Reports

Reports

Analysts’ Viewpoint on Market Scenario

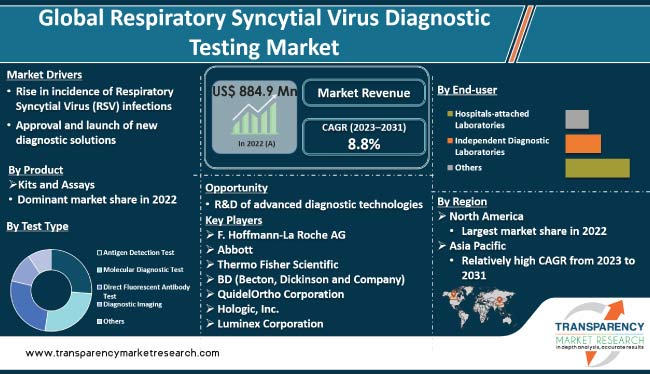

Respiratory syncytial virus diagnostic testing market value is projected to increase at a brisk pace in the near future owing to the surge in awareness about Respiratory Syncytial Virus (RSV) infection, especially in developed countries, and rise in need for early diagnosis.

Emergence of COVID-19 has led to an increase in demand for respiratory diagnostic tests. Growth in prevalence of RSV, particularly among the elderly and young children, is projected to boost market progress during the forecast period. However, high cost of RSV diagnostic tests and lack of awareness about RSV infection in developing countries are likely to pose challenges to industry growth in the next few years.

Respiratory syncytial virus (RSV) is a highly contagious virus that primarily affects the respiratory tract (lungs and breathing passages). It is a common cause of upper and lower respiratory infections in infants, young children, and elderly people. The infection can lead to severe complications such as pneumonia and bronchiolitis.

Currently, no specific treatment is available for RSV. However, symptoms can be managed with supportive care. Prevention measures include good hygiene practices, such as frequent hand washing, and avoiding close contact with infected individuals.

RSV diagnostic tests come in various formats including laboratory-based tests, rapid antigen tests, and molecular tests. Laboratory-based tests, such as ELISA and PCR, provide highly accurate results. Rapid Antigen Diagnostic Tests (RADTs) provide quick results and are used in point-of-care settings. Molecular tests offer high accuracy and are widely employed in hospitals and diagnostic centers.

Increase in awareness about RSV and the need for early diagnosis are anticipated to boost the demand for RSV diagnostic tests in the next few years. Prevalence of RSV is high in young children and older adults. It is responsible for a significant number of hospitalizations and deaths in infants, children, and older adults, particularly among those with pre-existing respiratory conditions such as asthma and Chronic Obstructive Pulmonary Disease (COPD). Thus, increase in incidence of RSV infections is projected to spur the respiratory syncytial virus diagnostic testing market growth during the forecast period.

Emergence of the COVID-19 pandemic led to surge in demand for RSV diagnostic tests, as symptoms of RSV and COVID-19 are similar. The pandemic also put a strain on healthcare systems, thereby leading to a rise in need for rapid and accurate diagnostic tests. Thus, growth in cases of COVID-19 is estimated to augment market expansion in the near future.

Robust diagnostic tests are crucial for the effective treatment and management of RSV infections. Molecular diagnostics methods such as Reverse Transcriptase Polymerase Chain Reaction (RT-PCR) allow for rapid and accurate detection of RSV genetic material. Such advanced tests help improve the speed and accuracy of RSV diagnosis.

R&D of advanced diagnostic solutions is estimated to propel market statistics in the next few years. Speed and accuracy in diagnosis gained importance post the outbreak of COVID-19. Accurate and timely diagnosis became crucial to determine the most appropriate course of treatment, as COVID-19 and RSV infections had common characteristics. Thus, rapid antigen detection tests for RSV were deployed in many countries.

According to the latest respiratory syncytial virus diagnostic testing market trends, the antigen detection test is expected to dominate the industry during the forecast period. Antigen detection tests are popular due to their high sensitivity, rapid results, and ability to detect RSV in the early stages of infection. Ease of use and low cost of antigen detection tests make them an attractive option for medical professionals and patients alike.

RADTs can produce results within 15 minutes. Numerous studies have demonstrated the accuracy of antigen detection tests in detecting RSV. A study published in the Journal of Clinical Microbiology found that RADTs offered a sensitivity of 97.1% in detecting RSV compared to a sensitivity of 94.1% for molecular diagnostics tests.

