Reports

Reports

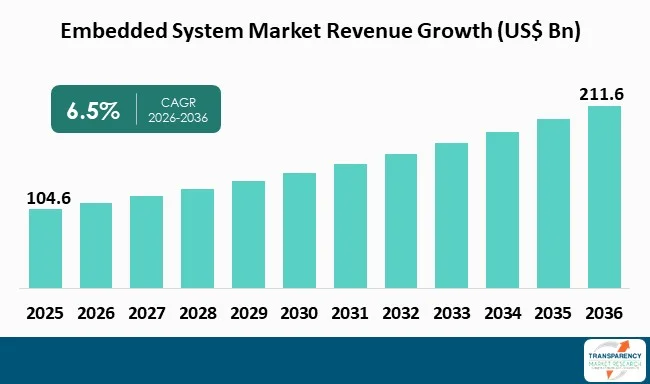

The global embedded system market was valued at US$ 104.6 Bn in 2025 and is projected to reach US$ 211.6 Bn by 2036, expanding at a CAGR of 6.5% from 2026 to 2036. The market growth is primarily driven by the rapid growth of automotive electronics, expansion of industrial automation & industry 4.0, and proliferation of IoT & connected devices.

The embedded system market continues to expand as embedded computing functions as a fundamental building block that supports all modern-day electronic and digital systems. Vehicles, industrial machinery, consumer electronics, and connected devices now include embedded systems that provide real-time control, automated operations, and smart decision capabilities. The increasing complexity of electronic products together with their performance requirements and energy efficiency demands has made embedded systems more essential than ever before.

The market shows transition from hardware-based solutions to software-based systems that now contain intelligence capabilities according to analyst’s observations. The hardware elements continue to play a vital role but the market now distinguishes itself through firmware, middleware, and real-time operating systems that provide adaptable systems, expandable solutions, and quick modification capabilities. Embedded platforms now come with built-in connectivity, edge computing capabilities, and security features. These have become their standard features.

The core elements that drive market demand consist of automotive electronic systems, industrial automation technology, and Internet of Things network structures. The progress of semiconductor production methods along with system-on-chip development has resulted in improved performance through reduced power consumption.

The embedded system market includes dedicated computer systems that run particular functions inside complete mechanical or electronic systems. The design of embedded systems differs from general-purpose computers as they focus on particular functions while operating under time constraints, power limitations, and require dependable operations. These systems combine their hardware elements, which include microcontrollers, processors, and system-on-chip devices with embedded software to provide exact control operations and system features.

Multiple fields require the deployment of embedded systems that operate in automotive control units, industrial automation equipment, medical devices, telecommunications infrastructure, and consumer electronics products. The system enables core operational capabilities that consist of sensing, monitoring, actuation, data processing, and communication functions. The design of embedded systems needs to follow application requirements as these systems work independently while handling time-critical tasks, maintaining network connections, and functioning as mobile devices.

The market consists of physical components together with software elements, which include operating systems, middleware, and firmware to achieve proper system functionality. The development of semiconductor integration together with connectivity protocols and power management systems enables embedded systems to perform additional functions. The adoption of automation and smart technologies by industries has made embedded systems their fundamental technology. This enables modern electronic products to achieve dependable performance and intelligent operation.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The automotive electronics industry has expanded rapidly, which creates a major market for embedded systems. Modern vehicles depend on embedded systems to operate their engine management systems, their advanced driver assistance systems (ADAS), their infotainment systems, body electronics, and electric vehicle battery management systems. The growing number of electronic control units (ECUs) has led to an increase in the incorporation of embedded technology in each car.

The shift toward electric vehicles that operate autonomously is observed. Being connected to networks has created an increasing need for embedded systems that deliver superior performance. The operation of electric vehicles depends on complex embedded systems that control their power electronics and thermal systems, and optimize energy usage, and connected vehicles need embedded processors to handle their communication needs, navigation functions, and cybersecurity protection.

The implementation of advanced embedded solutions receives support from regulatory requirements that focus on enhancing vehicle safety and reducing emissions. The real-time processing needs of adaptive cruise control, lane-keeping assistance, and collision avoidance systems require embedded systems to function properly. The market will continue to grow through embedded systems as automotive manufacturers use digital vehicle architectures and software-defined vehicle concepts to develop their vehicles.

Industrial automation expansion together with Industry 4.0 initiatives drives the major market growth for embedded systems. Smart machines together with robotics and automated control systems now operate in manufacturing facilities to boost their production output, decrease their equipment breakdowns, and enhance their operational performance. The main computing units of embedded systems enable industrial process monitoring together with control operations, which operate in real-time.

The operation of industrial sensors, machine vision systems, and robotics controllers, as well as programmable logic controllers (PLCs), depends on embedded platforms that they use as their foundation. The systems provide continuous monitoring. This enables them to acquire data while optimizing their operations and predicting maintenance requirements. Industrial IoT platforms achieve better connectivity and decision-making abilities through their embedded systems integration.

The market needs dependable embedded solutions that can handle production systems running autonomously and distributing operations across decentralized factories. Industry 4.0 initiatives depend on three essential elements, which include interoperability, cybersecurity, and edge intelligence. These need advanced embedded system designs. The increased use of digital twins and smart manufacturing technologies will generate ongoing demand for embedded systems that operate in industrial settings.

| Attribute | Detail |

|---|---|

| Market Opportunity |

|

The market experiences the major growth potential as software-defined embedded systems now work with AI-enabled systems. The development of standard embedded systems into adaptable platforms now lets users modify system operations through software updates instead of redesigning physical hardware. The new system enables developers to create products faster while it supports various applications with better flexibility.

AI-enabled embedded systems perform real-time data analysis through edge-based pattern recognition, which enables them to make automated decisions. The system needs these features to operate properly in its main uses. These include autonomous driving, industrial robotics, medical diagnostics, and smart consumer devices. The development of power-efficient AI chips together with embedded software frameworks, which run at their best, has brought artificial intelligence capabilities to devices that operate in limited power environments.

Software-defined embedded architectures provide two main benefits, which include remote update capabilities, improved cybersecurity protection, and lifecycle monitoring systems. The quick expansion of embedded platforms, which run AI workloads and software-defined functions, is bound to occur as industries now focus on intelligent connected systems. The change process enables semiconductor manufacturers and software vendors, and system integrators to create fresh revenue streams for their businesses.

