Reports

Reports

The exponential growth in the electronics industry has created significant opportunities for a host of component manufacturers. Varactor diode manufacturers have also seen demand increasing steadily in the recent past; however, reliance on quantity alone may not suffice in the long run. As devices becoming smarter and high-tech, varactor diode manufacturers are staring at a future where legacy components may become obsolete. To sustain and succeed, development of new products, through rigorous research and development, will be the key. Transparency Market Research (TMR) in its latest study, analyzes these global varactor diode market comprehensively, offering readers rare insights and analysis on how demand will evolve in the future.

The proliferation of smart devices has necessitated the need for smarter components used in the manufacturing of these devices. Component manufacturers are being hard-pressed to develop and enhance the working of varactor diodes, as they play a significant role in providing the desired capacitance changes. Device manufacturers are looking for diodes that are reliable, incur lesser cost, and generate low noise—varactor diodes more or less satisfy these requirements. Driven by their growing applicability, the varactor diode market is likely to cross US$ 800 million by the end of 2027.

The adoption of varactor diodes has substantially increased in the aerospace and defense industry too. Varactor diode manufacturers are aware of the growing opportunities, and it is highly likely that demand from aerospace and defense will translate into a larger revenue share than it does currently.

Varactor diodes mainly work on the reverse bias mode. As such, their application is limited in a few industries. On the other hand, ordinary diodes work on the forward bias mode, allowing them to have a wide range of industrial applications. Owing to this fact, varactor diode manufacturers have limited scope in which to experiment, which also limits their scope of innovation. This, in turn, is obstructing the growth of the global varactor diode market.

The semiconductor industry is keenly observing the broader developments in wireless and 5G technology. The massive investments in these technologies has already created significant opportunities for semiconductor industry in general, and varactor diode manufacturers in particular. In a bid to capitalize on these opportunities, strategic partnerships, mergers, and acquisitions are in the offing.

Recently, Movandi and NXP Semiconductors N.V. entered into a strategic partnership to collectively work on millimeter wave solutions for 5G networks. With this initiative, they will collectively deliver high-performance 5G solutions and wireless communication infrastructure for applications such as smart homes, self-driving cars, and mobile cloud-based services.

Skyworks Solutions, Inc., another prominent player in the global varactor diode market, entered into a collaboration with MediaTalk Incorporated to deliver a standard-based 5G solution.

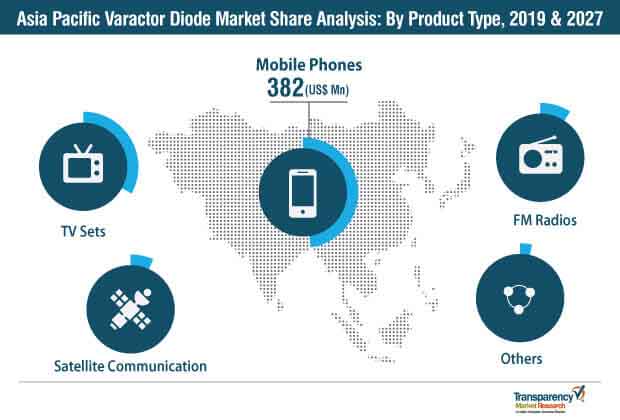

Growing demand for smartphones in China and India continue to drive demand for varactor diodes. Based on recent studies, the number of mobile phone users in Asia Pacific is projected to cross 2.8 billion by the end of 2019. Increasing Internet penetration and disposable income have meant that demand for smartphones is not going to subside anytime soon—a critical factor that can ensure sustained demand for varactor diodes in the region.

In the global varactor diode market, the competition seems moderately consolidated, as leading players in this market hold more than 50% share. However, in the coming years, the market may experience a fragmented nature due to the emergence of prominent and new players.

Key players in the market are focusing on organic and inorganic strategies that create a dynamic competitive landscape in the global varactor diode market. Innovation and geographic expansion are also some of the key focus points of players in the market. For example, Skyworks Solution Inc. acquired Avnera Corporation to expand its leadership in wireless connectivity solutions. With this acquisition, Skyworks intends to capitalize on the rapid proliferation of audio functionality and its convergence with advanced connectivity solutions.

Another example is of Infineon Technologies AG, which recently expanded its development site in Liz, Austria. With this expansion, the company will offer room for around 400 employees. Further, it will strengthen its research and development efforts in the area of high-frequency components. The company’s R&D mainly focuses on 77GHzradar chips for driver assistance systems.

Analyst Take On Varactor Diode Market Growth

Analysts of this report opine that, the global varactor diode market will experience significant growth in the coming years. The rising focus on 5G technology has opened numerous opportunities in the varactor diode market. Owing to these developments, the varactor diode market promises to stand at a higher revenue base of more than US$ 800 million by the end of 2027. Additionally, Asia Pacific and North America are likely to remain the key markets for varactor diode manufacturers, due to the high population base and development of advanced technologies, respectively. The emergence of new entrants in the market is further contributing to the diversifying growth of the varactor diode market.

