Reports

Reports

The US caps & closures market is anticipated to observe humungous growth in the forecast period of 2016-2024 owing to the rising demand for non-carbonated beverages across the United States. The growing popularity of single-serving containers is also expected to boost the growth prospects of the US caps & closures market. Many manufacturers across various industries are preferring plastic over metal or glass packaging. Hence, this can prove to be a growth multiplier for the US caps & closures market.

There has been a spike in the recent rate of consumption of single-serve beverages. The growth in their demand is currently the leading factor driving the market for caps and closures for non-carbonated beverages in the U.S. The demand for these caps and closures is also specifically on the rise due to a growing aversion to carbonated beverages amid the growing obesity crisis. The increasing number of consumers demanding smaller bottles and convenience packaging is also driving the U.S. caps and closures market for non-carbonated beverages. The market is also being spurred by the increasing favorability of seasonal beverages. However, the U.S. caps and closures market for non-carbonated beverages is currently being restricted by the high costs of replacing manufacturing equipment and the switching costs associated with changing from two piece to one piece caps. Conventional manufacturers are also facing a solid competition from closure-less packaging. The U.S. caps and closures market for non-carbonated beverages is also being restricted by the stringent regulations by FDA and the high number of cases against companies regarding sealing breaches.

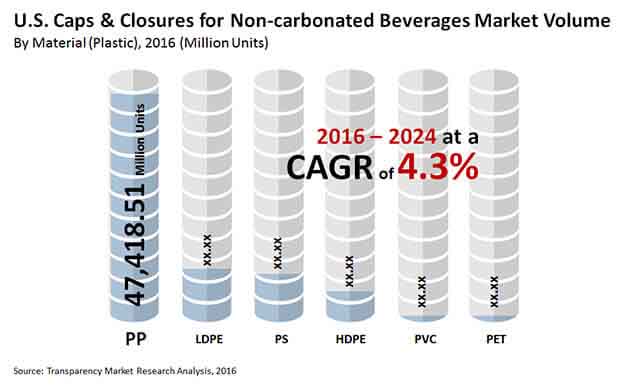

The U.S. caps and closures for noncarbonated beverages market was valued at around US$2.64 bn in 2016, registering a CAGR of 4.3% over 2016 to 2024. By the end of 2024, this revenue is expected to reach US$3.82 bn.

Among material types used in the manufacture of caps and closures for non-carbonated beverages in the U.S., polypropylene accounted for leading market share of 60.2% in 2016 and is expected to retain its lead as well as gain a maximum incremental opportunity in terms of market revenue over the coming years. However, HDPE is anticipated to witness the leading CAGR of 13% over the forecast period from 2016 to 2024, due to the cost advantages of HDPE over others as well as its easier availability, and the increasing adoption of HDPE one piece injection-molded closures.

The U.S. caps and closures market for non-carbonated beverages is segmented on the basis of cap types, into screw caps, snap on caps, and push on caps. On the basis of material, the market is segmented into polypropylene, low density polyethylene, high density polyethylene, polyvinyl chloride and polyethylene terephthalate. On the basis of application, the U.S. caps and closures market for non-carbonated beverages is segmented into bottled water, fruit beverages, ready-to-drink milk, sports beverages, and others.

The bottled water segment is estimated to account for the leading share in the U.S. caps and closures market for non-carbonated beverages in 2016, and is anticipated to expand at a CAGR of 6.1% over the given forecast period. Bottled water is expected to witness maximum increase in basis points during the forecast period, expectedly accounting for 69.3% of the U.S. caps and closures market for non-carbonated beverages by 2024. The ready to drink segment was calculated to account for 8.4% in 2016 and is expected to expand at a CAGR of 9.8% from 2016 to 2024.

Key players in the U.S. caps and closure market for non-carbonated beverages so far have included Closure Systems International, Inc., Silgan Plastic Closure Solutions, Bericap GmbH and Co KG, Global Closure Systems, AptarGroup, Inc., Berry Plastics Group, Inc., Amcor Limited, O.Berk Company, LLC, Blackhawk Molding Co. Inc., and Tecnocap S.p.A.

