Reports

Reports

Analysts’ Viewpoint

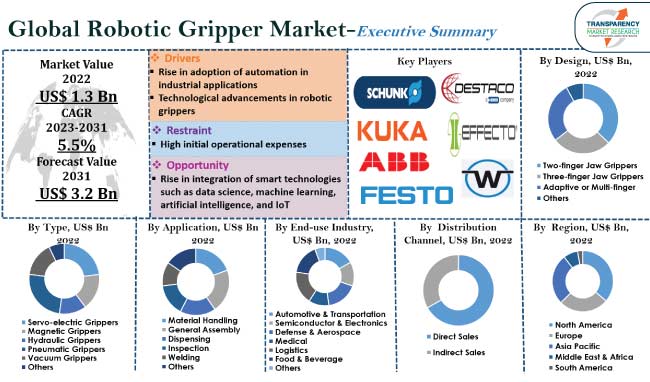

The global robotic gripper market size is expected to increase at a steady pace in the near future due to rise in adoption of factory automation, smart manufacturing, and collaborative robots. Smart technologies, such as the Internet of Things (IoT), data science, machine learning, and artificial intelligence, are being implemented in smart factories to boost productivity and efficiency, while ensuring more dependable pick-and-place and product handling.

Advent of Industry 4.0 and incorporation of smart IoT-enabled sensors in robotic components are projected to open up new opportunities for vendors in the global robotic gripper industry in the next few years. Robotic gripper manufacturers are offering a wide range of robotic grippers built for various robot arms, with a variety of possible gripping forces to suit different applications. They are also incorporating smart technologies in robotic grippers.

Robotic gripper, also known as an end effector, is a device attached to the end of a robotic arm that is used to hold, operate, and move things during a manufacturing or industrial process. It is in charge of grasping, manipulating, and handling items in an automated process.

Robotic grippers offer several benefits, including enhanced efficiency, precision, and safety. They may also be programmed to execute a variety of activities. Thus, they are highly adaptable.

Robotic grippers can also be employed to automate operations that people might find risky, such as handling hazardous products, working in high-radiation situations, or operating in hot environments.

Gripping robots are employed in various industries including automotive, aerospace, medical, and food & beverage. In the automobile sector, robotic grippers are employed in production plants to handle and assemble car parts. They are used in the aerospace sector to handle and assemble aircraft components. They are adopted in the medical sector to handle and assemble medical devices and surgical tools.

Increase in usage of robotics in manufacturing, e-commerce order fulfillment, and other pick-and-place applications has led to growth in demand for industrial robotic grippers with enhanced capabilities.

Collaborative robots rely on robotic grippers capable of handling a wide range of objects in an automated setting. Thus, increase in adoption of automation in industrial applications is expected to spur market growth in the near future.

Industrial manufacturers are focusing on improving their production efficiency and supply chain processes. This, in turn, is boosting the usage of claw, parallel, rotary, magnetic, and vacuum grippers in automotive, electronics, and food processing industries.

Several types of robotic grippers are also employed in pharmaceutical, healthcare, plastics, and agricultural industries due to their improved functionality.

Technological advancements in robotic grippers have led to significant improvements in productivity and worker safety. IoT, data science, machine learning, and artificial intelligence are essential technologies that have influenced the development of robotic grippers in a variety of ways.

Data science and machine learning can be used to analyze data collected by robotic grippers, identify patterns, and predict the behavior of objects. IoT can be utilized to improve gripper performance and the ability to handle various types of objects. IoT can also be used to increase the grabbing and manipulation abilities of grippers. AI-powered machine vision can instruct grippers on how to approach items.

Some robots have two distinct arms with different gripper configurations. AI can choose which robotic arm gripper to employ for a specific task. This enhances speed and dependability. Thus, technological advancements in robotic grippers are fueling market expansion.

According to the latest robotic gripper market trends, the pneumatic grippers type segment is anticipated to hold the largest share from 2023 to 2031.

Pneumatic grippers offer excellent controls, sensors, and feedback communication. These grippers coordinate with the machine axis or robotic arm to which they are mounted. The jaws or robotic fingers of a pneumatic gripper are operated by compressed air.

Pneumatic robotic grippers are compact and lightweight, and can easily fit into tight places. They are widely employed in various industrial applications such as robotic pick-and-place, machine tools, work piece cutting, and assembly operations. These grippers assist in holding, lifting, rotating, and positioning things into predetermined positions.

According to the latest robotic gripper market analysis, the automotive & transportation segment is estimated to dominate the business during the forecast period. Automated gripper systems are gaining traction in the automotive & transportation sector to attain optimal product quality.

Robotic grippers can be used in challenging manufacturing processes, such as spot welding, during assembly, or spray painting where a consistent paint finish is required. Robotic gripper makes it easier to meet precision and speed requirements in the automotive & transportation sector.

According to the latest robotic gripper market forecast, North America is likely to account for the largest share from 2023 to 2031. Presence of prominent manufacturers and expansion in logistics and e-commerce sectors are boosting the market revenue in the region.

Several players in the e-commerce sector, including Amazon, eBay, Walmart, and Best-buy, with their headquarters in the U.S., are utilizing robotic grippers.

The market in Asia Pacific is anticipated to grow at a steady pace in the near future. Rapid industrialization and growth in the manufacturing sector in China, India, South Korea, Japan, and other Southeast Asian countries are fueling market statistics in the region.

