Reports

Reports

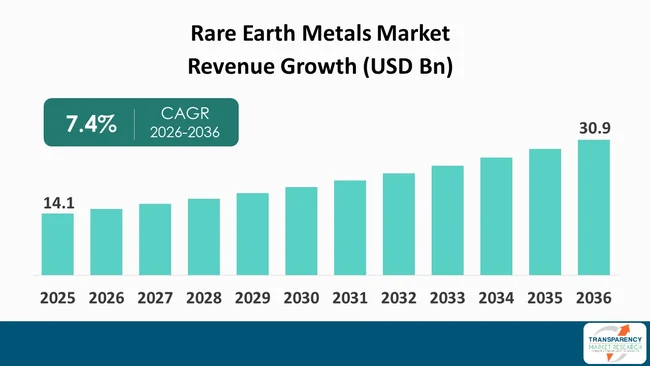

The global Rare Earth Metals market size was valued at US$ 14.1 Billion in 2025 and is projected to reach US$ 30.9 Billion by 2036, expanding at a CAGR of 7.4% from 2026 to 2036. The market is expected to be driven by accelerating demand from electric vehicles and clean energy technologies.

The increased usage of mobile phones and the other electronic gadgets is also looked upon as one of the drivers to the rare earth metals market. The rise in environmental concerns that are responsible for changes in the climate has resulted in an increase in the demand for clean energy sources. R&D activities in next-generation electric motors and turbines are bound to address the increasing demand.

Rare earth elements are used in the production of such machines due to their magnetic and high-temperature-resistant characteristics. They are also available for different applications including electronics and the military. The rise in usage of rare earth magnets in the renewable sector is prognosticated to drive the market going forward. They are very important in the construction of turbines and permanent magnet motors in the renewable sector. However, the rising costs of rare earth metals are seen as one of the primary market inhibitors.

Rare earth metals are a class of elements comprising the 15 lanthanide series elements. These elements are widely spread throughout the earth, mostly in the form of convent complexes. They cannot always be separated easily and have a similar set of properties. They have multiple uses in the electronics industry.

One of the rare earth metals called scandium is used in high-intensity metal halide lamps, high-strength aluminum alloys, electronics, and lasers. Some products made from REEs include digital memory devices, fluorescent lighting, smartphones, catalytic converters used in automotive exhaust systems, and rechargeable batteries. Rare earth magnets have visible applications in the electronic, automotive, and healthcare industries. They form one of the major parts of medical appliances such as MRI machines, pacemakers, sleep apnea machines, and insulin pumps.

| Attribute | Detail |

|---|---|

| Drivers |

|

The growing globalization toward low-carbon energy systems across the globe is currently driving the rare earth metal market, especially neodymium, praseodymium, dysprosium, and terbium-based alloys. The rare earths are looked upon as key materials for producing high-performance rare earth permanent magnets utilized in EV motors and wind turbines, as well as industrial equipment with high efficiency capacity. As economies start imposing stringent regulations toward low-carbon emissions and carmakers launch EV platform rollouts as quickly as possible, the rare earth portion within EVs continues to grow significantly.

Another driving force for the adoption of rare earth metals is the increasing energy obtained from the utilization of renewable energy sources. In fact, wind-energy harvesting, both - from offshore and onshore locations, largely employs rare earth metals for the purpose of increasing the efficiency of the permanent magnet generators associated with the turbines, thereby facilitating the minimization of the overall cost of the equipment including its compactness.

From a business perspective, this driver improves long-term demand visibility and pricing power for producers. OEMs have started demanding secure supply deals, hence the push for volatility risk mitigation through backward integration. Therefore, value capture for rare earth suppliers is possible for the ones that have diversified reserves and magnet-grade separation.

Geopolitics has put rare earth elements at the forefront of the strategies for the growth and progress of various economies across the globe. Government interventions have been crucial in fueling significant growth in the rare earth element market. Governments in North America, Europe, and various parts of Asia are actively supporting the mining, processing, and refining of rare earth elements in their respective countries to avoid over-concentration in the global market supply chain.

This move toward localization of the supply chain is impacting the nature of investment in the rare earth space. Public and private sector initiatives, which provide a risk mitigation advantage for investors, are resulting in investments being made in exploration, separation technologies, and magnet manufacturing. At the same time, defense and security strategies require sourcing of rare earth metals from within the national borders, which acts as an end consumer for these materials.

For businesses, it opens up the market by ensuring that barriers to entry are reduced and that the certainty of ultimate returns is increased, as the industry is capital-intensive and technically complex. The government is helping to integrate the industry downstream, and there is an increasing focus on supporting the development of the whole value chain and not just the export of raw materials. Rare earth metals are moving away from the turbulent commodity market and into the strategically managed ecosystem, supported by strong institutions.

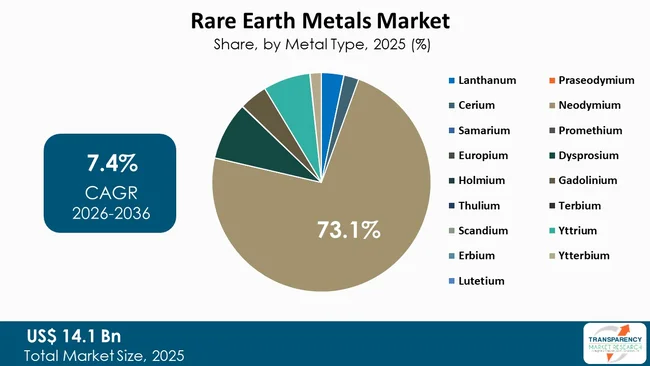

In terms of metal, the Neodymium segment dominated the rare earth metals market with a major share of 73.1% due to their specific application and importance in the production of technologically advanced permanent magnets. Permanent magnets form a major part of different electric vehicle technologies, wind turbines, industrial controllers, and electronic devices used routinely. The faster adoption of electric vehicles and rising renewable energy infrastructure. Besides, the consistent need for motor technology with minimal weight, are creating a positive demand scenario for using Neodymium magnets.

