Reports

Reports

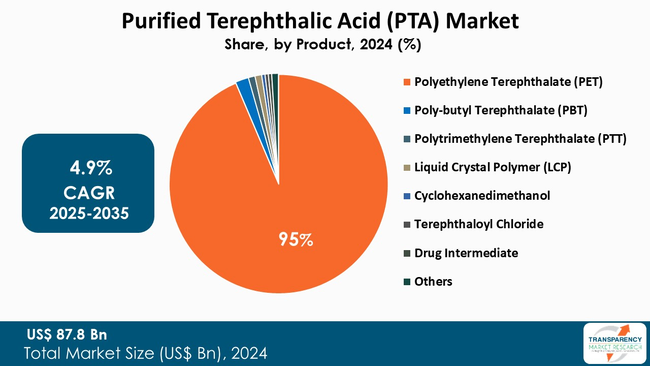

The global purified terephthalic acid (PTA) market was valued at US$ 87.8 Bn in 2024 and is projected to reach US$ 148.6 Bn by 2035, expanding at a CAGR of 4.9% from 2025 to 2035. The market growth is driven primarily by rising demand for polyester fiber and synthetic textiles. Rapid growth in PET packaging and demand for lightweight technical resins further augment the growth.

The purified terephthalic acid (PTA) market is experiencing decent growth basically driven by increasing use of polyester fibers and PET resins in textiles, packaging, and industrial applications. As an important intermediate from the oxidation of paraxylene, PTA is a key material in the polyester value chain including markets for apparel, beverage, and automotive manufacturers.

The market is also supported by increasing consumption of lightweight and recyclable PET packaging, and the growth of synthetic fiber consumption in emerging markets, such as China and India. In order to remain apace with future long-term demand from polyester applications, leading manufacturers like Reliance Industries, Indorama Ventures, Sinopec, and Mitsubishi Chemical have invested in making production processes more efficient with the use of bio-based PTA products.

Technological changes include the installation of improved oxidation systems, carbon emission reduction initiatives, and are driving integration of refinery-petrochemical operations to produce better yields while lowering the cost of production.

The purified terephthalic acid (PTA) market encompasses the processing of a more basic organic chemical compound that is widely used for polyester fiber, PET resins, and films. PTA is produced by oxidizing paraxylene and represents an important raw material in the polyester value chain.

PTA represents an important chemical component of many textiles, packaging materials, beverage bottles, and industrial films/leather-like materials due to its excellent chemical stability and durability. The method of oxidation involves using a flow reaction with a catalyst, and then completing process of purification to get the desired quality.

PTA’s demand is growing steadily from all sectors, particularly textiles, packaging, and automotive, with the globalization of lightweight, recyclable, and cost-effective materials.

| Attribute | Detail |

|---|---|

| Purified Terephthalic Acid (PTA) Market Drivers |

|

The PTA market is significantly driven by growing global demand for polyester-based fibers. and the applications include apparel, home furnishings, and industrial non-wovens. PTA is the primary raw material used for producing polyester, and its use is limited when supply of PTA is constrained.

Textile and garment manufacturing is rapidly expanding, especially in developing economies such as China, India, and Southeast Asia, which increases demand for fiber and, in turn, provides upstream pull for PTA. The demand for PTA is further driven by urbanization and consumer preferences for fast-fashion and activewear, many items of which are made using polyester or polyester blends.

From a market perspective, the increase in fiber production means PTA producers should expect a higher level of uptake, which will incentivize PTA producers to increase capacity, build a vertical integration (to capture value along the polyester value chain), and improve efficiencies.

Another important growth driver for purified terephthalic acid (PTA) industry is the growth of polyethylene-terephthalate (PET) resins in bottling, packaging, films, electronics and automotive applications i.e., PTA is converted into PET, so the growth of the packaging sector is relevant. PET’s importance has grown due to global trends towards lighter, recyclable, clear plastic containers for beverages, food products, consumables and personal care products, requiring more PET, and therefore ultimately more PTA.

Beyond ordinary bottles, PET films and engineering plastics (including construction, insulation, and automotive interiors) have also emerged as demand sources for PTA. Moreover, in many regions packaging waste regulations are tightening, along with incentives to use recyclable formats that favor PET (and indirectly PTA) due to the material being recyclable.

