Reports

Reports

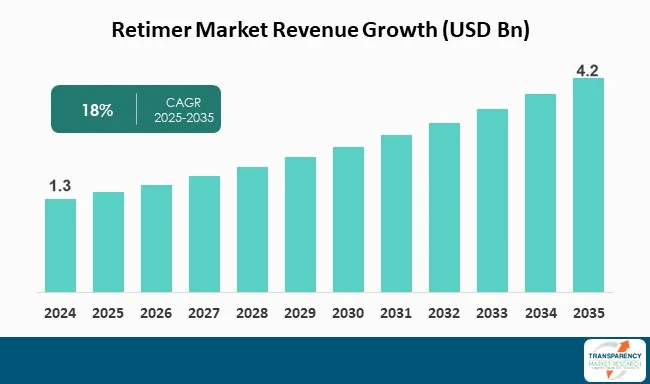

The global retimer market size was valued at US$ 1.3 Bn in 2024 and is projected to reach US$ 4.2 Bn by 2035, expanding at a CAGR of 18.0% from 2025 to 2035. The market growth is driven by rapid expansion of hyperscale data centers and cloud infrastructure, adoption of high-speed interconnect standards.

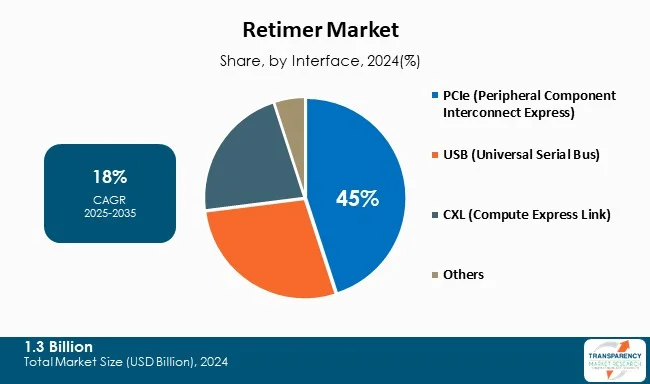

The growing dependency on Interconnect Technologies from companies, e.g. PCIe 4.0/5.0/ CXL and a rise of Data Rates among Interconnect Technologies create an increased need for Retimers to maintain reliable data communication over long distances.

Also, retimer market’s growth will be accelerated by increased high-power computing, high-capacity storage devices, high-power networking equipment, and high-power accelerators manufacturers. North America currently holds a top position in this market as a result of the number of hyper scale data centers and cloud computing infrastructure within North America. This market is growing at the fastest rate in the Asia-Pacific region due to the increased manufacturing capabilities as along with increased investments in IT Infrastructure within Asia-Pacific countries. Financial barriers and technological

There will thus be sustained strong growth in the market continuing into the future. The first significant growth will be in high-end enterprise applications, followed by incremental penetration into the mainstream computing, storage, and networking markets as these solutions become increasingly affordable and power efficient.

The retimer market represents an impressive segment of the semiconductor industry, which develops device technology to maintain signal integrity, or high-speed data signals. Retimers are primarily designed for serving high-performance computing, data centers, storage solutions, and advanced networking equipment to compensate for signals degrading or "attenuating", when used with either long-distance cabling or very high-bandwidth connectors. As the requirements of modern communication protocols (from PCIe 4.0/4.1 versions through PCIe 5.0 and in the near future CXL) increase in data rate over their predecessors, retimers will become increasingly necessary to achieving reliable and error free transmissions.

The rapid growth of cloud-based services, artificial intelligence and machine learning, and the explosion of big data are driving significant growth in the retimer market by creating a growing need for reliable, robust and high-speed interfaces. Additionally, the increasing demand for retiming technology from industries such as telecommunications, consumer electronics, automotive, and industrial applications will continue to provide momentum for growth in this marketplace.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The retimer market continues to grow in part due to the rapid expansion of hyperscale data centers and cloud infrastructure. As enterprises and cloud service providers (like AWS, Microsoft Azure and Google Cloud) increase their data center's size to meet the growing requirement for storage, computing power and Artificial Intelligence (AI) workloads, there is an increased need for more reliable high-speed interconnects. Retimers maintain signal integrity across long PCIe, CXL and the other high-speed interconnects and allow for error-free transmission of data between servers, storage devices, and networking equipment.

