Reports

Reports

Analysts’ Viewpoint on Market Scenario

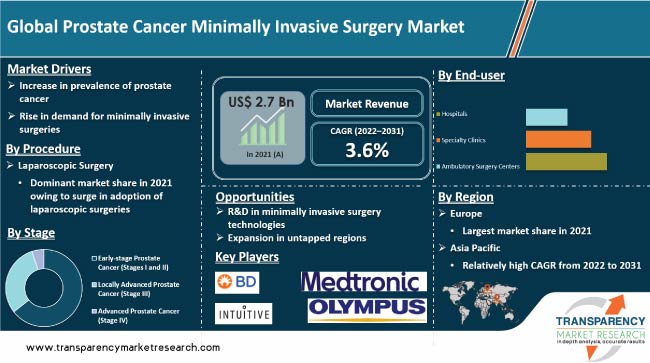

Increase in the prevalence of prostate cancer and rise in demand for minimally invasive surgeries are driving the prostate cancer minimally invasive surgery market size. Minimally invasive surgery for prostate cancer is associated with several benefits, including shorter hospital stays, faster recovery, less pain, and fewer complications as compared to traditional open surgery.

R&D in minimally invasive surgery technologies is expected to augment market expansion during the forecast period. Development of new and advanced surgical technologies, such as robotics and laparoscopy, has made it possible to perform minimally invasive surgery with greater precision and accuracy. Vendors in the industry are focused on expansion of their presence in untapped regions in order to consolidate their prostate cancer minimally invasive surgery market share.

Prostate cancer is a form of cancer that begins in the gland cells of the prostate in males. Minimally invasive surgeries are widely used for the treatment of prostate cancer. These surgeries involve the use of specialized instruments and techniques to remove cancerous tissues with a minimum risk of damage to surrounding healthy tissues. Laparoscopic surgery, robotic surgery, and cryotherapy are various types of minimally invasive surgeries employed for the treatment of prostate cancer.

The COVID-19 pandemic has had a short-term negative impact on the global prostate cancer minimally invasive surgery industry. However, the industry recovered as the pandemic came under control and normal business operations resumed. During the pandemic, the measures taken to control the spread of the virus, such as lockdowns, travel restrictions, and the closure of non-essential businesses, disrupted the supply chain for surgical instruments and other medical equipment. These measures also reduced the number of elective surgeries being performed.

Demand for minimally invasive surgeries for the treatment of prostate cancer remained relatively stable due to the severity of the condition and the need for timely treatment. Numerous hospitals and clinics have implemented measures to ensure the safety of patients and staff, such as screening for COVID-19 symptoms and mandating the use of personal protective equipment.

Prostate cancer is the second-most commonly occurring cancer in men and the fourth-most common cancer overall. According to the International Agency for Research on Cancer (IARC), 1,414,259 people suffered from prostate cancer worldwide, which accounted for 7.3% of all new cancer cases. Additionally, as per statistics published by the American Society of Clinical Oncology (ASCO), the prevalence of prostate cancer is increasing globally, with an estimated 1 in 8 men being diagnosed with the disease at some point in their lives. Thus, high incidence of prostate cancer is anticipated to drive market progress in the next few years.

Governments of various countries are promoting the adoption of minimally invasive surgeries for the treatment of prostate cancer through various initiatives. These include R&D funding and financial incentives to hospitals and surgeons. These initiatives are also boosting the prostate cancer minimally invasive surgery market development.

The laparoscopic surgery procedure segment held largest share of the market in 2021. The segment is likely to maintain its dominance during the forecast period. Laparoscopic surgery is a viable treatment option for prostate cancer. It offers significant benefits to patients who are suitable for the procedure.

Laparoscopic surgery involves the use of specialized instruments and techniques to remove cancerous tissues with minimum risk of damage to surrounding healthy tissues. Laparoscopic prostatectomy facilitates the precise removal of the prostate. Patients also experience significantly less blood loss.

The robotic surgery segment is projected to grow at a significant rate during the forecast period. Robotic surgery offers several advantages over traditional open surgery and laparoscopic surgery. These benefits include higher precision and accuracy, reduced risk of complications, shorter recovery time, and less postoperative pain and discomfort.

According to the latest prostate cancer minimally invasive surgery market trends, the early-stage prostate cancer (stages I and II) segment held largest share in 2021. Minimally invasive prostate surgery can be an effective treatment option for early-stage prostate cancer. Patients who are not suitable for traditional open surgery due to their age or other health conditions can benefit from minimally invasive prostate surgery.

