Reports

Reports

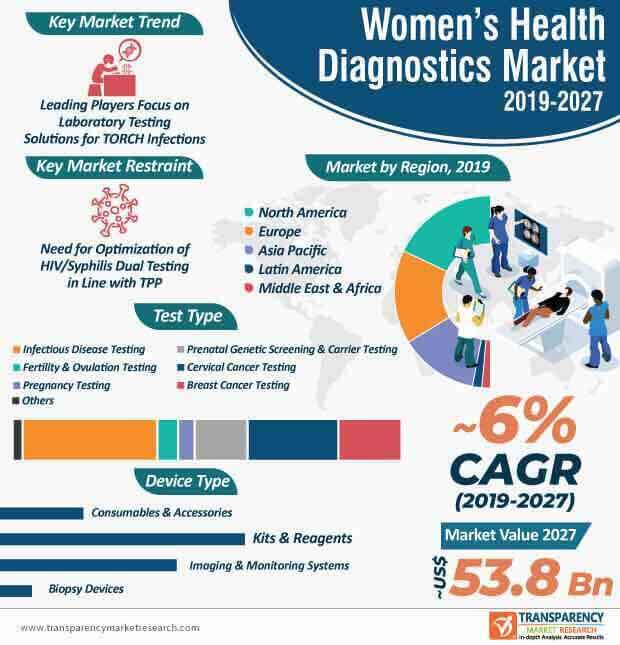

High risks associated with the transmission of infectious diseases to pregnant women have raised concerns about the effective diagnosis of various infections. As such, the infectious disease testing type segment of the women’s health diagnostics market is projected to reach a value of ~US$ 19.2 Bn by the end of 2027. Hence, leading players in the market for women’s health diagnostics are increasing their efficacy in laboratory testing solutions to improve patient outcomes. For instance, leading global medical technology company Siemens Healthineers offers a range of laboratory testing solutions for women related to TORCH (toxoplasmosis, other (e.g., syphilis, HIV), rubella, cytomegalovirus (CMV), and herpes simplex virus) infections, malnutrition, and bone diseases.

Healthcare companies in the women’s health diagnostics market are tapping into opportunities in diagnostic laboratory testing and infectious disease testing, as both segments are anticipated to grow rapidly during the forecast period. The growing prevalence of infections causing miscarriage and birth defects in infants is fueling the demand for efficacious treatment options in women’s health diagnostics.

Apart from expanding product portfolios, companies in the market for women’s health diagnostics are strengthening their global presence through inorganic strategies such as mergers and acquisitions. For instance, in August 2019, Nova Satra Dx - a provider of innovative diagnostics for cancer, announced its merger with a Singapore-based molecular diagnostic company INEX Innovations Exchange Pte. Ltd., to offer healthcare solutions tailored for Asian women. As such, Asia Pacific accounts for the third-highest revenue in the women’s health diagnostics market. This market in the Asia Pacific is anticipated for exponential growth during the forecast period.

Companies are collaborating to offer enhanced treatment options in the Asia Pacific. Efforts are being made to increase the availability of faster and more accurate diagnostic tests to improve the quality of life in patients. The concept of precision healthcare is another key driver that is creating incremental opportunities for companies. The women’s health diagnostics industry is undergoing change with increased efforts toward providing women’s reproductive health solutions.

New Testing Approaches Create Revenue Opportunities for Companies and Healthcare Providers

Complications associated with cervical cancer have led to the availability of new tests for early detection of the human papillomavirus (HPV). As such, in terms of test type, the cervical cancer testing segment of the women’s health diagnostics market is estimated to reach a value of ~US$ 12.5 Bn by 2027. Hence, companies are introducing new testing options to determine the type of HPV that may lead to cancer.