With the increase in data rates and the complexity of systems, traditional methods of signal amplification or equalization are not always capable of delivering reliable results, which is why retimers are essential in high-performance applications. With continued growth in cloud service utilization, deployment of hyperscale servers and the proliferation of AI, machine learning and big data workloads, there will be a substantial increase in the need for Retimers and subsequently, further highlight their value in the improved infrastructure of data centers.

The retimer market is determined by the growing emphasis on high-speed interconnect standards across all modern computing and communication systems, which require quick and dependable transfers of data. As new technologies gain popularity, such as cloud computing, artificial intelligence (AI), edge computing, and advanced networking, system designers are moving toward new generations of interfaces including PCI Express (PCIe) 5.0/6.0, USB4, CXL, and next generation Ethernet architectures. In addition to delivering higher bandwidth, hence an increase in overall throughput, many of these new standards present additional challenges associated with maintaining signal integrity across multiple boards, connectors, and wires for complex system-level designs. Therefore, retimers help solve the problems of signal degradation by regenerating signals, thus restoring the original quality of the signal; decreasing or eliminating jitter; and enhancing the reach of the signal.

Therefore, in order to meet stringent specifications for system performance, reduce latency, and maximize system dependability, the industries adopting multi-lane/high-speed topologies temporarily rely on retimers until the electrical characteristics of the components used within these systems meet the same level of system performance.

The PCIe (Peripheral Component Interconnect Express) segment is leading the worldwide retimer market with 45% revenue share in 2024 mainly due to its vital role in achieving accelerated and low-latency transmission of digital data across all types of computing/networking equipment. As the PCIe standards progress, (recently moving from PCIe 4.0 to 5.0 to now PCIe 6.0), the increasing requirement for higher bandwidth has increased dramatically in data centers, AI/ML accelerators, HPCs (high-performance networks), SSD (solid state drive) storage arrays, advanced graphics platforms, etc.

However, moving forward with higher-speed data rates creates additional challenges related to maintaining the quality of the signals transmitted-specifically issues concerning attenuation, jitter, and noise-especially over longer PCB traces and complex motherboards.

| Attribute | Detail |

|---|---|

| Leading Region |

|

North America held 38% market share in 2024 and has emerged as a leader in the worldwide retimer market primary due to the area's advanced technological capabilities, and increasing acceptance of high-speed networks. Many of the largest cloud services providers (CSPs) and hyper scale data centers (HSDCs) are located in North America, including but not limited to AWS, GCP, Microsoft, and Facebook, and these companies are aggressively upgrading their existing infrastructures to enable them to provide the required support for next-generation workloads such as Artificial Intelligence (AI), Machine Learning (ML), Big Data Analytics, and Advanced Networking (AN).

The demand for such applications places increasing demands on bandwidth and latency, resulting in widespread deployment of PCIe 5.0 and 6.0, CXL, USB 4, and High-Speed Ethernet Interfaces.

Key players operating in the retimer market are investing in technological advancements, innovation, and strategic partnerships. They emphasize expanding product portfolios and enhancing imaging clarity, thereby ascertaining sustained growth and leadership in the evolving healthcare landscape.

Astera Labs, Analogix Semiconductor, Intel Corporation, Texas Instruments, Broadcom, Marvell, Kandou Bus SA, Parade Technologies, Ltd, Diodes Incorporated, Montage Technology, Microchip Technology Inc, Renesas Electronics, and Rambus are the key players in global market.

Each of these players has been profiled in the retimer Industry research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 1.3 Bn |

| Forecast Value in 2035 | US$ 4.2 Bn |

| CAGR | 18% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Interface

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The retimer market was valued at US$ 1.3 Bn in 2024

The retimer market is projected to reach US$ 4.2 Bn by the end of 2035

Rapid expansion of hyperscale data centers and cloud infrastructure, adoption of high-speed interconnect standards are some of the driving factor of retimer market.

The CAGR is anticipated to be 18% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Astera Labs, Analogix Semiconductor, Intel Corporation, Texas Instruments, Broadcom, Marvell, Kandou Bus SA, Parade Technologies, Ltd, Diodes Incorporated, Montage Technology, Microchip Technology Inc, Renesas Electronics, Rambus and others.

