Reports

Reports

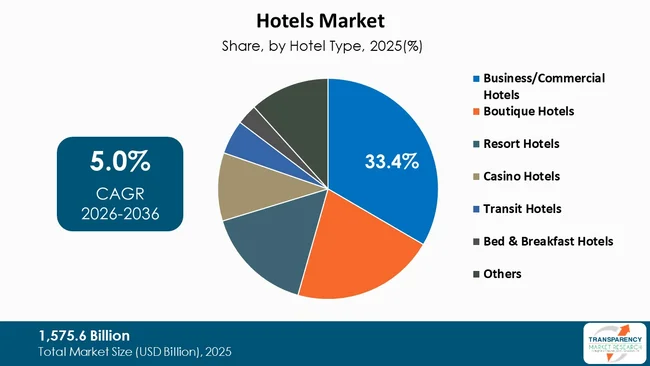

The global Hotels market size was valued at US$ 1,575.6 Bn in 2025 and is projected to reach US$ 2,694.9 Bn by 2036, expanding at a CAGR of 5.0% from 2026 to 2036. The market growth is driven by increasing digital innovation reshapes hotels and guest satisfaction and rising corporate travel boosts RevPAR, group bookings, and service needs.

The global hotels market is dynamic, maintained by growing demand for travel, the rising income of the middle class in emerging markets, and rapid technology adoption across booking and guest experience infrastructure. Key players including international lodging companies, regional players, and tech-enabled brands are significant. They expand aggressively using franchisees, acquisitions, and brand developments. The lifestyle hotels are differentiating with experience, food, and tech.

Moreover, partnerships with digital travel intermediaries as well as loyalty ecosystems increase the efficiency of distribution and guest retention. Competition makes hoteliers invest in new analytics for pricing, occupancy, and personalization of the guest's stay, which generates the RevPAR (Revenue Per Available Room) opportunity. However, the growth is supported by the travel demand, brand loyalty investment, and innovation, thereby creating a worthy cycle feeding each other, operators, distribution channels, and the consumers' expectations.

The hotels market includes all kinds of lodging arrangements from basic motels and business accommodations to classy resorts and boutique hotels. The hotels provide rental of rooms and some attendant guest services for a fee. The current growth in the market is being stimulated by an increase in global travel, both leisure and business, further stimulated by the rise in disposable income in emerging economies, alongside a growing tendency for urban movement.

The digital age has greatly enhanced the ease of travel exploration and booking, in addition to evolving and developing growing guest expectations surrounding comfort, personalization, convenience, and sustainability through innovation around operational products. Moreover, infrastructural investment, massage or relaxation service incentives from governments that promote tourism, and airport expansions help new hotels to succeed. All these factors are driving demand and activating new service evolutions and competitive differentiation in the hotels market.

Rising tourism in developing markets and overdue demand from post-downturn recoveries are continuing to increase occupancy. Business travel is also expected to drive demand for business/commercial properties as these economies stabilize.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

Technology-driven innovation and digital transformation are formidable disruptors of the hotels market. Hotels are now allocating more resources to digital solutions to optimize guest experience, elevating operational performance, and optimizing revenue.

The models of technological innovation in the hospitality industry are copious and demonstrate advances through contactless processes, such as mobile check-in/check-out, digital room keys, touchless elevators, and mobile payment, to provide convenience and cleanliness in a post-COVID world. For instance, as per the data published by one of research, in 2024 more than 50% of hotel bookings are now completed via mobile devices, a figure that continues to grow as consumers prioritize convenience and instant access.

AI-enabled personalization utilizes guest data that is generally collected through mobile check-in/check-out for identifying personalized recommendations and targeted promotional offers to guests. Revenue management systems utilize data analytics and real-time demand for adjusting a hotel’s optimal pricing approach, which will consistently increase (Average Daily Rate) ADR and RevPAR.

