Reports

Reports

The warehouse robotics industry is influenced by the explosive growth in e-Commerce, which has dramatically changed customer requirements to shorter lead times, more accurate deliveries, and more reliable service levels. With the growth of online shopping there is pressure for businesses to streamline their order fulfillment process and handle time-based high-volume operations quickly.

The companies are experiencing labor shortages in the sectors where work is repetitive or laborious or most difficult to fill. Partly this doing with automation or warehouse robotics excuses the need for labor, and no dependency on labor increases.

Besides, companies have been focusing on minimizing operational costs. Robotics helps to significantly minimize costs as they can work 24/7 with little error and promote throughput. Adoption also is accelerating as one can see that technology is advancing rapidly - artificial intelligence, machine learning, IoT sensors, and smart sensors. These innovations and updates help the robots to learn from the experience, allow to make adjustments, and interface the warehouse management system. In this case, the robots are becoming more intelligent, adaptable, and easier to scale; thus, making them the newest and most important assets in warehouse operations.

The warehouse robotics market is being shaped by several key trends, with the continued proliferation of AI-powered multi-functional robots that can handle complex tasks such as dynamic picking and mixed-item palletizing.

Robotics-as-a-Service (RaaS) model is also growing, which allows the companies to implement robotics systems while investing less initially. Companies are also moving toward more modular and collaborative robots (commonly known as "cobots"), as they can safely work with people and adapt the change in warehouse workflow and layout.

The warehouse robotics industry focuses on designing, developing, and implementing robotic systems that will automate different warehouse operations. These types of robots help improve efficiency, accuracy, and safety involving material handling and logistics processes, as well as reduce the labor costs and streamline supply chain processes.

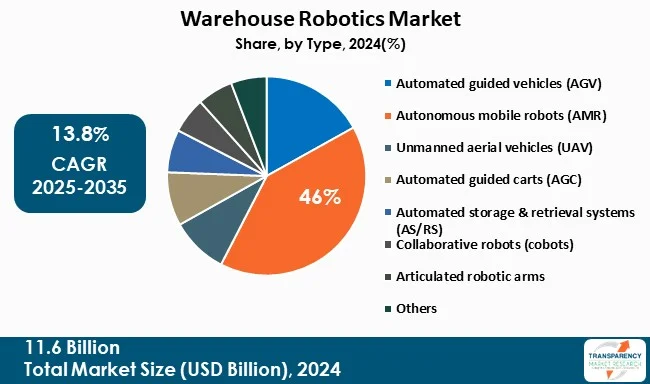

Warehouse robots can be divided into several styles, with specific applications. Some common warehouse robot categories are: Autonomous Mobile Robots (AMRs) that navigate the warehouse floor freely - Automated Guided Vehicles (AGVs) that follow paths within the warehouse; robotic arms that pick and place inventory; gantry robots that stack and palletize loads, and drones that scan and navigate the warehouse floor. Each of these types are capable of establishing key differences based on the intricacies of the task at hand and the scale of the operation.

From order picking to sorting, packing, palletizing, inventory management and moving goods around a warehouse, robots are utilized in many warehousing applications. There is also a growing trend for robotic systems to be implemented in automated loading and unloading with the goal of achieving minimum throughput while reducing the rate of errors.

Warehouse robots are basically used in industries with high volume, high-speed logistics operations. Important industries include commerce, retail, third-party logistics, food and beverage, pharmaceuticals, automotive, and electronics manufacturing. They use robotics for speeding up order fulfillment, improving inventory management, and scaling their operations in a manner that meets the increasing consumer demand, while also providing them with a competitive edge.

| Attribute | Detail |

|---|---|

| Warehouse Robotics Market Drivers |

|

The rapidly advancement of artificial intelligence and machine vision are becoming transformational aspects for warehouse robotics with a wide spectrum of non-uniform items. Notably, artificial intelligence allows robots to communicate in real-time with the environment.

Machine vision not only gives the robot spatial awareness but it allows the robot to work within a moving environment to avoid collisions and quality checks during operation. All these things require robots that can touch and hold non-uniform items and also apply themselves dynamically and adaptively in complex workflows with the potential to reduce human error.

That's how these capabilities can improve the speed and throughput within the capacity of a physical warehouse context when humans are having to manage everything else with complex human layering. And all of this means that AI and vision robotics will make warehouses faster and more efficient but lower labor dependency, offer safety, and more generally meet the dynamic evolution and scalability needs of the modern supply chain context.

As we see a growing focus on contactless operations, it has fueled significant growth in the warehouse robotics market. The COVID-19 pandemic highlighted the weaknesses of labor-intensive, high-touch, supply chains; and resulted in companies looking more toward physical automation solutions to eliminate or lessen human interaction when performing crucial supply chain processes such as the picking, sorting, packing, and transportation of goods.

Apart from the obvious health and safety motives, companies are looking to use these technologies to improve efficiencies, reduce downtime, and have continuity in the supply chain when staffing is either limited or only available under extreme circumstances. By deploying autonomous robots to perform functions previously done by humans, workers can focus on the "human functions" of monitoring and maintenance. They can also handle exceptions.

The Autonomous Mobile Robots (AMRs) segment is dominating the global warehouse robotics market owing to the rising demand for flexible, scalable, low cost automation solutions. AMRs cannot only facilitate level of automation due to their lack of fixed infrastructure and flexibility, but also navigate dynamic environments.

AMRs can perform tasks related to transport goods, order picking, and material handling, and can still adapt to layout changes. The advances made in artificial intelligence (AI), sensors, and fleet management software help improve AMR performance and lead them to being preferred choices over traditional automated guided vehicles (AGVs) for a large number of warehouse automation tasks. Further, the growth in e-Commerce activity as well as the demand for same day delivery has driven the adoption of AMRs toward a higher pace of acceptance and acceleration of AMRs by fulfillment centers globally.

| Attribute | Detail |

|---|---|

| Leading Region |

|

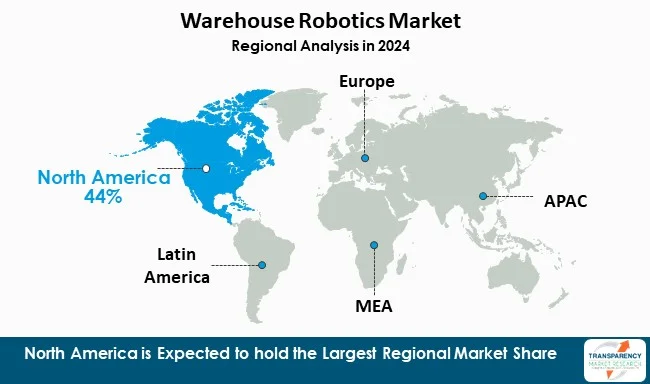

North America leads the global market given the growth of e-Commerce giants such as Amazon, Berkshire Grey, GreyOrange. e-Commerce growth, warehousing labor shortages, and market pressures to minimize order fulfillment times and improve accuracy have led to higher adoption of robotics and automation across Canada and the U.S. High levels of government support for manufacturing innovation and robust robotics research and development ecosystems further consolidate their position as the largest warehouse robotics market.

Companies operating in the warehouse robotics market are investing in AI-powered systems, fully autonomous AMRs, and sophisticated grippers for enhancing efficiency and flexibility. Robotics companies are positioning themselves with simulation technology for enabling safer, faster deployment in a busy warehouse environment, with designs built for modular capability and autonomous operation or human-robot collaboration.

FANUC, Standard Bots, ABB, Daifuku Co., Ltd., Zebra Technologies Corp, Honeywell International Inc, KNAPP AG, KUKA AG, Omron Corporation, YASKAWA ELECTRIC CORPORATION, KION GROUP AG, Toyota Material Handling, GreyOrange, JBT, Amazon.com, Inc., and Ambi Robotics are the key players in warehouse robotics market.