Expansion in automotive & transportation and semiconductor & electronics sectors in China and India is also augmenting market prioress in Asia Pacific. Robotic grippers are widely employed in industrial, shipping, and warehouse sectors in China.

According to the latest robotic gripper market research, manufacturers are anticipated to face fierce competition during the forecast period. They are launching products with advanced designs, variable speed, and enhanced output rate & consistency. They are also engaging in R&D investments, mergers & acquisitions, and agreements with local distributors and dealers to increase their robotic gripper market share.

ABB Ltd., Bastian Solutions, DESTACO, Effecto Group, Festo Inc., Infineon Technologies AG, KUKA AG, Schunk Se & Co. KG, Weiss Robotics GmbH & Co. KG, and Zimmer Group are leading players operating in this industry.

Each of these players has been profiled in the global robotic gripper market report based on parameters such as product portfolio, recent developments, financial overview, business segments, company overview, and business strategies.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 (Base Year) |

US$ 1.3 Bn |

|

Market Forecast Value in 2031 |

US$ 3.2 Bn |

|

Growth Rate (CAGR) |

5.5% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes drivers, restraints, key trends, upcoming key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, regulatory analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

It was valued at US$ 1.3 Bn in 2022

The CAGR is estimated to be 5.5% from 2023 to 2031

Rise in adoption of automation in industrial applications and technological advancements in robotic grippers

The pneumatic grippers type segment held the largest share in 2022

North America is expected to record the highest demand during the forecast period

ABB Ltd., Bastian Solutions, DESTACO, Effecto Group, Festo Inc., Infineon Technologies AG, KUKA AG, Schunk Se & Co. KG, Weiss Robotics GmbH & Co. KG, and Zimmer Group

