Reports

Reports

The AI (Artificial Intelligence)-driven COVID-19 drug discovery is gaining increased popularity in the respiratory virus infection drugs market. Since the coronavirus has become an international health concern, there has been an unprecedented demand for drugs and vaccines. As such, AI holds promising potentials in quick identification of COVID-19 drugs. Thus, companies in the respiratory virus infection drugs market are collaborating with scientists and researchers to predict drugs and peptides that can be used as therapeutic medication for coronavirus treatment.

Pharmaceutical companies are increasing efforts to predict drugs directly from the sequences of infected patients, since they have a better affinity with the target. However, companies need to accelerate their testing capabilities in order to verify safety and feasibility to combat COVID-19. Intelligent algorithms based on machine learning (ML) and Big Data are supporting molecular applications.

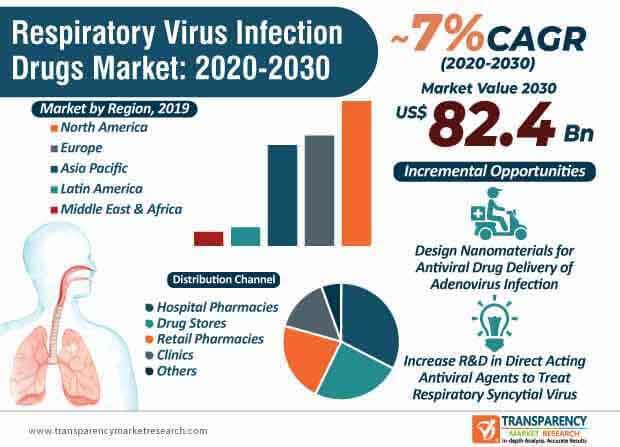

The respiratory virus infection drugs market is expected to surpass a value of US$ 82.4 Bn by the end of 2030. However, individuals are becoming increasingly aware about the disadvantages and side effects of influenza drugs, namely favipiravir and baloxavir. Pharma companies need to address low solubility of favipiravir in aqueous media, which may reduce its efficacy in vitro. This indicates that pharma companies need to increase their R&D activities to prevent adverse events of drugs.

Pharma companies are focusing on discoveries in influenza virus polymerase complex. It has been found that influenza viruses are severe human pathogens that pose as a persistent threat to public health. Hence, companies in the respiratory virus infection drugs market are capitalizing on this issue to increase their R&D in influenza virus polymerase complex.

Companies in the respiratory virus infection drugs market are increasing their focus in nanomaterials designed for antiviral drug delivery of adenovirus infection. This has become important, since respiratory virus infections have become a global health problem causing a significant amount of mortality and morbidity in individuals. Emerging drug resistance and constant viral replication have led to the demand for nanotechnology in antiviral therapies, as nanomaterials offer unique physic-chemical properties ideal for the treatment of adenovirus infection.

Different nanomaterials such as nanosheres, liposomes, nanoparticles, nanogels, and the likes hold promising potentials for efficacious drug administration in order to improve patient outcomes. Companies in the respiratory virus infection drugs market are innovating in nanosuspensions and nanoemulsions to enable drug delivery of unique antiviral agents with prospects in clinical practice.

The COVID-19 pandemic has brought startups in the respiratory virus infection drugs market under great emphasis. For instance, Vir Biotechnology— a specialist in immune therapeutics, is leveraging the advantages of AI and ML in influenza drug development. It has been found that infectious diseases have increased resistance to antibiotics. Startups in the respiratory virus infection drugs market are capitalizing on this opportunity to integrate AI and ML in common cold and influenza drug development.

In order to broaden their revenue streams, the U.S.-based tech startups are working on solutions to address antibiotic resistance in certain strains of influenza A, SARS-CoV-2, and tuberculosis. They are adopting a multi-program and multi-platform approach to develop successful candidates in order to tackle antibiotic resistance. Manufacturers are innovating in antibody platforms and T cell platforms to isolate rare antibodies and use them to boost the immune system.

The respiratory syncytial virus (RSV) is being associated with limited treatment options, resulting in millions of hospitalizations per year. Palivizumab, a monoclonal antibody, is considered as the gold standard for prophylaxis in high-risk infants. However, palivizumab and ribavirin are prone to limited efficacy and significant safety concerns. Hence, manufacturers in the respiratory virus infection drugs market are increasing their research in direct acting antiviral agents (DAAs) to target key steps in the viral life cycle.

It has been found that DAAs are producing landmark clinical studies, which involve nucleoside inhibitors. On the other hand, non-nucleoside inhibitors of replication are being reviewed in addition to inhibitors of other mechanisms. As such, pharma companies in the respiratory virus infection drugs market are taking giant strides in R&D pertaining to viral proteins or host cell factors for inhibition of viral replication.

