Reports

Reports

Analysts’ Viewpoint on Market Scenario

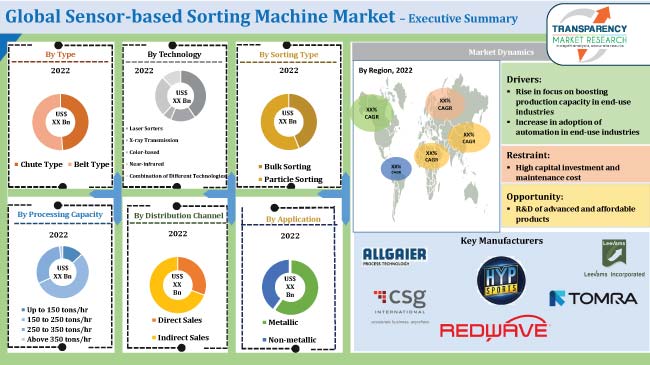

Rise in focus on boosting production capacity in end-use industries is expected to propel the sensor-based sorting machine market size in the near future. Increase in adoption of automation in end-use industries is also projected to augment market expansion in the next few years.

Sensor-based sorting machines are gaining traction in the food & beverage sector as they help ensure the quality of raw materials used. These machines are also employed in the pharmaceutical sector to facilitate continuous batch manufacturing processes. Vendors operating in the global sensor-based sorting machine industry are offering improved automated sensor sorter technologies to broaden their customer base. They are also investing significantly in comprehensive R&D activities to increase their sensor-based sorting machine market share.

Sensor-based sorting machines are used in various industries including distribution, packaging, food processing, mining, recycling, waste management, chemicals, and plastics. Camera-based, X-ray, laser, LED, and hyperspectral imaging are various types of sensor-based sorting machines. Near-infrared (NIR) spectroscopy is one of the most widely utilized smart sensor technologies for material sorting. Food sorters are an integration of mechanical and optical sorting technologies. They perform alignment, packaging, distribution, transportation, collection, defect removal, and other functions. Vendors are adopting AI and machine learning in sensor-based sorting to boost production capabilities.

Sensor-based sorting is typically used for particle sizes ranging from 0.5 to 300 mm and is completed before the application of fine comminution and chemical processing. In the metal & mining sector, smart sorting machines are utilized to remove waste before it enters production and recover viable ore.

The pharmaceutical sector is one of the major end-users of sensor-based sorting machines. These machines are employed in sorting capsules and tablets according to their weight, size, or shape to maintain quality and production accuracy. The demand for intelligent sensor-based sorters grew rapidly during the COVID-19 lockdown as food & beverage and pharmaceutical industries operated on high volumes. Use of intelligent sensor-based sorters helps reduce labor costs and accelerates the production process. Hence, increase in focus on boosting production capacity in end-use industries is fueling the sensor-based sorting machine market development.

Governments and regulatory bodies across the globe are implementing stringent rules and regulations to help maintain food quality. In the U.S., the FDA conducts inspections at various manufacturing and processing sites (including food processing facilities; dairy farms; animal feed processors; and foreign manufacturing and processing sites) to verify that they comply with relevant regulations. Thus, surge in focus on product safety is expected to spur the sensor-based sorting machine market growth in the near future.

Major companies operating in the food & beverage sector are adopting automation to boost their product capabilities. They are employing innovative and advanced processing mechanisms for various operations. Sorting facilities are using a range of technologies, including cameras, lighting, and machine learning software, to remove product defects and foreign materials by color, shape, or structure.

Surge in demand for metals and rise in metal prices is projected to boost demand for XRF sorting technology in the recycling sector, thereby driving sensor-based sorting machine market value. XRF sorting technology provides a highly efficient and accurate method for analyzing and sorting metal waste and metal scrap in the recycling sector. It aids in increasing process efficiency and reducing operational costs.

According to the latest sensor-based sorting machine market forecast, North America is projected to hold largest share from 2023 to 2031. Increase in demand for processed and nutritional food products is augmenting market dynamics in the region. Additionally, surge in adoption of automation in various end-user industries, such as pharmaceutical and food & beverage, is fueling market statistics in North America.

The industry in Asia Pacific is anticipated to exhibit the highest CAGR during the forecast period. Rapid industrialization and growth in various end-user industries, such as mining, food & beverage, and pharmaceutical, are boosting market progress in the region. Major international pharmaceutical companies are setting up their manufacturing facilities in Asia Pacific, which is presenting huge opportunities for industry growth in the region.