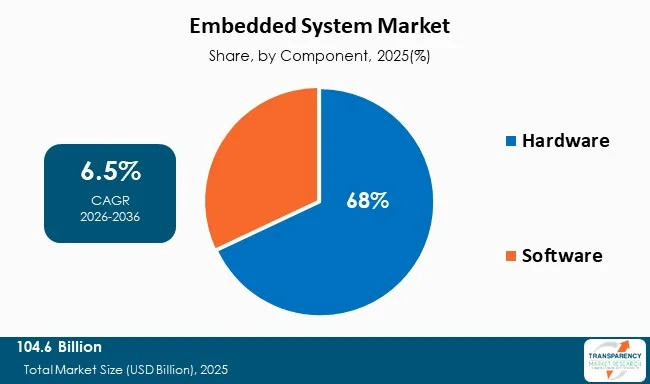

The hardware segment dominates the global embedded system market, accounting for a revenue share of 68% in 2025, which will reach this level by 2025. The market controls majority of the space as microcontrollers, microprocessors, system-on-chip devices, and application-specific integrated circuits find usage in multiple different industries. Hardware components serve as the base for embedded systems as they enable systems to perform calculations and maintain control and network connections.

Microcontrollers and SoCs serve as fundamental components for automotive electronics, consumer devices, and industrial equipment as they combine processing capabilities with memory storage and peripheral interfaces into one integrated chip. The manufacturing process for semiconductors has reached new levels that allow devices to perform better while using less energy and combining more functions into single units. This supports their growing market presence.

The ever-expanding use of embedded hardware in IoT devices, industrial automation systems, and connected infrastructure networks drives the continuing strong market demand. The hardware sector will continue to lead the market throughout the forecast period as embedded applications have grown more complex and their scale has expanded.

| Attribute | Detail |

|---|---|

| Leading Region |

|

The Asia Pacific region leads the worldwide embedded system market as it generated 41% of total revenue during 2025. The region maintains its leadership position as it operates a strong semiconductor production network together with its established electronics manufacturing capabilities, and its quick acceptance of automated systems and digital solutions.

The semiconductor manufacturing industry operates through two main hubs, which Asia Pacific hosts through its Chinese and Japanese, and South Korean, and Taiwanese facilities. The area operates with supply chains, which run from start to finish to deliver affordable production costs and fast product development. The automotive industry together with consumer electronics and industrial sectors create high demand. This drives the growth of regional markets.

The government supports embedded system growth through their programs, which promote smart manufacturing, electric mobility, and digital infrastructure development. The presence of leading semiconductor companies and growing investments in R& D reinforce Asia Pacific’s dominance. The free market access enabled by industrialization and urbanization in developing nations will lead Asia Pacific to establish itself as the top global source for embedded system revenue.

Key players operating in the embedded system market are investing in technological advancements, innovation, and strategic partnerships. They emphasize expanding product portfolios and improving clarity, thereby ensuring sustained growth and leadership in the evolving industry.

Intel Corporation, NXP Semiconductors, STMicroelectronics, Texas Instruments Incorporated, Renesas Electronics Corporation, Infineon Technologies AG, Qualcomm Incorporated, Microchip Technology Inc., Broadcom Inc., Samsung Electronics Co., Ltd., Advanced Micro Devices, Inc., Arm Holdings plc, Siemens AG, Bosch Sensortec GmbH, and Analog Devices, Inc. are the key players operating in the Embedded System market.

Each of these players have been profiled in the embedded system market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2025 | US$ 104.6 Bn |

| Forecast Value in 2036 | US$ 211.6 Bn |

| CAGR | 6.5% |

| Forecast Period | 2026-2036 |

| Historical Data Available for | 2021-2025 |

| Quantitative Units | US$ Bn |

| Embedded System Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Component

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The embedded system market was valued at US$ 104.6 Bn in 2025

The embedded system market is projected to reach US$ 211.6 Bn by the end of 2036

Rapid Growth of Automotive Electronics, Expansion of Industrial Automation & Industry 4.0, and Proliferation of IoT & Connected Devices are some of the driving factors of Embedded system market.

The CAGR is anticipated to be 6.5% from 2026 to 2036

Asia Pacific is expected to account for the largest share

Intel Corporation, NXP Semiconductors, STMicroelectronics, Texas Instruments Incorporated, Renesas Electronics Corporation, Infineon Technologies AG, Qualcomm Incorporated, Microchip Technology Inc., Broadcom Inc., Samsung Electronics Co., Ltd., Advanced Micro Devices, Inc., Arm Holdings plc, Siemens AG, Bosch Sensortec GmbH, and Analog Devices, Inc. among others.

Table 01: Global Embedded System Market Value (US$ Bn) Forecast, by Component, 2021 to 2036

Table 02: Global Embedded System Market Value (US$ Bn) Forecast, by Hardware, 2021 to 2036

Table 03: Global Embedded System Market Value (US$ Bn) Forecast, by Software, 2021 to 2036

Table 04: Global Embedded System Market Value (US$ Bn) Forecast, by System Type, 2021 to 2036

Table 05: Global Embedded System Market Value (US$ Bn) Forecast, by System Size, 2021 to 2036

Table 06: Global Embedded System Market Value (US$ Bn) Forecast, by End-Use Industry, 2021 to 2036

Table 07: Global Embedded System Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 08: North America Embedded System Market Value (US$ Bn) Forecast, by Component, 2021 to 2036

Table 09: North America Embedded System Market Value (US$ Bn) Forecast, by Hardware, 2021 to 2036

Table 10: North America Embedded System Market Value (US$ Bn) Forecast, by Software, 2021 to 2036

Table 11: North America Embedded System Market Value (US$ Bn) Forecast, by System Type, 2021 to 2036

Table 12: North America Embedded System Market Value (US$ Bn) Forecast, by System Size, 2021 to 2036

Table 13: North America Embedded System Market Value (US$ Bn) Forecast, by End-Use Industry, 2021 to 2036

Table 14: North America Embedded System Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 15: U.S. Embedded System Market Value (US$ Bn) Forecast, by Component, 2021 to 2036

Table 16: U.S. Embedded System Market Value (US$ Bn) Forecast, by Hardware, 2021 to 2036

Table 17: U.S. Embedded System Market Value (US$ Bn) Forecast, by Software, 2021 to 2036

Table 18: U.S. Embedded System Market Value (US$ Bn) Forecast, by System Type, 2021 to 2036

Table 19: U.S. Embedded System Market Value (US$ Bn) Forecast, by System Size, 2021 to 2036

Table 20: U.S. Embedded System Market Value (US$ Bn) Forecast, by End-Use Industry, 2021 to 2036

Table 21: Canada Embedded System Market Value (US$ Bn) Forecast, by Component, 2021 to 2036

Table 22: Canada Embedded System Market Value (US$ Bn) Forecast, by Hardware, 2021 to 2036

Table 23: Canada Embedded System Market Value (US$ Bn) Forecast, by Software, 2021 to 2036

