Reports

Reports

Analysts’ Viewpoint on Refurbished Medical Imaging Equipment Market Scenario

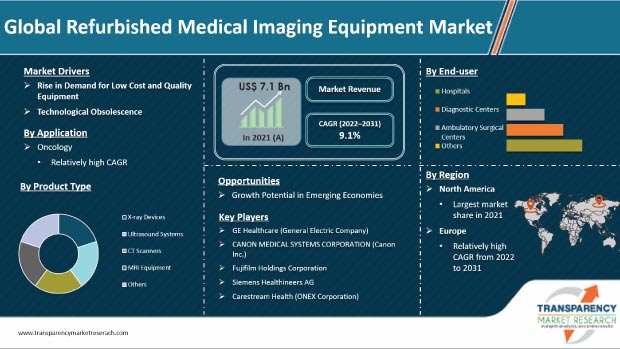

The refurbished medical imaging equipment market is estimated to grow at a rapid pace in the next few years due to the increase in demand for imaging devices for the diagnosis of various conditions. Medical imaging equipment such as X-ray machines, MRI machines, and CT scan machines are extensively used to diagnose almost every condition, barring just a few mild sicknesses. Refurbished medical imaging equipment works as good as the original equipment. Increase in number of diseases is augmenting the need for refurbished medical imaging equipment across the globe. Several hospitals depend upon refurbished medical imaging equipment, as they do not have to spend exorbitantly on new equipment. This is expected to provide lucrative opportunities for manufacturers operating in the refurbished medical imaging equipment market.

Refurbishment is the restoration of a device to its original specifications. It ranges from replacement of basic wear parts and esthetic changes to a complete end-to-end refurbishment. Demand for used and refurbished medicine equipment; and refurbished nuclear medicine equipment is rising across the globe. The refurbishment process offers safety, reliability, quality, and improved performance by extending the product lifecycle. Refurbished equipment is cost-effective, and can be used for longer periods. Refurbishment of medical imaging equipment is carried out in two ways: cosmetic refurbishment and mechanical/electrical refurbishment. Cosmetic refurbishment includes surface treatment and painting, while mechanical/electrical refurbishment comprises complete replacement or restoration of parts/components. The global refurbished medical imaging equipment market share is estimated to increase during the forecast period, due to the rise in cost constraints on hospitals and diagnostic imaging centers; and budget cuts from governing agencies for public hospitals. Furthermore, decrease in reimbursement for imaging procedures is compelling hospitals and diagnostic imaging centers to opt for low-priced and quality imaging equipment.

Various public hospitals across the globe are undergoing privatization, which has led to cost constraints. This coupled with a decrease in budgeted expenditure and reduction in reimbursement for imaging procedures has prompted hospitals to opt for affordable and quality refurbished equipment. For example, public hospitals in the Netherlands are undergoing privatization, which is likely to drive the demand for refurbished medical equipment in the country. Refurbished medical imaging equipment and parts are available at 40% to 60% of the prices of new devices. Furthermore, suppliers assure timely delivery and services. This makes refurbished medical devices a preferred choice among hospitals, diagnostic imaging centers, and private practitioners. OEMs are also offering quality refurbished equipment and parts at low costs along with a comprehensive warranty on refurbished devices.

Ongoing developments in imaging technologies are enabling companies to be competitive in the healthcare services market. Several healthcare providers are opting for replacement or upgrade of existing imaging equipment. Rise in demand for technically advanced imaging equipment and simultaneous cost constraints among hospitals and imaging diagnostic centers are likely to fuel the demand for refurbished imaging equipment and parts. Increase in penetration of key manufacturers in developing countries to reduce capital investment is also anticipated to propel the refurbished medical imaging equipment market in the next few years.

Based on product type, the global market for refurbished medical imaging equipment has been classified into X-ray devices, ultrasound systems, CT scanners, MRI equipment, and others. The MRI equipment segment dominated the global refurbished medical imaging equipment market with around 28% share in 2021. The segment is anticipated to maintain its dominance during the forecast period. Applications of MRI scanners are increasing in the diagnosis of neurological, cardiovascular, skeletomuscular, and oncology diseases. This is likely to drive the demand for MRI scanners across the globe. Introduction of open MRI scanners is also creating lucrative opportunities for market players.