Global Varactor Diode Market: Overview

A varactor diode is a semiconductor device that operates in a reverse-bias mode. A diode whose internal capacitance varies according to variations in the reverse voltage is known as a varactor diode. In a voltage-dependent device, the output of the diode depends upon the input voltage. A Varactor diode is also called a varicap diode, voltage-variable capacitance, or tuning diode. Varactor diodes are largely used in applications wherein variable capacitance is required. The global varactor diode market is anticipated to expand at a CAGR of more than 6.5% between 2019 and 2027, and reach value of more than US$ 800 Mn by the year 2027.

Varactor diodes are largely used in the filters and tuning circuits of various electronic devices such as mobile phones, TV sets, FM radios, and satellite communication equipment. These diodes are also extensively utilized in wireless system infrastructure. They play a key role in the operation of 5G technology. Varactor didoes enhance the linearity function for the high-speed applications of 5G technology. With the implementation of 5G technology and the growing use of varactor diodes in tuning circuits, the varactor diode market is estimated to expand at a significant pace during the forecast period.

The demand for varactor didoes for use in consumer electronics products such as mobile phones, TV sets, FM radios, and satellite communication equipment; and in their circuits, such as voltage-controlled oscillators, RF filters, and automatic frequency controls; is rising. This factor is expected to provide lucrative opportunities to the global varactor diode market during the forecast period. Since semiconductors form an integral part of electronic and computing products, the boom in the consumer electronics industry and the high consumption rate of mobile phones and TV sets are also driving the global varactor diode market.

Varactor diodes offer several advantages over other types of diodes. A varactor diode operates in the reverse-bias mode. In this mode, a varactor diode operates at up to 20 volts. Some diodes can operate at up to 60 volts too. Some of the key characteristics of varactor diodes are reliability (varactor diodes are more reliable than other p–n junction diodes), low noise (varactor diodes generate less noise than other diodes), low power consumption, portability (varactor diodes are small in size and easy to carry), and low price.

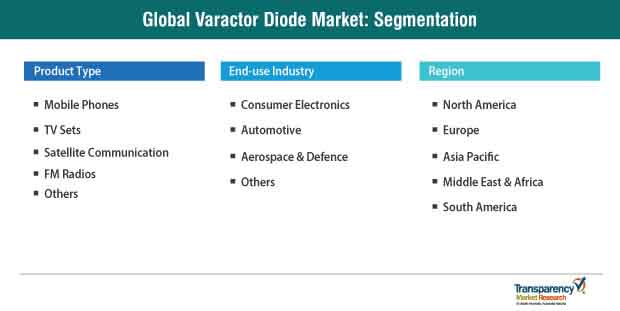

The global varactor diode market has been segmented based on product, end-use industry, and region. In terms of product, the varactor diode market has been classified into mobile phones, TV sets, FM radios, satellite communication, and others. The mobile phone segment dominated the market in 2018, due to the increasing consumption of mobile phones with varactor didoes being used in their circuits.

In terms of end-use industry, the global varactor diode market has been divided into consumer electronics, automotive, aerospace & defense, and others. The consumer electronics segment is expected to dominate the market during the forecast period, due to the increasing adoption of consumer electronic devices such as mobile phones, TV sets, and FM radios.

In terms of region, the global varactor diode market has been segmented into North America, Europe, Asia Pacific, South America, and the Middle East & Africa. Asia Pacific accounted for a major share of the global market in the year 2018. The varactor diode market in the region is driven by the strong presence of key players and high rate of adoption of consumer electronic devices in the region.

Attracted by the anticipated growth of the global varactor diode market and underlying latent demand, several players are expanding their businesses through strategic mergers and acquisitions, as well as partnerships. Some of the prominent players operating in the global varactor diode market are NXP Semiconductor, Skyworks Solution Inc., Infineon Technologies AG, Microsemi Corporation, MACOM Technology Solutions Holdings, Inc., Toshiba Corporation, On Semiconductor, ST Microelectronics, ASI Semiconductor Inc., and Murata Manufacturing Co., Ltd.

The Varactor Diode Market is studied from 2019-2027

The Varactor Diode market is projected to reach the valuation of US$ 800 million by 2027

The Varactor Diode market is expected to grow at a CAGR of 6.5% during 2019-2030

NXP Semiconductor, Skyworks Solution Inc., Infineon Technologies AG, Microsemi Corporation, MACOM Technology Solutions Holdings, Inc., Toshiba Corporation are the key vendors in the Varactor Diode market.