Neodymium, is a light rare earth element used for neodymium iron boron permanent magnet manufacturing due to its magnetic properties, which make compact motors and generators highly efficient. Neodymium magnets are highly sought in the electric vehicle space and other alternative energy-related systems and electronic devices.

| Attribute | Detail |

|---|---|

| Opportunity |

|

Applications in electric motor car, wind turbine electrical generator, robotics, and automation equipment are a few applications that drive the demand for the rare earth permanent magnets, namely Neodymium, Praseodymium, Dysprosium, and Terbium. The use of direct drive electrical generator applicable in the wind electric generator and electrical car traction motor employs these rare earth magnets in order to achieve energy efficiency as well as compactness in design. The existing EV growth rate and capacity in terms of renewable energy imply high magnet intensity per unit, providing a lucrative high-margin opportunity for players in the magnet-grade rare earth oxides and alloys space.

| Attribute | Detail |

|---|---|

| Leading Region |

|

Regional dynamics play a huge role in influencing the global rare earth metals market as Asia Pacific holds approximately 71.8% of the market share. This is primarily due to the strong control exercised by these regions over the mining, refining, as well as the downstream processing of these metals. Potentially though, the other players such as China, Australia, as well as the emerging Southeast Asian players can leverage the huge availability of resources, the low cost of production, as well as the existing separation technologies to increase their overall market presence.

Each of these players has been profiled in the rare earth metals market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments

| Attribute | Detail |

|---|---|

| Market Size Value in 2025 | US$ 14.1 Bn |

| Market Forecast Value in 2036 | US$ 30.9 Bn |

| Growth Rate (CAGR) | 7.4% |

| Forecast Period | 2026-2036 |

| Historical Data Available for | 2021-2025 |

| Quantitative Units | US$ Bn for Value and Tons for Volume |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, Rare Earth Metals market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Metal Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The rare earth metals market was valued at US$ 14.1 Bn in 2025

The rare earth metals industry is expected to grow at a CAGR of 7.4% from 2026 to 2036

Accelerating demand from electric vehicles and clean energy technologies and strategic government support and supply chain localization initiatives.

Neodymium was the largest metal type segment and its value is anticipated to grow at a CAGR of 7.0% during the forecast period

Asia Pacific was the most lucrative region in 2025

Lynas Rare Earth Ltd., Arafura Resources Ltd., Rare Element Resources Ltd., Iluka Resources Limited, Energy Transition Minerals Ltd., Frontier Rare Earth Ltd., IREL (India) Limited, Peak Rare Earths, China Rare Earth Holdings, Baotou Iron & Steel (Group) Co Ltd are the major players in the rare earth metals market

Table 1 Global Rare Earth Metals Market Volume (Tons) Forecast, by Metal Type, 2026 to 2036

Table 2 Global Rare Earth Metals Market Value (US$ Bn) Forecast, by Metal Type, 2026 to 2036

Table 3 Global Rare Earth Metals Market Volume (Tons) Forecast, by Source, 2026 to 2036

Table 4 Global Rare Earth Metals Market Value (US$ Bn) Forecast, by Source, 2026 to 2036

Table 5 Global Rare Earth Metals Market Volume (Tons) Forecast, by Extraction Technique 2026 to 2036

Table 6 Global Rare Earth Metals Market Value (US$ Bn) Forecast, by Extraction Technique 2026 to 2036

Table 7 Global Rare Earth Metals Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 8 Global Rare Earth Metals Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 9 Global Rare Earth Metals Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 10 Global Rare Earth Metals Market Value (US$ Bn) Forecast, by End-use, 2026 to 2036

Table 11 Global Rare Earth Metals Market Volume (Tons) Forecast, by Region, 2026 to 2036

Table 12 Global Rare Earth Metals Market Value (US$ Bn) Forecast, by Region, 2026 to 2036

Table 13 North America Rare Earth Metals Market Volume (Tons) Forecast, by Metal Type, 2026 to 2036

Table 14 North America Rare Earth Metals Market Value (US$ Bn) Forecast, by Metal Type, 2026 to 2036

Table 15 North America Rare Earth Metals Market Volume (Tons) Forecast, by Source, 2026 to 2036

Table 16 North America Rare Earth Metals Market Value (US$ Bn) Forecast, by Source, 2026 to 2036

Table 17 North America Rare Earth Metals Market Volume (Tons) Forecast, by Extraction Technique 2026 to 2036

Table 18 North America Rare Earth Metals Market Value (US$ Bn) Forecast, by Extraction Technique 2026 to 2036

Table 19 North America Rare Earth Metals Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 20 North America Rare Earth Metals Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 21 North America Rare Earth Metals Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 22 North America Rare Earth Metals Market Value (US$ Bn) Forecast, by End-use, 2026 to 2036

Table 23 North America Rare Earth Metals Market Volume (Tons) Forecast, by Country, 2026 to 2036

Table 24 North America Rare Earth Metals Market Value (US$ Bn) Forecast, by Country, 2026 to 2036