In vitro and in vivo model systems of the RSV disease are being highlighted in order to create novel drug targets. Companies in the respiratory virus infection drugs market are expanding their treatment options for lower respiratory tract infections (LRTI). For instance, Sanofi— a global biopharmaceutical company, announced that it received positive Phase 2b trial for nirsevimab, since it showed significant decline in medically attended lower respiratory tract infections. This involves increased hospitalization caused due to RSV in healthy preterm infants.

Single dose monoclonal antibodies are found to significantly reduce medically attended RSV LRTI infants through the full RSV season. Nirsevimad is being highly publicized as an extended half-life RSV monoclonal antibody. Companies are entering into strategic partnerships to innovate in treatments for LRTI in infants. Nirsevimab is gaining popularity as the new standard of care by offering innovative immunization for immediate and sustained protection for all infants during the first season of RSV.

Companies in the respiratory virus infection drugs market are increasing their production capabilities for anti-influenza drugs. Pharma companies in the respiratory virus infection drugs market are developing inhibitors of influenza virus polymerase, which are among the most promising types of drugs. Favipiravir and boloxavir are being approved for influenza treatment in Japan and the U.S. It has been found that favipiravir effectively and selectively inhibits the RNA dependent RNA polymerase of RNA viruses.

Analysts’ Viewpoint

Sustainable pharmaceutical innovations in COVID-19 treatment hold promising potentials for other infectious diseases. Thus, the respiratory virus infection drugs market is estimated to grow at a healthy CAGR of ~7% during the assessment period. However, the issue of drug resistance in case of constant mutation of influenza virus is impacting market growth. Hence, pharma companies should conduct a sustained surveillance of the drug susceptibility of influenza viruses. Moreover, limited efficacy of influenza vaccines and drug resistance from small molecule antiviral drugs have led to the demand for new antivirals with novel mode of action.

Respiratory virus infection drugs market is expected to surpass a value of US$ 82.4 Bn by the end of 2030

Respiratory virus infection drugs market is projected to expand at a CAGR of ~7% from 2020 to 2030

Respiratory virus infection drugs market is driven by increase in focus on research & development, steady rise in prevalence of respiratory virus infections across the globe

North America dominated the global respiratory virus infection drugs market and the trend is anticipated to continue during the forecast period

Key players in the global respiratory virus infection drugs market include GlaxoSmithKline plc, Merck & Co., Inc., AstraZeneca, Boehringer Ingelheim International GmbH, F. Hoffmann-La Roche Ltd.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Respiratory Virus Infection Drugs Market

4. Market Overview

4.1. Introduction

4.1.1. Drug Type Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Respiratory Virus Infection Drugs Market Analysis and Forecast, 2018–2030

5. Key Insights

5.1. Healthcare Industry Overview

5.2. Pipeline Analysis (asthma and COPD)

5.3. Regulatory Scenario

5.4. Disease Prevalence Rate in Key Countries

5.5. Key Market Events

5.6. COVID-19 Pandemic Impact on Industry

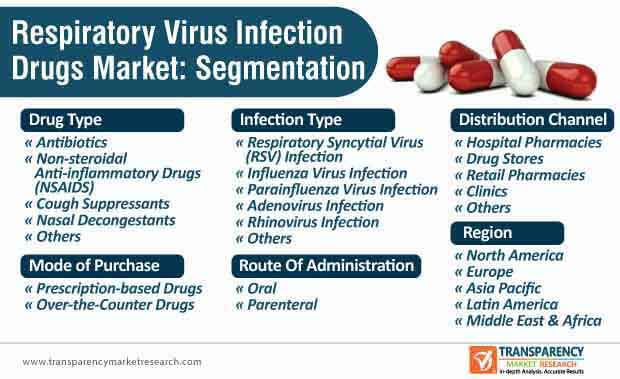

6. Global Respiratory Virus Infection Drugs Market Analysis and Forecast, by Drug Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Drug Type, 2018–2030

6.3.1. Antibiotics

6.3.2. Non-steroidal Anti-inflammatory Drugs (NSAIDS)

6.3.3. Cough Suppressants

6.3.4. Nasal Decongestants

6.3.5. Others

6.4. Market Attractiveness Analysis, by Drug Type

7. Global Respiratory Virus Infection Drugs Market Analysis and Forecast, by Infection Type

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Infection Type, 2018–2030

7.3.1. Respiratory Syncytial Virus (RSV) Infection

7.3.2. Influenza Virus Infection

7.3.3. Parainfluenza Virus Infection

7.3.4. Adenovirus Infection

7.3.5. Rhinovirus Infection

7.3.6. Others

7.4. Market Attractiveness Analysis, by Infection Type

8. Global Respiratory Virus Infection Drugs Market Analysis and Forecast, by Route of Administration

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Route of Administration, 2018–2030

8.3.1. Oral

8.3.2. Parenteral

8.4. Market Attractiveness Analysis, by Route of Administration

9. Global Respiratory Virus Infection Drugs Market Analysis and Forecast, by Mode of Purchase

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast, by Mode of Purchase, 2018–2030