Table 24: Canada Embedded System Market Value (US$ Bn) Forecast, by System Type, 2021 to 2036

Table 25: Canada Embedded System Market Value (US$ Bn) Forecast, by System Size, 2021 to 2036

Table 26: Canada Embedded System Market Value (US$ Bn) Forecast, by End-Use Industry, 2021 to 2036

Table 27: Europe Embedded System Market Value (US$ Bn) Forecast, by Component, 2021 to 2036

Table 28: Europe Embedded System Market Value (US$ Bn) Forecast, by Hardware, 2021 to 2036

Table 29: Europe Embedded System Market Value (US$ Bn) Forecast, by Software, 2021 to 2036

Table 30: Europe Embedded System Market Value (US$ Bn) Forecast, by System Type, 2021 to 2036

Table 31: Europe Embedded System Market Value (US$ Bn) Forecast, by System Size, 2021 to 2036

Table 32: Europe Embedded System Market Value (US$ Bn) Forecast, by End-Use Industry, 2021 to 2036

Table 33: Europe Embedded System Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 34: Germany Embedded System Market Value (US$ Bn) Forecast, by Component, 2021 to 2036

Table 35: Germany Embedded System Market Value (US$ Bn) Forecast, by Hardware, 2021 to 2036

Table 36: Germany Embedded System Market Value (US$ Bn) Forecast, by Software, 2021 to 2036

Table 37: Germany Embedded System Market Value (US$ Bn) Forecast, by System Type, 2021 to 2036

Table 38: Germany Embedded System Market Value (US$ Bn) Forecast, by System Size, 2021 to 2036

Table 39: Germany Embedded System Market Value (US$ Bn) Forecast, by End-Use Industry, 2021 to 2036

Table 40: U.K. Embedded System Market Value (US$ Bn) Forecast, by Component, 2021 to 2036

Table 41: U.K. Embedded System Market Value (US$ Bn) Forecast, by Hardware, 2021 to 2036

Table 42: U.K. Embedded System Market Value (US$ Bn) Forecast, by Software, 2021 to 2036

Table 43: U.K. Embedded System Market Value (US$ Bn) Forecast, by System Type, 2021 to 2036

Table 44: U.K. Embedded System Market Value (US$ Bn) Forecast, by System Size, 2021 to 2036

Table 45: U.K. Embedded System Market Value (US$ Bn) Forecast, by End-Use Industry, 2021 to 2036

Table 46: France Embedded System Market Value (US$ Bn) Forecast, by Component, 2021 to 2036

Table 47: France Embedded System Market Value (US$ Bn) Forecast, by Hardware, 2021 to 2036

Table 48: France Embedded System Market Value (US$ Bn) Forecast, by Software, 2021 to 2036

Table 49: France Embedded System Market Value (US$ Bn) Forecast, by System Type, 2021 to 2036

Table 50: France Embedded System Market Value (US$ Bn) Forecast, by System Size, 2021 to 2036

Table 51: France Embedded System Market Value (US$ Bn) Forecast, by End-Use Industry, 2021 to 2036

Table 52: Italy Embedded System Market Value (US$ Bn) Forecast, by Component, 2021 to 2036

Table 53: Italy Embedded System Market Value (US$ Bn) Forecast, by Hardware, 2021 to 2036

Table 54: Italy Embedded System Market Value (US$ Bn) Forecast, by Software, 2021 to 2036

Table 55: Italy Embedded System Market Value (US$ Bn) Forecast, by System Type, 2021 to 2036

Table 56: Italy Embedded System Market Value (US$ Bn) Forecast, by System Size, 2021 to 2036

Table 57: Italy Embedded System Market Value (US$ Bn) Forecast, by End-Use Industry, 2021 to 2036

Table 58: Spain Embedded System Market Value (US$ Bn) Forecast, by Component, 2021 to 2036

Table 59: Spain Embedded System Market Value (US$ Bn) Forecast, by Hardware, 2021 to 2036

Table 60: Spain Embedded System Market Value (US$ Bn) Forecast, by Software, 2021 to 2036

Table 61: Spain Embedded System Market Value (US$ Bn) Forecast, by System Type, 2021 to 2036

Table 62: Spain Embedded System Market Value (US$ Bn) Forecast, by System Size, 2021 to 2036

Table 63: Spain Embedded System Market Value (US$ Bn) Forecast, by End-Use Industry, 2021 to 2036

Table 64: Switzerland Embedded System Market Value (US$ Bn) Forecast, by Component, 2021 to 2036

Table 65: Switzerland Embedded System Market Value (US$ Bn) Forecast, by Hardware, 2021 to 2036

Table 66: Switzerland Embedded System Market Value (US$ Bn) Forecast, by Software, 2021 to 2036

Table 67: Switzerland Embedded System Market Value (US$ Bn) Forecast, by System Type, 2021 to 2036

Table 68: Switzerland Embedded System Market Value (US$ Bn) Forecast, by System Size, 2021 to 2036

Table 69: Switzerland Embedded System Market Value (US$ Bn) Forecast, by End-Use Industry, 2021 to 2036

Table 70: The Netherlands Embedded System Market Value (US$ Bn) Forecast, by Component, 2021 to 2036

Table 71: The Netherlands Embedded System Market Value (US$ Bn) Forecast, by Hardware, 2021 to 2036

Table 72: The Netherlands Embedded System Market Value (US$ Bn) Forecast, by Software, 2021 to 2036

Table 73: The Netherlands Embedded System Market Value (US$ Bn) Forecast, by System Type, 2021 to 2036

Table 74: The Netherlands Embedded System Market Value (US$ Bn) Forecast, by System Size, 2021 to 2036

Table 75: The Netherlands Embedded System Market Value (US$ Bn) Forecast, by End-Use Industry, 2021 to 2036

Table 76: Rest of Europe Embedded System Market Value (US$ Bn) Forecast, by Component, 2021 to 2036

Table 77: Rest of Europe Embedded System Market Value (US$ Bn) Forecast, by Hardware, 2021 to 2036

Table 78: Rest of Europe Embedded System Market Value (US$ Bn) Forecast, by Software, 2021 to 2036

Table 79: Rest of Europe Embedded System Market Value (US$ Bn) Forecast, by System Type, 2021 to 2036

Table 80: Rest of Europe Embedded System Market Value (US$ Bn) Forecast, by System Size, 2021 to 2036

Table 81: Rest of Europe Embedded System Market Value (US$ Bn) Forecast, by End-Use Industry, 2021 to 2036

Table 82: Asia Pacific Embedded System Market Value (US$ Bn) Forecast, by Component, 2021 to 2036

Table 83: Asia Pacific Embedded System Market Value (US$ Bn) Forecast, by Hardware, 2021 to 2036