PTA producers are responding to this growth driver by increasing capacity, integration with PET resin producers, producing higher purity PTA grades for food-grade, and resin applications. From a “business language” perspective: this driver has relevance across multiple industries (packaging, automotive, electronics) rather than only textile fibers, meaning PTA producers have diversified demand and rationale for investments to grow capacity and alter technology to keep pace with changing quality requirements.

| Attribute | Detail |

|---|---|

| Leading Region |

|

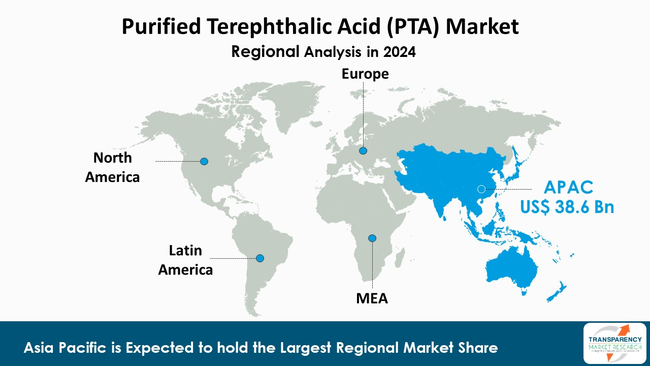

Asia-Pacific is the largest PTA market globally due to its extensive textile and polyester production infrastructure. This is due to a strong demand for polyester fiber and PET resin from China, Japan, and India due to urbanization and a growing e-Commerce market. A strong investment in PTA production facilities, expansion of capacity, and refining-petrochemical integration ensures that supply matches increased consumption and growth, thereby making APAC the largest contributor to the global PTA demand.

North America’s PTA market is expanding due to increased demand for PET packaging, especially food & beverages products. In addition to business and environmental sustainability initiatives for recyclable materials, PTA’s uptake in transportation, high-performance films, and electronics is expected to continue.

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 | US$ 87.8 Bn |

| Market Forecast Value in 2035 | US$ 148.6 Bn |

| Growth Rate (CAGR) | 4.9% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value and Kilo Tons for Volume |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, Purified Terephthalic Acid (PTA) Market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Grade

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The purified terephthalic acid (PTA) market was valued at US$ 87.8 Bn in 2024

The purified terephthalic acid (PTA) industry is expected to grow at a CAGR of 4.9% from 2025 to 2035

Escalating demand for polyester fiber and synthetic textiles and rapid growth in PET packaging and demand for lightweight technical resins

Polyethylene terephthalate (PET) held the largest share respectively within the product type segment and was anticipated to grow at an estimated CAGR of 4.3% during the forecast period

Asia Pacific was the most lucrative region in 2024

Mitsubishi Chemical, Reliance Industries Limited, BP plc, Tongkun Group Co., Ltd., Sinopec Yizheng Chemical Fiber Company Limited, Eastman Chemical Company and Taekwang Industrial are the major players in the Purified Terephthalic Acid (PTA) market

Table 1: Global Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 2: Global Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 3: Global Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Product, 2025 to 2035

Table 4: Global Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 5: Global Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 6: Global Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 7: Global Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Region, 2025 to 2035

Table 8: Global Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Region, 2025 to 2035

Table 9: North America Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 10: North America Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 11: North America Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Product, 2025 to 2035

Table 12: North America Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 13: North America Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 14: North America Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 15: North America Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Country, 2025 to 2035

Table 16: North America Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Country, 2025 to 2035

Table 17: U.S. Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 18: U.S. Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 19: U.S. Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Product, 2025 to 2035

Table 20: U.S. Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 21: U.S. Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 22: U.S. Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 23: Canada Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 24: Canada Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 25: Canada Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Product, 2025 to 2035

Table 26: Canada Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 27: Canada Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 28: Canada Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 29: Europe Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 30: Europe Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 31: Europe Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Product, 2025 to 2035

Table 32: Europe Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 33: Europe Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 34: Europe Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 35: Europe Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2025 to 2035

Table 36: Europe Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 37: Germany Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 38: Germany Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 39: Germany Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Product, 2025 to 2035

Table 40: Germany Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 41: Germany Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 42: Germany Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 43: France Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 44: France Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 45: France Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Product, 2025 to 2035

Table 46: France Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 47: France Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 48: France Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 49: U.K. Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 50: U.K. Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 51: U.K. Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Product, 2025 to 2035

Table 52: U.K. Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 53: U.K. Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 54: U.K. Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 55: Italy Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 56: Italy Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 57: Italy Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Product, 2025 to 2035