Each of these players has been profiled in the warehouse robotics market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

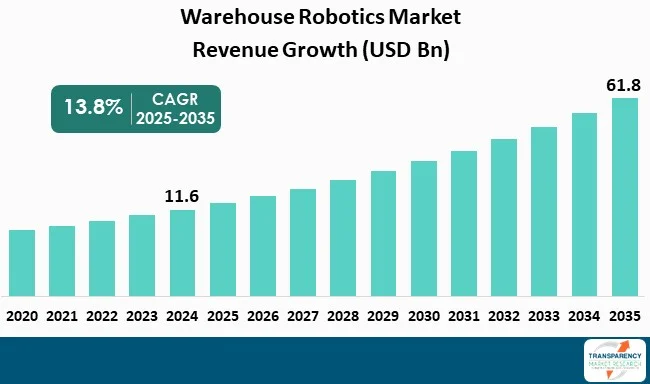

| Size in 2024 | US$ 11.6 Bn |

| Forecast Value in 2035 | US$ 61.8 Bn |

| CAGR | 13.8% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Warehouse Robotics Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Types

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The warehouse robotics market was valued at US$ 11.6 Bn in 2024

The warehouse robotics market is projected to reach US$ 61.8 Bn by 2035

Advancements in AI & machine vision and rising demand for contactless operations

The CAGR is anticipated to be 13.8% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

FANUC, Standard Bots, ABB, Daifuku Co., Ltd., Zebra Technologies Corp, Honeywell International Inc, KNAPP AG, KUKA AG, Omron Corporation, YASKAWA ELECTRIC CORPORATION, KION GROUP AG, Toyota Material Handling, GreyOrange, JBT, Amazon.com, Inc., and Ambi Robotics, among others

Table 01: Global Warehouse Robotics Market Value (US$ Mn) Forecast, by Types, 2020 to 2035

Table 02: Global Warehouse Robotics Market Value (US$ Mn) Forecast, by Functions, 2020 to 2035

Table 03: Global Warehouse Robotics Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 04: Global Warehouse Robotics Market Value (US$ Mn) Forecast, by Payload, 2020 to 2035

Table 05: Global Warehouse Robotics Market Value (US$ Mn) Forecast, by End-user Industry, 2020 to 2035

Table 06: Global Warehouse Robotics Market Value (US$ Mn) Forecast, by Region, 2020 to 2035

Table 07: North America Warehouse Robotics Market Value (US$ Mn) Forecast, by Types, 2020 to 2035

Table 08: North America Warehouse Robotics Market Value (US$ Mn) Forecast, by Functions, 2020 to 2035

Table 09: North America Warehouse Robotics Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 10: North America Warehouse Robotics Market Value (US$ Mn) Forecast, by Payload, 2020 to 2035

Table 11: North America Warehouse Robotics Market Value (US$ Mn) Forecast, by End-user Industry, 2020 to 2035

Table 12: North America Warehouse Robotics Market Value (US$ Mn) Forecast, by Country, 2020 to 2035

Table 13: U.S. Warehouse Robotics Market Value (US$ Mn) Forecast, by Types, 2020 to 2035

Table 14: U.S. Warehouse Robotics Market Value (US$ Mn) Forecast, by Functions, 2020 to 2035

Table 15: U.S. Warehouse Robotics Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 16: U.S. Warehouse Robotics Market Value (US$ Mn) Forecast, by Payload, 2020 to 2035

Table 17: U.S. Warehouse Robotics Market Value (US$ Mn) Forecast, by End-user Industry, 2020 to 2035

Table 18: Canada Warehouse Robotics Market Value (US$ Mn) Forecast, by Types, 2020 to 2035

Table 19: Canada Warehouse Robotics Market Value (US$ Mn) Forecast, by Functions, 2020 to 2035

Table 20: Canada Warehouse Robotics Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 21: Canada Warehouse Robotics Market Value (US$ Mn) Forecast, by Payload, 2020 to 2035

Table 22: Canada Warehouse Robotics Market Value (US$ Mn) Forecast, by End-user Industry, 2020 to 2035

Table 23: Europe Warehouse Robotics Market Value (US$ Mn) Forecast, by Types, 2020 to 2035

Table 24: Europe Warehouse Robotics Market Value (US$ Mn) Forecast, by Functions, 2020 to 2035

Table 25: Europe Warehouse Robotics Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 26: Europe Warehouse Robotics Market Value (US$ Mn) Forecast, by Payload, 2020 to 2035

Table 27: Europe Warehouse Robotics Market Value (US$ Mn) Forecast, by End-user Industry, 2020 to 2035

Table 28: Europe Warehouse Robotics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 29: Germany Warehouse Robotics Market Value (US$ Mn) Forecast, by Types, 2020 to 2035

Table 30: Germany Warehouse Robotics Market Value (US$ Mn) Forecast, by Functions, 2020 to 2035

Table 31: Germany Warehouse Robotics Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 32: Germany Warehouse Robotics Market Value (US$ Mn) Forecast, by Payload, 2020 to 2035

Table 33: Germany Warehouse Robotics Market Value (US$ Mn) Forecast, by End-user Industry, 2020 to 2035

Table 34: U.K. Warehouse Robotics Market Value (US$ Mn) Forecast, by Types, 2020 to 2035

Table 35: U.K. Warehouse Robotics Market Value (US$ Mn) Forecast, by Functions, 2020 to 2035

Table 36: U.K. Warehouse Robotics Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 37: U.K. Warehouse Robotics Market Value (US$ Mn) Forecast, by Payload, 2020 to 2035

Table 38: U.K. Warehouse Robotics Market Value (US$ Mn) Forecast, by End-user Industry, 2020 to 2035

Table 39: France Warehouse Robotics Market Value (US$ Mn) Forecast, by Types, 2020 to 2035

Table 40: France Warehouse Robotics Market Value (US$ Mn) Forecast, by Functions, 2020 to 2035

Table 41: France Warehouse Robotics Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 42: France Warehouse Robotics Market Value (US$ Mn) Forecast, by Payload, 2020 to 2035

Table 43: France Warehouse Robotics Market Value (US$ Mn) Forecast, by End-user Industry, 2020 to 2035

Table 44: Italy Warehouse Robotics Market Value (US$ Mn) Forecast, by Types, 2020 to 2035

Table 45: Italy Warehouse Robotics Market Value (US$ Mn) Forecast, by Functions, 2020 to 2035

Table 46: Italy Warehouse Robotics Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 47: Italy Warehouse Robotics Market Value (US$ Mn) Forecast, by Payload, 2020 to 2035

Table 48: Italy Warehouse Robotics Market Value (US$ Mn) Forecast, by End-user Industry, 2020 to 2035

Table 49: Spain Warehouse Robotics Market Value (US$ Mn) Forecast, by Types, 2020 to 2035

Table 50: Spain Warehouse Robotics Market Value (US$ Mn) Forecast, by Functions, 2020 to 2035

Table 51: Spain Warehouse Robotics Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 52: Spain Warehouse Robotics Market Value (US$ Mn) Forecast, by Payload, 2020 to 2035

Table 53: Spain Warehouse Robotics Market Value (US$ Mn) Forecast, by End-user Industry, 2020 to 2035

Table 54: Switzerland Warehouse Robotics Market Value (US$ Mn) Forecast, by Types, 2020 to 2035

Table 55: Switzerland Warehouse Robotics Market Value (US$ Mn) Forecast, by Functions, 2020 to 2035

Table 56: Switzerland Warehouse Robotics Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 57: Switzerland Warehouse Robotics Market Value (US$ Mn) Forecast, by Payload, 2020 to 2035

Table 58: Switzerland Warehouse Robotics Market Value (US$ Mn) Forecast, by End-user Industry, 2020 to 2035

