Reports

Reports

Analysts’ Viewpoint on Process Spectroscopy Market Scenario

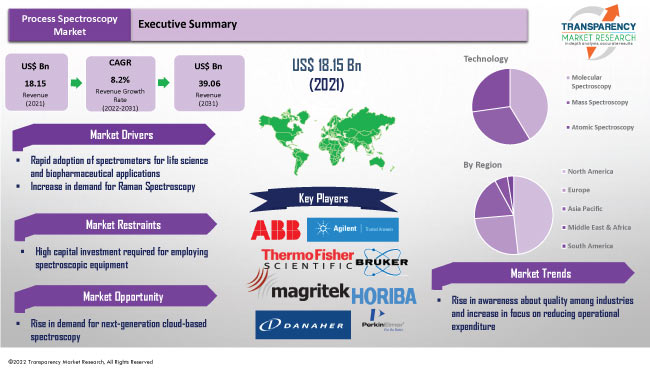

The global process spectroscopy market is flourishing due to a growing focus on maintaining international quality standards by various industries and a rising usage of process technologies in the food & beverage and agricultural sectors. Introduction of cloud-based spectroscopy offers significant opportunity for adoption by different end-use industries. Computational resources can be dynamically scaled up and down to match changing workloads in next-generation cloud-based spectroscopy. Moreover, the application of Process Analytical Technology (PAT) to ensure optimum performance of the finished product offers additional benefits. Increase in adoption of Raman imaging spectroscopy for non-destructive and non-invasive 3D investigation imaging of chemical and molecular compounds to quickly identify and analyze tiny contaminants in sample also offers lucrative opportunities for manufacturers of Raman spectroscopy. High precision and ability to determine finest molecular details, such as presence of functional groups and molecular weight, make this technology more attractive for companies engaged in drug development and chemical analysis. Based on end-use industry, adoption of process spectroscopy in pharmaceuticals, chemical, and food & agriculture industries is boosting preference for advanced spectroscopy instruments. North America is likely to hold largest share of the global process spectroscopy market during the forecast period owing to stringent government quality control legislation and improved requirements for process monitoring.

Process spectroscopy instruments are designed to determine the physical and electronic structure of matter/sample at atomic or molecular/macro levels. The key principle of spectroscopy involves the analysis of interactions between matter and electromagnetic radiation with the aid of wavelength or frequency of the radiation. Mass spectrometers can detect, identify, and quantify molecules within samples based on molecular mass-to-charge ratio after ionization. However, molecular spectroscopy is the interactions that occur between molecules and electromagnetic radiation. These radiations are electric and magnetic fields that vary simultaneously.

The global process spectroscopy market is likely to rise at a significant growth rate during the forecast period 2022-2031 due to increasing adoption of various types of spectroscopy for diverse applications such as nanotechnology, microplastics testing, polymer/chemical analysis, electronics & semiconductor testing, material science research, academic research, pharmaceutical sample testing, and geology research.

Fluorescence spectroscopy is extensively utilized to detect intracellular ion concentrations, analyze the rotational motion of molecules, and finely control sample temperatures for protein and peptide analysis.

Rise in adoption of various spectroscopy technologies for a wide range of life science applications fuels the market. These life science applications include characterization of bio-labels for live cell imaging, characterizing GPCR oligomerization, detection of specific bacterial strains, analysis of platelet response using cellular signaling, analysis of changes in tertiary structure of proteins, and testing thermal stability of biocatalysts and pharmaceuticals.

Key players of process spectroscopy market are continuously developing advanced spectrometers to gain a competitive edge in the market. For instance, in July 2018, PerkinElmer, Inc. launched FL 6500 Pulse Xenon and FL 8500 Continuous Wave Fluorescence Spectrometers, for industrial companies, universities, government, and pharmaceutical laboratories to analyze diverse sample types for research and evolving compliance requirements. The FL 6500 fluorescence spectrometer is widely used for cell biology, molecular biology, immunology, enzymology, and protein analysis.

In November 2021, Thermo Fisher Scientific Inc. launched new-generation mass spectrometry instruments, workflows and software at American Society for Mass Spectrometry (ASMS) Conference on Mass Spectrometry and Allied Topics, Pennsylvania U.S. The launched instrument included Orbitrap Exploris MX mass detector that enables biopharmaceutical laboratories implement multi-attribute method (MAM) and perform intact analysis of monoclonal antibodies, oligonucleotide mass determination, and peptide mapping.

