Reports

Reports

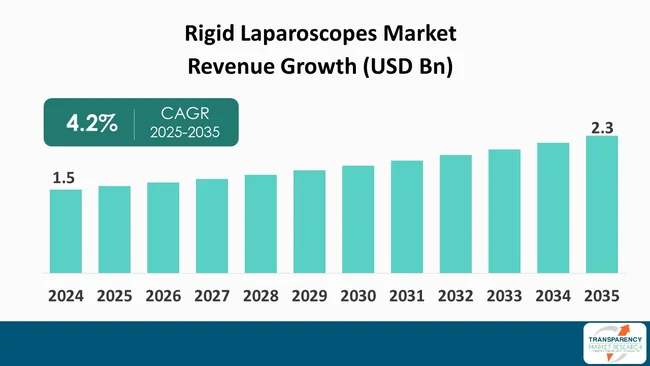

The global rigid laparoscopes market size was valued at US$ 1.5 billion in 2024 and is projected to reach US$ 2.3 billion by 2035, expanding at a CAGR of 4.2% from 2025 to 2035. The market growth is driven by the increasing demand for minimally invasive surgeries (MIS), rising incidence of chronic diseases and significant technological advancements such as improved visualization.

The growing incidences of chronic diseases such as gastrointestinal, gynecological, and urological are driving the rigid laparoscopes market. Additionally, the increase in elderly population and demand for accurate surgical visualization devices are aiding in fueling the demand for rigid laparoscopes around the world.

Another significant driver includes healthcare infrastructure expansion and investments on surgical technology in the emerging economies. Private sector firms and governments are both - increasingly adopting advanced endoscopic systems within their hospitals to improve surgical outcomes and lower healthcare expenses, in turn, bolstering rigid laparoscopic market growth.

Artificial intelligence for image analysis, use of robotic-assisted platforms for precision, and miniaturization of optical components for better ergonomics are amongst the recent developments in the rigid laparoscopes industry. Besides, much emphasis is being laid on sustainable device design and reusable instruments to reduce medical waste.

The competitive environment features a series of continuous innovations, strategic collaborations, and product diversification. Firms are committing themselves to extensive research and development activities in order to develop small, rugged, and thermally stable laparoscopes. Numerous companies engage in digital visualization methods, ergonomic designs, and sterilization facilitation to reinforce their position in the market and broaden their product portfolios worldwide.

A rigid laparoscope is a surgical instrument designed for visualizing and accessing internal organs during minimally-invasive procedures. Rigid instruments, as against flexible instruments, comprise a straight rigid tube that does not flex or change shape, thereby allowing the surgeon to maintain firm images and clear control in the surgical field. Rigid laparoscopes are used in the majority of procedures in the abdomen, pelvis, and chest cavity.

A standard rigid laparoscope is made up of a rigid optical tube, which has an accompanying lens system, light source, and eyepiece or camera attachment. The optical system brings high-quality images within the body to an external monitor, where diagnostic and therapeutic procedures are carried out by surgeons with greater precision. The instruments are generally offered in various diameters and lengths based on the surgical use.

Rigid laparoscopes have transformed the manner wherein surgeons operate by significantly decreasing the need for large incisions. With a sturdy build, they maintain image quality and are therefore are often preferred in complicated procedures where precision and stability are paramount. Rigid laparoscopes are adaptable to many different instruments and imaging systems, providing overall efficiency in any given procedure.

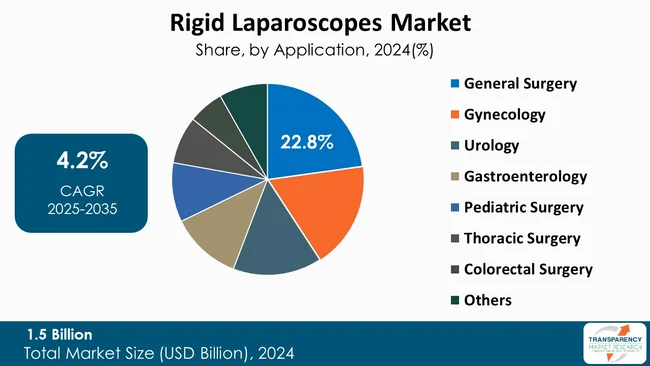

Basically, rigid laparoscopes are used across different medical departments like gynecology, urology, gastroenterology, and general surgery. Their stable nature and remarkable optical quality continue to render them the first choice in minimally invasive operations.

| Attribute | Detail |

|---|---|

| Rigid Laparoscopes Market Drivers |

|

Increasing demand for minimally invasive surgeries (MIS) is a significant driver to the rigid laparoscopes market since these instruments enable to view and access internal organs with small incisions. Rigid laparoscopes are used by doctors for offering precise, focused procedures with low trauma and hence better patient recuperation and fewer post-operative complications.

