Reports

Reports

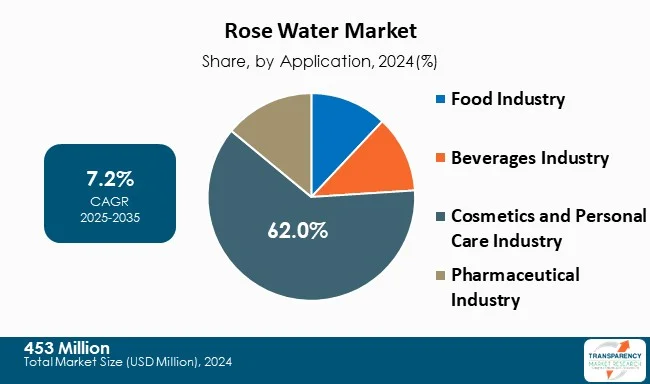

The market for rose water is growing at consistent pace, owing largely to consumers' increasing demand for natural, organic, and multi-faceted products in skincare including wellness and culinary applications. Increased awareness of clean-label beauty and the perceived health benefits of botanical ingredients is placing rose water as a key ingredient in the formulation of toners, facial mists, creams, and cleansers. Its gentle formulation and suitability for all skin types, including sensitive skin, has further helped its adoptions in cosmetics and personal care - the leading category in the rose water market. The fast-growing e-commerce and direct-to-consumer (D2C) channels going forward also helps brands reach a larger audience, provide opportunity for personalized consumer experiences, and increase overall engagement of consumers.

The Asia Pacific region is becoming the fastest-growing market in rose water because of cultural familiarity with herbal remedies and government initiatives surrounding the production of aromatic plants and clean-label manufacturing. Ongoing innovation in product formulation, marketing strategies, and overall accessibility of products has significantly increased the adoption of rose water reinforced the widespread use and popularity of rose water across various industries.

Rose water is a natural scented oil, which is distilled in steam using rose petals or mixed rose oil and purified water. It is rich in antioxidants, vitamins, and volatile oils and has calming, hydrating, and anti-inflammatory effects which have made it one of the highly-regarded ingredients in various industries. Its aromatic properties, gentle composition, and natural purity have made it an essential product in beauty, wellness, and culinary applications.

Rose water is used in the cosmetics and personal care industry for the preparation facial toners, cleansers and mists to balance skin pH, reduce irritation and rejuvenate dull skin. In the food and beverage industry rose water is used as a flavoring agent in sweets, desserts, and beverages. In addition to this, it also finds importance in aromatherapy and traditional medicine as a means of relaxation, stress relief and emotional well-being, turning rose water as a functional product and a holistic product. It is also increasingly being incorporated into modern skincare routines due to its compatibility with sensitive skin. Many premium brands are now launching rose water-based formulations to cater to growing consumer demand for natural and organic products.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The growing popularity of natural and organic skincare products among consumers is one of the major drivers of the rose water market. Customers are becoming increasingly aware of the contents of the personal care products and prefer products that do not contain any harsh chemicals, parabens or synthetic fragrances. As a natural extract which is hydrating, anti-inflammatory, and antioxidant, rose water is the ideal fit in this transition to clean beauty. Its gentle formulation makes it suitable for all skin types, including sensitive skin, which further enhances its appeal.

Additionally, the increasing demand for wellness-focused lifestyles and increased awareness of the health benefits of plant-based skincare. Consumers are actively-seeking products that enhance beauty but also provide therapeutic and holistic benefits. Rose water has become one of the favored toners, facial mists, and creams ingredients and has also boosted the growth of the market, especially in the areas where the trends of natural and organic beauty have gained momentum.

The rise in the number of e-commerce and direct-to-consumer (D2C) sales channels is significantly contributing to the expansion of the rose water market. Due to the growing adoption of smart phones, internet connectivity and online payment systems, consumers have access a wide range of skincare and personal care products online, including natural ingredients such as rose water. E-commerce sites are convenient, have more variety and provide detailed product information thus enabling the consumers to make informed buying decisions without necessarily going to physical stores.

D2C channels also increase the level of consumer interaction through these channels where the brands can have a direct relationship with consumers. This allows for personalized offerings, subscription models, and targeted marketing, which increases brand loyalty and repeat purchases. Moreover, awareness has increased in terms of the benefits of rose water, due to social media and influencer marketing. As a result, owing to the online reach, convenience, and customized consumer experiences, the rise of rose water adoption is gaining momentum, which is adding strength to the overall development of the market.

The cosmetics and personal care market has remained the biggest dominates market in the rose water market, owing to rising customer preference of natural and mild skincare products. Rose water is preferred due to its hydrating, anti-inflammatory and antioxidant qualities that makes it an important component in toners, facial mists, creams, and cleansers. It is gentle in composition and can be applied on all skin types such as sensitive skin and this has increased its user base to a broad consumer group. The growing attention to the clean, organic, and chemical-free beauty products has only increased the popularity of rose water as an ingredient in the daily skincare, with the consumers choosing products that provide them with both aesthetic and meditative value.