Table 01: Global Retimer Market Value (US$ Bn) Forecast, by Interface, 2020 to 2035

Table 02: Global Retimer Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 03: Global Retimer Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 04: Global Retimer Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 05: Global Retimer Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 06: North America Retimer Market Value (US$ Bn) Forecast, by Interface, 2020 to 2035

Table 07: North America Retimer Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 08: North America Retimer Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 09: North America Retimer Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 10: North America Retimer Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 11: U.S. Retimer Market Value (US$ Bn) Forecast, by Interface, 2020 to 2035

Table 12: U.S. Retimer Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 13: U.S. Retimer Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 14: U.S. Retimer Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 15: Canada Retimer Market Value (US$ Bn) Forecast, by Interface, 2020 to 2035

Table 16: Canada Retimer Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 17: Canada Retimer Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 18: Canada Retimer Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 19: Europe Retimer Market Value (US$ Bn) Forecast, by Interface, 2020 to 2035

Table 20: Europe Retimer Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 21: Europe Retimer Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 22: Europe Retimer Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 23: Europe Retimer Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 24: Germany Retimer Market Value (US$ Bn) Forecast, by Interface, 2020 to 2035

Table 25: Germany Retimer Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 26: Germany Retimer Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 27: Germany Retimer Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 28: U.K. Retimer Market Value (US$ Bn) Forecast, by Interface, 2020 to 2035

Table 29: U.K. Retimer Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 30: U.K. Retimer Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 31: U.K. Retimer Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 32: France Retimer Market Value (US$ Bn) Forecast, by Interface, 2020 to 2035

Table 33: France Retimer Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 34: France Retimer Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 35: France Retimer Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 36: Italy Retimer Market Value (US$ Bn) Forecast, by Interface, 2020 to 2035

Table 37: Italy Retimer Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 38: Italy Retimer Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 39: Italy Retimer Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 40: Spain Retimer Market Value (US$ Bn) Forecast, by Interface, 2020 to 2035

Table 41: Spain Retimer Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 42: Spain Retimer Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 43: Spain Retimer Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 44: Switzerland Retimer Market Value (US$ Bn) Forecast, by Interface, 2020 to 2035

Table 45: Switzerland Retimer Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 46: Switzerland Retimer Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 47: Switzerland Retimer Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 48: The Netherlands Retimer Market Value (US$ Bn) Forecast, by Interface, 2020 to 2035

Table 49: The Netherlands Retimer Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 50: The Netherlands Retimer Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 51: The Netherlands Retimer Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 52: Rest of Europe Retimer Market Value (US$ Bn) Forecast, by Interface, 2020 to 2035

Table 53: Rest of Europe Retimer Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 54: Rest of Europe Retimer Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 55: Rest of Europe Retimer Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 56: Asia Pacific Retimer Market Value (US$ Bn) Forecast, by Interface, 2020 to 2035

Table 57: Asia Pacific Retimer Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 58: Asia Pacific Retimer Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 59: Asia Pacific Retimer Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 60: Asia Pacific Retimer Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 61: China Retimer Market Value (US$ Bn) Forecast, by Interface, 2020 to 2035

Table 62: China Retimer Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 63: China Retimer Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 64: China Retimer Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 65: Japan Retimer Market Value (US$ Bn) Forecast, by Interface, 2020 to 2035

Table 66: Japan Retimer Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 67: Japan Retimer Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 68: Japan Retimer Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 69: India Retimer Market Value (US$ Bn) Forecast, by Interface, 2020 to 2035

Table 70: India Retimer Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 71: India Retimer Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 72: India Retimer Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 73: South Korea Retimer Market Value (US$ Bn) Forecast, by Interface, 2020 to 2035

Table 74: South Korea Retimer Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 75: South Korea Retimer Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 76: South Korea Retimer Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 77: Australia and New Zealand Retimer Market Value (US$ Bn) Forecast, by Interface, 2020 to 2035

Table 78: Australia and New Zealand Retimer Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 79: Australia and New Zealand Retimer Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 80: Australia and New Zealand Retimer Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 81: Rest of Asia Pacific Retimer Market Value (US$ Bn) Forecast, by Interface, 2020 to 2035

Table 82: Rest of Asia Pacific Retimer Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 83: Rest of Asia Pacific Retimer Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 84: Rest of Asia Pacific Retimer Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 85: Latin America Retimer Market Value (US$ Bn) Forecast, by Interface, 2020 to 2035

Table 86: Latin America Retimer Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 87: Latin America Retimer Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 88: Latin America Retimer Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 89: Latin America Retimer Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 90: Brazil Retimer Market Value (US$ Bn) Forecast, by Interface, 2020 to 2035

Table 91: Brazil Retimer Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 92: Brazil Retimer Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 93: Brazil Retimer Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 94: Mexico Retimer Market Value (US$ Bn) Forecast, by Interface, 2020 to 2035