Early-stage prostate cancer generally grows very slowly and can take several years to show any symptoms or other health problems. Radiation therapy (external beam or brachytherapy) can also be employed for the treatment of early-stage prostate cancer. Robotic prostatectomy or laparoscopic prostatectomy is less invasive than radical prostatectomy and may shorten the recovery time of early-stage prostate cancer patients.

The hospitals end-user segment dominated the prostate cancer minimally invasive surgery market in 2021. Minimally invasive surgeries for the treatment of prostate cancer are typically performed in hospitals due to the availability of specialized equipment and trained medical staff. Minimally invasive surgeries involve the use of small incisions and specialized instruments to perform procedures, which requires a high level of skill and expertise.

Hospitals are equipped with the necessary equipment and staffed with trained medical professionals to perform minimally invasive surgeries. Rise in the number of hospitals worldwide is driving the segment. According to the American Hospital Association (AHA), the number of hospitals in the U.S. increased from 5,564 in 2017 to 6,093 in 2022.

According to the latest prostate cancer minimally invasive surgery market forecast, Europe is anticipated to hold largest share during 2022-2031. High prevalence of prostate cancer is driving the market in the region.

North America accounted for significant share in 2021. This can be ascribed to the presence of major market participants and well-established healthcare infrastructure. High incidence of prostate cancer and rise in adoption of minimally invasive surgeries are also fueling market statistics in the region. According to the American Cancer Society, around 268,490 new cases of prostate cancer were diagnosed in the U.S. in 2022.

The industry in Asia Pacific is expected to grow at a rapid pace during the forecast period. Surge in the prevalence of prostate cancer, rise in the geriatric population, and changes in lifestyle habits, such as smoking and unhealthy diet, are propelling market revenue in the region. Increase in the availability of affordable minimally invasive surgeries is also leading to market growth in Asia Pacific.

The prostate cancer minimally invasive surgery market report concludes with the company profiles section that includes key information such as company overview, financial overview, strategies, portfolio, segments, and recent developments.

Stakeholders in the industry are adopting various marketing strategies to expand their revenue share. These include educational and social media marketing that highlights the benefits of minimally invasive surgeries. Vendors are also adopting product launches, M&As, partnerships, and collaboration strategies to expand their market share.

AngioDynamics, B. Braun SE, Becton, Dickinson and Company, Ethicon Endo-Surgery, Inc. (Johnson & Johnson Services, Inc.), Intuitive Surgical, Medtronic, Olympus Corporation, Siemens Healthcare GmbH, and Teleflex Incorporated are key entities operating in the industry.

|

Attribute |

Detail |

|

Size Value in 2021 |

US$ 2.7 Bn |

|

Forecast (Value) in 2031 |

More than US$ 3.9 Bn |

|

Compound Annual Growth Rate (CAGR) |

3.6% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 2.7 Bn in 2021.

It is projected to reach a value of more than US$ 3.9 Bn 2031.

It is anticipated to expand at a CAGR of 3.6% from 2022 to 2031.

Increase in prevalence of prostate cancer and rise in demand for minimally invasive surgeries.

The laparoscopic surgery segment accounted for more than 60.0% share in 2021.

Europe is expected to account for largest share from 2022 to 2031.

AngioDynamics, B. Braun SE, Becton, Dickinson and Company, Ethicon Endo-Surgery, Inc. (Johnson & Johnson Services, Inc.), Intuitive Surgical, Medtronic, Olympus Corporation, Siemens Healthcare GmbH, and Teleflex Incorporated.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Prostate Cancer Minimally Invasive Surgery Market

4. Market Overview

4.1. Overview

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Global Prostate Cancer Minimally Invasive Surgery Market Value Analysis and Forecast, 2017–2031

5. Key Insights

5.1. Regulatory Scenario by Region/Globally

5.2. Key Industry Events

5.3. COVID-19 Pandemic Impact on Industry (Value Chain and Short/Mid/Long-term Impact)

6. Global Prostate Cancer Minimally Invasive Surgery Market Analysis and Forecast, by Procedure

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Procedure, 2017–2031

6.3.1. Laparoscopic Surgery

6.3.2. Robotic Surgery

6.3.3. Radiation Therapy

6.3.4. Cryosurgery

6.3.5. Others

6.4. Market Attractiveness Analysis, by Procedure

7. Global Prostate Cancer Minimally Invasive Surgery Market Analysis and Forecast, by Stage

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Stage, 2017–2031

7.3.1. Early-stage Prostate Cancer (Stages I and II)

7.3.2. Locally Advanced Prostate Cancer (Stage III)

7.3.3. Advanced Prostate Cancer (Stage IV)

7.4. Market Attractiveness Analysis, by Stage

8. Global Prostate Cancer Minimally Invasive Surgery Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Hospitals

8.3.2. Specialty Clinics

8.3.3. Ambulatory Surgery Centers

8.4. Market Attractiveness Analysis, by End-user

9. Global Prostate Cancer Minimally Invasive Surgery Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2017–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Prostate Cancer Minimally Invasive Surgery Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Procedure, 2017–2031