Government initiatives promoting the cultivation of aromatic and medicinal plants, including roses, support the consistent availability of raw materials for rose water production. Combined with the overall increasing influence of social media, the existence of online beauty communities, and skincare influencers, these factors reinforce the cosmetics and personal care pivotal role in the expansion of the rose water market.

| Attribute | Detail |

|---|---|

| Leading Region | Asia Pacific |

The rose water market in the Asia Pacific region is growing at the fastest rate. This is driven by a cultural inclination toward herbs and traditional medicines, and rapidly growing middle-class consumers. India has a deep-rooted Ayurvedic culture of using rose water in beauty types of products going back centuries, whether it has been from personal or ceremonial use in temples. This history has cultivated domestic brands to sell enormous quantities of rose water products in various formats. In South Korea and Japan, the K-beauty and J-beauty movement of gentler, more hydrating skincare products sees rose water being used as the base in toners or facial mists.

With increasing purchasing power, consumers are increasingly able to treat themselves with premium herbal brands for beauty, wellness, and personal care products. The regional government promotion of Ayurveda and associated traditional medicine systems, alongside government support for clean-label manufacturing and distribution, also promotes overall confidence in the use of products, hence boosting confidence amongst consumers.

The growth of e-Commerce and mobile commerce is also allowing consumers in tier-2 and tier-3 cities to access products previously unavailable. The rise of natural beauty solutions is driving the demand of consumers.

Dabur, ALTEYA ORGANICS, L'Oréal Paris, Poppy Austin Limited, Khadi Natural, Forest Essentials, Bioprocess, Sva Naturals, Taj Agro International (Taj Pharma Group), Patanjali Ayurved Limited, KAMA AYURVEDA, Biosash, Lavino, EVE HANSEN, ZOFLA LIFE ENTERPRISES are some of the leading companies operating in the global Rose Water.

Each of these companies has been profiled in the rose water report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

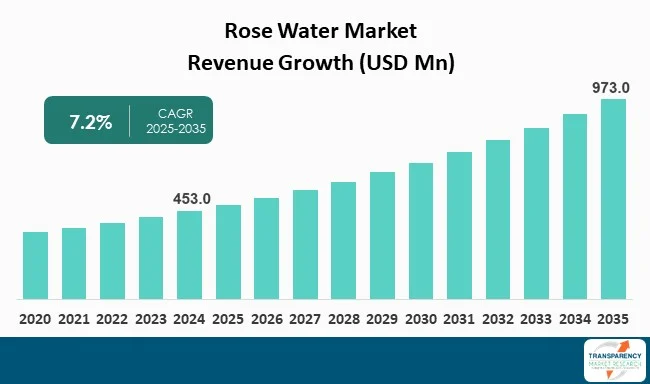

| Market Size Value in 2024 (Base Year) | US$ 453.0 Mn |

| Market Forecast Value in 2035 | US$ 973.0 Mn |

| Growth Rate (CAGR 2025 to 2035) | 7.2% |

| Forecast Period | 2025 - 2035 |

| Historical data Available for | 2020 - 2023 |

| Quantitative Units | US$ Mn for Value and Thousand Liters for Volume |

| Market Analysis | Global qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape | Market Player – Competition Dashboard and Revenue Share Analysis 2024 Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview) |

| Format | Electronic (PDF) + Excel |

| Market Segmentation | By Nature

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

The rose water market was valued at US$ 453.0 Mn in 2024

The rose water industry is projected to reach at US$ 973.0 Mn by the end of 2035

Increasing preference for natural & organic skincare, and expansion of E-Commerce & D2C sales channels are some of the factors driving the expansion of rose water market.

The CAGR is anticipated to be 7.2% from 2025 to 2035

Dabur, ALTEYA ORGANICS, L'Oréal Paris, Poppy Austin Limited, Khadi Natural, Forest Essentials, Bioprocess, Sva Naturals, Taj Agro International (Taj Pharma Group), Patanjali Ayurved Limited, KAMA AYURVEDA, Biosash, Lavino, EVE HANSEN, ZOFLA LIFE ENTERPRISES and others and others are some of the leading companies operating in the rose water market.

Table 1: Global Market Value (US$ Mn) Projection, 2020 to 2035 By Nature

Table 2: Global Market Volume (Thousand Liters) Projection, 2020 to 2035 By Nature

Table 3: Global Market Value (US$ Mn) Projection, 2020 to 2035 By Type

Table 4: Global Market Volume (Thousand Liters) Projection, 2020 to 2035 By Type

Table 5: Global Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 6: Global Market Volume (Thousand Liters) Projection, 2020 to 2035 By Application

Table 7: Global Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 8: Global Market Volume (Thousand Liters) Projection, 2020 to 2035 By Distribution Channel

Table 9: Global Market Value (US$ Mn) Projection, 2020 to 2035 By Region

Table 10: Global Market Volume (Thousand Liters) Projection, 2020 to 2035 By Region

Table 11: North America Market Value (US$ Mn) Projection, 2020 to 2035 By Nature

Table 12: North America Market Volume (Thousand Liters) Projection, 2020 to 2035 By Nature

Table 13: North America Market Value (US$ Mn) Projection, 2020 to 2035 By Type

Table 14: North America Market Volume (Thousand Liters) Projection, 2020 to 2035 By Type

Table 15: North America Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 16: North America Market Volume (Thousand Liters) Projection, 2020 to 2035 By Application

Table 17: North America Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 18: North America Market Volume (Thousand Liters) Projection, 2020 to 2035 By Distribution Channel