The global industry is consolidated, with several small-scale sensor-based sorting machine companies controlling majority of the market share. Most vendors are launching advanced products to expand their product portfolio. In 2022, TOMRA launched the TOMRA 5C premium-sorting machine with unique biometric signature identification technology for frozen vegetables. One of the emerging trends in sensor-based sorting technology is the integration of artificial intelligence algorithms to enhance the accuracy and efficiency of material identification and separation processes.

Allgaier Process Technology GmbH, CSG, HypSorting, IMS Engineering, Leevams Incorporated, Redwave, Sesotec, Stark Resources, Steinert Global, and TOMRA are prominent entities operating in this sector.

Each of these players has been profiled in the global sensor-based sorting machine market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 4.2 Bn |

|

Market Forecast Value in 2031 |

US$ 6.9 Bn |

|

Growth Rate (CAGR) |

5.7% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2022 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

Includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 4.2 Bn in 2022

It is estimated to be 5.7% from 2023 to 2031

It is expected to reach US$ 6.9 Bn by the end of 2031

Rise in focus on boosting production capacity in end-use industries and increase in adoption of automation in end-use industries

North America recorded the highest demand in 2022

Allgaier Process Technology GmbH, CSG, HypSorting, IMS Engineering, Leevams Incorporated, Redwave, Sesotec, Stark Resources, Steinert Global, and TOMRA

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.4. Porter’s Five Forces Analysis