Companies in the women’s health diagnostics business are increasing R&D to study the ‘two-for-one’ diagnostic approach that not only detects the type of HPV infection but also evaluates precancerous makers. Patients are increasingly benefitting from this approach since it serves as a low-cost alternative to diagnose the riskiest forms of HPV infection. Thus, to cater to the convenience of patients, companies in the market for women’s health diagnostics are collaborating with research labs to improve outcomes that help to avoid unnecessary diagnostic procedures. Moreover, healthcare providers are increasing efficacy in novel in-vitro molecular diagnostics procedures to assess high-risk HPV infections.

Diagnostic laboratory centers are collaborating with renowned universities to introduce new combined HIV/syphilis testing options. For instance, Junco Labs - a provider of smartphone diagnostics, revealed its collaboration with Columbia University to demonstrate the integration of smartphone-connected blood tests for combined HIV/syphilis tests.

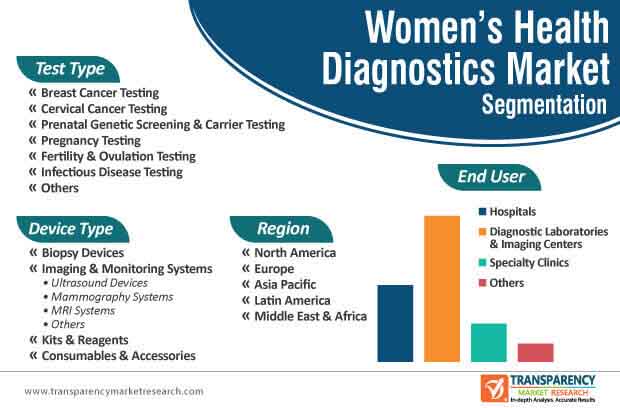

Thus, the diagnostic laboratories & imaging centers end-user segment of the women’s health diagnostics market is expected to reach a value of ~US$ 20.7 Bn by 2022. Hence, stakeholders in diagnostic labs are seeking innovations in dual HIV/syphilis tests.

In the global market, efforts are being made to increase the availability of point-of-care (POC) treatments for women. Companies in the women’s health diagnostics business are introducing novel testing options that provide qualitative detection of non-TP (Treponema Pallidum) syphilis. However, there is still a need for effective HIV/syphilis testing options that align with the existing target product profile (TPP). Companies in the market for women’s health diagnostics are offering cost-effective and easy-to-assess tests for combined HIV/syphilis diagnosis.

Companies in the women’s health diagnostics market are offering increased laboratory testing options to assess biomarkers for allergies, thyroid, and renal diseases in women. Companies should increase focus on expansion of diagnostic services in growing economies of Asia Pacific such as Indonesia and Bangladesh.

However, challenges such as poor supply chain management and stock-outs of POC diagnostic tests in developing economies, such as Ghana, pose as a challenge for manufacturing companies. Hence, companies should adopt inventory management techniques and aid health commissions to increase the human resource capacity for ensuring accessibility and sustainability toward POC testing in resource-limited settings.

Major Players in Global Market

The global market for Women’s health diagnostics is projected to reach a value of ~US$ 19.2 Bn by the end of 2027

The market is projected to expand at a CAGR of ~6% from 2019 to 2027

Women’s health diagnostics market is driven by increase in awareness among people about the availability of treatments for sexually transmitted diseases

The end-use segments in women’s health diagnostics market are hospitals, diagnostic laboratories & imaging centers and specialty clinics

Key players in the global market for women’s health diagnostics include Abbott Laboratories, Becton, Dickinson and Company, bioMérieux SA, F. Hoffmann-La Roche AG

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. 3. Executive Summary: Global Women’s Health Diagnostics Market

4. Market Overview

4.1. Introduction

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Women’s Health Diagnostics Market Analysis and Forecast, 2017–2027