Increase in adoption of Raman spectroscopy for airport security screening, pharmaceutical quality control, and hazardous chemical identification in field is propelling the market. These spectrometers are widely deployed at airports, which provides exceptional detection capabilities with an ultra-low false alarm rate for non-metallic containers. Moreover, Raman analyzer enable the rapid identification of explosives, narcotics, toxic industrial chemicals, chemical warfare agents, and other materials through sealed, opaque containers. These are heavily used in hazardous chemical identification and incident response. Thus, the Raman spectroscopy market is growing owing to the deployment of these spectroscopes in hazmat response, EOD, CBRN, law enforcement, and parcel screening at customs, ports, and borders.

Major market players are investing heavily in R&D for Raman spectrometers and launching innovative products in the market to remain competitive. For instance, in June 2022, Timegate Instruments Ltd. launched its third-generation instrument PicoRaman M3, integrated with patented Timegated Raman technology with real fluorescence rejection. This instrument offers benefits such as quick & continuous, real-time, and online measurements of highly specific chemicals and widely used for non-destructive analysis. The PicoRaman M3 spectrometer also deployed in application of science and process industries, such as the biopharmaceutical sector, to monitor bioprocess and calculate nutrients.

In terms of technology, the global process spectroscopy market has been classified into molecular spectroscopy, mass spectroscopy, and atomic spectroscopy. The molecular spectroscopy segment has been further divided into Near Infrared (NIR) spectroscopy, Raman spectroscopy, Fourier Transform Infrared (FT-IR) spectroscopy, fluorescence spectroscopy, and others.

Near Infrared (NIR) spectroscopy sub-segment held the largest market share in 2021, and it is likely to advance at a significant CAGR during the forecast period. Near-infrared spectroscopy offers highly flexible form of analysis, and it is used in a broad range of research and industrial process applications. It is a cost-effective tool for measuring materials in order to optimize processes and manage costs in various industries.

Near-infrared spectroscopy is widely used in quality control and quality assurance processes to accurately determine chemical and physical properties of samples. Thus, NIR spectrometers are heavily deployed for chemical production, cosmetics, pulp and paper, pharmaceuticals, petrochemicals, and polymer production applications.

In terms of applications, the global process spectroscopy has been classified into biopharma research, life science research, polymer analysis, forensic drug analysis, academic research, petrochemical analysis, and others. In terms of application, biopharma research is one of the key market segments in process spectroscopy, and it accounted for significant share of the market in 2021. The segment is projected to rise at the highest CAGR during the forecast period.

Rise in demand for FT-IR and NIR spectroscopy for remote and real-time monitoring of continuous and batch processes in the pharmaceutical industry fuels the market. Various spectrometers used for content uniformity testing, drug product identification, polymorph, and crystallinity applications. Furthermore, demand analysis of process spectroscopy reveals that utilization of process spectroscopy for analytical measurements in pharmaceutical applications ranges from verification of raw materials to process monitoring of drug production and quality control of products, which in turn further propels the market. Process spectroscopy in the pharmaceutical industry helps in efficient process monitoring and enhancing quality control in the entire process chain.

The process spectroscopy market in North America held the highest share and accounted for 48.3% of the global market in 2021 owing to the presence of key market players, technological advancements, and countries, such as the U.S. and Canada offering ample and lucrative opportunities for manufacturers on a long-term basis in the region.

Increased use of spectroscopy to meet the standards of drug safety regulations and early adoption and extensive R &D in field of spectroscopy have propelled the demand for process spectroscopy in the region. The chemical industry is one of the largest private-sector industry in research and development of the U.S. According to the American Chemistry Council, Inc., around US$ 517 billion is generated annually by the business of chemistry, and it contributes around 25% to the U.S GDP. Thus, growth in the chemical sector offers significant opportunities for manufacturers of the process spectroscopy instruments in the country.

The market in Europe and Asia Pacific is also growing significantly due to rapidly expansion of the chemical industry in these regions, demand for safe handling of chemicals, and stringent government regulations, which make spectroscopic analysis essential in these regions. Moreover, ongoing research and development in the pharmaceutical sector and demand for precise analytical measurements also propel the process spectroscopy market in Europe and Asia Pacific.

Middle East & Africa is a larger market of process spectroscopy as compared to South America; however, the market in Middle East & Africa is estimated to expand at a rapid pace as compared to the market in South America.