Table 59: The Netherlands Warehouse Robotics Market Value (US$ Mn) Forecast, by Types, 2020 to 2035

Table 60: The Netherlands Warehouse Robotics Market Value (US$ Mn) Forecast, by Functions, 2020 to 2035

Table 61: The Netherlands Warehouse Robotics Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 62: The Netherlands Warehouse Robotics Market Value (US$ Mn) Forecast, by Payload, 2020 to 2035

Table 63: The Netherlands Warehouse Robotics Market Value (US$ Mn) Forecast, by End-user Industry, 2020 to 2035

Table 64: Rest of Europe Warehouse Robotics Market Value (US$ Mn) Forecast, by Types, 2020 to 2035

Table 65: Rest of Europe Warehouse Robotics Market Value (US$ Mn) Forecast, by Functions, 2020 to 2035

Table 66: Rest of Europe Warehouse Robotics Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 67: Rest of Europe Warehouse Robotics Market Value (US$ Mn) Forecast, by Payload, 2020 to 2035

Table 68: Rest of Europe Warehouse Robotics Market Value (US$ Mn) Forecast, by End-user Industry, 2020 to 2035

Table 69: Asia Pacific Warehouse Robotics Market Value (US$ Mn) Forecast, by Types, 2020 to 2035

Table 70: Asia Pacific Warehouse Robotics Market Value (US$ Mn) Forecast, by Functions, 2020 to 2035

Table 71: Asia Pacific Warehouse Robotics Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 72: Asia Pacific Warehouse Robotics Market Value (US$ Mn) Forecast, by Payload, 2020 to 2035

Table 73: Asia Pacific Warehouse Robotics Market Value (US$ Mn) Forecast, by End-user Industry, 2020 to 2035

Table 74: Asia Pacific Warehouse Robotics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 75: China Warehouse Robotics Market Value (US$ Mn) Forecast, by Types, 2020 to 2035

Table 76: China Warehouse Robotics Market Value (US$ Mn) Forecast, by Functions, 2020 to 2035

Table 77: China Warehouse Robotics Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 78: China Warehouse Robotics Market Value (US$ Mn) Forecast, by Payload, 2020 to 2035

Table 79: China Warehouse Robotics Market Value (US$ Mn) Forecast, by End-user Industry, 2020 to 2035

Table 80: Japan Warehouse Robotics Market Value (US$ Mn) Forecast, by Types, 2020 to 2035

Table 81: Japan Warehouse Robotics Market Value (US$ Mn) Forecast, by Functions, 2020 to 2035

Table 82: Japan Warehouse Robotics Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 83: Japan Warehouse Robotics Market Value (US$ Mn) Forecast, by Payload, 2020 to 2035

Table 84: Japan Warehouse Robotics Market Value (US$ Mn) Forecast, by End-user Industry, 2020 to 2035

Table 85: India Warehouse Robotics Market Value (US$ Mn) Forecast, by Types, 2020 to 2035

Table 86: India Warehouse Robotics Market Value (US$ Mn) Forecast, by Functions, 2020 to 2035

Table 87: India Warehouse Robotics Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 88: India Warehouse Robotics Market Value (US$ Mn) Forecast, by Payload, 2020 to 2035

Table 89: India Warehouse Robotics Market Value (US$ Mn) Forecast, by End-user Industry, 2020 to 2035

Table 90: South Korea Warehouse Robotics Market Value (US$ Mn) Forecast, by Types, 2020 to 2035

Table 91: South Korea Warehouse Robotics Market Value (US$ Mn) Forecast, by Functions, 2020 to 2035

Table 92: South Korea Warehouse Robotics Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 93: South Korea Warehouse Robotics Market Value (US$ Mn) Forecast, by Payload, 2020 to 2035

Table 94: South Korea Warehouse Robotics Market Value (US$ Mn) Forecast, by End-user Industry, 2020 to 2035

Table 95: Australia and New Zealand Warehouse Robotics Market Value (US$ Mn) Forecast, by Types, 2020 to 2035

Table 96: Australia and New Zealand Warehouse Robotics Market Value (US$ Mn) Forecast, by Functions, 2020 to 2035

Table 97: Australia and New Zealand Warehouse Robotics Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 98: Australia and New Zealand Warehouse Robotics Market Value (US$ Mn) Forecast, by Payload, 2020 to 2035

Table 99: Australia and New Zealand Warehouse Robotics Market Value (US$ Mn) Forecast, by End-user Industry, 2020 to 2035

Table 100: Rest of Asia Pacific Warehouse Robotics Market Value (US$ Mn) Forecast, by Types, 2020 to 2035

Table 101: Rest of Asia Pacific Warehouse Robotics Market Value (US$ Mn) Forecast, by Functions, 2020 to 2035

Table 102: Rest of Asia Pacific Warehouse Robotics Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 103: Rest of Asia Pacific Warehouse Robotics Market Value (US$ Mn) Forecast, by Payload, 2020 to 2035

Table 104: Rest of Asia Pacific Warehouse Robotics Market Value (US$ Mn) Forecast, by End-user Industry, 2020 to 2035

Table 105: Latin America Warehouse Robotics Market Value (US$ Mn) Forecast, by Types, 2020 to 2035

Table 106: Latin America Warehouse Robotics Market Value (US$ Mn) Forecast, by Functions, 2020 to 2035

Table 107: Latin America Warehouse Robotics Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 108: Latin America Warehouse Robotics Market Value (US$ Mn) Forecast, by Payload, 2020 to 2035

Table 109: Latin America Warehouse Robotics Market Value (US$ Mn) Forecast, by End-user Industry, 2020 to 2035

Table 110: Latin America Warehouse Robotics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 111: Brazil Warehouse Robotics Market Value (US$ Mn) Forecast, by Types, 2020 to 2035

Table 112: Brazil Warehouse Robotics Market Value (US$ Mn) Forecast, by Functions, 2020 to 2035

Table 113: Brazil Warehouse Robotics Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 114: Brazil Warehouse Robotics Market Value (US$ Mn) Forecast, by Payload, 2020 to 2035

Table 115: Brazil Warehouse Robotics Market Value (US$ Mn) Forecast, by End-user Industry, 2020 to 2035

Table 116: Mexico Warehouse Robotics Market Value (US$ Mn) Forecast, by Types, 2020 to 2035

Table 117: Mexico Warehouse Robotics Market Value (US$ Mn) Forecast, by Functions, 2020 to 2035

Table 118: Mexico Warehouse Robotics Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 119: Mexico Warehouse Robotics Market Value (US$ Mn) Forecast, by Payload, 2020 to 2035

Table 120: Mexico Warehouse Robotics Market Value (US$ Mn) Forecast, by End-user Industry, 2020 to 2035

Table 121: Argentina Warehouse Robotics Market Value (US$ Mn) Forecast, by Types, 2020 to 2035

Table 122: Argentina Warehouse Robotics Market Value (US$ Mn) Forecast, by Functions, 2020 to 2035

Table 123: Argentina Warehouse Robotics Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 124: Argentina Warehouse Robotics Market Value (US$ Mn) Forecast, by Payload, 2020 to 2035

Table 125: Argentina Warehouse Robotics Market Value (US$ Mn) Forecast, by End-user Industry, 2020 to 2035

Table 126: Rest of Latin America Warehouse Robotics Market Value (US$ Mn) Forecast, by Types, 2020 to 2035

Table 127: Rest of Latin America Warehouse Robotics Market Value (US$ Mn) Forecast, by Functions, 2020 to 2035

Table 128: Rest of Latin America Warehouse Robotics Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 129: Rest of Latin America Warehouse Robotics Market Value (US$ Mn) Forecast, by Payload, 2020 to 2035

Table 130: Rest of Latin America Warehouse Robotics Market Value (US$ Mn) Forecast, by End-user Industry, 2020 to 2035

