Reports

Reports

Analysts’ Viewpoint on Market Scenario

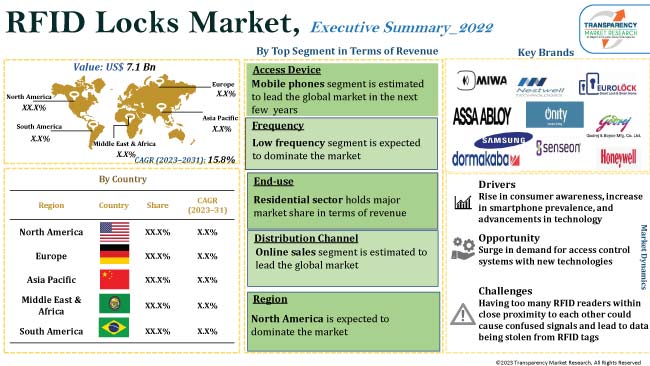

Rapid industrialization & globalization, an easy to access process, and focus on safety are the key factors augmenting the global RFID locks market growth. Demand for radio frequency identification locks is expected to increase as a result of surge in urbanization, and expansion in smart home construction.

Smartphone penetration in China, India, Japan and other developed countries is driving the demand for biometric locks such as RFID locking systems. Rise in consumer awareness, and technological advancements are offering value-grab opportunities for RFID locks manufacturers who are focusing on offering cost-effective and sophisticated door safety solutions.

Future demand of the RFID locks market is expected to be influenced by these key market catalysts.

Radio Frequency Identification (RFID) locks are electronically operated locks. Access control locks provide a reliable, consistent user interface with trackable data. RFID locking systems are contactless locks, which means that the credential does not need to touch the reader in order to operate, compared to other conventional access control methods such as swipe cards. RFID readers function similar to barcode readers by sending and receiving data, except instead of scanning a code, the data is delivered through radio waves. RFID tags, antennas, an RFID reader, and a transmitter are necessary for an RFID door locking system to work as a whole.

Generally, in an RFID door lock access control system, the user's credential is used, which is typically a keycard or fob with an RFID chip that carries a tag which is a special element of identifying data. The RFID tag's information can be detected by the reader's signal when the user approaches it, and it is transmitted by antennae and transceivers to enable the tag in the access control lock system. After reading the request, the system either grants or denies access to unlock the door. An access control system's ability to track entry activity is made possible by the automatic storing of data from an RFID-enabled system.

The global RFID locks industry is growing due to the rise in concerns related to security and safety and preference for electromechanical devices over conventional locking systems. These are the main factors driving the RFID locks market demand. RFID locks offer convenient and easy-to-use access which permits users to unlock doors using a key card, wearable, fingerprint, or other methods instead of using physical keys.

Flexibility, universal design, ADA compliance, and a user-friendly layout are the other benefits of RFID locks. RFID locks market value is expected to rise as these locks offer many advantages to organizations in terms of electronic security such as enhanced safety, compliance, audit trails, and efficiency.

The lock industry is constantly evolving with new technological advancements improving the security and functionality of locks. Rapid urbanization and increase in population are driving the demand for smart and innovative infrastructure solutions. The RFID locks market share is rising due to the construction of new residential and commercial buildings, airports, and hospitals that require high quality locks and security systems.

Additionally, improvement in products with more innovative technological features such as touch screens, Wi-Fi, and Bluetooth (BLE) locking are creating new growth prospects for the RFID locks market.

Operating RFID Locks with cellphones, wearables, and other smart devices are the emerging trends of the RFID locks market. Furthermore, as more new buildings are built, property owners are increasingly choosing cutting-edge security systems such as RFID locks, thus offering lucrative opportunities for market expansion.

The global RFID locks market segmentation in terms of access device comprises key cards, mobile phones, wearables, key fobs, and others (biometric, etc.). The mobile phones segment is estimated to lead the global market in the next few years as it is easy to access, user-friendly, and has voice assistance. RFID locks that can be accessed through smartphones are becoming highly popular worldwide.