According to the latest respiratory syncytial virus diagnostic testing market analysis, the kits and assays product segment is anticipated to account for the largest share during the forecast period. Kits and assays are easy to use, affordable, and highly accurate. Growth in awareness about RSV and increase in incidence of RSV-related illnesses are likely to propel the segment in the near future.

Kits and assays witnessed surge in demand post the emergence of COVID-19. Need for quick and accurate RSV testing became more critical, as health systems in various countries were overwhelmed by the rise in cases of COVID-19.

The independent diagnostic laboratories end-user segment is projected to dominate the market during the forecast period. Increase in prevalence of respiratory infections and rise in demand for accurate and reliable diagnostic tests are likely to boost the segment in the near future.

Independent diagnostic laboratories offer a wide range of RSV diagnostic tests that are quick, efficient, and highly accurate. This makes them a preferred choice for many patients and healthcare providers. Independent diagnostic laboratories have access to the latest diagnostic equipment and techniques. This allows them to provide accurate results within a short turnaround time.

According to the latest respiratory syncytial virus diagnostic testing market forecast, North America is estimated to hold the largest share from 2023 to 2031. High prevalence of RSV infections and presence of developed healthcare infrastructure are boosting market dynamics in the region. Additionally, R&D of new products is anticipated to drive the demand for RSV diagnostic tests.

The industry in Europe is expected to grow at a significant pace during the forecast period. Increase in cases of RSV infections and launch of new tests are fueling market development in the region. High prevalence of RSV infections and surge in investment in healthcare infrastructure are likely to boost the market revenue of Asia Pacific during the forecast period.

The respiratory syncytial virus diagnostic testing market report profiles prominent vendors based on various parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

F. Hoffmann-La Roche AG, Abbott, Thermo Fisher Scientific, BD (Becton, Dickinson and Company), QuidelOrtho Corporation, Hologic, Inc., Luminex Corporation, Agilent Technologies, Inc., Cepheid (Danaher Corporation), and DiaSorin S.p.A. are key players operating in this industry.

Leading companies are focusing on R&D of new products to increase their respiratory syncytial virus diagnostic testing market share. They are also adopting various organic and inorganic growth strategies to strengthen their market position.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 884.9 Mn |

|

Market Forecast Value in 2031 |

More than US$ 1.9 Bn |

|

Compound Annual Growth Rate (CAGR) |

8.8% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2022 |

|

Quantitative Units |

US$ Mn/Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 884.9 Mn in 2022.

It is projected to reach more than US$ 1.9 Bn by the end of 2031.

It is anticipated to be 8.8% from 2023 to 2031.

Rise in incidence of Respiratory Syncytial Virus (RSV) infections and approval and launch of new diagnostic solutions.

The kits and assays product segment held the largest share in 2022.

North America is expected to account for major share from 2023 to 2031.

F. Hoffmann-La Roche AG, Abbott, Thermo Fisher Scientific, BD (Becton, Dickinson and Company), QuidelOrtho Corporation, Hologic, Inc., Luminex Corporation, Agilent Technologies, Inc., Cepheid (Danaher Corporation), and DiaSorin S.p.A.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Respiratory Syncytial Virus Diagnostic Testing Market

4. Market Overview

4.1. Introduction

4.1.1. Respiratory Syncytial Virus Diagnostic Testing Definition

4.1.2. Industry Evolution/Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Respiratory Syncytial Virus Diagnostic Testing Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projection (US$ Mn)

5. Market Outlook

5.1. Disease Incidence and Prevalence Across the Globe

5.2. COVID-19 Impact on Industry

5.3. Regulatory Scenario Across the Globe/Key Countries

6. Global Respiratory Syncytial Virus Diagnostic Testing Market Analysis and Forecast, by Test Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Test Type, 2017–2031

6.3.1. Antigen Detection Test

6.3.2. Molecular Diagnostic Test

6.3.3. Direct Fluorescent Antibody Test

6.3.4. Diagnostic Imaging

6.3.5. Others

6.4. Market Attractiveness, by Test Type

7. Global Respiratory Syncytial Virus Diagnostic Testing Market Analysis and Forecast, by Product

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Product, 2017–2031

7.3.1. Kits and Assays

7.3.2. Instruments/Devices

7.4. Market Attractiveness, by Product

8. Global Respiratory Syncytial Virus Diagnostic Testing Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Hospitals-attached Laboratories

