Reports

Reports

Analyst Viewpoint

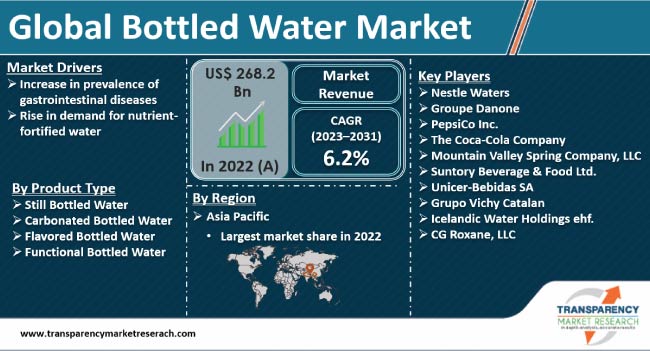

Increase in prevalence of gastrointestinal diseases and rise in demand for nutrient-fortified water are expected to propel the bottled water market size during the forecast period. Sustainable bottled water consumption is gaining traction among consumers considering the environmental, social, and economic impacts associated with the production, use, and disposal of bottled water.

Emerging brands in the bottled water sector are offering flavored bottled water as a healthier substitute for high-calorie energy drinks. Consumption of polluted drinking water is likely to cause severe diseases among children. Thus, governments in various countries are providing clean drinking water in underdeveloped and developing regions.

Bottled water is purified packaged drinking water. It is bought for several reasons including poor tap water quality, taste, safety concerns, convenience, and unavailability of drinking water. Bottled water comes in different packaging such as plastic bottles, glass bottles, and cans. Manufacturers implement various processes to purify water from different sources. Filtration, distillation, deionization, ozonation, reverse osmosis, and ultraviolet light disinfection are significant methods used to purify natural water.

Spring water, purified water, mineral water, and sparkling water are some types of bottled water. Packaging plays a pivotal role in maintaining the quality of bottled water. It can be reused and recycled to boost sustainability and limit adverse environmental effects.

Gastric issues, such as amoebiasis, jaundice, typhoid, and ascariasis, are caused by the consumption of contaminated or polluted water. Chemical and microbial contamination of water are major causes of gastrointestinal diseases. Furthermore, excessive consumption of dairy products and eating a low-fiber diet can cause gastrointestinal diseases. Bloating and constipation, heartburn, and indigestion are significant symptoms of gastrointestinal disease. Poor quality of tap water in developing regions is one of the significant reasons causing various health concerns such as gastrointestinal disease, typhoid, hepatitis, and cholera.

According to data published by the World Health Organization in 2022, approximately 1.7 billion people across the globe use feces-contaminated water sources. Microbial and fecal water contamination poses a high risk to drinking water safety.

Nutrient-fortified water is gaining traction owing to increase in awareness about the importance of hydration, wellness, and health. Increase in demand for electrolyte-rich, caffeinated water, alkaline, fortified, and carbonated water among sports professionals and fitness enthusiasts is expected to spur the bottled water market growth in the near future. Nutrient-fortified water is a healthier alternative to sugary, high-calorie, and carbonated drinks.

Consumers are preferring purified and ultra-purified bottled water during travel to avoid consumption of contaminated water. Furthermore, unavailability of clean drinking water is boosting demand for bottled water. Consumption of nutrient-fortified water keeps consumers hydrated during heavy workout sessions. Surge in awareness regarding the health benefits of purified water is creating a high demand for nutrient-fortified water.

According to the latest bottled water market trends, the PET bottles packaging segment is expected to dominate the industry during the forecast period. Polyethylene Terephthalate (PET) bottles are resistant to breakage, lightweight, and versatile. These bottles come in different sizes and shapes. PET bottles are cost-effective and easy to manufacture. Bottled water manufacturers are investing in recycling and reuse of PET bottles to ensure sustainability and profitability. Consumers prefer plastic bottles on the go as they are break-resistant and easy to handle.

According to the latest bottled water market forecast, Asia Pacific is projected to hold largest share from 2023 to 2031. Unavailability of safe drinking water in developing countries is driving the market dynamics of the region. Increase in population in India and China is also fueling demand for bottled water. Furthermore, surge in awareness among consumers about the importance of hygienic and clean drinking water is bolstering the bottled water industry share in Asia Pacific.

Key players in the market are launching new products to expand their product portfolio. Nestle Waters, Kona Deep, PepsiCo Inc., Groupe Danone, The Coca-Cola Company, Mountain Valley Spring Company, LLC, Bisleri International, Parle Agro, Himalayan, Oxyrich, Tata Global Beverages Ltd. (TGBL), BlueTriton Brands, Inc., FIJI Water Company LLC, Perrier, KHS Group, IRCTC, Patel Beverages Pvt Ltd., Água Mineral Kaiary, Angosto, Alba, Suntory Beverage & Food Ltd., Unicer-Bebidas SA, Grupo Vichy Catalan, Icelandic Water Holdings ehf., and CG Roxane, LLC are leading payers operating in this market.