Furthermore, the widespread usage of smartphones and the integration of their numerous features into daily life are creating attractive opportunities for RFID locks industry growth.

Based on end-use, the global RFID locks market has been segmented into residential, hospitality, retail, automotive, BFSI, and others (transport & logistics, etc.). The residential sector is likely to lead the global market during the forecast period compared to the other sectors due to rise in smart building projects. Adoption of RFID locks for the residential market is further accelerated by the growth in popularity of smart home architecture across the globe that includes features such as voice control, remote access, and seamless communication.

Additionally, the popularity of high-rise buildings has increased the demand for RFID locks that are simple to connect with devices such as security cameras, lighting controls, and thermostats. These characteristics act as further market catalysts.

According to the RFID locks market forecast, North America is likely to dominate the global market during the forecast period, owing to the rise in construction activities and increase in demand for advanced electronic lock systems across countries such as the U.S, Canada, and Mexico.

Furthermore, expanding infrastructure projects, and transition from conventional to smart appliances, is making North America the fastest growing market for RFID locks. The rise in number of consumers and businesses updating their existing lock systems are expected to drive the RFID locks market size across this region.

The market in Asia Pacific is anticipated to show moderate growth during the forecast period.

The RFID locks market is fragmented due to the presence of many local and global players. Competition is expected to intensify in the next few years due to the entry of local players. RFID locks market development is anticipated to be positive due to the various marketing strategies being adopted by RFID locks companies.

Observing the RFID locks market trends and future of RFID locks, suppliers and manufacturers in the industry are focusing on product development and meeting the demands of customers by introducing more efficient products at reasonable prices.

Assa Abloy AB, Samsung Electronics Co.Ltd., Godrej & Boyce Manufacturing Company Ltd., Honeywell International Inc., Nestwell Technologies, MIWA Lock Company Ltd., Euro Locks SA NV, Dormakaba Groups, Onity Inc. and SenseOn are some of the leading players in the RFID locks market.

Each of these players has been profiled in the RFID locks market report based on parameters such as company overview, business strategies, financial overview, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Value in 2022 (Base Year) |

US$ 7.1 Bn |

|

Market Forecast Value in 2031 |

US$ 31.0 Bn |

|

Growth Rate (CAGR) |

15.8% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Bn for Value and Million Units for Volume |

|

Market Analysis |

Global qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, regulatory analysis, technology overview, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, brand analysis and consumer buying behavior analysis. |

|

Competition Landscape |

|

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

It was valued at US$ 7.1 Bn in 2022

It is projected to reach US$ 31.0 Bn by 2031

It is expected to advance at a CAGR of 15.8% from 2023 to 2031

Rise in consumer awareness, increase in penetration of smartphones, and advancement in products with innovative technological features

In terms of access device, the mobile phones segment is likely to hold major share in the industry

North America is a more attractive region for vendors, followed by Asia Pacific

Assa Abloy AB, Samsung Electronics Co.Ltd., Godrej & Boyce Manufacturing Company Ltd., Honeywell International Inc., Nestwell Technologies, MIWA Lock Company Ltd., Euro Locks SA NV, Dormakaba Groups, Onity Inc., and SenseOn.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Technology Overview