The preference for MIS by patients and providers has grown due to the clinical advantages in terms of short hospitalization, less pain, and low incidence of infection. As health systems become more efficient and cost-effective, the practice of laparoscopic techniques is being used in every specialty such as gynecology, urology, and general surgery.

Rigid laparoscopes form an important part of supporting these procedures as they offer better optical clarity, stability, and durability than flexible instruments. The rigid laparoscope provides finer control over the surgical apparatus and superior depth of vision than flexible instruments, hence yielding better surgery outcomes.

Advancements in high-definition (HD) imaging have had a considerable effect on the rigid laparoscopes industry by facilitating improved visualization in surgeries. HD imaging allows for detailed and clearer images of anatomical structures presented to surgeons, allowing for accurate identification of tissues, blood vessels, and pathological areas. Increased precision minimizes risks of surgical complications as well as enhances patient outcomes.

As rigid laparoscopes offer HD imaging. They have also gained widespread acceptance amongst several specialties like urology, gynecology, gastroenterology, and general surgery. Surgeons are now able to carry out complex procedures with more confidence as finer image quality provides better depth perception and spatial orientation when operating on the surgical field. This ability is especially useful in minimally invasive surgery, where the surgeon's view is constrained by the size of incision.

HD imaging also facilitates the new trend of digital surgery, whereby laparoscopes are attached to monitors and video recording units to offer instant guidance and training. This technology improves team working among surgical groups, documentation, as well as learning for trainees, thus driving the use of rigid laparoscopes with HD systems.

Also, consistent R&D efforts to improve image resolution, color contrast, and transmission of light have continued to enhance market demand for rigid laparoscopes. Surgical facilities and hospitals are switching to these sophisticated imaging systems in order to provide high-quality surgical services, fueling consistent market growth worldwide.

The general surgery segment is leading the rigid laparoscopes industry due to its application in various kinds of procedures such as cholecystectomy, appendectomy, and hernia repair that are broadly conducted. These operations usually call for accurate visualization of the abdominal cavity, thus making rigid laparoscopes the most suitable tools for ensuring accuracy and lessening the invasiveness.

Besides, the switch to laparoscopic techniques in general surgery is largely influenced by the fact that patients recover quickly, their hospital stay is shortened, and their overall health gets better. Hospitals and surgical centers are increasingly willing to invest on state-of-the-art rigid laparoscopes in order to lift their operational efficiency, thus the segment is holding a strong market share and remains dominant on the global stage.

| Attribute | Detail |

|---|---|

| Leading Region |

|

As per the latest rigid laparoscopes market analysis, North America dominated in 2024. This is attributed to this region’s well-developed healthcare infrastructure and a high level of surgical technologies adoption. The region enjoys the advantages of good reimbursement policies, a wide accessibility of minimally invasive surgery programs, and a rising trend of hospital modernization through which the demand for rigid laparoscopes is propelled.

Furthermore, the presence of substantial R&D activities and the early adoption of innovative medical devices are the factors that contribute to the region’s dominance. The continuous training programs for surgeons and awareness of the benefits of minimally invasive procedures also facilitate the extensive use of rigid laparoscopes in different specialties in North America.

The companies operating in the rigid laparoscopes industry are primarily committed to perpetual product innovation, wherein they integrate advanced imaging and ergonomic designs. The companies’ strategic partnerships with hospitals, R&D investments, and distribution network extension contribute to the global reach. Besides that, surgeons’ training programs and cost-reduction initiatives facilitate adoption and strengthen the competitive positioning in the market.

Stryker, CONMED Corporation, Arthrex, Inc., FUJIFILM Corporation, Medtronic, B. Braun SE, Stalwart Meditech Private Limited, EndoMed Systems GmbH, Ethicon (Johnson & Johnson), Olympus Corporation, ELMED INCORPORATED, Kara Mediclust Private Limited, Hangzhou Tonglu Shikonghou Medical Instrument Co., Ltd., Netcare Surgicals Corporation and Henke Sass Wolf GmbH are some of the leading players operating in the global rigid laparoscopes industry.