Each of these players has been profiled in the bottled water market report based on factors such as key developments, company overview, business strategies, product portfolio, business segments, and financial overview.

| Attribute | Detail |

|---|---|

| Market Size in 2022 | US$ 268.2 Bn |

| Market Forecast (Value) in 2031 | US$ 460.8 Bn |

| Growth Rate (CAGR) | 6.2% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2018-2022 |

| Quantitative Tons | US$ Bn for Value and Liters for Volume |

| Market Analysis | It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces Analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 268.2 Bn in 2022

It is projected to register a CAGR of 6.2% from 2023 to 2031

Increase in prevalence of gastrointestinal diseases and rise in demand for nutrient-fortified water

Asia Pacific was the most lucrative region in 2022

Nestle Waters, Kona Deep, PepsiCo Inc., Groupe Danone, The Coca-Cola Company, Mountain Valley Spring Company, LLC, Bisleri International, Parle Agro, Himalayan, Oxyrich, Tata Global Beverages Ltd. (TGBL), BlueTriton Brands, Inc., FIJI Water Company LLC, Perrier, KHS Group, IRCTC, Patel Beverages Pvt Ltd., Água Mineral Kaiary, Angosto, Alba, Suntory Beverage & Food Ltd., Unicer-Bebidas SA, Grupo Vichy Catalan, Icelandic Water Holdings ehf., and CG Roxane, LLC