Table 131: Middle East and Africa Warehouse Robotics Market Value (US$ Mn) Forecast, by Types, 2020 to 2035

Table 132: Middle East and Africa Warehouse Robotics Market Value (US$ Mn) Forecast, by Functions, 2020 to 2035

Table 133: Middle East and Africa Warehouse Robotics Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 134: Middle East and Africa Warehouse Robotics Market Value (US$ Mn) Forecast, by Payload, 2020 to 2035

Table 135: Middle East and Africa Warehouse Robotics Market Value (US$ Mn) Forecast, by End-user Industry, 2020 to 2035

Table 136: Middle East and Africa Warehouse Robotics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 137: GCC Countries Warehouse Robotics Market Value (US$ Mn) Forecast, by Types, 2020 to 2035

Table 138: GCC Countries Warehouse Robotics Market Value (US$ Mn) Forecast, by Functions, 2020 to 2035

Table 139: GCC Countries Warehouse Robotics Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 140: GCC Countries Warehouse Robotics Market Value (US$ Mn) Forecast, by Payload, 2020 to 2035

Table 141: GCC Countries Warehouse Robotics Market Value (US$ Mn) Forecast, by End-user Industry, 2020 to 2035

Table 142: South Africa Warehouse Robotics Market Value (US$ Mn) Forecast, by Types, 2020 to 2035

Table 143: South Africa Warehouse Robotics Market Value (US$ Mn) Forecast, by Functions, 2020 to 2035

Table 144: South Africa Warehouse Robotics Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 145: South Africa Warehouse Robotics Market Value (US$ Mn) Forecast, by Payload, 2020 to 2035

Table 146: South Africa Warehouse Robotics Market Value (US$ Mn) Forecast, by End-user Industry, 2020 to 2035

Table 147: Rest of Middle East and Africa Warehouse Robotics Market Value (US$ Mn) Forecast, by Types, 2020 to 2035

Table 148: Rest of Middle East and Africa Warehouse Robotics Market Value (US$ Mn) Forecast, by Functions, 2020 to 2035

Table 149: Rest of Middle East and Africa Warehouse Robotics Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 150: Rest of Middle East and Africa Warehouse Robotics Market Value (US$ Mn) Forecast, by Payload, 2020 to 2035

Table 151: Rest of Middle East and Africa Warehouse Robotics Market Value (US$ Mn) Forecast, by End-user Industry, 2020 to 2035

Figure 01: Global Warehouse Robotics Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 02: Global Warehouse Robotics Market Value Share Analysis, by Types, 2024 and 2035

Figure 03: Global Warehouse Robotics Market Attractiveness Analysis, by Types, 2025 to 2035

Figure 04: Global Warehouse Robotics Market Revenue (US$ Mn), by Automated guided vehicles (AGV), 2020 to 2035

Figure 05: Global Warehouse Robotics Market Revenue (US$ Mn), by Autonomous mobile robots (AMR), 2020 to 2035

Figure 06: Global Warehouse Robotics Market Revenue (US$ Mn), by Unmanned aerial vehicles (UAV), 2020 to 2035

Figure 07: Global Warehouse Robotics Market Revenue (US$ Mn), by Automated guided carts (AGC), 2020 to 2035

Figure 08: Global Warehouse Robotics Market Revenue (US$ Mn), by Automated storage & retrieval systems (AS/RS), 2020 to 2035

Figure 09: Global Warehouse Robotics Market Revenue (US$ Mn), by Collaborative robots (cobots), 2020 to 2035

Figure 10: Global Warehouse Robotics Market Revenue (US$ Mn), by Articulated robotic arms, 2020 to 2035

Figure 11: Global Warehouse Robotics Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 12: Global Warehouse Robotics Market Value Share Analysis, by Functions, 2024 and 2035

Figure 13: Global Warehouse Robotics Market Attractiveness Analysis, by Functions, 2025 to 2035

Figure 14: Global Warehouse Robotics Market Revenue (US$ Mn), by Loading and unloading, 2020 to 2035

Figure 15: Global Warehouse Robotics Market Revenue (US$ Mn), by Palletizing and depalletizing, 2020 to 2035

Figure 16: Global Warehouse Robotics Market Revenue (US$ Mn), by Sorting, 2020 to 2035

Figure 17: Global Warehouse Robotics Market Revenue (US$ Mn), by Packaging, 2020 to 2035

Figure 18: Global Warehouse Robotics Market Revenue (US$ Mn), by Transportation, 2020 to 2035

Figure 19: Global Warehouse Robotics Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 20: Global Warehouse Robotics Market Value Share Analysis, by Components, 2024 and 2035

Figure 21: Global Warehouse Robotics Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 22: Global Warehouse Robotics Market Revenue (US$ Mn), by Hardware, 2020 to 2035

Figure 23: Global Warehouse Robotics Market Revenue (US$ Mn), by Software, 2020 to 2035

Figure 24: Global Warehouse Robotics Market Value Share Analysis, by Payload, 2024 and 2035

Figure 25: Global Warehouse Robotics Market Attractiveness Analysis, by Payload, 2025 to 2035

Figure 26: Global Warehouse Robotics Market Revenue (US$ Mn), by 1-7kg, 2020 to 2035

Figure 27: Global Warehouse Robotics Market Revenue (US$ Mn), by 7-20kg, 2020 to 2035

Figure 28: Global Warehouse Robotics Market Revenue (US$ Mn), by 20-80kg, 2020 to 2035

Figure 29: Global Warehouse Robotics Market Revenue (US$ Mn), by 80-150kg, 2020 to 2035

Figure 30: Global Warehouse Robotics Market Revenue (US$ Mn), by 150-250kg, 2020 to 2035

Figure 31: Global Warehouse Robotics Market Revenue (US$ Mn), by 250-500kg, 2020 to 2035

Figure 32: Global Warehouse Robotics Market Revenue (US$ Mn), by 500-1000kg, 2020 to 2035

Figure 33: Global Warehouse Robotics Market Revenue (US$ Mn), by >1000kg, 2020 to 2035

Figure 34: Global Warehouse Robotics Market Value Share Analysis, by End-user Industry, 2024 and 2035

Figure 35: Global Warehouse Robotics Market Attractiveness Analysis, by End-user Industry, 2025 to 2035

Figure 36: Global Warehouse Robotics Market Revenue (US$ Mn), by E-Commerce, 2020 to 2035

Figure 37: Global Warehouse Robotics Market Revenue (US$ Mn), by Automotive, 2020 to 2035

Figure 38: Global Warehouse Robotics Market Revenue (US$ Mn), by Food and Beverages, 2020 to 2035

Figure 39: Global Warehouse Robotics Market Revenue (US$ Mn), by Electronics and Semiconductors, 2020 to 2035

Figure 40: Global Warehouse Robotics Market Revenue (US$ Mn), by Pharmaceuticals, 2020 to 2035

Figure 41: Global Warehouse Robotics Market Revenue (US$ Mn), by Chemical, 2020 to 2035

Figure 42: Global Warehouse Robotics Market Revenue (US$ Mn), by Metal and Machinery, 2020 to 2035

Figure 43: Global Warehouse Robotics Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 44: Global Warehouse Robotics Market Value Share Analysis, by Region, 2024 and 2035

Figure 45: Global Warehouse Robotics Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 46: North America Warehouse Robotics Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 47: North America Warehouse Robotics Market Value Share Analysis, by Types, 2024 and 2035

Figure 48: North America Warehouse Robotics Market Attractiveness Analysis, by Types, 2025 to 2035

Figure 49: North America Warehouse Robotics Market Value Share Analysis, by Functions, 2024 and 2035

Figure 50: North America Warehouse Robotics Market Attractiveness Analysis, by Functions, 2025 to 2035

Figure 51: North America Warehouse Robotics Market Value Share Analysis, by Components, 2024 and 2035