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Market Indicators

5.2.1. Overall Gripper Industry Overview

5.3. Key Trends Analysis

5.3.1. Supply Side

5.3.2. Demand Side

5.4. Industry SWOT Analysis

5.5. Porter’s Five Forces Analysis

5.6. Value Chain Analysis

5.7. COVID-19 Impact Analysis

5.8. Regulatory Framework & Guidelines

5.9. Technology Overview

5.10. Global Robotic Gripper Market Analysis and Forecast, 2017-2031

5.10.1. Market Value Projections (US$ Bn)

5.10.2. Market Volume Projections (Thousand Units)

6. Global Robotic Gripper Market Analysis and Forecast, by Type

6.1. Global Robotic Gripper Market Size (US$ Bn) (Thousand Units) by Type, 2017-2031

6.1.1. Servo-electric Grippers

6.1.2. Magnetic Grippers

6.1.3. Hydraulic Grippers

6.1.4. Pneumatic Grippers

6.1.5. Vacuum Grippers

6.1.6. Others (Hydro-mechanical Grippers, etc.)

6.2. Incremental Opportunity, by Type

7. Global Robotic Gripper Market Analysis and Forecast, by Design

7.1. Global Robotic Gripper Market Size (US$ Bn) (Thousand Units) by Design, 2017-2031

7.1.1. Two-finger Jaw Grippers

7.1.2. Three-finger Jaw Grippers

7.1.3. Adaptive or Multi-finger

7.1.4. Others (Jamming Grippers, Needle Grippers, etc.)

7.2. Incremental Opportunity, by Design

8. Global Robotic Gripper Market Analysis and Forecast, by Application

8.1. Global Robotic Gripper Market Size (US$ Bn) (Thousand Units) by Application, 2017-2031

8.1.1. Material Handling

8.1.2. General Assembly

8.1.3. Dispensing

8.1.4. Inspection

8.1.5. Welding

8.1.6. Others (Processing, etc.)

8.2. Incremental Opportunity, by Application

9. Global Robotic Gripper Market Analysis and Forecast, by End-use Industry

9.1. Global Robotic Gripper Market Size (US$ Bn) (Thousand Units) by End-use Industry, 2017-2031

9.1.1. Automotive & Transportation

9.1.2. Semiconductor & Electronics

9.1.3. Defense & Aerospace

9.1.4. Medical

9.1.5. Logistics

9.1.6. Food & Beverage

9.1.7. Others (Chemicals, Plastics, etc.)

9.2. Incremental Opportunity, by End-use Industry

10. Global Robotic Gripper Market Analysis and Forecast, by Distribution Channel

10.1. Global Robotic Gripper Market Size (US$ Bn) (Thousand Units) by Distribution Channel, 2017-2031

10.1.1. Direct Sales

10.1.2. Indirect Sales

10.2. Incremental Opportunity, by Distribution Channel

11. Global Robotic Gripper Market Analysis and Forecast, by Region

11.1. Global Robotic Gripper Market Size (US$ Bn) (Thousand Units) by Region, 2017-2031

11.1.1. North America

11.1.2. Europe

11.1.3. Middle East & Africa

11.1.4. Asia Pacific

11.1.5. South America

11.2. Incremental Opportunity, by Region

12. North America Robotic Gripper Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Manufacturers Analysis

12.3. COVID-19 Impact Analysis

12.4. Key Trends Analysis

12.4.1. Supply Side

12.4.2. Demand Side

12.5. Robotic Gripper Market Size (US$ Bn) (Thousand Units) by Type, 2017-2031

12.5.1. Servo-electric Grippers

12.5.2. Magnetic Grippers

12.5.3. Hydraulic Grippers

12.5.4. Pneumatic Grippers

12.5.5. Vacuum Grippers

12.5.6. Others (Hydro-mechanical Grippers, etc.)

12.6. Robotic Gripper Market Size (US$ Bn) (Thousand Units) by Design, 2017-2031

12.6.1. Two-finger Jaw Grippers

12.6.2. Three-finger Jaw Grippers

12.6.3. Adaptive or Multi-finger

12.6.4. Others (Jamming Grippers, Needle Grippers, etc.)

12.7. Robotic Gripper Market Size (US$ Bn) (Thousand Units) by Application, 2017-2031

12.7.1. Material Handling

12.7.2. General Assembly

12.7.3. Dispensing

12.7.4. Inspection

12.7.5. Welding

12.7.6. Others (Processing, etc.)

12.8. Robotic Gripper Market Size (US$ Bn) (Thousand Units) by End-use Industry, 2017-2031

12.8.1. Automotive & Transportation

12.8.2. Semiconductor & Electronics

12.8.3. Defense & Aerospace

12.8.4. Medical

12.8.5. Logistics

12.8.6. Food & Beverage

12.8.7. Others (Chemicals, Plastics, etc.)

12.9. Robotic Gripper Market Size (US$ Bn) (Thousand Units) by Distribution Channel, 2017-2031

12.9.1. Direct Sales

12.9.2. Indirect Sales

12.10. Robotic Gripper Market Size (US$ Bn) (Thousand Units) Forecast, by Country, 2017-2031

12.10.1. U.S.

12.10.2. Canada

12.10.3. Rest of North America

12.11. Incremental Opportunity Analysis

13. Europe Robotic Gripper Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Manufacturers Analysis

13.3. COVID-19 Impact Analysis

13.4. Key Trends Analysis

13.4.1. Supply Side

13.4.2. Demand Side

13.5. Robotic Gripper Market Size (US$ Bn) (Thousand Units) by Type, 2017-2031

13.5.1. Servo-electric Grippers

13.5.2. Magnetic Grippers

13.5.3. Hydraulic Grippers

13.5.4. Pneumatic Grippers

13.5.5. Vacuum Grippers

13.5.6. Others (Hydro-mechanical Grippers, etc.)

13.6. Robotic Gripper Market Size (US$ Bn) (Thousand Units) by Design, 2017-2031

13.6.1. Two-finger Jaw Grippers

13.6.2. Three-finger Jaw Grippers

13.6.3. Adaptive or Multi-finger

13.6.4. Others (Jamming Grippers, Needle Grippers, etc.)

13.7. Robotic Gripper Market Size (US$ Bn) (Thousand Units) by Application, 2017-2031

13.7.1. Material Handling

13.7.2. General Assembly

13.7.3. Dispensing

13.7.4. Inspection

13.7.5. Welding

13.7.6. Others (Processing, etc.)

13.8. Robotic Gripper Market Size (US$ Bn) (Thousand Units) by End-use Industry, 2017-2031

13.8.1. Automotive & Transportation

13.8.2. Semiconductor & Electronics

13.8.3. Defense & Aerospace

13.8.4. Medical

13.8.5. Logistics

13.8.6. Food & Beverage