4.4.1. Market Revenue Projections (US$ Mn)

5. Global Women’s Health Diagnostics Market Analysis and Forecast, by Device Type

5.1. Introduction

5.2. Key Findings

5.3. Global Women’s Health Diagnostics Market Value Forecast, by Device Type, 2017–2027

5.3.1. Biopsy Devices

5.3.2. Imaging & Monitoring System

5.3.2.1. Ultrasound Devices

5.3.2.2. Mammography Systems

5.3.2.3. MRI Systems

5.3.2.4. Others

5.3.3. Kits & Reagents

5.3.4. Consumables & Accessories

5.4. Global Women’s Health Diagnostics Market Attractiveness, by Device Type

6. Global Women’s Health Diagnostics Market Analysis and Forecast, by Test Type

6.1. Introduction & Definition

6.2. Key Findings

6.3. Global Women’s Health Diagnostics Market Value Forecast, by Test Type, 2017–2027

6.3.1. Breast Cancer Testing

6.3.2. Cervical Cancer Testing

6.3.3. Prenatal Genetic Screening & Carrier Testing

6.3.4. Pregnancy Testing

6.3.5. Fertility & Ovulation Testing

6.3.6. Infectious Disease Testing

6.3.7. Others

6.4. Global Women’s Health Diagnostics Market Attractiveness, by Test Type

7. Global Women’s Health Diagnostics Market Analysis and Forecast, by End-user

7.1. Introduction

7.2. Key Findings

7.3. Global Women’s Health Diagnostics Market Value Forecast, by End-user, 2017–2027

7.3.1. Hospitals

7.3.2. Diagnostic Laboratories & Imaging Centers

7.3.3. Specialty Clinics

7.3.4. Others

7.4. Global Women’s Health Diagnostics Market Attractiveness, by End-user

8. Global Women’s Health Diagnostics Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Global Women’s Health Diagnostics Market Value Forecast, by Region, 2017–2027

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Global Women’s Health Diagnostics Market Attractiveness, by Region

9. North America Women’s Health Diagnostics Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. North America Women’s Health Diagnostics Market Value Forecast, by Device Type, 2017–2027

9.2.1. Biopsy Devices

9.2.2. Imaging & Monitoring System

9.2.2.1. Ultrasound Devices

9.2.2.2. Mammography Systems

9.2.2.3. MRI Systems

9.2.2.4. Others

9.2.3. Kits & Reagents

9.2.4. Consumables & Accessories

9.3. North America Women’s Health Diagnostics Market Value Forecast, by Test Type, 2017–2027

9.3.1. Breast Cancer Testing

9.3.2. Cervical Cancer Testing

9.3.3. Prenatal Genetic Screening & Carrier Testing

9.3.4. Pregnancy Testing

9.3.5. Fertility & Ovulation Testing

9.3.6. Infectious Disease Testing

9.3.7. Others

9.4. North America Women’s Health Diagnostics Market Value Forecast, by End-user, 2017–2027

9.4.1. Hospitals

9.4.2. Diagnostic Laboratories & Imaging Centers

9.4.3. Specialty Clinics

9.4.4. Others

9.5. North America Women’s Health Diagnostics Market Value Forecast, by Country, 2017–2027

9.5.1. U.S.

9.5.2. Canada

9.6. North America Women’s Health Diagnostics Market Attractiveness Analysis

9.6.1. By Device Type

9.6.2. By Test Type

9.6.3. By End-user

9.6.4. By Country

10. Europe Women’s Health Diagnostics Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Europe Women’s Health Diagnostics Market Value Forecast, by Device Type, 2017–2027