1. Executive Summary

2. Research Methodology

3. Assumptions and Acronyms Used

4. Market Introduction

5. Market Dynamics

5.1. Drivers

5.3. Restraints

5.4. Trends

5.5. Opportunity

5.6. Quality Assurance factors

5.5. Consumer Survey Analysis

6. U.S. Caps and Closures Market For Non-Carbonated Beverages Overview

6.1. U.S Caps & Closures for Non-Carbonated beverages market analysis by Cap Type

6.2. U.S. Caps & Closures for Non-carbonated Beverages Market Value (US$ Mn) and Volume (Million Units), 2015–2024

6.3. Market Consumption Growth By Material Type

6.3. Market Consumption Growth By Application

7. U.S. Caps and Closures Market For Non-Carbonated Beverages: Screw Caps Analysis

7.1. Supply Side Survey

7.2. U.S. Screw Caps & Closures for Non-carbonated Beverages Market Value (US$ Mn) and Volume (Million Units), 2015–2024

7.3. U.S. Screw Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity (US$ Mn), 2016?2024

7.4. Basis Point Share (BPS) Analysis, By Material

7.5. Y-o-Y Growth Projections, By Material

7.6. U.S. Screw Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity, by Material, 2016–2024

7.6.1. PP

7.6.2. LDPE

7.6.3. PS

7.6.4. HDPE

7.6.5. PVC

7.6.6. PET

7.7. Market Attractiveness Analysis, by Material

7.8. Basis Point Share (BPS) Analysis, By Application

7.9. Y-o-Y Growth Projections, By Application

7.10. U.S. Screw Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity, by Application, 2016–2024

7.10.1. Bottled Water

7.10.2. Fruit beverages

7.10.3. Ready to drink

7.10.4. Milk

7.10.5. Sports beverages

7.10.6. Others

7.11. Market Attractiveness Analysis, by Application

8. U.S. Caps and Closures Market For Non-Carbonated Beverages: Snap On Caps Analysis

8.1. Supply Side Survey

8.2. U.S. Snap On Caps & Closures for Non-carbonated Beverages Market Value (US$ Mn) and Volume (Million Units), 2015–2024

8.3. U.S. Snap On Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity (US$ Mn), 2016?2024

8.4. Basis Point Share (BPS) Analysis, By Material

8.5. Y-o-Y Growth Projections, By Material

8.6. U.S. Snap On Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity, by Material, 2016–2024

8.6.1. PP

8.6.2. LDPE

8.6.3. PS

8.6.4. HDPE

8.6.5. PVC

8.6.6. PET

8.7. Market Attractiveness Analysis, by Material

8.8. Basis Point Share (BPS) Analysis, By Application

8.9. Y-o-Y Growth Projections, By Application

8.10. U.S. Snap On Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity, by Application, 2016–2024

8.10.1. Bottled Water

8.10.2. Fruit beverages

8.10.3. Ready to drink

8.10.4. Milk

8.10.5. Sports beverages

8.10.6. Others

8.11. Market Attractiveness Analysis, by Application

9. U.S. Caps and Closures Market For Non - Carbonated Beverages: Push On Caps Analysis

9.1. Supply Side Survey

9.2. U.S. Push On Caps & Closures for Non-carbonated Beverages Market Value (US$ Mn) and Volume (Million Units), 2015–2024