9.3.1. Prescription-based Drugs

9.3.2. Over-the-Counter Drugs

9.4. Market Attractiveness Analysis, by Mode of Purchase

10. Global Respiratory Virus Infection Drugs Market Analysis and Forecast, by Distribution Channel

10.1. Introduction & Definition

10.2. Key Findings / Developments

10.3. Market Value Forecast, by Distribution Channel, 2018–2030

10.3.1. Hospital Pharmacies

10.3.2. Drug Stores

10.3.3. Retail Pharmacies

10.3.4. Clinics

10.3.5. Others

10.4. Market Attractiveness Analysis, by Distribution Channel

11. Global Respiratory Virus Infection Drugs Market Analysis and Forecast, by Region

11.1. Key Findings

11.2. Market Value Forecast, by Region

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Latin America

11.2.5. Middle East & Africa

11.3. Market Attractiveness Analysis, by Country/Region

12. North America Respiratory Virus Infection Drugs Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Drug Type, 2018–2030

12.2.1. Antibiotics

12.2.2. Non-steroidal Anti-inflammatory Drugs (NSAIDS)

12.2.3. Cough Suppressants

12.2.4. Nasal Decongestants

12.2.5. Others

12.3. Market Value Forecast, by Infection Type, 2018–2030

12.3.1. Respiratory syncytial viruses (RSV) Infection

12.3.2. Influenza Virus Infection

12.3.3. Parainfluenza Virus Infection

12.3.4. Adenovirus Infection

12.3.5. Rhinovirus Infection

12.3.6. Others

12.4. Market Value Forecast, by Route of Administration, 2018–2030

12.4.1. Oral

12.4.2. Parenteral

12.5. Market Value Forecast, by Mode of Purchase, 2018–2030

12.5.1. Prescription-based Drugs

12.5.2. Over-the-Counter Drugs

12.6. Market Value Forecast, by Distribution Channel, 2018–2030

12.6.1. Hospital Pharmacies

12.6.2. Drug Stores

12.6.3. Retail Pharmacies

12.6.4. Clinics

12.6.5. Others

12.7. Market Value Forecast, by Country, 2018–2030

12.7.1. U.S.

12.7.2. Canada

12.8. Market Attractiveness Analysis

12.8.1. By Drug Type

12.8.2. By Infection Type

12.8.3. By Route Of Administration

12.8.4. By Mode of Purchase

12.8.5. By Distribution Channel

12.8.6. By Country

13. Europe Respiratory Virus Infection Drugs Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Drug Type, 2018–2030

13.2.1. Antibiotics

13.2.2. Non-steroidal Anti-inflammatory Drugs (NSAIDS)

13.2.3. Cough Suppressants

13.2.4. Nasal Decongestants

13.2.5. Others

13.3. Market Value Forecast, by Infection Type, 2018–2030

13.3.1. Respiratory Syncytial Virus (RSV) Infection

13.3.2. Influenza Virus Infection

13.3.3. Parainfluenza Virus Infection

13.3.4. Adenovirus Infection

13.3.5. Rhinovirus Infection

13.3.6. Others

13.4. Market Value Forecast, by Route of Administration, 2018–2030

13.4.1. Oral

13.4.2. Parenteral

13.5. Market Value Forecast, by Mode of Purchase, 2018–2030

13.5.1. Prescription-based Drugs

13.5.2. Over-the-Counter Drugs

13.6. Market Value Forecast, by Distribution Channel, 2018–2030

13.6.1. Hospital Pharmacies

13.6.2. Drug Stores

13.6.3. Retail Pharmacies

13.6.4. Clinics

13.6.5. Others

13.7. Market Value Forecast, by Country/Sub-region, 2018–2030

13.7.1. Germany

13.7.2. U.K.

13.7.3. France

13.7.4. Spain

13.7.5. Italy

13.7.6. Rest of Europe

13.8. Market Attractiveness Analysis

13.8.1. By Drug Type

13.8.2. By Infection Type

13.8.3. By Route Of Administration

13.8.4. By Mode of Purchase

13.8.5. By Distribution Channel

13.8.6. By Country/Sub-region

14. Asia Pacific Respiratory Virus Infection Drugs Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Drug Type, 2018–2030