5.5. Key Market Indicators

5.6. Porter’s Five Forces Analysis

5.7. Industry SWOT Analysis

5.8. Value Chain Analysis

5.9. Global RFID Locks Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Value Projections (US$ Bn)

5.9.2. Market Volume Projections (Million Units)

6. Global RFID Locks Market Analysis and Forecast, By Access Device

6.1. RFID Locks Market Size (US$ Bn and Million Units) Forecast, By Access Device, 2017 - 2031

6.1.1. Key Cards

6.1.2. Mobile Phones

6.1.3. Wearables

6.1.4. Key Fobs

6.1.5. Others

6.2. Incremental Opportunity, By Access Device

7. Global RFID Locks Market Analysis and Forecast, By Frequency

7.1. RFID Locks Market Size (US$ Bn and Million Units) Forecast, By Frequency, 2017 - 2031

7.1.1. Low Frequency

7.1.2. High Frequency

7.1.3. Ultra-high Frequency

7.2. Incremental Opportunity, By Frequency

8. Global RFID Locks Market Analysis and Forecast, By End-use

8.1. RFID Locks Market Size (US$ Bn and Million Units) Forecast, By End-use, 2017 - 2031

8.1.1. Residential

8.1.2. Hospitality

8.1.3. Retail

8.1.4. Automotive

8.1.5. BFSI

8.1.6. Others

8.2. Incremental Opportunity, By End-use

9. Global RFID Locks Market Analysis and Forecast, By Distribution Channel

9.1. Freezer Market Size (US$ Bn and Million Units) Forecast, By Distribution Channel, 2017 - 2031

9.1.1. Online

9.1.1.1. E-Commerce Websites

9.1.1.2. Company Owned Websites

9.1.2. Offline

9.1.2.1. Specialty Stores

9.1.2.2. Multi-Brand Stores

9.1.2.3. Other Retail Stores

9.2. Incremental Opportunity, By Distribution Channel

10. Global RFID Locks Market Analysis and Forecast, By Region

10.1. RFID Locks Market Size (US$ Bn and Million Units) Forecast, By Region, 2017 - 2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Incremental Opportunity, By Region