10.2.1. Laparoscopic Surgery

10.2.2. Robotic Surgery

10.2.3. Radiation Therapy

10.2.4. Cryosurgery

10.2.5. Others

10.3. Market Value Forecast, by Stage, 2017–2031

10.3.1. Early-stage Prostate Cancer (Stages I and II)

10.3.2. Locally Advanced Prostate Cancer (Stage III)

10.3.3. Advanced Prostate Cancer (Stage IV)

10.4. Market Value Forecast, by End-user, 2017–2031

10.4.1. Hospitals

10.4.2. Specialty Clinics

10.4.3. Ambulatory Surgery Centers

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Procedure

10.6.2. By Stage

10.6.3. By End-user

10.6.4. By Country

11. Europe Prostate Cancer Minimally Invasive Surgery Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Procedure, 2017–2031

11.2.1. Laparoscopic Surgery

11.2.2. Robotic Surgery

11.2.3. Radiation Therapy

11.2.4. Cryosurgery

11.2.5. Others

11.3. Market Value Forecast, by Stage, 2017–2031

11.3.1. Early-stage Prostate Cancer (Stages I and II)

11.3.2. Locally Advanced Prostate Cancer (Stage III)

11.3.3. Advanced Prostate Cancer (Stage IV)

11.4. Market Value Forecast, by End-user, 2017–2031

11.4.1. Hospitals

11.4.2. Specialty Clinics

11.4.3. Ambulatory Surgery Centers

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Procedure

11.6.2. By Stage

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Prostate Cancer Minimally Invasive Surgery Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Procedure, 2017–2031

12.2.1. Laparoscopic Surgery

12.2.2. Robotic Surgery

12.2.3. Radiation Therapy

12.2.4. Cryosurgery

12.2.5. Others

12.3. Market Value Forecast, by Stage, 2017–2031

12.3.1. Early-stage Prostate Cancer (Stages I and II)

12.3.2. Locally Advanced Prostate Cancer (Stage III)

12.3.3. Advanced Prostate Cancer (Stage IV)

12.4. Market Value Forecast, by End-user, 2017–2031

12.4.1. Hospitals

12.4.2. Specialty Clinics

12.4.3. Ambulatory Surgery Centers

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Procedure

12.6.2. By Stage

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Prostate Cancer Minimally Invasive Surgery Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Procedure, 2017–2031

13.2.1. Laparoscopic Surgery

13.2.2. Robotic Surgery

13.2.3. Radiation Therapy

13.2.4. Cryosurgery

13.2.5. Others

13.3. Market Value Forecast, by Stage, 2017–2031

13.3.1. Early-stage Prostate Cancer (Stages I and II)

13.3.2. Locally Advanced Prostate Cancer (Stage III)

13.3.3. Advanced Prostate Cancer (Stage IV)

13.4. Market Value Forecast, by End-user, 2017–2031

13.4.1. Hospitals

13.4.2. Specialty Clinics

13.4.3. Ambulatory Surgery Centers

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Procedure

13.6.2. By Stage

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Prostate Cancer Minimally Invasive Surgery Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Procedure, 2017–2031

14.2.1. Laparoscopic Surgery

14.2.2. Robotic Surgery

14.2.3. Radiation Therapy

14.2.4. Cryosurgery

14.2.5. Others

14.3. Market Value Forecast, by Stage, 2017–2031

14.3.1. Early-stage Prostate Cancer (Stages I and II)

14.3.2. Locally Advanced Prostate Cancer (Stage III)

14.3.3. Advanced Prostate Cancer (Stage IV)

14.4. Market Value Forecast, by End-user, 2017–2031

14.4.1. Hospitals

14.4.2. Specialty Clinics

14.4.3. Ambulatory Surgery Centers

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Procedure

14.6.2. By Stage

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of Companies)

15.2. Market Share Analysis, by Company (2021)

15.3. Company Profiles

15.3.1. AngioDynamics

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Portfolio

15.3.1.3. Financial Overview

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. B. Braun SE

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. Becton, Dickinson and Company

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Portfolio

15.3.3.3. Financial Overview

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. Ethicon Endo-Surgery, Inc. (Johnson & Johnson Services, Inc.)