13.8.7. Others (Chemicals, Plastics, etc.)

13.9. Robotic Gripper Market Size (US$ Bn) (Thousand Units) by Distribution Channel, 2017-2031

13.9.1. Direct Sales

13.9.2. Indirect Sales

13.10. Robotic Gripper Market Size (US$ Bn) (Thousand Units) Forecast, by Country, 2017-2031

13.10.1. U.K.

13.10.2. Germany

13.10.3. France

13.10.4. Rest of Europe

13.11. Incremental Opportunity Analysis

14. Asia Pacific Robotic Gripper Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Manufacturers Analysis

14.3. COVID-19 Impact Analysis

14.4. Key Trends Analysis

14.4.1. Supply Side

14.4.2. Demand Side

14.5. Robotic Gripper Market Size (US$ Bn) (Thousand Units) by Type, 2017-2031

14.5.1. Servo-electric Grippers

14.5.2. Magnetic Grippers

14.5.3. Hydraulic Grippers

14.5.4. Pneumatic Grippers

14.5.5. Vacuum Grippers

14.5.6. Others (Hydro-mechanical Grippers, etc.)

14.6. Robotic Gripper Market Size (US$ Bn) (Thousand Units) by Design, 2017-2031

14.6.1. Two-finger Jaw Grippers

14.6.2. Three-finger Jaw Grippers

14.6.3. Adaptive or Multi-finger

14.6.4. Others (Jamming Grippers, Needle Grippers, etc.)

14.7. Robotic Gripper Market Size (US$ Bn) (Thousand Units) by Application, 2017-2031

14.7.1. Material Handling

14.7.2. General Assembly

14.7.3. Dispensing

14.7.4. Inspection

14.7.5. Welding

14.7.6. Others (Processing, etc.)

14.8. Robotic Gripper Market Size (US$ Bn) (Thousand Units) by End-use Industry, 2017-2031

14.8.1. Automotive & Transportation

14.8.2. Semiconductor & Electronics

14.8.3. Defense & Aerospace

14.8.4. Medical

14.8.5. Logistics

14.8.6. Food & Beverage

14.8.7. Others (Chemicals, Plastics, etc.)

14.9. Robotic Gripper Market Size (US$ Bn) (Thousand Units) by Distribution Channel, 2017-2031

14.9.1. Direct Sales

14.9.2. Indirect Sales

14.10. Robotic Gripper Market Size (US$ Bn) (Thousand Units) Forecast, by Country, 2017-2031

14.10.1. China

14.10.2. India

14.10.3. Japan

14.10.4. Rest of Asia Pacific

14.11. Incremental Opportunity Analysis

15. Middle East & Africa Robotic Gripper Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Manufacturers Analysis

15.3. COVID-19 Impact Analysis

15.4. Key Trends Analysis

15.4.1. Supply Side

15.4.2. Demand Side

15.5. Robotic Gripper Market Size (US$ Bn) (Thousand Units) by Type, 2017-2031

15.5.1. Servo-electric Grippers

15.5.2. Magnetic Grippers

15.5.3. Hydraulic Grippers

15.5.4. Pneumatic Grippers

15.5.5. Vacuum Grippers

15.5.6. Others (Hydro-mechanical Grippers, etc.)

15.6. Robotic Gripper Market Size (US$ Bn) (Thousand Units) by Design, 2017-2031

15.6.1. Two-finger Jaw Grippers

15.6.2. Three-finger Jaw Grippers

15.6.3. Adaptive or Multi-finger

15.6.4. Others (Jamming Grippers, Needle Grippers, etc.)

15.7. Robotic Gripper Market Size (US$ Bn) (Thousand Units) by Application, 2017-2031

15.7.1. Material Handling

15.7.2. General Assembly

15.7.3. Dispensing

15.7.4. Inspection

15.7.5. Welding

15.7.6. Others (Processing, etc.)

15.8. Robotic Gripper Market Size (US$ Bn) (Thousand Units) by End-use Industry, 2017-2031

15.8.1. Automotive & Transportation

15.8.2. Semiconductor & Electronics

15.8.3. Defense & Aerospace

15.8.4. Medical

15.8.5. Logistics

15.8.6. Food & Beverage

15.8.7. Others (Chemicals, Plastics, etc.)

15.9. Robotic Gripper Market Size (US$ Bn) (Thousand Units) by Distribution Channel, 2017-2031

15.9.1. Direct Sales

15.9.2. Indirect Sales

15.10. Robotic Gripper Market Size (US$ Bn) (Thousand Units) Forecast, by Country, 2017-2031

15.10.1. GCC

15.10.2. South Africa

15.10.3. Rest of Middle East & Africa

15.11. Incremental Opportunity Analysis

16. South America Robotic Gripper Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Key Manufacturers Analysis

16.3. COVID-19 Impact Analysis

16.4. Key Trends Analysis

16.4.1. Supply Side

16.4.2. Demand Side

16.5. Robotic Gripper Market Size (US$ Bn) (Thousand Units) by Type, 2017-2031

16.5.1. Servo-electric Grippers

16.5.2. Magnetic Grippers

16.5.3. Hydraulic Grippers

16.5.4. Pneumatic Grippers

16.5.5. Vacuum Grippers

16.5.6. Others (Hydro-mechanical Grippers, etc.)

16.6. Robotic Gripper Market Size (US$ Bn) (Thousand Units) by Design, 2017-2031

16.6.1. Two-finger Jaw Grippers

16.6.2. Three-finger Jaw Grippers

16.6.3. Adaptive or Multi-finger

16.6.4. Others (Jamming Grippers, Needle Grippers, etc.)

16.7. Robotic Gripper Market Size (US$ Bn) (Thousand Units) by Application, 2017-2031

16.7.1. Material Handling

16.7.2. General Assembly

16.7.3. Dispensing

16.7.4. Inspection

16.7.5. Welding

16.7.6. Others (Processing, etc.)

16.8. Robotic Gripper Market Size (US$ Bn) (Thousand Units) by End-use Industry, 2017-2031

16.8.1. Automotive & Transportation

16.8.2. Semiconductor & Electronics

16.8.3. Defense & Aerospace

16.8.4. Medical

16.8.5. Logistics

16.8.6. Food & Beverage

16.8.7. Others (Chemicals, Plastics, etc.)

16.9. Robotic Gripper Market Size (US$ Bn) (Thousand Units) by Distribution Channel, 2017-2031

16.9.1. Direct Sales

16.9.2. Indirect Sales

16.10. Robotic Gripper Market Size (US$ Bn) (Thousand Units) Forecast, by Country, 2017-2031

16.10.1. Brazil

16.10.2. Rest of South America

16.11. Incremental Opportunity Analysis

17. Competition Landscape

17.1. Competition Dashboard

17.2. Market Share Analysis % (2020)

17.3. Company Profiles [Company Overview, Product Portfolio, Financial Information, (Subject to Data Availability), Business Strategies / Recent Developments]