Table 19: North America Market Value (US$ Mn) Projection, 2020 to 2035 By Country

Table 20: North America Market Volume (Thousand Liters) Projection, 2020 to 2035 By Country

Table 21: U.S. Market Value (US$ Mn) Projection, 2020 to 2035 By Nature

Table 22: U.S. Market Volume (Thousand Liters) Projection, 2020 to 2035 By Nature

Table 23: U.S. Market Value (US$ Mn) Projection, 2020 to 2035 By Type

Table 24: U.S. Market Volume (Thousand Liters) Projection, 2020 to 2035 By Type

Table 25: U.S. Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 26: U.S. Market Volume (Thousand Liters) Projection, 2020 to 2035 By Application

Table 27: U.S. Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 28: U.S. Market Volume (Thousand Liters) Projection, 2020 to 2035 By Distribution Channel

Table 29: Canada Market Value (US$ Mn) Projection, 2020 to 2035 By Nature

Table 30: Canada Market Volume (Thousand Liters) Projection, 2020 to 2035 By Nature

Table 31: Canada Market Value (US$ Mn) Projection, 2020 to 2035 By Type

Table 32: Canada Market Volume (Thousand Liters) Projection, 2020 to 2035 By Type

Table 33: Canada Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 34: Canada Market Volume (Thousand Liters) Projection, 2020 to 2035 By Application

Table 35: Canada Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 36: Canada Market Volume (Thousand Liters) Projection, 2020 to 2035 By Distribution Channel

Table 37: Europe Market Value (US$ Mn) Projection, 2020 to 2035 By Nature

Table 38: Europe Market Volume (Thousand Liters) Projection, 2020 to 2035 By Nature

Table 39: Europe Market Value (US$ Mn) Projection, 2020 to 2035 By Type

Table 40: Europe Market Volume (Thousand Liters) Projection, 2020 to 2035 By Type

Table 41: Europe Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 42: Europe Market Volume (Thousand Liters) Projection, 2020 to 2035 By Application

Table 43: Europe Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 44: Europe Market Volume (Thousand Liters) Projection, 2020 to 2035 By Distribution Channel

Table 45: Europe Market Value (US$ Mn) Projection, 2020 to 2035 By Country

Table 46: Europe Market Volume (Thousand Liters) Projection, 2020 to 2035 By Country

Table 47: U.K. Market Value (US$ Mn) Projection, 2020 to 2035 By Nature

Table 48: U.K. Market Volume (Thousand Liters) Projection, 2020 to 2035 By Nature

Table 49: U.K. Market Value (US$ Mn) Projection, 2020 to 2035 By Type

Table 50: U.K. Market Volume (Thousand Liters) Projection, 2020 to 2035 By Type

Table 51: U.K. Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 52: U.K. Market Volume (Thousand Liters) Projection, 2020 to 2035 By Application

Table 53: U.K. Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 54: U.K. Market Volume (Thousand Liters) Projection, 2020 to 2035 By Distribution Channel

Table 55: Germany Market Value (US$ Mn) Projection, 2020 to 2035 By Nature

Table 56: Germany Market Volume (Thousand Liters) Projection, 2020 to 2035 By Nature

Table 57: Germany Market Value (US$ Mn) Projection, 2020 to 2035 By Type

Table 58: Germany Market Volume (Thousand Liters) Projection, 2020 to 2035 By Type

Table 59: Germany Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 60: Germany Market Volume (Thousand Liters) Projection, 2020 to 2035 By Application

Table 61: Germany Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 62: Germany Market Volume (Thousand Liters) Projection, 2020 to 2035 By Distribution Channel

Table 63: France Market Value (US$ Mn) Projection, 2020 to 2035 By Nature

Table 64: France Market Volume (Thousand Liters) Projection, 2020 to 2035 By Nature

Table 65: France Market Value (US$ Mn) Projection, 2020 to 2035 By Type

Table 66: France Market Volume (Thousand Liters) Projection, 2020 to 2035 By Type

Table 67: France Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 68: France Market Volume (Thousand Liters) Projection, 2020 to 2035 By Application

Table 69: France Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 70: France Market Volume (Thousand Liters) Projection, 2020 to 2035 By Distribution Channel

Table 71: Italy Market Value (US$ Mn) Projection, 2020 to 2035 By Nature

Table 72: Italy Market Volume (Thousand Liters) Projection, 2020 to 2035 By Nature

Table 73: Italy Market Value (US$ Mn) Projection, 2020 to 2035 By Type

Table 74: Italy Market Volume (Thousand Liters) Projection, 2020 to 2035 By Type

Table 75: Italy Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 76: Italy Market Volume (Thousand Liters) Projection, 2020 to 2035 By Application

Table 77: Italy Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 78: Italy Market Volume (Thousand Liters) Projection, 2020 to 2035 By Distribution Channel

Table 79: Spain Market Value (US$ Mn) Projection, 2020 to 2035 By Nature

Table 80: Spain Market Volume (Thousand Liters) Projection, 2020 to 2035 By Nature

Table 81: Spain Market Value (US$ Mn) Projection, 2020 to 2035 By Type

Table 82: Spain Market Volume (Thousand Liters) Projection, 2020 to 2035 By Type

Table 83: Spain Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 84: Spain Market Volume (Thousand Liters) Projection, 2020 to 2035 By Application