Each of these players has been profiled in the rigid laparoscopes market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 1.5 Bn |

| Forecast Value in 2035 | US$ 2.3 Bn |

| CAGR | 4.2% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Rigid Laparoscopes Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Product Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global rigid laparoscopes market was valued at US$ 1.5 Bn in 2024

The global rigid laparoscopes industry is projected to reach more than US$ 2.3 Bn by the end of 2035

The increasing demand for minimally invasive surgeries (MIS), the rising incidence of chronic diseases, significant technological advancements such as improved visualization, and the rising aging population are some of the factors driving the expansion of rigid laparoscopes market.

The CAGR is anticipated to be 4.2% from 2025 to 2035

Stryker, CONMED Corporation, Arthrex, Inc., FUJIFILM Corporation, Medtronic, B. Braun SE, Stalwart Meditech Private Limited, EndoMed Systems GmbH, Ethicon (Johnson & Johnson), Olympus Corporation, ELMED INCORPORATED, Kara Mediclust Private Limited, Hangzhou Tonglu Shikonghou Medical Instrument Co., Ltd., Netcare Surgicals Corporation, and Henke Sass Wolf GmbH

Table 01: Global Rigid Laparoscopes Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 02: Global Rigid Laparoscopes Market Value (US$ Bn) Forecast, By Angle of View, 2020 to 2035

Table 03: Global Rigid Laparoscopes Market Value (US$ Bn) Forecast, By Product Dimension, 2020 to 2035

Table 04: Global Rigid Laparoscopes Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 05: Global Rigid Laparoscopes Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 06: Global Rigid Laparoscopes Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 07: North America Rigid Laparoscopes Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 08: North America Rigid Laparoscopes Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 09: North America Rigid Laparoscopes Market Value (US$ Bn) Forecast, By Angle of View, 2020 to 2035

Table 10: North America Rigid Laparoscopes Market Value (US$ Bn) Forecast, By Product Dimension, 2020 to 2035

Table 11: North America Rigid Laparoscopes Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 12: North America Rigid Laparoscopes Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 13: Europe Rigid Laparoscopes Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 14: Europe Rigid Laparoscopes Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 15: Europe Rigid Laparoscopes Market Value (US$ Bn) Forecast, By Angle of View, 2020 to 2035

Table 16: Europe Rigid Laparoscopes Market Value (US$ Bn) Forecast, By Product Dimension, 2020 to 2035

Table 17: Europe Rigid Laparoscopes Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 18: Europe Rigid Laparoscopes Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 19: Asia Pacific Rigid Laparoscopes Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 20: Asia Pacific Rigid Laparoscopes Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 21: Asia Pacific Rigid Laparoscopes Market Value (US$ Bn) Forecast, By Angle of View, 2020 to 2035

Table 22: Asia Pacific Rigid Laparoscopes Market Value (US$ Bn) Forecast, By Product Dimension, 2020 to 2035

Table 23: Asia Pacific Rigid Laparoscopes Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 24: Asia Pacific Rigid Laparoscopes Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 25: Latin America Rigid Laparoscopes Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 26: Latin America Rigid Laparoscopes Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 27: Latin America Rigid Laparoscopes Market Value (US$ Bn) Forecast, By Angle of View, 2020 to 2035

Table 28: Latin America Rigid Laparoscopes Market Value (US$ Bn) Forecast, By Product Dimension, 2020 to 2035

Table 29: Latin America Rigid Laparoscopes Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 30: Latin America Rigid Laparoscopes Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 31: Middle East & Africa Rigid Laparoscopes Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 32: Middle East & Africa Rigid Laparoscopes Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 33: Middle East & Africa Rigid Laparoscopes Market Value (US$ Bn) Forecast, By Angle of View, 2020 to 2035

Table 34: Middle East & Africa Rigid Laparoscopes Market Value (US$ Bn) Forecast, By Product Dimension, 2020 to 2035

Table 35: Middle East & Africa Rigid Laparoscopes Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 36: Middle East & Africa Rigid Laparoscopes Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Figure 01: Global Rigid Laparoscopes Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 02: Global Rigid Laparoscopes Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 03: Global Rigid Laparoscopes Market Revenue (US$ Bn), by Telescopic Rod Lens System Laparoscopes, 2020 to 2035

Figure 04: Global Rigid Laparoscopes Market Revenue (US$ Bn), by Digital Video Laparoscopes, 2020 to 2035

Figure 05: Global Rigid Laparoscopes Market Revenue (US$ Bn), by 3D Laparoscopes, 2020 to 2035

Figure 06: Global Rigid Laparoscopes Market Value Share Analysis, By Angle of View, 2024 and 2035