Table 95: Mexico Retimer Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 96: Mexico Retimer Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 97: Mexico Retimer Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 98: Argentina Retimer Market Value (US$ Bn) Forecast, by Interface, 2020 to 2035

Table 99: Argentina Retimer Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 100: Argentina Retimer Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 101: Argentina Retimer Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 102: Rest of Latin America Retimer Market Value (US$ Bn) Forecast, by Interface, 2020 to 2035

Table 103: Rest of Latin America Retimer Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 104: Rest of Latin America Retimer Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 105: Rest of Latin America Retimer Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 106: Middle East and Africa Retimer Market Value (US$ Bn) Forecast, by Interface, 2020 to 2035

Table 107: Middle East and Africa Retimer Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 108: Middle East and Africa Retimer Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 109: Middle East and Africa Retimer Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 110: Middle East and Africa Retimer Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 111: GCC Countries Retimer Market Value (US$ Bn) Forecast, by Interface, 2020 to 2035

Table 112: GCC Countries Retimer Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 113: GCC Countries Retimer Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 114: GCC Countries Retimer Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 115: South Africa Retimer Market Value (US$ Bn) Forecast, by Interface, 2020 to 2035

Table 116: South Africa Retimer Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 117: South Africa Retimer Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 118: South Africa Retimer Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 119: Rest of Middle East and Africa Retimer Market Value (US$ Bn) Forecast, by Interface, 2020 to 2035

Table 120: Rest of Middle East and Africa Retimer Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 121: Rest of Middle East and Africa Retimer Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 122: Rest of Middle East and Africa Retimer Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Figure 01: Global Retimer Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 02: Global Retimer Market Value Share Analysis, by Interface, 2024 and 2035

Figure 03: Global Retimer Market Attractiveness Analysis, by Interface, 2025 to 2035

Figure 04: Global Retimer Market Revenue (US$ Bn), by PCIe (Peripheral Component Interconnect Express), 2020 to 2035

Figure 05: Global Retimer Market Revenue (US$ Bn), by USB (Universal Serial Bus), 2020 to 2035

Figure 06: Global Retimer Market Revenue (US$ Bn), by CXL (Compute Express Link), 2020 to 2035

Figure 07: Global Retimer Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 08: Global Retimer Market Value Share Analysis, by Technology, 2024 and 2035

Figure 09: Global Retimer Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 10: Global Retimer Market Revenue (US$ Bn), by ASIC-based Retimers, 2020 to 2035

Figure 11: Global Retimer Market Revenue (US$ Bn), by FPGA-based Retimers, 2020 to 2035

Figure 12: Global Retimer Market Revenue (US$ Bn), by Silicon-based Retimers, 2020 to 2035

Figure 13: Global Retimer Market Value Share Analysis, by Application, 2024 and 2035

Figure 14: Global Retimer Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 15: Global Retimer Market Revenue (US$ Bn), by Servers, 2020 to 2035

Figure 16: Global Retimer Market Revenue (US$ Bn), by Storage Devices, 2020 to 2035

Figure 17: Global Retimer Market Revenue (US$ Bn), by Hardware Devices/Accessories, 2020 to 2035

Figure 18: Global Retimer Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 19: Global Retimer Market Value Share Analysis, by End-user, 2024 and 2035

Figure 20: Global Retimer Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 21: Global Retimer Market Revenue (US$ Bn), by IT & Telecommunications, 2020 to 2035

Figure 22: Global Retimer Market Revenue (US$ Bn), by Consumer Electronics, 2020 to 2035

Figure 23: Global Retimer Market Revenue (US$ Bn), by Automotive, 2020 to 2035

Figure 24: Global Retimer Market Revenue (US$ Bn), by Industrial/Healthcare, 2020 to 2035

Figure 25: Global Retimer Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 26: Global Retimer Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 27: Global Retimer Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 28: North America Retimer Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 29: North America Retimer Market Value Share Analysis, by Interface, 2024 and 2035

Figure 30: North America Retimer Market Attractiveness Analysis, by Interface, 2025 to 2035

Figure 31: North America Retimer Market Value Share Analysis, by Technology, 2024 and 2035

Figure 32: North America Retimer Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 33: North America Retimer Market Value Share Analysis, by Application, 2024 and 2035

Figure 34: North America Retimer Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 35: North America Retimer Market Value Share Analysis, by End-user, 2024 and 2035