11. North America RFID Locks Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Price Trend Analysis

11.2.1. Weighted Average Price

11.3. Key Trends Analysis

11.3.1. Demand Side Analysis

11.3.2. Supply Side Analysis

11.4. Brand Analysis

11.5. Consumer Buying Behavior Analysis

11.6. RFID Locks Market Size (US$ Bn and Million Units) Forecast, By Access Device, 2017 - 2031

11.6.1. Key Cards

11.6.2. Mobile Phones

11.6.3. Wearables

11.6.4. Key Fobs

11.6.5. Others

11.7. RFID Locks Market Size (US$ Bn and Million Units) Forecast, By Frequency, 2017 - 2031

11.7.1. Low Frequency

11.7.2. High Frequency

11.7.3. Ultra-High Frequency

11.8. RFID Locks Market Size (US$ Bn and Million Units) Forecast, By End-use, 2017 - 2031

11.8.1. Residential

11.8.2. Hospitality

11.8.3. Retail

11.8.4. Automotive

11.8.5. BFSI

11.8.6. Others

11.9. RFID Locks Market Size (US$ Bn and Million Units) Forecast, By Distribution Channel, 2017 - 2031

11.9.1. Online

11.9.1.1. E-Commerce Websites

11.9.1.2. Company Owned Websites

11.9.2. Offline

11.9.2.1. Specialty Stores

11.9.2.2. Multi-Brand Stores

11.9.2.3. Other Retail Stores

11.10. RFID Locks Market Size (US$ Bn) (Bn Units) Forecast, by Country/Sub-region, 2017 - 2027

11.10.1. U.S.

11.10.2. Canada

11.10.3. Rest of North America

11.11. Incremental Opportunity Analysis

12. Europe RFID Locks Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Price Trend Analysis

12.2.1. Weighted Average Price

12.3. Key Trends Analysis

12.3.1. Demand Side Analysis

12.3.2. Supply Side Analysis

12.4. Brand Analysis

12.5. Consumer Buying Behavior Analysis

12.6. RFID Locks Market Size (US$ Bn and Million Units) Forecast, By Access Device, 2017 - 2031

12.6.1. Key Cards

12.6.2. Mobile Phones

12.6.3. Wearables

12.6.4. Key Fobs

12.6.5. Others

12.7. RFID Locks Market Size (US$ Bn and Million Units) Forecast, By Frequency, 2017 - 2031

12.7.1. Low Frequency

12.7.2. High Frequency

12.7.3. Ultra-High Frequency

12.8. RFID Locks Market Size (US$ Bn and Million Units) Forecast, By End-use, 2017 - 2031

12.8.1. Residential

12.8.2. Hospitality

12.8.3. Retail

12.8.4. Automotive

12.8.5. BFSI

12.8.6. Others

12.9. RFID Locks Market Size (US$ Bn and Million Units) Forecast, By Distribution Channel, 2017 - 2031

12.9.1. Online

12.9.1.1. E-Commerce Websites

12.9.1.2. Company Owned Websites

12.9.2. Offline

12.9.2.1. Specialty Stores

12.9.2.2. Multi-Brand Stores

12.9.2.3. Other Retail Stores

12.10. RFID Locks Market Size (US$ Bn) (Bn Units) Forecast, by Country/Sub-region, 2017 - 2031

12.10.1. U.K.

12.10.2. Germany

12.10.3. France

12.10.4. Rest of Europe

12.11. Incremental Opportunity Analysis

13. Asia Pacific RFID Locks Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Price Trend Analysis

13.2.1. Weighted Average Price

13.3. Key Trends Analysis

13.3.1. Demand Side Analysis

13.3.2. Supply Side Analysis

13.4. Brand Analysis

13.5. Consumer Buying Behavior Analysis

13.6. RFID Locks Market Size (US$ Bn and Million Units) Forecast, By Access Device, 2017 - 2031

13.6.1. Key Cards

13.6.2. Mobile Phones

13.6.3. Wearables

13.6.4. Key Fobs

13.6.5. Others

13.7. RFID Locks Market Size (US$ Bn and Million Units) Forecast, By Frequency, 2017 - 2031

13.7.1. Low Frequency

13.7.2. High Frequency

13.7.3. Ultra-High Frequency

13.8. RFID Locks Market Size (US$ Bn and Million Units) Forecast, By End-use, 2017 - 2031

13.8.1. Residential

13.8.2. Hospitality

13.8.3. Retail

13.8.4. Automotive

13.8.5. BFSI

13.8.6. Others

13.9. RFID Locks Market Size (US$ Bn and Million Units) Forecast, By Distribution Channel, 2017 - 2031

13.9.1. Online

13.9.1.1. E-Commerce Websites

13.9.1.2. Company Owned Websites

13.9.2. Offline

13.9.2.1. Specialty Stores

13.9.2.2. Multi-Brand Stores

13.9.2.3. Other Retail Stores

13.10. RFID Locks Market Size (US$ Bn) (Bn Units) Forecast, by Country/Sub-region, 2017 - 2031

13.10.1. China

13.10.2. India

13.10.3. Japan

13.10.4. Rest of Asia Pacific

13.11. Incremental Opportunity Analysis

14. Middle East & Africa RFID Locks Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Price Trend Analysis

14.2.1. Weighted Average Price

14.3. Key Trends Analysis

14.3.1. Demand Side Analysis

14.3.2. Supply Side Analysis

14.4. Brand Analysis

14.5. Consumer Buying Behavior Analysis

14.6. RFID Locks Market Size (US$ Bn and Million Units) Forecast, By Access Device, 2017 - 2031

