Reports

Reports

Analysts’ Viewpoint

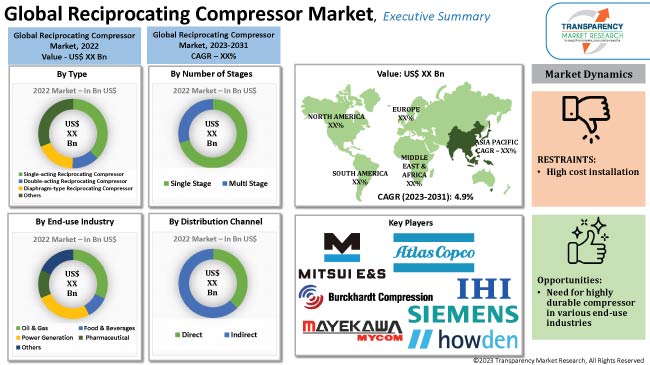

Expansion of the oil & gas industry is projected to drive the global reciprocating compressors market during the forecast period. Increase in usage of reciprocating compressors in the health and pharmaceutical industries where technological advancements in medical equipment is anticipated to propel market development. Furthermore, innovative advances, significant research & development ventures, and access to cutting edge technology are fueling market progress.

Growing emphasis on reducing crosshead vibration and early fault detection & damage offers lucrative opportunities for market players. Reciprocating compressor manufacturers are developing technologically advanced compressors to meet the requirements of sectors such as semiconductors and electronics.

Reciprocating compressor, also known as positive displacement machine, uses a piston to compress gas and deliver it at high pressure. It is capable of handling gases with a high mass to pressure ratio.

Single stage reciprocating air compressor and two stage reciprocating air compressor are the two common types of reciprocating compressors utilized in the industry. During the operation, a reciprocating air compressor takes gas from the suction line, compresses it with the reciprocating motion of the crankshaft driven piston, and releases the compressed gas to the discharge line. Reciprocating compressors are employed when a relatively dry process fluid necessitates high compression ratios per stage without high flow rates. Based on crankshaft driven piston, the global reciprocating compressor market has been segmented into single acting compressor and double acting compressor. Compression cylinders of a double acting compressor are arranged horizontally, while those of a single acting compressor is typically arranged vertically.

Advantages of reciprocating compressor include flexibility of use, higher pressure generation, high efficiencies achieved, and efficiency of use in intermittent cycling. The refrigeration cycle is the primary application of reciprocating compressors. It is used extensively in pipelines for natural gas, oil refineries, chemical plants, and other facilities.

Expansion of the oil & gas industry is anticipated to propel the global reciprocating compressor market during the forecast period. Oil and gas are still the most dependable sources of energy in the world. According to the U.S. Energy Data Organization, the U.S. alone uses 20.5 million barrels of petrol each day. The petroleum and natural gas industries in the country accounted for 8% of GDP in 2021. With a favorable regulatory framework, gas production in Europe can be maintained or even increased by supplementing truly necessary energy investment funds.

Asia Pacific produced 8.4% of the world's oil in 2020. China and India led the region. India has set an objective to raise the portion of flammable gas in the energy blend from around 6.7% presently to 15% by 2030. The task declared by the country focuses on setting up 12 business-scale 2G bio-ethanol projects and 5000 compacted biogas (CBG) units. The Petroleum Planning & Analysis Cell (PPAC), a division of the Ministry of Petroleum & Natural Gas, predicts that India's energy demand will rise by 4% to 5% annually in the next ten years.

Compressors can handle all volume capacities and pressures; hence, reciprocating compressors are most commonly used in natural gas compressors. Natural gas can have its pressure increased and the right amount of pressure maintained in a reservoir depending on the type of compressor used. Different governments mandate that the natural gas contained in petroleum be compressed by 95%. Therefore, in order to raise gas pressure, a significant portion of the petroleum must be processed prior to pipeline transportation.

Advancements in medical technology, which are rapidly and significantly altering the healthcare landscape, is likely to drive the global reciprocating compressors market. Several types of medical equipment rely on reciprocating compressors to operate optimally.