10.2.1. Biopsy Devices

10.2.2. Imaging & Monitoring System

10.2.2.1. Ultrasound Devices

10.2.2.2. Mammography Systems

10.2.2.3. MRI Systems

10.2.2.4. Others

10.2.3. Kits & Reagents

10.2.4. Consumables & Accessories

10.3. Europe Women’s Health Diagnostics Market Value Forecast, by Test Type, 2017–2027

10.3.1. Breast Cancer Testing

10.3.2. Cervical Cancer Testing

10.3.3. Prenatal Genetic Screening & Carrier Testing

10.3.4. Pregnancy Testing

10.3.5. Fertility & Ovulation Testing

10.3.6. Infectious Disease Testing

10.3.7. Others

10.4. Europe Women’s Health Diagnostics Market Value Forecast, by End-user, 2017–2027

10.4.1. Hospitals

10.4.2. Diagnostic Laboratories & Imaging Centers

10.4.3. Specialty Clinics

10.4.4. Others

10.5. Europe Women’s Health Diagnostics Market Value Forecast, by Country/Sub-region, 2017–2027

10.5.1. Germany

10.5.2. U.K.

10.5.3. France

10.5.4. Spain

10.5.5. Italy

10.5.6. Rest of Europe

10.6. Europe Women’s Health Diagnostics Market Attractiveness Analysis

10.6.1. By Device Type

10.6.2. By Test Type

10.6.3. By End-user

10.6.4. By Country/Sub-region

11. Asia Pacific Women’s Health Diagnostics Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Asia Pacific Women’s Health Diagnostics Market Value Forecast, by Device Type, 2017–2027

11.2.1. Biopsy Devices

11.2.2. Imaging & Monitoring System

11.2.2.1. Ultrasound Devices

11.2.2.2. Mammography Systems

11.2.2.3. MRI Systems

11.2.2.4. Others

11.2.3. Kits & Reagents

11.2.4. Consumables & Accessories

11.3. Asia Pacific Women’s Health Diagnostics Market Value Forecast, by Test Type, 2017–2027

11.3.1. Breast Cancer Testing

11.3.2. Cervical Cancer Testing

11.3.3. Prenatal Genetic Screening & Carrier Testing

11.3.4. Pregnancy Testing

11.3.5. Fertility & Ovulation Testing

11.3.6. Infectious Disease Testing

11.3.7. Others

11.4. Asia Pacific Women’s Health Diagnostics Market Value Forecast, by End-user, 2017–2027

11.4.1. Hospitals

11.4.2. Diagnostic Laboratories & Imaging Centers

11.4.3. Specialty Clinics

11.4.4. Others

11.5. Asia Pacific Women’s Health Diagnostics Market Value Forecast, by Country/Sub-region, 2017–2027

11.5.1. China

11.5.2. Japan

11.5.3. India

11.5.4. Australia & New Zealand

11.5.5. Rest of Asia Pacific

11.6. Asia Pacific Women’s Health Diagnostics Market Attractiveness Analysis

11.6.1. By Device Type

11.6.2. By Test Type

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Latin America Women’s Health Diagnostics Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Latin America Women’s Health Diagnostics Market Value Forecast, by Device Type, 2017–2027

12.2.1. Biopsy Devices

12.2.2. Imaging & Monitoring System

12.2.2.1. Ultrasound Devices

12.2.2.2. Mammography Systems

12.2.2.3. MRI Systems

12.2.2.4. Others

12.2.3. Kits & Reagents

12.2.4. Consumables & Accessories

12.3. Latin America Women’s Health Diagnostics Market Value Forecast, by Test Type, 2017–2027

12.3.1. Breast Cancer Testing

12.3.2. Cervical Cancer Testing

12.3.3. Prenatal Genetic Screening & Carrier Testing

12.3.4. Pregnancy Testing

12.3.5. Fertility & Ovulation Testing

12.3.6. Infectious Disease Testing

12.3.7. Others

12.4. Latin America Women’s Health Diagnostics Market Value Forecast, by End-user, 2017–2027

12.4.1. Hospitals

12.4.2. Diagnostic Laboratories & Imaging Centers

12.4.3. Specialty Clinics

12.4.4. Others

12.5. Latin America Women’s Health Diagnostics Market Attractiveness Analysis

12.5.1. By Device Type

12.5.2. By Test Type

12.5.3. By End-user

12.5.4. By Country/Sub-region

13. Middle East & Africa Women’s Health Diagnostics Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Middle East & Africa Women’s Health Diagnostics Market Value Forecast, by Device Type, 2017–2027

