Reports

Reports

Most successful semiconductor and electronics producers have established their business in countries of Asia Pacific. Hence, companies in the underfill market are now exploring untapped opportunities in North America and Europe to broaden their scope for new revenue streams. On the other hand, manufacturers are increasing their focus on next-gen high-reliability electronics applications. For instance, in April 2019, leading chemical and consumer goods company Henkel AG announced the launch of its new silicone-free underfill material that can be used in electric vehicles (EVs). The growing adoption of electric vehicles and the ever-increasing automotive industry are generating incremental opportunities for manufacturers in the underfill market.

Moreover, leading players are collaborating with online distribution platforms to increase the uptake of underfill materials. Uniform and void-free encapsulating underfill are being highly publicized to maximize a device’s temperature cycling capability. Manufacturers are increasing R&D to develop fast curing underfill that provide essential interconnect protection from shock, drop or vibration.

Innovative underfill materials are helping companies to gain global recognition. As such, top five players continue to account for ~70-75% of the underfill market. Leading players are increasingly participating in trade events to tie up with potential partners. Companies in the underfill market are initiatives to deliver products that are reliable, prioritize sustainability, and enhance the performance of next-gen electronic devices and systems. Manufacturers are working closely with practicing engineers that are capable of developing cost-effective and innovative underfill materials.

Moreover, manufacturers are increasing their research efforts to develop underfill materials that offer reliable device protection, even in challenging conditions. They are increasing their production capabilities to develop underfill that protects fine-pitch array devices with the help of highly filled formulations that adapt to exceptionally advanced glass transition temperatures.

The demand for embedded systems is projected to grow in the coming years. This trend has led to the demand for compact-sized components, unmatched reliability, and their ability to withstand harsh conditions. All these factors contribute to the growth of the underfill market, which is expected to reach a revenue of ~US$ 600 Mn by the end of 2027.

Manufacturers in the underfill market are offering various options to its stakeholders to increase the reliability of their final-product embedded systems. For instance, Transcend Information, Inc.— a leading manufacturer of industrial-grade products, is offering corner bond and underfill materials to stakeholders dealing in embedded products to enhance the product’s reliability under high vibratory stress or high gravitational acceleration.

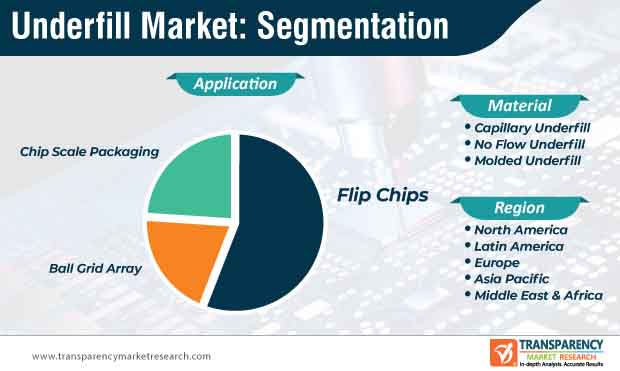

Ongoing investments in developing cutting-edge technologies and innovations in embedded-use flash and DRAM products are generating revenue streams for manufacturers. Underfill materials are being pervasively used in ball grid array-based storage such as in handheld devices that must pass drop or tumble tests. This is evident since ball grid array application segment is estimated to account for the third-highest revenue in the market for underfill.

Companies in the underfill market are tapping into incremental opportunities to develop pre-applied underfill materials that support collective bonding processes. This trend has led to exponential growth of the underfill market, which is anticipated to reach an output of ~1,180 tons by the end of 2027.

However, proliferation of IoT in various 5G applications leads to barriers in semiconductor packaging technologies. For instance, the flip chip bonding technology is required for the development of ultrafine-pitch products such as graphic, network, and AI processors. In order to achieve this, companies are adopting thermal compression bonding (TCB) with the help of pre-applied underfill materials. However, the scarcity of underfill materials such as nonconductive paste or nonconductive film has led to high process cost. Hence, there is a need for reasonable TCB costing to support the expansion of IoT in 5G applications. There is a growing need to maximize the production of underfill materials to support multiple die bonding processes.