Table 25 U.S. Rare Earth Metals Market Volume (Tons) Forecast, by Metal Type, 2026 to 2036

Table 26 U.S. Rare Earth Metals Market Value (US$ Bn) Forecast, by Metal Type, 2026 to 2036

Table 27 U.S. Rare Earth Metals Market Volume (Tons) Forecast, by Source, 2026 to 2036

Table 28 U.S. Rare Earth Metals Market Value (US$ Bn) Forecast, by Source, 2026 to 2036

Table 29 U.S. Rare Earth Metals Market Volume (Tons) Forecast, by Extraction Technique 2026 to 2036

Table 30 U.S. Rare Earth Metals Market Value (US$ Bn) Forecast, by Extraction Technique, 2026 to 2036

Table 31 U.S. Rare Earth Metals Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 32 U.S. Rare Earth Metals Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 33 U.S. Rare Earth Metals Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 34 U.S. Rare Earth Metals Market Value (US$ Bn) Forecast, by End-use, 2026 to 2036

Table 35 Canada Rare Earth Metals Market Volume (Tons) Forecast, by Metal Type, 2026 to 2036

Table 36 Canada Rare Earth Metals Market Value (US$ Bn) Forecast, by Metal Type, 2026 to 2036

Table 37 Canada Rare Earth Metals Market Volume (Tons) Forecast, by Source, 2026 to 2036

Table 38 Canada Rare Earth Metals Market Value (US$ Bn) Forecast, by Source, 2026 to 2036

Table 39 Canada Rare Earth Metals Market Volume (Tons) Forecast, by Extraction Technique, 2026 to 2036

Table 40 Canada Rare Earth Metals Market Value (US$ Bn) Forecast, by Extraction Technique, 2026 to 2036

Table 41 Canada Rare Earth Metals Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 42 Canada Rare Earth Metals Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 43 Canada Rare Earth Metals Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 44 Canada Rare Earth Metals Market Value (US$ Bn) Forecast, by End-use 2026 to 2036

Table 45 Europe Rare Earth Metals Market Volume (Tons) Forecast, by Metal Type, 2026 to 2036

Table 46 Europe Rare Earth Metals Market Value (US$ Bn) Forecast, by Metal Type, 2026 to 2036

Table 47 Europe Rare Earth Metals Market Volume (Tons) Forecast, by Source, 2026 to 2036

Table 48 Europe Rare Earth Metals Market Value (US$ Bn) Forecast, by Source, 2026 to 2036

Table 49 Europe Rare Earth Metals Market Volume (Tons) Forecast, by Extraction Technique 2026 to 2036

Table 50 Europe Rare Earth Metals Market Value (US$ Bn) Forecast, by Extraction Technique, 2026 to 2036

Table 51 Europe Rare Earth Metals Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 52 Europe Rare Earth Metals Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 53 Europe Rare Earth Metals Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 54 Europe Rare Earth Metals Market Value (US$ Bn) Forecast, by End-use 2026 to 2036

Table 55 Europe Rare Earth Metals Market Volume (Tons) Forecast, by Country and Sub-region, 2026 to 2036

Table 56 Europe Rare Earth Metals Market Value (US$ Bn) Forecast, by Country and Sub-region, 2026 to 2036

Table 57 Germany Rare Earth Metals Market Volume (Tons) Forecast, by Metal Type, 2026 to 2036

Table 58 Germany Rare Earth Metals Market Value (US$ Bn) Forecast, by Metal Type, 2026 to 2036

Table 59 Germany Rare Earth Metals Market Volume (Tons) Forecast, by Source, 2026 to 2036

Table 60 Germany Rare Earth Metals Market Value (US$ Bn) Forecast, by Source, 2026 to 2036

Table 61 Germany Rare Earth Metals Market Volume (Tons) Forecast, by Extraction Technique, 2026 to 2036

Table 62 Germany Rare Earth Metals Market Value (US$ Bn) Forecast, by Extraction Technique, 2026 to 2036

Table 63 Germany Rare Earth Metals Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 64 Germany Rare Earth Metals Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 65 Germany Rare Earth Metals Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 66 Germany Rare Earth Metals Market Value (US$ Bn) Forecast, by End-use 2026 to 2036

Table 67 U.K. Rare Earth Metals Market Volume (Tons) Forecast, by Metal Type, 2026 to 2036

Table 68 U.K. Rare Earth Metals Market Value (US$ Bn) Forecast, by Metal Type, 2026 to 2036

Table 69 U.K. Rare Earth Metals Market Volume (Tons) Forecast, by Source, 2026 to 2036

Table 70 U.K. Rare Earth Metals Market Value (US$ Bn) Forecast, by Source, 2026 to 2036

Table 71 U.K. Rare Earth Metals Market Volume (Tons) Forecast, by Extraction Technique, 2026 to 2036

Table 72 U.K. Rare Earth Metals Market Value (US$ Bn) Forecast, by Extraction Technique, 2026 to 2036

Table 73 U.K. Rare Earth Metals Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 74 U.K. Rare Earth Metals Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 75 U.K. Rare Earth Metals Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 76 U.K. Rare Earth Metals Market Value (US$ Bn) Forecast, by End-use 2026 to 2036

Table 77 France Rare Earth Metals Market Volume (Tons) Forecast, by Metal Type, 2026 to 2036

Table 78 France Rare Earth Metals Market Value (US$ Bn) Forecast, by Metal Type, 2026 to 2036

Table 79 France Rare Earth Metals Market Volume (Tons) Forecast, by Source, 2026 to 2036