14.2.1. Antibiotics

14.2.2. Non-steroidal Anti-inflammatory Drugs (NSAIDS)

14.2.3. Cough Suppressants

14.2.4. Nasal Decongestants

14.2.5. Others

14.3. Market Value Forecast, by Infection Type, 2018–2030

14.3.1. Respiratory Syncytial Virus (RSV) Infection

14.3.2. Influenza Virus Infection

14.3.3. Parainfluenza Virus Infection

14.3.4. Adenovirus Infection

14.3.5. Rhinovirus Infection

14.3.6. Others

14.4. Market Value Forecast, by Route Of Administration, 2018–2030

14.4.1. Oral

14.4.2. Parenteral

14.5. Market Value Forecast, by Mode of Purchase, 2018–2030

14.5.1. Prescription-based Drugs

14.5.2. Over-the-Counter Drugs

14.6. Market Value Forecast, by Distribution Channel, 2018–2030

14.6.1. Hospital Pharmacies

14.6.2. Drug Stores

14.6.3. Retail Pharmacies

14.6.4. Clinics

14.6.5. Others

14.7. Market Value Forecast, by Country/Sub-region, 2018–2030

14.7.1. China

14.7.2. Japan

14.7.3. India

14.7.4. Australia & New Zealand

14.7.5. Rest of Asia Pacific

14.8. Market Attractiveness Analysis

14.8.1. By Drug Type

14.8.2. By Infection Type

14.8.3. By Route of Administration

14.8.4. By Mode of Purchase

14.8.5. By Distribution Channel

14.8.6. By Country/Sub-region

15. Latin America Respiratory Virus Infection Drugs Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Drug Type, 2018–2030