14.6.1. Key Cards

14.6.2. Mobile Phones

14.6.3. Wearables

14.6.4. Key Fobs

14.6.5. Others

14.7. RFID Locks Market Size (US$ Bn and Million Units) Forecast, By Frequency, 2017 - 2031

14.7.1. Low Frequency

14.7.2. High Frequency

14.7.3. Ultra-High Frequency

14.8. RFID Locks Market Size (US$ Bn and Million Units) Forecast, By End-use, 2017 - 2031

14.8.1. Residential

14.8.2. Hospitality

14.8.3. Retail

14.8.4. Automotive

14.8.5. BFSI

14.8.6. Others

14.9. RFID Locks Market Size (US$ Bn and Million Units) Forecast, By Distribution Channel, 2017 - 2031

14.9.1. Online

14.9.1.1. E-Commerce Websites

14.9.1.2. Company Owned Websites

14.9.2. Offline

14.9.2.1. Specialty Stores

14.9.2.2. Multi-Brand Stores

14.9.2.3. Other Retail Stores

14.10. RFID Locks Market Size (US$ Bn) (Bn Units) Forecast, by Country/Sub-region, 2017 - 2031

14.10.1. GCC

14.10.2. South Africa

14.10.3. Rest of Middle East & Africa

14.11. Incremental Opportunity Analysis

15. South America RFID Locks Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Price Trend Analysis

15.2.1. Weighted Average Price

15.3. Key Trends Analysis

15.3.1. Demand Side Analysis

15.3.2. Supply Side Analysis

15.4. Brand Analysis

15.5. Consumer Buying Behavior Analysis

15.6. RFID Locks Market Size (US$ Bn and Million Units) Forecast, By Access Device, 2017 - 2031

15.6.1. Key Cards

15.6.2. Mobile Phones

15.6.3. Wearables

15.6.4. Key Fobs

15.6.5. Others

15.7. RFID Locks Market Size (US$ Bn and Million Units) Forecast, By Frequency, 2017 - 2031

15.7.1. Low Frequency

15.7.2. High Frequency

15.7.3. Ultra-High Frequency

15.8. RFID Locks Market Size (US$ Bn and Million Units) Forecast, By End-use, 2017 - 2031

15.8.1. Residential

15.8.2. Hospitality

15.8.3. Retail

15.8.4. Automotive

15.8.5. BFSI

15.8.6. Others

15.9. RFID Locks Market Size (US$ Bn and Million Units) Forecast, By Distribution Channel, 2017 - 2031

15.9.1. Online

15.9.1.1. E-Commerce Websites

15.9.1.2. Company Owned Websites

15.9.2. Offline

15.9.2.1. Specialty Stores

15.9.2.2. Multi-Brand Stores

15.9.2.3. Other Retail Stores

15.10. RFID Locks Market Size (US$ Bn) (Bn Units) Forecast, by Country/Sub-region, 2017 - 2031

15.10.1. Brazil

15.10.2. Rest of South America

15.11. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Market Player - Competition Dashboard

16.2. Market Share Analysis - 2022 (%)

16.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

16.3.1. Assa Abloy AB

16.3.1.1. Company Overview

16.3.1.2. Sales Area/Geographical Presence

16.3.1.3. Revenue

16.3.1.4. Strategy & Business Overview

16.3.2. Samsung Electronics Co.Ltd.

16.3.2.1. Company Overview

16.3.2.2. Sales Area/Geographical Presence

16.3.2.3. Revenue

16.3.2.4. Strategy & Business Overview

16.3.3. Godrej & Boyce Manufacturing Company Ltd.

16.3.3.1. Company Overview

16.3.3.2. Sales Area/Geographical Presence

16.3.3.3. Revenue

16.3.3.4. Strategy & Business Overview

16.3.4. Honeywell International Inc.

16.3.4.1. Company Overview

16.3.4.2. Sales Area/Geographical Presence

16.3.4.3. Revenue

16.3.4.4. Strategy & Business Overview

16.3.5. Nestwell Technologies

16.3.5.1. Company Overview

16.3.5.2. Sales Area/Geographical Presence

16.3.5.3. Revenue

16.3.5.4. Strategy & Business Overview

16.3.6. MIWA Lock Company Ltd.

16.3.6.1. Company Overview

16.3.6.2. Sales Area/Geographical Presence

16.3.6.3. Revenue

16.3.6.4. Strategy & Business Overview

16.3.7. Euro Locks SA NV

16.3.7.1. Company Overview

16.3.7.2. Sales Area/Geographical Presence

16.3.7.3. Revenue

16.3.7.4. Strategy & Business Overview

16.3.8. Dormakaba Groups

16.3.8.1. Company Overview

16.3.8.2. Sales Area/Geographical Presence

16.3.8.3. Revenue

16.3.8.4. Strategy & Business Overview

16.3.9. Onity Inc.

16.3.9.1. Company Overview

16.3.9.2. Sales Area/Geographical Presence

16.3.9.3. Revenue

16.3.9.4. Strategy & Business Overview

16.3.10. SenseOn

16.3.10.1. Company Overview

16.3.10.2. Sales Area/Geographical Presence

16.3.10.3. Revenue

16.3.10.4. Strategy & Business Overview

17. Key Takeaways

17.1. Identification of Potential Market Spaces

17.1.1. Access Device

17.1.2. Frequency

17.1.3. End-use

17.1.4. Distribution Channel

17.1.5. Region

17.2. Understanding the Procurement Process of End-Users

17.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global RFID Locks Market by Access Device, Million Units 2017-2031