In addition, integrated CRM systems support omnichannel marketing, thereby making loyalty programs and direct bookings more effective. For instance, in 2024, 72% of hotel room nights were booked by Loyalty Program members in the U.S. for Marriott International, and 65% of hotel room nights globally. The capacity to upsell late-stay options, F&B credits, or experiences also adds an ancillary revenue source.

Adoption of contactless travel also resonates with technology-driven and health-conscious travelers and enhances brand identity.

One of the most significant growth drivers for hotels is the resurgence of corporate and business travel. Public company filings of major lodging brand holding entities attest to the fact that corporate and meetings, incentives, conferences, and exhibitions (MICE) revenue have sharply rebounded and contributed a higher percentage to the RevPAR portfolio and group bookings so far.

Corporate traveler’s generally spend more, tend to book premium products, and utilize meeting facilities, F&B, and services. Corporate events like conferences and conventions have produced consistent demand for multiple rooms and banquet space. Corporate demand also stabilizes mid-week occupancy levels, smoothing out the weak weekday conditions characteristic of leisure markets.

For instance, the American Hotel & Lodging Association's report from 2024 mentions that business travel recovery within the U.S. hotel industry has begun, with 439 million sold room nights recorded in 2023. Furthermore, the recovery of business travel also generates product demand for hotels in downtown areas and locations near airports.

Expanding service options such as co-working lounges and flexible meeting spaces, plus express, high-touch service, become easier to align when there is an uptick in business travel. Once the international landscape of trade, conference demands, and corporate activity resumes, hotels whose heavy focus is on business travel and those that provide flexibility in meeting venues, travel loyalty programs, and corporate booking systems will benefit from business travel demand.

The global hotel market receives significant benefits from emerging travel destinations. The current travel surges in areas that saw limited development in previous years results in new hotel requirements and creates enticing investment opportunities. International travel patterns now show increasing diversity because travelers prefer to experience distinct cultural elements and local traditions in non-traditional cities. The current business environment enables hotel developers to enter markets that provide opportunities for both leisure and business development.

Emerging regions now become easier to reach because several countries are expanding their air travel network together with implementing simplified visa requirements. Governments are developing tourism infrastructure through their investments in airports and highways and cultural sites to attract international visitors. Hotel development and service improvement projects receive funding from international hotel chains together with local businesses after these developments take place. The establishment of new routes creates connections between secondary airports and primary airport hubs.

Travelers now prioritize sustainability and genuine experiences which has led to increased interest in wellness tourism and eco-tourism. The current environmental sustainability movement enables the development of organic boutique hotels and resorts together with eco-friendly nature-based hotels. Local tourism authorities are enhancing travel demand through their promotion of festivals and heritage sites and regional gastronomic tours. The current global business travel market experiences rapid growth as multinational companies establish their operations in emerging markets and conduct conferences and trade shows.

The fast-growing international travel market which will reach 1.4 billion global tourists in 2024 allows hotels in emerging markets to grow their businesses by creating offers that match changing customer preferences.

The business and commercial hotel segment is dominant with 33.4% in the global hotels market. Business hotels are usually located in downtown, the central business district (CBD), and areas near the airport. Business hotels primarily service a corporate customer base, and all hotels have predictable and stable occupancy due to MICE events, transient corporate customers, and corporate travel contracts.

Corporate customers and group contracts provide some of the most stable demand sources, even during fluctuating periods of leisure travel. Commercial hotels offer quick turnaround service with higher profitability, aided by services such as flexible check-ins and business centers, while repeat stays and referrals from loyalty programs are effects of successful commercial hotel service delivery. For instance, Marriott acquired Dutch Hotel and Coworking Services Provider CitizenM for EUR 312 Mn (USD 353 Mn) in April 2025. The alignment with the corporate accounts provides volume pricing, the ability to block group space early, year-end corporate travel budgets, and predictability and higher ADR yield.

| Attribute | Detail |

|---|---|

| Leading Region |

|

North America (36.0%), particularly the United States, has exhibited dominant market characteristics driven by a large domestic travel base, strong corporate travel recovery, and concentrated investment in branded development. The region benefits from diverse demand streams, government, corporate meetings, and leisure, plus advanced distribution and analytics ecosystems that enable sophisticated revenue management.