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. Intuitive Surgical

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Portfolio

15.3.5.3. Financial Overview

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

15.3.6. Medtronic

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Portfolio

15.3.6.3. Financial Overview

15.3.6.4. SWOT Analysis

15.3.6.5. Strategic Overview

15.3.7. Olympus Corporation

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Product Portfolio

15.3.7.3. Financial Overview

15.3.7.4. SWOT Analysis

15.3.7.5. Strategic Overview

15.3.8. Siemens Healthcare GmbH

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Portfolio

15.3.8.3. Financial Overview

15.3.8.4. SWOT Analysis

15.3.8.5. Strategic Overview

15.3.9. Teleflex Incorporated

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Product Portfolio

15.3.9.3. Product Portfolio

15.3.9.4. SWOT Analysis

15.3.9.5. Strategic Overview

List of Tables

Table 01: Global Prostate Cancer Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Procedure, 2017–2031

Table 02: Global Prostate Cancer Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Stage, 2017–2031

Table 03: Global Prostate Cancer Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 04: Global Prostate Cancer Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Prostate Cancer Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Procedure, 2017–2031

Table 06: North America Prostate Cancer Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Stage, 2017–2031

Table 07: North America Prostate Cancer Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 08: North America Prostate Cancer Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 09: Europe Prostate Cancer Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Procedure, 2017–2031

Table 10: Europe Prostate Cancer Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Stage, 2017–2031

Table 11: Europe Prostate Cancer Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 12: Europe Prostate Cancer Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 13: Asia Pacific Prostate Cancer Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Procedure, 2017–2031

Table 14: Asia Pacific Prostate Cancer Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Stage, 2017–2031

Table 15: Asia Pacific Prostate Cancer Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 16: Asia Pacific Prostate Cancer Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Latin America Prostate Cancer Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Procedure, 2017–2031

Table 18: Latin America Prostate Cancer Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Stage, 2017–2031

Table 19: Latin America Prostate Cancer Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 20: Latin America Prostate Cancer Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 21: Middle East & Africa Prostate Cancer Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Procedure, 2017–2031

Table 22: Middle East & Africa Prostate Cancer Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Stage, 2017–2031

Table 23: Middle East & Africa Prostate Cancer Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 24: Middle East & Africa Prostate Cancer Minimally Invasive Surgery Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

List of Figures

Figure 01: Global Prostate Cancer Minimally Invasive Surgery Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Prostate Cancer Minimally Invasive Surgery Market Value Share Analysis, by Procedure, 2021 and 2031

Figure 03: Global Prostate Cancer Minimally Invasive Surgery Market Attractiveness Analysis, by Procedure, 2022–2031

Figure 04: Global Prostate Cancer Minimally Invasive Surgery Market Value Share Analysis, by Stage, 2021 and 2031

Figure 05: Global Prostate Cancer Minimally Invasive Surgery Market Attractiveness Analysis, by Stage, 2022–2031

Figure 06: Global Prostate Cancer Minimally Invasive Surgery Market Value Share Analysis, by End-user, 2021 and 2031

Figure 07: Global Prostate Cancer Minimally Invasive Surgery Market Attractiveness Analysis, by End-user, 2022–2031

Figure 08: Global Prostate Cancer Minimally Invasive Surgery Market Value Share Analysis, by Region, 2021 and 2031

Figure 09: Global Prostate Cancer Minimally Invasive Surgery Market Attractiveness Analysis, by Region, 2022–2031

Figure 10: North America Prostate Cancer Minimally Invasive Surgery Market Value (US$ Mn) Forecast, 2017–2031

Figure 11: North America Prostate Cancer Minimally Invasive Surgery Market Value Share Analysis, by Procedure, 2021 and 2031

Figure 12: North America Prostate Cancer Minimally Invasive Surgery Market Attractiveness Analysis, by Procedure, 2022–2031

Figure 13: North America Prostate Cancer Minimally Invasive Surgery Market Value Share Analysis, by Stage, 2021 and 2031

Figure 14: North America Prostate Cancer Minimally Invasive Surgery Market Attractiveness Analysis, by Stage, 2022–2031

Figure 15: North America Prostate Cancer Minimally Invasive Surgery Market Value Share Analysis, by End-user, 2021 and 2031

Figure 16: North America Prostate Cancer Minimally Invasive Surgery Market Attractiveness Analysis, by End-user, 2022–2031

Figure 17: North America Prostate Cancer Minimally Invasive Surgery Market Value Share Analysis, by Country, 2021 and 2031

Figure 18: North America Prostate Cancer Minimally Invasive Surgery Market Attractiveness Analysis, by Country, 2022–2031

Figure 19: Europe Prostate Cancer Minimally Invasive Surgery Market Value (US$ Mn) Forecast, 2017–2031