Table 84: Asia Pacific Embedded System Market Value (US$ Bn) Forecast, by Software, 2021 to 2036

Table 85: Asia Pacific Embedded System Market Value (US$ Bn) Forecast, by System Type, 2021 to 2036

Table 86: Asia Pacific Embedded System Market Value (US$ Bn) Forecast, by System Size, 2021 to 2036

Table 87: Asia Pacific Embedded System Market Value (US$ Bn) Forecast, by End-Use Industry, 2021 to 2036

Table 88: Asia Pacific Embedded System Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 89: China Embedded System Market Value (US$ Bn) Forecast, by Component, 2021 to 2036

Table 90: China Embedded System Market Value (US$ Bn) Forecast, by Hardware, 2021 to 2036

Table 91: China Embedded System Market Value (US$ Bn) Forecast, by Software, 2021 to 2036

Table 92: China Embedded System Market Value (US$ Bn) Forecast, by System Type, 2021 to 2036

Table 93: China Embedded System Market Value (US$ Bn) Forecast, by System Size, 2021 to 2036

Table 94: China Embedded System Market Value (US$ Bn) Forecast, by End-Use Industry, 2021 to 2036

Table 95: Japan Embedded System Market Value (US$ Bn) Forecast, by Component, 2021 to 2036

Table 96: Japan Embedded System Market Value (US$ Bn) Forecast, by Hardware, 2021 to 2036

Table 97: Japan Embedded System Market Value (US$ Bn) Forecast, by Software, 2021 to 2036

Table 98: Japan Embedded System Market Value (US$ Bn) Forecast, by System Type, 2021 to 2036

Table 99: Japan Embedded System Market Value (US$ Bn) Forecast, by System Size, 2021 to 2036

Table 100: Japan Embedded System Market Value (US$ Bn) Forecast, by End-Use Industry, 2021 to 2036

Table 101: India Embedded System Market Value (US$ Bn) Forecast, by Component, 2021 to 2036

Table 102: India Embedded System Market Value (US$ Bn) Forecast, by Hardware, 2021 to 2036

Table 103: India Embedded System Market Value (US$ Bn) Forecast, by Software, 2021 to 2036

Table 104: India Embedded System Market Value (US$ Bn) Forecast, by System Type, 2021 to 2036

Table 105: India Embedded System Market Value (US$ Bn) Forecast, by System Size, 2021 to 2036

Table 106: India Embedded System Market Value (US$ Bn) Forecast, by End-Use Industry, 2021 to 2036

Table 107: South Korea Embedded System Market Value (US$ Bn) Forecast, by Component, 2021 to 2036

Table 108: South Korea Embedded System Market Value (US$ Bn) Forecast, by Hardware, 2021 to 2036

Table 109: South Korea Embedded System Market Value (US$ Bn) Forecast, by Software, 2021 to 2036

Table 110: South Korea Embedded System Market Value (US$ Bn) Forecast, by System Type, 2021 to 2036

Table 111: South Korea Embedded System Market Value (US$ Bn) Forecast, by System Size, 2021 to 2036

Table 112: South Korea Embedded System Market Value (US$ Bn) Forecast, by End-Use Industry, 2021 to 2036

Table 113: Australia and New Zealand Embedded System Market Value (US$ Bn) Forecast, by Component, 2021 to 2036

Table 114: Australia and New Zealand Embedded System Market Value (US$ Bn) Forecast, by Hardware, 2021 to 2036

Table 115: Australia and New Zealand Embedded System Market Value (US$ Bn) Forecast, by Software, 2021 to 2036

Table 116: Australia and New Zealand Embedded System Market Value (US$ Bn) Forecast, by System Type, 2021 to 2036

Table 117: Australia and New Zealand Embedded System Market Value (US$ Bn) Forecast, by System Size, 2021 to 2036

Table 118: Australia and New Zealand Embedded System Market Value (US$ Bn) Forecast, by End-Use Industry, 2021 to 2036

Table 119: Rest of Asia Pacific Embedded System Market Value (US$ Bn) Forecast, by Component, 2021 to 2036

Table 120: Rest of Asia Pacific Embedded System Market Value (US$ Bn) Forecast, by Hardware, 2021 to 2036

Table 121: Rest of Asia Pacific Embedded System Market Value (US$ Bn) Forecast, by Software, 2021 to 2036

Table 122: Rest of Asia Pacific Embedded System Market Value (US$ Bn) Forecast, by System Type, 2021 to 2036

Table 123: Rest of Asia Pacific Embedded System Market Value (US$ Bn) Forecast, by System Size, 2021 to 2036

Table 124: Rest of Asia Pacific Embedded System Market Value (US$ Bn) Forecast, by End-Use Industry, 2021 to 2036

Table 125: Latin America Embedded System Market Value (US$ Bn) Forecast, by Component, 2021 to 2036

Table 126: Latin America Embedded System Market Value (US$ Bn) Forecast, by Hardware, 2021 to 2036

Table 127: Latin America Embedded System Market Value (US$ Bn) Forecast, by Software, 2021 to 2036

Table 128: Latin America Embedded System Market Value (US$ Bn) Forecast, by System Type, 2021 to 2036

Table 129: Latin America Embedded System Market Value (US$ Bn) Forecast, by System Size, 2021 to 2036

Table 130: Latin America Embedded System Market Value (US$ Bn) Forecast, by End-Use Industry, 2021 to 2036

Table 131: Latin America Embedded System Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 132: Brazil Embedded System Market Value (US$ Bn) Forecast, by Component, 2021 to 2036

Table 133: Brazil Embedded System Market Value (US$ Bn) Forecast, by Hardware, 2021 to 2036

Table 134: Brazil Embedded System Market Value (US$ Bn) Forecast, by Software, 2021 to 2036

Table 135: Brazil Embedded System Market Value (US$ Bn) Forecast, by System Type, 2021 to 2036

Table 136: Brazil Embedded System Market Value (US$ Bn) Forecast, by System Size, 2021 to 2036

Table 137: Brazil Embedded System Market Value (US$ Bn) Forecast, by End-Use Industry, 2021 to 2036

Table 138: Mexico Embedded System Market Value (US$ Bn) Forecast, by Component, 2021 to 2036

Table 139: Mexico Embedded System Market Value (US$ Bn) Forecast, by Hardware, 2021 to 2036

Table 140: Mexico Embedded System Market Value (US$ Bn) Forecast, by Software, 2021 to 2036

Table 141: Mexico Embedded System Market Value (US$ Bn) Forecast, by System Type, 2021 to 2036

Table 142: Mexico Embedded System Market Value (US$ Bn) Forecast, by System Size, 2021 to 2036