Figure 52: North America Warehouse Robotics Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 53: North America Warehouse Robotics Market Value Share Analysis, by Payload, 2024 and 2035

Figure 54: North America Warehouse Robotics Market Attractiveness Analysis, by Payload, 2025 to 2035

Figure 55: North America Warehouse Robotics Market Value Share Analysis, by End-user Industry, 2024 and 2035

Figure 56: North America Warehouse Robotics Market Attractiveness Analysis, by End-user Industry, 2025 to 2035

Figure 57: North America Warehouse Robotics Market Value Share Analysis, by Country, 2024 and 2035

Figure 58: North America Warehouse Robotics Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 59: U.S. Warehouse Robotics Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 60: U.S. Warehouse Robotics Market Value Share Analysis, by Types, 2024 and 2035

Figure 61: U.S. Warehouse Robotics Market Attractiveness Analysis, by Types, 2025 to 2035

Figure 62: U.S. Warehouse Robotics Market Value Share Analysis, by Functions, 2024 and 2035

Figure 63: U.S. Warehouse Robotics Market Attractiveness Analysis, by Functions, 2025 to 2035

Figure 64: U.S. Warehouse Robotics Market Value Share Analysis, by Components, 2024 and 2035

Figure 65: U.S. Warehouse Robotics Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 66: U.S. Warehouse Robotics Market Value Share Analysis, by Payload, 2024 and 2035

Figure 67: U.S. Warehouse Robotics Market Attractiveness Analysis, by Payload, 2025 to 2035

Figure 68: U.S. Warehouse Robotics Market Value Share Analysis, by End-user Industry, 2024 and 2035

Figure 69: U.S. Warehouse Robotics Market Attractiveness Analysis, by End-user Industry, 2025 to 2035

Figure 70: Canada Warehouse Robotics Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 71: Canada Warehouse Robotics Market Value Share Analysis, by Types, 2024 and 2035

Figure 72: Canada Warehouse Robotics Market Attractiveness Analysis, by Types, 2025 to 2035

Figure 73: Canada Warehouse Robotics Market Value Share Analysis, by Functions, 2024 and 2035

Figure 74: Canada Warehouse Robotics Market Attractiveness Analysis, by Functions, 2025 to 2035

Figure 75: Canada Warehouse Robotics Market Value Share Analysis, by Components, 2024 and 2035

Figure 76: Canada Warehouse Robotics Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 77: Canada Warehouse Robotics Market Value Share Analysis, by Payload, 2024 and 2035

Figure 78: Canada Warehouse Robotics Market Attractiveness Analysis, by Payload, 2025 to 2035

Figure 79: Canada Warehouse Robotics Market Value Share Analysis, by End-user Industry, 2024 and 2035

Figure 80: Canada Warehouse Robotics Market Attractiveness Analysis, by End-user Industry, 2025 to 2035

Figure 81: Europe Warehouse Robotics Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 82: Europe Warehouse Robotics Market Value Share Analysis, by Types, 2024 and 2035

Figure 83: Europe Warehouse Robotics Market Attractiveness Analysis, by Types, 2025 to 2035

Figure 84: Europe Warehouse Robotics Market Value Share Analysis, by Functions, 2024 and 2035

Figure 85: Europe Warehouse Robotics Market Attractiveness Analysis, by Functions, 2025 to 2035

Figure 86: Europe Warehouse Robotics Market Value Share Analysis, by Components, 2024 and 2035

Figure 87: Europe Warehouse Robotics Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 88: Europe Warehouse Robotics Market Value Share Analysis, by Payload, 2024 and 2035

Figure 89: Europe Warehouse Robotics Market Attractiveness Analysis, by Payload, 2025 to 2035

Figure 90: Europe Warehouse Robotics Market Value Share Analysis, by End-user Industry, 2024 and 2035

Figure 91: Europe Warehouse Robotics Market Attractiveness Analysis, by End-user Industry, 2025 to 2035

Figure 92: Europe Warehouse Robotics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 93: Europe Warehouse Robotics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 94: Germany Warehouse Robotics Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 95: Germany Warehouse Robotics Market Value Share Analysis, by Types, 2024 and 2035

Figure 96: Germany Warehouse Robotics Market Attractiveness Analysis, by Types, 2025 to 2035

Figure 97: Germany Warehouse Robotics Market Value Share Analysis, by Functions, 2024 and 2035

Figure 98: Germany Warehouse Robotics Market Attractiveness Analysis, by Functions, 2025 to 2035

Figure 99: Germany Warehouse Robotics Market Value Share Analysis, by Components, 2024 and 2035

Figure 100: Germany Warehouse Robotics Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 101: Germany Warehouse Robotics Market Value Share Analysis, by Payload, 2024 and 2035

Figure 102: Germany Warehouse Robotics Market Attractiveness Analysis, by Payload, 2025 to 2035

Figure 103: Germany Warehouse Robotics Market Value Share Analysis, by End-user Industry, 2024 and 2035

Figure 104: Germany Warehouse Robotics Market Attractiveness Analysis, by End-user Industry, 2025 to 2035

Figure 105: U.K. Warehouse Robotics Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 106: U.K. Warehouse Robotics Market Value Share Analysis, by Types, 2024 and 2035

Figure 107: U.K. Warehouse Robotics Market Attractiveness Analysis, by Types, 2025 to 2035

Figure 108: U.K. Warehouse Robotics Market Value Share Analysis, by Functions, 2024 and 2035

Figure 109: U.K. Warehouse Robotics Market Attractiveness Analysis, by Functions, 2025 to 2035

Figure 110: U.K. Warehouse Robotics Market Value Share Analysis, by Components, 2024 and 2035

Figure 111: U.K. Warehouse Robotics Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 112: U.K. Warehouse Robotics Market Value Share Analysis, by Payload, 2024 and 2035

Figure 113: U.K. Warehouse Robotics Market Attractiveness Analysis, by Payload, 2025 to 2035

Figure 114: U.K. Warehouse Robotics Market Value Share Analysis, by End-user Industry, 2024 and 2035

Figure 115: U.K. Warehouse Robotics Market Attractiveness Analysis, by End-user Industry, 2025 to 2035

Figure 116: France Warehouse Robotics Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 117: France Warehouse Robotics Market Value Share Analysis, by Types, 2024 and 2035

Figure 118: France Warehouse Robotics Market Attractiveness Analysis, by Types, 2025 to 2035

Figure 119: France Warehouse Robotics Market Value Share Analysis, by Functions, 2024 and 2035

Figure 120: France Warehouse Robotics Market Attractiveness Analysis, by Functions, 2025 to 2035

Figure 121: France Warehouse Robotics Market Value Share Analysis, by Components, 2024 and 2035

Figure 122: France Warehouse Robotics Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 123: France Warehouse Robotics Market Value Share Analysis, by Payload, 2024 and 2035

Figure 124: France Warehouse Robotics Market Attractiveness Analysis, by Payload, 2025 to 2035

Figure 125: France Warehouse Robotics Market Value Share Analysis, by End-user Industry, 2024 and 2035

Figure 126: France Warehouse Robotics Market Attractiveness Analysis, by End-user Industry, 2025 to 2035

Figure 127: Italy Warehouse Robotics Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 128: Italy Warehouse Robotics Market Value Share Analysis, by Types, 2024 and 2035

Figure 129: Italy Warehouse Robotics Market Attractiveness Analysis, by Types, 2025 to 2035

Figure 130: Italy Warehouse Robotics Market Value Share Analysis, by Functions, 2024 and 2035

Figure 131: Italy Warehouse Robotics Market Attractiveness Analysis, by Functions, 2025 to 2035

Figure 132: Italy Warehouse Robotics Market Value Share Analysis, by Components, 2024 and 2035

Figure 133: Italy Warehouse Robotics Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 134: Italy Warehouse Robotics Market Value Share Analysis, by Payload, 2024 and 2035