Table 2: Global RFID Locks Market by Access Device, US$ Bn 2017-2031

Table 3: Global RFID Locks Market by Frequency, Million Units 2017-2031

Table 4: Global RFID Locks Market by Frequency, US$ Bn 2017-2031

Table 5: Global RFID Locks Market by End-use , Million Units 2017-2031

Table 6: Global RFID Locks Market by End-use , US$ Bn 2017-2031

Table 7: Global RFID Locks Market by Distribution Channel, Million Units, 2017-2031

Table 8: Global RFID Locks Market by Distribution Channel, US$ Bn 2017-2031

Table 9: Global RFID Locks Market by Region, Million Units, 2017-2031

Table 10: Global RFID Locks Market by Region, US$ Bn 2017-2031

Table 11: North America RFID Locks Market by Access Device, Million Units 2017-2031

Table 12: North America RFID Locks Market by Access Device, US$ Bn 2017-2031

Table 13: North America RFID Locks Market by Frequency, Million Units 2017-2031

Table 14: North America RFID Locks Market by Frequency, US$ Bn 2017-2031

Table 15: North America RFID Locks Market by End-use , Million Units 2017-2031

Table 16: North America RFID Locks Market by End-use , US$ Bn 2017-2031

Table 17: North America RFID Locks Market by Distribution Channel, Million Units, 2017-2031

Table 18: North America RFID Locks Market by Distribution Channel, US$ Bn 2017-2031

Table 19: Europe RFID Locks Market by Access Device, Million Units 2017-2031

Table 20: Europe RFID Locks Market by Access Device, US$ Bn 2017-2031

Table 21: Europe RFID Locks Market by Frequency, Million Units 2017-2031

Table 22: Europe RFID Locks Market by Frequency, US$ Bn 2017-2031

Table 23: Europe RFID Locks Market by End-use , Million Units 2017-2031

Table 24: Europe RFID Locks Market by End-use , US$ Bn 2017-2031

Table 25: Europe RFID Locks Market by Distribution Channel, Million Units, 2017-2031

Table 26: Europe RFID Locks Market by Distribution Channel, US$ Bn 2017-2031

Table 27: Asia Pacific RFID Locks Market by Access Device, Million Units 2017-2031

Table 28: Asia Pacific RFID Locks Market by Access Device, US$ Bn 2017-2031

Table 29: Asia Pacific RFID Locks Market by Frequency, Million Units 2017-2031

Table 30: Asia Pacific RFID Locks Market by Frequency, US$ Bn 2017-2031

Table 31: Asia Pacific RFID Locks Market by End-use , Million Units 2017-2031

Table 32: Asia Pacific RFID Locks Market by End-use , US$ Bn 2017-2031

Table 33: Asia Pacific RFID Locks Market by Distribution Channel, Million Units, 2017-2031

Table 34: Asia Pacific RFID Locks Market by Distribution Channel, US$ Bn 2017-2031

Table 35: Middle East & Africa RFID Locks Market by Access Device, Million Units 2017-2031

Table 36: Middle East & Africa RFID Locks Market by Access Device, US$ Bn 2017-2031

Table 37: Middle East & Africa RFID Locks Market by Frequency, Million Units 2017-2031

Table 38: Middle East & Africa RFID Locks Market by Frequency, US$ Bn 2017-2031

Table 39: Middle East & Africa RFID Locks Market by End-use , Million Units 2017-2031

Table 40: Middle East & Africa RFID Locks Market by End-use , US$ Bn 2017-2031

Table 41: Middle East & Africa RFID Locks Market by Distribution Channel, Million Units, 2017-2031