The key factors driving the Varactor Diode market growth are: Adoption of 5G Technology to Influence the Smarter Adoption of Varactor Diodes

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Varactor Diode Market

4. Market Overview

4.1. Introduction

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Key Trends Analysis

4.4. Global Varactor Diode Market Analysis and Forecast, 2017–2027

4.4.1. Market Revenue Projection (US$ Mn)

4.4.2. Market Volume Projection (Million Units)

4.5. Porter’s Five Forces Analysis - Global Varactor Diode Market

4.6. Value Chain Analysis - Global Varactor Diode Market

4.7. Market Outlook

5. Global Varactor Diode Market Analysis and Forecast, by Product

5.1. Overview and Definitions

5.2. Global Varactor Diode Market Size (US$ Mn and Million Units) Forecast, by Product, 2017–2027

5.2.1. Mobile Phones

5.2.1.1. VCOs

5.2.1.2. RF Filters

5.2.1.3. AFCs

5.2.1.4. Others

5.2.2. TV Sets

5.2.2.1. VCOs

5.2.2.2. RF Filters

5.2.2.3. AFCs

5.2.2.4. Others

5.2.3. Satellite Communication

5.2.3.1. VCOs

5.2.3.2. RF Filters

5.2.3.3. AFCs

5.2.3.4. Others

5.2.4. FM Radios

5.2.4.1. VCOs

5.2.4.2. RF Filters

5.2.4.3. AFCs

5.2.4.4. Others

5.2.5. Others

5.3. Product Comparison Matrix

5.4. Global Varactor Diode Market Attractiveness, by Product

6. Global Varactor Diode Market Analysis and Forecast, by End-use Industry

6.1. Overview and Definitions

6.2. Global Varactor Diode Market Size (US$ Mn and Million Units) Forecast, by End-use Industry, 2017–2027

6.2.1. Consumer Electronics

6.2.2. Automotive

6.2.3. Aerospace & Defense

6.2.4. Others

6.3. End-use Industry Comparison Matrix

6.4. Global Varactor Diode Market Attractiveness, by End-use Industry

7. Global Varactor Diode Market Analysis and Forecast, by Region

7.1. Key Findings

7.2. Global Varactor Diode Market Size (US$ Mn and Million Units) Forecast, by Region, 2017–2027

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Middle East & Africa

7.2.5. South America

7.3. Global Varactor Diode Market Attractiveness, by Region

8. North America Varactor Diode Market Analysis and Forecast

8.1. Key Findings

8.2. Key Trends

8.3. North America Varactor Diode Market Size (US$ Mn and Million Units) Forecast, by Product, 2017–2027

8.3.1. Mobile Phones

8.3.1.1. VCOs

8.3.1.2. RF Filters

8.3.1.3. AFCs

8.3.1.4. Others

8.3.2. TV Sets

8.3.2.1. VCOs

8.3.2.2. RF Filters

8.3.2.3. AFCs

8.3.2.4. Others

8.3.3. Satellite Communication

8.3.3.1. VCOs

8.3.3.2. RF Filters

8.3.3.3. AFCs

8.3.3.4. Others

8.3.4. FM Radios

8.3.4.1. VCOs

8.3.4.2. RF Filters

8.3.4.3. AFCs

8.3.4.4. Others

8.3.5. Others

8.4. North America Varactor Diode Market Size (US$ Mn and Million Units) Forecast, by End-use Industry, 2017–2027

8.4.1. Consumer Electronics

8.4.2. Automotive

8.4.3. Aerospace & Defense

8.4.4. Others

8.5. North America Varactor Diode Market Size (US$ Mn and Million Units) Forecast, by Country/Sub-region, 2017–2027

8.5.1. U.S.

8.5.2. Canada

8.5.3. Rest of North America

8.6. North America Varactor Diode Market Attractiveness Analysis

8.6.1. by Product

8.6.2. by End-use Industry

8.6.3. by Country/Sub-region

9. Europe Varactor Diode Market Analysis and Forecast