Analysts’ Viewpoint

The underfill market is estimated to expand at a CAGR of ~9% during the forecast period. Apart from Asia Pacific and North America, companies are exploring untapped opportunities in Latin America and Middle East & Africa to broaden their scope of future revenue opportunities.

Multiple die bonding processes are boosting the proliferation of IoT in 5G applications. However, conventional underfill materials pose difficulty in multiple bonding processes due to a mismatch between reactivities of materials. Hence, manufacturers should innovate in new underfill materials such as nonconductive paste or nonconductive films that offer thermal stability and electrical insulation. They should explore opportunities in high-performance electronics applications for aerospace and automotive sectors.

1. Executive Summary

2. Market Introduction

2.1. Market Definition

2.2. Market Taxonomy

2.3. Semiconductor (Parent) Market Overview

3. Underfill Material Market Analysis Scenario

3.1. Pricing Analysis

3.1.1. Pricing Assumption

3.1.2. Cost to Produce Analysis

3.1.3. Price Projections By Region

3.1.4. Pricing Trends

3.2. Market Size (US$ Mn) and Forecast

3.2.1. Market Size and Y-o-Y Growth

3.2.2. Absolute $ Opportunity

3.3. Market Overview

3.3.1. Value Chain Analysis

3.3.2. Supply Demand Analysis

3.3.3. Profitability Margins

3.3.4. Key Developments and Future Outlook

3.3.5. Key Dispensing Applications Outlook

3.3.6. Manufacturing Process

3.3.7. List of Active Participants

3.3.7.1. Raw Material Suppliers

3.3.7.2. Manufacturers

3.3.7.3. Distributors / Retailers

3.4. Product – Cost Teardown Analysis

4. Market Dynamics

4.1. Macro-economic Factors

4.2. Drivers

4.2.1. Supply Side

4.2.2. Demand Side

4.3. Restraints

4.4. Market Opportunity

4.5. Forecast Factors – Relevance and Impact

5. Global Underfill Material Market Analysis and Forecast, By Material Type

5.1. Introduction

5.1.1. Basis Point Share (BPS) Analysis By Material Type

5.1.2. Y-o-Y Growth Projections By Material Type

5.2. Market Size (US$ Mn) and Volume (Units) Forecast By Material Type

5.2.1. Capillary Underfill Material (CUF)

5.2.2. No Flow Underfill Material (NUF)

5.2.3. Molded Underfill Material (MUF)

5.3. Market Attractiveness Analysis By Material Type

5.4. Prominent Trends

6. Global Underfill Material Market Analysis and Forecast, By Application

6.1. Introduction

6.1.1. Basis Point Share (BPS) Analysis By Application

6.1.2. Y-o-Y Growth Projections By Application

6.2. Market Size (US$ Mn) and Volume (Units) Forecast By Application

6.2.1. Flip Chips

6.2.2. Ball Grid Array (BGA)

6.2.3. Chip Scale Packaging (CSP)

6.3. Market Attractiveness Analysis By Application

6.4. Prominent Trends

7. Global Underfill Material Market Analysis and Forecast, By Region

7.1. Introduction

7.1.1. Basis Point Share (BPS) Analysis By Region

7.1.2. Y-o-Y Growth Projections By Region

7.2. Market Size (US$ Mn) and Volume (Units) Forecast By Region

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Latin America

7.2.5. Middle East and Africa (MEA)

7.3. Market Attractiveness Analysis By Region

8. North America Underfill Material Market Analysis and Forecast

8.1. Introduction

8.1.1. Basis Point Share (BPS) Analysis By Country

8.1.2. Y-o-Y Growth Projections By Country

8.1.3. Key Regulations

8.2. Market Size (US$ Mn) and Volume (Units) Forecast By Country

8.2.1. U.S.

8.2.2. Canada

8.3. Market Size (US$ Mn) and Volume (Units) Forecast By Material Type