Table 80 France Rare Earth Metals Market Value (US$ Bn) Forecast, by Source, 2026 to 2036

Table 81 France Rare Earth Metals Market Volume (Tons) Forecast, by Extraction Technique, 2026 to 2036

Table 82 France Rare Earth Metals Market Value (US$ Bn) Forecast, by Extraction Technique, 2026 to 2036

Table 83 France Rare Earth Metals Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 84 France Rare Earth Metals Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 85 France Rare Earth Metals Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 86 France Rare Earth Metals Market Value (US$ Bn) Forecast, by End-use 2026 to 2036

Table 87 Spain Rare Earth Metals Market Volume (Tons) Forecast, by Metal Type, 2026 to 2036

Table 88 Spain Rare Earth Metals Market Value (US$ Bn) Forecast, by Metal Type, 2026 to 2036

Table 89 Spain Rare Earth Metals Market Volume (Tons) Forecast, by Source, 2026 to 2036

Table 90 Spain Rare Earth Metals Market Value (US$ Bn) Forecast, by Source, 2026 to 2036

Table 91 Spain Rare Earth Metals Market Volume (Tons) Forecast, by Extraction Technique, 2026 to 2036

Table 92 Spain Rare Earth Metals Market Value (US$ Bn) Forecast, by Extraction Technique, 2026 to 2036

Table 93 Spain Rare Earth Metals Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 94 Spain Rare Earth Metals Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 95 Spain Rare Earth Metals Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 96 Spain Rare Earth Metals Market Value (US$ Bn) Forecast, by End-use 2026 to 2036

Table 97 Italy Rare Earth Metals Market Volume (Tons) Forecast, by Metal Type, 2026 to 2036

Table 98 Italy Rare Earth Metals Market Value (US$ Bn) Forecast, by Metal Type, 2026 to 2036

Table 99 Italy Rare Earth Metals Market Volume (Tons) Forecast, by Source, 2026 to 2036

Table 100 Italy Rare Earth Metals Market Value (US$ Bn) Forecast, by Source, 2026 to 2036

Table 101 Italy Rare Earth Metals Market Volume (Tons) Forecast, by Extraction Technique, 2026 to 2036

Table 102 Italy Rare Earth Metals Market Value (US$ Bn) Forecast, by Extraction Technique, 2026 to 2036

Table 103 Italy Rare Earth Metals Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 104 Italy Rare Earth Metals Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 105 Italy Rare Earth Metals Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 106 Italy Rare Earth Metals Market Value (US$ Bn) Forecast, by End-use 2026 to 2036

Table 107 Russia & CIS Rare Earth Metals Market Volume (Tons) Forecast, by Metal Type, 2026 to 2036

Table 108 Russia & CIS Rare Earth Metals Market Value (US$ Bn) Forecast, by Metal Type, 2026 to 2036

Table 109 Russia & CIS Rare Earth Metals Market Volume (Tons) Forecast, by Source, 2026 to 2036

Table 110 Russia & CIS Rare Earth Metals Market Value (US$ Bn) Forecast, by Source, 2026 to 2036

Table 111 Russia & CIS Rare Earth Metals Market Volume (Tons) Forecast, by Extraction Technique, 2026 to 2036

Table 112 Russia & CIS Rare Earth Metals Market Value (US$ Bn) Forecast, by Extraction Technique, 2026 to 2036

Table 113 Russia & CIS Rare Earth Metals Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 114 Russia & CIS Rare Earth Metals Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 115 Russia & CIS Rare Earth Metals Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 116 Russia & CIS Rare Earth Metals Market Value (US$ Bn) Forecast, by End-use 2026 to 2036

Table 117 Rest of Europe Rare Earth Metals Market Volume (Tons) Forecast, by Metal Type, 2026 to 2036

Table 118 Rest of Europe Rare Earth Metals Market Value (US$ Bn) Forecast, by Metal Type, 2026 to 2036

Table 119 Rest of Europe Rare Earth Metals Market Volume (Tons) Forecast, by Source, 2026 to 2036

Table 120 Rest of Europe Rare Earth Metals Market Value (US$ Bn) Forecast, by Source, 2026 to 2036

Table 121 Rest of Europe Rare Earth Metals Market Volume (Tons) Forecast, by Extraction Technique, 2026 to 2036

Table 122 Rest of Europe Rare Earth Metals Market Value (US$ Bn) Forecast, by Extraction Technique, 2026 to 2036

Table 123 Rest of Europe Rare Earth Metals Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 124 Rest of Europe Rare Earth Metals Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 125 Rest of Europe Rare Earth Metals Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 126 Rest of Europe Rare Earth Metals Market Value (US$ Bn) Forecast, by End-use 2026 to 2036

Table 127 Asia Pacific Rare Earth Metals Market Volume (Tons) Forecast, by Metal Type, 2026 to 2036

Table 128 Asia Pacific Rare Earth Metals Market Value (US$ Bn) Forecast, by Metal Type, 2026 to 2036

Table 129 Asia Pacific Rare Earth Metals Market Volume (Tons) Forecast, by Source, 2026 to 2036

Table 130 Asia Pacific Rare Earth Metals Market Value (US$ Bn) Forecast, by Source, 2026 to 2036

Table 131 Asia Pacific Rare Earth Metals Market Volume (Tons) Forecast, by Extraction Technique, 2026 to 2036

Table 132 Asia Pacific Rare Earth Metals Market Value (US$ Bn) Forecast, by Extraction Technique, 2026 to 2036