5.5. Industry SWOT Analysis

5.6. Value Chain Analysis

5.7. COVID-19 Impact Analysis

5.8. Import/Export Analysis

5.9. Regulatory Framework

5.9.1. Weighted Average Selling Price (US$)

6. Global Sensor-based Sorting Machine Market Analysis and Forecast, By Type

6.1. Sensor-based Sorting Machine Market Size (US$ Bn and Thousand Units), By Type, 2017 - 2031

6.1.1. Chute Type

6.1.2. Belt Type

6.2. Incremental Opportunity, By Type

7. Global Sensor-based Sorting Machine Market Analysis and Forecast, By Technology

7.1. Sensor-based Sorting Machine Market Size (US$ Bn and Thousand Units), By Technology, 2017 - 2031

7.1.1. Laser Sorters

7.1.2. X-ray Transmission

7.1.3. Color-based

7.1.4. Near-infrared

7.1.5. Combination of Different Technologies

7.2. Incremental Opportunity, By Technology

8. Global Sensor-based Sorting Machine Market Analysis and Forecast, By Sorting Type

8.1. Sensor-based Sorting Machine Market Size (US$ Bn and Thousand Units), By Sorting Type, 2017 - 2031

8.1.1. Bulk Sorting

8.1.2. Particle Sorting

8.2. Incremental Opportunity, By Sorting Type

9. Global Sensor-based Sorting Machine Market Analysis and Forecast, By Processing Capacity

9.1. Sensor-based Sorting Machine Market Size (US$ Bn and Thousand Units), By Processing Capacity, 2017 - 2031

9.1.1. Up to 150 tons/hr

9.1.2. 150 to 250 tons/hr

9.1.3. 250 to 350 tons/hr

9.1.4. Above 350 tons/hr

9.2. Incremental Opportunity, By Processing Capacity

10. Global Sensor-based Sorting Machine Market Analysis and Forecast, By Application

10.1. Sensor-based Sorting Machine Market Size (US$ Bn and Thousand Units), By Application, 2017 - 2031

10.1.1.1. Metallic

10.1.1.2. Non-metallic

10.2. Incremental Opportunity, By Application

11. Global Sensor-based Sorting Machine Market Analysis and Forecast, By Distribution Channel

11.1. Sensor-based Sorting Machine Market Size (US$ Bn and Thousand Units), By Distribution Channel, 2017 - 2031

11.1.1.1. Direct Sales

11.1.1.2. Indirect Sales

11.2. Incremental Opportunity, By Distribution Channel

12. Global Sensor-based Sorting Machine Market Analysis and Forecast, By Region

12.1. Sensor-based Sorting Machine Market Size (US$ Bn and Thousand Units), By Region, 2017 - 2031

12.1.1.1. North America

12.1.1.2. Europe

12.1.1.3. Asia Pacific

12.1.1.4. Middle East & Africa

12.1.1.5. South America

12.2. Incremental Opportunity, By Region

13. North America Sensor-based Sorting Machine Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Supplier Analysis

13.3. Key Trends Analysis

13.3.1. Supply Side

13.3.2. Demand Side

13.4. Price Trend Analysis

13.4.1. Weighted Average Selling Price (US$)

13.5. Sensor-based Sorting Machine Market Size (US$ Bn and Thousand Units), By Technology, 2017 - 2031

13.5.1. Laser Sorters

13.5.2. X-ray Transmission

13.5.3. Color-based

13.5.4. Near-infrared

13.5.5. Combination of Different Technologies

13.6. Sensor-based Sorting Machine Market Size (US$ Bn and Thousand Units), By Sorting Type, 2017 - 2031

13.6.1. Bulk Sorting

13.6.2. Particle Sorting

13.7. Sensor-based Sorting Machine Market Size (US$ Bn and Thousand Units), By Processing Capacity, 2017 - 2031

13.7.1. Up to 150 tons/hr

13.7.2. 150 to 250 tons/hr

13.7.3. 250 to 350 tons/hr

13.7.4. Above 350 tons/hr

13.8. Sensor-based Sorting Machine Market Size (US$ Bn and Thousand Units), By Application, 2017 - 2031

13.8.1.1. Metallic

13.8.1.2. Non-metallic

13.9. Sensor-based Sorting Machine Market Size (US$ Bn and Thousand Units), By Distribution Channel, 2017 - 2031

13.9.1.1. Direct Sales

13.9.1.2. Indirect Sales

13.10. Sensor-based Sorting Machine Market Size (US$ Bn, Thousand Units), by Country, 2017- 2031

13.10.1. U.S.

13.10.2. Canada

13.10.3. Rest of North America

13.11. Incremental Opportunity Analysis

14. Europe Sensor-based Sorting Machine Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Supplier Analysis

14.3. Key Trends Analysis

14.3.1. Supply Side

14.3.2. Demand Side

14.4. Price Trend Analysis

14.4.1. Weighted Average Selling Price (US$)

14.5. Sensor-based Sorting Machine Market Size (US$ Bn and Thousand Units), By Technology, 2017 - 2031

14.5.1. Laser Sorters

14.5.2. X-ray Transmission

14.5.3. Color-based

14.5.4. Near-infrared

14.5.5. Combination of Different Technologies

14.6. Sensor-based Sorting Machine Market Size (US$ Bn and Thousand Units), By Sorting Type, 2017 - 2031

14.6.1. Bulk Sorting

14.6.2. Particle Sorting

14.7. Sensor-based Sorting Machine Market Size (US$ Bn and Thousand Units), By Processing Capacity, 2017 - 2031

14.7.1. Up to 150 tons/hr

14.7.2. 150 to 250 tons/hr

14.7.3. 250 to 350 tons/hr

14.7.4. Above 350 tons/hr

14.8. Sensor-based Sorting Machine Market Size (US$ Bn and Thousand Units), By Application, 2017 - 2031

14.8.1.1. Metallic

14.8.1.2. Non-metallic