Institutional ownership models and active franchise pipelines have produced rapid system-wide expansion for major brands, while an active investor market for hotel assets has sustained transaction liquidity. Employment and occupational data in the accommodation sector also support operational scaling. Labor market statistics and wage trends have guided operators to invest in productivity solutions and staff training to meet recovering demand.

For instance, as indicated in reporting by U.S. industry sources, occupancy and ADR trends are continuing to improve, and major hotel companies are increasingly contributing to net room growth, all of which support North America's leadership position as the most extensible hotel and hospitality market in the world.

Accor, Marriott International, Hyatt Hotels, Hilton Worldwide, InterContinental Hotels Group, Best Western Hotels, Choice Hotels International, Inc., Wyndham Destinations, Radisson Hotel Group, Indian Hotels Company Limited, La Mamounia, Royal Mansour Marrakech, The Royal Portfolio, Angama (Pty) Ltd, Capella Hotel Group Pte Ltd. are some of the leading manufacturers operating in the global hotels market.

Each of these companies has been profiled in the Hotels market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2025 (Base Year) | US$ 1,575.6 Bn |

| Market Forecast Value in 2036 | US$ 2,694.9 Bn |

| Growth Rate (CAGR 2026 to 2036) | 5.0% |

| Forecast Period | 2026-2036 |

| Historical data Available for | 2021-2024 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | Global qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape | Market Player - Competition Dashboard and Revenue Share Analysis 2025 Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview) |

| Format | Electronic (PDF) + Excel |

| Market Segmentations | By Hotel Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

The global hotels market was valued at US$ 1,575.6 Bn in 2025

The global hotels industry is projected to reach at US$ 2,694.9 Bn by the end of 2036

Increasing digital innovation reshapes hotels and guest satisfaction & rising corporate travel boosts RevPAR, group bookings, and service needs, are some of the driving factors for this market

The CAGR is anticipated to be 5.0% from 2026 to 2036

Accor, Marriott International, Hyatt Hotels, Hilton Worldwide, InterContinental Hotels Group, Best Western Hotels, Choice Hotels International, Inc., Wyndham Destinations, Radisson Hotel Group, Indian Hotels Company Limited, La Mamounia, Royal Mansour Marrakech, The Royal Portfolio, Angama (Pty) Ltd, Capella Hotel Group Pte Ltd., and others

Table 01: Global Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Table 02: Global Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Table 03: Global Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Table 04: Global Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Table 05: Global Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Table 06: Global Hotels Market Value (US$ Bn) Projection, By Region 2021 to 2036

Table 07: North America Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Table 08: North America Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Table 09: North America Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Table 10: North America Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Table 11: North America Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Table 12: North America Hotels Market Value (US$ Bn) Projection, By Country 2021 to 2036

Table 13: U.S. Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Table 14: U.S. Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Table 15: U.S. Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Table 16: U.S. Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Table 17: U.S. Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Table 18: Canada Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Table 19: Canada Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Table 20: Canada Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Table 21: Canada Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Table 22: Canada Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Table 23: Europe Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Table 24: Europe Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Table 25: Europe Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Table 26: Europe Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Table 27: Europe Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Table 28: Europe Hotels Market Value (US$ Bn) Projection, By Country 2021 to 2036