The global process spectroscopy market is consolidated with number of large-scale vendors controlling the majority of the market share. A majority of the firms are spending significantly on comprehensive research and development, and new product development. Expansion of product portfolios and mergers and acquisitions are major strategies adopted by key players. Bruker Optics GmbH & Co. KG, Agilent Technologies, Inc., Magritek, Danaher Corporation, Foss A/S, Sartorius AG, HORIBA, Ltd., Kett Electric Laboratory Co.Ltd., ABB Ltd., BÜCHI Labortechnik AG, Thermo Fisher Scientific Inc., PerkinElmer, Inc., and Timegate Instruments Ltd. are the key players operating in the global process spectroscopy market.

Each of these players has been profiled in the process spectroscopy market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 18.15 Bn |

|

Market Forecast Value in 2031 |

US$ 39.06 Bn |

|

Growth Rate (CAGR) |

8.2% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The process spectroscopy market stood at US$ 18.15 Bn in 2021.

The process spectroscopy market is expected to rise at a CAGR of 8.2% by 2031.

The process spectroscopy market would reach US$ 39.06 Bn in 2031.

Bruker Optics GmbH & Co. KG, Agilent Technologies, Inc., Magritek, Danaher Corporation, Foss A/S, Sartorius AG, HORIBA, Ltd., Kett Electric Laboratory Co.Ltd., ABB Ltd., BÜCHI Labortechnik AG, Thermo Fisher Scientific Inc., PerkinElmer, Inc., and Timegate Instruments Ltd.

The U.S. accounted for 38.2% share of the global process spectroscopy market in 2021.

Based on technology, the molecular spectroscopy segment held 41.2% share of the process spectroscopy market in 2021.

Emergence of effective medical remedies leading to various drug discoveries by utilizing Raman spectroscopy, rising awareness about quality among industries, and increasing focus on reducing operational expenditure.

North America is more lucrative region of the global process spectroscopy market.

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Process Spectroscopy Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Scenario

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global Analytical Measurement Industry Overview

4.2. Supply Chain Analysis

4.3. Technology Roadmap Analysis

4.4. Industry SWOT Analysis

4.5. Porter Five Forces Analysis

4.6. Covid-19 Impact and Recovery Analysis

5. Process Spectroscopy Market Analysis, by Technology

5.1. Process Spectroscopy Market Size (US$ Bn) Analysis & Forecast, by Technology, 2017–2031

5.1.1. Molecular Spectroscopy

5.1.1.1. Near Infrared (NIR) Spectroscopy

5.1.1.2. Raman Spectroscopy

5.1.1.3. Fourier Transform Infrared (FT-IR) Spectroscopy

5.1.1.4. Fluorescence Spectroscopy

5.1.1.5. Others

5.1.2. Mass Spectroscopy

5.1.3. Atomic Spectroscopy

5.2. Market Attractiveness Analysis, by Technology

6. Process Spectroscopy Market Analysis, by Application

6.1. Process Spectroscopy Market Size (US$ Bn) Analysis & Forecast, by Application, 2017–2031

6.1.1. Biopharma Research

6.1.2. Life Science Research

6.1.3. Polymer Analysis

6.1.4. Forensic Drug Analysis

6.1.5. Academic Research

6.1.6. Petrochemical Analysis

6.1.7. Others

6.2. Market Attractiveness Analysis, by Application

7. Process Spectroscopy Market Analysis, by End-use Industry

7.1. Process Spectroscopy Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

7.1.1. Chemical

7.1.2. Healthcare & Life Science

7.1.3. Pharmaceutical

7.1.4. Research & Academia

7.1.5. Food & Beverage

7.1.6. Oil & Gas

7.1.7. Others

7.2. Market Attractiveness Analysis, by End-use Industry

8. Process Spectroscopy Market Analysis and Forecast, by Region

8.1. Process Spectroscopy Market Size (US$ Bn) Analysis & Forecast, by Region, 2017–2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Market Attractiveness Analysis, by Region