14.9. Sensor-based Sorting Machine Market Size (US$ Bn and Thousand Units), By Distribution Channel, 2017 - 2031

14.9.1.1. Direct Sales

14.9.1.2. Indirect Sales

14.10. Sensor-based Sorting Machine Market Size (US$ Bn, Thousand Units), by Country, 2017- 2031

14.10.1. U.K.

14.10.2. Germany

14.10.3. France

14.10.4. Rest of Europe

14.11. Incremental Opportunity Analysis

15. Asia Pacific Sensor-based Sorting Machine Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Supplier Analysis

15.3. Key Trends Analysis

15.3.1. Supply Side

15.3.2. Demand Side

15.4. Price Trend Analysis

15.4.1. Weighted Average Selling Price (US$)

15.5. Sensor-based Sorting Machine Market Size (US$ Bn and Thousand Units), By Technology, 2017 - 2031

15.5.1. Laser Sorters

15.5.2. X-ray Transmission

15.5.3. Color-based

15.5.4. Near-infrared

15.5.5. Combination of Different Technologies

15.6. Sensor-based Sorting Machine Market Size (US$ Bn and Thousand Units), By Sorting Type, 2017 - 2031

15.6.1. Bulk Sorting

15.6.2. Particle Sorting

15.7. Sensor-based Sorting Machine Market Size (US$ Bn and Thousand Units), By Processing Capacity, 2017 - 2031

15.7.1. Up to 150 tons/hr

15.7.2. 150 to 250 tons/hr

15.7.3. 250 to 350 tons/hr

15.7.4. Above 350 tons/hr

15.8. Sensor-based Sorting Machine Market Size (US$ Bn and Thousand Units), By Application, 2017 - 2031

15.8.1.1. Metallic

15.8.1.2. Non-metallic

15.9. Sensor-based Sorting Machine Market Size (US$ Bn and Thousand Units), By Distribution Channel, 2017 - 2031

15.9.1.1. Direct Sales

15.9.1.2. Indirect Sales

15.10. Sensor-based Sorting Machine Market Size (US$ Bn, Thousand Units), by Country, 2017- 2031

15.10.1. China

15.10.2. India

15.10.3. Japan

15.10.4. Rest of Asia Pacific

15.11. Incremental Opportunity Analysis

16. Middle East & Africa Sensor-based Sorting Machine Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Key Supplier Analysis

16.3. Key Trends Analysis

16.3.1. Supply Side

16.3.2. Demand Side

16.4. Price Trend Analysis

16.4.1. Weighted Average Selling Price (US$)

16.5. Sensor-based Sorting Machine Market Size (US$ Bn and Thousand Units), By Technology, 2017 - 2031

16.5.1. Laser Sorters

16.5.2. X-ray Transmission

16.5.3. Color-based

16.5.4. Near-infrared

16.5.5. Combination of Different Technologies

16.6. Sensor-based Sorting Machine Market Size (US$ Bn and Thousand Units), By Sorting Type, 2017 - 2031

16.6.1. Bulk Sorting

16.6.2. Particle Sorting

16.7. Sensor-based Sorting Machine Market Size (US$ Bn and Thousand Units), By Processing Capacity, 2017 - 2031

16.7.1. Up to 150 tons/hr

16.7.2. 150 to 250 tons/hr

16.7.3. 250 to 350 tons/hr

16.7.4. Above 350 tons/hr

16.8. Sensor-based Sorting Machine Market Size (US$ Bn and Thousand Units), By Application, 2017 - 2031

16.8.1.1. Metallic

16.8.1.2. Non-metallic

16.9. Sensor-based Sorting Machine Market Size (US$ Bn and Thousand Units), By Distribution Channel, 2017 - 2031

16.9.1.1. Direct Sales

16.9.1.2. Indirect Sales

16.10. Sensor-based Sorting Machine Market Size (US$ Bn, Thousand Units), by Country, 2017- 2031

16.10.1. GCC

16.10.2. South Africa

16.10.3. Egypt

16.10.4. Rest of Middle East & Africa

16.11. Incremental Opportunity Analysis

17. South America Sensor-based Sorting Machine Market Analysis and Forecast

17.1. Regional Snapshot

17.2. Key Supplier Analysis

17.3. Key Trends Analysis

17.3.1. Supply Side

17.3.2. Demand Side

17.4. Price Trend Analysis

17.4.1. Weighted Average Selling Price (US$)

17.5. Sensor-based Sorting Machine Market Size (US$ Bn and Thousand Units), By Technology, 2017 - 2031

17.5.1. Laser Sorters

17.5.2. X-ray Transmission

17.5.3. Color-based

17.5.4. Near-infrared

17.5.5. Combination of Different Technologies

17.6. Sensor-based Sorting Machine Market Size (US$ Bn and Thousand Units), By Sorting Type, 2017 - 2031

17.6.1. Bulk Sorting

17.6.2. Particle Sorting

17.7. Sensor-based Sorting Machine Market Size (US$ Bn and Thousand Units), By Processing Capacity, 2017 - 2031

17.7.1. Up to 150 tons/hr

17.7.2. 150 to 250 tons/hr

17.7.3. 250 to 350 tons/hr

17.7.4. Above 350 tons/hr

17.8. Sensor-based Sorting Machine Market Size (US$ Bn and Thousand Units), By Application, 2017 - 2031

17.8.1.1. Metallic

17.8.1.2. Non-metallic

17.9. Sensor-based Sorting Machine Market Size (US$ Bn and Thousand Units), By Distribution Channel, 2017 - 2031

17.9.1.1. Direct Sales

17.9.1.2. Indirect Sales

17.10. Sensor-based Sorting Machine Market Size (US$ Bn, Thousand Units), by Country, 2017- 2031

17.10.1. Brazil

17.10.2. Rest of South America

17.11. Incremental Opportunity Analysis

18. Competition Landscape

18.1. Market Player - Competition Dashboard

18.2. Market Share Analysis (%), 2022

18.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview, Go-To-Market Strategy)