Healthcare costs more in the U.S. than in most other nations. The country spent nearly 16.8% of GDP in 2019 on healthcare, according to the Commonwealth Fund. With a spending percentage of 11.7%, Germany came in second, followed by Switzerland with a spending percentage of 11.3%. Hospitals, medical devices, clinical trials, and medical equipment make up India's healthcare industry. Since 2016, India's healthcare sector has grown approximately 22%, according to government factsheet. The clinical gadget is a quickly developing segment in China's medical services market, with twofold digit development rates for more than 10 years.

Compressors remain 100% reliable even after performing full duty cycle; hence, these are utilized extensively in medical facilities. Reciprocating compressors are used to produce clean air in most medical facilities. Furthermore, the pressure of the air needs to be just right for it to be useful. The cooler-running piston systems found in more recent advanced reciprocating compressor models effectively combat heat buildup. For optimal operation, several types of medical equipment rely on reciprocating compressors. Pneumatic surgical instruments and ventilators are included in this category.

As per reciprocating compressor market trends, North America is anticipated to dominate the global market during the forecast period. The oil & petroleum gas industry is likely to drive the market in the region in the next few years. Advancements in reciprocating compressor systems and wide availability of high-quality compressors are bolstering the reciprocating compressor market in North America.

The market in Asia Pacific is expected to grow at a rapid pace during the forecast period. As per reciprocating compressor market analysis, expanding electronics, oil & gas, and healthcare industries are propelling the market in the region. Furthermore, the utilization of reciprocating compressors in assembling lines by major automotive manufacturers is expected to augment the reciprocating compressor market in Asia Pacific in the near future. The Government of China has implemented stricter regulations to improve air quality as a result of the country's growing environmental consciousness and initiatives. This is projected to bolster the reciprocating compressor market growth in the region in the next few years.

Prominent manufacturers in the industry have adopted strategies such as investment in R&D, product development, product expansion, and merger & acquisition to increase market share and presence. The global market is highly stagnant and competitive, with the presence of various global and regional players. Ariel Corporation, Atlas Copco, Burckhardt Compression AG, Gardner Denver Holdings, Inc., GE Company, Howden Group Ltd., IHI Corporation, Ltd., Mayekawa Mfg. Co., LTD, Mitsui E&S Holdings Co., Ltd., and Siemens AG are the prominent players in the market.

Each of these players has been profiled in the reciprocating compressor industry report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Size in 2022 |

US$ 5.3 Bn |

|

Forecast (Value) in 2031 |

US$ 8.1 Bn |

|

Growth Rate (CAGR) |

4.9% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value & Thousand Units for Volume |

|

Market Analysis |

It includes cross segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Region Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global industry was valued at US$ 5.3 Bn in 2022.

The CAGR is projected to be 4.9% from 2023 to 2031

Expansion of oil & gas industry and growing health industry are driving the global market for reciprocating compressor

Double-acting reciprocating compressor segment accounted for significant share of the global market in 2022

Asia Pacific is likely to be one of the lucrative markets in the next few years

Ariel Corporation, Atlas Copco, Burckhardt Compression AG, Gardner Denver Holdings, Inc., GE Company, Howden Group Ltd., IHI Corporation, Ltd., Mayekawa Mfg. Co., LTD, Mitsui E&S Holdings Co., Ltd., and Siemens AG are the prominent players in the market.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.5. Technological Overview Analysis