Figure 135: Italy Warehouse Robotics Market Attractiveness Analysis, by Payload, 2025 to 2035

Figure 136: Italy Warehouse Robotics Market Value Share Analysis, by End-user Industry, 2024 and 2035

Figure 137: Italy Warehouse Robotics Market Attractiveness Analysis, by End-user Industry, 2025 to 2035

Figure 138: Spain Warehouse Robotics Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 139: Spain Warehouse Robotics Market Value Share Analysis, by Types, 2024 and 2035

Figure 140: Spain Warehouse Robotics Market Attractiveness Analysis, by Types, 2025 to 2035

Figure 141: Spain Warehouse Robotics Market Value Share Analysis, by Functions, 2024 and 2035

Figure 142: Spain Warehouse Robotics Market Attractiveness Analysis, by Functions, 2025 to 2035

Figure 143: Spain Warehouse Robotics Market Value Share Analysis, by Components, 2024 and 2035

Figure 144: Spain Warehouse Robotics Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 145: Spain Warehouse Robotics Market Value Share Analysis, by Payload, 2024 and 2035

Figure 146: Spain Warehouse Robotics Market Attractiveness Analysis, by Payload, 2025 to 2035

Figure 147: Spain Warehouse Robotics Market Value Share Analysis, by End-user Industry, 2024 and 2035

Figure 148: Spain Warehouse Robotics Market Attractiveness Analysis, by End-user Industry, 2025 to 2035

Figure 149: Switzerland Warehouse Robotics Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 150: Switzerland Warehouse Robotics Market Value Share Analysis, by Types, 2024 and 2035

Figure 151: Switzerland Warehouse Robotics Market Attractiveness Analysis, by Types, 2025 to 2035

Figure 152: Switzerland Warehouse Robotics Market Value Share Analysis, by Functions, 2024 and 2035

Figure 153: Switzerland Warehouse Robotics Market Attractiveness Analysis, by Functions, 2025 to 2035

Figure 154: Switzerland Warehouse Robotics Market Value Share Analysis, by Components, 2024 and 2035

Figure 155: Switzerland Warehouse Robotics Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 156: Switzerland Warehouse Robotics Market Value Share Analysis, by Payload, 2024 and 2035

Figure 157: Switzerland Warehouse Robotics Market Attractiveness Analysis, by Payload, 2025 to 2035

Figure 158: Switzerland Warehouse Robotics Market Value Share Analysis, by End-user Industry, 2024 and 2035

Figure 159: Switzerland Warehouse Robotics Market Attractiveness Analysis, by End-user Industry, 2025 to 2035

Figure 160: The Netherlands Warehouse Robotics Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 161: The Netherlands Warehouse Robotics Market Value Share Analysis, by Types, 2024 and 2035

Figure 162: The Netherlands Warehouse Robotics Market Attractiveness Analysis, by Types, 2025 to 2035

Figure 163: The Netherlands Warehouse Robotics Market Value Share Analysis, by Functions, 2024 and 2035

Figure 164: The Netherlands Warehouse Robotics Market Attractiveness Analysis, by Functions, 2025 to 2035

Figure 165: The Netherlands Warehouse Robotics Market Value Share Analysis, by Components, 2024 and 2035

Figure 166: The Netherlands Warehouse Robotics Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 167: The Netherlands Warehouse Robotics Market Value Share Analysis, by Payload, 2024 and 2035

Figure 168: The Netherlands Warehouse Robotics Market Attractiveness Analysis, by Payload, 2025 to 2035

Figure 169: The Netherlands Warehouse Robotics Market Value Share Analysis, by End-user Industry, 2024 and 2035

Figure 170: The Netherlands Warehouse Robotics Market Attractiveness Analysis, by End-user Industry, 2025 to 2035

Figure 171: Rest of Europe Warehouse Robotics Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 172: Rest of Europe Warehouse Robotics Market Value Share Analysis, by Types, 2024 and 2035

Figure 173: Rest of Europe Warehouse Robotics Market Attractiveness Analysis, by Types, 2025 to 2035

Figure 174: Rest of Europe Warehouse Robotics Market Value Share Analysis, by Functions, 2024 and 2035

Figure 175: Rest of Europe Warehouse Robotics Market Attractiveness Analysis, by Functions, 2025 to 2035

Figure 176: Rest of Europe Warehouse Robotics Market Value Share Analysis, by Components, 2024 and 2035

Figure 177: Rest of Europe Warehouse Robotics Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 178: Rest of Europe Warehouse Robotics Market Value Share Analysis, by Payload, 2024 and 2035

Figure 179: Rest of Europe Warehouse Robotics Market Attractiveness Analysis, by Payload, 2025 to 2035

Figure 180: Rest of Europe Warehouse Robotics Market Value Share Analysis, by End-user Industry, 2024 and 2035

Figure 181: Rest of Europe Warehouse Robotics Market Attractiveness Analysis, by End-user Industry, 2025 to 2035

Figure 182: Asia Pacific Warehouse Robotics Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 183: Asia Pacific Warehouse Robotics Market Value Share Analysis, by Types, 2024 and 2035

Figure 184: Asia Pacific Warehouse Robotics Market Attractiveness Analysis, by Types, 2025 to 2035

Figure 185: Asia Pacific Warehouse Robotics Market Value Share Analysis, by Functions, 2024 and 2035

Figure 186: Asia Pacific Warehouse Robotics Market Attractiveness Analysis, by Functions, 2025 to 2035

Figure 187: Asia Pacific Warehouse Robotics Market Value Share Analysis, by Components, 2024 and 2035

Figure 188: Asia Pacific Warehouse Robotics Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 189: Asia Pacific Warehouse Robotics Market Value Share Analysis, by Payload, 2024 and 2035

Figure 190: Asia Pacific Warehouse Robotics Market Attractiveness Analysis, by Payload, 2025 to 2035

Figure 191: Asia Pacific Warehouse Robotics Market Value Share Analysis, by End-user Industry, 2024 and 2035

Figure 192: Asia Pacific Warehouse Robotics Market Attractiveness Analysis, by End-user Industry, 2025 to 2035

Figure 193: Asia Pacific Warehouse Robotics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 194: Asia Pacific Warehouse Robotics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 195: China Warehouse Robotics Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 196: China Warehouse Robotics Market Value Share Analysis, by Types, 2024 and 2035

Figure 197: China Warehouse Robotics Market Attractiveness Analysis, by Types, 2025 to 2035

Figure 198: China Warehouse Robotics Market Value Share Analysis, by Functions, 2024 and 2035

Figure 199: China Warehouse Robotics Market Attractiveness Analysis, by Functions, 2025 to 2035

Figure 200: China Warehouse Robotics Market Value Share Analysis, by Components, 2024 and 2035

Figure 201: China Warehouse Robotics Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 202: China Warehouse Robotics Market Value Share Analysis, by Payload, 2024 and 2035

Figure 203: China Warehouse Robotics Market Attractiveness Analysis, by Payload, 2025 to 2035

Figure 204: China Warehouse Robotics Market Value Share Analysis, by End-user Industry, 2024 and 2035

Figure 205: China Warehouse Robotics Market Attractiveness Analysis, by End-user Industry, 2025 to 2035

Figure 206: Japan Warehouse Robotics Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 207: Japan Warehouse Robotics Market Value Share Analysis, by Types, 2024 and 2035

Figure 208: Japan Warehouse Robotics Market Attractiveness Analysis, by Types, 2025 to 2035

Figure 209: Japan Warehouse Robotics Market Value Share Analysis, by Functions, 2024 and 2035

Figure 210: Japan Warehouse Robotics Market Attractiveness Analysis, by Functions, 2025 to 2035

Figure 211: Japan Warehouse Robotics Market Value Share Analysis, by Components, 2024 and 2035