Table 85: Spain Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 86: Spain Market Volume (Thousand Liters) Projection, 2020 to 2035 By Distribution Channel

Table 87: The Netherlands Market Value (US$ Mn) Projection, 2020 to 2035 By Nature

Table 88: The Netherlands Market Volume (Thousand Liters) Projection, 2020 to 2035 By Nature

Table 89: The Netherlands Market Value (US$ Mn) Projection, 2020 to 2035 By Type

Table 90: The Netherlands Market Volume (Thousand Liters) Projection, 2020 to 2035 By Type

Table 91: The Netherlands Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 92: The Netherlands Market Volume (Thousand Liters) Projection, 2020 to 2035 By Application

Table 93: The Netherlands Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 94: The Netherlands Market Volume (Thousand Liters) Projection, 2020 to 2035 By Distribution Channel

Table 95: Asia Pacific Market Value (US$ Mn) Projection, 2020 to 2035 By Nature

Table 96: Asia Pacific Market Volume (Thousand Liters) Projection, 2020 to 2035 By Nature

Table 97: Asia Pacific Market Value (US$ Mn) Projection, 2020 to 2035 By Type

Table 98: Asia Pacific Market Volume (Thousand Liters) Projection, 2020 to 2035 By Type

Table 99: Asia Pacific Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 100: Asia Pacific Market Volume (Thousand Liters) Projection, 2020 to 2035 By Application

Table 101: Asia Pacific Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 102: Asia Pacific Market Volume (Thousand Liters) Projection, 2020 to 2035 By Distribution Channel

Table 103: Asia Pacific Market Value (US$ Mn) Projection, 2020 to 2035 By Country

Table 104: Asia Pacific Market Volume (Thousand Liters) Projection, 2020 to 2035 By Country

Table 105: China Market Value (US$ Mn) Projection, 2020 to 2035 By Nature

Table 106: China Market Volume (Thousand Liters) Projection, 2020 to 2035 By Nature

Table 107: China Market Value (US$ Mn) Projection, 2020 to 2035 By Type

Table 108: China Market Volume (Thousand Liters) Projection, 2020 to 2035 By Type

Table 109: China Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 110: China Market Volume (Thousand Liters) Projection, 2020 to 2035 By Application

Table 111: China Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 112: China Market Volume (Thousand Liters) Projection, 2020 to 2035 By Distribution Channel

Table 113: India Market Value (US$ Mn) Projection, 2020 to 2035 By Nature

Table 114: India Market Volume (Thousand Liters) Projection, 2020 to 2035 By Nature

Table 115: India Market Value (US$ Mn) Projection, 2020 to 2035 By Type

Table 116: India Market Volume (Thousand Liters) Projection, 2020 to 2035 By Type

Table 117: India Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 118: India Market Volume (Thousand Liters) Projection, 2020 to 2035 By Application

Table 119: India Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 120: India Market Volume (Thousand Liters) Projection, 2020 to 2035 By Distribution Channel

Table 121: Japan Market Value (US$ Mn) Projection, 2020 to 2035 By Nature

Table 122: Japan Market Volume (Thousand Liters) Projection, 2020 to 2035 By Nature

Table 123: Japan Market Value (US$ Mn) Projection, 2020 to 2035 By Type

Table 124: Japan Market Volume (Thousand Liters) Projection, 2020 to 2035 By Type

Table 125: Japan Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 126: Japan Market Volume (Thousand Liters) Projection, 2020 to 2035 By Application

Table 127: Japan Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 128: Japan Market Volume (Thousand Liters) Projection, 2020 to 2035 By Distribution Channel

Table 129: Australia Market Value (US$ Mn) Projection, 2020 to 2035 By Nature

Table 130: Australia Market Volume (Thousand Liters) Projection, 2020 to 2035 By Nature

Table 131: Australia Market Value (US$ Mn) Projection, 2020 to 2035 By Type

Table 132: Australia Market Volume (Thousand Liters) Projection, 2020 to 2035 By Type

Table 133: Australia Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 134: Australia Market Volume (Thousand Liters) Projection, 2020 to 2035 By Application

Table 135: Australia Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 136: Australia Market Volume (Thousand Liters) Projection, 2020 to 2035 By Distribution Channel

Table 137: South Korea Market Value (US$ Mn) Projection, 2020 to 2035 By Nature

Table 138: South Korea Market Volume (Thousand Liters) Projection, 2020 to 2035 By Nature

Table 139: South Korea Market Value (US$ Mn) Projection, 2020 to 2035 By Type

Table 140: South Korea Market Volume (Thousand Liters) Projection, 2020 to 2035 By Type

Table 141: South Korea Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 142: South Korea Market Volume (Thousand Liters) Projection, 2020 to 2035 By Application

Table 143: South Korea Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 144: South Korea Market Volume (Thousand Liters) Projection, 2020 to 2035 By Distribution Channel

Table 145: ASEAN Market Value (US$ Mn) Projection, 2020 to 2035 By Nature

Table 146: ASEAN Market Volume (Thousand Liters) Projection, 2020 to 2035 By Nature

Table 147: ASEAN Market Value (US$ Mn) Projection, 2020 to 2035 By Type

Table 148: ASEAN Market Volume (Thousand Liters) Projection, 2020 to 2035 By Type

Table 149: ASEAN Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 150: ASEAN Market Volume (Thousand Liters) Projection, 2020 to 2035 By Application