5.6. Porter’s Five Forces Analysis

5.7. Industry SWOT Analysis

5.8. Value Chain Analysis

5.9. Regulatory Framework

5.10. Global Reciprocating Compressor Market Analysis and Forecast, 2017–2031

5.10.1. Market Value Projections (US$ Bn)

5.10.2. Market Volume Projections (Thousand Units)

6. Global Reciprocating Compressor Market Analysis and Forecast, by Type

6.1. Reciprocating Compressor Market Size (US$ Bn and Thousand Units) Forecast, by Type, 2017 – 2031

6.1.1. Single-acting Reciprocating Compressor

6.1.2. Double-acting Reciprocating Compressor

6.1.3. Diaphragm-type Reciprocating Compressor

6.1.4. Others

6.2. Incremental Opportunity, by Type

7. Global Reciprocating Compressor Market Analysis and Forecast, by Number of Stages

7.1. Reciprocating Compressor Market Size (US$ Bn and Thousand Units) Forecast, by Number of Stages, 2017–2031

7.1.1. Single Stage

7.1.2. Multi Stage

7.2. Incremental Opportunity, by Number of Stages

8. Global Reciprocating Compressor Market Analysis and Forecast, by End-use Industry

8.1. Reciprocating Compressor Market Size (US$ Bn and Thousand Units) Forecast, by End-use Industry, 2017 – 2031

8.1.1. Oil & Gas

8.1.2. Food & Beverages

8.1.3. Power Generation

8.1.4. Pharmaceutical

8.1.5. Others

8.2. Incremental Opportunity, by End-use Industry

9. Global Reciprocating Compressor Market Analysis and Forecast, by Distribution Channel

9.1. Reciprocating Compressor Market Size (US$ Bn and Thousand Units) Forecast, by Distribution Channel, 2017–2031

9.1.1. Direct

9.1.2. Indirect

9.2. Incremental Opportunity, by Distribution Channel

10. Global Reciprocating Compressor Market Analysis and Forecast, by Region

10.1. Reciprocating Compressor Market Size (US$ Bn and Thousand Units) Forecast, by Region, 2017 - 2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Incremental Opportunity, by Region