Figure 212: Japan Warehouse Robotics Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 213: Japan Warehouse Robotics Market Value Share Analysis, by Payload, 2024 and 2035

Figure 214: Japan Warehouse Robotics Market Attractiveness Analysis, by Payload, 2025 to 2035

Figure 215: Japan Warehouse Robotics Market Value Share Analysis, by End-user Industry, 2024 and 2035

Figure 216: Japan Warehouse Robotics Market Attractiveness Analysis, by End-user Industry, 2025 to 2035

Figure 217: India Warehouse Robotics Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 218: India Warehouse Robotics Market Value Share Analysis, by Types, 2024 and 2035

Figure 219: India Warehouse Robotics Market Attractiveness Analysis, by Types, 2025 to 2035

Figure 220: India Warehouse Robotics Market Value Share Analysis, by Functions, 2024 and 2035

Figure 221: India Warehouse Robotics Market Attractiveness Analysis, by Functions, 2025 to 2035

Figure 222: India Warehouse Robotics Market Value Share Analysis, by Components, 2024 and 2035

Figure 223: India Warehouse Robotics Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 224: India Warehouse Robotics Market Value Share Analysis, by Payload, 2024 and 2035

Figure 225: India Warehouse Robotics Market Attractiveness Analysis, by Payload, 2025 to 2035

Figure 226: India Warehouse Robotics Market Value Share Analysis, by End-user Industry, 2024 and 2035

Figure 227: India Warehouse Robotics Market Attractiveness Analysis, by End-user Industry, 2025 to 2035

Figure 228: South Korea Warehouse Robotics Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 229: South Korea Warehouse Robotics Market Value Share Analysis, by Types, 2024 and 2035

Figure 230: South Korea Warehouse Robotics Market Attractiveness Analysis, by Types, 2025 to 2035

Figure 231: South Korea Warehouse Robotics Market Value Share Analysis, by Functions, 2024 and 2035

Figure 232: South Korea Warehouse Robotics Market Attractiveness Analysis, by Functions, 2025 to 2035

Figure 233: South Korea Warehouse Robotics Market Value Share Analysis, by Components, 2024 and 2035

Figure 234: South Korea Warehouse Robotics Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 235: South Korea Warehouse Robotics Market Value Share Analysis, by Payload, 2024 and 2035

Figure 236: South Korea Warehouse Robotics Market Attractiveness Analysis, by Payload, 2025 to 2035

Figure 237: South Korea Warehouse Robotics Market Value Share Analysis, by End-user Industry, 2024 and 2035

Figure 238: South Korea Warehouse Robotics Market Attractiveness Analysis, by End-user Industry, 2025 to 2035

Figure 239: Australia and New Zealand Warehouse Robotics Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 240: Australia and New Zealand Warehouse Robotics Market Value Share Analysis, by Types, 2024 and 2035

Figure 241: Australia and New Zealand Warehouse Robotics Market Attractiveness Analysis, by Types, 2025 to 2035

Figure 242: Australia and New Zealand Warehouse Robotics Market Value Share Analysis, by Functions, 2024 and 2035

Figure 243: Australia and New Zealand Warehouse Robotics Market Attractiveness Analysis, by Functions, 2025 to 2035

Figure 244: Australia and New Zealand Warehouse Robotics Market Value Share Analysis, by Components, 2024 and 2035

Figure 245: Australia and New Zealand Warehouse Robotics Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 246: Australia and New Zealand Warehouse Robotics Market Value Share Analysis, by Payload, 2024 and 2035

Figure 247: Australia and New Zealand Warehouse Robotics Market Attractiveness Analysis, by Payload, 2025 to 2035

Figure 248: Australia and New Zealand Warehouse Robotics Market Value Share Analysis, by End-user Industry, 2024 and 2035

Figure 249: Australia and New Zealand Warehouse Robotics Market Attractiveness Analysis, by End-user Industry, 2025 to 2035

Figure 250: Rest of Asia Pacific Warehouse Robotics Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 251: Rest of Asia Pacific Warehouse Robotics Market Value Share Analysis, by Types, 2024 and 2035

Figure 252: Rest of Asia Pacific Warehouse Robotics Market Attractiveness Analysis, by Types, 2025 to 2035

Figure 253: Rest of Asia Pacific Warehouse Robotics Market Value Share Analysis, by Functions, 2024 and 2035

Figure 254: Rest of Asia Pacific Warehouse Robotics Market Attractiveness Analysis, by Functions, 2025 to 2035

Figure 255: Rest of Asia Pacific Warehouse Robotics Market Value Share Analysis, by Components, 2024 and 2035

Figure 256: Rest of Asia Pacific Warehouse Robotics Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 257: Rest of Asia Pacific Warehouse Robotics Market Value Share Analysis, by Payload, 2024 and 2035

Figure 258: Rest of Asia Pacific Warehouse Robotics Market Attractiveness Analysis, by Payload, 2025 to 2035

Figure 259: Rest of Asia Pacific Warehouse Robotics Market Value Share Analysis, by End-user Industry, 2024 and 2035

Figure 260: Rest of Asia Pacific Warehouse Robotics Market Attractiveness Analysis, by End-user Industry, 2025 to 2035

Figure 261: Latin America Warehouse Robotics Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 262: Latin America Warehouse Robotics Market Value Share Analysis, by Types, 2024 and 2035

Figure 263: Latin America Warehouse Robotics Market Attractiveness Analysis, by Types, 2025 to 2035

Figure 264: Latin America Warehouse Robotics Market Value Share Analysis, by Functions, 2024 and 2035

Figure 265: Latin America Warehouse Robotics Market Attractiveness Analysis, by Functions, 2025 to 2035

Figure 266: Latin America Warehouse Robotics Market Value Share Analysis, by Components, 2024 and 2035

Figure 267: Latin America Warehouse Robotics Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 268: Latin America Warehouse Robotics Market Value Share Analysis, by Payload, 2024 and 2035

Figure 269: Latin America Warehouse Robotics Market Attractiveness Analysis, by Payload, 2025 to 2035

Figure 270: Latin America Warehouse Robotics Market Value Share Analysis, by End-user Industry, 2024 and 2035

Figure 271: Latin America Warehouse Robotics Market Attractiveness Analysis, by End-user Industry, 2025 to 2035

Figure 272: Latin America Warehouse Robotics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 273: Latin America Warehouse Robotics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 274: Brazil Warehouse Robotics Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 275: Brazil Warehouse Robotics Market Value Share Analysis, by Types, 2024 and 2035

Figure 276: Brazil Warehouse Robotics Market Attractiveness Analysis, by Types, 2025 to 2035

Figure 277: Brazil Warehouse Robotics Market Value Share Analysis, by Functions, 2024 and 2035

Figure 278: Brazil Warehouse Robotics Market Attractiveness Analysis, by Functions, 2025 to 2035

Figure 279: Brazil Warehouse Robotics Market Value Share Analysis, by Components, 2024 and 2035

Figure 280: Brazil Warehouse Robotics Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 281: Brazil Warehouse Robotics Market Value Share Analysis, by Payload, 2024 and 2035

Figure 282: Brazil Warehouse Robotics Market Attractiveness Analysis, by Payload, 2025 to 2035

Figure 283: Brazil Warehouse Robotics Market Value Share Analysis, by End-user Industry, 2024 and 2035

Figure 284: Brazil Warehouse Robotics Market Attractiveness Analysis, by End-user Industry, 2025 to 2035

Figure 285: Mexico Warehouse Robotics Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 286: Mexico Warehouse Robotics Market Value Share Analysis, by Types, 2024 and 2035

Figure 287: Mexico Warehouse Robotics Market Attractiveness Analysis, by Types, 2025 to 2035

Figure 288: Mexico Warehouse Robotics Market Value Share Analysis, by Functions, 2024 and 2035

Figure 289: Mexico Warehouse Robotics Market Attractiveness Analysis, by Functions, 2025 to 2035