Table 42: Middle East & Africa RFID Locks Market by Distribution Channel, US$ Bn 2017-2031

Table 43: South America RFID Locks Market by Access Device, Million Units 2017-2031

Table 44: South America RFID Locks Market by Access Device, US$ Bn 2017-2031

Table 45: South America RFID Locks Market by Frequency, Million Units 2017-2031

Table 46: South America RFID Locks Market by Frequency, US$ Bn 2017-2031

Table 47: South America RFID Locks Market by End-use , Million Units 2017-2031

Table 48: South America RFID Locks Market by End-use , US$ Bn 2017-2031

Table 49: South America RFID Locks Market by Distribution Channel, Million Units, 2017-2031

Table 50: South America RFID Locks Market by Distribution Channel, US$ Bn 2017-2031

List of Figures

Figure 1: Global RFID Locks Market Projections, by Access Device, Million Units, 2017-2031

Figure 2: Global RFID Locks Market Projections, by Access Device, US$ Bn 2017-2031

Figure 3: Global RFID Locks Market, Incremental Opportunity, by Access Device, US$ Bn 2023-2031

Figure 4: Global RFID Locks Market Projections, by Frequency, Million Units, 2017-2031

Figure 5: Global RFID Locks Market Projections, by Frequency, US$ Bn 2017-2031

Figure 6: Global RFID Locks Market, Incremental Opportunity, by Frequency, US$ Bn 2023-2031

Figure 7: Global RFID Locks Market Projections, by End-use, Million Units, 2017-2031

Figure 8: Global RFID Locks Market Projections, by End-use, US$ Bn 2017-2031

Figure 9: Global RFID Locks Market, Incremental Opportunity, by End-use, US$ Bn 2023-2031

Figure 10: Global RFID Locks Market Projections, by Distribution Channel, Million Units, 2017-2031

Figure 11: Global RFID Locks Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 12: Global RFID Locks Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023-2031

Figure 13: Global RFID Locks Market Projections, by Region, Million Units, 2017-2031

Figure 14: Global RFID Locks Market Projections, by Region, US$ Bn 2017-2031

Figure 15: Global RFID Locks Market, Incremental Opportunity, by Region, US$ Bn 2023-2031

Figure 16: North America RFID Locks Market Projections, by Access Device, Million Units, 2017-2031

Figure 17: North America RFID Locks Market Projections, by Access Device, US$ Bn 2017-2031

Figure 18: North America RFID Locks Market, Incremental Opportunity, by Access Device, US$ Bn 2023-2031

Figure 19: North America RFID Locks Market Projections, by Frequency, Million Units, 2017-2031

Figure 20: North America RFID Locks Market Projections, by Frequency, US$ Bn 2017-2031

Figure 21: North America RFID Locks Market, Incremental Opportunity, by Frequency, US$ Bn 2023-2031

Figure 22: North America RFID Locks Market Projections, by End-use , Million Units, 2017-2031

Figure 23: North America RFID Locks Market Projections, by End-use , US$ Bn 2017-2031

Figure 24: North America RFID Locks Market, Incremental Opportunity, by End-use, US$ Bn 2023-2031

Figure 25: North America RFID Locks Market Projections, by Distribution Channel, Million Units, 2017-2031

Figure 26: North America RFID Locks Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 27: North America RFID Locks Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023-2031

Figure 28: Europe RFID Locks Market Projections, by Access Device, Million Units, 2017-2031

Figure 29: Europe RFID Locks Market Projections, by Access Device, US$ Bn 2017-2031

Figure 30: Europe RFID Locks Market, Incremental Opportunity, by Access Device, US$ Bn 2023-2031

Figure 31: Europe RFID Locks Market Projections, by Frequency, Million Units, 2017-2031

Figure 32: Europe RFID Locks Market Projections, by Frequency, US$ Bn 2017-2031

Figure 33: Europe RFID Locks Market, Incremental Opportunity, by Frequency, US$ Bn 2023-2031

Figure 34: Europe RFID Locks Market Projections, by End-use , Million Units, 2017-2031