Table 151: ASEAN Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 152: ASEAN Market Volume (Thousand Liters) Projection, 2020 to 2035 By Distribution Channel

Table 153: Middle East & Africa Market Value (US$ Mn) Projection, 2020 to 2035 By Nature

Table 154: Middle East & Africa Market Volume (Thousand Liters) Projection, 2020 to 2035 By Nature

Table 155: Middle East & Africa Market Value (US$ Mn) Projection, 2020 to 2035 By Type

Table 156: Middle East & Africa Market Volume (Thousand Liters) Projection, 2020 to 2035 By Type

Table 157: Middle East & Africa Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 158: Middle East & Africa Market Volume (Thousand Liters) Projection, 2020 to 2035 By Application

Table 159: Middle East & Africa Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 160: Middle East & Africa Market Volume (Thousand Liters) Projection, 2020 to 2035 By Distribution Channel

Table 161: Middle East & Africa Market Value (US$ Mn) Projection, 2020 to 2035 By Country

Table 162: Middle East & Africa Market Volume (Thousand Liters) Projection, 2020 to 2035 By Country

Table 163: GCC Countries Market Value (US$ Mn) Projection, 2020 to 2035 By Nature

Table 164: GCC Countries Market Volume (Thousand Liters) Projection, 2020 to 2035 By Nature

Table 165: GCC Countries Market Value (US$ Mn) Projection, 2020 to 2035 By Type

Table 166: GCC Countries Market Volume (Thousand Liters) Projection, 2020 to 2035 By Type

Table 167: GCC Countries Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 168: GCC Countries Market Volume (Thousand Liters) Projection, 2020 to 2035 By Application

Table 169: GCC Countries Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 170: GCC Countries Market Volume (Thousand Liters) Projection, 2020 to 2035 By Distribution Channel

Table 171: South Africa Market Value (US$ Mn) Projection, 2020 to 2035 By Nature

Table 172: South Africa Market Volume (Thousand Liters) Projection, 2020 to 2035 By Nature

Table 173: South Africa Market Value (US$ Mn) Projection, 2020 to 2035 By Type

Table 174: South Africa Market Volume (Thousand Liters) Projection, 2020 to 2035 By Type

Table 175: South Africa Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 176: South Africa Market Volume (Thousand Liters) Projection, 2020 to 2035 By Application

Table 177: South Africa Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 178: South Africa Market Volume (Thousand Liters) Projection, 2020 to 2035 By Distribution Channel

Table 179: Latin America Market Value (US$ Mn) Projection, 2020 to 2035 By Nature

Table 180: Latin America Market Volume (Thousand Liters) Projection, 2020 to 2035 By Nature

Table 181: Latin America Market Value (US$ Mn) Projection, 2020 to 2035 By Type

Table 182: Latin America Market Volume (Thousand Liters) Projection, 2020 to 2035 By Type

Table 183: Latin America Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 184: Latin America Market Volume (Thousand Liters) Projection, 2020 to 2035 By Application

Table 185: Latin America Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 186: Latin America Market Volume (Thousand Liters) Projection, 2020 to 2035 By Distribution Channel

Table 187: Latin America Market Value (US$ Mn) Projection, 2020 to 2035 By Country

Table 188: Latin America Market Volume (Thousand Liters) Projection, 2020 to 2035 By Country

Table 189: Brazil Market Value (US$ Mn) Projection, 2020 to 2035 By Nature

Table 190: Brazil Market Volume (Thousand Liters) Projection, 2020 to 2035 By Nature

Table 191: Brazil Market Value (US$ Mn) Projection, 2020 to 2035 By Type

Table 192: Brazil Market Volume (Thousand Liters) Projection, 2020 to 2035 By Type

Table 193: Brazil Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 194: Brazil Market Volume (Thousand Liters) Projection, 2020 to 2035 By Application

Table 195: Brazil Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 196: Brazil Market Volume (Thousand Liters) Projection, 2020 to 2035 By Distribution Channel

Table 197: Argentina Market Value (US$ Mn) Projection, 2020 to 2035 By Nature

Table 198: Argentina Market Volume (Thousand Liters) Projection, 2020 to 2035 By Nature

Table 199: Argentina Market Value (US$ Mn) Projection, 2020 to 2035 By Type

Table 200: Argentina Market Volume (Thousand Liters) Projection, 2020 to 2035 By Type

Table 201: Argentina Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 202: Argentina Market Volume (Thousand Liters) Projection, 2020 to 2035 By Application

Table 203: Argentina Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 204: Argentina Market Volume (Thousand Liters) Projection, 2020 to 2035 By Distribution Channel

Table 205: Mexico Market Value (US$ Mn) Projection, 2020 to 2035 By Nature

Table 206: Mexico Market Volume (Thousand Liters) Projection, 2020 to 2035 By Nature

Table 207: Mexico Market Value (US$ Mn) Projection, 2020 to 2035 By Type

Table 208: Mexico Market Volume (Thousand Liters) Projection, 2020 to 2035 By Type

Table 209: Mexico Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 210: Mexico Market Volume (Thousand Liters) Projection, 2020 to 2035 By Application

Table 211: Mexico Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 212: Mexico Market Volume (Thousand Liters) Projection, 2020 to 2035 By Distribution Channel