11. North America Reciprocating Compressor Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Brand Analysis

11.3. Price Trend Analysis

11.3.1. Weighted Average Price

11.4. Key Trends Analysis

11.4.1. Demand Side

11.4.2. Supplier Side

11.5. Reciprocating Compressor Market Size (US$ Bn and Thousand Units) Forecast, by Type, 2017 – 2031

11.5.1. Single-acting Reciprocating Compressor

11.5.2. Double-acting Reciprocating Compressor

11.5.3. Diaphragm-type Reciprocating Compressor

11.5.4. Others

11.6. Reciprocating Compressor Market Size (US$ Bn and Thousand Units) Forecast, by Number of Stages, 2017–2031

11.6.1. Single Stage

11.6.2. Multi Stage

11.7. Reciprocating Compressor Market Size (US$ Bn and Thousand Units) Forecast, by End-use Industry, 2017 – 2031

11.7.1. Oil & Gas

11.7.2. Food & Beverages

11.7.3. Power Generation

11.7.4. Pharmaceutical

11.7.5. Others

11.8. Reciprocating Compressor Market Size (US$ Bn and Thousand Units) Forecast, by Distribution Channel, 2017–2031

11.8.1. Direct

11.8.2. Indirect

11.9. Reciprocating Compressor Market Size (US$ Bn and Thousand Units) Forecast, by Country, 2017–2031

11.9.1. U.S

11.9.2. Canada

11.9.3. Rest of North America

11.10. Incremental Opportunity Analysis

12. Europe Reciprocating Compressor Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Brand Analysis

12.3. Price Trend Analysis

12.3.1. Weighted Average Price

12.4. Key Trends Analysis

12.4.1. Demand Side

12.4.2. Supplier Side

12.5. Reciprocating Compressor Market Size (US$ Bn and Thousand Units) Forecast, by Type, 2017 – 2031

12.5.1. Single-acting Reciprocating Compressor

12.5.2. Double-acting Reciprocating Compressor

12.5.3. Diaphragm-type Reciprocating Compressor

12.5.4. Others

12.6. Reciprocating Compressor Market Size (US$ Bn and Thousand Units) Forecast, by Number of Stages, 2017–2031

12.6.1. Single Stage

12.6.2. Multi Stage

12.7. Reciprocating Compressor Market Size (US$ Bn and Thousand Units) Forecast, by End-use Industry, 2017 – 2031

12.7.1. Oil & Gas

12.7.2. Food & Beverages

12.7.3. Power Generation

12.7.4. Pharmaceutical

12.7.5. Others

12.8. Reciprocating Compressor Market Size (US$ Bn and Thousand Units) Forecast, by Distribution Channel, 2017–2031

12.8.1. Direct

12.8.2. Indirect

12.9. Reciprocating Compressor Market Size (US$ Bn and Thousand Units) Forecast, by Country, 2017–2031

12.9.1. U.K.

12.9.2. Germany

12.9.3. France

12.9.4. Rest of Europe

12.10. Incremental Opportunity Analysis

13. Asia Pacific Reciprocating Compressor Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Brand Analysis

13.3. Key Trends Analysis

13.3.1. Demand Side

13.3.2. Supplier Side

13.4. Reciprocating Compressor Market Size (US$ Bn and Thousand Units) Forecast, by Type, 2017 – 2031

13.4.1. Single-acting Reciprocating Compressor

13.4.2. Double-acting Reciprocating Compressor

13.4.3. Diaphragm-type Reciprocating Compressor

13.4.4. Others

13.5. Reciprocating Compressor Market Size (US$ Bn and Thousand Units) Forecast, by Number of Stages, 2017–2031

13.5.1. Single Stage

13.5.2. Multi Stage

13.6. Reciprocating Compressor Market Size (US$ Bn and Thousand Units) Forecast, by End-use Industry, 2017 – 2031

13.6.1. Oil & Gas

13.6.2. Food & Beverages

13.6.3. Power Generation

13.6.4. Pharmaceutical

13.6.5. Others

13.7. Reciprocating Compressor Market Size (US$ Bn and Thousand Units) Forecast, by Distribution Channel, 2017–2031

13.7.1. Direct

13.7.2. Indirect

13.8. Reciprocating Compressor Market Size (US$ Bn and Thousand Units) Forecast, by Country, 2017–2031

13.8.1. India

13.8.2. China

13.8.3. Japan

13.8.4. Rest of Asia Pacific

13.9. Incremental Opportunity Analysis

14. Middle East & South Africa Reciprocating Compressor Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Brand Analysis

14.3. Price Trend Analysis

14.3.1. Weighted Average Price

14.4. Key Trends Analysis

14.4.1. Demand Side

14.4.2. Supplier Side

14.5. Reciprocating Compressor Market Size (US$ Bn and Thousand Units) Forecast, by Type, 2017 – 2031

14.5.1. Single-acting Reciprocating Compressor

14.5.2. Double-acting Reciprocating Compressor

14.5.3. Diaphragm-type Reciprocating Compressor

14.5.4. Others

14.6. Reciprocating Compressor Market Size (US$ Bn and Thousand Units) Forecast, by Number of Stages, 2017–2031

14.6.1. Single Stage

14.6.2. Multi Stage

14.7. Reciprocating Compressor Market Size (US$ Bn and Thousand Units) Forecast, by End-use Industry, 2017 – 2031

14.7.1. Oil & Gas

14.7.2. Food & Beverages

14.7.3. Power Generation

14.7.4. Pharmaceutical

14.7.5. Others

14.8. Reciprocating Compressor Market Size (US$ Bn and Thousand Units) Forecast, by Distribution Channel, 2017–2031

14.8.1. Direct

14.8.2. Indirect

14.9. Reciprocating Compressor Market Size (US$ Bn and Thousand Units) Forecast, by Country, 2017–2031

14.9.1. GCC

14.9.2. Rest of MEA

14.10. Incremental Opportunity Analysis

15. South America Reciprocating Compressor Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Brand Analysis

15.3. Price Trend Analysis

15.3.1. Weighted Average Price

15.4. Key Trends Analysis

15.4.1. Demand Side

15.4.2. Supplier Side

15.5. Reciprocating Compressor Market Size (US$ Bn and Thousand Units) Forecast, by Type, 2017 – 2031

15.5.1. Single-acting Reciprocating Compressor

15.5.2. Double-acting Reciprocating Compressor

15.5.3. Diaphragm-type Reciprocating Compressor

15.5.4. Others

15.6. Reciprocating Compressor Market Size (US$ Bn and Thousand Units) Forecast, by Number of Stages, 2017–2031

15.6.1. Single Stage

15.6.2. Multi Stage

15.7. Reciprocating Compressor Market Size (US$ Bn and Thousand Units) Forecast, by End-use Industry, 2017 – 2031

15.7.1. Oil & Gas

15.7.2. Food & Beverages

15.7.3. Power Generation

15.7.4. Pharmaceutical

15.7.5. Others

15.8. Reciprocating Compressor Market Size (US$ Bn and Thousand Units) Forecast, by Distribution Channel, 2017–2031

15.8.1. Direct

15.8.2. Indirect

15.9. Reciprocating Compressor Market Size (US$ Bn and Thousand Units) Forecast, by Country, 2017–2031

15.9.1. Brazil

15.9.2. Rest of South America

15.10. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Market Player – Competition Dashboard