Figure 35: Europe RFID Locks Market Projections, by End-use , US$ Bn 2017-2031

Figure 36: Europe RFID Locks Market, Incremental Opportunity, by End-use , US$ Bn 2023-2031

Figure 37: Europe RFID Locks Market Projections, by Distribution Channel, Million Units, 2017-2031

Figure 38: Europe RFID Locks Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 39: Europe RFID Locks Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023-2031

Figure 40: Asia Pacific RFID Locks Market Projections, by Access Device, Million Units, 2017-2031

Figure 41: Asia Pacific RFID Locks Market Projections, by Access Device, US$ Bn 2017-2031

Figure 42: Asia Pacific RFID Locks Market, Incremental Opportunity, by Access Device, US$ Bn 2023-2031

Figure 43: Asia Pacific RFID Locks Market Projections, by Frequency, Million Units, 2017-2031

Figure 44: Asia Pacific RFID Locks Market Projections, by Frequency, US$ Bn 2017-2031

Figure 45: Asia Pacific RFID Locks Market, Incremental Opportunity, by Frequency, US$ Bn 2023-2031

Figure 46: Asia Pacific RFID Locks Market Projections, by End-use , Million Units, 2017-2031

Figure 47: Asia Pacific RFID Locks Market Projections, by End-use , US$ Bn 2017-2031

Figure 48: Asia Pacific RFID Locks Market, Incremental Opportunity, by End-use , US$ Bn 2023-2031

Figure 49: Asia Pacific RFID Locks Market Projections, by Distribution Channel, Million Units, 2017-2031

Figure 50: Asia Pacific RFID Locks Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 51: Asia Pacific RFID Locks Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023-2031

Figure 52: Middle East & Africa RFID Locks Market Projections, by Access Device, Million Units, 2017-2031

Figure 53: Middle East & Africa RFID Locks Market Projections, by Access Device, US$ Bn 2017-2031

Figure 54: Middle East & Africa RFID Locks Market, Incremental Opportunity, by Access Device, US$ Bn 2023-2031

Figure 55: Middle East & Africa RFID Locks Market Projections, by Frequency, Million Units, 2017-2031

Figure 56: Middle East & Africa RFID Locks Market Projections, by Frequency, US$ Bn 2017-2031

Figure 57: Middle East & Africa RFID Locks Market, Incremental Opportunity, by Frequency, US$ Bn 2023-2031

Figure 58: Middle East & Africa RFID Locks Market Projections, by End-use , Million Units, 2017-2031

Figure 59: Middle East & Africa RFID Locks Market Projections, by End-use , US$ Bn 2017-2031

Figure 60: Middle East & Africa RFID Locks Market, Incremental Opportunity, by End-use , US$ Bn 2023-2031

Figure 61: Middle East & Africa RFID Locks Market Projections, by Distribution Channel, Million Units, 2017-2031

Figure 62: Middle East & Africa RFID Locks Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 63: Middle East & Africa RFID Locks Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023-2031

Figure 64: South America RFID Locks Market Projections, by Access Device, Million Units, 2017-2031

Figure 65: South America RFID Locks Market Projections, by Access Device, US$ Bn 2017-2031

Figure 66: South America RFID Locks Market, Incremental Opportunity, by Access Device, US$ Bn 2023-2031

Figure 67: South America RFID Locks Market Projections, by Frequency, Million Units, 2017-2031

Figure 68: South America RFID Locks Market Projections, by Frequency, US$ Bn 2017-2031

Figure 69: South America RFID Locks Market, Incremental Opportunity, by Frequency, US$ Bn 2023-2031

Figure 70: South America RFID Locks Market Projections, by End-use , Million Units, 2017-2031

Figure 71: South America RFID Locks Market Projections, by End-use , US$ Bn 2017-2031

Figure 72: South America RFID Locks Market, Incremental Opportunity, by End-use , US$ Bn 2023-2031

Figure 73: South America RFID Locks Market Projections, by Distribution Channel, Million Units, 2017-2031

Figure 74: South America RFID Locks Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 75: South America RFID Locks Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023-2031