18.3.1. Allgaier Process Technology GmbH

18.3.1.1. Company Overview

18.3.1.2. Sales Area/Geographical Presence

18.3.1.3. Revenue

18.3.1.4. Strategy & Business Overview

18.3.1.5. Go-To-Market Strategy

18.3.2. CSG

18.3.2.1. Company Overview

18.3.2.2. Sales Area/Geographical Presence

18.3.2.3. Revenue

18.3.2.4. Strategy & Business Overview

18.3.2.5. Go-To-Market Strategy

18.3.3. HypSorting

18.3.3.1. Company Overview

18.3.3.2. Sales Area/Geographical Presence

18.3.3.3. Revenue

18.3.3.4. Strategy & Business Overview

18.3.3.5. Go-To-Market Strategy

18.3.4. IMS Engineering

18.3.4.1. Company Overview

18.3.4.2. Sales Area/Geographical Presence

18.3.4.3. Revenue

18.3.4.4. Strategy & Business Overview

18.3.4.5. Go-To-Market Strategy

18.3.5. Leevams Incorporated

18.3.5.1. Company Overview

18.3.5.2. Sales Area/Geographical Presence

18.3.5.3. Revenue

18.3.5.4. Strategy & Business Overview

18.3.5.5. Go-To-Market Strategy

18.3.6. Redwave

18.3.6.1. Company Overview

18.3.6.2. Sales Area/Geographical Presence

18.3.6.3. Revenue

18.3.6.4. Strategy & Business Overview

18.3.6.5. Go-To-Market Strategy

18.3.7. Sesotec

18.3.7.1. Company Overview

18.3.7.2. Sales Area/Geographical Presence

18.3.7.3. Revenue

18.3.7.4. Strategy & Business Overview

18.3.7.5. Go-To-Market Strategy

18.3.8. Stark resources

18.3.8.1. Company Overview

18.3.8.2. Sales Area/Geographical Presence

18.3.8.3. Revenue

18.3.8.4. Strategy & Business Overview

18.3.8.5. Go-To-Market Strategy

18.3.9. Steinert Global

18.3.9.1. Company Overview

18.3.9.2. Sales Area/Geographical Presence

18.3.9.3. Revenue

18.3.9.4. Strategy & Business Overview

18.3.9.5. Go-To-Market Strategy

18.3.10. TOMRA

18.3.10.1. Company Overview

18.3.10.2. Sales Area/Geographical Presence

18.3.10.3. Revenue

18.3.10.4. Strategy & Business Overview

18.3.10.5. Go-To-Market Strategy

18.3.11. Other Key Players

18.3.11.1. Company Overview

18.3.11.2. Sales Area/Geographical Presence

18.3.11.3. Revenue

18.3.11.4. Strategy & Business Overview

18.3.11.5. Go-To-Market Strategy

19. Go To Market Strategy

19.1. Identification of Potential Market Spaces

19.2. Understanding Buying Process of Customers

List of Tables

Table 1: Global Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Type 2017-2031

Table 2: Global Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Type 2017-2031

Table 3: Global Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Sorting Type 2017-2031

Table 4: Global Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Sorting Type 2017-2031

Table 5: Global Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Technology 2017-2031

Table 6: Global Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Technology 2017-2031

Table 7: Global Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Processing Capacity 2017-2031

Table 8: Global Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Processing Capacity 2017-2031

Table 9: Global Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Application 2017-2031

Table 10: Global Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Application 2017-2031

Table 11: Global Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Distribution Channel 2017-2031

Table 12: Global Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Distribution Channel 2017-2031

Table 13: Global Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Region 2017-2031

Table 14: Global Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Region 2017-2031

Table 15: North America Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Type 2017-2031

Table 16: North America Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Type 2017-2031

Table 17: North America Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Sorting Type 2017-2031

Table 18: North America Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Sorting Type 2017-2031

Table 19: North America Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Technology 2017-2031