Figure 07: Global Rigid Laparoscopes Market Attractiveness Analysis, By Angle of View, 2025 to 2035

Figure 08: Global Rigid Laparoscopes Market Revenue (US$ Bn), by 0° (Forward-viewing), 2020 to 2035

Figure 09: Global Rigid Laparoscopes Market Revenue (US$ Bn), by 30° (Forward-oblique), 2020 to 2035

Figure 10: Global Rigid Laparoscopes Market Revenue (US$ Bn), by 45° (Oblique-viewing), 2020 to 2035

Figure 11: Global Rigid Laparoscopes Market Revenue (US$ Bn), by 70°, 90°, and 120° (Lateral and Retrograde-viewing), 2020 to 2035

Figure 12: Global Rigid Laparoscopes Market Value Share Analysis, By Product Dimension, 2024 and 2035

Figure 13: Global Rigid Laparoscopes Market Attractiveness Analysis, By Product Dimension, 2025 to 2035

Figure 14: Global Rigid Laparoscopes Market Revenue (US$ Bn), by Less than 2 mm, 2020 to 2035

Figure 15: Global Rigid Laparoscopes Market Revenue (US$ Bn), by 2-3.9 mm, 2020 to 2035

Figure 16: Global Rigid Laparoscopes Market Revenue (US$ Bn), by 4-5.9 mm, 2020 to 2035

Figure 17: Global Rigid Laparoscopes Market Revenue (US$ Bn), by More than 6 mm, 2020 to 2035

Figure 18: Global Rigid Laparoscopes Market Value Share Analysis, By Application, 2024 and 2035

Figure 19: Global Rigid Laparoscopes Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 20: Global Rigid Laparoscopes Market Revenue (US$ Bn), by General Surgery, 2020 to 2035

Figure 21: Global Rigid Laparoscopes Market Revenue (US$ Bn), by Gynecology, 2020 to 2035

Figure 22: Global Rigid Laparoscopes Market Revenue (US$ Bn), by Urology, 2020 to 2035

Figure 23: Global Rigid Laparoscopes Market Revenue (US$ Bn), by Gastroenterology, 2020 to 2035

Figure 24: Global Rigid Laparoscopes Market Revenue (US$ Bn), by Pediatric Surgery, 2020 to 2035

Figure 25: Global Rigid Laparoscopes Market Revenue (US$ Bn), by Thoracic Surgery, 2020 to 2035

Figure 26: Global Rigid Laparoscopes Market Revenue (US$ Bn), by Colorectal Surgery, 2020 to 2035

Figure 27: Global Rigid Laparoscopes Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 28: Global Rigid Laparoscopes Market Value Share Analysis, By End-user, 2024 and 2035

Figure 29: Global Rigid Laparoscopes Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 30: Global Rigid Laparoscopes Market Revenue (US$ Bn), by Hospitals, 2020 to 2035

Figure 31: Global Rigid Laparoscopes Market Revenue (US$ Bn), by Ambulatory Surgical Centers (ASCs), 2020 to 2035

Figure 32: Global Rigid Laparoscopes Market Revenue (US$ Bn), by Outpatient Clinics, 2020 to 2035

Figure 33: Global Rigid Laparoscopes Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 34: Global Rigid Laparoscopes Market Value Share Analysis, By Region, 2024 and 2035

Figure 35: Global Rigid Laparoscopes Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 36: North America Rigid Laparoscopes Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 37: North America Rigid Laparoscopes Market Value Share Analysis, by Country, 2024 and 2035

Figure 38: North America Rigid Laparoscopes Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 39: North America Rigid Laparoscopes Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 40: North America Rigid Laparoscopes Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 41: North America Rigid Laparoscopes Market Value Share Analysis, By Angle of View, 2024 and 2035

Figure 42: North America Rigid Laparoscopes Market Attractiveness Analysis, By Angle of View, 2025 to 2035

Figure 43: North America Rigid Laparoscopes Market Value Share Analysis, By Product Dimension, 2024 and 2035

Figure 44: North America Rigid Laparoscopes Market Attractiveness Analysis, By Product Dimension, 2025 to 2035

Figure 45: North America Rigid Laparoscopes Market Value Share Analysis, By Application, 2024 and 2035

Figure 46: North America Rigid Laparoscopes Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 47: North America Rigid Laparoscopes Market Value Share Analysis, By End-user, 2024 and 2035

