Reports

Reports

Analyst Viewpoint

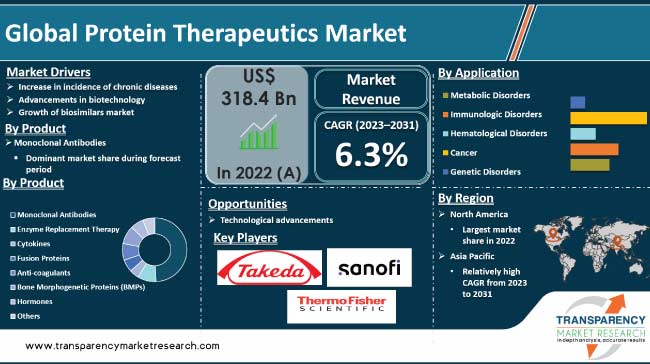

Increase in incidence of chronic diseases such as cancer, diabetes, and autoimmune disorders is driving the global market. Proteins play a crucial role in various biological processes, and leveraging their therapeutic potential has paved the way for innovative treatments for a wide range of diseases. Advancements in biotechnology and genetic engineering enabling large-scale production of therapeutic proteins and addressing the challenges associated with sourcing proteins from natural origins is another factor propelling market expansion. Furthermore, growth of the biosimilars market is likely to fuel the global protein therapeutics market size during the forecast period.

Advancements in protein engineering and formulation techniques offer lucrative opportunities to protein therapeutics market players. Companies are focusing on developing personalized medicine, with emphasis on targeted therapies tailored to individual patients based on their genetic makeup and disease characteristics.

Protein therapeutics refer to the use of proteins as therapeutic agents to treat various medical conditions and diseases. Unlike traditional small-molecule drugs, protein therapeutics are larger, more complex molecules that often mimic or interfere with natural proteins in the body to modify or regulate biological processes. These therapeutic proteins can be naturally occurring or engineered through biotechnological methods.

Rise in incidence of chronic conditions, including cancer, diabetes, and autoimmune disorders, is propelling demand for innovative therapeutic approaches with proteins, particularly monoclonal antibodies that are playing a pivotal role in addressing these complex medical challenges.

Cancer, a leading cause of morbidity and mortality globally, has witnessed a steady rise in new cases each year. Similarly, the escalating rates of diabetes, both type 1 and type 2, contribute to a substantial burden on healthcare systems.

Proteins, especially monoclonal antibodies, have emerged as crucial agents in the treatment of these chronic conditions. Monoclonal antibodies, designed to mimic the immune system's ability to fight off harmful pathogens, are engineered to target specific proteins involved in disease processes. In cancer treatment, monoclonal antibodies can selectively bind to cancer cells, modulating the immune response and inhibiting tumor growth.

Ongoing research and development efforts continue to refine protein therapeutics, expanding their applications and improving treatment outcomes. Development of next-generation monoclonal antibodies, bispecific antibodies, and other protein-based modalities showcases the commitment to innovation. Thus, surge in incidence of chronic diseases is fueling the global protein therapeutics market growth.

Expiration of patents for key biologics is fueling the biosimilars market. This has provided manufacturers opportunities to develop more affordable alternatives, fostering competition and increasing accessibility to critical biologic therapies. Expiration of patents for established biologics marks the entry of biosimilars into the market.

Biosimilars are biological products that are highly similar to, and have no clinically meaningful differences from, an existing approved reference biologic. The expiration of patents allows other manufacturers to develop and market biosimilars, introducing competition to the market for specific biologic therapies.

Potential for cost savings is a primary catalyst for the rise of biosimilars. Biologics, which are complex and often high-cost therapeutic proteins, contribute significantly to healthcare expenditure. As patents expire and biosimilars enter the market, they are generally priced lower than the originator biologics. This competitive pricing creates opportunities for healthcare systems, providers, and patients to access these vital treatments at reduced costs.