15.2.1. Antibiotics

15.2.2. Non-steroidal Anti-inflammatory Drugs (NSAIDS)

15.2.3. Cough Suppressants

15.2.4. Nasal Decongestants

15.2.5. Others

15.3. Market Value Forecast, by Infection Type, 2018–2030

15.3.1. Respiratory Syncytial Virus (RSV) Infection

15.3.2. Influenza Virus Infection

15.3.3. Parainfluenza Virus Infection

15.3.4. Adenovirus Infection

15.3.5. Rhinovirus Infection

15.3.6. Others

15.4. Market Value Forecast, by Route of Administration, 2018–2030

15.4.1. Oral

15.4.2. Parenteral

15.5. Market Value Forecast, by Mode of Purchase, 2018–2030

15.5.1. Prescription-based Drugs

15.5.2. Over-the-Counter Drugs

15.6. Market Value Forecast, by Distribution Channel, 2018–2030

15.6.1. Hospital Pharmacies

15.6.2. Drug Stores

15.6.3. Retail Pharmacies

15.6.4. Clinics

15.6.5. Others

15.7. Market Value Forecast, by Country/Sub-region, 2018–2030

15.7.1. Brazil

15.7.2. Mexico

15.7.3. Rest of Latin America

15.8. Market Attractiveness Analysis

15.8.1. By Drug Type

15.8.2. By Infection Type

15.8.3. By Route of Administration

15.8.4. By Mode of Purchase

15.8.5. By Distribution Channel

15.8.6. By Country/Sub-region

16. Middle East & Africa Respiratory Virus Infection Drugs Market Analysis and Forecast

16.1. Introduction

16.1.1. Key Findings

16.2. Market Value Forecast, by Drug Type, 2018–2030

16.2.1. Antibiotics

16.2.2. Non-steroidal Anti-inflammatory Drugs (NSAIDS)

16.2.3. Cough Suppressants

16.2.4. Nasal Decongestants

16.2.5. Others

16.3. Market Value Forecast, by Infection Type, 2018–2030

16.3.1. Respiratory Syncytial Virus (RSV) Infection

16.3.2. Influenza Virus Infection

16.3.3. Parainfluenza Virus Infection

16.3.4. Adenovirus Infection

16.3.5. Rhinovirus Infection

16.3.6. Others

16.4. Market Value Forecast, by Route of Administration, 2018–2030

16.4.1. Oral

16.4.2. Parenteral

16.5. Market Value Forecast, by Mode of Purchase, 2018–2030

16.5.1. Prescription-based Drugs

16.5.2. Over-the-Counter Drugs

16.6. Market Value Forecast, by Distribution Channel, 2018–2030

16.6.1. Hospital Pharmacies

16.6.2. Drug Stores

16.6.3. Retail Pharmacies

16.6.4. Clinics

16.6.5. Others

16.7. Market Value Forecast, by Country/Sub-region, 2018–2030

16.7.1. GCC Countries

16.7.2. South Africa

16.7.3. Rest of Middle East & Africa

16.8. Market Attractiveness Analysis

16.8.1. By Drug Type

16.8.2. By Infection Type

16.8.3. By Route of Administration

16.8.4. By Mode of Purchase

16.8.5. By Distribution Channel

16.8.6. By Country/Sub-region

17. Competition Landscape

17.1. Market Player - Competition Matrix (by tier and size of companies)

17.2. Market Share Analysis/Ranking, by Company, 2019

17.3. Company Profiles

17.3.1. GlaxoSmithKline plc

17.3.1.1. Company Overview

17.3.1.2. Company Financials

17.3.1.3. Growth Strategies

17.3.1.4. SWOT Analysis

17.3.2. Merck & Co., Inc.

17.3.2.1. Company Overview

17.3.2.2. Company Financials

17.3.2.3. Growth Strategies

17.3.2.4. SWOT Analysis

17.3.3. AstraZeneca

17.3.3.1. Company Overview

17.3.3.2. Company Financials

17.3.3.3. Growth Strategies

17.3.3.4. SWOT Analysis

17.3.4. Boehringer Ingelheim International GmbH

17.3.4.1. Company Overview

17.3.4.2. Company Financials

17.3.4.3. Growth Strategies

17.3.4.4. SWOT Analysis

17.3.5. F. Hoffmann-La Roche Ltd.

17.3.5.1. Company Overview

17.3.5.2. Company Financials

17.3.5.3. Growth Strategies

17.3.5.4. SWOT Analysis

17.3.6. Teva Pharmaceutical Industries Ltd.

17.3.6.1. Company Overview

17.3.6.2. Company Financials

17.3.6.3. Growth Strategies

17.3.6.4. SWOT Analysis

17.3.7. Sanofi

17.3.7.1. Company Overview

17.3.7.2. Company Financials

17.3.7.3. Growth Strategies

17.3.7.4. SWOT Analysis

17.3.8. Cipla, Inc.

17.3.8.1. Company Overview

17.3.8.2. Company Financials

17.3.8.3. Growth Strategies

17.3.8.4. SWOT Analysis

17.3.9. CHIESI Farmaceutici S.p.A.

17.3.9.1. Company Overview

17.3.9.2. Company Financials

17.3.9.3. Growth Strategies

17.3.9.4. SWOT Analysis

17.3.10. Orion Corporation

17.3.10.1. Company Overview

17.3.10.2. Growth Strategies

17.3.10.3. SWOT Analysis

List of Tables

Table 01: Global Respiratory Virus Infection Drugs Market Value (US$ Mn) Forecast, by Drug Type, 2018–2030

Table 02: Global Respiratory Virus Infection Drugs Market Value (US$ Mn) Forecast, by Infection Type, 2018–2030

Table 03: Global Respiratory Virus Infection Drugs Market Value (US$ Mn) Forecast, by Route of Administration, 2018–2030

Table 04: Global Respiratory Virus Infection Drugs Market Value (US$ Mn) Forecast, by Drug Type, 2018–2030

Table 05: Global Respiratory Virus Infection Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2018–2030

Table 06: Global Respiratory Virus Infection Drugs Market Value (US$ Mn) Forecast, by Region, 2018–2030

Table 07: North America Respiratory Virus Infection Drugs Market Revenue (US$ Mn) Forecast, by Country, 2018–2030

Table 08: North America Respiratory Virus Infection Drugs Market Value (US$ Mn) Forecast, by Drug Type, 2018–2030

Table 09: North America Respiratory Virus Infection Drugs Market Value (US$ Mn) Forecast, by Infection Type, 2018–2030

Table 10: North America Respiratory Virus Infection Drugs Market Value (US$ Mn) Forecast, by Route of Administration, 2018–2030

Table 11: North America Respiratory Virus Infection Drugs Market Value (US$ Mn) Forecast, by Mode of Purchase, 2018–2030

Table 12: North America Respiratory Virus Infection Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2018–2030

Table 13: Europe Respiratory Virus Infection Drugs Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

Table 14: Europe Respiratory Virus Infection Drugs Market Value (US$ Mn) Forecast, by Drug Type, 2018–2030

Table 15: Europe Respiratory Virus Infection Drugs Market Value (US$ Mn) Forecast, by Infection Type, 2018–2030

Table 16: Europe Respiratory Virus Infection Drugs Market Value (US$ Mn) Forecast, by Route of Administration, 2018–2030

Table 17: Europe Respiratory Virus Infection Drugs Market Value (US$ Mn) Forecast, by Mode of Purchase, 2018–2030

Table 18: Europe Respiratory Virus Infection Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2018–2030

Table 19: Asia Pacific Respiratory Virus Infection Drugs Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

Table 20: Asia Pacific Respiratory Virus Infection Drugs Market Value (US$ Mn) Forecast, by Drug Type, 2018–2030

Table 21: Asia Pacific Respiratory Virus Infection Drugs Market Value (US$ Mn) Forecast, by Infection Type, 2018–2030

Table 22: Asia Pacific Respiratory Virus Infection Drugs Market Value (US$ Mn) Forecast, by Route of Administration, 2018–2030

Table 23: Asia Pacific Respiratory Virus Infection Drugs Market Value (US$ Mn) Forecast, by Mode of Purchase, 2018–2030

Table 24: Asia Pacific Respiratory Virus Infection Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2018–2030

Table 25: Latin America Respiratory Virus Infection Drugs Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

Table 26: Latin America Respiratory Virus Infection Drugs Market Value (US$ Mn) Forecast, by Drug Type, 2018–2030

Table 27: Latin America Respiratory Virus Infection Drugs Market Value (US$ Mn) Forecast, by Infection Type, 2018–2030