In terms of application, the global refurbished medical imaging equipment market has been segmented into oncology, cardiovascular, gynecology, orthopedic, and others. The oncology segment held major share of 25% of the global market in 2021. It is projected to remain dominant during the forecast period. Growth of the segment can be ascribed to the rise in focus on early diagnosis, expanding patient population, and increase in number of diagnostic imaging procedures to detect cancer. Additionally, presence of a large number of OEMs and rise in agreements & collaborations between end-users and service providers are the prominent factors fueling the oncology segment.

Based on end-user, the global refurbished medical imaging equipment market has been classified into hospitals, diagnostic centers, ambulatory surgical centers, and others. The hospitals segment dominated the global refurbished medical imaging equipment market in 2021 with the largest market share of around 46%. The segment is also expected to register the highest CAGR during the forecast period. Rise in demand for refurbished hospital equipment offers lucrative opportunities for manufacturers. Growth of the hospitals segment can be ascribed to budget constraints among hospitals, competitive scenario in terms of advanced service provision, and increase in number of private hospitals in Asia Pacific and emerging markets.

North America held the largest volume share of around 37% of the global refurbished medical imaging equipment market in 2021. The region is expected to dominate the global market during the forecast period. This can be ascribed to the increase in presence of OEMs and third-party refurbishers in North America. Europe held around 32% value share of the global refurbished medical imaging equipment market in 2021. It is projected to be the fastest-growing region during the forecast period, owing to the rise in demand for new and efficient refurbished diagnostic imaging equipment. Asia Pacific held larger share of the market than Latin America and Middle East & Africa; however, the market in Latin America region is expected to grow at a faster pace compared to that in Middle East & Africa.

The global refurbished medical imaging equipment market report includes vital information about the leading players in the market. Companies are focusing on strategies such as new product launches, mergers & acquisitions, and partnerships to strengthen their position in the market. Leading players in the global refurbished medical imaging equipment market include CANON MEDICAL SYSTEMS CORPORATION (Canon Inc.), Carestream Health (ONEX Corporation), GE Healthcare (General Electric Company), Hologic, Inc., Koninklijke Philips N.V., Shimadzu Corporation, Fujifilm Holdings Corporation, and Siemens Healthineers AG.

Each of these players has been profiled in the global refurbished medical imaging equipment market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 7.1 Bn |

|

Market Forecast Value in 2031 |

US$ 18.3 Bn |

|

Growth Rate (CAGR) |

9.1% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global refurbished medical imaging equipment market was valued at US$ 7.1 Bn in 2021.

The global refurbished medical imaging equipment market will surpass US$ 18.3 Bn by 2031.

The global refurbished medical imaging equipment market is anticipated to grow at a CAGR of 9.1% from 2022 to 2031.

The MRI equipment segment held over 28% share of the global refurbished medical imaging equipment market in 2021.

North America is expected to hold major share of the global refurbished medical imaging equipment market during the forecast period.

Prominent players in the global refurbished medical imaging equipment market are CANON MEDICAL SYSTEMS CORPORATION (Canon Inc.), GE Healthcare (General Electric Company), Koninklijke Philips N.V., Fujifilm Holding Corporation, Siemens Healthineers AG, and Hologic, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Refurbished Medical Imaging Equipment Market

4. Market Overview

4.1. Introduction

4.1.1. Product Type Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Refurbished Medical Imaging Equipment Market Analysis and Forecast, 2017 - 2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Key Industry Events

5.2. Key Vendor and Distributor Analysis

5.3. COVID-19 Pandemic Impact on Industry

6. Global Refurbished Medical Imaging Equipment Market Analysis and Forecast, By Product Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast By Product Type, 2017 - 2031

6.3.1. X-ray Devices

6.3.2. Ultrasound Systems

6.3.3. CT Scanners

6.3.4. MRI Equipment

6.3.5. Others

6.4. Market Attractiveness By Product Type

7. Global Refurbished Medical Imaging Equipment Market Analysis and Forecast, By Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast By Application, 2017 - 2031