Table 29: U.K. Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Table 30: U.K. Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Table 31: U.K. Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Table 32: U.K. Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Table 33: U.K. Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Table 34: Germany Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Table 35: Germany Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Table 36: Germany Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Table 37: Germany Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Table 38: Germany Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Table 39: France Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Table 40: France Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Table 41: France Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Table 42: France Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Table 43: France Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Table 44: Italy Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Table 45: Italy Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Table 46: Italy Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Table 47: Italy Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Table 48: Italy Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Table 49: Spain Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Table 50: Spain Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Table 51: Spain Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Table 52: Spain Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Table 53: Spain Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Table 54: The Netherlands Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Table 55: The Netherlands Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Table 56: The Netherlands Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Table 57: The Netherlands Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Table 58: The Netherlands Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Table 59: Asia Pacific Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Table 60: Asia Pacific Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Table 61: Asia Pacific Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Table 62: Asia Pacific Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Table 63: Asia Pacific Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Table 64: Asia Pacific Hotels Market Value (US$ Bn) Projection, By Country 2021 to 2036

Table 65: China Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Table 66: China Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Table 67: China Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Table 68: China Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Table 69: China Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Table 70: India Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Table 71: India Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Table 72: India Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Table 73: India Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Table 74: India Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Table 75: Japan Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Table 76: Japan Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Table 77: Japan Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Table 78: Japan Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Table 79: Japan Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Table 80: Australia Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Table 81: Australia Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Table 82: Australia Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Table 83: Australia Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Table 84: Australia Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Table 85: South Korea Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Table 86: South Korea Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Table 87: South Korea Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Table 88: South Korea Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Table 89: South Korea Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Table 90: ASEAN Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Table 91: ASEAN Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Table 92: ASEAN Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Table 93: ASEAN Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Table 94: ASEAN Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Table 95: Middle East & Africa Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Table 96: Middle East & Africa Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Table 97: Middle East & Africa Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Table 98: Middle East & Africa Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Table 99: Middle East & Africa Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Table 100: Middle East & Africa Hotels Market Value (US$ Bn) Projection, By Country 2021 to 2036

Table 101: GCC Countries Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Table 102: GCC Countries Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Table 103: GCC Countries Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Table 104: GCC Countries Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Table 105: GCC Countries Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Table 106: South Africa Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Table 107: South Africa Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Table 108: South Africa Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Table 109: South Africa Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Table 110: South Africa Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Table 111: Latin America Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Table 112: Latin America Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Table 113: Latin America Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Table 114: Latin America Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Table 115: Latin America Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Table 116: Latin America Hotels Market Value (US$ Bn) Projection, By Country 2021 to 2036

Table 117: Brazil Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Table 118: Brazil Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Table 119: Brazil Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Table 120: Brazil Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Table 121: Brazil Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Table 122: Mexico Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Table 123: Mexico Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Table 124: Mexico Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Table 125: Mexico Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Table 126: Mexico Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Table 127: Argentina Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Table 128: Argentina Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Table 129: Argentina Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Table 130: Argentina Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Table 131: Argentina Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Figure 01: Global Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Figure 02: Global Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Hotel Type 2026 to 2036

Figure 03: Global Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Figure 04: Global Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Business Model 2026 to 2036

Figure 05: Global Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Figure 06: Global Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Room Capacity 2026 to 2036

Figure 07: Global Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Figure 08: Global Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Price Level 2026 to 2036

Figure 09: Global Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Figure 10: Global Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Booking Mode 2026 to 2036

Figure 11: Global Hotels Market Value (US$ Bn) Projection, By Region 2021 to 2036

Figure 12: Global Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Region 2026 to 2036

Figure 13: North America Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Figure 14: North America Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Hotel Type 2026 to 2036

Figure 15: North America Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Figure 16: North America Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Business Model 2026 to 2036

Figure 17: North America Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Figure 18: North America Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Room Capacity 2026 to 2036

Figure 19: North America Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Figure 20: North America Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Price Level 2026 to 2036

Figure 21: North America Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Figure 22: North America Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Booking Mode 2026 to 2036

Figure 23: North America Hotels Market Value (US$ Bn) Projection, By Country 2021 to 2036

Figure 24: North America Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Country 2026 to 2036

Figure 25: U.S. Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Figure 26: U.S. Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Hotel Type 2026 to 2036