Manufacturers of biosimilars benefit from a streamlined regulatory pathway, designed to ensure the safety, efficacy, and quality of these products. The regulatory framework for biosimilars aims to strike a balance between incentivizing innovation and promoting competition, encouraging manufacturers to invest in the development of biosimilars.

Introduction of biosimilars also plays a role in increasing market competition and improving overall healthcare system sustainability. With multiple manufacturers producing biosimilars for a given biologic, market forces drive prices down, providing cost-effective alternatives for patients and healthcare providers.

In terms of product, the monoclonal antibodies segment accounted for the largest global protein therapeutics market share in 2022. This is ascribed to the pivotal role played by monoclonal antibodies in treating various diseases.

Engineered to mimic the immune system's ability to target specific cells, mAbs are extensively utilized for their precision in binding to disease-related antigens. Ongoing research, technological advancements, and approval of novel therapies are bolstering the monoclonal antibodies segment. With their high specificity and therapeutic potential, monoclonal antibodies are a cornerstone in the rapidly expanding landscape of protein therapeutics.

Based on application, the cancer segment dominated the global protein therapeutics market in 2022. The trend is expected to continue during the forecast period.

Monoclonal antibodies, particularly immune checkpoint inhibitors and antibody-drug conjugates, have revolutionized cancer treatment by specifically targeting cancer cells while minimizing damage to healthy tissues. These protein therapeutics have demonstrated remarkable success in various cancer types, significantly improving patient outcomes and survival rates.

According to protein therapeutics market analysis, North America is expected to witness robust growth in the next few years. This is ascribed to technological advancements, increase in prevalence of chronic diseases, and well-established biopharmaceutical sector.

The region boasts a strong biopharmaceutical industry, particularly in the U.S. Presence of major pharmaceutical companies, research institutions, and skilled workforce fosters innovation and accelerates the development of protein therapeutics. The U.S. FDA's proactive regulatory approach toward biologics and protein-based drugs further supports the rapid entry of novel therapies into the protein therapeutics market.

As per protein therapeutics market research, Asia Pacific witnessed robust growth in 2022. Increase in healthcare infrastructure, large & diverse patient population, rise in prevalence of chronic diseases, and growing emphasis on biopharmaceutical research and development are propelling the market in the region.

The region's healthcare landscape is evolving rapidly, with countries such as China, India, Japan, and South Korea investing significantly in healthcare infrastructure. This growth enhances the accessibility of protein therapeutics, contributing to increased patient demand.

The global protein therapeutics market is fragmented, with the presence of large number of players. Companies are focusing on investment in R&D and collaborations to increase market share.

Thermo Fisher Scientific, Inc., Genzyme Corporation (Sanofi), AbbVie, Inc., Sanofi, Leadiant Biosciences, Takeda Pharmaceutical Company Limited, Amicus Therapeutics, Bayer AG, Bristol-Myers Squibb, Daiichi Sankyo Company, Abbott, and Sanofi are the prominent players in the protein therapeutics market.

Key players have been profiled in the protein therapeutics market report based on parameters such as company overview, latest developments, business strategies, application portfolio, business segments, and financial overview.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 318.4 Bn |

| Forecast (Value) in 2031 | More than US$ 549.4 Bn |

| Growth Rate (CAGR) | 6.3% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 318.4 Bn in 2022.

It is projected to reach more than US$ 549.4 Bn by 2031.

The CAGR is anticipated be 6.3% from 2023 to 2031.

Increase in incidence of chronic diseases, advancements in biotechnology, and growth of biosimilars market

The monoclonal antibodies product segment accounted for more than 49% share in 2022.

North America is expected to account for the largest share from 2023 to 2031.