Table 143: Mexico Embedded System Market Value (US$ Bn) Forecast, by End-Use Industry, 2021 to 2036

Table 144: Argentina Embedded System Market Value (US$ Bn) Forecast, by Component, 2021 to 2036

Table 145: Argentina Embedded System Market Value (US$ Bn) Forecast, by Hardware, 2021 to 2036

Table 146: Argentina Embedded System Market Value (US$ Bn) Forecast, by Software, 2021 to 2036

Table 147: Argentina Embedded System Market Value (US$ Bn) Forecast, by System Type, 2021 to 2036

Table 148: Argentina Embedded System Market Value (US$ Bn) Forecast, by System Size, 2021 to 2036

Table 149: Argentina Embedded System Market Value (US$ Bn) Forecast, by End-Use Industry, 2021 to 2036

Table 150: Rest of Latin America Embedded System Market Value (US$ Bn) Forecast, by Component, 2021 to 2036

Table 151: Rest of Latin America Embedded System Market Value (US$ Bn) Forecast, by Hardware, 2021 to 2036

Table 152: Rest of Latin America Embedded System Market Value (US$ Bn) Forecast, by Software, 2021 to 2036

Table 153: Rest of Latin America Embedded System Market Value (US$ Bn) Forecast, by System Type, 2021 to 2036

Table 154: Rest of Latin America Embedded System Market Value (US$ Bn) Forecast, by System Size, 2021 to 2036

Table 155: Rest of Latin America Embedded System Market Value (US$ Bn) Forecast, by End-Use Industry, 2021 to 2036

Table 156: Middle East and Africa Embedded System Market Value (US$ Bn) Forecast, by Component, 2021 to 2036

Table 157: Middle East and Africa Embedded System Market Value (US$ Bn) Forecast, by Hardware, 2021 to 2036

Table 158: Middle East and Africa Embedded System Market Value (US$ Bn) Forecast, by Software, 2021 to 2036

Table 159: Middle East and Africa Embedded System Market Value (US$ Bn) Forecast, by System Type, 2021 to 2036

Table 160: Middle East and Africa Embedded System Market Value (US$ Bn) Forecast, by System Size, 2021 to 2036

Table 161: Middle East and Africa Embedded System Market Value (US$ Bn) Forecast, by End-Use Industry, 2021 to 2036

Table 162: Middle East and Africa Embedded System Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 163: GCC Countries Embedded System Market Value (US$ Bn) Forecast, by Component, 2021 to 2036

Table 164: GCC Countries Embedded System Market Value (US$ Bn) Forecast, by Hardware, 2021 to 2036

Table 165: GCC Countries Embedded System Market Value (US$ Bn) Forecast, by Software, 2021 to 2036

Table 166: GCC Countries Embedded System Market Value (US$ Bn) Forecast, by System Type, 2021 to 2036

Table 167: GCC Countries Embedded System Market Value (US$ Bn) Forecast, by System Size, 2021 to 2036

Table 168: GCC Countries Embedded System Market Value (US$ Bn) Forecast, by End-Use Industry, 2021 to 2036

Table 169: South Africa Embedded System Market Value (US$ Bn) Forecast, by Component, 2021 to 2036

Table 170: South Africa Embedded System Market Value (US$ Bn) Forecast, by Hardware, 2021 to 2036

Table 171: South Africa Embedded System Market Value (US$ Bn) Forecast, by Software, 2021 to 2036

Table 172: South Africa Embedded System Market Value (US$ Bn) Forecast, by System Type, 2021 to 2036

Table 173: South Africa Embedded System Market Value (US$ Bn) Forecast, by System Size, 2021 to 2036

Table 174: South Africa Embedded System Market Value (US$ Bn) Forecast, by End-Use Industry, 2021 to 2036

Table 175: Rest of Middle East and Africa Embedded System Market Value (US$ Bn) Forecast, by Component, 2021 to 2036

Table 176: Rest of Middle East and Africa Embedded System Market Value (US$ Bn) Forecast, by Hardware, 2021 to 2036

Table 177: Rest of Middle East and Africa Embedded System Market Value (US$ Bn) Forecast, by Software, 2021 to 2036

Table 178: Rest of Middle East and Africa Embedded System Market Value (US$ Bn) Forecast, by System Type, 2021 to 2036

Table 179: Rest of Middle East and Africa Embedded System Market Value (US$ Bn) Forecast, by System Size, 2021 to 2036

Table 180: Rest of Middle East and Africa Embedded System Market Value (US$ Bn) Forecast, by End-Use Industry, 2021 to 2036

Figure 01: Global Embedded System Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 02: Global Embedded System Market Value Share Analysis, by Component, 2025 and 2036

Figure 03: Global Embedded System Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 04: Global Embedded System Market Revenue (US$ Bn), by Hardware, 2021 to 2036

Figure 05: Global Embedded System Market Revenue (US$ Bn), by Software, 2021 to 2036

Figure 06: Global Embedded System Market Value Share Analysis, by System Type, 2025 and 2036

Figure 07: Global Embedded System Market Attractiveness Analysis, by System Type, 2026 to 2036

Figure 08: Global Embedded System Market Revenue (US$ Bn), by Standalone, 2021 to 2036

Figure 09: Global Embedded System Market Revenue (US$ Bn), by Real Time, 2021 to 2036

Figure 10: Global Embedded System Market Revenue (US$ Bn), by Networked, 2021 to 2036

Figure 11: Global Embedded System Market Revenue (US$ Bn), by Mobile, 2021 to 2036

Figure 12: Global Embedded System Market Value Share Analysis, by System Size, 2025 and 2036

Figure 13: Global Embedded System Market Attractiveness Analysis, by System Size, 2026 to 2036

Figure 14: Global Embedded System Market Revenue (US$ Bn), by Small scale, 2021 to 2036

Figure 15: Global Embedded System Market Revenue (US$ Bn), by Medium scale, 2021 to 2036

Figure 16: Global Embedded System Market Revenue (US$ Bn), by Large scale, 2021 to 2036

Figure 17: Global Embedded System Market Value Share Analysis, by End-Use Industry, 2025 and 2036

Figure 18: Global Embedded System Market Attractiveness Analysis, by End-Use Industry, 2026 to 2036

Figure 19: Global Embedded System Market Revenue (US$ Bn), by Automotive & Transportation, 2021 to 2036

Figure 20: Global Embedded System Market Revenue (US$ Bn), by Consumer Electronics, 2021 to 2036

Figure 21: Global Embedded System Market Revenue (US$ Bn), by Manufacturing, 2021 to 2036

Figure 22: Global Embedded System Market Revenue (US$ Bn), by Aerospace & Defense, 2021 to 2036

Figure 23: Global Embedded System Market Revenue (US$ Bn), by IT & Telecom, 2021 to 2036