7.3.1. Oncology

7.3.2. Cardiovascular

7.3.3. Gynecology

7.3.4. Orthopedic

7.3.5. Others

7.4. Market Attractiveness By Application

8. Global Refurbished Medical Imaging Equipment Market Analysis and Forecast, By End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast By End-user, 2017 - 2031

8.3.1. Hospitals

8.3.2. Diagnostic Centers

8.3.3. Ambulatory Surgical Centers

8.3.4. Others

8.4. Market Attractiveness By End-user

9. Global Refurbished Medical Imaging Equipment Market Analysis and Forecast, By Region

9.1. Key Findings

9.2. Market Value Forecast By Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness By Country/Region

10. North America Refurbished Medical Imaging Equipment Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast By Product Type, 2017 - 2031

10.2.1. X-ray Devices

10.2.2. Ultrasound Systems

10.2.3. CT Scanners

10.2.4. MRI Equipment

10.2.5. Others

10.3. Market Value Forecast By Application, 2017 - 2031

10.3.1. Oncology

10.3.2. Cardiovascular

10.3.3. Gynecology

10.3.4. Orthopedic

10.3.5. Others

10.4. Market Value Forecast By End-user, 2017 - 2031

10.4.1. Hospitals

10.4.2. Diagnostic Centers

10.4.3. Ambulatory Surgical Centers

10.4.4. Others

10.5. Market Value Forecast By Country, 2017 - 2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product Type

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Refurbished Medical Imaging Equipment Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast By Product Type, 2017 - 2031

11.2.1. X-ray Devices

11.2.2. Ultrasound Systems

11.2.3. CT Scanners

11.2.4. MRI Equipment

11.2.5. Others

11.3. Market Value Forecast By Application, 2017 - 2031

11.3.1. Oncology

11.3.2. Cardiovascular

11.3.3. Gynecology

11.3.4. Orthopedic

11.3.5. Others

11.4. Market Value Forecast By End-user, 2017 - 2031

11.4.1. Hospitals

11.4.2. Diagnostic Centers

11.4.3. Ambulatory Surgical Centers

11.4.4. Others

11.5. Market Value Forecast By Country, 2017 - 2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product Type

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country

12. Asia Pacific Refurbished Medical Imaging Equipment Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast By Product Type, 2017 - 2031

12.2.1. X-ray Devices

12.2.2. Ultrasound Systems

12.2.3. CT Scanners

12.2.4. MRI Equipment

12.2.5. Others

12.3. Market Value Forecast By Application, 2017 - 2031

12.3.1. Oncology

12.3.2. Cardiovascular

12.3.3. Gynecology

12.3.4. Orthopedic

12.3.5. Others

12.4. Market Value Forecast By End-user, 2017 - 2031

12.4.1. Hospitals

12.4.2. Diagnostic Centers

12.4.3. Ambulatory Surgical Centers

12.4.4. Others

12.5. Market Value Forecast By Country, 2017 - 2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product Type

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country

13. Latin America Refurbished Medical Imaging Equipment Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast By Product Type, 2017 - 2031

13.2.1. X-ray Devices

13.2.2. Ultrasound Systems

13.2.3. CT Scanners

13.2.4. MRI Equipment

13.2.5. Others

13.3. Market Value Forecast By Application, 2017 - 2031

13.3.1. Oncology

13.3.2. Cardiovascular

13.3.3. Gynecology

13.3.4. Orthopedic

13.3.5. Others

13.4. Market Value Forecast By End-user, 2017 - 2031

13.4.1. Hospitals

13.4.2. Diagnostic Centers

13.4.3. Ambulatory Surgical Centers

13.4.4. Others

13.5. Market Value Forecast By Country, 2017 - 2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product Type

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country

14. Middle East & Africa Refurbished Medical Imaging Equipment Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast By Product Type, 2017 - 2031

14.2.1. X-ray Devices

14.2.2. Ultrasound Systems

14.2.3. CT Scanners

14.2.4. MRI Equipment

14.2.5. Others

14.3. Market Value Forecast By Application, 2017 - 2031

14.3.1. Oncology

14.3.2. Cardiovascular

14.3.3. Gynecology

14.3.4. Orthopedic

14.3.5. Others

14.4. Market Value Forecast By End-user, 2017 - 2031

14.4.1. Hospitals

14.4.2. Diagnostic Centers

14.4.3. Ambulatory Surgical Centers

14.4.4. Others

14.5. Market Value Forecast By Country, 2017 - 2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product Type

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of companies)