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Supply Side Trends

1.4. Analysis and Recommendations

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

3. Key Market Trends

3.1. Key Trends Impacting Market

3.2. Product Innovation / Development Trends

4. Key Success Factors

4.1. Product Adoption / Usage Analysis

4.2. Product USPs / Features

4.3. Strategic Promotional Strategies

5. Global Bottled Water Market Demand Analysis 2018–2022 and Forecast, 2023–2031

5.1. Historical Market Volume (Liters) Analysis, 2018–2022

5.2. Current and Future Market Volume (Liters) Projections, 2023–2031

6. Global Bottled Water Market - Pricing Analysis

6.1. Pricing Analysis

6.2. Global Average Pricing Analysis Benchmark

7. Global Bottled Water Market Demand (in Value or Size in US$ Bn) Analysis 2018–2022 and Forecast, 2023–2031

7.1. Historical Market Value (US$ Bn) Analysis, 2018–2022

7.2. Current and Future Market Value (US$ Bn) Projections, 2023–2031

7.2.1. Y-o-Y Growth Trend Analysis

7.2.2. Absolute $ Opportunity Analysis

8. Market Background

8.1. Macro-Economic Factors

8.1.1. Global GDP Growth Outlook

8.1.2. Global Industry Value Added

8.1.3. Global Urbanization Growth Outlook

8.1.4. Global Food Security Index Outlook

8.1.5. Global Rank – Ease of Doing Business

8.1.6. Global Rank – Trading Across Borders

8.2. Global Retail Market Outlook

8.3. Industry Value and Supply Chain Analysis

8.3.1. Profit Margin Analysis at Each Point of Sales

8.3.1.1. Bottled Water Processors/Producers

8.3.1.2. Distributors/Suppliers/Wholesalers

8.3.1.3. Traders/Retailers

8.3.2. End-users

8.4. Key Regulations

8.5. Market Dynamics

8.5.1. Drivers

8.5.2. Restraints

8.5.3. Opportunity Analysis

8.6. Forecast Factors - Relevance & Impact Analysis

9. Global Bottled Water Market Analysis 2018–2022 and Forecast 2023–2031, By Packaging

9.1. Introduction / Key Findings

9.2. Historical Market Size (US$ Bn) and Volume Analysis By Packaging, 2018–2022

9.3. Current and Future Market Size (US$ Bn) and Volume Analysis and Forecast By Packaging, 2023–2031

9.3.1. PET Bottles

9.3.2. Glass Bottles

9.3.3. Others

9.4. Market Attractiveness Analysis By Packaging

10. Global Bottled Water Market Analysis 2018–2022 and Forecast 2023–2031, By Product Type

10.1. Introduction / Key Findings

10.2. Historical Market Size (US$ Bn) and Volume Analysis By Product Type, 2018–2022

10.3. Current and Future Market Size (US$ Bn) and Volume Analysis and Forecast By Product Type, 2023–2031

10.3.1. Still Bottled Water

10.3.2. Carbonated Bottled Water

10.3.3. Flavored Bottled Water

10.3.4. Functional Bottled Water

10.4. Market Attractiveness Analysis By Product Type

11. Global Bottled Water Market Analysis 2018–2022 and Forecast 2023–2031, By Sales Channel

11.1. Introduction / Key Findings

11.2. Historical Market Size (US$ Bn) and Volume Analysis By Sales Channel, 2018–2022

11.3. Current and Future Market Size (US$ Bn) and Volume Analysis and Forecast By Sales Channel, 2023–2031

11.3.1. Hypermarkets/Supermarkets

11.3.2. Convenience Stores /Drug Stores

11.3.3. Grocery Stores/Club Stores

11.3.4. Foodservice

11.3.5. Others

11.4. Market Attractiveness Analysis By Sales Channel

12. Global Bottled Water Market Analysis 2018–2022 and Forecast 2023–2031, By Region

12.1. Introduction

12.2. Historical Market Size (US$ Bn) and Volume Analysis By Region, 2018–2022

12.3. Current Market Size (US$ Bn) and Volume Analysis and Forecast By Region, 2023–2031

12.3.1. North America

12.3.2. Latin America

12.3.3. Western Europe

12.3.4. Eastern Europe

12.3.5. South Asia & Pacific

12.3.6. East Asia

12.3.7. Middle East & Africa

12.4. Market Attractiveness Analysis By Region

13. North America Bottled Water Market Analysis 2018–2022 and Forecast 2023–2031

13.1. Introduction

13.2. Historical Market Size (US$ Bn) and Volume Trend Analysis By Market Taxonomy, 2018–2022

13.3. Market Size (US$ Bn) and Volume Forecast By Market Taxonomy, 2023–2031

13.3.1. By Country

13.3.1.1. U.S.

13.3.1.2. Canada

13.3.1.3. Mexcio

13.3.2. By Packaging

13.3.3. By Product Type

13.3.4. By Sales Channel

13.4. Market Attractiveness Analysis

13.4.1. By Packaging

13.4.2. By Product Type

13.4.3. By Sales Channel

13.5. Drivers and Restraints - Impact Analysis

14. Latin America Bottled Water Market Analysis 2018–2022 and Forecast 2023–2031

14.1. Introduction

14.2. Historical Market Size (US$ Bn) and Volume Trend Analysis By Market Taxonomy, 2018–2022

14.3. Market Size (US$ Bn) and Volume Forecast By Market Taxonomy, 2023–2031

14.3.1. By Country

14.3.1.1. Brazil

14.3.1.2. Chile

14.3.1.3. Rest of Latin America

14.3.2. By Packaging

14.3.3. By Product Type

14.3.4. By Sales Channel

14.4. Market Attractiveness Analysis

14.4.1. By Packaging

14.4.2. By Product Type

14.4.3. By Sales Channel

14.5. Drivers and Restraints - Impact Analysis

15. Western Europe Bottled Water Market Analysis 2018–2022 and Forecast 2023–2031

15.1. Introduction

15.2. Historical Market Size (US$ Bn) and Volume Trend Analysis By Market Taxonomy, 2018–2022

15.3. Market Size (US$ Bn) and Volume Forecast By Market Taxonomy, 2023–2031

15.3.1. By Country

15.3.1.1. Germany

15.3.1.2. Italy

15.3.1.3. France

15.3.1.4. U.K.

15.3.1.5. Spain

15.3.1.6. BENELUX

15.3.1.7. Nordic

15.3.1.8. Rest of W. Europe

15.3.2. By Packaging

15.3.3. By Product Type

15.3.4. By Sales Channel

15.4. Market Attractiveness Analysis