Table 133 Asia Pacific Rare Earth Metals Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 134 Asia Pacific Rare Earth Metals Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 135 Asia Pacific Rare Earth Metals Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 136 Asia Pacific Rare Earth Metals Market Value (US$ Bn) Forecast, by End-use 2026 to 2036

Table 137 Asia Pacific Rare Earth Metals Market Volume (Tons) Forecast, by Country and Sub-region, 2026 to 2036

Table 138 Asia Pacific Rare Earth Metals Market Value (US$ Bn) Forecast, by Country and Sub-region, 2026 to 2036

Table 139 China Rare Earth Metals Market Volume (Tons) Forecast, by Metal Type, 2026 to 2036

Table 140 China Rare Earth Metals Market Value (US$ Bn) Forecast, by Metal Type 2026 to 2036

Table 141 China Rare Earth Metals Market Volume (Tons) Forecast, by Source, 2026 to 2036

Table 142 China Rare Earth Metals Market Value (US$ Bn) Forecast, by Source, 2026 to 2036

Table 143 China Rare Earth Metals Market Volume (Tons) Forecast, by Extraction Technique, 2026 to 2036

Table 144 China Rare Earth Metals Market Value (US$ Bn) Forecast, by Extraction Technique, 2026 to 2036

Table 145 China Rare Earth Metals Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 146 China Rare Earth Metals Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 147 China Rare Earth Metals Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 148 China Rare Earth Metals Market Value (US$ Bn) Forecast, by End-use 2026 to 2036

Table 149 India Rare Earth Metals Market Volume (Tons) Forecast, by Metal Type, 2026 to 2036

Table 150 India Rare Earth Metals Market Value (US$ Bn) Forecast, by Metal Type, 2026 to 2036

Table 151 India Rare Earth Metals Market Volume (Tons) Forecast, by Source, 2026 to 2036

Table 152 India Rare Earth Metals Market Value (US$ Bn) Forecast, by Source, 2026 to 2036

Table 153 India Rare Earth Metals Market Volume (Tons) Forecast, by Extraction Technique, 2026 to 2036

Table 154 India Rare Earth Metals Market Value (US$ Bn) Forecast, by Extraction Technique, 2026 to 2036

Table 155 India Rare Earth Metals Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 156 India Rare Earth Metals Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 157 India Rare Earth Metals Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 158 India Rare Earth Metals Market Value (US$ Bn) Forecast, by End-use 2026 to 2036

Table 159 Japan Rare Earth Metals Market Volume (Tons) Forecast, by Metal Type, 2026 to 2036

Table 160 Japan Rare Earth Metals Market Value (US$ Bn) Forecast, by Metal Type, 2026 to 2036

Table 161 Japan Rare Earth Metals Market Volume (Tons) Forecast, by Source, 2026 to 2036

Table 162 Japan Rare Earth Metals Market Value (US$ Bn) Forecast, by Source, 2026 to 2036

Table 163 Japan Rare Earth Metals Market Volume (Tons) Forecast, by Extraction Technique, 2026 to 2036

Table 164 Japan Rare Earth Metals Market Value (US$ Bn) Forecast, by Extraction Technique, 2026 to 2036

Table 165 Japan Rare Earth Metals Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 166 Japan Rare Earth Metals Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 167 Japan Rare Earth Metals Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 168 Japan Rare Earth Metals Market Value (US$ Bn) Forecast, by End-use 2026 to 2036

Table 169 ASEAN Rare Earth Metals Market Volume (Tons) Forecast, by Metal Type, 2026 to 2036

Table 170 ASEAN Rare Earth Metals Market Value (US$ Bn) Forecast, by Metal Type, 2026 to 2036

Table 171 ASEAN Rare Earth Metals Market Volume (Tons) Forecast, by Source, 2026 to 2036

Table 172 ASEAN Rare Earth Metals Market Value (US$ Bn) Forecast, by Source, 2026 to 2036

Table 173 ASEAN Rare Earth Metals Market Volume (Tons) Forecast, by Extraction Technique, 2026 to 2036

Table 174 ASEAN Rare Earth Metals Market Value (US$ Bn) Forecast, by Extraction Technique, 2026 to 2036

Table 175 ASEAN Rare Earth Metals Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 176 ASEAN Rare Earth Metals Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 177 ASEAN Rare Earth Metals Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 178 ASEAN Rare Earth Metals Market Value (US$ Bn) Forecast, by End-use 2026 to 2036

Table 179 Rest of Asia Pacific Rare Earth Metals Market Volume (Tons) Forecast, by Metal Type, 2026 to 2036

Table 180 Rest of Asia Pacific Rare Earth Metals Market Value (US$ Bn) Forecast, by Metal Type, 2026 to 2036

Table 181 Rest of Asia Pacific Rare Earth Metals Market Volume (Tons) Forecast, by Source, 2026 to 2036

Table 182 Rest of Asia Pacific Rare Earth Metals Market Value (US$ Bn) Forecast, by Source, 2026 to 2036

Table 183 Rest of Asia Pacific Rare Earth Metals Market Volume (Tons) Forecast, by Extraction Technique, 2026 to 2036

Table 184 Rest of Asia Pacific Rare Earth Metals Market Value (US$ Bn) Forecast, by Extraction Technique, 2026 to 2036

Table 185 Rest of Asia Pacific Rare Earth Metals Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 186 Rest of Asia Pacific Rare Earth Metals Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 187 Rest of Asia Pacific Rare Earth Metals Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 188 Rest of Asia Pacific Rare Earth Metals Market Value (US$ Bn) Forecast, by End-use 2026 to 2036