15.2. Market Share Analysis By Company (2021)

15.3. Company Profiles

15.3.1. CANON MEDICAL SYSTEMS CORPORATION (Canon Inc.)

15.3.1.1. Company overview

15.3.1.2. Financial overview

15.3.1.3. Business strategies

15.3.1.4. SWOT analysis

15.3.1.5. Recent developments

15.3.2. Carestream Health (ONEX Corporation)

15.3.2.1. Company overview

15.3.2.2. Financial overview

15.3.2.3. Business strategies

15.3.2.4. SWOT analysis

15.3.2.5. Recent developments

15.3.3. GE Healthcare (General Electric Company)

15.3.3.1. Company overview

15.3.3.2. Financial overview

15.3.3.3. Business strategies

15.3.3.4. SWOT analysis

15.3.3.5. Recent developments

15.3.4. Hologic, Inc.

15.3.4.1. Company overview

15.3.4.2. Financial overview

15.3.4.3. Business strategies

15.3.4.4. SWOT analysis

15.3.4.5. Recent developments

15.3.5. Koninklijke Philips N.V.

15.3.5.1. Company overview

15.3.5.2. Financial overview

15.3.5.3. Business strategies

15.3.5.4. SWOT analysis

15.3.5.5. Recent developments

15.3.6. Shimadzu Corporation

15.3.6.1. Company overview

15.3.6.2. Financial overview

15.3.6.3. Business strategies

15.3.6.4. SWOT analysis

15.3.6.5. Recent developments

15.3.7. Fujifilm Holding Corporation

15.3.7.1. Company overview

15.3.7.2. Financial overview

15.3.7.3. Business strategies

15.3.7.4. SWOT analysis

15.3.7.5. Recent developments

15.3.8. Siemens Healthineers AG

15.3.8.1. Company overview

15.3.8.2. Financial overview

15.3.8.3. Business strategies

15.3.8.4. SWOT analysis

15.3.8.5. Recent developments

List of Tables

Table 01: Global Refurbished Medical Imaging Equipment Market Value (US$ Mn) Forecast, by Product Type 2017–2031

Table 02: Global Refurbished Medical Imaging Equipment Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 03: Global Refurbished Medical Imaging Equipment Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 04: Global Refurbished Medical Imaging Equipment Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Refurbished Medical Imaging Equipment Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America Refurbished Medical Imaging Equipment Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 07: North America Refurbished Medical Imaging Equipment Market (US$ Mn) Forecast, by Application, 2017–2031

Table 08: North America Refurbished Medical Imaging Equipment Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 09: Europe Refurbished Medical Imaging Equipment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Europe Refurbished Medical Imaging Equipment Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 11: Europe Refurbished Medical Imaging Equipment Market (US$ Mn) Forecast, by Application, 2017–2031

Table 12: Europe Refurbished Medical Imaging Equipment Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: Asia Pacific Refurbished Medical Imaging Equipment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific Refurbished Medical Imaging Equipment Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 15: Asia Pacific Refurbished Medical Imaging Equipment Market (US$ Mn) Forecast, by Application, 2017–2031

Table 16: Asia Pacific Refurbished Medical Imaging Equipment Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 17: Latin America Refurbished Medical Imaging Equipment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 18: Latin America Refurbished Medical Imaging Equipment Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 19: Latin America Refurbished Medical Imaging Equipment Market (US$ Mn) Forecast, by Application, 2017–2031

Table 20: Latin America Refurbished Medical Imaging Equipment Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 21: Middle East & Africa Refurbished Medical Imaging Equipment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Middle East & Africa Refurbished Medical Imaging Equipment Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 23: Middle East & Africa Refurbished Medical Imaging Equipment Market (US$ Mn) Forecast, by Application, 2017–2031

Table 24: Middle East & Africa Refurbished Medical Imaging Equipment Market Value (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Refurbished Medical Imaging Equipment Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Refurbished Medical Imaging Equipment Market Value Share Analysis, by Product Type, 2020 and 2031