Figure 27: U.S. Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Figure 28: U.S. Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Business Model 2026 to 2036

Figure 29: U.S. Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Figure 30: U.S. Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Room Capacity 2026 to 2036

Figure 31: U.S. Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Figure 32: U.S. Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Price Level 2026 to 2036

Figure 33: U.S. Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Figure 34: U.S. Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Booking Mode 2026 to 2036

Figure 35: Canada Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Figure 36: Canada Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Hotel Type 2026 to 2036

Figure 37: Canada Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Figure 38: Canada Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Business Model 2026 to 2036

Figure 39: Canada Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Figure 40: Canada Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Room Capacity 2026 to 2036

Figure 41: Canada Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Figure 42: Canada Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Price Level 2026 to 2036

Figure 43: Canada Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Figure 44: Canada Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Booking Mode 2026 to 2036

Figure 45: Europe Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Figure 46: Europe Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Hotel Type 2026 to 2036

Figure 47: Europe Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Figure 48: Europe Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Business Model 2026 to 2036

Figure 49: Europe Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Figure 50: Europe Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Room Capacity 2026 to 2036

Figure 51: Europe Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Figure 52: Europe Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Price Level 2026 to 2036

Figure 53: Europe Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Figure 54: Europe Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Booking Mode 2026 to 2036

Figure 55: Europe Hotels Market Value (US$ Bn) Projection, By Country 2021 to 2036

Figure 56: Europe Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Country 2026 to 2036

Figure 57: U.K. Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Figure 58: U.K. Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Hotel Type 2026 to 2036

Figure 59: U.K. Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Figure 60: U.K. Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Business Model 2026 to 2036

Figure 61: U.K. Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Figure 62: U.K. Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Room Capacity 2026 to 2036

Figure 63: U.K. Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Figure 64: U.K. Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Price Level 2026 to 2036

Figure 65: U.K. Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Figure 66: U.K. Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Booking Mode 2026 to 2036

Figure 67: Germany Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Figure 68: Germany Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Hotel Type 2026 to 2036

Figure 69: Germany Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Figure 70: Germany Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Business Model 2026 to 2036

Figure 71: Germany Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Figure 72: Germany Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Room Capacity 2026 to 2036

Figure 73: Germany Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Figure 74: Germany Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Price Level 2026 to 2036

Figure 75: Germany Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Figure 76: Germany Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Booking Mode 2026 to 2036

Figure 77: France Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Figure 78: France Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Hotel Type 2026 to 2036

Figure 79: France Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Figure 80: France Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Business Model 2026 to 2036

Figure 81: France Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Figure 82: France Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Room Capacity 2026 to 2036

Figure 83: France Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Figure 84: France Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Price Level 2026 to 2036

Figure 85: France Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Figure 86: France Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Booking Mode 2026 to 2036

Figure 87: Italy Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Figure 88: Italy Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Hotel Type 2026 to 2036

Figure 89: Italy Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Figure 90: Italy Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Business Model 2026 to 2036

Figure 91: Italy Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Figure 92: Italy Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Room Capacity 2026 to 2036

Figure 93: Italy Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Figure 94: Italy Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Price Level 2026 to 2036

Figure 95: Italy Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Figure 96: Italy Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Booking Mode 2026 to 2036

Figure 97: Spain Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Figure 98: Spain Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Hotel Type 2026 to 2036

Figure 99: Spain Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Figure 100: Spain Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Business Model 2026 to 2036

Figure 101: Spain Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Figure 102: Spain Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Room Capacity 2026 to 2036

Figure 103: Spain Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Figure 104: Spain Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Price Level 2026 to 2036

Figure 105: Spain Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Figure 106: Spain Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Booking Mode 2026 to 2036

Figure 107: The Netherlands Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Figure 108: The Netherlands Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Hotel Type 2026 to 2036

Figure 109: The Netherlands Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Figure 110: The Netherlands Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Business Model 2026 to 2036

Figure 111: The Netherlands Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Figure 112: The Netherlands Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Room Capacity 2026 to 2036