9. North America Process Spectroscopy Market Analysis and Forecast

9.1. Market Snapshot

9.2. Drivers and Restraints: Impact Analysis

9.3. Process Spectroscopy Market Size (US$ Bn) Analysis & Forecast, by Technology, 2017–2031

9.3.1. Molecular Spectroscopy

9.3.1.1. Near Infrared (NIR) Spectroscopy

9.3.1.2. Raman Spectroscopy

9.3.1.3. Fourier Transform Infrared (FT-IR) Spectroscopy

9.3.1.4. Fluorescence Spectroscopy

9.3.1.5. Others

9.3.2. Mass Spectroscopy

9.3.3. Atomic Spectroscopy

9.4. Process Spectroscopy Market Size (US$ Bn) Analysis & Forecast, by Application, 2017–2031

9.4.1. Biopharma Research

9.4.2. Life Science Research

9.4.3. Polymer Analysis

9.4.4. Forensic Drug Analysis

9.4.5. Academic Research

9.4.6. Petrochemical Analysis

9.4.7. Others

9.5. Process Spectroscopy Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

9.5.1. Chemical

9.5.2. Healthcare & Life Science

9.5.3. Pharmaceutical

9.5.4. Research & Academia

9.5.5. Food & Beverage

9.5.6. Oil & Gas

9.5.7. Others

9.6. Process Spectroscopy Market Size (US$ Bn) Analysis & Forecast, by Country and Sub-region, 2017–2031

9.6.1. U.S.

9.6.2. Canada

9.6.3. Rest of America

9.7. Market Attractiveness Analysis

9.7.1. By Technology

9.7.2. By Application

9.7.3. By End-use Industry

9.7.4. By Country and Sub-region

10. Europe Process Spectroscopy Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Process Spectroscopy Market Size (US$ Bn) Analysis & Forecast, by Technology, 2017–2031

10.3.1. Molecular Spectroscopy

10.3.1.1. Near Infrared (NIR) Spectroscopy

10.3.1.2. Raman Spectroscopy

10.3.1.3. Fourier Transform Infrared (FT-IR) Spectroscopy

10.3.1.4. Fluorescence Spectroscopy

10.3.1.5. Others

10.3.2. Mass Spectroscopy

10.3.3. Atomic Spectroscopy

10.4. Process Spectroscopy Market Size (US$ Bn) Analysis & Forecast, by Application, 2017–2031

10.4.1. Biopharma Research

10.4.2. Life Science Research

10.4.3. Polymer Analysis

10.4.4. Forensic Drug Analysis

10.4.5. Academic Research

10.4.6. Petrochemical Analysis

10.4.7. Others

10.5. Process Spectroscopy Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

10.5.1. Chemical

10.5.2. Healthcare & Life Science

10.5.3. Pharmaceutical

10.5.4. Research & Academia

10.5.5. Food & Beverage

10.5.6. Oil & Gas

10.5.7. Others

10.6. Process Spectroscopy Market Size (US$ Bn) Analysis & Forecast, by Country and Sub-region, 2017–2031

10.6.1. Germany

10.6.2. UK

10.6.3. France

10.6.4. Rest of Europe

10.7. Market Attractiveness Analysis

10.7.1. By Technology

10.7.2. By Application

10.7.3. By End-use Industry

10.7.4. By Country and Sub-region

11. Asia Pacific Process Spectroscopy Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Process Spectroscopy Market Size (US$ Bn) Analysis & Forecast, by Technology, 2017–2031

11.3.1. Molecular Spectroscopy

11.3.1.1. Near Infrared (NIR) Spectroscopy

11.3.1.2. Raman Spectroscopy

11.3.1.3. Fourier Transform Infrared (FT-IR) Spectroscopy

11.3.1.4. Fluorescence Spectroscopy

11.3.1.5. Others

11.3.2. Mass Spectroscopy

11.3.3. Atomic Spectroscopy

11.4. Process Spectroscopy Market Size (US$ Bn) Analysis & Forecast, by Application, 2017–2031

11.4.1. Biopharma Research

11.4.2. Life Science Research

11.4.3. Polymer Analysis

11.4.4. Forensic Drug Analysis

11.4.5. Academic Research

11.4.6. Petrochemical Analysis

11.4.7. Others

11.5. Process Spectroscopy Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

11.5.1. Chemical

11.5.2. Healthcare & Life Science

11.5.3. Pharmaceutical

11.5.4. Research & Academia

11.5.5. Food & Beverage

11.5.6. Oil & Gas

11.5.7. Others

11.6. Process Spectroscopy Market Size (US$ Bn) Analysis & Forecast, by Country and Sub-region, 2017–2031

11.6.1. China

11.6.2. Japan

11.6.3. India

11.6.4. South Korea

11.6.5. ASEAN

11.6.6. Rest of Asia Pacific

11.7. Market Attractiveness Analysis

11.7.1. By Technology

11.7.2. By Application

11.7.3. By End-use Industry

11.7.4. By Country and Sub-region

12. Middle East & Africa Process Spectroscopy Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Process Spectroscopy Market Size (US$ Bn) Analysis & Forecast, by Technology, 2017–2031