13.2.1. Biopsy Devices

13.2.2. Imaging & Monitoring System

13.2.2.1. Ultrasound Devices

13.2.2.2. Mammography Systems

13.2.2.3. MRI Systems

13.2.2.4. Others

13.2.3. Kits & Reagents

13.2.4. Consumables & Accessories

13.3. Middle East & Africa Women’s Health Diagnostics Market Value Forecast, by Test Type, 2017–2027

13.3.1. Breast Cancer Testing

13.3.2. Cervical Cancer Testing

13.3.3. Prenatal Genetic Screening & Carrier Testing

13.3.4. Pregnancy Testing

13.3.5. Fertility & Ovulation Testing

13.3.6. Infectious Disease Testing

13.3.7. Others

13.4. Middle East & Africa Women’s Health Diagnostics Market Value Forecast, by End-user, 2017–2027

13.4.1. Hospitals

13.4.2. Diagnostic Laboratories & Imaging Centers

13.4.3. Specialty Clinics

13.4.4. Others

13.5. Middle East & Africa Women’s Health Diagnostics Market Value Forecast, by Country/Sub-region, 2017–2027

13.5.1. GCC Countries

13.5.2. South Africa

13.5.3. Rest of Middle East & Africa

13.6. Middle East & Africa Women’s Health Diagnostics Market Attractiveness Analysis

13.6.1. By Device Type

13.6.2. By Test Type

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Competition Landscape

14.1. Market Players - Competition Matrix (By Tier and Size of companies)

14.2. Market Share Analysis, by Company, 2018

14.3. Company Profiles

14.3.1. Abbott Laboratories

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Financial Overview

14.3.1.3. Product Portfolio

14.3.1.4. SWOT Analysis

14.3.1.5. Strategic Overview

14.3.2. Becton, Dickinson and Company

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Financial Overview

14.3.2.3. Product Portfolio

14.3.2.4. SWOT Analysis

14.3.2.5. Strategic Overview

14.3.3. bioMérieux SA

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Financial Overview

14.3.3.3. Product Portfolio

14.3.3.4. SWOT Analysis

14.3.3.5. Strategic Overview

14.3.4. F. Hoffmann-La Roche AG

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Financial Overview

14.3.4.3. Product Portfolio

14.3.4.4. SWOT Analysis

14.3.4.5. Strategic Overview

14.3.5. GE Healthcare

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Financial Overview

14.3.5.3. Product Portfolio

14.3.5.4. SWOT Analysis

14.3.5.5. Strategic Overview

14.3.6. Hologic, Inc.

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Financial Overview

14.3.6.3. Product Portfolio

14.3.6.4. SWOT Analysis

14.3.6.5. Strategic Overview

14.3.7. Koninklijke Philips N.V.

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Financial Overview

14.3.7.3. Product Portfolio

14.3.7.4. SWOT Analysis

14.3.7.5. Strategic Overview

14.3.8. Quest Diagnostics, Inc.

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Financial Overview

14.3.8.3. Product Portfolio

14.3.8.4. SWOT Analysis

14.3.8.5. Strategic Overview

14.3.9. Cardinal Health

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Financial Overview

14.3.9.3. Product Portfolio

14.3.9.4. SWOT Analysis

14.3.9.5. Strategic Overview

14.3.10. Siemens AG

14.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.10.2. Financial Overview

14.3.10.3. Product Portfolio

14.3.10.4. SWOT Analysis

14.3.10.5. Strategic Overview

List of Tables

Table 01: Global Women's Health Diagnostics Market Value (US$ Mn) Forecast, by Device Type, 2017–2027

Table 02: Global Women's Health Diagnostics Market Value (US$ Mn) Forecast, by Imaging and Monitoring Systems, 2017–2027