Figure 113: The Netherlands Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Figure 114: The Netherlands Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Price Level 2026 to 2036

Figure 115: The Netherlands Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Figure 116: The Netherlands Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Booking Mode 2026 to 2036

Figure 117: Asia Pacific Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Figure 118: Asia Pacific Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Hotel Type 2026 to 2036

Figure 119: Asia Pacific Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Figure 120: Asia Pacific Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Business Model 2026 to 2036

Figure 121: Asia Pacific Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Figure 122: Asia Pacific Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Room Capacity 2026 to 2036

Figure 123: Asia Pacific Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Figure 124: Asia Pacific Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Price Level 2026 to 2036

Figure 125: Asia Pacific Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Figure 126: Asia Pacific Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Booking Mode 2026 to 2036

Figure 127: Asia Pacific Hotels Market Value (US$ Bn) Projection, By Country 2021 to 2036

Figure 128: Asia Pacific Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Country 2026 to 2036

Figure 129: China Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Figure 130: China Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Hotel Type 2026 to 2036

Figure 131: China Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Figure 132: China Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Business Model 2026 to 2036

Figure 133: China Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Figure 134: China Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Room Capacity 2026 to 2036

Figure 135: China Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Figure 136: China Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Price Level 2026 to 2036

Figure 137: China Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Figure 138: China Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Booking Mode 2026 to 2036

Figure 139: India Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Figure 140: India Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Hotel Type 2026 to 2036

Figure 141: India Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Figure 142: India Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Business Model 2026 to 2036

Figure 143: India Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Figure 144: India Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Room Capacity 2026 to 2036

Figure 145: India Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Figure 146: India Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Price Level 2026 to 2036

Figure 147: India Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Figure 148: India Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Booking Mode 2026 to 2036

Figure 149: Japan Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Figure 150: Japan Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Hotel Type 2026 to 2036

Figure 151: Japan Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Figure 152: Japan Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Business Model 2026 to 2036

Figure 153: Japan Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Figure 154: Japan Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Room Capacity 2026 to 2036

Figure 155: Japan Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Figure 156: Japan Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Price Level 2026 to 2036

Figure 157: Japan Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Figure 158: Japan Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Booking Mode 2026 to 2036

Figure 159: Australia Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Figure 160: Australia Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Hotel Type 2026 to 2036

Figure 161: Australia Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Figure 162: Australia Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Business Model 2026 to 2036

Figure 163: Australia Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Figure 164: Australia Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Room Capacity 2026 to 2036

Figure 165: Australia Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Figure 166: Australia Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Price Level 2026 to 2036

Figure 167: Australia Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Figure 168: Australia Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Booking Mode 2026 to 2036

Figure 169: South Korea Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Figure 170: South Korea Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Hotel Type 2026 to 2036

Figure 171: South Korea Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Figure 172: South Korea Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Business Model 2026 to 2036

Figure 173: South Korea Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Figure 174: South Korea Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Room Capacity 2026 to 2036

Figure 175: South Korea Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Figure 176: South Korea Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Price Level 2026 to 2036

Figure 177: South Korea Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Figure 178: South Korea Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Booking Mode 2026 to 2036

Figure 179: ASEAN Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Figure 180: ASEAN Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Hotel Type 2026 to 2036

Figure 181: ASEAN Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Figure 182: ASEAN Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Business Model 2026 to 2036

Figure 183: ASEAN Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Figure 184: ASEAN Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Room Capacity 2026 to 2036

Figure 185: ASEAN Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Figure 186: ASEAN Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Price Level 2026 to 2036

Figure 187: ASEAN Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Figure 188: ASEAN Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Booking Mode 2026 to 2036

Figure 189: Middle East & Africa Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Figure 190: Middle East & Africa Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Hotel Type 2026 to 2036

Figure 191: Middle East & Africa Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Figure 192: Middle East & Africa Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Business Model 2026 to 2036

Figure 193: Middle East & Africa Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Figure 194: Middle East & Africa Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Room Capacity 2026 to 2036