9.1. Key Findings

9.2. Key Trends

9.3. Europe Varactor Diode Market Size (US$ Mn and Million Units) Forecast, by Product, 2017–2027

9.3.1. Mobile Phones

9.3.1.1. VCOs

9.3.1.2. RF Filters

9.3.1.3. AFCs

9.3.1.4. Others

9.3.2. TV Sets

9.3.2.1. VCOs

9.3.2.2. RF Filters

9.3.2.3. AFCs

9.3.2.4. Others

9.3.3. Satellite Communication

9.3.3.1. VCOs

9.3.3.2. RF Filters

9.3.3.3. AFCs

9.3.3.4. Others

9.3.4. FM Radios

9.3.4.1. VCOs

9.3.4.2. RF Filters

9.3.4.3. AFCs

9.3.4.4. Others

9.3.5. Others

9.4. Europe Varactor Diode Market Size (US$ Mn and Million Units) Forecast, by End-use Industry, 2017–2027

9.4.1. Consumer Electronics

9.4.2. Automotive

9.4.3. Aerospace & Defense

9.4.4. Others

9.5. Europe Varactor Diode Market Size (US$ Mn and Million Units) Forecast, by Country/Sub-region, 2017–2027

9.5.1. U.K.

9.5.2. Germany

9.5.3. France

9.5.4. Rest of Europe

9.6. Europe Varactor Diode Market Attractiveness Analysis

9.6.1. by Product

9.6.2. by End-use Industry

9.6.3. by Country/Sub-region

10. Asia Pacific Varactor Diode Market Analysis and Forecast

10.1. Key Findings

10.2. Key Trends

10.3. Asia Pacific Varactor Diode Market Size (US$ Mn and Million Units) Forecast, by Product, 2017–2027

10.3.1. Mobile Phones

10.3.1.1. VCOs

10.3.1.2. RF Filters

10.3.1.3. AFCs

10.3.1.4. Others

10.3.2. TV Sets

10.3.2.1. VCOs

10.3.2.2. RF Filters

10.3.2.3. AFCs

10.3.2.4. Others

10.3.3. Satellite Communication

10.3.3.1. VCOs

10.3.3.2. RF Filters

10.3.3.3. AFCs

10.3.3.4. Others

10.3.4. FM Radios

10.3.4.1. VCOs

10.3.4.2. RF Filters

10.3.4.3. AFCs

10.3.4.4. Others

10.3.5. Others

10.4. Asia Pacific Varactor Diode Market Size (US$ Mn and Million Units) Forecast, by End-use Industry, 2017–2027

10.4.1. Consumer Electronics

10.4.2. Automotive

10.4.3. Aerospace & Defense

10.4.4. Others

10.5. Asia Pacific Varactor Diode Market Size (US$ Mn and Million Units) Forecast, by Country/Sub-region, 2017–2027

10.5.1. China

10.5.2. India

10.5.3. Japan

10.5.4. Australia

10.5.5. Rest of Asia Pacific

10.6. Asia Pacific Varactor Diode Market Attractiveness Analysis

10.6.1. by Product

10.6.2. by End-use Industry

10.6.3. by Country/Sub-region

11. Middle East & Africa (MEA) Varactor Diode Market Analysis and Forecast

11.1. Key Findings

11.2. Key Trends

11.3. Middle East & Africa (MEA) Varactor Diode Market Size (US$ Mn and Million Units) Forecast, by Product, 2017–2027

11.3.1. Mobile Phones

11.3.1.1. VCOs

11.3.1.2. RF Filters

11.3.1.3. AFCs

11.3.1.4. Others

11.3.2. TV Sets

11.3.2.1. VCOs

11.3.2.2. RF Filters

11.3.2.3. AFCs

11.3.2.4. Others

11.3.3. Satellite Communication

11.3.3.1. VCOs

11.3.3.2. RF Filters

11.3.3.3. AFCs

11.3.3.4. Others

11.3.4. FM Radios

11.3.4.1. VCOs

11.3.4.2. RF Filters

11.3.4.3. AFCs

11.3.4.4. Others

11.3.5. Others

11.4. Middle East & Africa (MEA) Varactor Diode Market Size (US$ Mn and Million Units) Forecast, by End-use Industry, 2017–2027

11.4.1. Consumer Electronics

11.4.2. Automotive

11.4.3. Aerospace & Defense

11.4.4. Others

11.5. Middle East & Africa (MEA) Varactor Diode Market Size (US$ Mn and Million Units) Forecast, by Country/Sub-region, 2017–2027