Table 03: Global Women's Health Diagnostics Market Value (US$ Mn) Forecast, by Test Type, 2017–2027

Table 04: Global Women's Health Diagnostics Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 05: Global Women's Health Diagnostics Market Value (US$ Mn) Forecast, by Region, 2017–2027

Table 06: North America Women's Health Diagnostics Market Value (US$ Mn) Forecast, by Country, 2017–2027

Table 07: North America Women's Health Diagnostics Market Value (US$ Mn) Forecast, by Device Type, 2017–2027

Table 08: North America Women's Health Diagnostics Market Value (US$ Mn) Forecast, by Imaging and Monitoring System

Table 09: North America Women's Health Diagnostics Market Value (US$ Mn) Forecast, by Test Type, 2017–2027

Table 10: North America Women's Health Diagnostics Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 11: Europe Women's Health Diagnostics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 12: Europe Women's Health Diagnostics Market Value (US$ Mn) Forecast, by Device Type, 2017–2027

Table 13: Europe Women's Health Diagnostics Market Value (US$ Mn) Forecast, by Imaging and Monitoring System

Table 14: Europe Women's Health Diagnostics Market Value (US$ Mn) Forecast, by Test Type, 2017–2027

Table 15: Europe Women's Health Diagnostics Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 16: Asia Pacific Women's Health Diagnostics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 17: Asia Pacific Women's Health Diagnostics Market Value (US$ Mn) Forecast, by Device Type, 2017–2027

Table 18: Asia Pacific Women's Health Diagnostics Market Value (US$ Mn) Forecast, by Imaging and Monitoring System

Table 19: Asia Pacific Women's Health Diagnostics Market Value (US$ Mn) Forecast, by Test Type, 2017–2027

Table 20: Asia Pacific Women's Health Diagnostics Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 21: Latin America Women's Health Diagnostics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 22: Latin America Women's Health Diagnostics Market Value (US$ Mn) Forecast, by Device Type, 2017–2027

Table 23: Latin America Women's Health Diagnostics Market Value (US$ Mn) Forecast, by Imaging and Monitoring System

Table 24: Latin America Women's Health Diagnostics Market Value (US$ Mn) Forecast, by Test Type, 2017–2027

Table 25: Latin America Women's Health Diagnostics Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 26: Middle East & Africa Women's Health Diagnostics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 27: Middle East & Africa Women's Health Diagnostics Market Value (US$ Mn) Forecast, by Device Type, 2017–2027

Table 28: Middle East & Africa Women's Health Diagnostics Market Value (US$ Mn) Forecast, by Imaging and Monitoring System

Table 29: Middle East & Africa Women's Health Diagnostics Market Value (US$ Mn) Forecast, by Test Type, 2017–2027

Table 30: Middle East & Africa Women's Health Diagnostics Market Value (US$ Mn) Forecast, by End-user, 2017–2027

List of Figures

Figure 01: Global Women's Health Diagnostics Market Value (US$ Mn) Forecast, 2017–2027

Figure 02: Global Women's Health Diagnostics Market Value Share by Device Type (2018)

Figure 03: Global Women's Health Diagnostics Market Value Share by End-users (2018)

Figure 04: Global Women's Health Diagnostics Market Value Share by Test Type (2018)

Figure 05: Global Women's Health Diagnostics Market Value Share by Region (2018)

Figure 06: Global Women's Health Diagnostics Market Value Share, by Device Type, 2018 and 2027

Figure 07: Global Women's Health Diagnostics Market Attractiveness, by Device Type, 2018

Figure 08: Global Women's Health Diagnostics Market Value (US$ Mn) and Y-o-Y Growth (%), by Biopsy Devices, 2017–2027

Figure 09: Global Women's Health Diagnostics Market Value (US$ Mn) and Y-o-Y Growth (%), by Imaging and Monitoring Systems, 2017–2027