16.2. Market Share Analysis (%), by Company, (2022)

16.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

16.3.1. Ariel Corporation

16.3.1.1. Company Overview

16.3.1.2. Sales Area/Geographical Presence

16.3.1.3. Revenue

16.3.1.4. Strategy & Business Overview

16.3.2. Atlas Copco

16.3.2.1. Company Overview

16.3.2.2. Sales Area/Geographical Presence

16.3.2.3. Revenue

16.3.2.4. Strategy & Business Overview

16.3.3. Burckhardt Compression AG

16.3.3.1. Company Overview

16.3.3.2. Sales Area/Geographical Presence

16.3.3.3. Revenue

16.3.3.4. Strategy & Business Overview

16.3.4. Gardner Denver Holdings Inc.

16.3.4.1. Company Overview

16.3.4.2. Sales Area/Geographical Presence

16.3.4.3. Revenue

16.3.4.4. Strategy & Business Overview

16.3.5. GE Company

16.3.5.1. Company Overview

16.3.5.2. Sales Area/Geographical Presence

16.3.5.3. Revenue

16.3.5.4. Strategy & Business Overview

16.3.6. Howden Group Ltd.

16.3.6.1. Company Overview

16.3.6.2. Sales Area/Geographical Presence

16.3.6.3. Revenue

16.3.6.4. Strategy & Business Overview

16.3.7. IHI Corporation, Ltd.

16.3.7.1. Company Overview

16.3.7.2. Sales Area/Geographical Presence

16.3.7.3. Revenue

16.3.7.4. Strategy & Business Overview

16.3.8. Mayekawa Mfg. Co., LTD

16.3.8.1. Company Overview

16.3.8.2. Sales Area/Geographical Presence

16.3.8.3. Revenue

16.3.8.4. Strategy & Business Overview

16.3.9. Mitsui E&S Holdings Co., Ltd.

16.3.9.1. Company Overview

16.3.9.2. Sales Area/Geographical Presence

16.3.9.3. Revenue

16.3.9.4. Strategy & Business Overview

16.3.10. Siemens AG

16.3.10.1. Company Overview

16.3.10.2. Sales Area/Geographical Presence

16.3.10.3. Revenue

16.3.10.4. Strategy & Business Overview

17. Key Takeaways

17.1. Identification of Potential Market Spaces

17.1.1. By Type

17.1.2. By Number of Stages

17.1.3. By End-use Industry

17.1.4. By Distribution Channel

17.1.5. By Region

17.2. Prevailing Market Risks

17.3. Understanding the Buying Process of the Customers

17.4. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Reciprocating Compressor Market Value (US$ Bn), by Type, 2017-2031

Table 2: Global Reciprocating Compressor Market Volume (Thousand Units), by Type, 2017-2031

Table 3: Global Reciprocating Compressor Market Value (US$ Bn), by Number of Stages, 2017-2031

Table 4: Global Reciprocating Compressor Market Volume (Thousand Units), by Number of Stages, 2017-2031

Table 5: Global Reciprocating Compressor Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 6: Global Reciprocating Compressor Market Volume (Thousand Units), by End-use Industry, 2017-2031

Table 7: Global Reciprocating Compressor Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 8: Global Reciprocating Compressor Market Volume (Thousand Units), by Distribution Channel, 2017-2031

Table 9: Global Reciprocating Compressor Market Value (US$ Bn), by Region, 2017-2031

Table 10: Global Reciprocating Compressor Market Volume (Thousand Units), by Region, 2017-2031

Table 11: North America Reciprocating Compressor Market Value (US$ Bn), by Type, 2017-2031

Table 12: North America Reciprocating Compressor Market Volume (Thousand Units), by Type, 2017-2031

Table 13: North America Reciprocating Compressor Market Value (US$ Bn), by Number of Stages, 2017-2031

Table 14: North America Reciprocating Compressor Market Volume (Thousand Units), by Number of Stages, 2017-2031

Table 15: North America Reciprocating Compressor Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 16: North America Reciprocating Compressor Market Volume (Thousand Units), by End-use Industry, 2017-2031