Figure 24: Global Embedded System Market Revenue (US$ Bn), by Healthcare, 2021 to 2036

Figure 25: Global Embedded System Market Revenue (US$ Bn), by Consumer Goods, 2021 to 2036

Figure 26: Global Embedded System Market Revenue (US$ Bn), by Energy & Power, 2021 to 2036

Figure 27: Global Embedded System Market Revenue (US$ Bn), by Others, 2021 to 2036

Figure 28: Global Embedded System Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 29: Global Embedded System Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 30: North America Embedded System Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 31: North America Embedded System Market Value Share Analysis, by Component, 2025 and 2036

Figure 32: North America Embedded System Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 33: North America Embedded System Market Value Share Analysis, by System Type, 2025 and 2036

Figure 34: North America Embedded System Market Attractiveness Analysis, by System Type, 2026 to 2036

Figure 35: North America Embedded System Market Value Share Analysis, by System Size, 2025 and 2036

Figure 36: North America Embedded System Market Attractiveness Analysis, by System Size, 2026 to 2036

Figure 37: North America Embedded System Market Value Share Analysis, by End-Use Industry, 2025 and 2036

Figure 38: North America Embedded System Market Attractiveness Analysis, by End-Use Industry, 2026 to 2036

Figure 39: North America Embedded System Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 40: North America Embedded System Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 41: U.S. Embedded System Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 42: U.S. Embedded System Market Value Share Analysis, by Component, 2025 and 2036

Figure 43: U.S. Embedded System Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 44: U.S. Embedded System Market Value Share Analysis, by System Type, 2025 and 2036

Figure 45: U.S. Embedded System Market Attractiveness Analysis, by System Type, 2026 to 2036

Figure 46: U.S. Embedded System Market Value Share Analysis, by System Size, 2025 and 2036

Figure 47: U.S. Embedded System Market Attractiveness Analysis, by System Size, 2026 to 2036

Figure 48: U.S. Embedded System Market Value Share Analysis, by End-Use Industry, 2025 and 2036

Figure 49: U.S. Embedded System Market Attractiveness Analysis, by End-Use Industry, 2026 to 2036

Figure 50: Canada Embedded System Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 51: Canada Embedded System Market Value Share Analysis, by Component, 2025 and 2036

Figure 52: Canada Embedded System Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 53: Canada Embedded System Market Value Share Analysis, by System Type, 2025 and 2036

Figure 54: Canada Embedded System Market Attractiveness Analysis, by System Type, 2026 to 2036

Figure 55: Canada Embedded System Market Value Share Analysis, by System Size, 2025 and 2036

Figure 56: Canada Embedded System Market Attractiveness Analysis, by System Size, 2026 to 2036

Figure 57: Canada Embedded System Market Value Share Analysis, by End-Use Industry, 2025 and 2036

Figure 58: Canada Embedded System Market Attractiveness Analysis, by End-Use Industry, 2026 to 2036

Figure 59: Europe Embedded System Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 60: Europe Embedded System Market Value Share Analysis, by Component, 2025 and 2036

Figure 61: Europe Embedded System Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 62: Europe Embedded System Market Value Share Analysis, by System Type, 2025 and 2036

Figure 63: Europe Embedded System Market Attractiveness Analysis, by System Type, 2026 to 2036

Figure 64: Europe Embedded System Market Value Share Analysis, by System Size, 2025 and 2036

Figure 65: Europe Embedded System Market Attractiveness Analysis, by System Size, 2026 to 2036

Figure 66: Europe Embedded System Market Value Share Analysis, by End-Use Industry, 2025 and 2036

Figure 67: Europe Embedded System Market Attractiveness Analysis, by End-Use Industry, 2026 to 2036

Figure 68: Europe Embedded System Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 69: Europe Embedded System Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 70: Germany Embedded System Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 71: Germany Embedded System Market Value Share Analysis, by Component, 2025 and 2036

Figure 72: Germany Embedded System Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 73: Germany Embedded System Market Value Share Analysis, by System Type, 2025 and 2036

Figure 74: Germany Embedded System Market Attractiveness Analysis, by System Type, 2026 to 2036

Figure 75: Germany Embedded System Market Value Share Analysis, by System Size, 2025 and 2036

Figure 76: Germany Embedded System Market Attractiveness Analysis, by System Size, 2026 to 2036

Figure 77: Germany Embedded System Market Value Share Analysis, by End-Use Industry, 2025 and 2036

Figure 78: Germany Embedded System Market Attractiveness Analysis, by End-Use Industry, 2026 to 2036

Figure 79: U.K. Embedded System Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 80: U.K. Embedded System Market Value Share Analysis, by Component, 2025 and 2036

Figure 81: U.K. Embedded System Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 82: U.K. Embedded System Market Value Share Analysis, by System Type, 2025 and 2036

Figure 83: U.K. Embedded System Market Attractiveness Analysis, by System Type, 2026 to 2036

Figure 84: U.K. Embedded System Market Value Share Analysis, by System Size, 2025 and 2036

Figure 85: U.K. Embedded System Market Attractiveness Analysis, by System Size, 2026 to 2036

Figure 86: U.K. Embedded System Market Value Share Analysis, by End-Use Industry, 2025 and 2036

Figure 87: U.K. Embedded System Market Attractiveness Analysis, by End-Use Industry, 2026 to 2036

Figure 88: France Embedded System Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 89: France Embedded System Market Value Share Analysis, by Component, 2025 and 2036

Figure 90: France Embedded System Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 91: France Embedded System Market Value Share Analysis, by System Type, 2025 and 2036

Figure 92: France Embedded System Market Attractiveness Analysis, by System Type, 2026 to 2036

Figure 93: France Embedded System Market Value Share Analysis, by System Size, 2025 and 2036

Figure 94: France Embedded System Market Attractiveness Analysis, by System Size, 2026 to 2036

Figure 95: France Embedded System Market Value Share Analysis, by End-Use Industry, 2025 and 2036

Figure 96: France Embedded System Market Attractiveness Analysis, by End-Use Industry, 2026 to 2036

Figure 97: Italy Embedded System Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 98: Italy Embedded System Market Value Share Analysis, by Component, 2025 and 2036

Figure 99: Italy Embedded System Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 100: Italy Embedded System Market Value Share Analysis, by System Type, 2025 and 2036

Figure 101: Italy Embedded System Market Attractiveness Analysis, by System Type, 2026 to 2036

Figure 102: Italy Embedded System Market Value Share Analysis, by System Size, 2025 and 2036

Figure 103: Italy Embedded System Market Attractiveness Analysis, by System Size, 2026 to 2036

Figure 104: Italy Embedded System Market Value Share Analysis, by End-Use Industry, 2025 and 2036