Table 189 Latin America Rare Earth Metals Market Volume (Tons) Forecast, by Metal Type, 2026 to 2036

Table 190 Latin America Rare Earth Metals Market Value (US$ Bn) Forecast, by Metal Type, 2026 to 2036

Table 191 Latin America Rare Earth Metals Market Volume (Tons) Forecast, by Source, 2026 to 2036

Table 192 Latin America Rare Earth Metals Market Value (US$ Bn) Forecast, by Source, 2026 to 2036

Table 193 Latin America Rare Earth Metals Market Volume (Tons) Forecast, by Extraction Technique, 2026 to 2036

Table 194 Latin America Rare Earth Metals Market Value (US$ Bn) Forecast, by Extraction Technique, 2026 to 2036

Table 195 Latin America Rare Earth Metals Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 196 Latin America Rare Earth Metals Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 197 Latin America Rare Earth Metals Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 198 Latin America Rare Earth Metals Market Value (US$ Bn) Forecast, by End-use 2026 to 2036

Table 199 Latin America Rare Earth Metals Market Volume (Tons) Forecast, by Country and Sub-region, 2026 to 2036

Table 200 Latin America Rare Earth Metals Market Value (US$ Bn) Forecast, by Country and Sub-region, 2026 to 2036

Table 201 Brazil Rare Earth Metals Market Volume (Tons) Forecast, by Metal Type, 2026 to 2036

Table 202 Brazil Rare Earth Metals Market Value (US$ Bn) Forecast, by Metal Type, 2026 to 2036

Table 203 Brazil Rare Earth Metals Market Volume (Tons) Forecast, by Source, 2026 to 2036

Table 204 Brazil Rare Earth Metals Market Value (US$ Bn) Forecast, by Source, 2026 to 2036

Table 205 Brazil Rare Earth Metals Market Volume (Tons) Forecast, by Extraction Technique, 2026 to 2036

Table 206 Brazil Rare Earth Metals Market Value (US$ Bn) Forecast, by Extraction Technique, 2026 to 2036

Table 207 Brazil Rare Earth Metals Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 208 Brazil Rare Earth Metals Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 209 Brazil Rare Earth Metals Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 210 Brazil Rare Earth Metals Market Value (US$ Bn) Forecast, by End-use 2026 to 2036

Table 211 Mexico Rare Earth Metals Market Volume (Tons) Forecast, by Metal Type, 2026 to 2036

Table 212 Mexico Rare Earth Metals Market Value (US$ Bn) Forecast, by Metal Type, 2026 to 2036

Table 213 Mexico Rare Earth Metals Market Volume (Tons) Forecast, by Source, 2026 to 2036

Table 214 Mexico Rare Earth Metals Market Value (US$ Bn) Forecast, by Source, 2026 to 2036

Table 215 Mexico Rare Earth Metals Market Volume (Tons) Forecast, by Extraction Technique, 2026 to 2036

Table 216 Mexico Rare Earth Metals Market Value (US$ Bn) Forecast, by Extraction Technique, 2026 to 2036

Table 217 Mexico Rare Earth Metals Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 218 Mexico Rare Earth Metals Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 219 Mexico Rare Earth Metals Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 220 Mexico Rare Earth Metals Market Value (US$ Bn) Forecast, by End-use 2026 to 2036

Table 221 Rest of Latin America Rare Earth Metals Market Volume (Tons) Forecast, by Metal Type, 2026 to 2036

Table 222 Rest of Latin America Rare Earth Metals Market Value (US$ Bn) Forecast, by Metal Type, 2026 to 2036

Table 223 Rest of Latin America Rare Earth Metals Market Volume (Tons) Forecast, by Source, 2026 to 2036

Table 224 Rest of Latin America Rare Earth Metals Market Value (US$ Bn) Forecast, by Source, 2026 to 2036

Table 225 Rest of Latin America Rare Earth Metals Market Volume (Tons) Forecast, by Extraction Technique, 2026 to 2036

Table 226 Rest of Latin America Rare Earth Metals Market Value (US$ Bn) Forecast, by Extraction Technique, 2026 to 2036

Table 227 Rest of Latin America Rare Earth Metals Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 228 Rest of Latin America Rare Earth Metals Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 229 Rest of Latin America Rare Earth Metals Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 230 Rest of Latin America Rare Earth Metals Market Value (US$ Bn) Forecast, by End-use 2026 to 2036

Table 231 Middle East & Africa Rare Earth Metals Market Volume (Tons) Forecast, by Metal Type, 2026 to 2036

Table 232 Middle East & Africa Rare Earth Metals Market Value (US$ Bn) Forecast, by Metal Type, 2026 to 2036

Table 233 Middle East & Africa Rare Earth Metals Market Volume (Tons) Forecast, by Source, 2026 to 2036

Table 234 Middle East & Africa Rare Earth Metals Market Value (US$ Bn) Forecast, by Source, 2026 to 2036

Table 235 Middle East & Africa Rare Earth Metals Market Volume (Tons) Forecast, by Extraction Technique, 2026 to 2036

Table 236 Middle East & Africa Rare Earth Metals Market Value (US$ Bn) Forecast, by Extraction Technique, 2026 to 2036

Table 237 Middle East & Africa Rare Earth Metals Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 238 Middle East & Africa Rare Earth Metals Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 239 Middle East & Africa Rare Earth Metals Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 240 Middle East & Africa Rare Earth Metals Market Value (US$ Bn) Forecast, by End-use 2026 to 2036

Table 241 Middle East & Africa Rare Earth Metals Market Volume (Tons) Forecast, by Country and Sub-region, 2026 to 2036