Thermo Fisher Scientific, Inc., Genzyme Corporation (Sanofi), AbbVie, Inc., Sanofi, Leadiant Biosciences, Takeda Pharmaceutical Company Limited, Amicus Therapeutics, Bayer AG, Bristol-Myers Squibb, Daiichi Sankyo Company, Abbott, and Sanofi.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Protein Therapeutics Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Protein Therapeutics Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

4.4.2. Market Volume/Unit Shipments Projections

4.5. Porter’s Five Force Analysis

5. Key Insights

5.1. Therapeutic monoclonal antibodies approved or in review in the EU or US.

5.2. Regulatory Scenario

5.3. Key Products or Brand Analysis

5.4. Technological Advances in Protein Therapeutics.

5.5. Engineering protein-based therapeutics through structural and chemical design

6. Global Protein Therapeutics Market Analysis and Forecast, By Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product, 2017–2031

6.3.1. Monoclonal Antibodies

6.3.2. Enzyme Replacement Therapy

6.3.3. Cytokines

6.3.3.1. Interferons

6.3.3.2. Interleukins

6.3.3.3. Growth Factors

6.3.4. Fusion Proteins

6.3.5. Anti-coagulants

6.3.6. Bone Morphogenetic Proteins (BMPs)

6.3.7. Hormones

6.3.8. Others (engineered protein scaffolds, etc.)

6.4. Market Attractiveness Analysis, By Product

7. Global Protein Therapeutics Market Analysis and Forecast, By Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Application, 2017–2031

7.3.1. Metabolic Disorders

7.3.2. Immunologic Disorders

7.3.3. Hematological Disorders

7.3.4. Cancer

7.3.5. Genetic Disorders

7.4. Market Attractiveness Analysis, By Application

8. Global Protein Therapeutics Market Analysis and Forecast, By Route of Administration

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Route of Administration, 2017–2031

8.3.1. Injectable Proteins

8.3.2. Oral Proteins

8.4. Market Attractiveness Analysis, By Route of Administration

9. Global Protein Therapeutics Market Analysis and Forecast, By Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, By Region