Table 58: Italy Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 59: Italy Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 60: Italy Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 61: Spain Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 62: Spain Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 63: Spain Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Product, 2025 to 2035

Table 64: Spain Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 65: Spain Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 66: Spain Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 67: Russia & CIS Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 68: Russia & CIS Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 69: Russia & CIS Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Product, 2025 to 2035

Table 70: Russia & CIS Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 71: Russia & CIS Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 72: Russia & CIS Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 73:: Rest of Europe Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 74:: Rest of Europe Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 75:: Rest of Europe Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Product, 2025 to 2035

Table 76:: Rest of Europe Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 77:: Rest of Europe Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 78:: Rest of Europe Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 79: Asia Pacific Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 80: Asia Pacific Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 81: Asia Pacific Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Product, 2025 to 2035

Table 82: Asia Pacific Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 83: Asia Pacific Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 84: Asia Pacific Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 85: Asia Pacific Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2025 to 2035

Table 86: Asia Pacific Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 87: China Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 88: China Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Grade 2025 to 2035

Table 89: China Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Product, 2025 to 2035

Table 90: China Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 91: China Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 92: China Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 93: Japan Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 94: Japan Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 95: Japan Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Product, 2025 to 2035

Table 96: Japan Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 97: Japan Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 98: Japan Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 99: India Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 100: India Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 101: India Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Product, 2025 to 2035

Table 102: India Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 103: India Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 104: India Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 105: India Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 106: India Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by End-use 2025 to 2035

Table 107: ASEAN Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 108: ASEAN Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 109: ASEAN Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Product, 2025 to 2035

Table 110: ASEAN Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 111: ASEAN Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 112: ASEAN Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 113: Rest of Asia Pacific Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 114: Rest of Asia Pacific Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 115: Rest of Asia Pacific Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Product, 2025 to 2035

Table 116: Rest of Asia Pacific Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 117: Rest of Asia Pacific Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 118: Rest of Asia Pacific Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 119: Latin America Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 120: Latin America Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 121: Latin America Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Product, 2025 to 2035

Table 122: Latin America Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 123: Latin America Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 124: Latin America Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 125: Latin America Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2025 to 2035

Table 126: Latin America Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 127: Brazil Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 128: Brazil Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 129: Brazil Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Product, 2025 to 2035

Table 130: Brazil Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 131: Brazil Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 132: Brazil Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 133: Mexico Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 134: Mexico Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 135: Mexico Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Product, 2025 to 2035

Table 136: Mexico Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 137: Mexico Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 138: Mexico Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 139: Rest of Latin America Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 140: Rest of Latin America Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 141: Rest of Latin America Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Product, 2025 to 2035

Table 142: Rest of Latin America Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 143: Rest of Latin America Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 144: Rest of Latin America Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 145: Middle East & Africa Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 146: Middle East & Africa Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 147: Middle East & Africa Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Product, 2025 to 2035

Table 148: Middle East & Africa Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 149: Middle East & Africa Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 150: Middle East & Africa Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 151: Middle East & Africa Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2025 to 2035

Table 152: Middle East & Africa Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 153: GCC Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 154: GCC Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 155: GCC Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Product, 2025 to 2035

Table 156: GCC Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 157: GCC Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 158: GCC Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 159: South Africa Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 160: South Africa Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 161: South Africa Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Product, 2025 to 2035

Table 162: South Africa Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 163: South Africa Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 164: South Africa Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 165: Rest of Middle East & Africa Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 166: Rest of Middle East & Africa Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 167: Rest of Middle East & Africa Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by Product, 2025 to 2035

Table 168: Rest of Middle East & Africa Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by Product, 2025 to 2035

Table 169: Rest of Middle East & Africa Purified Terephthalic Acid (PTA) Market Volume (Kilo Tons) Forecast, by End-use, 2025 to 2035

Table 170: Rest of Middle East & Africa Purified Terephthalic Acid (PTA) Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Figure 1: Global Purified Terephthalic Acid (PTA) Market Volume Share Analysis, by Grade, 2024, 2028, and 2035

Figure 2: Global Purified Terephthalic Acid (PTA) Market Attractiveness, by Grade

Figure 3: Global Purified Terephthalic Acid (PTA) Market Volume Share Analysis, by Product, 2024, 2028, and 2035

Figure 4: Global Purified Terephthalic Acid (PTA) Market Attractiveness, by Product

Figure 5: Global Purified Terephthalic Acid (PTA) Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 6: Global Purified Terephthalic Acid (PTA) Market Attractiveness, by End-use

Figure 7: Global Purified Terephthalic Acid (PTA) Market Volume Share Analysis, by Region, 2024, 2028, and 2035