Figure 03: Global Refurbished Medical Imaging Equipment Market Attractiveness Analysis, by Product Type, 2021–2031

Figure 04: Global Refurbished Medical Imaging Equipment Market Value (US$ Mn) Forecast, by X-ray Devices, 2017–2031

Figure 05: Global Refurbished Medical Imaging Equipment Market Value (US$ Mn) Forecast, by Ultrasound Systems, 2017–2031

Figure 06: Global Refurbished Medical Imaging Equipment Market Value (US$ Mn) Forecast, by CT Scanners, 2017–2031

Figure 07: Global Refurbished Medical Imaging Equipment Market Value (US$ Mn) Forecast, by MRI Equipment, 2017–2031

Figure 08: Global Refurbished Medical Imaging Equipment Market Value (US$ Mn) Forecast, by Others, 2017–2031

Figure 09: Global Refurbished Medical Imaging Equipment Market Value Share Analysis, by Application, 2020 and 2031

Figure 10: Global Refurbished Medical Imaging Equipment Market Attractiveness Analysis, by Application, 2021–2031

Figure 11: Global Refurbished Medical Imaging Equipment Market Value (US$ Mn) Forecast, by Oncology, 2017–2031

Figure 12: Global Refurbished Medical Imaging Equipment Market Value (US$ Mn) Forecast, by Cardiovascular, 2017–2031

Figure 13: Global Refurbished Medical Imaging Equipment Market Value (US$ Mn) Forecast, by Gynecology, 2017–2031

Figure 13: Global Refurbished Medical Imaging Equipment Market Value (US$ Mn) Forecast, by Orthopedic, 2017–2031

Figure 14: Global Refurbished Medical Imaging Equipment Market Value (US$ Mn) Forecast, by Others, 2017–2031

Figure 15: Global Refurbished Medical Imaging Equipment Market Value Share Analysis, by End-user, 2020 and 2031

Figure 16: Global Refurbished Medical Imaging Equipment Market Attractiveness Analysis, by End-user, 2021–2031

Figure 17: Global Refurbished Medical Imaging Equipment Market Value (US$ Mn) Forecast, by Hospitals, 2017–2031

Figure 18: Global Refurbished Medical Imaging Equipment Market Value (US$ Mn) Forecast, by Diagnostic Centers, 2017–2031

Figure 19: Global Refurbished Medical Imaging Equipment Market Value (US$ Mn) Forecast, by Ambulatory Surgical Centers, 2017–2031

Figure 20: Global Refurbished Medical Imaging Equipment Market Value (US$ Mn) Forecast, by Others, 2017–2031

Figure 21: Global Refurbished Medical Imaging Equipment Market Value Share Analysis, by Region, 2020 and 2031

Figure 22: Global Refurbished Medical Imaging Equipment Market Attractiveness Analysis, by Region, 2021–2031

Figure 23: North America Refurbished Medical Imaging Equipment Market Value (US$ Mn) Forecast, 2017–2031

Figure 24: North America Refurbished Medical Imaging Equipment Market Value Share Analysis, by Country, 2020 and 2031

Figure 25: North America Refurbished Medical Imaging Equipment Market Attractiveness Analysis, by Country, 2021–2031

Figure 26: North America Refurbished Medical Imaging Equipment Market Value Share Analysis, by Product Type, 2020 and 2031

Figure 27: North America Refurbished Medical Imaging Equipment Market Attractiveness Analysis, by Product Type, 2021–2031

Figure 28: North America Refurbished Medical Imaging Equipment Market Value Share Analysis, by Application, 2020 and 2031

Figure 29: North America Refurbished Medical Imaging Equipment Market Attractiveness Analysis, by Application, 2021–2031

Figure 30: North America Refurbished Medical Imaging Equipment Market Value Share Analysis, by End-user, 2020 and 2031

Figure 31: North America Refurbished Medical Imaging Equipment Market Attractiveness Analysis, by End-user, 2021–2031

Figure 32: Europe Refurbished Medical Imaging Equipment Market Value (US$ Mn) Forecast, 2017–2031

Figure 33: Europe Refurbished Medical Imaging Equipment Market Value Share Analysis, by Country/Sub-region, 2020 and 2031