17.3.1. ABB Ltd.

17.3.1.1. Company Overview

17.3.1.2. Product Portfolio

17.3.1.3. Financial Information, (Subject to Data Availability)

17.3.1.4. Business Strategies / Recent Developments

17.3.2. Bastian Solutions

17.3.2.1. Company Overview

17.3.2.2. Product Portfolio

17.3.2.3. Financial Information, (Subject to Data Availability)

17.3.2.4. Business Strategies / Recent Developments

17.3.3. DESTACO

17.3.3.1. Company Overview

17.3.3.2. Product Portfolio

17.3.3.3. Financial Information, (Subject to Data Availability)

17.3.3.4. Business Strategies / Recent Developments

17.3.4. Effecto Group

17.3.4.1. Company Overview

17.3.4.2. Product Portfolio

17.3.4.3. Financial Information, (Subject to Data Availability)

17.3.4.4. Business Strategies / Recent Developments

17.3.5. Festo Inc.

17.3.5.1. Company Overview

17.3.5.2. Product Portfolio

17.3.5.3. Financial Information, (Subject to Data Availability)

17.3.5.4. Business Strategies / Recent Developments

17.3.6. Infineon Technologies AG

17.3.6.1. Company Overview

17.3.6.2. Product Portfolio

17.3.6.3. Financial Information, (Subject to Data Availability)

17.3.6.4. Business Strategies / Recent Developments

17.3.7. KUKA AG

17.3.7.1. Company Overview

17.3.7.2. Product Portfolio

17.3.7.3. Financial Information, (Subject to Data Availability)

17.3.7.4. Business Strategies / Recent Developments

17.3.8. SCHUNK SE & Co. KG

17.3.8.1. Company Overview

17.3.8.2. Product Portfolio

17.3.8.3. Financial Information, (Subject to Data Availability)

17.3.8.4. Business Strategies / Recent Developments

17.3.9. Weiss Robotics GmbH & Co. KG

17.3.9.1. Company Overview

17.3.9.2. Product Portfolio

17.3.9.3. Financial Information, (Subject to Data Availability)

17.3.9.4. Business Strategies / Recent Developments

17.3.10. Zimmer Group

17.3.10.1. Company Overview

17.3.10.2. Product Portfolio

17.3.10.3. Financial Information, (Subject to Data Availability)

17.3.10.4. Business Strategies / Recent Developments

17.3.11. Other Key Players

17.3.11.1. Company Overview

17.3.11.2. Product Portfolio

17.3.11.3. Financial Information, (Subject to Data Availability)

17.3.11.4. Business Strategies / Recent Developments

18. Go To Market Strategy

18.1. Identification of Potential Market Spaces

18.2. Prevailing Market Risks

18.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Robotic Gripper Market, by Type, Thousand Units, 2017-2031

Table 2: Global Robotic Gripper Market, by Type, US$ Bn, 2017-2031

Table 3: Global Robotic Gripper Market, by Design, Thousand Units, 2017-2031

Table 4: Global Robotic Gripper Market, by Design, US$ Bn, 2017-2031

Table 5: Global Robotic Gripper Market, by Application, Thousand Units, 2017-2031

Table 6: Global Robotic Gripper Market, by Application, US$ Bn, 2017-2031

Table 7: Global Robotic Gripper Market, by End-use Industry, Thousand Units, 2017-2031

Table 8: Global Robotic Gripper Market, by End-use Industry, US$ Bn, 2017-2031

Table 9: Global Robotic Gripper Market, by Distribution Channel, Thousand Units, 2017-2031

Table 10: Global Robotic Gripper Market, by Distribution Channel, US$ Bn, 2017-2031

Table 11: Global Robotic Gripper Market, by Region, Thousand Units, 2017-2031

Table 12: Global Robotic Gripper Market, by Region, US$ Bn, 2017-2031

Table 13: North America Robotic Gripper Market, by Type, Thousand Units, 2017-2031

Table 14: North America Robotic Gripper Market, by Type, US$ Bn, 2017-2031

Table 15: North America Robotic Gripper Market, by Design, Thousand Units, 2017-2031

Table 16: North America Robotic Gripper Market, by Design, US$ Bn, 2017-2031

Table 17: North America Robotic Gripper Market, by Application, Thousand Units, 2017-2031

Table 18: North America Robotic Gripper Market, by Application, US$ Bn, 2017-2031

Table 19: North America Robotic Gripper Market, by End-use Industry, Thousand Units, 2017-2031

Table 20: North America Robotic Gripper Market, by End-use Industry, US$ Bn, 2017-2031

Table 21: North America Robotic Gripper Market, by Distribution Channel, Thousand Units, 2017-2031

Table 22: North America Robotic Gripper Market, by Distribution Channel, US$ Bn, 2017-2031

Table 23: North America Robotic Gripper Market, by Country, Thousand Units, 2017-2031

Table 24: North America Robotic Gripper Market, by Country, US$ Bn, 2017-2031

Table 25: Europe Robotic Gripper Market, by Type, Thousand Units, 2017-2031

Table 26: Europe Robotic Gripper Market, by Type, US$ Bn, 2017-2031

Table 27: Europe Robotic Gripper Market, by Design, Thousand Units, 2017-2031

Table 28: Europe Robotic Gripper Market, by Design, US$ Bn, 2017-2031

Table 29: Europe Robotic Gripper Market, by Application, Thousand Units, 2017-2031

Table 30: Europe Robotic Gripper Market, by Application, US$ Bn, 2017-2031

Table 31: Europe Robotic Gripper Market, by End-use Industry, Thousand Units, 2017-2031

Table 32: Europe Robotic Gripper Market, by End-use Industry, US$ Bn, 2017-2031

Table 33: Europe Robotic Gripper Market, by Distribution Channel, Thousand Units, 2017-2031

Table 34: Europe Robotic Gripper Market, by Distribution Channel, US$ Bn, 2017-2031