Table 17: North America Reciprocating Compressor Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 18: North America Reciprocating Compressor Market Volume (Thousand Units), by Distribution Channel, 2017-2031

Table 19: North America Reciprocating Compressor Market Value (US$ Bn), by Region, 2017-2031

Table 20: North America Reciprocating Compressor Market Volume (Thousand Units), by Region 2017-2031

Table 21: Europe Reciprocating Compressor Market Value (US$ Bn), by Type, 2017-2031

Table 22: Europe Reciprocating Compressor Market Volume (Thousand Units), by Type 2017-2031

Table 23: Europe Reciprocating Compressor Market Value (US$ Bn), by Number of Stages, 2017-2031

Table 24: Europe Reciprocating Compressor Market Volume (Thousand Units), by Number of Stages, 2017-2031

Table 25: Europe Reciprocating Compressor Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 26: Europe Reciprocating Compressor Market Volume (Thousand Units), by End-use Industry, 2017-2031

Table 27: Europe Reciprocating Compressor Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 28: Europe Reciprocating Compressor Market Volume (Thousand Units), by Distribution Channel, 2017-2031

Table 29: Europe Reciprocating Compressor Market Value (US$ Bn), by Region, 2017-2031

Table 30: Europe Reciprocating Compressor Market Volume (Thousand Units), by Region, 2017-2031

Table 31: Asia Pacific Reciprocating Compressor Market Value (US$ Bn), by Type, 2017-2031

Table 32: Asia Pacific Reciprocating Compressor Market Volume (Thousand Units), by Type, 2017-2031

Table 33: Asia Pacific Reciprocating Compressor Market Value (US$ Bn), by Number of Stages, 2017-2031

Table 34: Asia Pacific Reciprocating Compressor Market Volume (Thousand Units), by Number of Stages, 2017-2031

Table 35: Asia Pacific Reciprocating Compressor Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 36: Asia Pacific Reciprocating Compressor Market Volume (Thousand Units), by End-use Industry, 2017-2031

Table 37: Asia Pacific Reciprocating Compressor Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 38: Asia Pacific Reciprocating Compressor Market Volume (Thousand Units), by Distribution Channel, 2017-2031

Table 39: Asia Pacific Reciprocating Compressor Market Value (US$ Bn), by Region, 2017-2031

Table 40: Asia Pacific Reciprocating Compressor Market Volume (Thousand Units), by Region, 2017-2031

Table 41: Middle East & Africa Reciprocating Compressor Market Value (US$ Bn), by Type, 2017-2031

Table 42: Middle East & Africa Reciprocating Compressor Market Volume (Thousand Units), by Type, 2017-2031

Table 43: Middle East & Africa Reciprocating Compressor Market Value (US$ Bn), by Number of Stages, 2017-2031

Table 44: Middle East & Africa Reciprocating Compressor Market Volume (Thousand Units), by Number of Stages, 2017-2031

Table 45: Middle East & Africa Reciprocating Compressor Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 46: Middle East & Africa Reciprocating Compressor Market Volume (Thousand Units), by End-use Industry, 2017-2031

Table 47: Middle East & Africa Reciprocating Compressor Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 48: Middle East & Africa Reciprocating Compressor Market Volume (Thousand Units), by Distribution Channel, 2017-2031

Table 49: Middle East & Africa Reciprocating Compressor Market Value (US$ Bn), by Region, 2017-2031

Table 50: Middle East & Africa Reciprocating Compressor Market Volume (Thousand Units), by Region, 2017-2031

Table 51: South America Reciprocating Compressor Market Value (US$ Bn), by Type, 2017-2031

Table 52: South America Reciprocating Compressor Market Volume (Thousand Units), by Type, 2017-2031

Table 53: South America Reciprocating Compressor Market Value (US$ Bn), by Number of Stages, 2017-2031

Table 54: South America Reciprocating Compressor Market Volume (Thousand Units), by Number of Stages, 2017-2031

Table 55: South America Reciprocating Compressor Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 56: South America Reciprocating Compressor Market Volume (Thousand Units), by End-use Industry, 2017-2031

Table 57: South America Reciprocating Compressor Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 58: South America Reciprocating Compressor Market Volume (Thousand Units), by Distribution Channel, 2017-2031