Figure 105: Italy Embedded System Market Attractiveness Analysis, by End-Use Industry, 2026 to 2036

Figure 106: Spain Embedded System Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 107: Spain Embedded System Market Value Share Analysis, by Component, 2025 and 2036

Figure 108: Spain Embedded System Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 109: Spain Embedded System Market Value Share Analysis, by System Type, 2025 and 2036

Figure 110: Spain Embedded System Market Attractiveness Analysis, by System Type, 2026 to 2036

Figure 111: Spain Embedded System Market Value Share Analysis, by System Size, 2025 and 2036

Figure 112: Spain Embedded System Market Attractiveness Analysis, by System Size, 2026 to 2036

Figure 113: Spain Embedded System Market Value Share Analysis, by End-Use Industry, 2025 and 2036

Figure 114: Spain Embedded System Market Attractiveness Analysis, by End-Use Industry, 2026 to 2036

Figure 115: Switzerland Embedded System Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 116: Switzerland Embedded System Market Value Share Analysis, by Component, 2025 and 2036

Figure 117: Switzerland Embedded System Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 118: Switzerland Embedded System Market Value Share Analysis, by System Type, 2025 and 2036

Figure 119: Switzerland Embedded System Market Attractiveness Analysis, by System Type, 2026 to 2036

Figure 120: Switzerland Embedded System Market Value Share Analysis, by System Size, 2025 and 2036

Figure 121: Switzerland Embedded System Market Attractiveness Analysis, by System Size, 2026 to 2036

Figure 122: Switzerland Embedded System Market Value Share Analysis, by End-Use Industry, 2025 and 2036

Figure 123: Switzerland Embedded System Market Attractiveness Analysis, by End-Use Industry, 2026 to 2036

Figure 124: The Netherlands Embedded System Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 125: The Netherlands Embedded System Market Value Share Analysis, by Component, 2025 and 2036

Figure 126: The Netherlands Embedded System Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 127: The Netherlands Embedded System Market Value Share Analysis, by System Type, 2025 and 2036

Figure 128: The Netherlands Embedded System Market Attractiveness Analysis, by System Type, 2026 to 2036

Figure 129: The Netherlands Embedded System Market Value Share Analysis, by System Size, 2025 and 2036

Figure 130: The Netherlands Embedded System Market Attractiveness Analysis, by System Size, 2026 to 2036

Figure 131: The Netherlands Embedded System Market Value Share Analysis, by End-Use Industry, 2025 and 2036

Figure 132: The Netherlands Embedded System Market Attractiveness Analysis, by End-Use Industry, 2026 to 2036

Figure 133: Rest of Europe Embedded System Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 134: Rest of Europe Embedded System Market Value Share Analysis, by Component, 2025 and 2036

Figure 135: Rest of Europe Embedded System Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 136: Rest of Europe Embedded System Market Value Share Analysis, by System Type, 2025 and 2036

Figure 137: Rest of Europe Embedded System Market Attractiveness Analysis, by System Type, 2026 to 2036

Figure 138: Rest of Europe Embedded System Market Value Share Analysis, by System Size, 2025 and 2036

Figure 139: Rest of Europe Embedded System Market Attractiveness Analysis, by System Size, 2026 to 2036

Figure 140: Rest of Europe Embedded System Market Value Share Analysis, by End-Use Industry, 2025 and 2036

Figure 141: Rest of Europe Embedded System Market Attractiveness Analysis, by End-Use Industry, 2026 to 2036

Figure 142: Asia Pacific Embedded System Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 143: Asia Pacific Embedded System Market Value Share Analysis, by Component, 2025 and 2036

Figure 144: Asia Pacific Embedded System Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 145: Asia Pacific Embedded System Market Value Share Analysis, by System Type, 2025 and 2036

Figure 146: Asia Pacific Embedded System Market Attractiveness Analysis, by System Type, 2026 to 2036

Figure 147: Asia Pacific Embedded System Market Value Share Analysis, by System Size, 2025 and 2036

Figure 148: Asia Pacific Embedded System Market Attractiveness Analysis, by System Size, 2026 to 2036

Figure 149: Asia Pacific Embedded System Market Value Share Analysis, by End-Use Industry, 2025 and 2036

Figure 150: Asia Pacific Embedded System Market Attractiveness Analysis, by End-Use Industry, 2026 to 2036

Figure 151: Asia Pacific Embedded System Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 152: Asia Pacific Embedded System Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 153: China Embedded System Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 154: China Embedded System Market Value Share Analysis, by Component, 2025 and 2036

Figure 155: China Embedded System Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 156: China Embedded System Market Value Share Analysis, by System Type, 2025 and 2036

Figure 157: China Embedded System Market Attractiveness Analysis, by System Type, 2026 to 2036

Figure 158: China Embedded System Market Value Share Analysis, by System Size, 2025 and 2036

Figure 159: China Embedded System Market Attractiveness Analysis, by System Size, 2026 to 2036

Figure 160: China Embedded System Market Value Share Analysis, by End-Use Industry, 2025 and 2036

Figure 161: China Embedded System Market Attractiveness Analysis, by End-Use Industry, 2026 to 2036

Figure 162: Japan Embedded System Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 163: Japan Embedded System Market Value Share Analysis, by Component, 2025 and 2036

Figure 164: Japan Embedded System Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 165: Japan Embedded System Market Value Share Analysis, by System Type, 2025 and 2036

Figure 166: Japan Embedded System Market Attractiveness Analysis, by System Type, 2026 to 2036

Figure 167: Japan Embedded System Market Value Share Analysis, by System Size, 2025 and 2036

Figure 168: Japan Embedded System Market Attractiveness Analysis, by System Size, 2026 to 2036

Figure 169: Japan Embedded System Market Value Share Analysis, by End-Use Industry, 2025 and 2036

Figure 170: Japan Embedded System Market Attractiveness Analysis, by End-Use Industry, 2026 to 2036

Figure 171: India Embedded System Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 172: India Embedded System Market Value Share Analysis, by Component, 2025 and 2036

Figure 173: India Embedded System Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 174: India Embedded System Market Value Share Analysis, by System Type, 2025 and 2036

Figure 175: India Embedded System Market Attractiveness Analysis, by System Type, 2026 to 2036

Figure 176: India Embedded System Market Value Share Analysis, by System Size, 2025 and 2036

Figure 177: India Embedded System Market Attractiveness Analysis, by System Size, 2026 to 2036

Figure 178: India Embedded System Market Value Share Analysis, by End-Use Industry, 2025 and 2036

Figure 179: India Embedded System Market Attractiveness Analysis, by End-Use Industry, 2026 to 2036

Figure 180: South Korea Embedded System Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 181: South Korea Embedded System Market Value Share Analysis, by Component, 2025 and 2036