15.4.1. By Packaging

15.4.2. By Product Type

15.4.3. By Sales Channel

15.5. Drivers and Restraints - Impact Analysis

16. Eastern Europe Bottled Water Market Analysis 2018–2022 and Forecast 2023–2031

16.1. Introduction

16.2. Historical Market Size (US$ Bn) and Volume Trend Analysis By Market Taxonomy, 2018–2022

16.3. Market Size (US$ Bn) and Volume Forecast By Market Taxonomy, 2023–2031

16.3.1. By Country

16.3.1.1. Russia

16.3.1.2. Hungary

16.3.1.3. Poland

16.3.1.4. Balkan & Baltics

16.3.1.5. Rest of E. Europe

16.3.2. By Packaging

16.3.3. By Product Type

16.3.4. By Sales Channel

16.4. Market Attractiveness Analysis

16.4.1. By Packaging

16.4.2. By Product Type

16.4.3. By Sales Channel

16.5. Drivers and Restraints - Impact Analysis

17. South Asia & Pacific Bottled Water Market Analysis 2018–2022 and Forecast 2023–2031

17.1. Introduction

17.2. Historical Market Size (US$ Bn) and Volume Trend Analysis By Market Taxonomy, 2018–2022

17.3. Market Size (US$ Bn) and Volume Forecast By Market Taxonomy, 2023–2031

17.3.1. By Country

17.3.1.1. India

17.3.1.2. ASEAN

17.3.1.3. ANZ

17.3.1.4. Rest of SAP

17.3.2. By Packaging

17.3.3. By Product Type

17.3.4. By Sales Channel

17.4. Market Attractiveness Analysis

17.4.1. By Packaging

17.4.2. By Product Type

17.4.3. By Sales Channel

17.5. Drivers and Restraints - Impact Analysis

18. East Asia Bottled Water Market Analysis 2018–2022 and Forecast 2023–2031

18.1. Introduction

18.2. Historical Market Size (US$ Bn) and Volume Trend Analysis By Market Taxonomy, 2018–2022

18.3. Market Size (US$ Bn) and Volume Forecast By Market Taxonomy, 2023–2031

18.3.1. By Country

18.3.1.1. China

18.3.1.2. Japan

18.3.1.3. South Korea

18.3.2. By Packaging

18.3.3. By Product Type

18.3.4. By Sales Channel

18.4. Market Attractiveness Analysis

18.4.1. By Packaging

18.4.2. By Product Type

18.4.3. By Sales Channel

18.5. Drivers and Restraints - Impact Analysis

19. Middle East & Africa Bottled Water Market Analysis 2018–2022 and Forecast 2023–2031

19.1. Introduction

19.2. Historical Market Size (US$ Bn) and Volume Trend Analysis By Market Taxonomy, 2018–2022

19.3. Market Size (US$ Bn) and Volume Forecast By Market Taxonomy, 2023–2031

19.3.1. By Country

19.3.1.1. KSA

19.3.1.2. Other GCC

19.3.1.3. Turkiye

19.3.1.4. South Africa

19.3.1.5. Other African Union

19.3.1.6. Rest of Middle East & Africa

19.3.2. By Packaging

19.3.3. By Product Type

19.3.4. By Sales Channel

19.4. Market Attractiveness Analysis

19.4.1. By Packaging

19.4.2. By Product Type

19.4.3. By Sales Channel

19.5. Drivers and Restraints - Impact Analysis

20. Country Wise Bottled Water Market Analysis, 2022

20.1. Introduction

20.1.1. Market Value Proportion Analysis, By Key Countries

20.1.2. Global Vs. Country Growth Comparison

20.2. U.S. Bottled Water Market Analysis

20.2.1. By Packaging

20.2.2. By Product Type

20.2.3. By Sales Channel

20.3. Canada Bottled Water Market Analysis

20.3.1. By Packaging

20.3.2. By Product Type

20.3.3. By Sales Channel

20.4. Mexico Bottled Water Market Analysis

20.4.1. By Packaging

20.4.2. By Product Type

20.4.3. By Sales Channel

20.5. Brazil Bottled Water Market Analysis

20.5.1. By Packaging

20.5.2. By Product Type

20.5.3. By Sales Channel

20.6. Germany Bottled Water Market Analysis

20.6.1. By Packaging

20.6.2. By Product Type

20.6.3. By Sales Channel

20.7. Italy Bottled Water Market Analysis

20.7.1. By Packaging

20.7.2. By Product Type

20.7.3. By Sales Channel

20.8. France Bottled Water Market Analysis

20.8.1. By Packaging

20.8.2. By Product Type

20.8.3. By Sales Channel

20.9. U.K. Bottled Water Market Analysis

20.9.1. By Packaging

20.9.2. By Product Type

20.9.3. By Sales Channel

20.10. Spain Bottled Water Market Analysis

20.10.1. By Packaging

20.10.2. By Product Type

20.10.3. By Sales Channel

20.11. Russia Bottled Water Market Analysis

20.11.1. By Packaging

20.11.2. By Product Type

20.11.3. By Sales Channel

20.12. China Bottled Water Market Analysis

20.12.1. By Packaging

20.12.2. By Product Type

20.12.3. By Sales Channel

20.13. Japan Bottled Water Market Analysis

20.13.1. By Packaging

20.13.2. By Product Type

20.13.3. By Sales Channel

20.14. S. Korea Bottled Water Market Analysis

20.14.1. By Packaging

20.14.2. By Product Type

20.14.3. By Sales Channel

20.15. India Bottled Water Market Analysis

20.15.1. By Packaging

20.15.2. By Product Type

20.15.3. By Sales Channel

20.16. Turkiye Bottled Water Market Analysis

20.16.1. By Packaging

20.16.2. By Product Type

20.16.3. By Sales Channel

20.17. South Africa Bottled Water Market Analysis

20.17.1. By Packaging

20.17.2. By Product Type

20.17.3. By Sales Channel

21. Market Structure Analysis

21.1. Market Analysis by Tier of Companies

21.2. Market Concentration

21.3. Market Presence Analysis

22. Competition Analysis

22.1. Competition Dashboard

22.2. Competition Benchmarking

22.3. Competition Deep Dive

22.3.1. Nestle Waters

22.3.1.1. Overview

22.3.1.2. Product Portfolio

22.3.1.3. Key Developments/Takeaways

22.3.1.4. Strategy Overview

22.3.2. Kona Deep

22.3.2.1. Overview

22.3.2.2. Product Portfolio

22.3.2.3. Key Developments/Takeaways

22.3.2.4. Strategy Overview

22.3.3. PepsiCo Inc.

22.3.3.1. Overview

22.3.3.2. Product Portfolio

22.3.3.3. Key Developments/Takeaways

22.3.3.4. Strategy Overview

22.3.4. Groupe Danone

22.3.4.1. Overview

22.3.4.2. Product Portfolio