Table 20: North America Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Technology 2017-2031

Table 21: North America Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Processing Capacity 2017-2031

Table 22: North America Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Processing Capacity 2017-2031

Table 23: North America Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Application 2017-2031

Table 24: North America Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Application 2017-2031

Table 25: North America Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Distribution Channel 2017-2031

Table 26: North America Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Distribution Channel 2017-2031

Table 27: North America Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Country 2017-2031

Table 28: North America Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Country 2017-2031

Table 29: Europe Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Type 2017-2031

Table 30: Europe Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Type 2017-2031

Table 31: Europe Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Sorting Type 2017-2031

Table 32: Europe Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Sorting Type 2017-2031

Table 33: Europe Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Technology 2017-2031

Table 34: Europe Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Technology 2017-2031

Table 35: Europe Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Processing Capacity 2017-2031

Table 36: Europe Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Processing Capacity 2017-2031

Table 37: Europe Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Application 2017-2031

Table 38: Europe Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Application 2017-2031

Table 39: Europe Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Distribution Channel 2017-2031

Table 40: Europe Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Distribution Channel 2017-2031

Table 41: Europe Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Country 2017-2031

Table 42: Europe Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Country 2017-2031

Table 43: Asia Pacific Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Type 2017-2031

Table 44: Asia Pacific Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Type 2017-2031

Table 45: Asia Pacific Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Sorting Type 2017-2031

Table 46: Asia Pacific Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Sorting Type 2017-2031

Table 47: Asia Pacific Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Technology 2017-2031

Table 48: Asia Pacific Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Technology 2017-2031

Table 49: Asia Pacific Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Processing Capacity 2017-2031

Table 50: Asia Pacific Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Processing Capacity 2017-2031

Table 51: Asia Pacific Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Application 2017-2031

Table 52: Asia Pacific Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Application 2017-2031

Table 53: Asia Pacific Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Distribution Channel 2017-2031

Table 54: Asia Pacific Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Distribution Channel 2017-2031

Table 55: Asia Pacific Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Country 2017-2031

Table 56: Asia Pacific Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Country 2017-2031

Table 57: Middle East & Africa Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Type 2017-2031

Table 58: Middle East & Africa Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Type 2017-2031

Table 59: Middle East & Africa Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Sorting Type 2017-2031

Table 60: Middle East & Africa Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Sorting Type 2017-2031

Table 61: Middle East & Africa Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Technology 2017-2031

Table 62: Middle East & Africa Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Technology 2017-2031

Table 63: Middle East & Africa Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Processing Capacity 2017-2031

Table 64: Middle East & Africa Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Processing Capacity 2017-2031

Table 65: Middle East & Africa Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Application 2017-2031

Table 66: Middle East & Africa Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Application 2017-2031

Table 67: Middle East & Africa Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Distribution Channel 2017-2031

Table 68: Middle East & Africa Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Distribution Channel 2017-2031

Table 69: Middle East & Africa Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Country 2017-2031

Table 70: Middle East & Africa Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Country 2017-2031

Table 71: South America Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Type 2017-2031

Table 72: South America Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Type 2017-2031

Table 73: South America Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Sorting Type 2017-2031

Table 74: South America Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Sorting Type 2017-2031

Table 75: South America Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Technology 2017-2031

Table 76: South America Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Technology 2017-2031

Table 77: South America Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Processing Capacity 2017-2031

Table 78: South America Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Processing Capacity 2017-2031

Table 79: South America Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Application 2017-2031

Table 80: South America Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Application 2017-2031

Table 81: South America Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Distribution Channel 2017-2031

Table 82: South America Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Distribution Channel 2017-2031

Table 83: South America Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Country 2017-2031

Table 84: South America Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Country 2017-2031

List of Figures

Figure 1: Global Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Type 2017-2031

Figure 2: Global Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Type 2017-2031

Figure 3: Global Sensor-based Sorting Machine Market Incremental Opportunity (US$ Bn), By Type 2017-2031

Figure 4: Global Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Sorting Type 2017-2031

Figure 5: Global Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Sorting Type 2017-2031

Figure 6: Global Sensor-based Sorting Machine Market Incremental Opportunity (US$ Bn), By Sorting Type 2017-2031

Figure 7: Global Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Technology 2017-2031

Figure 8: Global Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Technology 2017-2031

Figure 9: Global Sensor-based Sorting Machine Market Incremental Opportunity (US$ Bn), By Technology 2017-2031

Figure 10: Global Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Processing Capacity 2017-2031