12.3.1. Molecular Spectroscopy

12.3.1.1. Near Infrared (NIR) Spectroscopy

12.3.1.2. Raman Spectroscopy

12.3.1.3. Fourier Transform Infrared (FT-IR) Spectroscopy

12.3.1.4. Fluorescence Spectroscopy

12.3.1.5. Others

12.3.2. Mass Spectroscopy

12.3.3. Atomic Spectroscopy

12.4. Process Spectroscopy Market Size (US$ Bn) Analysis & Forecast, by Application, 2017–2031

12.4.1. Biopharma Research

12.4.2. Life Science Research

12.4.3. Polymer Analysis

12.4.4. Forensic Drug Analysis

12.4.5. Academic Research

12.4.6. Petrochemical Analysis

12.4.7. Others

12.5. Process Spectroscopy Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

12.5.1. Chemical

12.5.2. Healthcare & Life Science

12.5.3. Pharmaceutical

12.5.4. Research & Academia

12.5.5. Food & Beverage

12.5.6. Oil & Gas

12.5.7. Others

12.6. Process Spectroscopy Market Size (US$ Bn) Analysis & Forecast, by Country and Sub-region, 2017–2031

12.6.1. GCC

12.6.2. South Africa

12.6.3. Rest of Middle East & Africa

12.7. Market Attractiveness Analysis

12.7.1. By Technology

12.7.2. By Application

12.7.3. By End-use Industry

12.7.4. By Country and Sub-region

13. South America Process Spectroscopy Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Process Spectroscopy Market Size (US$ Bn) Analysis & Forecast, by Technology, 2017–2031