22.3.4.3. Key Developments/Takeaways

22.3.4.4. Strategy Overview

22.3.5. The Coca Cola Company

22.3.5.1. Overview

22.3.5.2. Product Portfolio

22.3.5.3. Key Developments/Takeaways

22.3.5.4. Strategy Overview

22.3.6. Mountain Valley Spring Company LLC

22.3.6.1. Overview

22.3.6.2. Product Portfolio

22.3.6.3. Key Developments/Takeaways

22.3.6.4. Strategy Overview

22.3.7. Bisleri International

22.3.7.1. Overview

22.3.7.2. Product Portfolio

22.3.7.3. Key Developments/Takeaways

22.3.7.4. Strategy Overview

22.3.8. Parle Agro

22.3.8.1. Overview

22.3.8.2. Product Portfolio

22.3.8.3. Key Developments/Takeaways

22.3.8.4. Strategy Overview

22.3.9. Himalayan

22.3.9.1. Overview

22.3.9.2. Product Portfolio

22.3.9.3. Key Developments/Takeaways

22.3.9.4. Strategy Overview

22.3.10. Oxyrich

22.3.10.1. Overview

22.3.10.2. Product Portfolio

22.3.10.3. Key Developments/Takeaways

22.3.10.4. Strategy Overview

22.3.11. Tata Global Beverages Ltd. (TGBL)

22.3.11.1. Overview

22.3.11.2. Product Portfolio

22.3.11.3. Key Developments/Takeaways

22.3.11.4. Strategy Overview

22.3.12. BlueTriton Brands, Inc.

22.3.12.1. Overview

22.3.12.2. Product Portfolio

22.3.12.3. Key Developments/Takeaways

22.3.12.4. Strategy Overview

22.3.13. FIJI Water Company LLC

22.3.13.1. Overview

22.3.13.2. Product Portfolio

22.3.13.3. Key Developments/Takeaways

22.3.13.4. Strategy Overview

22.3.14. Perrier

22.3.14.1. Overview

22.3.14.2. Product Portfolio

22.3.14.3. Key Developments/Takeaways

22.3.14.4. Strategy Overview

22.3.15. KHS Group

22.3.15.1. Overview

22.3.15.2. Product Portfolio

22.3.15.3. Key Developments/Takeaways

22.3.15.4. Strategy Overview

22.3.16. IRCTC

22.3.16.1. Overview

22.3.16.2. Product Portfolio

22.3.16.3. Key Developments/Takeaways

22.3.16.4. Strategy Overview

22.3.17. Patel Beverages Pvt Ltd.

22.3.17.1. Overview

22.3.17.2. Product Portfolio

22.3.17.3. Key Developments/Takeaways

22.3.17.4. Strategy Overview

22.3.18. Água Mineral Kaiary

22.3.18.1. Overview

22.3.18.2. Product Portfolio

22.3.18.3. Key Developments/Takeaways

22.3.18.4. Strategy Overview

22.3.19. Angosto

22.3.19.1. Overview

22.3.19.2. Product Portfolio

22.3.19.3. Key Developments/Takeaways

22.3.19.4. Strategy Overview

22.3.20. Alba

22.3.20.1. Overview

22.3.20.2. Product Portfolio

22.3.20.3. Key Developments/Takeaways

22.3.20.4. Strategy Overview

22.3.21. Suntory Beverage & Food Ltd.

22.3.21.1. Overview

22.3.21.2. Product Portfolio

22.3.21.3. Key Developments/Takeaways

22.3.21.4. Strategy Overview

22.3.22. Unicer-Bebidas SA

22.3.22.1. Overview

22.3.22.2. Product Portfolio

22.3.22.3. Key Developments/Takeaways

22.3.22.4. Strategy Overview

22.3.23. Grupo Vichy Catalan

22.3.23.1. Overview

22.3.23.2. Product Portfolio

22.3.23.3. Key Developments/Takeaways

22.3.23.4. Strategy Overview

22.3.24. Icelandic Water Holdings ehf.

22.3.24.1. Overview

22.3.24.2. Product Portfolio

22.3.24.3. Key Developments/Takeaways

22.3.24.4. Strategy Overview

22.3.25. CG Roxane, LLC

22.3.25.1. Overview

22.3.25.2. Product Portfolio

22.3.25.3. Key Developments/Takeaways

22.3.25.4. Strategy Overview

22.3.26. Others (Available on Request)

22.3.26.1. Overview

22.3.26.2. Product Portfolio

22.3.26.3. Key Developments/Takeaways

22.3.26.4. Strategy Overview

23. Assumptions and Acronyms Used

24. Research Methodology

List of Tables

Table 1: Global Bottled Water Market Forecast, by Product Type, 2023–2031

Table 2: Global Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Product Type, 2023–2031

Table 3: Global Bottled Water Market Forecast, by Packaging, 2023–2031

Table 4: Global Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Packaging, 2023–2031

Table 5: Global Bottled Water Market Forecast, by Sales Channel, 2023–2031

Table 6: Global Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Sales Channel, 2023–2031

Table 7: Global Bottled Water Market Forecast, by Region, 2023–2031

Table 8: Global Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Region, 2023–2031

Table 9: North America Bottled Water Market Forecast, by Product Type, 2023–2031

Table 10: North America Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Product Type, 2023–2031

Table 11: North America Bottled Water Market Forecast, by Packaging, 2023–2031

Table 12: North America Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Packaging, 2023–2031

Table 13: North America Bottled Water Market Forecast, by Sales Channel, 2023–2031

Table 14: North America Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Sales Channel, 2023–2031

Table 15: North America Bottled Water Market Forecast, by Country, 2023–2031

Table 16: North America Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Country, 2023–2031

Table 17: U.S. Bottled Water Market Forecast, by Product Type, 2023–2031

Table 18: U.S. Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Product Type, 2023–2031

Table 19: U.S. Bottled Water Market Forecast, by Packaging, 2023–2031

Table 20: U.S. Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Packaging, 2023–2031

Table 21: U.S. Bottled Water Market Forecast, by Sales Channel, 2023–2031

Table 22: U.S. Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Sales Channel, 2023–2031

Table 23: Canada Bottled Water Market Forecast, by Product Type, 2023–2031

Table 24: Canada Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Product Type, 2023–2031