Figure 290: Mexico Warehouse Robotics Market Value Share Analysis, by Components, 2024 and 2035

Figure 291: Mexico Warehouse Robotics Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 292: Mexico Warehouse Robotics Market Value Share Analysis, by Payload, 2024 and 2035

Figure 293: Mexico Warehouse Robotics Market Attractiveness Analysis, by Payload, 2025 to 2035

Figure 294: Mexico Warehouse Robotics Market Value Share Analysis, by End-user Industry, 2024 and 2035

Figure 295: Mexico Warehouse Robotics Market Attractiveness Analysis, by End-user Industry, 2025 to 2035

Figure 296: Argentina Warehouse Robotics Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 297: Argentina Warehouse Robotics Market Value Share Analysis, by Types, 2024 and 2035

Figure 298: Argentina Warehouse Robotics Market Attractiveness Analysis, by Types, 2025 to 2035

Figure 299: Argentina Warehouse Robotics Market Value Share Analysis, by Functions, 2024 and 2035

Figure 300: Argentina Warehouse Robotics Market Attractiveness Analysis, by Functions, 2025 to 2035

Figure 301: Argentina Warehouse Robotics Market Value Share Analysis, by Components, 2024 and 2035

Figure 302: Argentina Warehouse Robotics Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 303: Argentina Warehouse Robotics Market Value Share Analysis, by Payload, 2024 and 2035

Figure 304: Argentina Warehouse Robotics Market Attractiveness Analysis, by Payload, 2025 to 2035

Figure 305: Argentina Warehouse Robotics Market Value Share Analysis, by End-user Industry, 2024 and 2035

Figure 306: Argentina Warehouse Robotics Market Attractiveness Analysis, by End-user Industry, 2025 to 2035

Figure 307: Rest of Latin America Warehouse Robotics Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 308: Rest of Latin America Warehouse Robotics Market Value Share Analysis, by Types, 2024 and 2035

Figure 309: Rest of Latin America Warehouse Robotics Market Attractiveness Analysis, by Types, 2025 to 2035

Figure 310: Rest of Latin America Warehouse Robotics Market Value Share Analysis, by Functions, 2024 and 2035

Figure 311: Rest of Latin America Warehouse Robotics Market Attractiveness Analysis, by Functions, 2025 to 2035

Figure 312: Rest of Latin America Warehouse Robotics Market Value Share Analysis, by Components, 2024 and 2035

Figure 313: Rest of Latin America Warehouse Robotics Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 314: Rest of Latin America Warehouse Robotics Market Value Share Analysis, by Payload, 2024 and 2035

Figure 315: Rest of Latin America Warehouse Robotics Market Attractiveness Analysis, by Payload, 2025 to 2035

Figure 316: Rest of Latin America Warehouse Robotics Market Value Share Analysis, by End-user Industry, 2024 and 2035

Figure 317: Rest of Latin America Warehouse Robotics Market Attractiveness Analysis, by End-user Industry, 2025 to 2035

Figure 318: Middle East and Africa Warehouse Robotics Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 319: Middle East and Africa Warehouse Robotics Market Value Share Analysis, by Types, 2024 and 2035

Figure 320: Middle East and Africa Warehouse Robotics Market Attractiveness Analysis, by Types, 2025 to 2035

Figure 321: Middle East and Africa Warehouse Robotics Market Value Share Analysis, by Functions, 2024 and 2035

Figure 322: Middle East and Africa Warehouse Robotics Market Attractiveness Analysis, by Functions, 2025 to 2035

Figure 323: Middle East and Africa Warehouse Robotics Market Value Share Analysis, by Components, 2024 and 2035

Figure 324: Middle East and Africa Warehouse Robotics Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 325: Middle East and Africa Warehouse Robotics Market Value Share Analysis, by Payload, 2024 and 2035

Figure 326: Middle East and Africa Warehouse Robotics Market Attractiveness Analysis, by Payload, 2025 to 2035

Figure 327: Middle East and Africa Warehouse Robotics Market Value Share Analysis, by End-user Industry, 2024 and 2035

Figure 328: Middle East and Africa Warehouse Robotics Market Attractiveness Analysis, by End-user Industry, 2025 to 2035

Figure 329: Middle East and Africa Warehouse Robotics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 330: Middle East and Africa Warehouse Robotics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 331: GCC Countries Warehouse Robotics Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 332: GCC Countries Warehouse Robotics Market Value Share Analysis, by Types, 2024 and 2035

Figure 333: GCC Countries Warehouse Robotics Market Attractiveness Analysis, by Types, 2025 to 2035

Figure 334: GCC Countries Warehouse Robotics Market Value Share Analysis, by Functions, 2024 and 2035

Figure 335: GCC Countries Warehouse Robotics Market Attractiveness Analysis, by Functions, 2025 to 2035

Figure 336: GCC Countries Warehouse Robotics Market Value Share Analysis, by Components, 2024 and 2035

Figure 337: GCC Countries Warehouse Robotics Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 338: GCC Countries Warehouse Robotics Market Value Share Analysis, by Payload, 2024 and 2035

Figure 339: GCC Countries Warehouse Robotics Market Attractiveness Analysis, by Payload, 2025 to 2035

Figure 340: GCC Countries Warehouse Robotics Market Value Share Analysis, by End-user Industry, 2024 and 2035

Figure 341: GCC Countries Warehouse Robotics Market Attractiveness Analysis, by End-user Industry, 2025 to 2035

Figure 342: South Africa Warehouse Robotics Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 343: South Africa Warehouse Robotics Market Value Share Analysis, by Types, 2024 and 2035

Figure 344: South Africa Warehouse Robotics Market Attractiveness Analysis, by Types, 2025 to 2035

Figure 345: South Africa Warehouse Robotics Market Value Share Analysis, by Functions, 2024 and 2035

Figure 346: South Africa Warehouse Robotics Market Attractiveness Analysis, by Functions, 2025 to 2035

Figure 347: South Africa Warehouse Robotics Market Value Share Analysis, by Components, 2024 and 2035

Figure 348: South Africa Warehouse Robotics Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 349: South Africa Warehouse Robotics Market Value Share Analysis, by Payload, 2024 and 2035

Figure 350: South Africa Warehouse Robotics Market Attractiveness Analysis, by Payload, 2025 to 2035

Figure 351: South Africa Warehouse Robotics Market Value Share Analysis, by End-user Industry, 2024 and 2035

Figure 352: South Africa Warehouse Robotics Market Attractiveness Analysis, by End-user Industry, 2025 to 2035

Figure 353: Rest of Middle East and Africa Warehouse Robotics Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 354: Rest of Middle East and Africa Warehouse Robotics Market Value Share Analysis, by Types, 2024 and 2035

Figure 355: Rest of Middle East and Africa Warehouse Robotics Market Attractiveness Analysis, by Types, 2025 to 2035

Figure 356: Rest of Middle East and Africa Warehouse Robotics Market Value Share Analysis, by Functions, 2024 and 2035

Figure 357: Rest of Middle East and Africa Warehouse Robotics Market Attractiveness Analysis, by Functions, 2025 to 2035

Figure 358: Rest of Middle East and Africa Warehouse Robotics Market Value Share Analysis, by Components, 2024 and 2035

Figure 359: Rest of Middle East and Africa Warehouse Robotics Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 360: Rest of Middle East and Africa Warehouse Robotics Market Value Share Analysis, by Payload, 2024 and 2035

Figure 361: Rest of Middle East and Africa Warehouse Robotics Market Attractiveness Analysis, by Payload, 2025 to 2035

Figure 362: Rest of Middle East and Africa Warehouse Robotics Market Value Share Analysis, by End-user Industry, 2024 and 2035

Figure 363: Rest of Middle East and Africa Warehouse Robotics Market Attractiveness Analysis, by End-user Industry, 2025 to 2035