Figure 8: Global Purified Terephthalic Acid (PTA) Market Attractiveness, by Region

Figure 9: North America Purified Terephthalic Acid (PTA) Market Volume Share Analysis, by Grade, 2024, 2028, and 2035

Figure 10: North America Purified Terephthalic Acid (PTA) Market Attractiveness, by Grade

Figure 11: North America Purified Terephthalic Acid (PTA) Market Attractiveness, by Grade

Figure 12: North America Purified Terephthalic Acid (PTA) Market Volume Share Analysis, by Product, 2024, 2028, and 2035

Figure 13: North America Purified Terephthalic Acid (PTA) Market Attractiveness, by Product

Figure 14: North America Purified Terephthalic Acid (PTA) Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 15: North America Purified Terephthalic Acid (PTA) Market Attractiveness, by End-use

Figure 16: North America Purified Terephthalic Acid (PTA) Market Attractiveness, by Country and Sub-region

Figure 17: Europe Purified Terephthalic Acid (PTA) Market Volume Share Analysis, by Grade, 2024, 2028, and 2035

Figure 18: Europe Purified Terephthalic Acid (PTA) Market Attractiveness, by Grade

Figure 19: Europe Purified Terephthalic Acid (PTA) Market Volume Share Analysis, by Product, 2024, 2028, and 2035

Figure 20: Europe Purified Terephthalic Acid (PTA) Market Attractiveness, by Product

Figure 21: Europe Purified Terephthalic Acid (PTA) Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 22: Europe Purified Terephthalic Acid (PTA) Market Attractiveness, by End-use

Figure 23: Europe Purified Terephthalic Acid (PTA) Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 24: Europe Purified Terephthalic Acid (PTA) Market Attractiveness, by Country and Sub-region

Figure 25: Asia Pacific Purified Terephthalic Acid (PTA) Market Volume Share Analysis, by Grade, 2024, 2028, and 2035

Figure 26: Asia Pacific Purified Terephthalic Acid (PTA) Market Attractiveness, by Grade

Figure 27: Asia Pacific Purified Terephthalic Acid (PTA) Market Volume Share Analysis, by Product, 2024, 2028, and 2035

Figure 28: Asia Pacific Purified Terephthalic Acid (PTA) Market Attractiveness, by Product

Figure 29: Asia Pacific Purified Terephthalic Acid (PTA) Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 30: Asia Pacific Purified Terephthalic Acid (PTA) Market Attractiveness, by End-use

Figure 31: Asia Pacific Purified Terephthalic Acid (PTA) Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 32: Asia Pacific Purified Terephthalic Acid (PTA) Market Attractiveness, by Country and Sub-region

Figure 33: Latin America Purified Terephthalic Acid (PTA) Market Volume Share Analysis, by Grade, 2024, 2028, and 2035

Figure 34: Latin America Purified Terephthalic Acid (PTA) Market Attractiveness, by Grade

Figure 35: Latin America Purified Terephthalic Acid (PTA) Market Volume Share Analysis, by Product, 2024, 2028, and 2035

Figure 36: Latin America Purified Terephthalic Acid (PTA) Market Attractiveness, by Product

Figure 37: Latin America Purified Terephthalic Acid (PTA) Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 38: Latin America Purified Terephthalic Acid (PTA) Market Attractiveness, by End-use

Figure 39: Latin America Purified Terephthalic Acid (PTA) Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 40: Latin America Purified Terephthalic Acid (PTA) Market Attractiveness, by Country and Sub-region

Figure 41: Middle East & Africa Purified Terephthalic Acid (PTA) Market Volume Share Analysis, by Grade, 2024, 2028, and 2035

Figure 42: Middle East & Africa Purified Terephthalic Acid (PTA) Market Attractiveness, by Grade

Figure 43: Middle East & Africa Purified Terephthalic Acid (PTA) Market Volume Share Analysis, by Product, 2024, 2028, and 2035

Figure 44: Middle East & Africa Purified Terephthalic Acid (PTA) Market Attractiveness, by Product

Figure 45: Middle East & Africa Purified Terephthalic Acid (PTA) Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 46: Middle East & Africa Purified Terephthalic Acid (PTA) Market Attractiveness, by End-use

Figure 47: Middle East & Africa Purified Terephthalic Acid (PTA) Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 48: Middle East & Africa Purified Terephthalic Acid (PTA) Market Attractiveness, by Country and Sub-region