Figure 1: Global Market Value (US$ Mn) Projection, By Nature 2020 to 2035

Figure 2: Global Market Volume (Thousand Litres) Projection, By Nature 2020 to 2035

Figure 3: Global Market Incremental Opportunities (US$ Mn) Forecast, By Nature 2025 to 2035

Figure 4: Global Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 5: Global Market Volume (Thousand Litres) Projection, By Type 2020 to 2035

Figure 6: Global Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 7: Global Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 8: Global Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 9: Global Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 10: Global Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 11: Global Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 12: Global Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 13: Global Market Value (US$ Mn) Projection, By Region 2020 to 2035

Figure 14: Global Market Volume (Thousand Litres) Projection, By Region 2020 to 2035

Figure 15: Global Market Incremental Opportunities (US$ Mn) Forecast, By Region 2025 to 2035

Figure 16: North America Market Value (US$ Mn) Projection, By Nature 2020 to 2035

Figure 17: North America Market Volume (Thousand Litres) Projection, By Nature 2020 to 2035

Figure 18: North America Market Incremental Opportunities (US$ Mn) Forecast, By Nature 2025 to 2035

Figure 19: North America Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 20: North America Market Volume (Thousand Litres) Projection, By Type 2020 to 2035

Figure 21: North America Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 22: North America Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 23: North America Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 24: North America Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 25: North America Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 26: North America Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 27: North America Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 28: North America Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 29: North America Market Volume (Thousand Litres) Projection, By Country 2020 to 2035

Figure 30: North America Market Incremental Opportunities (US$ Mn) Forecast, By Country 2025 to 2035

Figure 31: U.S. Market Value (US$ Mn) Projection, By Nature 2020 to 2035

Figure 32: U.S. Market Volume (Thousand Litres) Projection, By Nature 2020 to 2035

Figure 33: U.S. Market Incremental Opportunities (US$ Mn) Forecast, By Nature 2025 to 2035

Figure 34: U.S. Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 35: U.S. Market Volume (Thousand Litres) Projection, By Type 2020 to 2035

Figure 36: U.S. Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 37: U.S. Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 38: U.S. Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 39: U.S. Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 40: U.S. Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 41: U.S. Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 42: U.S. Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 43: Canada Market Value (US$ Mn) Projection, By Nature 2020 to 2035

Figure 44: Canada Market Volume (Thousand Litres) Projection, By Nature 2020 to 2035

Figure 45: Canada Market Incremental Opportunities (US$ Mn) Forecast, By Nature 2025 to 2035

Figure 46: Canada Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 47: Canada Market Volume (Thousand Litres) Projection, By Type 2020 to 2035

Figure 48: Canada Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 49: Canada Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 50: Canada Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 51: Canada Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 52: Canada Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 53: Canada Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 54: Canada Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 55: Europe Market Value (US$ Mn) Projection, By Nature 2020 to 2035

Figure 56: Europe Market Volume (Thousand Litres) Projection, By Nature 2020 to 2035

Figure 57: Europe Market Incremental Opportunities (US$ Mn) Forecast, By Nature 2025 to 2035

Figure 58: Europe Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 59: Europe Market Volume (Thousand Litres) Projection, By Type 2020 to 2035

Figure 60: Europe Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 61: Europe Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 62: Europe Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 63: Europe Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 64: Europe Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 65: Europe Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 66: Europe Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 67: Europe Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 68: Europe Market Volume (Thousand Litres) Projection, By Country 2020 to 2035

Figure 69: Europe Market Incremental Opportunities (US$ Mn) Forecast, By Country 2025 to 2035

Figure 70: U.K. Market Value (US$ Mn) Projection, By Nature 2020 to 2035

Figure 71: U.K. Market Volume (Thousand Litres) Projection, By Nature 2020 to 2035

Figure 72: U.K. Market Incremental Opportunities (US$ Mn) Forecast, By Nature 2025 to 2035

Figure 73: U.K. Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 74: U.K. Market Volume (Thousand Litres) Projection, By Type 2020 to 2035

Figure 75: U.K. Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 76: U.K. Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 77: U.K. Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 78: U.K. Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 79: U.K. Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 80: U.K. Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 81: U.K. Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 82: Germany Market Value (US$ Mn) Projection, By Nature 2020 to 2035

Figure 83: Germany Market Volume (Thousand Litres) Projection, By Nature 2020 to 2035

Figure 84: Germany Market Incremental Opportunities (US$ Mn) Forecast, By Nature 2025 to 2035

Figure 85: Germany Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 86: Germany Market Volume (Thousand Litres) Projection, By Type 2020 to 2035

Figure 87: Germany Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 88: Germany Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 89: Germany Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 90: Germany Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 91: Germany Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 92: Germany Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 93: Germany Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 94: France Market Value (US$ Mn) Projection, By Nature 2020 to 2035

Figure 95: France Market Volume (Thousand Litres) Projection, By Nature 2020 to 2035

Figure 96: France Market Incremental Opportunities (US$ Mn) Forecast, By Nature 2025 to 2035

Figure 97: France Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 98: France Market Volume (Thousand Litres) Projection, By Type 2020 to 2035

Figure 99: France Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 100: France Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 101: France Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 102: France Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 103: France Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 104: France Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 105: France Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 106: Italy Market Value (US$ Mn) Projection, By Nature 2020 to 2035

Figure 107: Italy Market Volume (Thousand Litres) Projection, By Nature 2020 to 2035

Figure 108: Italy Market Incremental Opportunities (US$ Mn) Forecast, By Nature 2025 to 2035