9.3. U.S. Push On Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity (US$ Mn), 2016?2024

9.4. Basis Point Share (BPS) Analysis, By Material

9.5. Y-o-Y Growth Projections, By Material

9.6. U.S. Push On Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity, by Material, 2016–2024

9.6.1. PP

9.6.2. LDPE

9.6.3. PS

9.6.4. HDPE

9.6.5. PVC

9.6.6. PET

9.7. Market Attractiveness Analysis, by Material

9.8. Basis Point Share (BPS) Analysis, By Application

9.9. Y-o-Y Growth Projections, By Application

9.10. U.S. Push On Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity, by Application, 2016–2024

9.10.1. Bottled Water

9.10.2. Fruit beverages

9.10.3. Ready to drink

9.10.4. Milk

9.10.5. Sports beverages

9.10.6. Others

9.11. Market Attractiveness Analysis, by Application

10. Competition Dashboard

10.1. Market Share Analysis, By Company

10.2. Company Profiles (Details – Overview, Financials, Strategy, Recent Developments, SWOT analysis)

10.2.1. Closure Systems International, Inc.

Overview

Financials

Strategy

Recent Developments

SWOT Analysis

10.2.2. Silgan Plastic Closure Solutions

Overview

Financials

Strategy

Recent Developments

SWOT Analysis

10.2.3. Bericap GmbH and Co KG

Overview

Financials

Strategy

Recent Developments

SWOT Analysis

10.2.4. Global Closure Systems

Overview

Financials

Strategy

Recent Developments

SWOT Analysis

10.2.5. AptarGroup, Inc.

Overview

Financials

Strategy

Recent Developments

SWOT Analysis

10.2.6. Berry Plastics Group, Inc.

Overview

Financials

Strategy

Recent Developments

SWOT Analysis

10.2.7. Amcor Limited

Overview

Financials

Strategy

Recent Developments

SWOT Analysis

10.2.8. O.Berk Company, LLC

Overview

Financials

Strategy

Recent Developments

SWOT Analysis

10.2.9. Blackhawk Molding Co. Inc.

Overview

Financials

Strategy

Recent Developments

SWOT Analysis

10.2.10. Tecnocap S.p.A.

Overview

Financials

Strategy

Recent Developments

SWOT Analysis

List of Tables

Table 01: U.S. Screw Caps & Closures for Non-carbonated Beverages Market Size (US$ Mn) and Volume (Million Units), by Material (Plastic), 2015–2024

Table 02: U.S. Screw Caps & Closures for Non-carbonated Beverages Market Size (US$ Mn) and Volume (Million Units) by Application, 2015–2024

Table 03: U.S. Snap On Caps & Closures for Non-carbonated Beverages Market Size (US$ Mn) and Volume (Million Units), by Material (Plastic), 2015–2024

Table 04: U.S. Snap On Caps & Closures for Non-carbonated Beverages Market Size (US$ Mn) and Volume (Million Units) by Application, 2015–2024

Table 05: U.S. Push On Caps & Closures for Non-carbonated Beverages Market Size (US$ Mn) and Volume (Million Units), by Material (Plastic), 2015–2024

Table 06: U.S. Push On Caps & Closures for Non-carbonated Beverages Market Size (US$ Mn) and Volume (Million Units) by Application, 2015–2024

List of Figures

Figure 01: U.S. Screw Caps & Closures for Non-carbonated Beverages Market Value (US$ Mn) and Volume (Million Units), 2015–2024

Figure 02: U.S. Screw Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity (US$ Mn), 2016?2024

Figure 03: U.S. Screw Caps & Closures for Non-Carbonated Beverages in U.S. Value Share (%) and BPS Analysis by Material Type (Plastic) 2016 & 2024

Figure 04: U.S. Screw Caps & Closures for Non-carbonated Beverages Market Y-o-Y Growth, by Material (Plastic), 2015–2024

Figure 05: U.S. Screw Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity, by PP, 2016–2024

Figure 06: U.S. Screw Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity, by LDPE, 2016–2024

Figure 07: U.S. Screw Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity, by PS, 2016–2024

Figure 08: U.S. Screw Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity, by HDPE, 2016–2024

Figure 09: U.S. Screw Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity, by PVC, 2016–2024

Figure 10: U.S. Screw Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity, by PET, 2016–2024

Figure 11: U.S. Screw Caps & Closures for Non-carbonated Beverages Market Attractiveness, by Material (Plastic), 2016–2024

Figure 12: U.S. Screw Caps & Closures for Non-carbonated Beverages Market Value Share (%) and BPS Analysis, by Application, 2016 & 2024

Figure 13: U.S. Screw Caps & Closures for Non-carbonated Beverages Market Y-o-Y Growth, by Application, 2015–2024

Figure 14: U.S. Screw Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity by Bottled water segment, 2016-2024

Figure 15: U.S. Screw Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity by Fruit beverages segment, 2016-2024

Figure 16: U.S. Screw Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity, by Ready to Drink, 2016–2024

Figure 17: U.S. Screw Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity, by Milk, 2016–2024

Figure 18: U.S. Screw Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity, by Sport Beverages, 2016–2024

Figure 19: U.S. Screw Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity, by Others, 2016–2024