Figure 36: North America Retimer Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 37: North America Retimer Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 38: North America Retimer Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 39: U.S. Retimer Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 40: U.S. Retimer Market Value Share Analysis, by Interface, 2024 and 2035

Figure 41: U.S. Retimer Market Attractiveness Analysis, by Interface, 2025 to 2035

Figure 42: U.S. Retimer Market Value Share Analysis, by Technology, 2024 and 2035

Figure 43: U.S. Retimer Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 44: U.S. Retimer Market Value Share Analysis, by Application, 2024 and 2035

Figure 45: U.S. Retimer Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 46: U.S. Retimer Market Value Share Analysis, by End-user, 2024 and 2035

Figure 47: U.S. Retimer Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 48: Canada Retimer Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 49: Canada Retimer Market Value Share Analysis, by Interface, 2024 and 2035

Figure 50: Canada Retimer Market Attractiveness Analysis, by Interface, 2025 to 2035

Figure 51: Canada Retimer Market Value Share Analysis, by Technology, 2024 and 2035

Figure 52: Canada Retimer Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 53: Canada Retimer Market Value Share Analysis, by Application, 2024 and 2035

Figure 54: Canada Retimer Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 55: Canada Retimer Market Value Share Analysis, by End-user, 2024 and 2035

Figure 56: Canada Retimer Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 57: Europe Retimer Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 58: Europe Retimer Market Value Share Analysis, by Interface, 2024 and 2035

Figure 59: Europe Retimer Market Attractiveness Analysis, by Interface, 2025 to 2035

Figure 60: Europe Retimer Market Value Share Analysis, by Technology, 2024 and 2035

Figure 61: Europe Retimer Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 62: Europe Retimer Market Value Share Analysis, by Application, 2024 and 2035

Figure 63: Europe Retimer Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 64: Europe Retimer Market Value Share Analysis, by End-user, 2024 and 2035

Figure 65: Europe Retimer Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 66: Europe Retimer Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 67: Europe Retimer Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 68: Germany Retimer Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 69: Germany Retimer Market Value Share Analysis, by Interface, 2024 and 2035

Figure 70: Germany Retimer Market Attractiveness Analysis, by Interface, 2025 to 2035

Figure 71: Germany Retimer Market Value Share Analysis, by Technology, 2024 and 2035

Figure 72: Germany Retimer Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 73: Germany Retimer Market Value Share Analysis, by Application, 2024 and 2035

Figure 74: Germany Retimer Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 75: Germany Retimer Market Value Share Analysis, by End-user, 2024 and 2035

Figure 76: Germany Retimer Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 77: U.K. Retimer Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 78: U.K. Retimer Market Value Share Analysis, by Interface, 2024 and 2035

Figure 79: U.K. Retimer Market Attractiveness Analysis, by Interface, 2025 to 2035

Figure 80: U.K. Retimer Market Value Share Analysis, by Technology, 2024 and 2035

Figure 81: U.K. Retimer Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 82: U.K. Retimer Market Value Share Analysis, by Application, 2024 and 2035

Figure 83: U.K. Retimer Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 84: U.K. Retimer Market Value Share Analysis, by End-user, 2024 and 2035

Figure 85: U.K. Retimer Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 86: France Retimer Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 87: France Retimer Market Value Share Analysis, by Interface, 2024 and 2035

Figure 88: France Retimer Market Attractiveness Analysis, by Interface, 2025 to 2035

Figure 89: France Retimer Market Value Share Analysis, by Technology, 2024 and 2035

Figure 90: France Retimer Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 91: France Retimer Market Value Share Analysis, by Application, 2024 and 2035

Figure 92: France Retimer Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 93: France Retimer Market Value Share Analysis, by End-user, 2024 and 2035

Figure 94: France Retimer Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 95: Italy Retimer Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 96: Italy Retimer Market Value Share Analysis, by Interface, 2024 and 2035

Figure 97: Italy Retimer Market Attractiveness Analysis, by Interface, 2025 to 2035

Figure 98: Italy Retimer Market Value Share Analysis, by Technology, 2024 and 2035

Figure 99: Italy Retimer Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 100: Italy Retimer Market Value Share Analysis, by Application, 2024 and 2035

Figure 101: Italy Retimer Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 102: Italy Retimer Market Value Share Analysis, by End-user, 2024 and 2035

Figure 103: Italy Retimer Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 104: Spain Retimer Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 105: Spain Retimer Market Value Share Analysis, by Interface, 2024 and 2035