Figure 109: Italy Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 110: Italy Market Volume (Thousand Litres) Projection, By Type 2020 to 2035

Figure 111: Italy Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 112: Italy Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 113: Italy Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 114: Italy Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 115: Italy Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 116: Italy Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 117: Italy Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 118: Spain Market Value (US$ Mn) Projection, By Nature 2020 to 2035

Figure 119: Spain Market Volume (Thousand Litres) Projection, By Nature 2020 to 2035

Figure 120: Spain Market Incremental Opportunities (US$ Mn) Forecast, By Nature 2025 to 2035

Figure 121: Spain Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 122: Spain Market Volume (Thousand Litres) Projection, By Type 2020 to 2035

Figure 123: Spain Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 124: Spain Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 125: Spain Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 126: Spain Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 127: Spain Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 128: Spain Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 129: Spain Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 130: The Netherlands Market Value (US$ Mn) Projection, By Nature 2020 to 2035

Figure 131: The Netherlands Market Volume (Thousand Litres) Projection, By Nature 2020 to 2035

Figure 132: The Netherlands Market Incremental Opportunities (US$ Mn) Forecast, By Nature 2025 to 2035

Figure 133: The Netherlands Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 134: The Netherlands Market Volume (Thousand Litres) Projection, By Type 2020 to 2035

Figure 135: The Netherlands Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 136: The Netherlands Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 137: The Netherlands Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 138: The Netherlands Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 139: The Netherlands Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 140: The Netherlands Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 141: The Netherlands Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 142: Asia Pacific Market Value (US$ Mn) Projection, By Nature 2020 to 2035

Figure 143: Asia Pacific Market Volume (Thousand Litres) Projection, By Nature 2020 to 2035

Figure 144: Asia Pacific Market Incremental Opportunities (US$ Mn) Forecast, By Nature 2025 to 2035

Figure 145: Asia Pacific Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 146: Asia Pacific Market Volume (Thousand Litres) Projection, By Type 2020 to 2035

Figure 147: Asia Pacific Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 148: Asia Pacific Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 149: Asia Pacific Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 150: Asia Pacific Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 151: Asia Pacific Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 152: Asia Pacific Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 153: Asia Pacific Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 154: Asia Pacific Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 155: Asia Pacific Market Volume (Thousand Litres) Projection, By Country 2020 to 2035

Figure 156: Asia Pacific Market Incremental Opportunities (US$ Mn) Forecast, By Country 2025 to 2035

Figure 157: China Market Value (US$ Mn) Projection, By Nature 2020 to 2035

Figure 158: China Market Volume (Thousand Litres) Projection, By Nature 2020 to 2035

Figure 159: China Market Incremental Opportunities (US$ Mn) Forecast, By Nature 2025 to 2035

Figure 160: China Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 161: China Market Volume (Thousand Litres) Projection, By Type 2020 to 2035

Figure 162: China Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 163: China Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 164: China Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 165: China Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 166: China Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 167: China Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 168: China Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 169: India Market Value (US$ Mn) Projection, By Nature 2020 to 2035

Figure 170: India Market Volume (Thousand Litres) Projection, By Nature 2020 to 2035

Figure 171: India Market Incremental Opportunities (US$ Mn) Forecast, By Nature 2025 to 2035

Figure 172: India Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 173: India Market Volume (Thousand Litres) Projection, By Type 2020 to 2035

Figure 174: India Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 175: India Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 176: India Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 177: India Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 178: India Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 179: India Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 180: India Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 181: Japan Market Value (US$ Mn) Projection, By Nature 2020 to 2035

Figure 182: Japan Market Volume (Thousand Litres) Projection, By Nature 2020 to 2035

Figure 183: Japan Market Incremental Opportunities (US$ Mn) Forecast, By Nature 2025 to 2035

Figure 184: Japan Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 185: Japan Market Volume (Thousand Litres) Projection, By Type 2020 to 2035

Figure 186: Japan Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 187: Japan Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 188: Japan Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 189: Japan Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 190: Japan Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 191: Japan Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 192: Japan Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 193: Australia Market Value (US$ Mn) Projection, By Nature 2020 to 2035

Figure 194: Australia Market Volume (Thousand Litres) Projection, By Nature 2020 to 2035

Figure 195: Australia Market Incremental Opportunities (US$ Mn) Forecast, By Nature 2025 to 2035

Figure 196: Australia Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 197: Australia Market Volume (Thousand Litres) Projection, By Type 2020 to 2035

Figure 198: Australia Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 199: Australia Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 200: Australia Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 201: Australia Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 202: Australia Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 203: Australia Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 204: Australia Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 205: South Korea Market Value (US$ Mn) Projection, By Nature 2020 to 2035

Figure 206: South Korea Market Volume (Thousand Litres) Projection, By Nature 2020 to 2035

Figure 207: South Korea Market Incremental Opportunities (US$ Mn) Forecast, By Nature 2025 to 2035

Figure 208: South Korea Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 209: South Korea Market Volume (Thousand Litres) Projection, By Type 2020 to 2035

Figure 210: South Korea Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 211: South Korea Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 212: South Korea Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 213: South Korea Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 214: South Korea Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 215: South Korea Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 216: South Korea Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 217: ASEAN Market Value (US$ Mn) Projection, By Nature 2020 to 2035

Figure 218: ASEAN Market Volume (Thousand Litres) Projection, By Nature 2020 to 2035