Table 28: Latin America Respiratory Virus Infection Drugs Market Value (US$ Mn) Forecast, by Route of Administration, 2018–2030

Table 29: Latin America Respiratory Virus Infection Drugs Market Value (US$ Mn) Forecast, by Mode of Purchase, 2018–2030

Table 30: Latin America Respiratory Virus Infection Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2018–2030

Table 31: Middle East & Africa Respiratory Virus Infection Drugs Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

Table 32: Middle East & Africa Respiratory Virus Infection Drugs Market Value (US$ Mn) Forecast, by Drug Type, 2018–2030

Table 33: Middle East & Africa Respiratory Virus Infection Drugs Market Value (US$ Mn) Forecast, by Infection Type, 2018–2030

Table 34: Middle East & Africa Respiratory Virus Infection Drugs Market Value (US$ Mn) Forecast, by Route of Administration, 2018–2030

Table 35: Middle East & Africa Respiratory Virus Infection Drugs Market Value (US$ Mn) Forecast, by Mode of Purchase, 2018–2030

Table 36: Middle East & Africa Respiratory Virus Infection Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2018–2030

List of Figures

Figure 01: Global Respiratory Virus Infection Drugs Market Value (US$ Mn) Forecast, 2018–2030

Figure 02: Global Respiratory Virus Infection Drugs Market Value Share, by Drug Type, 2019

Figure 03: Global Respiratory Virus Infection Drugs Market Value Share, by Infection Type, 2019

Figure 04: Global Respiratory Virus Infection Drugs Market Value Share, by Route of Administration, 2019

Figure 05: Global Respiratory Virus Infection Drugs Market Value Share, by Mode of Purchase, 2019

Figure 06: Global Respiratory Virus Infection Drugs Market Value Share, by Distribution Channel, 2019

Figure 07: Global Respiratory Virus Infection Drugs Market Value Share, by Region, 2019

Figure 08: Global Respiratory Virus Infection Drugs Market Value Share Analysis, by Drug Type, 2019 and 2030

Figure 09: Global Respiratory Virus Infection Drugs Market Attractiveness Analysis, by Drug Type, 2020–2030

Figure 10: Global Respiratory Virus Infection Drugs Market Revenue (US$ Mn), by Antibiotics, 2018–2030

Figure 11: Global Respiratory Virus Infection Drugs Market Revenue (US$ Mn), by Non-steroidal Anti-inflammatory Drugs (NSAIDS), 2018–2030

Figure 12: Global Respiratory Virus Infection Drugs Market Revenue (US$ Mn), by Cough Suppressants, 2018–2030

Figure 13: Global Respiratory Virus Infection Drugs Market Revenue (US$ Mn), by Nasal Decongestants, 2018–2030

Figure 14: Global Respiratory Virus Infection Drugs Market Revenue (US$ Mn), by Others, 2018–2030

Figure 15: Global Respiratory Virus Infection Drugs Market Value Share Analysis, by Infection Type, 2019 and 2030

Figure 16: Global Respiratory Virus Infection Drugs Market Attractiveness Analysis, by Infection Type, 2020–2030

Figure 17: Global Respiratory Virus Infection Drugs Market Revenue (US$ Mn), by Respiratory Syncytial Virus (RSV) Infection, 2018–2030

Figure 18: Global Respiratory Virus Infection Drugs Market Revenue (US$ Mn), by Influenza Virus Infection, 2018–2030

Figure 19: Global Respiratory Virus Infection Drugs Market Revenue (US$ Mn), by Parainfluenza Virus Infection, 2018–2030

Figure 20: Global Respiratory Virus Infection Drugs Market Revenue (US$ Mn), by Adenovirus Infection, 2018–2030

Figure 21: Global Respiratory Virus Infection Drugs Market Revenue (US$ Mn), by Rhinovirus Infection, 2018–2030

Figure 22: Global Respiratory Virus Infection Drugs Market Revenue (US$ Mn), by Others, 2018–2030

Figure 23: Global Respiratory Virus Infection Drugs Market Value Share Analysis, by Route of Administration, 2019 and 2030

Figure 24: Global Respiratory Virus Infection Drugs Market Attractiveness Analysis, by Route of Administration, 2020–2030

Figure 25: Global Respiratory Virus Infection Drugs Market Revenue (US$ Mn), by Oral, 2018–2030

Figure 26: Global Respiratory Virus Infection Drugs Market Revenue (US$ Mn), by Parenteral, 2018–2030

Figure 27: Global Respiratory Virus Infection Drugs Market Value Share Analysis, by Mode of Purchase, 2019 and 2030

Figure 28: Global Respiratory Virus Infection Drugs Market Attractiveness Analysis, by Mode of Purchase, 2020–2030

Figure 29: Global Respiratory Virus Infection Drugs Market Revenue (US$ Mn), by Prescription-based Drugs, 2018–2030