10. North America Protein Therapeutics Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2017–2031

10.2.1. Monoclonal Antibodies

10.2.2. Enzyme Replacement Therapy

10.2.3. Cytokines

10.2.3.1. Interferons

10.2.3.2. Interleukins

10.2.3.3. Growth Factors

10.2.4. Fusion Proteins

10.2.5. Anti-coagulants

10.2.6. Bone Morphogenetic Proteins (BMPs)

10.2.7. Hormones

10.2.8. Others (engineered protein scaffolds, etc.)

10.3. Market Value Forecast, by Application, 2017–2031

10.3.1. Metabolic Disorders

10.3.2. Immunologic Disorders

10.3.3. Hematological Disorders

10.3.4. Cancer

10.3.5. Genetic Disorders

10.4. Market Value Forecast, by Route of Administration, 2017–2031

10.4.1. Injectable Proteins

10.4.2. Oral Proteins

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product

10.6.2. By Application

10.6.3. By Route of Administration

10.6.4. By Country

11. Europe Protein Therapeutics Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017–2031

11.2.1. Monoclonal Antibodies

11.2.2. Enzyme Replacement Therapy

11.2.3. Cytokines

11.2.3.1. Interferons

11.2.3.2. Interleukins

11.2.3.3. Growth Factors

11.2.4. Fusion Proteins

11.2.5. Anti-coagulants

11.2.6. Bone Morphogenetic Proteins (BMPs)

11.2.7. Hormones

11.2.8. Others (engineered protein scaffolds, etc.)

11.3. Market Value Forecast, by Application, 2017–2031

11.3.1. Metabolic Disorders

11.3.2. Immunologic Disorders

11.3.3. Hematological Disorders

11.3.4. Cancer

11.3.5. Genetic Disorders

11.4. Market Value Forecast, by Route of Administration, 2017–2031

11.4.1. Injectable Proteins

11.4.2. Oral Proteins

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product

11.6.2. By Application

11.6.3. By Route of Administration

11.6.4. By Country/Sub-region

12. Asia Pacific Protein Therapeutics Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017–2031

12.2.1. Monoclonal Antibodies

12.2.2. Enzyme Replacement Therapy

12.2.3. Cytokines

12.2.3.1. Interferons

12.2.3.2. Interleukins

12.2.3.3. Growth Factors

12.2.4. Fusion Proteins

12.2.5. Anti-coagulants

12.2.6. Bone Morphogenetic Proteins (BMPs)

12.2.7. Hormones

12.2.8. Others (engineered protein scaffolds, etc.)

12.3. Market Value Forecast, by Application, 2017–2031

12.3.1. Metabolic Disorders

12.3.2. Immunologic Disorders

12.3.3. Hematological Disorders

12.3.4. Cancer

12.3.5. Genetic Disorders

12.4. Market Value Forecast, by Route of Administration, 2017–2031

12.4.1. Injectable Proteins

12.4.2. Oral Proteins

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. India

12.5.3. Japan

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product

12.6.2. By Application

12.6.3. By Route of Administration

12.6.4. By Country/Sub-region

13. Latin America Protein Therapeutics Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017–2031

13.2.1. Monoclonal Antibodies

13.2.2. Enzyme Replacement Therapy

13.2.3. Cytokines

13.2.3.1. Interferons

13.2.3.2. Interleukins

13.2.3.3. Growth Factors

13.2.4. Fusion Proteins

13.2.5. Anti-coagulants

13.2.6. Bone Morphogenetic Proteins (BMPs)

13.2.7. Hormones

13.2.8. Others (engineered protein scaffolds, etc.)

13.3. Market Value Forecast, by Application, 2017–2031

13.3.1. Metabolic Disorders

13.3.2. Immunologic Disorders

13.3.3. Hematological Disorders

13.3.4. Cancer

13.3.5. Genetic Disorders

13.4. Market Value Forecast, by Route of Administration, 2017–2031

13.4.1. Injectable Proteins

13.4.2. Oral Proteins

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product

13.6.2. By Application

13.6.3. By Route of Administration

13.6.4. By Country/Sub-region

14. Middle East & Africa Protein Therapeutics Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product, 2017–2031

14.2.1. Monoclonal Antibodies

14.2.2. Enzyme Replacement Therapy

14.2.3. Cytokines

14.2.3.1. Interferons

14.2.3.2. Interleukins

14.2.3.3. Growth Factors

14.2.4. Fusion Proteins

14.2.5. Anti-coagulants

14.2.6. Bone Morphogenetic Proteins (BMPs)

14.2.7. Hormones

14.2.8. Others (engineered protein scaffolds, etc.)

14.3. Market Value Forecast, by Application, 2017–2031

14.3.1. Metabolic Disorders

14.3.2. Immunologic Disorders

14.3.3. Hematological Disorders

14.3.4. Cancer

14.3.5. Genetic Disorders

14.4. Market Value Forecast, by Route of Administration, 2017–2031

14.4.1. Injectable Proteins

14.4.2. Oral Proteins

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product

14.6.2. By Application

14.6.3. By Route of Administration

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of companies)

15.2. Market Share Analysis By Company (2022)

15.3. Company Profiles

15.3.1. Thermo Fisher Scientific, Inc.

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Material Portfolio

15.3.1.3. Financial Overview

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. Genzyme Corporation (Sanofi)

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Material Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. AbbVie, Inc.

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Material Portfolio

15.3.3.3. Financial Overview

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. Sanofi

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Material Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. Leadiant Biosciences

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Material Portfolio

15.3.5.3. Financial Overview

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

15.3.6. Takeda Pharmaceutical Company Limited

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Material Portfolio

15.3.6.3. Financial Overview

15.3.6.4. SWOT Analysis

15.3.6.5. Strategic Overview

15.3.7. Amicus Therapeutics

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Material Portfolio

15.3.7.3. Financial Overview

15.3.7.4. SWOT Analysis

15.3.7.5. Strategic Overview

15.3.8. Bayer AG

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Material Portfolio

15.3.8.3. Financial Overview

15.3.8.4. SWOT Analysis

15.3.8.5. Strategic Overview

15.3.9. Bristol-Myers Squibb

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Material Portfolio

15.3.9.3. Financial Overview

15.3.9.4. SWOT Analysis

15.3.9.5. Strategic Overview

15.3.10. DAIICHI SANKYO COMPANY

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Material Portfolio

15.3.10.3. Financial Overview

15.3.10.4. SWOT Analysis

15.3.10.5. Strategic Overview

15.3.11. Abbott

15.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.11.2. Material Portfolio