11.5.1. GCC

11.5.2. South Africa

11.5.3. Rest of Middle East & Africa

11.6. Middle East & Africa (MEA) Varactor Diode Market Attractiveness Analysis

11.6.1. by Product

11.6.2. by End-use Industry

11.6.3. by Country/Sub-region

12. South America Varactor Diode Market Analysis and Forecast

12.1. Key Findings

12.2. Key Trends

12.3. South America Varactor Diode Market Size (US$ Mn and Million Units) Forecast, by Product, 2017–2027

12.3.1. Mobile Phones

12.3.1.1. VCOs

12.3.1.2. RF Filters

12.3.1.3. AFCs

12.3.1.4. Others

12.3.2. TV Sets

12.3.2.1. VCOs

12.3.2.2. RF Filters

12.3.2.3. AFCs

12.3.2.4. Others

12.3.3. Satellite Communication

12.3.3.1. VCOs

12.3.3.2. RF Filters

12.3.3.3. AFCs

12.3.3.4. Others

12.3.4. FM Radios

12.3.4.1. VCOs

12.3.4.2. RF Filters

12.3.4.3. AFCs

12.3.5. Others

12.4. South America Varactor Diode Market Size (US$ Mn and Million Units) Forecast, by Country/Sub-region, 2017–2027

12.4.1. Brazil

12.4.2. Rest of South America

12.5. South America Varactor Diode Market Attractiveness Analysis

12.5.1. by Product

12.5.2. by End-use Industry

12.5.3. by Country/Sub-region

13. Competition Landscape

13.1. Market Players – Competition Matrix

13.2. Global Varactor Diode Market Share (%), by Company (2018)

14. Company Profiles (Details – Overview, Financials, SWOT Analysis, Strategy)

14.1. NXP Semiconductor

14.1.1. Company Description

14.1.2. Business Overview

14.1.3. Financials

14.1.4. Strategic Overview

14.2. Skyworks Solution Inc.

14.2.1. Company Description

14.2.2. Business Overview

14.2.3. Financials

14.2.4. Strategic Overview

14.3. Infineon Technologies AG

14.3.1. Company Description

14.3.2. Business Overview

14.3.3. Financials

14.3.4. Strategic Overview

14.4. Microsemi Corporation

14.4.1. Company Description

14.4.2. Business Overview

14.4.3. Financials

14.4.4. Strategic Overview

14.5. MACOM Technology Solutions Holdings, Inc.

14.5.1. Company Description

14.5.2. Business Overview

14.5.3. Financials

14.5.4. Strategic Overview

14.6. Toshiba Corporation

14.6.1. Company Description

14.6.2. Business Overview

14.6.3. Financials

14.6.4. Strategic Overview

14.7. On Semiconductor

14.7.1. Company Description

14.7.2. Business Overview

14.7.3. Financials

14.7.4. Strategic Overview

14.8. ST Microelectronics

14.8.1. Company Description

14.8.2. Business Overview

14.8.3. Financials

14.8.4. Strategic Overview

14.9. ASI Semiconductor Inc.

14.9.1. Company Description

14.9.2. Business Overview

14.9.3. Financials

14.9.4. Strategic Overview

14.10. Murata Manufacturing Co., Ltd

14.10.1. Company Details

14.10.2. Company Description

14.10.3. Business Overview

14.10.4. Financials

14.10.5. Strategic Overview

15. Key Takeaways

List of Table

Table 01: Global Varactor Diode Market Revenue (US$ Mn) Forecast, by Product, 2017–2027

Table 02: Global Varactor Diode Market Volume (Million Units) Forecast, by Product, 2017–2027

Table 03: Global Varactor Diode Market Revenue (US$ Mn) Forecast, by Product, Mobile Phones, 2017–2027

Table 04: Global Varactor Diode Market Volume (Million Units) Forecast, by Product, Mobile Phones, 2017–2027

Table 05: Global Varactor Diode Market Revenue (US$ Mn) Forecast, by Product, TV Sets, 2017–2027

Table 06: Global Varactor Diode Market Volume (Million Units) Forecast, by Product, TV Sets, 2017–2027

Table 07: Global Varactor Diode Market Revenue (US$ Mn) Forecast, by Product, Satellite Communication, 2017–2027

Table 08: Global Varactor Diode Market Volume (Million Units) Forecast, by Product, Satellite Communication, 2017–2027

Table 09: Global Varactor Diode Market Revenue (US$ Mn) Forecast, by Product, FM Radios, 2017–2027

Table 10: Global Varactor Diode Market Volume (Million Units) Forecast, by Product, FM Radios, 2017–2027

Table 11: Global Varactor Diode Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017–2027

Table 12: Global Varactor Diode Market Volume (Million Units) Forecast, by End-use Industry, 2017–2027

Table 13: Global Varactor Diode Market Revenue (US$ Mn) Forecast, by Region, 2017–2027

Table 14: Global Varactor Diode Market Volume (Million Units) Forecast, by Region, 2017–2027

Table 15: North America Varactor Diode Market Revenue (US$ Mn) Forecast, by Product, 2017–2027

Table 16: North America Varactor Diode Market Volume (Million Units) Forecast, by Product, 2017–2027

Table 17: North America Varactor Diode Market Revenue (US$ Mn) Forecast, by Product, Mobile Phones, 2017–2027

Table 18: North America Varactor Diode Market Volume (Million Units) Forecast, by Product, Mobile Phones, 2017–2027

Table 19: North America Varactor Diode Market Revenue (US$ Mn) Forecast, by Product, TV Sets, 2017–2027

Table 20: North America Varactor Diode Market Volume (Million Units) Forecast, by Product, TV Sets, 2017–2027

Table 21: North America Varactor Diode Market Revenue (US$ Mn) Forecast, by Product, Satellite Communication, 2017–2027

Table 22: North America Varactor Diode Market Volume (Million Units) Forecast, by Product, Satellite Communication, 2017–2027

Table 23: North America Varactor Diode Market Revenue (US$ Mn) Forecast, by Product, FM Radios, 2017–2027

Table 24: North America Varactor Diode Market Volume (Million Units) Forecast, by Product, FM Radios, 2017–2027

Table 25: North America Varactor Diode Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017–2027