Table 59: South America Reciprocating Compressor Market Value (US$ Bn), by Region, 2017-2031

Table 60: South America Reciprocating Compressor Market Volume (Thousand Units), by Region, 2017-2031

List of Figures

Figure 1: Global Reciprocating Compressor Market Value (US$ Bn), by Type, 2017-2031

Figure 2: Global Reciprocating Compressor Market Volume (Thousand Units), by Type, 2017-2031

Figure 3: Global Reciprocating Compressor Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 4: Global Reciprocating Compressor Market Value (US$ Bn), by Number of Stages, 2017-2031

Figure 5: Global Reciprocating Compressor Market Volume (Thousand Units), by Number of Stages, 2017-2031

Figure 6: Global Reciprocating Compressor Market Incremental Opportunity (US$ Bn), Forecast, by Number of Stages, 2023-2031

Figure 7: Global Reciprocating Compressor Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 8: Global Reciprocating Compressor Market Volume (Thousand Units), by End-use Industry, 2017-2031

Figure 9: Global Reciprocating Compressor Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 10: Global Reciprocating Compressor Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 11: Global Reciprocating Compressor Market Volume (Thousand Units), by Distribution Channel, 2017-2031

Figure 12: Global Reciprocating Compressor Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 13: Global Reciprocating Compressor Market Value (US$ Bn), by Region, 2017-2031

Figure 14: Global Reciprocating Compressor Market Volume (Thousand Units), by Region, 2017-2031

Figure 15: Global Reciprocating Compressor Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 16: North America Reciprocating Compressor Market Value (US$ Bn), by Type, 2017-2031

Figure 17: North America Reciprocating Compressor Market Volume (Thousand Units), by Type, 2017-2031

Figure 18: North America Reciprocating Compressor Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 19: North America Reciprocating Compressor Market Value (US$ Bn), by Number of Stages, 2017-2031

Figure 20: North America Reciprocating Compressor Market Volume (Thousand Units), by Number of Stages, 2017-2031

Figure 21: North America Reciprocating Compressor Market Incremental Opportunity (US$ Bn), Forecast, by Number of Stages, 2023-2031

Figure 22: North America Reciprocating Compressor Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 23: North America Reciprocating Compressor Market Volume (Thousand Units), by End-use Industry, 2017-2031

Figure 24: North America Reciprocating Compressor Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 25: North America Reciprocating Compressor Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 26: North America Reciprocating Compressor Market Volume (Thousand Units), by Distribution Channel, 2017-2031

Figure 27: North America Reciprocating Compressor Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 28: North America Reciprocating Compressor Market Value (US$ Bn), by Region, 2017-2031

Figure 29: North America Reciprocating Compressor Market Volume (Thousand Units), by Region, 2017-2031

Figure 30: North America Reciprocating Compressor Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 31: Europe Reciprocating Compressor Market Value (US$ Bn), by Type, 2017-2031

Figure 32: Europe Reciprocating Compressor Market Volume (Thousand Units), by Type, 2017-2031

Figure 33: Europe Reciprocating Compressor Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 34: Europe Reciprocating Compressor Market Value (US$ Bn), by Number of Stages, 2017-2031

Figure 35: Europe Reciprocating Compressor Market Volume (Thousand Units), by Number of Stages, 2017-2031

Figure 36: Europe Reciprocating Compressor Market Incremental Opportunity (US$ Bn), Forecast, by Number of Stages, 2023-2031

Figure 37: Europe Reciprocating Compressor Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 38: Europe Reciprocating Compressor Market Volume (Thousand Units), by End-use Industry, 2017-2031

Figure 39: Europe Reciprocating Compressor Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 40: Europe Reciprocating Compressor Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 41: Europe Reciprocating Compressor Market Volume (Thousand Units), by Distribution Channel, 2017-2031

Figure 42: Europe Reciprocating Compressor Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 43: Europe Reciprocating Compressor Market Value (US$ Bn), by Region, 2017-2031

Figure 44: Europe Reciprocating Compressor Market Volume (Thousand Units), by Region, 2017-2031

Figure 45: Europe Reciprocating Compressor Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 46: Asia Pacific Reciprocating Compressor Market Value (US$ Bn), by Type, 2017-2031