Table 25: Canada Bottled Water Market Forecast, by Packaging, 2023–2031

Table 26: Canada Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Packaging, 2023–2031

Table 27: Canada Bottled Water Market Forecast, by Sales Channel, 2023–2031

Table 28: Canada Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Sales Channel, 2023–2031

Table 29: Mexico Bottled Water Market Forecast, by Product Type, 2023–2031

Table 30: Mexico Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Product Type, 2023–2031

Table 31: Mexico Bottled Water Market Forecast, by Packaging, 2023–2031

Table 32: Mexico Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Packaging, 2023–2031

Table 33: Mexico Bottled Water Market Forecast, by Sales Channel, 2023–2031

Table 34: Mexico Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Sales Channel, 2023–2031

Table 35: Latin America Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Product Type, 2023–2031

Table 36: Latin America Bottled Water Market Forecast, by Packaging, 2023–2031

Table 37: Latin America Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Packaging, 2023–2031

Table 38: Latin America Bottled Water Market Forecast, by Sales Channel, 2023–2031

Table 39: Latin America Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Sales Channel, 2023–2031

Table 40: Latin America Bottled Water Market Forecast, by Country and Sub-region, 2023–2031

Table 41: Latin America Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Country, 2023–2031

Table 42: Brazil Bottled Water Market Forecast, by Product Type, 2023–2031

Table 43: Brazil Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Product Type, 2023–2031

Table 44: Brazil Bottled Water Market Forecast, by Packaging, 2023–2031

Table 45: Brazil Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Packaging, 2023–2031

Table 46: Brazil Bottled Water Market Forecast, by Sales Channel, 2023–2031

Table 47: Brazil Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Sales Channel, 2023–2031

Table 48: Western Europe Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Product Type, 2023–2031

Table 49: Western Europe Bottled Water Market Forecast, by Packaging, 2023–2031

Table 50: Western Europe Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Packaging, 2023–2031

Table 51: Western Europe Bottled Water Market Forecast, by Sales Channel, 2023–2031

Table 52: Western Europe Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Sales Channel, 2023–2031

Table 53: Western Europe Bottled Water Market Forecast, by Country, 2023–2031

Table 54: Western Europe Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Country, 2023–2031

Table 55: Germany Bottled Water Market Forecast, by Product Type, 2023–2031

Table 56: Germany Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Product Type, 2023–2031

Table 57: Germany Bottled Water Market Forecast, by Packaging, 2023–2031

Table 58: Germany Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Packaging, 2023–2031

Table 59: Germany Bottled Water Market Forecast, by Sales Channel, 2023–2031

Table 60: Germany Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Sales Channel, 2023–2031

Table 61: Italy Bottled Water Market Forecast, by Product Type, 2023–2031

Table 62: Italy Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Product Type, 2023–2031

Table 63: Italy Bottled Water Market Forecast, by Packaging, 2023–2031

Table 64: Italy Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Packaging, 2023–2031

Table 65: Italy Bottled Water Market Forecast, by Sales Channel, 2023–2031

Table 66: Italy Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Sales Channel, 2023–2031

Table 67: France Bottled Water Market Forecast, by Product Type, 2023–2031

Table 68: France Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Product Type, 2023–2031

Table 69: France Bottled Water Market Forecast, by Packaging, 2023–2031

Table 70: France Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Packaging, 2023–2031

Table 71: France Bottled Water Market Forecast, by Sales Channel, 2023–2031

Table 72: France Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Sales Channel, 2023–2031

Table 73: U.K. Bottled Water Market Forecast, by Product Type, 2023–2031

Table 74: U.K. Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Product Type, 2023–2031

Table 75: U.K. Bottled Water Market Forecast, by Packaging, 2023–2031

Table 76: U.K. Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Packaging, 2023–2031

Table 77: U.K. Bottled Water Market Forecast, by Sales Channel, 2023–2031

Table 78: U.K. Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Sales Channel, 2023–2031

Table 79: Spain Bottled Water Market Forecast, by Product Type, 2023–2031

Table 80: Spain Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Product Type, 2023–2031

Table 81: Spain Bottled Water Market Forecast, by Packaging, 2023–2031

Table 82: Spain Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Packaging, 2023–2031

Table 83: Spain Bottled Water Market Forecast, by Sales Channel, 2023–2031

Table 84: Spain Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Sales Channel, 2023–2031

Table 85: Eastern Europe Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Product Type, 2023–2031

Table 86: Eastern Europe Bottled Water Market Forecast, by Packaging, 2023–2031

Table 87: Eastern Europe Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Packaging, 2023–2031

Table 88: Eastern Europe Bottled Water Market Forecast, by Sales Channel, 2023–2031

Table 89: Eastern Europe Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Sales Channel, 2023–2031

Table 90: Eastern Europe Bottled Water Market Forecast, by Country, 2023–2031

Table 91: Eastern Europe Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Country, 2023–2031

Table 92: Russia Bottled Water Market Forecast, by Product Type, 2023–2031

Table 93: Russia Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Product Type, 2023–2031

Table 94: Russia Bottled Water Market Forecast, by Packaging, 2023–2031

Table 95: Russia Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Packaging, 2023–2031

Table 96: Russia Bottled Water Market Forecast, by Sales Channel, 2023–2031

Table 97: Russia Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Sales Channel, 2023–2031

Table 98: South Asia & Pacific Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Product Type, 2023–2031