8.3.1. Capillary Underfill Material (CUF)

8.3.2. No Flow Underfill Material (NUF)

8.3.3. Molded Underfill Material (MUF)

8.4. Market Size (US$ Mn) and Volume (Units) Forecast By Application

8.4.1. Flip Chips

8.4.2. Ball Grid Array (BGA)

8.4.3. Chip Scale Packaging (CSP)

8.5. Market Attractiveness Analysis

8.5.1. By Country

8.5.2. By Product

8.5.3. By Application

8.6. Prominent Trends

8.7. Drivers and Restraints: Impact Analysis

9. Latin America Underfill Material Market Analysis and Forecast

9.1. Introduction

9.1.1. Basis Point Share (BPS) Analysis By Country

9.1.2. Y-o-Y Growth Projections By Country

9.1.3. Key Regulations

9.2. Market Size (US$ Mn) and Volume (Units) Forecast By Country

9.2.1. Brazil

9.2.2. Mexico

9.2.3. Rest of Latin America

9.3. Market Size (US$ Mn) and Volume (Units) Forecast By Material Type

9.3.1. Capillary Underfill Material (CUF)

9.3.2. No Flow Underfill Material (NUF)

9.3.3. Molded Underfill Material (MUF)

9.4. Market Size (US$ Mn) and Volume (Units) Forecast By Application

9.4.1. Flip Chips

9.4.2. Ball Grid Array (BGA)

9.4.3. Chip Scale Packaging (CSP)

9.5. Market Attractiveness Analysis

9.5.1. By Country

9.5.2. By Product

9.5.3. By Application

9.6. Prominent Trends

9.7. Drivers and Restraints: Impact Analysis

10. Europe Underfill Material Market Analysis and Forecast

10.1. Introduction

10.1.1. Basis Point Share (BPS) Analysis By Country

10.1.2. Y-o-Y Growth Projections By Country

10.1.3. Key Regulations

10.2. Market Size (US$ Mn) and Volume (Units) Forecast By Country

10.2.1. Germany

10.2.2. Spain

10.2.3. Italy

10.2.4. France

10.2.5. U.K.

10.2.6. BENELUX

10.2.7. Russia

10.2.8. Rest of Europe

10.3. Market Size (US$ Mn) and Volume (Units) Forecast By Material Type

10.3.1. Capillary Underfill Material (CUF)

10.3.2. No Flow Underfill Material (NUF)

10.3.3. Molded Underfill Material (MUF)

10.4. Market Size (US$ Mn) and Volume (Units) Forecast By Application

10.4.1. Flip Chips

10.4.2. Ball Grid Array (BGA)

10.4.3. Chip Scale Packaging (CSP)

10.5. Market Attractiveness Analysis

10.5.1. By Country

10.5.2. By Product

10.5.3. By Application

10.6. Prominent Trends

10.7. Drivers and Restraints: Impact Analysis

11. Asia Pacific Underfill Material Market Analysis and Forecast

11.1. Introduction

11.1.1. Basis Point Share (BPS) Analysis By Country

11.1.2. Y-o-Y Growth Projections By Country

11.1.3. Key Regulations

11.2. Market Size (US$ Mn) and Volume (Units) Forecast By Country

11.2.1. China

11.2.2. India

11.2.3. Japan

11.2.4. Korea

11.2.5. ASEAN

11.2.6. Australia and New Zealand

11.2.7. Rest of APAC

11.3. Market Size (US$ Mn) and Volume (Units) Forecast By Material Type

11.3.1. Capillary Underfill Material (CUF)

11.3.2. No Flow Underfill Material (NUF)

11.3.3. Molded Underfill Material (MUF)

11.4. Market Size (US$ Mn) and Volume (Units) Forecast By Application

11.4.1. Flip Chips

11.4.2. Ball Grid Array (BGA)

11.4.3. Chip Scale Packaging (CSP)

11.5. Market Attractiveness Analysis

11.5.1. By Country

11.5.2. By Product

11.5.3. By Application

11.6. Prominent Trends

11.7. Drivers and Restraints: Impact Analysis

12. Middle East And Africa (MEA) Underfill Material Market Analysis and Forecast

12.1. Introduction

12.1.1. Basis Point Share (BPS) Analysis By Country

12.1.2. Y-o-Y Growth Projections By Country

12.1.3. Key Regulations

12.2. Market Size (US$ Mn) and Volume (Units) Forecast By Country

12.2.1. North Africa