Table 35: Europe Robotic Gripper Market, by Country, Thousand Units, 2017-2031

Table 36: Europe Robotic Gripper Market, by Country, US$ Bn, 2017-2031

Table 37: Asia Pacific Robotic Gripper Market, by Type, Thousand Units, 2017-2031

Table 38: Asia Pacific Robotic Gripper Market, by Type, US$ Bn, 2017-2031

Table 39: Asia Pacific Robotic Gripper Market, by Design, Thousand Units, 2017-2031

Table 40: Asia Pacific Robotic Gripper Market, by Design, US$ Bn, 2017-2031

Table 41: Asia Pacific Robotic Gripper Market, by Application, Thousand Units, 2017-2031

Table 42: Asia Pacific Robotic Gripper Market, by Application, US$ Bn, 2017-2031

Table 43: Asia Pacific Robotic Gripper Market, by End-use Industry, Thousand Units, 2017-2031

Table 44: Asia Pacific Robotic Gripper Market, by End-use Industry, US$ Bn, 2017-2031

Table 45: Asia Pacific Robotic Gripper Market, by Distribution Channel, Thousand Units, 2017-2031

Table 46: Asia Pacific Robotic Gripper Market, by Distribution Channel, US$ Bn, 2017-2031

Table 47: Asia Pacific Robotic Gripper Market, by Country, Thousand Units, 2017-2031

Table 48: Asia Pacific Robotic Gripper Market, by Country, US$ Bn, 2017-2031

Table 49: Middle East & Africa Robotic Gripper Market, by Type, Thousand Units, 2017-2031

Table 50: Middle East & Africa Robotic Gripper Market, by Type, US$ Bn, 2017-2031

Table 51: Middle East & Africa Robotic Gripper Market, by Design, Thousand Units, 2017-2031

Table 52: Middle East & Africa Robotic Gripper Market, by Design, US$ Bn, 2017-2031

Table 53: Middle East & Africa Robotic Gripper Market, by Application, Thousand Units, 2017-2031

Table 54: Middle East & Africa Robotic Gripper Market, by Application, US$ Bn, 2017-2031

Table 55: Middle East & Africa Robotic Gripper Market, by End-use Industry, Thousand Units, 2017-2031

Table 56: Middle East & Africa Robotic Gripper Market, by End-use Industry, US$ Bn, 2017-2031

Table 57: Middle East & Africa Robotic Gripper Market, by Distribution Channel, Thousand Units, 2017-2031

Table 58: Middle East & Africa Robotic Gripper Market, by Distribution Channel, US$ Bn, 2017-2031

Table 59: Middle East & Africa Robotic Gripper Market, by Country, Thousand Units, 2017-2031

Table 60: Middle East & Africa Robotic Gripper Market, by Country, US$ Bn, 2017-2031

Table 61: South America Robotic Gripper Market, by Type, Thousand Units, 2017-2031

Table 62: South America Robotic Gripper Market, by Type, US$ Bn, 2017-2031

Table 63: South America Robotic Gripper Market, by Design, Thousand Units, 2017-2031

Table 64: South America Robotic Gripper Market, by Design, US$ Bn, 2017-2031

Table 65: South America Robotic Gripper Market, by Application, Thousand Units, 2017-2031

Table 66: South America Robotic Gripper Market, by Application, US$ Bn, 2017-2031

Table 67: South America Robotic Gripper Market, by End-use Industry, Thousand Units, 2017-2031

Table 68: South America Robotic Gripper Market, by End-use Industry, US$ Bn, 2017-2031

Table 69: South America Robotic Gripper Market, by Distribution Channel, Thousand Units, 2017-2031

Table 70: South America Robotic Gripper Market, by Distribution Channel, US$ Bn, 2017-2031

Table 71: South America Robotic Gripper Market, by Country, Thousand Units, 2017-2031

Table 72: South America Robotic Gripper Market, by Country, US$ Bn, 2017-2031

List of Figures

Figure 1: Global Robotic Gripper Market Projections by Type, Thousand Units, 2017-2031

Figure 2: Global Robotic Gripper Market Projections by Type, US$ Bn, 2017-2031

Figure 3: Global Robotic Gripper Market, Incremental Opportunity, by Type, US$ Bn, 2017-2031

Figure 4: Global Robotic Gripper Market Projections by Design, Thousand Units, 2017-2031

Figure 5: Global Robotic Gripper Market Projections by Design, US$ Bn, 2017-2031

Figure 6: Global Robotic Gripper Market, Incremental Opportunity, by Design, US$ Bn, 2017-2031

Figure 7: Global Robotic Gripper Market Projections by Application, Thousand Units, 2017-2031

Figure 8: Global Robotic Gripper Market Projections by Application, US$ Bn, 2017-2031

Figure 9: Global Robotic Gripper Market, Incremental Opportunity, by Application, US$ Bn, 2017-2031

Figure 10: Global Robotic Gripper Market Projections by End-use Industry, Thousand Units, 2017-2031

Figure 11: Global Robotic Gripper Market Projections by End-use Industry, US$ Bn, 2017-2031

Figure 12: Global Robotic Gripper Market, Incremental Opportunity, by End-use Industry, US$ Bn, 2017-2031

Figure 13: Global Robotic Gripper Market Projections by Distribution Channel, Thousand Units, 2017-2031

Figure 14: Global Robotic Gripper Market Projections by Distribution Channel, US$ Bn, 2017-2031