Figure 47: Asia Pacific Reciprocating Compressor Market Volume (Thousand Units), by Type, 2017-2031

Figure 48: Asia Pacific Reciprocating Compressor Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 49: Asia Pacific Reciprocating Compressor Market Value (US$ Bn), by Number of Stages, 2017-2031

Figure 50: Asia Pacific Reciprocating Compressor Market Volume (Thousand Units), by Number of Stages, 2017-2031

Figure 51: Asia Pacific Reciprocating Compressor Market Incremental Opportunity (US$ Bn), Forecast, by Number of Stages, 2023-2031

Figure 52: Asia Pacific Reciprocating Compressor Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 53: Asia Pacific Reciprocating Compressor Market Volume (Thousand Units), by End-use Industry, 2017-2031

Figure 54: Asia Pacific Reciprocating Compressor Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 55: Asia Pacific Reciprocating Compressor Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 56: Asia Pacific Reciprocating Compressor Market Volume (Thousand Units), by Distribution Channel, 2017-2031

Figure 57: Asia Pacific Reciprocating Compressor Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 58: Asia Pacific Reciprocating Compressor Market Value (US$ Bn), by Region, 2017-2031

Figure 59: Asia Pacific Reciprocating Compressor Market Volume (Thousand Units), by Region, 2017-2031

Figure 60: Asia Pacific Reciprocating Compressor Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 61: Middle East & Africa Reciprocating Compressor Market Value (US$ Bn), by Type, 2017-2031

Figure 62: Middle East & Africa Reciprocating Compressor Market Volume (Thousand Units), by Type, 2017-2031

Figure 63: Middle East & Africa Reciprocating Compressor Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 64: Middle East & Africa Reciprocating Compressor Market Value (US$ Bn), by Number of Stages, 2017-2031

Figure 65: Middle East & Africa Reciprocating Compressor Market Volume (Thousand Units), by Number of Stages, 2017-2031

Figure 66: Middle East & Africa Reciprocating Compressor Market Incremental Opportunity (US$ Bn), Forecast, by Number of Stages,2023-2031

Figure 67: Middle East & Africa Reciprocating Compressor Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 68: Middle East & Africa Reciprocating Compressor Market Volume (Thousand Units), by End-use Industry, 2017-2031

Figure 69: Middle East & Africa Reciprocating Compressor Market Incremental Opportunity (US$ Bn), Forecast, by End Use Industry, 2017-2031

Figure 70: Middle East & Africa Reciprocating Compressor Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 71: Middle East & Africa Reciprocating Compressor Market Volume (Thousand Units), by Distribution Channel, 2017-2031

Figure 72: Middle East & Africa Reciprocating Compressor Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 73: Middle East & Africa Reciprocating Compressor Market Value (US$ Bn), by Region, 2017-2031

Figure 74: Middle East & Africa Reciprocating Compressor Market Volume (Thousand Units), by Region, 2017-2031

Figure 75: Middle East & Africa Reciprocating Compressor Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 76: South America Reciprocating Compressor Market Value (US$ Bn), by Type, 2017-2031

Figure 77: South America Reciprocating Compressor Market Volume (Thousand Units), by Type, 2017-2031

Figure 78: South America Reciprocating Compressor Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 79: South America Reciprocating Compressor Market Value (US$ Bn), by Number of Stages, 2017-2031

Figure 80: South America Reciprocating Compressor Market Volume (Thousand Units), by Number of Stages, 2017-2031

Figure 81: South America Reciprocating Compressor Market Incremental Opportunity (US$ Bn), Forecast, by Number of Stages, 2023-2031

Figure 82: South America Reciprocating Compressor Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 83: South America Reciprocating Compressor Market Volume (Thousand Units), by End-use Industry, 2017-2031

Figure 84: South America Reciprocating Compressor Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 85: South America Reciprocating Compressor Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 86: South America Reciprocating Compressor Market Volume (Thousand Units), by Distribution Channel, 2017-2031

Figure 87: South America Reciprocating Compressor Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 88: South America Reciprocating Compressor Market Value (US$ Bn), by Region, 2017-2031

Figure 89: South America Reciprocating Compressor Market Volume (Thousand Units), by Region, 2017-2031

Figure 90: South America Reciprocating Compressor Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031