Table 242 Middle East & Africa Rare Earth Metals Market Value (US$ Bn) Forecast, by Country and Sub-region, 2026 to 2036

Table 243 GCC Rare Earth Metals Market Volume (Tons) Forecast, by Metal Type, 2026 to 2036

Table 244 GCC Rare Earth Metals Market Value (US$ Bn) Forecast, by Metal Type, 2026 to 2036

Table 245 GCC Rare Earth Metals Market Volume (Tons) Forecast, by Source, 2026 to 2036

Table 246 GCC Rare Earth Metals Market Value (US$ Bn) Forecast, by Source, 2026 to 2036

Table 247 GCC Rare Earth Metals Market Volume (Tons) Forecast, by Extraction Technique, 2026 to 2036

Table 248 GCC Rare Earth Metals Market Value (US$ Bn) Forecast, by Extraction Technique, 2026 to 2036

Table 249 GCC Rare Earth Metals Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 250 GCC Rare Earth Metals Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 251 GCC Rare Earth Metals Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 252 GCC Rare Earth Metals Market Value (US$ Bn) Forecast, by End-use 2026 to 2036

Table 253 South Africa Rare Earth Metals Market Volume (Tons) Forecast, by Metal Type, 2026 to 2036

Table 254 South Africa Rare Earth Metals Market Value (US$ Bn) Forecast, by Metal Type, 2026 to 2036

Table 255 South Africa Rare Earth Metals Market Volume (Tons) Forecast, by Source, 2026 to 2036

Table 256 South Africa Rare Earth Metals Market Value (US$ Bn) Forecast, by Source, 2026 to 2036

Table 257 South Africa Rare Earth Metals Market Volume (Tons) Forecast, by Extraction Technique, 2026 to 2036

Table 258 South Africa Rare Earth Metals Market Value (US$ Bn) Forecast, by Extraction Technique, 2026 to 2036

Table 259 South Africa Rare Earth Metals Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 260 South Africa Rare Earth Metals Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 261 South Africa Rare Earth Metals Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 262 South Africa Rare Earth Metals Market Value (US$ Bn) Forecast, by End-use 2026 to 2036

Table 263 Rest of Middle East & Africa Rare Earth Metals Market Volume (Tons) Forecast, by Metal Type, 2026 to 2036

Table 264 Rest of Middle East & Africa Rare Earth Metals Market Value (US$ Bn) Forecast, by Metal Type, 2026 to 2036

Table 265 Rest of Middle East & Africa Rare Earth Metals Market Volume (Tons) Forecast, by Source, 2026 to 2036

Table 266 Rest of Middle East & Africa Rare Earth Metals Market Value (US$ Bn) Forecast, by Source, 2026 to 2036

Table 267 Rest of Middle East & Africa Rare Earth Metals Market Volume (Tons) Forecast, by Extraction Technique, 2026 to 2036

Table 268 Rest of Middle East & Africa Rare Earth Metals Market Value (US$ Bn) Forecast, by Extraction Technique, 2026 to 2036

Table 269 Rest of Middle East & Africa Rare Earth Metals Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 270 Rest of Middle East & Africa Rare Earth Metals Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 271 Rest of Middle East & Africa Rare Earth Metals Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 272 Rest of Middle East & Africa Rare Earth Metals Market Value (US$ Bn) Forecast, by End-use 2026 to 2036

Figure 1 Global Rare Earth Metals Market Volume Share Analysis, by Metal Type, 2025, 2029, and 2036

Figure 2 Global Rare Earth Metals Market Attractiveness, by Metal Type

Figure 3 Global Rare Earth Metals Market Volume Share Analysis, by Source, 2025, 2029, and 2036

Figure 4 Global Rare Earth Metals Market Attractiveness, by Source

Figure 5 Global Rare Earth Metals Market Volume Share Analysis, by Extraction Technique, 2025, 2029, and 2036

Figure 6 Global Rare Earth Metals Market Attractiveness, by Extraction Technique

Figure 7 Global Rare Earth Metals Market Volume Share Analysis, by Application, 2025, 2029, and 2036

Figure 8 Global Rare Earth Metals Market Attractiveness, by Application

Figure 9 Global Rare Earth Metals Market Volume Share Analysis, by End-use, 2025, 2029, and 2036

Figure 10 Global Rare Earth Metals Market Attractiveness, by End-use

Figure 11 Global Rare Earth Metals Market Volume Share Analysis, by Region, 2025, 2029, and 2036

Figure 12 Global Rare Earth Metals Market Attractiveness, by Region

Figure 13 North America Rare Earth Metals Market Volume Share Analysis, by Metal Type, 2025, 2029, and 2036

Figure 14 North America Rare Earth Metals Market Attractiveness, by Metal Type

Figure 15 North America Rare Earth Metals Market Attractiveness, by Metal Type

Figure 16 North America Rare Earth Metals Market Volume Share Analysis, by Source, 2025, 2029, and 2036

Figure 17 North America Rare Earth Metals Market Attractiveness, by Source

Figure 18 North America Rare Earth Metals Market Volume Share Analysis, by Extraction Technique, 2025, 2029, and 2036

Figure 19 North America Rare Earth Metals Market Attractiveness, by Extraction Technique

Figure 20 North America Rare Earth Metals Market Volume Share Analysis, by Application, 2025, 2029, and 2036

Figure 21 North America Rare Earth Metals Market Attractiveness, by Application

Figure 22 North America Rare Earth Metals Market Volume Share Analysis, by End-use, 2025, 2029, and 2036