Figure 34: Europe Refurbished Medical Imaging Equipment Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 35: Europe Refurbished Medical Imaging Equipment Market Value Share Analysis, by Product Type, 2020 and 2031

Figure 36: Europe Refurbished Medical Imaging Equipment Market Attractiveness Analysis, by Product Type, 2021–2031

Figure 37: Europe Refurbished Medical Imaging Equipment Market Value Share Analysis, by Application, 2020 and 2031

Figure 38: Europe Refurbished Medical Imaging Equipment Market Attractiveness Analysis, by Application, 2021–2031

Figure 39: Europe Refurbished Medical Imaging Equipment Market Value Share Analysis, by End-user, 2020 and 2031

Figure 40: Europe Refurbished Medical Imaging Equipment Market Attractiveness Analysis, by End-user, 2021–2031

Figure 41: Asia Pacific Refurbished Medical Imaging Equipment Market Value (US$ Mn) Forecast, 2017–2031

Figure 42: Asia Pacific Refurbished Medical Imaging Equipment Market Value Share Analysis, by Country/Sub-region, 2020 and 2031

Figure 43: Asia Pacific Refurbished Medical Imaging Equipment Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 44: Asia Pacific Refurbished Medical Imaging Equipment Market Value Share Analysis, by Product Type, 2020 and 2031

Figure 45: Asia Pacific Refurbished Medical Imaging Equipment Market Attractiveness Analysis, by Product Type, 2021–2031

Figure 46: Asia Pacific Refurbished Medical Imaging Equipment Market Value Share Analysis, by Application, 2020 and 2031

Figure 47: Asia Pacific Refurbished Medical Imaging Equipment Market Attractiveness Analysis, by Application, 2021–2031

Figure 48: Asia Pacific Refurbished Medical Imaging Equipment Market Value Share Analysis, by End-user, 2020 and 2031

Figure 49: Asia Pacific Refurbished Medical Imaging Equipment Market Attractiveness Analysis, by End-user, 2021-2031

Figure 50: Latin America Refurbished Medical Imaging Equipment Market Value (US$ Mn) Forecast, 2017–2031

Figure 51: Latin America Refurbished Medical Imaging Equipment Market Value Share Analysis, by Country/Sub-region, 2020 and 2031

Figure 52: Latin America Refurbished Medical Imaging Equipment Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 53: Latin America Refurbished Medical Imaging Equipment Market Value Share Analysis, by Product Type, 2020 and 2031

Figure 54: Latin America Refurbished Medical Imaging Equipment Market Attractiveness Analysis, by Product Type, 2021–2031

Figure 55: Latin America Refurbished Medical Imaging Equipment Market Value Share Analysis, by Application, 2020 and 2031

Figure 56: Latin America Refurbished Medical Imaging Equipment Market Attractiveness Analysis, by Application, 2021–2031

Figure 57: Latin America Refurbished Medical Imaging Equipment Market Value Share Analysis, by End-user, 2020 and 2031

Figure 58: Latin America Refurbished Medical Imaging Equipment Market Attractiveness Analysis, by End-user, 2021–2031

Figure 59: Middle East & Africa Refurbished Medical Imaging Equipment Market Value (US$ Mn) Forecast, 2017–2031

Figure 60: Middle East & Africa Refurbished Medical Imaging Equipment Market Value Share Analysis, by Country/Sub-region, 2020 and 2031

Figure 61: Middle East & Africa Refurbished Medical Imaging Equipment Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 62: Middle East & Africa Refurbished Medical Imaging Equipment Market Value Share Analysis, by Product Type, 2020 and 2031

Figure 63: Middle East & Africa Refurbished Medical Imaging Equipment Market Attractiveness Analysis, by Product Type, 2021–2031

Figure 64: Middle East & Africa Refurbished Medical Imaging Equipment Market Value Share Analysis, by Application, 2020 and 2031

Figure 65: Middle East & Africa Refurbished Medical Imaging Equipment Market Attractiveness Analysis, by Application, 2021–2031

Figure 66: Middle East & Africa Refurbished Medical Imaging Equipment Market Value Share Analysis, by End-user, 2020 and 2031

Figure 67: Middle East & Africa Refurbished Medical Imaging Equipment Market Attractiveness Analysis, by End-user, 2021–2031