Table 26: North America Varactor Diode Market Volume (Million Units) Forecast, by End-use Industry, 2017–2027

Table 27: North America Varactor Diode Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 28: North America Varactor Diode Market Volume (Million Units) Forecast, by Country/Sub-region, 2017–2027

Table 29: Europe Varactor Diode Market Revenue (US$ Mn) Forecast, by Product, 2017–2027

Table 30: Europe Varactor Diode Market Volume (Million Units) Forecast, by Product, 2017–2027

Table 31: Europe Varactor Diode Market Revenue (US$ Mn) Forecast, by Product, Mobile Phones, 2017–2027

Table 32: Europe Varactor Diode Market Volume (Million Units) Forecast, by Product, Mobile Phones, 2017–2027

Table 33: Europe Varactor Diode Market Revenue (US$ Mn) Forecast, by Product, TV Sets, 2017–2027

Table 34: Europe Varactor Diode Market Volume (Million Units) Forecast, by Product, TV Sets, 2017–2027

Table 35: Europe Varactor Diode Market Revenue (US$ Mn) Forecast, by Product, Satellite Communication, 2017–2027

Table 36: Europe Varactor Diode Market Volume (Million Units) Forecast, by Product, Satellite Communication, 2017–2027

Table 37: Europe Varactor Diode Market Revenue (US$ Mn) Forecast, by Product, FM Radios, 2017–2027

Table 38: Europe Varactor Diode Market Volume (Million Units) Forecast, by Product, FM Radios, 2017–2027

Table 39: Europe Varactor Diode Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017–2027

Table 40: Europe Varactor Diode Market Volume (Million Units) Forecast, by End-use Industry, 2017–2027

Table 41: Europe Varactor Diode Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 42: Europe Varactor Diode Market Volume (Million Units) Forecast, by Country/Sub-region, 2017–2027

Table 43: Asia Pacific Varactor Diode Market Revenue (US$ Mn) Forecast, by Product, 2017–2027

Table 44: Asia Pacific Varactor Diode Market Volume (Million Units) Forecast, by Product, 2017–2027

Table 45: Asia Pacific Varactor Diode Market Revenue (US$ Mn) Forecast, by Product, Mobile Phones, 2017–2027

Table 46: Asia Pacific Varactor Diode Market Volume (Million Units) Forecast, by Product, Mobile Phones, 2017–2027

Table 47: Asia Pacific Varactor Diode Market Revenue (US$ Mn) Forecast, by Product, TV Sets, 2017–2027

Table 48: Asia Pacific Varactor Diode Market Volume (Million Units) Forecast, by Product, TV Sets, 2017–2027

Table 49: Asia Pacific Varactor Diode Market Revenue (US$ Mn) Forecast, by Product, Satellite Communication, 2017–2027

Table 50: Asia Pacific Varactor Diode Market Volume (Million Units) Forecast, by Product, Satellite Communication, 2017–2027

Table 51: Asia Pacific Varactor Diode Market Revenue (US$ Mn) Forecast, by Product, FM Radios, 2017–2027

Table 52: Asia Pacific Varactor Diode Market Volume (Million Units) Forecast, by Product, FM Radios, 2017–2027

Table 53: Asia Pacific Varactor Diode Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017–2027

Table 54: Asia Pacific Varactor Diode Market Volume (Million Units) Forecast, by End-use Industry, 2017–2027

Table 55: Asia Pacific Varactor Diode Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 56: Asia Pacific Varactor Diode Market Volume (Million Units) Forecast, by Country/Sub-region, 2017–2027

Table 57: Middle East & Africa Varactor Diode Market Revenue (US$ Mn) Forecast, by Product, 2017–2027

Table 58: Middle East & Africa Varactor Diode Market Volume (Million Units) Forecast, by Product, 2017–2027

Table 59: Middle East & Africa Varactor Diode Market Revenue (US$ Mn) Forecast, by Product, Mobile Phones, 2017–2027

Table 60: Middle East & Africa Varactor Diode Market Volume (Million Units) Forecast, by Product, Mobile Phones, 2017–2027

Table 61: Middle East & Africa Varactor Diode Market Revenue (US$ Mn) Forecast, by Product, TV Sets, 2017–2027

Table 62: Middle East & Africa Varactor Diode Market Volume (Million Units) Forecast, by Product, TV Sets, 2017–2027

Table 63: Middle East & Africa Varactor Diode Market Revenue (US$ Mn) Forecast, by Product, Satellite Communication, 2017–2027

Table 64: Middle East & Africa Varactor Diode Market Volume (Million Units) Forecast, by Product, Satellite Communication, 2017–2027

Table 65: Middle East & Africa Varactor Diode Market Revenue (US$ Mn) Forecast, by Product, FM Radios, 2017–2027

Table 66: Middle East & Africa Varactor Diode Market Volume (Million Units) Forecast, by Product, FM Radios, 2017–2027