8.3.2. Independent Diagnostic Laboratories

8.3.3. Others

8.4. Market Attractiveness, by End-user

9. Global Respiratory Syncytial Virus Diagnostic Testing Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness, by Country/Region

10. North America Respiratory Syncytial Virus Diagnostic Testing Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Test Type, 2017–2031

10.2.1. Antigen Detection Test

10.2.2. Molecular Diagnostic Test

10.2.3. Direct Fluorescent Antibody Test

10.2.4. Diagnostic Imaging

10.2.5. Others

10.3. Market Value Forecast, by Product, 2017–2031

10.3.1. Kits and Assays

10.3.2. Instruments/Devices

10.4. Market Value Forecast, by End-user, 2017–2031

10.4.1. Hospitals-attached Laboratories

10.4.2. Independent Diagnostic Laboratories

10.4.3. Others

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Test Type

10.6.2. By Product

10.6.3. By End-user

10.6.4. By Country

11. Europe Respiratory Syncytial Virus Diagnostic Testing Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Test Type, 2017–2031

11.2.1. Antigen Detection Test

11.2.2. Molecular Diagnostic Test

11.2.3. Direct Fluorescent Antibody Test

11.2.4. Diagnostic Imaging

11.2.5. Others

11.3. Market Value Forecast, by Product, 2017–2031

11.3.1. Kits and Assays

11.3.2. Instruments/Devices

11.4. Market Value Forecast, by End-user, 2017–2031

11.4.1. Hospitals-attached Laboratories

11.4.2. Independent Diagnostic Laboratories

11.4.3. Others

11.5. Market Value Forecast, by Country, 2017–2031

11.5.1. U.K.

11.5.2. Germany

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Test Type

11.6.2. By Product

11.6.3. By End-user

11.6.4. By Country

12. Asia Pacific Respiratory Syncytial Virus Diagnostic Testing Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Test Type, 2017–2031

12.2.1. Antigen Detection Test

12.2.2. Molecular Diagnostic Test

12.2.3. Direct Fluorescent Antibody Test

12.2.4. Diagnostic Imaging

12.2.5. Others

12.3. Market Value Forecast, by End-user, 2017–2031

12.3.1. Kits and Assays

12.3.2. Instruments/Devices

12.4. Market Value Forecast, by End-user, 2017–2031

12.4.1. Hospitals-attached Laboratories

12.4.2. Independent Diagnostic Laboratories

12.4.3. Others

12.5. Market Value Forecast, by Country, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Test Type

12.6.2. By Product

12.6.3. By End-user

12.6.4. By Country

13. Latin America Respiratory Syncytial Virus Diagnostic Testing Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Test Type, 2017–2031

13.2.1. Antigen Detection Test

13.2.2. Molecular Diagnostic Test

13.2.3. Direct Fluorescent Antibody Test

13.2.4. Diagnostic Imaging

13.2.5. Others

13.3. Market Value Forecast, by Product, 2017–2031

13.3.1. Kits and Assays

13.3.2. Instruments/Devices

13.4. Market Value Forecast, by End-user, 2017–2031

13.4.1. Hospitals-attached Laboratories

13.4.2. Independent Diagnostic Laboratories

13.4.3. Others

13.5. Market Value Forecast, by Country, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Test Type

13.6.2. By Product

13.6.3. By End-user

13.6.4. By Country

14. Middle East & Africa Respiratory Syncytial Virus Diagnostic Testing Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Test Type, 2017–2031

14.2.1. Antigen Detection Test

14.2.2. Molecular Diagnostic Test

14.2.3. Direct Fluorescent Antibody Test

14.2.4. Diagnostic Imaging

14.2.5. Others

14.3. Market Value Forecast, by Product, 2017–2031

14.3.1. Kits and Assays

14.3.2. Instruments/Devices

14.4. Market Value Forecast, by End-user, 2017–2031

14.4.1. Hospitals-attached Laboratories

14.4.2. Independent Diagnostic Laboratories

14.4.3. Others

14.5. Market Value Forecast, by Country, 2017–2031

14.5.1. GCC countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Test Type

14.6.2. By Product

14.6.3. By End-user

14.6.4. By Country

15. Competition Landscape

15.1. Market Player – Competition Matrix (by Tier and Size of Companies)

15.2. Market Share Analysis by Company (2022)

15.3. Company Profiles

15.3.1. F. Hoffmann-La Roche AG

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Test Type Portfolio

15.3.1.3. Financial Overview

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. Abbott

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Test Type Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. Thermo Fisher Scientific