Figure 11: Global Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Processing Capacity 2017-2031

Figure 12: Global Sensor-based Sorting Machine Market Incremental Opportunity (US$ Bn), By Processing Capacity 2017-2031

Figure 13: Global Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Application 2017-2031

Figure 14: Global Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Application 2017-2031

Figure 15: Global Sensor-based Sorting Machine Market Incremental Opportunity (US$ Bn), By Application 2017-2031

Figure 16: Global Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Distribution Channel 2017-2031

Figure 17: Global Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Distribution Channel 2017-2031

Figure 18: Global Sensor-based Sorting Machine Market Incremental Opportunity (US$ Bn), By Distribution Channel 2017-2031

Figure 19: Global Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Region 2017-2031

Figure 20: Global Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Region 2017-2031

Figure 21: Global Sensor-based Sorting Machine Market Incremental Opportunity (US$ Bn), By Region 2017-2031

Figure 22: North America Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Type 2017-2031

Figure 23: North America Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Type 2017-2031

Figure 24: North America Sensor-based Sorting Machine Market Incremental Opportunity (US$ Bn), By Type 2017-2031

Figure 25: North America Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Sorting Type 2017-2031

Figure 26: North America Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Sorting Type 2017-2031

Figure 27: North America Sensor-based Sorting Machine Market Incremental Opportunity (US$ Bn), By Sorting Type 2017-2031

Figure 28: North America Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Technology 2017-2031

Figure 29: North America Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Technology 2017-2031

Figure 30: North America Sensor-based Sorting Machine Market Incremental Opportunity (US$ Bn), By Technology 2017-2031

Figure 31: North America Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Processing Capacity 2017-2031

Figure 32: North America Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Processing Capacity 2017-2031

Figure 33: North America Sensor-based Sorting Machine Market Incremental Opportunity (US$ Bn), By Processing Capacity 2017-2031

Figure 34: North America Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Application 2017-2031

Figure 35: North America Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Application 2017-2031

Figure 36: North America Sensor-based Sorting Machine Market Incremental Opportunity (US$ Bn), By Application 2017-2031

Figure 37: North America Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Distribution Channel 2017-2031

Figure 38: North America Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Distribution Channel 2017-2031

Figure 39: North America Sensor-based Sorting Machine Market Incremental Opportunity (US$ Bn), By Distribution Channel 2017-2031

Figure 40: North America Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Country 2017-2031

Figure 41: North America Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Country 2017-2031

Figure 42: North America Sensor-based Sorting Machine Market Incremental Opportunity (US$ Bn), By Country 2017-2031

Figure 43: Europe Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Type 2017-2031

Figure 44: Europe Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Type 2017-2031

Figure 45: Europe Sensor-based Sorting Machine Market Incremental Opportunity (US$ Bn), By Type 2017-2031

Figure 46: Europe Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Sorting Type 2017-2031

Figure 47: Europe Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Sorting Type 2017-2031

Figure 48: Europe Sensor-based Sorting Machine Market Incremental Opportunity (US$ Bn), By Sorting Type 2017-2031

Figure 49: Europe Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Technology 2017-2031

Figure 50: Europe Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Technology 2017-2031

Figure 51: Europe Sensor-based Sorting Machine Market Incremental Opportunity (US$ Bn), By Technology 2017-2031

Figure 52: Europe Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Processing Capacity 2017-2031

Figure 53: Europe Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Processing Capacity 2017-2031

Figure 54: Europe Sensor-based Sorting Machine Market Incremental Opportunity (US$ Bn), By Processing Capacity 2017-2031

Figure 55: Europe Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Application

Figure 56: Europe Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Application

Figure 57: Europe Sensor-based Sorting Machine Market Incremental Opportunity (US$ Bn), By Application

Figure 58: Europe Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Distribution Channel

Figure 59: Europe Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Distribution Channel

Figure 60: Europe Sensor-based Sorting Machine Market Incremental Opportunity (US$ Bn), By Distribution Channel

Figure 61: Europe Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Country

Figure 62: Europe Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Country

Figure 63: Europe Sensor-based Sorting Machine Market Incremental Opportunity (US$ Bn), By Country

Figure 64: Asia Pacific Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Type

Figure 65: Asia Pacific Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Type

Figure 66: Asia Pacific Sensor-based Sorting Machine Market Incremental Opportunity (US$ Bn), By Type

Figure 67: Asia Pacific Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Sorting Type

Figure 68: Asia Pacific Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Sorting Type