Table 67: Middle East & Africa Varactor Diode Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017–2027

Table 68: Middle East & Africa Varactor Diode Market Volume (Million Units) Forecast, by End-use Industry, 2017–2027

Table 69: Middle East & Africa Varactor Diode Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 70: Middle East & Africa Varactor Diode Market Volume (Million Units) Forecast, by Country/Sub-region, 2017–2027

Table 71: South America Varactor Diode Market Revenue (US$ Mn) Forecast, by Product, 2017–2027

Table 72: South America Varactor Diode Market Volume (Million Units) Forecast, by Product, 2017–2027

Table 73: South America Varactor Diode Market Revenue (US$ Mn) Forecast, by Product, Mobile Phones, 2017–2027

Table 74: South America Varactor Diode Market Volume (Million Units) Forecast, by Product, Mobile Phones, 2017–2027

Table 75: South America Varactor Diode Market Revenue (US$ Mn) Forecast, by Product, TV Sets, 2017–2027

Table 76: South America Varactor Diode Market Volume (Million Units) Forecast, by Product, TV Sets, 2017–2027

Table 77: South America Varactor Diode Market Revenue (US$ Mn) Forecast, by Product, Satellite Communication, 2017–2027

Table 78: South America Varactor Diode Market Volume (Million Units) Forecast, by Product, Satellite Communication, 2017–2027

Table 79: South America Varactor Diode Market Revenue (US$ Mn) Forecast, by Product, FM Radios, 2017–2027

Table 80: South America Varactor Diode Market Volume (Million Units) Forecast, by Product, FM Radios, 2017–2027

Table 81: South America Varactor Diode Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017–2027

Table 82: South America Varactor Diode Market Volume (Million Units) Forecast, by End-use Industry, 2017–2027

Table 83: South America Varactor Diode Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 84: South America Varactor Diode Market Volume (Million Units) Forecast, by Country/Sub-region, 2017–2027

List of Figure

Figure 01: Global Varactor Diode Market Revenue (US$ Mn) Forecast and Y-o-Y Growth Projection, 2017–2027

Figure 02: Global Varactor Diode Market Volume (Million Units) Forecast and Y-o-Y Growth Projection, 2017–2027

Figure 03: Porter’s Five Forces Analysis

Figure 04: Value Chain Analysis

Figure 05: Global Varactor Diode Market Revenue (US$ Mn)

Figure 06: Global Varactor Diode Market, by Product (2019)

Figure 07: Global Varactor Diode Market, by End-use Industry (2019)

Figure 08: Global Varactor Diode Market Value Share Analysis, by Product, 2019 and 2027

Figure 09: Global Varactor Diode Market, by Product, Mobile Phones

Figure 10: Global Varactor Diode Market, by Product, TV Sets

Figure 11: Global Varactor Diode Market, by Product, Satellite Communication

Figure 12: Global Varactor Diode Market, by Product, FM Radios

Figure 13: Global Varactor Diode Market, by Product, Others

Figure 14: Segment Growth Matrix, 2019–2027 (%)

Figure 15: Segment Revenue Contribution, 2019–2027 (%)

Figure 16: Segment Compounded Growth Matrix (CAGR %)

Figure 17: Global Varactor Diode Market Attractiveness Analysis, by Product

Figure 18: Global Varactor Diode Market Value Share Analysis, by End-use Industry, 2019 and 2027

Figure 19: Global Varactor Diode Market, by End-use Industry, Consumer Electronics

Figure 20: Global Varactor Diode Market, by End-use Industry, Automotive

Figure 21: Global Varactor Diode Market, by End-use Industry, Aerospace & Defense

Figure 22: Global Varactor Diode Market, by End-use Industry, Others

Figure 23: Segment Growth Matrix, 2019–2027 (%)

Figure 24: Segment Revenue Contribution, 2019–2027 (%)

Figure 25: Segment Compounded Growth Matrix (CAGR %)

Figure 26: Global Varactor Diode Market Attractiveness Analysis, by End-use Industry

Figure 27: Global Varactor Diode Market, by Region, North America

Figure 28: Global Varactor Diode Market, by Region, Europe

Figure 29: Global Varactor Diode Market, by Region, Asia Pacific

Figure 30: Global Varactor Diode Market, by Region, Middle East & Africa

Figure 31: Global Varactor Diode Market, by Region, South America

Figure 32: Global Varactor Diode Market Attractiveness Analysis, by Region

Figure 33: North America Varactor Diode Market Revenue (US$ Mn) Forecast, 2017–2027

Figure 34: North America Varactor Diode Market Revenue Y-o-Y Growth Projection, 2017–2027

Figure 35: North America Varactor Diode Market Volume (Million Units) Forecast, 2017–2027

Figure 36: North America Varactor Diode Market Volume Y-o-Y Growth Projection, 2017–2027

Figure 37: North America Varactor Diode Market Value Share Analysis, by Product, 2019 and 2027