Figure 23 North America Rare Earth Metals Market Attractiveness, by End-use

Figure 24 North America Rare Earth Metals Market Attractiveness, by Country and Sub-region

Figure 25 Europe Rare Earth Metals Market Volume Share Analysis, by Metal Type, 2025, 2029, and 2036

Figure 26 Europe Rare Earth Metals Market Attractiveness, by Metal Type

Figure 27 Europe Rare Earth Metals Market Volume Share Analysis, by Source, 2025, 2029, and 2036

Figure 28 Europe Rare Earth Metals Market Attractiveness, by Source

Figure 29 Europe Rare Earth Metals Market Volume Share Analysis, by Extraction Technique, 2025, 2029, and 2036

Figure 30 Europe Rare Earth Metals Market Attractiveness, by Extraction Technique

Figure 31 Europe Rare Earth Metals Market Volume Share Analysis, by Application, 2025, 2029, and 2036

Figure 32 Europe Rare Earth Metals Market Attractiveness, by Application

Figure 33 Europe Rare Earth Metals Market Volume Share Analysis, by End-use, 2025, 2029, and 2036

Figure 34 Europe Rare Earth Metals Market Attractiveness, by End-use

Figure 35 Europe Rare Earth Metals Market Volume Share Analysis, by Country and Sub-region, 2025, 2029, and 2036

Figure 36 Europe Rare Earth Metals Market Attractiveness, by Country and Sub-region

Figure 37 Asia Pacific Rare Earth Metals Market Volume Share Analysis, by Metal Type, 2025, 2029, and 2036

Figure 38 Asia Pacific Rare Earth Metals Market Attractiveness, by Metal Type

Figure 39 Asia Pacific Rare Earth Metals Market Volume Share Analysis, by Source, 2025, 2029, and 2036

Figure 40 Asia Pacific Rare Earth Metals Market Attractiveness, by Source

Figure 41 Asia Pacific Rare Earth Metals Market Volume Share Analysis, by Extraction Technique, 2025, 2029, and 2036

Figure 42 Asia Pacific Rare Earth Metals Market Attractiveness, by Extraction Technique

Figure 43 Asia Pacific Rare Earth Metals Market Volume Share Analysis, by Application, 2025, 2029, and 2036

Figure 44 Asia Pacific Rare Earth Metals Market Attractiveness, by Application

Figure 45 Asia Pacific Rare Earth Metals Market Volume Share Analysis, by End-use, 2025, 2029, and 2036

Figure 46 Asia Pacific Rare Earth Metals Market Attractiveness, by End-use

Figure 47 Asia Pacific Rare Earth Metals Market Volume Share Analysis, by Country and Sub-region, 2025, 2029, and 2036

Figure 48 Asia Pacific Rare Earth Metals Market Attractiveness, by Country and Sub-region

Figure 49 Latin America Rare Earth Metals Market Volume Share Analysis, by Metal Type, 2025, 2029, and 2036

Figure 50 Latin America Rare Earth Metals Market Attractiveness, by Metal Type

Figure 51 Latin America Rare Earth Metals Market Volume Share Analysis, by Source, 2025, 2029, and 2036

Figure 52 Latin America Rare Earth Metals Market Attractiveness, by Source

Figure 53 Latin America Rare Earth Metals Market Volume Share Analysis, by Extraction Technique, 2025, 2029, and 2036

Figure 54 Latin America Rare Earth Metals Market Attractiveness, by Extraction Technique

Figure 55 Latin America Rare Earth Metals Market Volume Share Analysis, by Application, 2025, 2029, and 2036

Figure 56 Latin America Rare Earth Metals Market Attractiveness, by Application

Figure 57 Latin America Rare Earth Metals Market Volume Share Analysis, by End-use, 2025, 2029, and 2036

Figure 58 Latin America Rare Earth Metals Market Attractiveness, by End-use

Figure 59 Latin America Rare Earth Metals Market Volume Share Analysis, by Country and Sub-region, 2025, 2029, and 2036

Figure 60 Latin America Rare Earth Metals Market Attractiveness, by Country and Sub-region

Figure 61 Middle East & Africa Rare Earth Metals Market Volume Share Analysis, by Metal Type, 2025, 2029, and 2036

Figure 62 Middle East & Africa Rare Earth Metals Market Attractiveness, by Metal Type

Figure 63 Middle East & Africa Rare Earth Metals Market Volume Share Analysis, by Source, 2025, 2029, and 2036

Figure 64 Middle East & Africa Rare Earth Metals Market Attractiveness, by Source

Figure 65 Middle East & Africa Rare Earth Metals Market Volume Share Analysis, by Extraction Technique, 2025, 2029, and 2036

Figure 66 Middle East & Africa Rare Earth Metals Market Attractiveness, by Extraction Technique

Figure 67 Middle East & Africa Rare Earth Metals Market Volume Share Analysis, by Application, 2025, 2029, and 2036

Figure 68 Middle East & Africa Rare Earth Metals Market Attractiveness, by Application

Figure 69 Middle East & Africa Rare Earth Metals Market Volume Share Analysis, by End-use, 2025, 2029, and 2036

Figure 70 Middle East & Africa Rare Earth Metals Market Attractiveness, by End-use

Figure 71 Middle East & Africa Rare Earth Metals Market Volume Share Analysis, by Country and Sub-region, 2025, 2029, and 2036

Figure 72 Middle East & Africa Rare Earth Metals Market Attractiveness, by Country and Sub-region