Figure 15: Global Robotic Gripper Market, Incremental Opportunity, by Distribution Channel, US$ Bn, 2017-2031

Figure 16: Global Robotic Gripper Market Projections by Region, Thousand Units, 2017-2031

Figure 17: Global Robotic Gripper Market Projections by Region, US$ Bn, 2017-2031

Figure 18: Global Robotic Gripper Market, Incremental Opportunity, by Region, US$ Bn, 2017-2031

Figure 19: North America Robotic Gripper Market Projections by Type, Thousand Units, 2017-2031

Figure 20: North America Robotic Gripper Market Projections by Type, US$ Bn, 2017-2031

Figure 21: North America Robotic Gripper Market, Incremental Opportunity, by Type, US$ Bn, 2017-2031

Figure 22: North America Robotic Gripper Market Projections by Design, Thousand Units, 2017-2031

Figure 23: North America Robotic Gripper Market Projections by Design, US$ Bn, 2017-2031

Figure 24: North America Robotic Gripper Market, Incremental Opportunity, by Design, US$ Bn, 2017-2031

Figure 25: North America Robotic Gripper Market Projections by Application, Thousand Units, 2017-2031

Figure 26: North America Robotic Gripper Market Projections by Application, US$ Bn, 2017-2031

Figure 27: North America Robotic Gripper Market, Incremental Opportunity, by Application, US$ Bn, 2017-2031

Figure 28: North America Robotic Gripper Market Projections by End-use Industry, Thousand Units, 2017-2031

Figure 29: North America Robotic Gripper Market Projections by End-use Industry, US$ Bn, 2017-2031

Figure 30: North America Robotic Gripper Market, Incremental Opportunity, by End-use Industry, US$ Bn, 2017-2031

Figure 31: North America Robotic Gripper Market Projections by Distribution Channel, Thousand Units, 2017-2031

Figure 32: North America Robotic Gripper Market Projections by Distribution Channel, US$ Bn, 2017-2031

Figure 33: North America Robotic Gripper Market, Incremental Opportunity, by Distribution Channel, US$ Bn, 2017-2031

Figure 34: North America Robotic Gripper Market Projections by Country, Thousand Units, 2017-2031

Figure 35: North America Robotic Gripper Market Projections by Country, US$ Bn, 2017-2031

Figure 36: North America Robotic Gripper Market, Incremental Opportunity, by Country, US$ Bn, 2017-2031

Figure 37: Europe Robotic Gripper Market Projections by Type, Thousand Units, 2017-2031

Figure 38: Europe Robotic Gripper Market Projections by Type, US$ Bn, 2017-2031

Figure 39: Europe Robotic Gripper Market, Incremental Opportunity, by Type, US$ Bn, 2017-2031

Figure 40: Europe Robotic Gripper Market Projections by Design, Thousand Units, 2017-2031

Figure 41: Europe Robotic Gripper Market Projections by Design, US$ Bn, 2017-2031

Figure 42: Europe Robotic Gripper Market, Incremental Opportunity, by Design, US$ Bn, 2017-2031

Figure 43: Europe Robotic Gripper Market Projections by Application, Thousand Units, 2017-2031

Figure 44: Europe Robotic Gripper Market Projections by Application, US$ Bn, 2017-2031

Figure 45: Europe Robotic Gripper Market, Incremental Opportunity, by Application, US$ Bn, 2017-2031

Figure 46: Europe Robotic Gripper Market Projections by End-use Industry, Thousand Units, 2017-2031

Figure 47: Europe Robotic Gripper Market Projections by End-use Industry, US$ Bn, 2017-2031

Figure 48: Europe Robotic Gripper Market, Incremental Opportunity, by End-use Industry, US$ Bn, 2017-2031

Figure 49: Europe Robotic Gripper Market Projections by Distribution Channel, Thousand Units, 2017-2031

Figure 50: Europe Robotic Gripper Market Projections by Distribution Channel, US$ Bn, 2017-2031

Figure 51: Europe Robotic Gripper Market, Incremental Opportunity, by Distribution Channel, US$ Bn, 2017-2031

Figure 52: Europe Robotic Gripper Market Projections by Country, Thousand Units, 2017-2031

Figure 53: Europe Robotic Gripper Market Projections by Country, US$ Bn, 2017-2031

Figure 54: Europe Robotic Gripper Market, Incremental Opportunity, by Country, US$ Bn, 2017-2031

Figure 55: Asia Pacific Robotic Gripper Market Projections by Type, Thousand Units, 2017-2031

Figure 56: Asia Pacific Robotic Gripper Market Projections by Type, US$ Bn, 2017-2031

Figure 57: Asia Pacific Robotic Gripper Market, Incremental Opportunity, by Type, US$ Bn, 2017-2031

Figure 58: Asia Pacific Robotic Gripper Market Projections by Design, Thousand Units, 2017-2031

Figure 59: Asia Pacific Robotic Gripper Market Projections by Design, US$ Bn, 2017-2031

Figure 60: Asia Pacific Robotic Gripper Market, Incremental Opportunity, by Design, US$ Bn, 2017-2031

Figure 61: Asia Pacific Robotic Gripper Market Projections by Application, Thousand Units, 2017-2031

Figure 62: Asia Pacific Robotic Gripper Market Projections by Application, US$ Bn, 2017-2031