Figure 195: Middle East & Africa Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Figure 196: Middle East & Africa Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Price Level 2026 to 2036

Figure 197: Middle East & Africa Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Figure 198: Middle East & Africa Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Booking Mode 2026 to 2036

Figure 199: Middle East & Africa Hotels Market Value (US$ Bn) Projection, By Country 2021 to 2036

Figure 200: Middle East & Africa Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Country 2026 to 2036

Figure 201: GCC Countries Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Figure 202: GCC Countries Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Hotel Type 2026 to 2036

Figure 203: GCC Countries Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Figure 204: GCC Countries Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Business Model 2026 to 2036

Figure 205: GCC Countries Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Figure 206: GCC Countries Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Room Capacity 2026 to 2036

Figure 207: GCC Countries Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Figure 208: GCC Countries Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Price Level 2026 to 2036

Figure 209: GCC Countries Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Figure 210: GCC Countries Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Booking Mode 2026 to 2036

Figure 211: South Africa Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Figure 212: South Africa Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Hotel Type 2026 to 2036

Figure 213: South Africa Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Figure 214: South Africa Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Business Model 2026 to 2036

Figure 215: South Africa Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Figure 216: South Africa Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Room Capacity 2026 to 2036

Figure 217: South Africa Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Figure 218: South Africa Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Price Level 2026 to 2036

Figure 219: South Africa Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Figure 220: South Africa Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Booking Mode 2026 to 2036

Figure 221: Latin America Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Figure 222: Latin America Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Hotel Type 2026 to 2036

Figure 223: Latin America Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Figure 224: Latin America Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Business Model 2026 to 2036

Figure 225: Latin America Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Figure 226: Latin America Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Room Capacity 2026 to 2036

Figure 227: Latin America Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Figure 228: Latin America Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Price Level 2026 to 2036

Figure 229: Latin America Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Figure 230: Latin America Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Booking Mode 2026 to 2036

Figure 231: Latin America Hotels Market Value (US$ Bn) Projection, By Country 2021 to 2036

Figure 232: Latin America Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Country 2026 to 2036

Figure 233: Brazil Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Figure 234: Brazil Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Hotel Type 2026 to 2036

Figure 235: Brazil Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Figure 236: Brazil Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Business Model 2026 to 2036

Figure 237: Brazil Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Figure 238: Brazil Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Room Capacity 2026 to 2036

Figure 239: Brazil Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Figure 240: Brazil Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Price Level 2026 to 2036

Figure 241: Brazil Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Figure 242: Brazil Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Booking Mode 2026 to 2036

Figure 243: Mexico Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Figure 244: Mexico Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Hotel Type 2026 to 2036

Figure 245: Mexico Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Figure 246: Mexico Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Business Model 2026 to 2036

Figure 247: Mexico Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Figure 248: Mexico Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Room Capacity 2026 to 2036

Figure 249: Mexico Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Figure 250: Mexico Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Price Level 2026 to 2036

Figure 251: Mexico Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Figure 252: Mexico Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Booking Mode 2026 to 2036

Figure 253: Argentina Hotels Market Value (US$ Bn) Projection, By Hotel Type 2021 to 2036

Figure 254: Argentina Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Hotel Type 2026 to 2036

Figure 255: Argentina Hotels Market Value (US$ Bn) Projection, By Business Model 2021 to 2036

Figure 256: Argentina Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Business Model 2026 to 2036

Figure 257: Argentina Hotels Market Value (US$ Bn) Projection, By Room Capacity 2021 to 2036

Figure 258: Argentina Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Room Capacity 2026 to 2036

Figure 259: Argentina Hotels Market Value (US$ Bn) Projection, By Price Level 2021 to 2036

Figure 260: Argentina Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Price Level 2026 to 2036

Figure 261: Argentina Hotels Market Value (US$ Bn) Projection, By Booking Mode 2021 to 2036

Figure 262: Argentina Hotels Market Incremental Opportunities (US$ Bn) Forecast, By Booking Mode 2026 to 2036