Figure 20: U.S. Screw Caps & Closures for Non-carbonated Beverages Market Attractiveness, by Application, 2016–2024

Figure 21: U.S. Snap On Caps & Closures for Non-carbonated Beverages Market Value (US$ Mn) and Volume (Million Units), 2015–2024

Figure 22: U.S. Snap On Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity (US$ Mn), 2016?2024

Figure 23: U.S. Snap On Caps & Closures for Non-carbonated Beverages Market Value Share (%) and BPS Analysis, by Material (Plastic), 2016 & 2024

Figure 24: U.S. Snap On Caps & Closures for Non-carbonated Beverages Market Y-o-Y Growth, by Material (Plastic), 2015–2024

Figure 25: U.S. Snap On Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity, by PP, 2016–2024

Figure 26: U.S. Snap On Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity, by LDPE, 2016–2024

Figure 27: U.S. Snap On Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity, by PS, 2016–2024

Figure 28: U.S. Snap On Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity, by HDPE, 2016–2024

Figure 29: U.S. Snap On Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity, by PVC, 2016–2024

Figure 30: U.S. Snap On Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity, by PET, 2016–2024

Figure 31: U.S. Snap On Caps & Closures for Non-carbonated Beverages Market Attractiveness, by Material (Plastic), 2016–2024

Figure 32: U.S. Snap On Caps & Closures for Non-carbonated Beverages Market Value Share (%) and BPS Analysis, by Application, 2016 & 2024

Figure 33: U.S. Snap On Caps & Closures for Non-carbonated Beverages Market Y-o-Y Growth, by Application, 2015–2024

Figure 34: U.S. Snap On Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity, by Bottled Water, 2016–2024

Figure 35: U.S. Screw Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity, by Fruit Beverages, 2016–2024

Figure 36: U.S. Snap On Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity, by Ready to Drink, 2016–2024

Figure 37: U.S. Snap On Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity, by Milk, 2016–2024

Figure 38: U.S. Snap On Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity, by Sport Beverages, 2016–2024

Figure 39: U.S. Snap On Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity, by Others, 2016–2024

Figure 40: U.S. Snap On Caps & Closures for Non-carbonated Beverages Market Attractiveness by Application, 2016–2024

Figure 41: U.S. Push On Caps & Closures for Non-carbonated Beverages Market Value (US$ Mn) and Volume (Million Units), 2015–2024

Figure 42: U.S. Push On Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity (US$ Mn), 2016?2024

Figure 43: U.S. Push On Caps & Closures for Non-carbonated Beverages Market Value Share (%) and BPS Analysis, by Material (Plastic), 2016 & 2024

Figure 44: U.S. Push On Caps & Closures for Non-carbonated Beverages Market Y-o-Y Growth, by Material (Plastic), 2015–2024

Figure 45: U.S. Push On Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity, by PP, 2016–2024

Figure 46: U.S. Push On Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity, by LDPE, 2016–2024

Figure 47: U.S. Push On Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity, by PS, 2016–2024

Figure 48: U.S. Push On Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity, by HDPE, 2016–2024

Figure 49: U.S. Push On Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity, by PVC, 2016–2024

Figure 50: U.S. Push On Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity, by PET, 2016–2024

Figure 51: U.S. Push On Caps & Closures for Non-carbonated Beverages Market Attractiveness, by Material (Plastic), 2016–2024

Figure 52: U.S. Push On Caps & Closures for Non-carbonated Beverages Market Value Share (%) and BPS Analysis, by Application, 2016 & 2024

Figure 53: U.S. Push On Caps & Closures for Non-carbonated Beverages Market Y-o-Y Growth, by Application, 2015–2024

Figure 54: U.S. Push On Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity, by Bottled Water, 2016–2024

Figure 55: U.S. Push On Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity, by Fruit Beverages, 2016–2024

Figure 56: U.S. Push On Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity, by Ready to Drink, 2016–2024

Figure 57: U.S. Push On Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity, by Milk, 2016–2024

Figure 58: U.S. Push On Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity, by Sport Beverages, 2016–2024

Figure 59: U.S. Push On Caps & Closures for Non-carbonated Beverages Market Absolute $ Opportunity, by Others, 2016–2024