Figure 219: ASEAN Market Incremental Opportunities (US$ Mn) Forecast, By Nature 2025 to 2035

Figure 220: ASEAN Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 221: ASEAN Market Volume (Thousand Litres) Projection, By Type 2020 to 2035

Figure 222: ASEAN Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 223: ASEAN Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 224: ASEAN Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 225: ASEAN Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 226: ASEAN Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 227: ASEAN Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 228: ASEAN Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 229: Middle East & Africa Market Value (US$ Mn) Projection, By Nature 2020 to 2035

Figure 230: Middle East & Africa Market Volume (Thousand Litres) Projection, By Nature 2020 to 2035

Figure 231: Middle East & Africa Market Incremental Opportunities (US$ Mn) Forecast, By Nature 2025 to 2035

Figure 232: Middle East & Africa Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 233: Middle East & Africa Market Volume (Thousand Litres) Projection, By Type 2020 to 2035

Figure 234: Middle East & Africa Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 235: Middle East & Africa Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 236: Middle East & Africa Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 237: Middle East & Africa Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 238: Middle East & Africa Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 239: Middle East & Africa Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 240: Middle East & Africa Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 241: Middle East & Africa Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 242: Middle East & Africa Market Volume (Thousand Litres) Projection, By Country 2020 to 2035

Figure 243: Middle East & Africa Market Incremental Opportunities (US$ Mn) Forecast, By Country 2025 to 2035

Figure 244: GCC Countries Market Value (US$ Mn) Projection, By Nature 2020 to 2035

Figure 245: GCC Countries Market Volume (Thousand Litres) Projection, By Nature 2020 to 2035

Figure 246: GCC Countries Market Incremental Opportunities (US$ Mn) Forecast, By Nature 2025 to 2035

Figure 247: GCC Countries Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 248: GCC Countries Market Volume (Thousand Litres) Projection, By Type 2020 to 2035

Figure 249: GCC Countries Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 250: GCC Countries Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 251: GCC Countries Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 252: GCC Countries Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 253: GCC Countries Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 254: GCC Countries Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 255: GCC Countries Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 256: South Africa Market Value (US$ Mn) Projection, By Nature 2020 to 2035

Figure 257: South Africa Market Volume (Thousand Litres) Projection, By Nature 2020 to 2035

Figure 258: South Africa Market Incremental Opportunities (US$ Mn) Forecast, By Nature 2025 to 2035

Figure 259: South Africa Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 260: South Africa Market Volume (Thousand Litres) Projection, By Type 2020 to 2035

Figure 261: South Africa Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 262: South Africa Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 263: South Africa Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 264: South Africa Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 265: South Africa Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 266: South Africa Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 267: South Africa Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 268: Latin America Market Value (US$ Mn) Projection, By Nature 2020 to 2035

Figure 269: Latin America Market Volume (Thousand Litres) Projection, By Nature 2020 to 2035

Figure 270: Latin America Market Incremental Opportunities (US$ Mn) Forecast, By Nature 2025 to 2035

Figure 271: Latin America Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 272: Latin America Market Volume (Thousand Litres) Projection, By Type 2020 to 2035

Figure 273: Latin America Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 274: Latin America Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 275: Latin America Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 276: Latin America Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 277: Latin America Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 278: Latin America Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 279: Latin America Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 280: Latin America Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 281: Latin America Market Volume (Thousand Litres) Projection, By Country 2020 to 2035

Figure 282: Latin America Market Incremental Opportunities (US$ Mn) Forecast, By Country 2025 to 2035

Figure 283: Brazil Market Value (US$ Mn) Projection, By Nature 2020 to 2035

Figure 284: Brazil Market Volume (Thousand Litres) Projection, By Nature 2020 to 2035

Figure 285: Brazil Market Incremental Opportunities (US$ Mn) Forecast, By Nature 2025 to 2035

Figure 286: Brazil Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 287: Brazil Market Volume (Thousand Litres) Projection, By Type 2020 to 2035

Figure 288: Brazil Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 289: Brazil Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 290: Brazil Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 291: Brazil Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 292: Brazil Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 293: Brazil Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 294: Brazil Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 295: Argentina Market Value (US$ Mn) Projection, By Nature 2020 to 2035

Figure 296: Argentina Market Volume (Thousand Litres) Projection, By Nature 2020 to 2035

Figure 297: Argentina Market Incremental Opportunities (US$ Mn) Forecast, By Nature 2025 to 2035

Figure 298: Argentina Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 299: Argentina Market Volume (Thousand Litres) Projection, By Type 2020 to 2035

Figure 300: Argentina Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 301: Argentina Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 302: Argentina Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 303: Argentina Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 304: Argentina Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 305: Argentina Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 306: Argentina Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 307: Mexico Market Value (US$ Mn) Projection, By Nature 2020 to 2035

Figure 308: Mexico Market Volume (Thousand Litres) Projection, By Nature 2020 to 2035

Figure 309: Mexico Market Incremental Opportunities (US$ Mn) Forecast, By Nature 2025 to 2035

Figure 310: Mexico Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 311: Mexico Market Volume (Thousand Litres) Projection, By Type 2020 to 2035

Figure 312: Mexico Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 313: Mexico Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 314: Mexico Market Volume (Thousand Litres) Projection, By Application 2020 to 2035

Figure 315: Mexico Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 316: Mexico Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 317: Mexico Market Volume (Thousand Litres) Projection, By Distribution Channel 2020 to 2035

Figure 318: Mexico Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035