Figure 106: Spain Retimer Market Attractiveness Analysis, by Interface, 2025 to 2035

Figure 107: Spain Retimer Market Value Share Analysis, by Technology, 2024 and 2035

Figure 108: Spain Retimer Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 109: Spain Retimer Market Value Share Analysis, by Application, 2024 and 2035

Figure 110: Spain Retimer Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 111: Spain Retimer Market Value Share Analysis, by End-user, 2024 and 2035

Figure 112: Spain Retimer Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 113: Switzerland Retimer Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 114: Switzerland Retimer Market Value Share Analysis, by Interface, 2024 and 2035

Figure 115: Switzerland Retimer Market Attractiveness Analysis, by Interface, 2025 to 2035

Figure 116: Switzerland Retimer Market Value Share Analysis, by Technology, 2024 and 2035

Figure 117: Switzerland Retimer Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 118: Switzerland Retimer Market Value Share Analysis, by Application, 2024 and 2035

Figure 119: Switzerland Retimer Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 120: Switzerland Retimer Market Value Share Analysis, by End-user, 2024 and 2035

Figure 121: Switzerland Retimer Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 122: The Netherlands Retimer Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 123: The Netherlands Retimer Market Value Share Analysis, by Interface, 2024 and 2035

Figure 124: The Netherlands Retimer Market Attractiveness Analysis, by Interface, 2025 to 2035

Figure 125: The Netherlands Retimer Market Value Share Analysis, by Technology, 2024 and 2035

Figure 126: The Netherlands Retimer Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 127: The Netherlands Retimer Market Value Share Analysis, by Application, 2024 and 2035

Figure 128: The Netherlands Retimer Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 129: The Netherlands Retimer Market Value Share Analysis, by End-user, 2024 and 2035

Figure 130: The Netherlands Retimer Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 131: Rest of Europe Retimer Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 132: Rest of Europe Retimer Market Value Share Analysis, by Interface, 2024 and 2035

Figure 133: Rest of Europe Retimer Market Attractiveness Analysis, by Interface, 2025 to 2035

Figure 134: Rest of Europe Retimer Market Value Share Analysis, by Technology, 2024 and 2035

Figure 135: Rest of Europe Retimer Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 136: Rest of Europe Retimer Market Value Share Analysis, by Application, 2024 and 2035

Figure 137: Rest of Europe Retimer Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 138: Rest of Europe Retimer Market Value Share Analysis, by End-user, 2024 and 2035

Figure 139: Rest of Europe Retimer Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 140: Asia Pacific Retimer Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 141: Asia Pacific Retimer Market Value Share Analysis, by Interface, 2024 and 2035

Figure 142: Asia Pacific Retimer Market Attractiveness Analysis, by Interface, 2025 to 2035

Figure 143: Asia Pacific Retimer Market Value Share Analysis, by Technology, 2024 and 2035

Figure 144: Asia Pacific Retimer Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 145: Asia Pacific Retimer Market Value Share Analysis, by Application, 2024 and 2035

Figure 146: Asia Pacific Retimer Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 147: Asia Pacific Retimer Market Value Share Analysis, by End-user, 2024 and 2035

Figure 148: Asia Pacific Retimer Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 149: Asia Pacific Retimer Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 150: Asia Pacific Retimer Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 151: China Retimer Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 152: China Retimer Market Value Share Analysis, by Interface, 2024 and 2035

Figure 153: China Retimer Market Attractiveness Analysis, by Interface, 2025 to 2035

Figure 154: China Retimer Market Value Share Analysis, by Technology, 2024 and 2035

Figure 155: China Retimer Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 156: China Retimer Market Value Share Analysis, by Application, 2024 and 2035

Figure 157: China Retimer Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 158: China Retimer Market Value Share Analysis, by End-user, 2024 and 2035

Figure 159: China Retimer Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 160: Japan Retimer Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 161: Japan Retimer Market Value Share Analysis, by Interface, 2024 and 2035

Figure 162: Japan Retimer Market Attractiveness Analysis, by Interface, 2025 to 2035

Figure 163: Japan Retimer Market Value Share Analysis, by Technology, 2024 and 2035

Figure 164: Japan Retimer Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 165: Japan Retimer Market Value Share Analysis, by Application, 2024 and 2035

Figure 166: Japan Retimer Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 167: Japan Retimer Market Value Share Analysis, by End-user, 2024 and 2035