13.3.1. Molecular Spectroscopy

13.3.1.1. Near Infrared (NIR) Spectroscopy

13.3.1.2. Raman Spectroscopy

13.3.1.3. Fourier Transform Infrared (FT-IR) Spectroscopy

13.3.1.4. Fluorescence Spectroscopy

13.3.1.5. Others

13.3.2. Mass Spectroscopy

13.3.3. Atomic Spectroscopy

13.4. Process Spectroscopy Market Size (US$ Bn) Analysis & Forecast, by Application, 2017–2031

13.4.1. Biopharma Research

13.4.2. Life Science Research

13.4.3. Polymer Analysis

13.4.4. Forensic Drug Analysis

13.4.5. Academic Research

13.4.6. Petrochemical Analysis

13.4.7. Others

13.5. Process Spectroscopy Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

13.5.1. Chemical

13.5.2. Healthcare & Life Science

13.5.3. Pharmaceutical

13.5.4. Research & Academia

13.5.5. Food & Beverage

13.5.6. Oil & Gas

13.5.7. Others

13.6. Process Spectroscopy Market Size (US$ Bn) Analysis & Forecast, by Country and Sub-region, 2017–2031

13.6.1. Brazil

13.6.2. Rest of South America

13.7. Market Attractiveness Analysis

13.7.1. By Technology

13.7.2. By Application

13.7.3. By End-use Industry

13.7.4. By Country and Sub-region

14. Competition Assessment

14.1. Global Process Spectroscopy Market Competition Matrix - a Dashboard View

14.1.1. Global Process Spectroscopy Market Company Share Analysis, by Value (2021)

14.1.2. Technological Differentiator

15. Company Profiles (Global Manufacturers/Suppliers)

15.1. ABB Ltd.

15.1.1. Overview

15.1.2. Product Portfolio

15.1.3. Sales Footprint

15.1.4. Key Subsidiaries or Distributors

15.1.5. Strategy and Recent Developments

15.1.6. Key Financials

15.2. Agilent Technologies, Inc.

15.2.1. Overview

15.2.2. Product Portfolio

15.2.3. Sales Footprint

15.2.4. Key Subsidiaries or Distributors

15.2.5. Strategy and Recent Developments

15.2.6. Key Financials

15.3. Bruker Optics GmbH & Co. KG

15.3.1. Overview

15.3.2. Product Portfolio

15.3.3. Sales Footprint

15.3.4. Key Subsidiaries or Distributors

15.3.5. Strategy and Recent Developments

15.3.6. Key Financials

15.4. BÜCHI Labortechnik AG

15.4.1. Overview

15.4.2. Product Portfolio

15.4.3. Sales Footprint

15.4.4. Key Subsidiaries or Distributors

15.4.5. Strategy and Recent Developments

15.4.6. Key Financials

15.5. Danaher Corporation

15.5.1. Overview

15.5.2. Product Portfolio

15.5.3. Sales Footprint

15.5.4. Key Subsidiaries or Distributors

15.5.5. Strategy and Recent Developments

15.5.6. Key Financials

15.6. Foss A/S

15.6.1. Overview

15.6.2. Product Portfolio

15.6.3. Sales Footprint

15.6.4. Key Subsidiaries or Distributors

15.6.5. Strategy and Recent Developments

15.6.6. Key Financials

15.7. HORIBA, Ltd.

15.7.1. Overview

15.7.2. Product Portfolio

15.7.3. Sales Footprint

15.7.4. Key Subsidiaries or Distributors

15.7.5. Strategy and Recent Developments

15.7.6. Key Financials

15.8. Kett Electric Laboratory Co.Ltd.

15.8.1. Overview

15.8.2. Product Portfolio

15.8.3. Sales Footprint

15.8.4. Key Subsidiaries or Distributors

15.8.5. Strategy and Recent Developments

15.8.6. Key Financials

15.9. Magritek

15.9.1. Overview

15.9.2. Product Portfolio

15.9.3. Sales Footprint

15.9.4. Key Subsidiaries or Distributors

15.9.5. Strategy and Recent Developments

15.9.6. Key Financials

15.10. PerkinElmer, Inc.

15.10.1. Overview

15.10.2. Product Portfolio

15.10.3. Sales Footprint

15.10.4. Key Subsidiaries or Distributors

15.10.5. Strategy and Recent Developments

15.10.6. Key Financials

15.11. Sartorius AG

15.11.1. Overview

15.11.2. Product Portfolio

15.11.3. Sales Footprint

15.11.4. Key Subsidiaries or Distributors

15.11.5. Strategy and Recent Developments

15.11.6. Key Financials

15.12. Thermo Fisher Scientific Inc.

15.12.1. Overview

15.12.2. Product Portfolio

15.12.3. Sales Footprint

15.12.4. Key Subsidiaries or Distributors

15.12.5. Strategy and Recent Developments

15.12.6. Key Financials

15.13. Timegate Instruments Ltd.

15.13.1. Overview

15.13.2. Product Portfolio

15.13.3. Sales Footprint

15.13.4. Key Subsidiaries or Distributors

15.13.5. Strategy and Recent Developments

15.13.6. Key Financials

16. Recommendation

16.1. Opportunity Assessment

16.1.1. By Technology

16.1.2. By Application

16.1.3. By End-use Industry

16.1.4. By Region

List of Tables

Table 01: Global Process Spectroscopy Market Value (US$ Bn) & Forecast, by Technology, 2017‒2031

Table 02: Global Process Spectroscopy Market Value (US$ Bn) & Forecast, by Application, 2017‒2031

Table 03: Global Process Spectroscopy Market Value (US$ Bn) & Forecast, by End-use Industry, 2017‒2031

Table 04: Global Process Spectroscopy Market Value (US$ Bn) & Forecast, by Region, 2017‒2031

Table 05: North America Process Spectroscopy Market Value (US$ Bn) & Forecast, by Technology, 2017‒2031

Table 06: North America Process Spectroscopy Market Value (US$ Bn) & Forecast, by Application, 2017‒2031

Table 07: North America Process Spectroscopy Market Value (US$ Bn) & Forecast, by End-use Industry, 2017‒2031

Table 08: North America Process Spectroscopy Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017‒2031

Table 09: Europe Process Spectroscopy Market Value (US$ Bn) & Forecast, by Technology, 2017‒2031

Table 10: Europe Process Spectroscopy Market Value (US$ Bn) & Forecast, by Application, 2017‒2031

Table 11: Europe Process Spectroscopy Market Value (US$ Bn) & Forecast, by End-use Industry, 2017‒2031

Table 12: Europe Process Spectroscopy Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017‒2031

Table 13: Asia Pacific Process Spectroscopy Market Value (US$ Bn) & Forecast, by Technology, 2017‒2031

Table 14: Asia Pacific Process Spectroscopy Market Value (US$ Bn) & Forecast, by Application, 2017‒2031

Table 15: Asia Pacific Process Spectroscopy Market Value (US$ Bn) & Forecast, by End-use Industry, 2017‒2031

Table 16: Asia Pacific Process Spectroscopy Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017‒2031

Table 17: Middle East & Africa Process Spectroscopy Market Value (US$ Bn) & Forecast, by Technology, 2017‒2031

Table 18: Middle East & Africa Process Spectroscopy Market Value (US$ Bn) & Forecast, by Application, 2017‒2031