Table 99: South Asia & Pacific Bottled Water Market Forecast, by Packaging, 2023–2031

Table 100: South Asia & Pacific Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Packaging, 2023–2031

Table 101: South Asia & Pacific Bottled Water Market Forecast, by Sales Channel, 2023–2031

Table 102: South Asia & Pacific Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Sales Channel, 2023–2031

Table 103: South Asia & Pacific Bottled Water Market Forecast, by Country, 2023–2031

Table 104: South Asia & Pacific Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Country, 2023–2031

Table 105: India Bottled Water Market Forecast, by Product Type, 2023–2031

Table 106: India Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Product Type, 2023–2031

Table 107: India Bottled Water Market Forecast, by Packaging, 2023–2031

Table 108: India Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Packaging, 2023–2031

Table 109: India Bottled Water Market Forecast, by Sales Channel, 2023–2031

Table 110: India Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Sales Channel, 2023–2031

Table 111: East Asia Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Product Type, 2023–2031

Table 112: East Asia Bottled Water Market Forecast, by Packaging, 2023–2031

Table 113: East Asia Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Packaging, 2023–2031

Table 114: East Asia Bottled Water Market Forecast, by Sales Channel, 2023–2031

Table 115: East Asia Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Sales Channel, 2023–2031

Table 116: East Asia Bottled Water Market Forecast, by Country, 2023–2031

Table 117: East Asia Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Country, 2023–2031

Table 118: China Bottled Water Market Forecast, by Product Type, 2023–2031

Table 119: China Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Product Type, 2023–2031

Table 120: China Bottled Water Market Forecast, by Packaging, 2023–2031

Table 121: China Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Packaging, 2023–2031

Table 122: China Bottled Water Market Forecast, by Sales Channel, 2023–2031

Table 123: China Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Sales Channel, 2023–2031

Table 124: Japan Bottled Water Market Forecast, by Product Type, 2023–2031

Table 125: Japan Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Product Type, 2023–2031

Table 126: Japan Bottled Water Market Forecast, by Packaging, 2023–2031

Table 127: Japan Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Packaging, 2023–2031

Table 128: Japan Bottled Water Market Forecast, by Sales Channel, 2023–2031

Table 129: Japan Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Sales Channel, 2023–2031

Table 130: South Korea Bottled Water Market Forecast, by Product Type, 2023–2031

Table 131: South Korea Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Product Type, 2023–2031

Table 132: South Korea Bottled Water Market Forecast, by Packaging, 2023–2031

Table 133: South Korea Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Packaging, 2023–2031

Table 134: South Korea Bottled Water Market Forecast, by Sales Channel, 2023–2031

Table 135: South Korea Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Sales Channel, 2023–2031

Table 136: Middle East & Africa Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Product Type, 2023–2031

Table 137: Middle East & Africa Bottled Water Market Forecast, by Packaging, 2023–2031

Table 138: Middle East & Africa Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Packaging, 2023–2031

Table 139: Middle East & Africa Bottled Water Market Forecast, by Sales Channel, 2023–2031

Table 140: Middle East & Africa Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Sales Channel, 2023–2031

Table 141: Middle East & Africa Bottled Water Market Forecast, by Country and Sub-region, 2023–2031

Table 142: Middle East & Africa Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Country, 2023–2031

Table 143: Turkiye Bottled Water Market Forecast, by Product Type, 2023–2031

Table 144: Turkiye Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Product Type, 2023–2031

Table 145: Turkiye Bottled Water Market Forecast, by Packaging, 2023–2031

Table 146: Turkiye Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Packaging, 2023–2031

Table 147: Turkiye Bottled Water Market Forecast, by Sales Channel, 2023–2031

Table 148: Turkiye Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Sales Channel, 2023–2031

Table 149: South Africa Bottled Water Market Forecast, by Product Type, 2023–2031

Table 150: South Africa Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Product Type, 2023–2031

Table 151: South Africa Bottled Water Market Forecast, by Packaging, 2023–2031

Table 152: South Africa Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Packaging, 2023–2031

Table 153: South Africa Bottled Water Market Forecast, by Sales Channel, 2023–2031

Table 154: South Africa Bottled Water Market Volume (Liters) and Value (US$ Bn) Forecast, by Sales Channel, 2023–2031

List of Figures

Figure 1: Global Bottled Water Market Volume Share Analysis, by Product Type, 2022, 2025, and 2031

Figure 2: Global Bottled Water Market Attractiveness, by Product Type

Figure 3: Global Bottled Water Market Volume Share Analysis, by Packaging, 2022, 2025, and 2031

Figure 4: Global Bottled Water Market Attractiveness, by Packaging

Figure 5: Global Bottled Water Market Volume Share Analysis, by Sales Channel, 2022, 2025, and 2031

Figure 6: Global Bottled Water Market Attractiveness, by Sales Channel

Figure 7: Global Bottled Water Market Volume Share Analysis, by Region, 2022, 2025, and 2031

Figure 8: Global Bottled Water Market Attractiveness, by Region

Figure 9: North America Bottled Water Market Volume Share Analysis, by Product Type, 2022, 2025, and 2031

Figure 10: North America Bottled Water Market Attractiveness, by Product Type

Figure 11: North America Bottled Water Market Volume Share Analysis, by Packaging, 2022, 2025, and 2031