Figure 30: Global Respiratory Virus Infection Drugs Market Revenue (US$ Mn), by Over-the-Counter Drugs, 2018–2030

Figure 31: Global Respiratory Virus Infection Drugs Market Value Share Analysis, by Distribution Channel, 2019 and 2030

Figure 32: Global Respiratory Virus Infection Drugs Market Attractiveness Analysis, by Distribution Channel, 2020–2030

Figure 33: Global Respiratory Virus Infection Drugs Market Revenue (US$ Mn), by Hospital Pharmacies, 2018–2030

Figure 34: Global Respiratory Virus Infection Drugs Market Revenue (US$ Mn), by Drug Stores, 2018–2030

Figure 35: Global Respiratory Virus Infection Drugs Market Revenue (US$ Mn), by Retail Pharmacies, 2018–2030

Figure 36: Global Respiratory Virus Infection Drugs Market Revenue (US$ Mn), by Clinics, 2018–2030

Figure 37: Global Respiratory Virus Infection Drugs Market Revenue (US$ Mn), by Others, 2018–2030

Figure 38: Global Respiratory Virus Infection Drugs Market Value Share Analysis, by Region, 2019 and 2030

Figure 39: Global Respiratory Virus Infection Drugs Market Attractiveness Analysis, by Region

Figure 40: North America Respiratory Virus Infection Drugs Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2018–2030

Figure 41: North America Respiratory Virus Infection Drugs Market Value Share (%), by Country, 2019 and 2030

Figure 42: North America Respiratory Virus Infection Drugs Market Attractiveness, by Country, 2020–2030

Figure 43: North America Respiratory Virus Infection Drugs Market Value Share (%), by Drug Type, 2019 and 2030

Figure 44: North America Respiratory Virus Infection Drugs Market Attractiveness Analysis, by Drug Type, 2020–2030

Figure 45: North America Respiratory Virus Infection Drugs Market Value Share (%), by Infection Type, 2019 and 2030

Figure 46: North America Respiratory Virus Infection Drugs Market Attractiveness Analysis, by Infection Type, 2020–2030

Figure 47: North America Respiratory Virus Infection Drugs Market Value Share (%), by Route of Administration, 2019 and 2030

Figure 48: North America Respiratory Virus Infection Drugs Market Attractiveness Analysis, by Route of Administration, 2020–2030

Figure 49: North America Respiratory Virus Infection Drugs Market Value Share (%), by Mode of Purchase, 2019 and 2030

Figure 50: North America Respiratory Virus Infection Drugs Market Attractiveness Analysis, by Mode of Purchase, 2020–2030

Figure 51: North America Respiratory Virus Infection Drugs Market Value Share (%), by Distribution Channel, 2019 and 2030

Figure 52: North America Respiratory Virus Infection Drugs Market Attractiveness Analysis, by Distribution Channel, 2020–2030

Figure 53: Europe Respiratory Virus Infection Drugs Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2018–2030

Figure 54: Europe Respiratory Virus Infection Drugs Market Value Share (%), by Country/Sub-region, 2019 and 2030

Figure 55: Europe Respiratory Virus Infection Drugs Market Attractiveness Analysis, by Country/Sub-region, 2020–2030

Figure 56: Europe Respiratory Virus Infection Drugs Market Value Share (%), by Drug Type, 2019 and 2030

Figure 57: Europe Respiratory Virus Infection Drugs Market Attractiveness Analysis, by Drug Type, 2020–2030

Figure 58: Europe Respiratory Virus Infection Drugs Market Value Share (%), by Infection Type, 2019 and 2030

Figure 59: Europe Respiratory Virus Infection Drugs Market Attractiveness Analysis, by Infection Type, 2020–2030

Figure 60: Europe Respiratory Virus Infection Drugs Market Value Share (%), by Route of Administration, 2019 and 2030

Figure 61: Europe Respiratory Virus Infection Drugs Market Attractiveness Analysis, by Route of Administration, 2020–2030

Figure 62: Europe Respiratory Virus Infection Drugs Market Value Share (%), by Mode of Purchase, 2019 and 2030

Figure 63: Europe Respiratory Virus Infection Drugs Market Attractiveness Analysis, by Mode of Purchase, 2020–2030

Figure 64: Europe Respiratory Virus Infection Drugs Market Value Share (%), by Distribution Channel, 2019 and 2030

Figure 65: Europe Respiratory Virus Infection Drugs Market Attractiveness Analysis, by Distribution Channel, 2020–2030

Figure 66: Asia Pacific Respiratory Virus Infection Drugs Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2018–2030

Figure 67: Asia Pacific Respiratory Virus Infection Drugs Market Value Share (%), by Country/Sub-region, 2019 and 2030

Figure 68: Asia Pacific Respiratory Virus Infection Drugs Market Attractiveness Analysis, by Country/Sub-region, 2020–2030