Table 19: Middle East & Africa Process Spectroscopy Market Value (US$ Bn) & Forecast, by End-use Industry, 2017‒2031

Table 20: Middle East & Africa Process Spectroscopy Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017‒2031

Table 21: South America Process Spectroscopy Market Value (US$ Bn) & Forecast, by Technology, 2017‒2031

Table 22: South America Process Spectroscopy Market Value (US$ Bn) & Forecast, by Application, 2017‒2031

Table 23: South America Process Spectroscopy Market Value (US$ Bn) & Forecast, by End-use Industry, 2017‒2031

Table 24: South America Process Spectroscopy Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017‒2031

List of Figures

Figure 01: Global Process Spectroscopy Market, Value (US$ Bn), 2017‒2031

Figure 02: Global Process Spectroscopy Market Size & Forecast, by Technology, Value (US$ Bn), 2017‒2031

Figure 03: Global Process Spectroscopy Market Attractiveness, by Technology, Value (US$ Bn), 2022‒2031

Figure 04: Global Process Spectroscopy Market Share Analysis, by Technology, 2022 and 2031

Figure 05: Global Process Spectroscopy Market Size & Forecast, by Application, Value (US$ Bn), 2017‒2031

Figure 06: Global Process Spectroscopy Market Attractiveness, by Application, Value (US$ Bn), 2022‒2031

Figure 07: Global Process Spectroscopy Market Share Analysis, by Application, 2022 and 2031

Figure 08: Global Process Spectroscopy Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 09: Global Process Spectroscopy Market Attractiveness, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 10: Global Process Spectroscopy Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 11: Global Process Spectroscopy Market Size & Forecast, by Region, Value (US$ Bn), 2017‒2031

Figure 12: Global Process Spectroscopy Market Attractiveness, by Region, Value (US$ Bn), 2022‒2031

Figure 13: Global Process Spectroscopy Market Share Analysis, by Region, 2022 and 2031

Figure 14: North America Process Spectroscopy Market, Value (US$ Bn), 2017‒2031

Figure 15: North America Process Spectroscopy Market Size & Forecast, by Technology, Value (US$ Bn), 2017‒2031

Figure 16: North America Process Spectroscopy Market Attractiveness, by Technology, Value (US$ Bn), 2022‒2031

Figure 17: North America Process Spectroscopy Market Share Analysis, by Technology, 2022 and 2031

Figure 18: North America Process Spectroscopy Market Size & Forecast, by Application, Value (US$ Bn), 2017‒2031

Figure 19: North America Process Spectroscopy Market Attractiveness, by Application, Value (US$ Bn), 2022‒2031

Figure 20: North America Process Spectroscopy Market Share Analysis, by Application, 2022 and 2031

Figure 21: North America Process Spectroscopy Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 22: North America Process Spectroscopy Market Attractiveness, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 23: North America Process Spectroscopy Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 24: North America Process Spectroscopy Market Size & Forecast, by Country and Sub-region, Value (US$ Bn), 2017‒2031

Figure 25: North America Process Spectroscopy Market Attractiveness, by Country and Sub-region, Value (US$ Bn), 2022‒2031

Figure 26: North America Process Spectroscopy Market Share Analysis, by Country and Sub-region, 2022 and 2031

Figure 27: Europe Process Spectroscopy Market, Value (US$ Bn), 2017‒2031

Figure 28: Europe Process Spectroscopy Market Size & Forecast, by Technology, Value (US$ Bn), 2017‒2031

Figure 29: Europe Process Spectroscopy Market Attractiveness, by Technology, Value (US$ Bn), 2022‒2031

Figure 30: Europe Process Spectroscopy Market Share Analysis, by Technology, 2022 and 2031

Figure 31: Europe Process Spectroscopy Market Size & Forecast, by Application, Value (US$ Bn), 2017‒2031

Figure 32: Europe Process Spectroscopy Market Attractiveness, by Application, Value (US$ Bn), 2022‒2031

Figure 33: Europe Process Spectroscopy Market Share Analysis, by Application, 2022 and 2031

Figure 34: Europe Process Spectroscopy Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 35: Europe Process Spectroscopy Market Attractiveness, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 36: Europe Process Spectroscopy Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 37: Europe Process Spectroscopy Market Size & Forecast, by Country and Sub-region, Value (US$ Bn), 2017‒2031

Figure 38: Europe Process Spectroscopy Market Attractiveness, by Country and Sub-region, Value (US$ Bn), 2022‒2031