12.2.2. South Africa

12.2.3. GCC countries

12.2.4. Rest of MEA

12.3. Market Size (US$ Mn) and Volume (Units) Forecast By Material Type

12.3.1. Capillary Underfill Material (CUF)

12.3.2. No Flow Underfill Material (NUF)

12.3.3. Molded Underfill Material (MUF)

12.4. Market Size (US$ Mn) and Volume (Units) Forecast By Application

12.4.1. Flip Chips

12.4.2. Ball Grid Array (BGA)

12.4.3. Chip Scale Packaging (CSP)

12.5. Market Attractiveness Analysis

12.5.1. By Country

12.5.2. By Product

12.5.3. By Application

12.6. Prominent Trends

12.7. Drivers and Restraints: Impact Analysis

13. White Space Analysis (Market Potential)

13.1. Underfill Market Analysis – TAM and SAM, By Region

13.1.1. Market Opportunity Analysis

13.2. List of Potential Customers, By Region

14. Competitive Landscape

14.1. Competition Dashboard

14.2. List of Key Suppliers/Distributors, By Region

14.3. Company Market Share and Relative Positioning Analysis , 2018

14.4. Company Profiles (Details – c)

14.5. Global Players

14.5.1. Henkel AG & Co. KGaA

14.5.1.1. Overview

14.5.1.2. Manufacturing Base

14.5.1.3. Financials

14.5.1.4. Strategy

14.5.1.5. Recent Developments

14.5.2. NAMICS Corporation

14.5.2.1. Overview

14.5.2.2. Manufacturing Base

14.5.2.3. Financials

14.5.2.4. Strategy

14.5.2.5. Recent Developments

14.5.3. Nordson Corporation

14.5.3.1. Overview

14.5.3.2. Manufacturing Base

14.5.3.3. Financials

14.5.3.4. Strategy

14.5.3.5. Recent Developments

14.5.4. H.B Fuller

14.5.4.1. Overview

14.5.4.2. Manufacturing Base

14.5.4.3. Financials

14.5.4.4. Strategy

14.5.4.5. Recent Developments

14.5.5. Panasonic Corporation

14.5.5.1. Overview

14.5.5.2. Manufacturing Base

14.5.5.3. Financials

14.5.5.4. Strategy

14.5.5.5. Recent Developments

14.5.6. Epoxy Technology Inc.

14.5.6.1. Overview

14.5.6.2. Manufacturing Base

14.5.6.3. Financials

14.5.6.4. Strategy

14.5.6.5. Recent Developments

14.5.7. Yincae Advanced Material, LLC

14.5.7.1. Overview

14.5.7.2. Manufacturing Base

14.5.7.3. Financials

14.5.7.4. Strategy

14.5.7.5. Recent Developments

14.5.8. Master Bond Inc.

14.5.8.1. Overview

14.5.8.2. Manufacturing Base

14.5.8.3. Financials

14.5.8.4. Strategy

14.5.8.5. Recent Developments

14.5.9. Zymet Inc.

14.5.9.1. Overview

14.5.9.2. Manufacturing Base

14.5.9.3. Financials

14.5.9.4. Strategy

14.5.9.5. Recent Developments

14.5.10. AIM Metals & Alloys LP

14.5.10.1. Overview

14.5.10.2. Manufacturing Base

14.5.10.3. Financials

14.5.10.4. Strategy

14.5.10.5. Recent Developments

14.5.11. Won Chemicals Co. Ltd.

14.5.11.1. Overview

14.5.11.2. Manufacturing Base

14.5.11.3. Financials

14.5.11.4. Strategy

14.5.11.5. Recent Developments

14.5.12. Bondline Electronic Adhesives, Inc.

14.5.12.1. Overview

14.5.12.2. Manufacturing Base

14.5.12.3. Financials

14.5.12.4. Strategy

14.5.12.5. Recent Developments

15. Assumptions and Acronyms Used

16. Research Methodology

List of Tables

Table 01: Global Underfill Market Volume (Tons) 2014H-2027F, by Material

Table 02: Global Underfill Market Value (US$ Mn) 2014H-2027F, by Material

Table 03: Global Underfill Market Volume (Tons) 2014H-2027F, by Application

Table 04: Global Underfill Market Value (US$ Mn) 2014H-2027F, by Application

Table 05: Global Underfill Market Volume (Tons) 2014H-2027F, by Region

Table 06: Global Underfill Market Value (US$ Mn) 2014H-2027F, by Region

Table 07: North America Underfill Market Value (US$ Mn) 2014H-2027F, by Material, Application & Country