Figure 10: Global Women's Health Diagnostics Market Value (US$ Mn) and Y-o-Y Growth (%), by Kits & Reagents, 2017–2027

Figure 11: Global Women's Health Diagnostics Market Value (US$ Mn) and Y-o-Y Growth (%), by Consumables & Accessories, 2017–2027

Figure 12: Global Women's Health Diagnostics Market Value Share Analysis, by Test Type, 2018 and 2027

Figure 13: Global Women's Health Diagnostics Market Attractiveness Analysis, by Test Type, 2018

Figure 14: Global Women's Health Diagnostics Market Value (US$ Mn) and Y-o-Y Growth (%), by Breast Cancer Testing, 2017–2027

Figure 15: Global Women's Health Diagnostics Market Value (US$ Mn) and Y-o-Y Growth (%), by Cervical Cancer Testing, 2017- 2027

Figure 16: Global Women's Health Diagnostics Market Value (US$ Mn) and Y-o-Y Growth (%), by Prenatal Genetic Screening and Carrier Testing, 2017–2027

Figure 17: Global Women's Health Diagnostics Market Value (US$ Mn) and Y-o-Y Growth (%), by Pregnancy Testing, 2017- 2027

Figure 18: Global Women's Health Diagnostics Market Value (US$ Mn) and Y-o-Y Growth (%), by Fertility and Ovulation Testing, 2017–2027

Figure 19: Global Women's Health Diagnostics Market Value (US$ Mn) and Y-o-Y Growth (%), by Infectious Disease Testing, 2017- 2027

Figure 20: Global Women's Health Diagnostics Market Value (US$ Mn) and Y-o-Y Growth (%), by Others, 2017–2027

Figure 21: Global Women's Health Diagnostics Market Value Share Analysis, by End-user, 2018 and 2027

Figure 22: Global Women's Health Diagnostics Market Attractiveness Analysis, by End-user, 2018

Figure 23: Global Women's Health Diagnostics Market Value (US$ Mn) and Y-o-Y Growth (%), by Hospitals, 2017–2027

Figure 24: Global Women's Health Diagnostics Market Value (US$ Mn) and Y-o-Y Growth (%), by Diagnostic Laboratories & Imaging Centers, 2017–2027

Figure 25: Global Women's Health Diagnostics Market Value (US$ Mn) and Y-o-Y Growth (%), by Specialty Clinics, 2017–2027

Figure 26: Global Women's Health Diagnostics Market Value (US$ Mn) and Y-o-Y Growth (%), by Others, 2017–2027

Figure 27: Global Women's Health Diagnostics Market Value Share Analysis, by Region, 2018 and 2027

Figure 28: Global Women's Health Diagnostics Market Attractiveness Analysis, by Region, 2018

Figure 29: North America Women's Health Diagnostics Market Value (US$ Mn) Forecast, 2017–2027

Figure 30: North America Women's Health Diagnostics Market Attractiveness Analysis, by Country, 2018

Figure 31: North America Women's Health Diagnostics Market Value Share Analysis, by Country, 2018 and 2027

Figure 32: North America Women's Health Diagnostics Market Value Share Analysis, by Device Type, 2018 and 2027

Figure 33: North America Women's Health Diagnostics Market Attractiveness, by Device Type, 2018

Figure 34: North America Women's Health Diagnostics Market Value Share Analysis, by Test Type, 2018 and 2027

Figure 35: North America Women's Health Diagnostics Market Attractiveness Analysis, by Test Type, 2018

Figure 36: North America Women's Health Diagnostics Market Value Share Analysis, by End-user, 2018 and 2027

Figure 37: North America Women's Health Diagnostics Market Attractiveness Analysis, by End-user, 2018

Figure 38: Europe Women's Health Diagnostics Market Value (US$ Mn) Forecast, 2017–2027