Figure 69: Asia Pacific Sensor-based Sorting Machine Market Incremental Opportunity (US$ Bn), By Sorting Type

Figure 70: Asia Pacific Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Technology

Figure 71: Asia Pacific Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Technology

Figure 72: Asia Pacific Sensor-based Sorting Machine Market Incremental Opportunity (US$ Bn), By Technology

Figure 73: Asia Pacific Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Processing Capacity

Figure 74: Asia Pacific Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Processing Capacity

Figure 75: Asia Pacific Sensor-based Sorting Machine Market Incremental Opportunity (US$ Bn), By Processing Capacity

Figure 76: Asia Pacific Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Application

Figure 77: Asia Pacific Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Application

Figure 78: Asia Pacific Sensor-based Sorting Machine Market Incremental Opportunity (US$ Bn), By Application

Figure 79: Asia Pacific Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Distribution Channel

Figure 80: Asia Pacific Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Distribution Channel

Figure 81: Asia Pacific Sensor-based Sorting Machine Market Incremental Opportunity (US$ Bn), By Distribution Channel

Figure 82: Asia Pacific Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Country

Figure 83: Asia Pacific Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Country

Figure 84: Asia Pacific Sensor-based Sorting Machine Market Incremental Opportunity (US$ Bn), By Country

Figure 85: Middle East & Africa Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Type

Figure 86: Middle East & Africa Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Type

Figure 87: Middle East & Africa Sensor-based Sorting Machine Market Incremental Opportunity (US$ Bn), By Type

Figure 88: Middle East & Africa Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Sorting Type

Figure 89: Middle East & Africa Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Sorting Type

Figure 90: Middle East & Africa Sensor-based Sorting Machine Market Incremental Opportunity (US$ Bn), By Sorting Type

Figure 91: Middle East & Africa Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Technology

Figure 92: Middle East & Africa Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Technology

Figure 93: Middle East & Africa Sensor-based Sorting Machine Market Incremental Opportunity (US$ Bn), By Technology

Figure 94: Middle East & Africa Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Processing Capacity

Figure 95: Middle East & Africa Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Processing Capacity

Figure 96: Middle East & Africa Sensor-based Sorting Machine Market Incremental Opportunity (US$ Bn), By Processing Capacity

Figure 97: Middle East & Africa Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Application

Figure 98: Middle East & Africa Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Application

Figure 99: Middle East & Africa Sensor-based Sorting Machine Market Incremental Opportunity (US$ Bn), By Application

Figure 100: Middle East & Africa Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Distribution Channel

Figure 101: Middle East & Africa Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Distribution Channel

Figure 102: Middle East & Africa Sensor-based Sorting Machine Market Incremental Opportunity (US$ Bn), By Distribution Channel

Figure 103: Middle East & Africa Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Country

Figure 104: Middle East & Africa Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Country

Figure 105: Middle East & Africa Sensor-based Sorting Machine Market Incremental Opportunity (US$ Bn), By Country

Figure 106: South America Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Type

Figure 107: South America Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Type

Figure 108: South America Sensor-based Sorting Machine Market Incremental Opportunity (US$ Bn), By Type

Figure 109: South America Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Sorting Type

Figure 110: South America Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Sorting Type

Figure 111: South America Sensor-based Sorting Machine Market Incremental Opportunity (US$ Bn), By Sorting Type

Figure 112: South America Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Technology

Figure 113: South America Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Technology

Figure 114: South America Sensor-based Sorting Machine Market Incremental Opportunity (US$ Bn), By Technology

Figure 115: South America Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Processing Capacity

Figure 116: South America Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Processing Capacity

Figure 117: South America Sensor-based Sorting Machine Market Incremental Opportunity (US$ Bn), By Processing Capacity

Figure 118: South America Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Application

Figure 119: South America Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Application

Figure 120: South America Sensor-based Sorting Machine Market Incremental Opportunity (US$ Bn), By Application

Figure 121: South America Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Distribution Channel

Figure 122: South America Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Distribution Channel

Figure 123: South America Sensor-based Sorting Machine Market Incremental Opportunity (US$ Bn), By Distribution Channel

Figure 124: South America Sensor-based Sorting Machine Market Volume (Thousand Units) Share, By Country

Figure 125: South America Sensor-based Sorting Machine Market Value (US$ Bn) Share, By Country

Figure 126: South America Sensor-based Sorting Machine Market Incremental Opportunity (US$ Bn), By Country