Figure 168: Japan Retimer Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 169: India Retimer Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 170: India Retimer Market Value Share Analysis, by Interface, 2024 and 2035

Figure 171: India Retimer Market Attractiveness Analysis, by Interface, 2025 to 2035

Figure 172: India Retimer Market Value Share Analysis, by Technology, 2024 and 2035

Figure 173: India Retimer Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 174: India Retimer Market Value Share Analysis, by Application, 2024 and 2035

Figure 175: India Retimer Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 176: India Retimer Market Value Share Analysis, by End-user, 2024 and 2035

Figure 177: India Retimer Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 178: South Korea Retimer Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 179: South Korea Retimer Market Value Share Analysis, by Interface, 2024 and 2035

Figure 180: South Korea Retimer Market Attractiveness Analysis, by Interface, 2025 to 2035

Figure 181: South Korea Retimer Market Value Share Analysis, by Technology, 2024 and 2035

Figure 182: South Korea Retimer Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 183: South Korea Retimer Market Value Share Analysis, by Application, 2024 and 2035

Figure 184: South Korea Retimer Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 185: South Korea Retimer Market Value Share Analysis, by End-user, 2024 and 2035

Figure 186: South Korea Retimer Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 187: Australia and New Zealand Retimer Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 188: Australia and New Zealand Retimer Market Value Share Analysis, by Interface, 2024 and 2035

Figure 189: Australia and New Zealand Retimer Market Attractiveness Analysis, by Interface, 2025 to 2035

Figure 190: Australia and New Zealand Retimer Market Value Share Analysis, by Technology, 2024 and 2035

Figure 191: Australia and New Zealand Retimer Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 192: Australia and New Zealand Retimer Market Value Share Analysis, by Application, 2024 and 2035

Figure 193: Australia and New Zealand Retimer Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 194: Australia and New Zealand Retimer Market Value Share Analysis, by End-user, 2024 and 2035

Figure 195: Australia and New Zealand Retimer Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 196: Rest of Asia Pacific Retimer Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 197: Rest of Asia Pacific Retimer Market Value Share Analysis, by Interface, 2024 and 2035

Figure 198: Rest of Asia Pacific Retimer Market Attractiveness Analysis, by Interface, 2025 to 2035

Figure 199: Rest of Asia Pacific Retimer Market Value Share Analysis, by Technology, 2024 and 2035

Figure 200: Rest of Asia Pacific Retimer Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 201: Rest of Asia Pacific Retimer Market Value Share Analysis, by Application, 2024 and 2035

Figure 202: Rest of Asia Pacific Retimer Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 203: Rest of Asia Pacific Retimer Market Value Share Analysis, by End-user, 2024 and 2035

Figure 204: Rest of Asia Pacific Retimer Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 205: Latin America Retimer Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 206: Latin America Retimer Market Value Share Analysis, by Interface, 2024 and 2035

Figure 207: Latin America Retimer Market Attractiveness Analysis, by Interface, 2025 to 2035

Figure 208: Latin America Retimer Market Value Share Analysis, by Technology, 2024 and 2035

Figure 209: Latin America Retimer Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 210: Latin America Retimer Market Value Share Analysis, by Application, 2024 and 2035

Figure 211: Latin America Retimer Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 212: Latin America Retimer Market Value Share Analysis, by End-user, 2024 and 2035

Figure 213: Latin America Retimer Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 214: Latin America Retimer Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 215: Latin America Retimer Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 216: Brazil Retimer Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 217: Brazil Retimer Market Value Share Analysis, by Interface, 2024 and 2035

Figure 218: Brazil Retimer Market Attractiveness Analysis, by Interface, 2025 to 2035

Figure 219: Brazil Retimer Market Value Share Analysis, by Technology, 2024 and 2035

Figure 220: Brazil Retimer Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 221: Brazil Retimer Market Value Share Analysis, by Application, 2024 and 2035

Figure 222: Brazil Retimer Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 223: Brazil Retimer Market Value Share Analysis, by End-user, 2024 and 2035

Figure 224: Brazil Retimer Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 225: Mexico Retimer Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 226: Mexico Retimer Market Value Share Analysis, by Interface, 2024 and 2035

Figure 227: Mexico Retimer Market Attractiveness Analysis, by Interface, 2025 to 2035

Figure 228: Mexico Retimer Market Value Share Analysis, by Technology, 2024 and 2035

Figure 229: Mexico Retimer Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 230: Mexico Retimer Market Value Share Analysis, by Application, 2024 and 2035