Figure 39: Europe Process Spectroscopy Market Share Analysis, by Country and Sub-region, 2022 and 2031

Figure 40: Asia Pacific Process Spectroscopy Market, Value (US$ Bn), 2017‒2031

Figure 41: Asia Pacific Process Spectroscopy Market Size & Forecast, by Technology, Value (US$ Bn), 2017‒2031

Figure 42: Asia Pacific Process Spectroscopy Market Attractiveness, by Technology, Value (US$ Bn), 2022‒2031

Figure 43: Asia Pacific Process Spectroscopy Market Share Analysis, by Technology, 2022 and 2031

Figure 44: Asia Pacific Process Spectroscopy Market Size & Forecast, by Application, Value (US$ Bn), 2017‒2031

Figure 45: Asia Pacific Process Spectroscopy Market Attractiveness, by Application, Value (US$ Bn), 2022‒2031

Figure 46: Asia Pacific Process Spectroscopy Market Share Analysis, by Application, 2022 and 2031

Figure 47: Asia Pacific Process Spectroscopy Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 48: Asia Pacific Process Spectroscopy Market Attractiveness, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 49: Asia Pacific Process Spectroscopy Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 50: Asia Pacific Process Spectroscopy Market Size & Forecast, by Country and Sub-region, Value (US$ Bn), 2017‒2031

Figure 51: Asia Pacific Process Spectroscopy Market Attractiveness, by Country and Sub-region, Value (US$ Bn), 2022‒2031

Figure 52: Asia Pacific Process Spectroscopy Market Share Analysis, by Country and Sub-region, 2022 and 2031

Figure 53: Middle East & Africa Process Spectroscopy Market, Value (US$ Bn), 2017‒2031

Figure 54: Middle East & Africa Process Spectroscopy Market Size & Forecast, by Technology, Value (US$ Bn), 2017‒2031

Figure 55: Middle East & Africa Process Spectroscopy Market Attractiveness, by Technology, Value (US$ Bn), 2022‒2031

Figure 56: Middle East & Africa Process Spectroscopy Market Share Analysis, by Technology, 2022 and 2031

Figure 57: Middle East & Africa Process Spectroscopy Market Size & Forecast, by Application, Value (US$ Bn), 2017‒2031

Figure 58: Middle East & Africa Process Spectroscopy Market Attractiveness, by Application, Value (US$ Bn), 2022‒2031

Figure 59: Middle East & Africa Process Spectroscopy Market Share Analysis, by Application, 2022 and 2031

Figure 60: Middle East & Africa Process Spectroscopy Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 61: Middle East & Africa Process Spectroscopy Market Attractiveness, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 62: Middle East & Africa Process Spectroscopy Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 63: Middle East & Africa Process Spectroscopy Market Size & Forecast, by Country and Sub-region, Value (US$ Bn), 2017‒2031

Figure 64: Middle East & Africa Process Spectroscopy Market Attractiveness, by Country and Sub-region, Value (US$ Bn), 2022‒2031

Figure 65: Middle East & Africa Process Spectroscopy Market Share Analysis, by Country and Sub-region, 2022 and 2031

Figure 66: South America Process Spectroscopy Market, Value (US$ Bn), 2017‒2031

Figure 67: South America Process Spectroscopy Market Size & Forecast, by Technology, Value (US$ Bn), 2017‒2031

Figure 68: South America Process Spectroscopy Market Attractiveness, by Technology, Value (US$ Bn), 2022‒2031

Figure 69: South America Process Spectroscopy Market Share Analysis, by Technology, 2022 and 2031

Figure 70: South America Process Spectroscopy Market Size & Forecast, by Application, Value (US$ Bn), 2017‒2031

Figure 71: South America Process Spectroscopy Market Attractiveness, by Application, Value (US$ Bn), 2022‒2031

Figure 72: South America Process Spectroscopy Market Share Analysis, by Application, 2022 and 2031

Figure 73: South America Process Spectroscopy Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 74: South America Process Spectroscopy Market Attractiveness, by End-use Industry, Value (US$ Bn), 2022‒2031

Figure 75: South Amerca Process Spectroscopy Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 76: South America Process Spectroscopy Market Size & Forecast, by Country and Sub-region, Value (US$ Bn), 2017‒2031

Figure 77: South America Process Spectroscopy Market Attractiveness, by Country and Sub-region, Value (US$ Bn), 2022‒2031

Figure 78: South America Process Spectroscopy Market Share Analysis, by Country and Sub-region, 2022 and 2031