Figure 12: North America Bottled Water Market Attractiveness, by Packaging

Figure 13: North America Bottled Water Market Volume Share Analysis, by Sales Channel, 2022, 2025, and 2031

Figure 14: North America Bottled Water Market Attractiveness, by Sales Channel

Figure 15: North America Bottled Water Market Volume Share Analysis, by Country, 2022, 2025, and 2031

Figure 16: North America Bottled Water Market Attractiveness, by Country

Figure 17: Latin America Bottled Water Market Volume Share Analysis, by Product Type, 2022, 2025, and 2031

Figure 18: Latin America Bottled Water Market Attractiveness, by Product Type

Figure 19: Latin America Bottled Water Market Volume Share Analysis, by Packaging, 2022, 2025, and 2031

Figure 20: Latin America Bottled Water Market Attractiveness, by Packaging

Figure 21: Latin America Bottled Water Market Volume Share Analysis, by Sales Channel, 2022, 2025, and 2031

Figure 22: Latin America Bottled Water Market Attractiveness, by Sales Channel

Figure 23: Latin America Bottled Water Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 24: Latin America Bottled Water Market Attractiveness, by Country and Sub-region

Figure 25: Western Europe Bottled Water Market Volume Share Analysis, by Product Type, 2022, 2025, and 2031

Figure 26: Western Europe Bottled Water Market Attractiveness, by Product Type

Figure 27: Western Europe Bottled Water Market Volume Share Analysis, by Packaging, 2022, 2025, and 2031

Figure 28: Western Europe Bottled Water Market Attractiveness, by Packaging

Figure 29: Western Europe Bottled Water Market Volume Share Analysis, by Sales Channel, 2022, 2025, and 2031

Figure 30: Western Europe Bottled Water Market Attractiveness, by Sales Channel

Figure 31: Western Europe Bottled Water Market Volume Share Analysis, by Country, 2022, 2025, and 2031

Figure 32: Western Europe Bottled Water Market Attractiveness, by Country

Figure 33: Eastern Europe Bottled Water Market Volume Share Analysis, by Product Type, 2022, 2025, and 2031

Figure 34: Eastern Europe Bottled Water Market Attractiveness, by Product Type

Figure 35: Eastern Europe Bottled Water Market Volume Share Analysis, by Packaging, 2022, 2025, and 2031

Figure 36: Eastern Europe Bottled Water Market Attractiveness, by Packaging

Figure 37: Eastern Europe Bottled Water Market Volume Share Analysis, by Sales Channel, 2022, 2025, and 2031

Figure 38: Eastern Europe Bottled Water Market Attractiveness, by Sales Channel

Figure 39: Eastern Europe Bottled Water Market Volume Share Analysis, by Country, 2022, 2025, and 2031

Figure 40: Eastern Europe Bottled Water Market Attractiveness, by Country

Figure 41: South Asia & Pacific Bottled Water Market Volume Share Analysis, by Product Type, 2022, 2025, and 2031

Figure 42: South Asia & Pacific Bottled Water Market Attractiveness, by Product Type

Figure 43: South Asia & Pacific Bottled Water Market Volume Share Analysis, by Packaging, 2022, 2025, and 2031

Figure 44: South Asia & Pacific Bottled Water Market Attractiveness, by Packaging

Figure 45: South Asia & Pacific Bottled Water Market Volume Share Analysis, by Sales Channel, 2022, 2025, and 2031

Figure 46: South Asia & Pacific Bottled Water Market Attractiveness, by Sales Channel

Figure 47: South Asia & Pacific Bottled Water Market Volume Share Analysis, by Country, 2022, 2025, and 2031

Figure 48: South Asia & Pacific Bottled Water Market Attractiveness, by Country

Figure 49: East Asia Bottled Water Market Volume Share Analysis, by Product Type, 2022, 2025, and 2031

Figure 50: East Asia Bottled Water Market Attractiveness, by Product Type

Figure 51: East Asia Bottled Water Market Volume Share Analysis, by Packaging, 2022, 2025, and 2031

Figure 52: East Asia Bottled Water Market Attractiveness, by Packaging

Figure 53: East Asia Bottled Water Market Volume Share Analysis, by Sales Channel, 2022, 2025, and 2031

Figure 54: East Asia Bottled Water Market Attractiveness, by Sales Channel

Figure 55: East Asia Bottled Water Market Volume Share Analysis, by Country, 2022, 2025, and 2031

Figure 56: East Asia Bottled Water Market Attractiveness, by Country

Figure 57: Middle East & Africa Bottled Water Market Volume Share Analysis, by Product Type, 2022, 2025, and 2031

Figure 58: Middle East & Africa Bottled Water Market Attractiveness, by Product Type

Figure 59: Middle East & Africa Bottled Water Market Volume Share Analysis, by Packaging, 2022, 2025, and 2031

Figure 60: Middle East & Africa Bottled Water Market Attractiveness, by Packaging

Figure 61: Middle East & Africa Bottled Water Market Volume Share Analysis, by Sales Channel, 2022, 2025, and 2031

Figure 62: Middle East & Africa Bottled Water Market Attractiveness, by Sales Channel

Figure 63: Middle East & Africa Bottled Water Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 64: Middle East & Africa Bottled Water Market Attractiveness, by Country and Sub-region