Figure 69: Asia Pacific Respiratory Virus Infection Drugs Market Value Share (%), by Drug Type, 2019 and 2030

Figure 70: Asia Pacific Respiratory Virus Infection Drugs Market Attractiveness Analysis, by Drug Type, 2020–2030

Figure 71: Asia Pacific Respiratory Virus Infection Drugs Market Value Share (%), by Infection Type, 2019 and 2030

Figure 72: Asia Pacific Respiratory Virus Infection Drugs Market Attractiveness Analysis, by Infection Type, 2020–2030

Figure 73: Asia Pacific Respiratory Virus Infection Drugs Market Value Share (%), by Route of Administration, 2019 and 2030

Figure 74: Asia Pacific Respiratory Virus Infection Drugs Market Attractiveness Analysis, by Route of Administration, 2020–2030

Figure 75: Asia Pacific Respiratory Virus Infection Drugs Market Value Share (%), by Mode of Purchase, 2019 and 2030

Figure 76: Asia Pacific Respiratory Virus Infection Drugs Market Attractiveness Analysis, by Mode of Purchase, 2020–2030

Figure 77: Asia Pacific Respiratory Virus Infection Drugs Market Value Share (%), by Distribution Channel, 2019 and 2030

Figure 78: Asia Pacific Respiratory Virus Infection Drugs Market Attractiveness Analysis, by Distribution Channel, 2020–2030

Figure 79: Latin America Respiratory Virus Infection Drugs Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2018–2030

Figure 80: Latin America Respiratory Virus Infection Drugs Market Value Share (%), by Country/Sub-region, 2019 and 2030

Figure 81: Latin America Respiratory Virus Infection Drugs Market Attractiveness Analysis, by Country/Sub-region, 2020–2030

Figure 82: Latin America Respiratory Virus Infection Drugs Market Value Share (%), by Drug Type, 2019 and 2030

Figure 83: Latin America Respiratory Virus Infection Drugs Market Attractiveness Analysis, by Drug Type, 2020–2030

Figure 84: Latin America Respiratory Virus Infection Drugs Market Value Share (%), by Infection Type, 2019 and 2030

Figure 85: Latin America Respiratory Virus Infection Drugs Market Attractiveness Analysis, by Infection Type, 2020–2030

Figure 86: Latin America Respiratory Virus Infection Drugs Market Value Share (%), by Route of Administration, 2019 and 2030

Figure 87: Latin America Respiratory Virus Infection Drugs Market Attractiveness Analysis, by Route of Administration, 2020–2030

Figure 88: Latin America Respiratory Virus Infection Drugs Market Value Share (%), by Mode of Purchase, 2019 and 2030

Figure 89: Latin America Respiratory Virus Infection Drugs Market Attractiveness Analysis, by Mode of Purchase, 2020–2030

Figure 90: Latin America Respiratory Virus Infection Drugs Market Value Share (%), by Distribution Channel, 2019 and 2030

Figure 91: Latin America Respiratory Virus Infection Drugs Market Attractiveness Analysis, by Distribution Channel, 2020–2030

Figure 92: Middle East & Africa Respiratory Virus Infection Drugs Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2018–2030

Figure 93: Middle East & Africa Respiratory Virus Infection Drugs Market Value Share (%), by Country/Sub-region, 2019 and 2030

Figure 94: Middle East & Africa Respiratory Virus Infection Drugs Market Attractiveness Analysis, by Country/Sub-region, 2020–2030

Figure 95: Middle East & Africa Respiratory Virus Infection Drugs Market Value Share (%), by Drug Type, 2019 and 2030

Figure 96: Middle East & Africa Respiratory Virus Infection Drugs Market Attractiveness Analysis, by Drug Type, 2020–2030

Figure 97: Middle East & Africa Respiratory Virus Infection Drugs Market Value Share (%), by Infection Type, 2019 and 2030

Figure 98: Middle East & Africa Respiratory Virus Infection Drugs Market Attractiveness Analysis, by Infection Type, 2020–2030

Figure 99: Middle East & Africa Respiratory Virus Infection Drugs Market Value Share (%), by Route of Administration, 2019 and 2030

Figure 100: Middle East & Africa Respiratory Virus Infection Drugs Market Attractiveness Analysis, by Route of Administration, 2020–2030

Figure 101: Middle East & Africa Respiratory Virus Infection Drugs Market Value Share (%), by Mode of Purchase, 2019 and 2030

Figure 102: Middle East & Africa Respiratory Virus Infection Drugs Market Attractiveness Analysis, by Mode of Purchase, 2020–2030

Figure 103: Middle East & Africa Respiratory Virus Infection Drugs Market Value Share (%), by Distribution Channel, 2019 and 2030

Figure 104: Middle East & Africa Respiratory Virus Infection Drugs Market Attractiveness Analysis, by Distribution Channel, 2020–2030