Figure 38: North America Varactor Diode Market Value Share Analysis, by End-use Industry, 2019 and 2027

Figure 39: North America Varactor Diode Market Value Share Analysis, by Country/Sub-region, 2018 and 2026

Figure 40: North America Varactor Diode Market Attractiveness Analysis, by Product

Figure 41: North America Varactor Diode Market Attractiveness Analysis, by End-use Industry

Figure 42: North America Varactor Diode Market Attractiveness Analysis, by Country/Sub-region

Figure 43: Europe Varactor Diode Market Revenue (US$ Mn) Forecast, 2017–2027

Figure 44: Europe Varactor Diode Market Revenue Y-o-Y Growth Projection, 2017–2027

Figure 45: Europe Varactor Diode Market Volume (Million Units) Forecast, 2017–2027

Figure 46: Europe Varactor Diode Market Volume Y-o-Y Growth Projection, 2017–2027

Figure 47: Europe Varactor Diode Market Value Share Analysis, by Product, 2019 and 2027

Figure 48: Europe Varactor Diode Market Value Share Analysis, by End-use Industry, 2019 and 2027

Figure 49: Europe Varactor Diode Market Value Share Analysis, by Country/Sub-region, 2018 and 2026

Figure 50: Europe Varactor Diode Market Attractiveness Analysis, by Product

Figure 51: Europe Varactor Diode Market Attractiveness Analysis, by End-use Industry

Figure 52: Europe Varactor Diode Market Attractiveness Analysis, by Country/Sub-region

Figure 53: Asia Pacific Varactor Diode Market Revenue (US$ Mn) Forecast, 2017–2027

Figure 54: Asia Pacific Varactor Diode Market Revenue Y-o-Y Growth Projection, 2017–2027

Figure 55: Asia Pacific Varactor Diode Market Volume (Million Units) Forecast, 2017–2027

Figure 56: Asia Pacific Varactor Diode Market Volume Y-o-Y Growth Projection, 2017–2027

Figure 57: Asia Pacific Varactor Diode Market Value Share Analysis, by Product, 2019 and 2027

Figure 58: Asia Pacific Varactor Diode Market Value Share Analysis, by End-use Industry, 2019 and 2027

Figure 59: Asia Pacific Varactor Diode Market Value Share Analysis, by Country/Sub-region, 2018 and 2026

Figure 60: Asia Pacific Varactor Diode Market Attractiveness Analysis, by Product

Figure 61: Asia Pacific Varactor Diode Market Attractiveness Analysis, by End-use Industry

Figure 62: Asia Pacific Varactor Diode Market Attractiveness Analysis, by Country/Sub-region Product

Figure 63: Middle East & Africa Varactor Diode Market Revenue (US$ Mn) Forecast, 2017–2027

Figure 64: Middle East & Africa Varactor Diode Market Revenue Y-o-Y Growth Projection, 2017–2027

Figure 65: Middle East & Africa Varactor Diode Market Volume (Million Units) Forecast, 2017–2027

Figure 66: Middle East & Africa Varactor Diode Market Volume Y-o-Y Growth Projection, 2017–2027

Figure 67: Middle East & Africa Varactor Diode Market Value Share Analysis, by Product, 2019 and 2027

Figure 68: Middle East & Africa Varactor Diode Market Value Share Analysis, by End-use Industry, 2019 and 2027

Figure 69: Middle East & Africa Varactor Diode Market Value Share Analysis, by Country/Sub-region, 2018 and 2026

Figure 70: Middle East & Africa Varactor Diode Market Attractiveness Analysis, by Product

Figure 71: Middle East & Africa Varactor Diode Market Attractiveness Analysis, by End-use Industry

Figure 72: Middle East & Africa Varactor Diode Market Attractiveness Analysis, by Country/Sub-region

Figure 73: South America Varactor Diode Market Revenue (US$ Mn) Forecast, 2017–2027

Figure 74: South America Varactor Diode Market Revenue Y-o-Y Growth Projection, 2017–2027

Figure 75: South America Varactor Diode Market Volume (Million Units) Forecast, 2017–2027

Figure 76: South America Varactor Diode Market Volume Y-o-Y Growth Projection, 2017–2027

Figure 77: South America Varactor Diode Market Value Share Analysis, by Product, 2019 and 2027

Figure 78: South America Varactor Diode Market Value Share Analysis, by End-use Industry, 2019 and 2027

Figure 79: South America Varactor Diode Market Value Share Analysis, by Country/Sub-region, 2018 and 2026

Figure 80: South America Varactor Diode Market Attractiveness Analysis, by Product

Figure 81: South America Varactor Diode Market Attractiveness Analysis, by End-use Industry

Figure 82: South America Varactor Diode Market Attractiveness Analysis, by Country/Sub-region Product

Figure 83: Global Varactor Diode Market Share Analysis, by Company