Figure 48: North America Rigid Laparoscopes Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 49: Europe Rigid Laparoscopes Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 50: Europe Rigid Laparoscopes Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 51: Europe Rigid Laparoscopes Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 52: Europe Rigid Laparoscopes Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 53: Europe Rigid Laparoscopes Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 54: Europe Rigid Laparoscopes Market Value Share Analysis, By Angle of View, 2024 and 2035

Figure 55: Europe Rigid Laparoscopes Market Attractiveness Analysis, By Angle of View, 2025 to 2035

Figure 56: Europe Rigid Laparoscopes Market Value Share Analysis, By Product Dimension, 2024 and 2035

Figure 57: Europe Rigid Laparoscopes Market Attractiveness Analysis, By Product Dimension, 2025 to 2035

Figure 58: Europe Rigid Laparoscopes Market Value Share Analysis, By Application, 2024 and 2035

Figure 59: Europe Rigid Laparoscopes Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 60: Europe Rigid Laparoscopes Market Value Share Analysis, By End-user, 2024 and 2035

Figure 61: Europe Rigid Laparoscopes Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 62: Asia Pacific Rigid Laparoscopes Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 63: Asia Pacific Rigid Laparoscopes Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 64: Asia Pacific Rigid Laparoscopes Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 65: Asia Pacific Rigid Laparoscopes Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 66: Asia Pacific Rigid Laparoscopes Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 67: Asia Pacific Rigid Laparoscopes Market Value Share Analysis, By Angle of View, 2024 and 2035

Figure 68: Asia Pacific Rigid Laparoscopes Market Attractiveness Analysis, By Angle of View, 2025 to 2035

Figure 69: Asia Pacific Rigid Laparoscopes Market Value Share Analysis, By Product Dimension, 2024 and 2035

Figure 70: Asia Pacific Rigid Laparoscopes Market Attractiveness Analysis, By Product Dimension, 2025 to 2035

Figure 71: Asia Pacific Rigid Laparoscopes Market Value Share Analysis, By Application, 2024 and 2035

Figure 72: Asia Pacific Rigid Laparoscopes Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 73: Asia Pacific Rigid Laparoscopes Market Value Share Analysis, By End-user, 2024 and 2035

Figure 74: Asia Pacific Rigid Laparoscopes Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 75: Latin America Rigid Laparoscopes Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 76: Latin America Rigid Laparoscopes Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 77: Latin America Rigid Laparoscopes Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 78: Latin America Rigid Laparoscopes Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 79: Latin America Rigid Laparoscopes Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 80: Latin America Rigid Laparoscopes Market Value Share Analysis, By Angle of View, 2024 and 2035

Figure 81: Latin America Rigid Laparoscopes Market Attractiveness Analysis, By Angle of View, 2025 to 2035

Figure 82: Latin America Rigid Laparoscopes Market Value Share Analysis, By Product Dimension, 2024 and 2035

Figure 83: Latin America Rigid Laparoscopes Market Attractiveness Analysis, By Product Dimension, 2025 to 2035

Figure 84: Latin America Rigid Laparoscopes Market Value Share Analysis, By Application, 2024 and 2035

Figure 85: Latin America Rigid Laparoscopes Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 86: Latin America Rigid Laparoscopes Market Value Share Analysis, By End-user, 2024 and 2035

Figure 87: Latin America Rigid Laparoscopes Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 88: Middle East & Africa Rigid Laparoscopes Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 89: Middle East & Africa Rigid Laparoscopes Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 90: Middle East & Africa Rigid Laparoscopes Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 91: Middle East & Africa Rigid Laparoscopes Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 92: Middle East & Africa Rigid Laparoscopes Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 93: Middle East & Africa Rigid Laparoscopes Market Value Share Analysis, By Angle of View, 2024 and 2035

Figure 94: Middle East & Africa Rigid Laparoscopes Market Attractiveness Analysis, By Angle of View, 2025 to 2035

Figure 95: Middle East & Africa Rigid Laparoscopes Market Value Share Analysis, By Product Dimension, 2024 and 2035

Figure 96: Middle East & Africa Rigid Laparoscopes Market Attractiveness Analysis, By Product Dimension, 2025 to 2035

Figure 97: Middle East & Africa Rigid Laparoscopes Market Value Share Analysis, By Application, 2024 and 2035

Figure 98: Middle East & Africa Rigid Laparoscopes Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 99: Middle East & Africa Rigid Laparoscopes Market Value Share Analysis, By End-user, 2024 and 2035

Figure 100: Middle East & Africa Rigid Laparoscopes Market Attractiveness Analysis, By End-user, 2025 to 2035