Figure 20: Europe Prostate Cancer Minimally Invasive Surgery Market Value Share Analysis, by Procedure, 2021 and 2031

Figure 21: Europe Prostate Cancer Minimally Invasive Surgery Market Attractiveness Analysis, by Procedure, 2022–2031

Figure 22: Europe Prostate Cancer Minimally Invasive Surgery Market Value Share Analysis, by Stage, 2021 and 2031

Figure 23: Europe Prostate Cancer Minimally Invasive Surgery Market Attractiveness Analysis, by Stage, 2022–2031

Figure 24: Europe Prostate Cancer Minimally Invasive Surgery Market Value Share Analysis, by End-user, 2021 and 2031

Figure 25: Europe Prostate Cancer Minimally Invasive Surgery Market Attractiveness Analysis, by End-user, 2022–2031

Figure 26: Europe Prostate Cancer Minimally Invasive Surgery Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 27: Europe Prostate Cancer Minimally Invasive Surgery Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 28: Asia Pacific Prostate Cancer Minimally Invasive Surgery Market Value (US$ Mn) Forecast, 2017–2031

Figure 29: Asia Pacific Prostate Cancer Minimally Invasive Surgery Market Value Share Analysis, by Procedure, 2021 and 2031

Figure 30: Asia Pacific Prostate Cancer Minimally Invasive Surgery Market Attractiveness Analysis, by Procedure, 2022–2031

Figure 31: Asia Pacific Prostate Cancer Minimally Invasive Surgery Market Value Share Analysis, by Stage 2021 and 2031

Figure 32: Asia Pacific Prostate Cancer Minimally Invasive Surgery Market Attractiveness Analysis, by Stage, 2022–2031

Figure 33: Asia Pacific Prostate Cancer Minimally Invasive Surgery Market Value Share Analysis, by End-user, 2021 and 2031

Figure 34: Asia Pacific Prostate Cancer Minimally Invasive Surgery Market Attractiveness Analysis, by End-user, 2022–2031

Figure 35: Asia Pacific Prostate Cancer Minimally Invasive Surgery Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 36: Asia Pacific Prostate Cancer Minimally Invasive Surgery Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 37: Latin America Prostate Cancer Minimally Invasive Surgery Market Value (US$ Mn) Forecast, 2017–2031

Figure 38: Latin America Prostate Cancer Minimally Invasive Surgery Market Value Share Analysis, by Procedure, 2021 and 2031

Figure 39: Latin America Prostate Cancer Minimally Invasive Surgery Market Attractiveness Analysis, by Procedure, 2022–2031

Figure 40: Latin America Prostate Cancer Minimally Invasive Surgery Market Value Share Analysis, by Stage, 2021 and 2031

Figure 41: Latin America Prostate Cancer Minimally Invasive Surgery Market Attractiveness Analysis, by Stage, 2022–2031

Figure 42: Latin America Prostate Cancer Minimally Invasive Surgery Market Value Share Analysis, by End-user, 2021 and 2031

Figure 43: Latin America Prostate Cancer Minimally Invasive Surgery Market Attractiveness Analysis, by End-user, 2022–2031

Figure 44: Latin America Prostate Cancer Minimally Invasive Surgery Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 45: Latin America Prostate Cancer Minimally Invasive Surgery Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 46: Middle East & Africa Prostate Cancer Minimally Invasive Surgery Market Value (US$ Mn) Forecast, 2017–2031

Figure 47: Middle East & Africa Prostate Cancer Minimally Invasive Surgery Market Value Share Analysis, by Procedure, 2021 and 2031

Figure 48: Middle East & Africa Prostate Cancer Minimally Invasive Surgery Market Attractiveness Analysis, by Procedure, 2022–2031

Figure 49: Middle East & Africa Prostate Cancer Minimally Invasive Surgery Market Value Share Analysis, by Stage, 2021 and 2031

Figure 50: Middle East & Africa Prostate Cancer Minimally Invasive Surgery Market Attractiveness Analysis, by Stage, 2022–2031

Figure 51: Middle East & Africa Prostate Cancer Minimally Invasive Surgery Market Value Share Analysis, by End-user, 2021 and 2031

Figure 52: Middle East & Africa Prostate Cancer Minimally Invasive Surgery Market Attractiveness Analysis, by End-user, 2022–2031

Figure 53: Middle East & Africa Prostate Cancer Minimally Invasive Surgery Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 54: Middle East & Africa Prostate Cancer Minimally Invasive Surgery Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 55: Global Prostate Cancer Minimally Invasive Surgery Market Share Analysis, by Company, 2021