15.3.11.3. Financial Overview

15.3.11.4. SWOT Analysis

15.3.11.5. Strategic Overview

15.3.12. Sanofi

15.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.12.2. Material Portfolio

15.3.12.3. Financial Overview

15.3.12.4. SWOT Analysis

15.3.12.5. Strategic Overview

List of Tables

Table 01: Global Protein Therapeutics Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 02: Global Protein Therapeutics Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 03: Global Protein Therapeutics Market Value (US$ Mn) Forecast, by Route of Administration, 2017-2031

Table 04: Global Protein Therapeutics Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 05: North America Protein Therapeutics Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 06: North America Protein Therapeutics Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 07: North America Protein Therapeutics Market Value (US$ Mn) Forecast, by Route of Administration, 2017-2031

Table 08: North America Protein Therapeutics Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 09: Europe Protein Therapeutics Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 10: Europe Protein Therapeutics Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 11: Europe Protein Therapeutics Market Value (US$ Mn) Forecast, by Route of Administration, 2017-2031

Table 12: Europe Protein Therapeutics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 13: Asia Pacific Protein Therapeutics Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 14: Asia Pacific Protein Therapeutics Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 15: Asia Pacific Protein Therapeutics Market Value (US$ Mn) Forecast, by Route of Administration, 2017-2031

Table 16: Asia Pacific Protein Therapeutics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 17: Latin America Protein Therapeutics Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 18: Latin America Protein Therapeutics Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 19: Latin America Protein Therapeutics Market Value (US$ Mn) Forecast, by Route of Administration, 2017-2031

Table 20: Latin America Protein Therapeutics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 21: Middle East & Africa Protein Therapeutics Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 22: Middle East & Africa Protein Therapeutics Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 23: Middle East & Africa Protein Therapeutics Market Value (US$ Mn) Forecast, by Route of Administration, 2017-2031

Table 24: Middle East & Africa Protein Therapeutics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

List of Figures

Figure 01: Global Protein Therapeutics Market Size (US$ Mn) Forecast, 2017-2031

Figure 02: Global Protein Therapeutics Market Value Share, by Product (2022)

Figure 03: Global Protein Therapeutics Market Value Share, by Application (2022)

Figure 04: Global Protein Therapeutics Market Value Share, by End-user (2022)

Figure 05: Global Protein Therapeutics Market Value Share, by Region (2022)

Figure 06: Global Protein Therapeutics Market Value Share, by Application, 2022 and 2031

Figure 07: Global Protein Therapeutics Market Attractiveness Analysis, by Application, 2017-2031

Figure 08: Global Protein Therapeutics Market Value Share, by Product, 2022 and 2031

Figure 09: Global Protein Therapeutics Market Attractiveness Analysis, by Product, 2017-2031

Figure 10: Global Protein Therapeutics Market Value Share, by Route of Administration, 2022 and 2031

Figure 11: Global Protein Therapeutics Market Attractiveness Analysis, by Route of Administration, 2017-2031

Figure 12: Global Protein Therapeutics Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017-2031

Figure 13: Global Protein Therapeutics Market Value Share, by Region, 2017-2031

Figure 14: Global Protein Therapeutics Market Attractiveness Analysis, by Region, 2017-2031

Figure 15: North America Protein Therapeutics Market Value Share, by Application, 2022 and 2031

Figure 16: North America Protein Therapeutics Market Attractiveness Analysis, by Application, 2017-2031

Figure 17: North America Protein Therapeutics Market Value Share, by Product, 2022 and 2031

Figure 18: North America Protein Therapeutics Market Attractiveness Analysis, by Product, 2017-2031

Figure 19: North America Protein Therapeutics Market Value Share, by Route of Administration, 2022 and 2031

Figure 20: North America Protein Therapeutics Market Attractiveness Analysis, by Route of Administration, 2017-2031

Figure 21: North America Protein Therapeutics Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017-2031

Figure 22: North America Protein Therapeutics Market Value Share, by Country, 2017-2031