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Test Type Portfolio

15.3.3.3. Financial Overview

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. BD (Becton, Dickinson and Company)

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Test Type Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. QuidelOrtho Corporation

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Test Type Portfolio

15.3.5.3. Financial Overview

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

15.3.6. Hologic, Inc.

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Test Type Portfolio

15.3.6.3. Financial Overview

15.3.6.4. SWOT Analysis

15.3.6.5. Strategic Overview

15.3.7. Luminex Corporation

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Test Type Portfolio

15.3.7.3. Financial Overview

15.3.7.4. SWOT Analysis

15.3.7.5. Strategic Overview

15.3.8. Agilent Technologies, Inc.

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Test Type Portfolio

15.3.8.3. Financial Overview

15.3.8.4. SWOT Analysis

15.3.8.5. Strategic Overview

15.3.9. Cepheid (Danaher Corporation)

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Test Type Portfolio

15.3.9.3. Financial Overview

15.3.9.4. SWOT Analysis

15.3.9.5. Strategic Overview

15.3.10. DiaSorin S.p.A.

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Test Type Portfolio

15.3.10.3. Financial Overview

15.3.10.4. SWOT Analysis

15.3.10.5. Strategic Overview

List of Tables

Table 01: Global Respiratory Syncytial Virus Diagnostic Testing Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 02: Global Respiratory Syncytial Virus Diagnostic Testing Market Value (US$ Mn) Forecast, by Antigen Detection Test, 2017–2031

Table 03: Global Respiratory Syncytial Virus Diagnostic Testing Market Value (US$ Mn) Forecast, by Molecular Diagnostic Test, 2017–2031

Table 04: Global Respiratory Syncytial Virus Diagnostic Testing Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 05: Global Respiratory Syncytial Virus Diagnostic Testing Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 06: Global Respiratory Syncytial Virus Diagnostic Testing Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 07: North America Respiratory Syncytial Virus Diagnostic Testing Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 08: North America Respiratory Syncytial Virus Diagnostic Testing Market Value (US$ Mn) Forecast, by Antigen Detection Test, 2017–2031

Table 09: North America Respiratory Syncytial Virus Diagnostic Testing Market Value (US$ Mn) Forecast, by Molecular Diagnostic Test, 2017–2031

Table 10: North America Respiratory Syncytial Virus Diagnostic Testing Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 11: North America Respiratory Syncytial Virus Diagnostic Testing Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 12: North America Respiratory Syncytial Virus Diagnostic Testing Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 13: Europe Respiratory Syncytial Virus Diagnostic Testing Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 14: Europe Respiratory Syncytial Virus Diagnostic Testing Market Value (US$ Mn) Forecast, by Antigen Detection Test, 2017–2031

Table 15: Europe Respiratory Syncytial Virus Diagnostic Testing Market Value (US$ Mn) Forecast, by Molecular Diagnostic Test, 2017–2031

Table 16: Europe Respiratory Syncytial Virus Diagnostic Testing Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 17: Europe Respiratory Syncytial Virus Diagnostic Testing Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 18: Europe Respiratory Syncytial Virus Diagnostic Testing Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 19: Asia Pacific Respiratory Syncytial Virus Diagnostic Testing Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 20: Asia Pacific Respiratory Syncytial Virus Diagnostic Testing Market Value (US$ Mn) Forecast, by Antigen Detection Test, 2017–2031

Table 21: Asia Pacific Respiratory Syncytial Virus Diagnostic Testing Market Value (US$ Mn) Forecast, by Molecular Diagnostic Test, 2017–2031

Table 22: Asia Pacific Respiratory Syncytial Virus Diagnostic Testing Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 23: Asia Pacific Respiratory Syncytial Virus Diagnostic Testing Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 24: Asia Pacific Respiratory Syncytial Virus Diagnostic Testing Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 25: Latin America Respiratory Syncytial Virus Diagnostic Testing Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 26: Latin America Respiratory Syncytial Virus Diagnostic Testing Market Value (US$ Mn) Forecast, by Antigen Detection Test, 2017–2031

Table 27: Latin America Respiratory Syncytial Virus Diagnostic Testing Market Value (US$ Mn) Forecast, by Molecular Diagnostic Test, 2017–2031