Table 08: North America Underfill Market Volume (Tons) 2014H-2027F, by Material, Application & Country

Table 09: Latin America Underfill Market Value (US$ Mn) 2014H-2027F, by Material, Application & Country

Table 10: Latin America Underfill Market Volume (Tons) 2014H-2027F, by Material, Application & Country

Table 11: Europe Underfill Market Value (US$ Mn) 2014H-2027F, by Material, Application & Country

Table 12: Europe Underfill Market Volume (Tons) 2014H-2027F, by Material, Application & Country

Table 13: APAC Underfill Market Value (US$ Mn) 2014H-2027F, by Material, Application & Country

Table 14: APAC Underfill Market Volume (Tons) 2014H-2027F, by Material, Application & Country

Table 15: MEA Underfill Market Value (US$ Mn) 2014H-2027F, by Material, Application & Country

Table 16: MEA Underfill Market Volume (Tons) 2014H-2027F, by Material, Application & Country

List of Figures

Figure 01: Global Underfill Market Share Analysis, by Material, 2019 (E) – 2027 (F)

Figure 02: Global Underfill Market Attractiveness Index, by Material (2019 – 2027)

Figure 03: Global Underfill Market Share Analysis, by Application, 2019 (E) – 2027 (F)

Figure 04: Global Underfill Market Attractiveness Index, by Application (2019 – 2027)

Figure 05: Global Underfill Market Share Analysis, by Region, 2019 (E) – 2027 (F)

Figure 06: Global Underfill Market Attractiveness Index, by Region (2019 – 2027)

Figure 07: North America Underfill Market Share Analysis, by Material Type, 2019 (E) – 2027 (F)

Figure 09: North America Underfill Market Share Analysis, by Material, 2019 (E) – 2027 (F)

Figure 08: North America Underfill Market Attractiveness Index, by Application (2019 – 2027)

Figure 10: North America Underfill Market Attractiveness Index, by Application (2019 – 2027)

Figure 11: Latin America Underfill Market Share Analysis, by Material Type, 2019 (E) – 2027 (F)

Figure 13: Latin America Underfill Market Share Analysis, by Material, 2019 (E) – 2027 (F)

Figure 12: Latin America Underfill Market Attractiveness Index, by Application (2019 – 2027)

Figure 14: Latin America Underfill Market Attractiveness Index, by Application (2019 – 2027)

Figure 15: Europe Underfill Market Share Analysis, by Material Type, 2019 (E) – 2027 (F)

Figure 17: Europe Underfill Market Share Analysis, by Material, 2019 (E) – 2027 (F)

Figure 16: Europe Underfill Market Attractiveness Index, by Application (2019 – 2027)

Figure 18: Europe Underfill Market Attractiveness Index, by Application (2019 – 2027)

Figure 19: APAC Underfill Market Share Analysis, by Material Type, 2019 (E) – 2027 (F)

Figure 21: APAC Underfill Market Share Analysis, by Material, 2019 (E) – 2027 (F)

Figure 20: APAC Underfill Market Attractiveness Index, by Application (2019 – 2027)

Figure 22: APAC Underfill Market Attractiveness Index, by Application (2019 – 2027)

Figure 23: MEA Underfill Market Share Analysis, by Material Type, 2019 (E) – 2027 (F)

Figure 25: MEA Underfill Market Share Analysis, by Material, 2019 (E) – 2027 (F)

Figure 24: MEA Underfill Market Attractiveness Index, by Application (2019 – 2027)

Figure 26: MEA Underfill Market Attractiveness Index, by Application (2019 – 2027)