Figure 23: North America Protein Therapeutics Market Attractiveness Analysis, by Country, 2017-2031

Figure 24: Europe Protein Therapeutics Market Value Share, by Application, 2022 and 2031

Figure 25: Europe Protein Therapeutics Market Attractiveness Analysis, by Application, 2017-2031

Figure 26 : Europe Protein Therapeutics Market Value Share, by Product, 2022 and 2031

Figure 27: Europe Protein Therapeutics Market Attractiveness Analysis, by Product, 2017-2031

Figure 28: Europe Protein Therapeutics Market Value Share, by Route of Administration, 2022 and 2031

Figure 29: Europe Protein Therapeutics Market Attractiveness Analysis, by Route of Administration, 2017-2031

Figure 30: Europe Protein Therapeutics Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017-2031

Figure 31: Europe Protein Therapeutics Market Value Share, by Country/Sub-region, 2017-2031

Figure 32: Europe Protein Therapeutics Market Attractiveness Analysis, by Country/Sub-region, 2017-2031

Figure 33: Asia Pacific Protein Therapeutics Market Value Share, by Application, 2022 and 2031

Figure 34: Asia Pacific Protein Therapeutics Market Attractiveness Analysis, by Application, 2017-2031

Figure 35: Asia Pacific Protein Therapeutics Market Value Share, by Product, 2022 and 2031

Figure 36: Asia Pacific Protein Therapeutics Market Attractiveness Analysis, by Product, 2017-2031

Figure 37: Asia Pacific Protein Therapeutics Market Value Share, by Route of Administration, 2022 and 2031

Figure 38: Asia Pacific Protein Therapeutics Market Attractiveness Analysis, by Route of Administration, 2017-2031

Figure 39: Asia Pacific Protein Therapeutics Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017-2031

Figure 40 : Asia Pacific Protein Therapeutics Market Value Share, by Country/Sub-region, 2017-2031

Figure 41: Asia Pacific Protein Therapeutics Market Attractiveness Analysis, by Country/Sub-region, 2017-2031

Figure 42: Latin America Protein Therapeutics Market Value Share, by Application, 2022 and 2031

Figure 43: Latin America Protein Therapeutics Market Attractiveness Analysis, by Application, 2017-2031

Figure 44: Latin America Protein Therapeutics Market Value Share, by Product, 2022 and 2031

Figure 45: Latin America Protein Therapeutics Market Attractiveness Analysis, by Product, 2017-2031

Figure 46: Latin America Protein Therapeutics Market Value Share, by Route of Administration, 2022 and 2031

Figure 47: Latin America Protein Therapeutics Market Attractiveness Analysis, by Route of Administration, 2017-2031

Figure 48: Latin America Protein Therapeutics Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017-2031

Figure 45: Latin America Protein Therapeutics Market Value Share, by Country/Sub-region, 2017-2031

Figure 50: Latin America Protein Therapeutics Market Attractiveness Analysis, by Country/Sub-region, 2017-2031

Figure 51: Middle East & Africa Protein Therapeutics Market Value Share, by Application, 2022 and 2031

Figure 52: Middle East & Africa Protein Therapeutics Market Attractiveness Analysis, by Application, 2017-2031

Figure 53: Middle East & Africa Protein Therapeutics Market Value Share, by Product, 2022 and 2031

Figure 54: Middle East & Africa Protein Therapeutics Market Attractiveness Analysis, by Product, 2017-2031

Figure 55: Middle East & Africa Protein Therapeutics Market Value Share, by Route of Administration, 2022 and 2031

Figure 56: Middle East & Africa Protein Therapeutics Market Attractiveness Analysis, by Route of Administration, 2017-2031

Figure 57: Middle East & Africa Protein Therapeutics Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017-2031

Figure 58: Middle East & Africa Protein Therapeutics Market Value Share, by Country/Sub-region, 2017-2031

Figure 59: Middle East & Africa Protein Therapeutics Market Attractiveness Analysis, by Country/Sub-region, 2017-2031