Figure 39: Europe Women's Health Diagnostics Market Attractiveness, by Country/Sub-region, 2018

Figure 40: Europe Women's Health Diagnostics Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 41: Europe Women's Health Diagnostics Market Value Share Analysis, by Device Type, 2018 and 2027

Figure 42: Europe Women's Health Diagnostics Market Attractiveness, by Device Type, 2018

Figure 43: Europe Women's Health Diagnostics Market Value Share Analysis, by Test Type, 2018 and 2027

Figure 44: Europe Women's Health Diagnostics Market Attractiveness Analysis, by Test Type, 2018

Figure 45: Europe Women's Health Diagnostics Market Value Share Analysis, by End-user, 2018 and 2027

Figure 46: Europe Women's Health Diagnostics Market Attractiveness Analysis, by End-user, 2018

Figure 47: Asia Pacific Women's Health Diagnostics Market Value (US$ Mn) Forecast, 2017–2027

Figure 48: Asia Pacific Women's Health Diagnostics Market Attractiveness Analysis, by Country/Sub-region, 2018

Figure 49: Asia Pacific Women's Health Diagnostics Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 50: Asia Pacific Women's Health Diagnostics Market Value Share Analysis, by Device Type, 2018 and 2027

Figure 51: Asia Pacific Women's Health Diagnostics Market Attractiveness, by Device Type, 2018

Figure 52: Asia Pacific Women's Health Diagnostics Market Value Share Analysis, by Test Type, 2018 and 2027

Figure 53: Asia Pacific Women's Health Diagnostics Market Attractiveness Analysis, by Test Type, 2018

Figure 54: Asia Pacific Women's Health Diagnostics Market Value Share Analysis, by End-user, 2018 and 2027

Figure 55: Asia Pacific Women's Health Diagnostics Market Attractiveness Analysis, by End-user, 2018

Figure 56: Latin America Women's Health Diagnostics Market Value (US$ Mn) Forecast, 2017–2027

Figure 57: Latin America Women's Health Diagnostics Market Attractiveness, by Country/Sub-region, 2018

Figure 58: Latin America Women's Health Diagnostics Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 59: Latin America Women's Health Diagnostics Market Value Share Analysis, by Device Type, 2018 and 2027

Figure 60: Latin America Women's Health Diagnostics Market Attractiveness, by Device Type, 2018

Figure 61: Latin America Women's Health Diagnostics Market Value Share Analysis, by Test Type, 2018 and 2027

Figure 62: Latin America Women's Health Diagnostics Market Attractiveness Analysis, by Test Type, 2018

Figure 63: Latin America Women's Health Diagnostics Market Value Share Analysis, by End-user, 2018 and 2027

Figure 64: Latin America Women's Health Diagnostics Market Attractiveness Analysis, by End-user, 2018

Figure 65: Middle East & Africa Women's Health Diagnostics Market Value (US$ Mn) Forecast, 2017–2027

Figure 66: Middle East & Africa Women's Health Diagnostics Market Attractiveness, by Country/Sub-region, 2018

Figure 67: Middle East & Africa Women's Health Diagnostics Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 68: Middle East & Africa Women's Health Diagnostics Market Value Share Analysis, by Device Type, 2018 and 2027

Figure 69: Middle East & Africa Women's Health Diagnostics Market Attractiveness, by Device Type, 2018

Figure 70: Middle East & Africa Women's Health Diagnostics Market Value Share Analysis, by Test Type, 2018 and 2027

Figure 71: Middle East & Africa Women's Health Diagnostics Market Attractiveness Analysis, by Test Type, 2018

Figure 72: Middle East & Africa Women's Health Diagnostics Market Value Share Analysis, by End-user, 2018 and 2027

Figure 73: Middle East & Africa Women's Health Diagnostics Market Attractiveness Analysis, by End-user, 2018

Figure 74: Global Women's Health Diagnostics Market Share Analysis, by Company (2018)