Table 28: Latin America Respiratory Syncytial Virus Diagnostic Testing Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 29: Latin America Respiratory Syncytial Virus Diagnostic Testing Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 30: Latin America Respiratory Syncytial Virus Diagnostic Testing Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 31: Middle East & Africa Respiratory Syncytial Virus Diagnostic Testing Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 32: Middle East & Africa Respiratory Syncytial Virus Diagnostic Testing Market Value (US$ Mn) Forecast, by Antigen Detection Test, 2017–2031

Table 33: Middle East & Africa Respiratory Syncytial Virus Diagnostic Testing Market Value (US$ Mn) Forecast, by Molecular Diagnostic Test, 2017–2031

Table 34: Middle East & Africa Respiratory Syncytial Virus Diagnostic Testing Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 35: Middle East & Africa Respiratory Syncytial Virus Diagnostic Testing Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 36: Middle East & Africa Respiratory Syncytial Virus Diagnostic Testing Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

List of Figures

Figure 01: Global Respiratory Syncytial Virus Diagnostic Testing Market

Figure 02: Global Respiratory Syncytial Virus Diagnostic Testing Market Size (US$ Mn) Forecast, 2017–2031

Figure 03: Global Respiratory Syncytial Virus Diagnostic Testing Market Value Share, by Test Type (2022)

Figure 04: Global Respiratory Syncytial Virus Diagnostic Testing Market Value Share, by Product (2022)

Figure 05: Global Respiratory Syncytial Virus Diagnostic Testing Market Value Share, by End-user (2022)

Figure 06: Global Respiratory Syncytial Virus Diagnostic Testing Market Value Share, by Region (2022)

Figure 07: Global Respiratory Syncytial Virus Diagnostic Testing Market Value Share, by Test Type, 2022 and 2031

Figure 08 Global Respiratory Syncytial Virus Diagnostic Testing Market Attractiveness, by Test Type, 2022–2031

Figure 09: Global Respiratory Syncytial Virus Diagnostic Testing Market Value Share, by Product, 2022 and 2031

Figure 10: Global Respiratory Syncytial Virus Diagnostic Testing Market Attractiveness, by Product, 2022–2031

Figure 11: Global Respiratory Syncytial Virus Diagnostic Testing Market Value Share, by End-user, 2022 and 2031

Figure 12: Global Respiratory Syncytial Virus Diagnostic Testing Market Attractiveness, by End-user, 2022–2031

Figure 13: Global Respiratory Syncytial Virus Diagnostic Testing Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2031

Figure 14: Global Respiratory Syncytial Virus Diagnostic Testing Market Value Share, by Region, 2022–2031

Figure 15: Global Respiratory Syncytial Virus Diagnostic Testing Market Attractiveness, by Region, 2022–2031

Figure 16: North America Respiratory Syncytial Virus Diagnostic Testing Market Value Share, by Test Type, 2022 and 2031

Figure 17: North America Respiratory Syncytial Virus Diagnostic Testing Market Attractiveness, by Test Type, 2022–2031

Figure 18: North America Respiratory Syncytial Virus Diagnostic Testing Market Value Share, by Product, 2022 and 2031

Figure 19: North America Respiratory Syncytial Virus Diagnostic Testing Market Attractiveness, by Product, 2022–2031

Figure 20: North America Respiratory Syncytial Virus Diagnostic Testing Market Value Share, by End-user, 2022 and 2031

Figure 21: North America Respiratory Syncytial Virus Diagnostic Testing Market Attractiveness, by End-user, 2022–2031

Figure 22: North America Respiratory Syncytial Virus Diagnostic Testing Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2031

Figure 23: North America Respiratory Syncytial Virus Diagnostic Testing Market Value Share, by Country, 2022–2031

Figure 24: North America Respiratory Syncytial Virus Diagnostic Testing Market Attractiveness, by Country, 2022–2031

Figure 25: Europe Respiratory Syncytial Virus Diagnostic Testing Market Value Share, by Test Type, 2022 and 2031

Figure 26: Europe Respiratory Syncytial Virus Diagnostic Testing Market Attractiveness, by Test Type, 2022–2031

Figure 27: Europe Respiratory Syncytial Virus Diagnostic Testing Market Value Share, by Product, 2022 and 2031

Figure 28: Europe Respiratory Syncytial Virus Diagnostic Testing Market Attractiveness, by Product, 2022–2031

Figure 29: Europe Respiratory Syncytial Virus Diagnostic Testing Market Value Share, by End-user, 2022 and 2031