Figure 231: Mexico Retimer Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 232: Mexico Retimer Market Value Share Analysis, by End-user, 2024 and 2035

Figure 233: Mexico Retimer Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 234: Argentina Retimer Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 235: Argentina Retimer Market Value Share Analysis, by Interface, 2024 and 2035

Figure 236: Argentina Retimer Market Attractiveness Analysis, by Interface, 2025 to 2035

Figure 237: Argentina Retimer Market Value Share Analysis, by Technology, 2024 and 2035

Figure 238: Argentina Retimer Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 239: Argentina Retimer Market Value Share Analysis, by Application, 2024 and 2035

Figure 240: Argentina Retimer Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 241: Argentina Retimer Market Value Share Analysis, by End-user, 2024 and 2035

Figure 242: Argentina Retimer Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 243: Rest of Latin America Retimer Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 244: Rest of Latin America Retimer Market Value Share Analysis, by Interface, 2024 and 2035

Figure 245: Rest of Latin America Retimer Market Attractiveness Analysis, by Interface, 2025 to 2035

Figure 246: Rest of Latin America Retimer Market Value Share Analysis, by Technology, 2024 and 2035

Figure 247: Rest of Latin America Retimer Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 248: Rest of Latin America Retimer Market Value Share Analysis, by Application, 2024 and 2035

Figure 249: Rest of Latin America Retimer Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 250: Rest of Latin America Retimer Market Value Share Analysis, by End-user, 2024 and 2035

Figure 251: Rest of Latin America Retimer Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 252: Middle East and Africa Retimer Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 253: Middle East and Africa Retimer Market Value Share Analysis, by Interface, 2024 and 2035

Figure 254: Middle East and Africa Retimer Market Attractiveness Analysis, by Interface, 2025 to 2035

Figure 255: Middle East and Africa Retimer Market Value Share Analysis, by Technology, 2024 and 2035

Figure 256: Middle East and Africa Retimer Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 257: Middle East and Africa Retimer Market Value Share Analysis, by Application, 2024 and 2035

Figure 258: Middle East and Africa Retimer Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 259: Middle East and Africa Retimer Market Value Share Analysis, by End-user, 2024 and 2035

Figure 260: Middle East and Africa Retimer Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 261: Middle East and Africa Retimer Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 262: Middle East and Africa Retimer Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 263: GCC Countries Retimer Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 264: GCC Countries Retimer Market Value Share Analysis, by Interface, 2024 and 2035

Figure 265: GCC Countries Retimer Market Attractiveness Analysis, by Interface, 2025 to 2035

Figure 266: GCC Countries Retimer Market Value Share Analysis, by Technology, 2024 and 2035

Figure 267: GCC Countries Retimer Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 268: GCC Countries Retimer Market Value Share Analysis, by Application, 2024 and 2035

Figure 269: GCC Countries Retimer Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 270: GCC Countries Retimer Market Value Share Analysis, by End-user, 2024 and 2035

Figure 271: GCC Countries Retimer Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 272: South Africa Retimer Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 273: South Africa Retimer Market Value Share Analysis, by Interface, 2024 and 2035

Figure 274: South Africa Retimer Market Attractiveness Analysis, by Interface, 2025 to 2035

Figure 275: South Africa Retimer Market Value Share Analysis, by Technology, 2024 and 2035

Figure 276: South Africa Retimer Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 277: South Africa Retimer Market Value Share Analysis, by Application, 2024 and 2035

Figure 278: South Africa Retimer Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 279: South Africa Retimer Market Value Share Analysis, by End-user, 2024 and 2035

Figure 280: South Africa Retimer Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 281: Rest of Middle East and Africa Retimer Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 282: Rest of Middle East and Africa Retimer Market Value Share Analysis, by Interface, 2024 and 2035

Figure 283: Rest of Middle East and Africa Retimer Market Attractiveness Analysis, by Interface, 2025 to 2035

Figure 284: Rest of Middle East and Africa Retimer Market Value Share Analysis, by Technology, 2024 and 2035

Figure 285: Rest of Middle East and Africa Retimer Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 286: Rest of Middle East and Africa Retimer Market Value Share Analysis, by Application, 2024 and 2035

Figure 287: Rest of Middle East and Africa Retimer Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 288: Rest of Middle East and Africa Retimer Market Value Share Analysis, by End-user, 2024 and 2035

Figure 289: Rest of Middle East and Africa Retimer Market Attractiveness Analysis, by End-user, 2025 to 2035