Figure 63: Asia Pacific Robotic Gripper Market, Incremental Opportunity, by Application, US$ Bn, 2017-2031

Figure 64: Asia Pacific Robotic Gripper Market Projections by End-use Industry, Thousand Units, 2017-2031

Figure 65: Asia Pacific Robotic Gripper Market Projections by End-use Industry, US$ Bn, 2017-2031

Figure 66: Asia Pacific Robotic Gripper Market, Incremental Opportunity, by End-use Industry, US$ Bn, 2017-2031

Figure 67: Asia Pacific Robotic Gripper Market Projections by Distribution Channel, Thousand Units, 2017-2031

Figure 68: Asia Pacific Robotic Gripper Market Projections by Distribution Channel, US$ Bn, 2017-2031

Figure 69: Asia Pacific Robotic Gripper Market, Incremental Opportunity, by Distribution Channel, US$ Bn, 2017-2031

Figure 70: Asia Pacific Robotic Gripper Market Projections by Country, Thousand Units, 2017-2031

Figure 71: Asia Pacific Robotic Gripper Market Projections by Country, US$ Bn, 2017-2031

Figure 72: Asia Pacific Robotic Gripper Market, Incremental Opportunity, by Country, US$ Bn, 2017-2031

Figure 73: Middle East & Africa Robotic Gripper Market Projections by Type, Thousand Units, 2017-2031

Figure 74: Middle East & Africa Robotic Gripper Market Projections by Type, US$ Bn, 2017-2031

Figure 75: Middle East & Africa Robotic Gripper Market, Incremental Opportunity, by Type, US$ Bn, 2017-2031

Figure 76: Middle East & Africa Robotic Gripper Market Projections by Design, Thousand Units, 2017-2031

Figure 77: Middle East & Africa Robotic Gripper Market Projections by Design, US$ Bn, 2017-2031

Figure 78: Middle East & Africa Robotic Gripper Market, Incremental Opportunity, by Design, US$ Bn, 2017-2031

Figure 79: Middle East & Africa Robotic Gripper Market Projections by Application, Thousand Units, 2017-2031

Figure 80: Middle East & Africa Robotic Gripper Market Projections by Application, US$ Bn, 2017-2031

Figure 81: Middle East & Africa Robotic Gripper Market, Incremental Opportunity, by Application, US$ Bn, 2017-2031

Figure 82: Middle East & Africa Robotic Gripper Market Projections by End-use Industry, Thousand Units, 2017-2031

Figure 83: Middle East & Africa Robotic Gripper Market Projections by End-use Industry, US$ Bn, 2017-2031

Figure 84: Middle East & Africa Robotic Gripper Market, Incremental Opportunity, by End-use Industry, US$ Bn, 2017-2031

Figure 85: Middle East & Africa Robotic Gripper Market Projections by Distribution Channel, Thousand Units, 2017-2031

Figure 86: Middle East & Africa Robotic Gripper Market Projections by Distribution Channel, US$ Bn, 2017-2031

Figure 87: Middle East & Africa Robotic Gripper Market, Incremental Opportunity, by Distribution Channel, US$ Bn, 2017-2031

Figure 88: Middle East & Africa Robotic Gripper Market Projections by Country, Thousand Units, 2017-2031

Figure 89: Middle East & Africa Robotic Gripper Market Projections by Country, US$ Bn, 2017-2031

Figure 90: Middle East & Africa Robotic Gripper Market, Incremental Opportunity, by Country, US$ Bn, 2017-2031

Figure 91: South America Robotic Gripper Market Projections by Type, Thousand Units, 2017-2031

Figure 92: South America Robotic Gripper Market Projections by Type, US$ Bn, 2017-2031

Figure 93: South America Robotic Gripper Market, Incremental Opportunity, by Type, US$ Bn, 2017-2031

Figure 94: South America Robotic Gripper Market Projections by Design, Thousand Units, 2017-2031

Figure 95: South America Robotic Gripper Market Projections by Design, US$ Bn, 2017-2031

Figure 96: South America Robotic Gripper Market, Incremental Opportunity, by Design, US$ Bn, 2017-2031

Figure 97: South America Robotic Gripper Market Projections by Application, Thousand Units, 2017-2031

Figure 98: South America Robotic Gripper Market Projections by Application, US$ Bn, 2017-2031

Figure 99: South America Robotic Gripper Market, Incremental Opportunity, by Application, US$ Bn, 2017-2031

Figure 100: South America Robotic Gripper Market Projections by End-use Industry, Thousand Units, 2017-2031

Figure 101: South America Robotic Gripper Market Projections by End-use Industry, US$ Bn, 2017-2031

Figure 102: South America Robotic Gripper Market, Incremental Opportunity, by End-use Industry, US$ Bn, 2017-2031

Figure 103: South America Robotic Gripper Market Projections by Distribution Channel, Thousand Units, 2017-2031

Figure 104: South America Robotic Gripper Market Projections by Distribution Channel, US$ Bn, 2017-2031

Figure 105: South America Robotic Gripper Market, Incremental Opportunity, by Distribution Channel, US$ Bn, 2017-2031

Figure 106: South America Robotic Gripper Market Projections by Country, Thousand Units, 2017-2031

Figure 107: South America Robotic Gripper Market Projections by Country, US$ Bn, 2017-2031

Figure 108: South America Robotic Gripper Market, Incremental Opportunity, by Country, US$ Bn, 2017-2031