Figure 30: Europe Respiratory Syncytial Virus Diagnostic Testing Market Attractiveness, by End-user, 2022–2031

Figure 31: Europe Respiratory Syncytial Virus Diagnostic Testing Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2031

Figure 32: Europe Respiratory Syncytial Virus Diagnostic Testing Market Value Share, by Country/Sub-region, 2022–2031

Figure 33: Europe Respiratory Syncytial Virus Diagnostic Testing Market Attractiveness, by Country/Sub-region, 2022–2031

Figure 34: Asia Pacific Respiratory Syncytial Virus Diagnostic Testing Market Value Share, by Test Type, 2022 and 2031

Figure 35: Asia Pacific Respiratory Syncytial Virus Diagnostic Testing Market Attractiveness, by Test Type, 2022–2031

Figure 36: Asia Pacific Respiratory Syncytial Virus Diagnostic Testing Market Value Share, by Product, 2022 and 2031

Figure 37: Asia Pacific Respiratory Syncytial Virus Diagnostic Testing Market Attractiveness, by Product, 2022–2031

Figure 38: Asia Pacific Respiratory Syncytial Virus Diagnostic Testing Market Value Share, by End-user, 2022 and 2031

Figure 39: Asia Pacific Respiratory Syncytial Virus Diagnostic Testing Market Attractiveness, by End-user, 2022–2031

Figure 40: Asia Pacific Respiratory Syncytial Virus Diagnostic Testing Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2031

Figure 41: Asia Pacific Respiratory Syncytial Virus Diagnostic Testing Market Value Share, by Country/Sub-region, 2022–2031

Figure 42: Asia Pacific Respiratory Syncytial Virus Diagnostic Testing Market Attractiveness, by Country/Sub-region, 2022–2031

Figure 43: Latin America Respiratory Syncytial Virus Diagnostic Testing Market Value Share, by Test Type, 2022 and 2031

Figure 44: Latin America Respiratory Syncytial Virus Diagnostic Testing Market Attractiveness, by Test Type, 2022–2031

Figure 45: Latin America Respiratory Syncytial Virus Diagnostic Testing Market Value Share, by Product, 2022 and 2031

Figure 46: Latin America Respiratory Syncytial Virus Diagnostic Testing Market Attractiveness, by Product, 2022–2031

Figure 47: Latin America Respiratory Syncytial Virus Diagnostic Testing Market Value Share, by End-user, 2022 and 2031

Figure 48: Latin America Respiratory Syncytial Virus Diagnostic Testing Market Attractiveness, by End-user, 2022–2031

Figure 49: Latin America Respiratory Syncytial Virus Diagnostic Testing Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2031

Figure 50: Latin America Respiratory Syncytial Virus Diagnostic Testing Market Value Share, by Country/Sub-region, 2022–2031

Figure 51: Latin America Respiratory Syncytial Virus Diagnostic Testing Market Attractiveness, by Country/Sub-region, 2022–2031

Figure 52: Middle East & Africa Respiratory Syncytial Virus Diagnostic Testing Market Value Share, by Test Type, 2022 and 2031

Figure 53: Middle East & Africa Respiratory Syncytial Virus Diagnostic Testing Market Attractiveness, by Test Type, 2022–2031

Figure 54: Middle East & Africa Respiratory Syncytial Virus Diagnostic Testing Market Value Share, by Product, 2022 and 2031

Figure 55: Middle East & Africa Respiratory Syncytial Virus Diagnostic Testing Market Attractiveness, by Product, 2022–2031

Figure 56: Middle East & Africa Respiratory Syncytial Virus Diagnostic Testing Market Value Share, by End-user, 2022 and 2031

Figure 57: Middle East & Africa Respiratory Syncytial Virus Diagnostic Testing Market Attractiveness, by End-user, 2022–2031

Figure 58: Middle East & Africa Respiratory Syncytial Virus Diagnostic Testing Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2031

Figure 59: Middle East & Africa Respiratory Syncytial Virus Diagnostic Testing Market Value Share, by Country/Sub-region, 2022–2031

Figure 60: Middle East & Africa Respiratory Syncytial Virus Diagnostic Testing Market Attractiveness, by Country/Sub-region, 2022–2031

Figure 61: Global Respiratory Syncytial Virus Diagnostic Testing Market Share Analysis, by Company, 2022 (Estimated)

Figure 62: Global Respiratory Syncytial Virus Diagnostic Testing Market Performance, by Company, 2022

Figure 63: Competition Matrix