China Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Fabrication Process 2025 to 2035

Figure 83: China Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Material Type 2020 to 2035

Figure 84: China Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Material Type 2025 to 2035

Figure 85: China Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 86: China Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 87: India Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Fabrication Process 2020 to 2035

Figure 88: India Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Fabrication Process 2025 to 2035

Figure 89: India Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Material Type 2020 to 2035

Figure 90: India Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Material Type 2025 to 2035

Figure 91: India Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 92: India Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 93: Japan Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Fabrication Process 2020 to 2035

Figure 94: Japan Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Fabrication Process 2025 to 2035

Figure 95: Japan Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Material Type 2020 to 2035

Figure 96: Japan Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Material Type 2025 to 2035

Figure 97: Japan Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 98: Japan Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 99: Australia Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Fabrication Process 2020 to 2035

Figure 100: Australia Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Fabrication Process 2025 to 2035

Figure 101: Australia Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Material Type 2020 to 2035

Figure 102: Australia Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Material Type 2025 to 2035

Figure 103: Australia Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 104: Australia Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 105: South Korea Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Fabrication Process 2020 to 2035

Figure 106: South Korea Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Fabrication Process 2025 to 2035

Figure 107: South Korea Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Material Type 2020 to 2035

Figure 108: South Korea Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Material Type 2025 to 2035

Figure 109: South Korea Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 110: South Korea Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 111: ASEAN Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Fabrication Process 2020 to 2035

Figure 112: ASEAN Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Fabrication Process 2025 to 2035

Figure 113: ASEAN Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Material Type 2020 to 2035

Figure 114: ASEAN Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Material Type 2025 to 2035

Figure 115: ASEAN Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 116: ASEAN Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 117: Middle East & Africa Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Fabrication Process 2020 to 2035

Figure 118: Middle East & Africa Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Fabrication Process 2025 to 2035

Figure 119: Middle East & Africa Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Material Type 2020 to 2035

Figure 120: Middle East & Africa Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Material Type 2025 to 2035

Figure 121: Middle East & Africa Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 122: Middle East & Africa Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 123: Middle East & Africa Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 124: Middle East & Africa Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 125: GCC Countries Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Fabrication Process 2020 to 2035

Figure 126: GCC Countries Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Fabrication Process 2025 to 2035

Figure 127: GCC Countries Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Material Type 2020 to 2035

Figure 128: GCC Countries Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Material Type 2025 to 2035

Figure 129: GCC Countries Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 130: GCC Countries Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 131: South Africa Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Fabrication Process 2020 to 2035

Figure 132: South Africa Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Fabrication Process 2025 to 2035

Figure 133: South Africa Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Material Type 2020 to 2035

Figure 134: South Africa Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Material Type 2025 to 2035

Figure 135: South Africa Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 136: South Africa Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 137: Latin America Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Fabrication Process 2020 to 2035

Figure 138: Latin America Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Fabrication Process 2025 to 2035

Figure 139: Latin America Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Material Type 2020 to 2035

Figure 140: Latin America Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Material Type 2025 to 2035

Figure 141: Latin America Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 142: Latin America Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 143: Latin America Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 144: Latin America Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 145: Brazil Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Fabrication Process 2020 to 2035

Figure 146: Brazil Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Fabrication Process 2025 to 2035

Figure 147: Brazil Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Material Type 2020 to 2035

Figure 148: Brazil Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Material Type 2025 to 2035

Figure 149: Brazil Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 150: Brazil Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 151: Argentina Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Fabrication Process 2020 to 2035

Figure 152: Argentina Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Fabrication Process 2025 to 2035

Figure 153: Argentina Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Material Type 2020 to 2035

Figure 154: Argentina Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Material Type 2025 to 2035

Figure 155: Argentina Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 156: Argentina Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 157: Mexico Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Fabrication Process 2020 to 2035

Figure 158: Mexico Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Fabrication Process 2025 to 2035

Figure 159: Mexico Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By Material Type 2020 to 2035

Figure 160: Mexico Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By Material Type 2025 to 2035

Figure 161: Mexico Sheet Metal Fabrication Services Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 162: Mexico Sheet Metal Fabrication Services Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035