Figure 182: South Korea Embedded System Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 183: South Korea Embedded System Market Value Share Analysis, by System Type, 2025 and 2036

Figure 184: South Korea Embedded System Market Attractiveness Analysis, by System Type, 2026 to 2036

Figure 185: South Korea Embedded System Market Value Share Analysis, by System Size, 2025 and 2036

Figure 186: South Korea Embedded System Market Attractiveness Analysis, by System Size, 2026 to 2036

Figure 187: South Korea Embedded System Market Value Share Analysis, by End-Use Industry, 2025 and 2036

Figure 188: South Korea Embedded System Market Attractiveness Analysis, by End-Use Industry, 2026 to 2036

Figure 189: Australia and New Zealand Embedded System Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 190: Australia and New Zealand Embedded System Market Value Share Analysis, by Component, 2025 and 2036

Figure 191: Australia and New Zealand Embedded System Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 192: Australia and New Zealand Embedded System Market Value Share Analysis, by System Type, 2025 and 2036

Figure 193: Australia and New Zealand Embedded System Market Attractiveness Analysis, by System Type, 2026 to 2036

Figure 194: Australia and New Zealand Embedded System Market Value Share Analysis, by System Size, 2025 and 2036

Figure 195: Australia and New Zealand Embedded System Market Attractiveness Analysis, by System Size, 2026 to 2036

Figure 196: Australia and New Zealand Embedded System Market Value Share Analysis, by End-Use Industry, 2025 and 2036

Figure 197: Australia and New Zealand Embedded System Market Attractiveness Analysis, by End-Use Industry, 2026 to 2036

Figure 198: Rest of Asia Pacific Embedded System Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 199: Rest of Asia Pacific Embedded System Market Value Share Analysis, by Component, 2025 and 2036

Figure 200: Rest of Asia Pacific Embedded System Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 201: Rest of Asia Pacific Embedded System Market Value Share Analysis, by System Type, 2025 and 2036

Figure 202: Rest of Asia Pacific Embedded System Market Attractiveness Analysis, by System Type, 2026 to 2036

Figure 203: Rest of Asia Pacific Embedded System Market Value Share Analysis, by System Size, 2025 and 2036

Figure 204: Rest of Asia Pacific Embedded System Market Attractiveness Analysis, by System Size, 2026 to 2036

Figure 205: Rest of Asia Pacific Embedded System Market Value Share Analysis, by End-Use Industry, 2025 and 2036

Figure 206: Rest of Asia Pacific Embedded System Market Attractiveness Analysis, by End-Use Industry, 2026 to 2036

Figure 207: Latin America Embedded System Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 208: Latin America Embedded System Market Value Share Analysis, by Component, 2025 and 2036

Figure 209: Latin America Embedded System Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 210: Latin America Embedded System Market Value Share Analysis, by System Type, 2025 and 2036

Figure 211: Latin America Embedded System Market Attractiveness Analysis, by System Type, 2026 to 2036

Figure 212: Latin America Embedded System Market Value Share Analysis, by System Size, 2025 and 2036

Figure 213: Latin America Embedded System Market Attractiveness Analysis, by System Size, 2026 to 2036

Figure 214: Latin America Embedded System Market Value Share Analysis, by End-Use Industry, 2025 and 2036

Figure 215: Latin America Embedded System Market Attractiveness Analysis, by End-Use Industry, 2026 to 2036

Figure 216: Latin America Embedded System Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 217: Latin America Embedded System Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 218: Brazil Embedded System Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 219: Brazil Embedded System Market Value Share Analysis, by Component, 2025 and 2036

Figure 220: Brazil Embedded System Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 221: Brazil Embedded System Market Value Share Analysis, by System Type, 2025 and 2036

Figure 222: Brazil Embedded System Market Attractiveness Analysis, by System Type, 2026 to 2036

Figure 223: Brazil Embedded System Market Value Share Analysis, by System Size, 2025 and 2036

Figure 224: Brazil Embedded System Market Attractiveness Analysis, by System Size, 2026 to 2036

Figure 225: Brazil Embedded System Market Value Share Analysis, by End-Use Industry, 2025 and 2036

Figure 226: Brazil Embedded System Market Attractiveness Analysis, by End-Use Industry, 2026 to 2036

Figure 227: Mexico Embedded System Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 228: Mexico Embedded System Market Value Share Analysis, by Component, 2025 and 2036

Figure 229: Mexico Embedded System Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 230: Mexico Embedded System Market Value Share Analysis, by System Type, 2025 and 2036

Figure 231: Mexico Embedded System Market Attractiveness Analysis, by System Type, 2026 to 2036

Figure 232: Mexico Embedded System Market Value Share Analysis, by System Size, 2025 and 2036

Figure 233: Mexico Embedded System Market Attractiveness Analysis, by System Size, 2026 to 2036

Figure 234: Mexico Embedded System Market Value Share Analysis, by End-Use Industry, 2025 and 2036

Figure 235: Mexico Embedded System Market Attractiveness Analysis, by End-Use Industry, 2026 to 2036

Figure 236: Argentina Embedded System Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 237: Argentina Embedded System Market Value Share Analysis, by Component, 2025 and 2036

Figure 238: Argentina Embedded System Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 239: Argentina Embedded System Market Value Share Analysis, by System Type, 2025 and 2036

Figure 240: Argentina Embedded System Market Attractiveness Analysis, by System Type, 2026 to 2036

Figure 241: Argentina Embedded System Market Value Share Analysis, by System Size, 2025 and 2036

Figure 242: Argentina Embedded System Market Attractiveness Analysis, by System Size, 2026 to 2036

Figure 243: Argentina Embedded System Market Value Share Analysis, by End-Use Industry, 2025 and 2036

Figure 244: Argentina Embedded System Market Attractiveness Analysis, by End-Use Industry, 2026 to 2036

Figure 245: Rest of Latin America Embedded System Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 246: Rest of Latin America Embedded System Market Value Share Analysis, by Component, 2025 and 2036

Figure 247: Rest of Latin America Embedded System Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 248: Rest of Latin America Embedded System Market Value Share Analysis, by System Type, 2025 and 2036

Figure 249: Rest of Latin America Embedded System Market Attractiveness Analysis, by System Type, 2026 to 2036

Figure 250: Rest of Latin America Embedded System Market Value Share Analysis, by System Size, 2025 and 2036

Figure 251: Rest of Latin America Embedded System Market Attractiveness Analysis, by System Size, 2026 to 2036

Figure 252: Rest of Latin America Embedded System Market Value Share Analysis, by End-Use Industry, 2025 and 2036

Figure 253: Rest of Latin America Embedded System Market Attractiveness Analysis, by End-Use Industry, 2026 to 2036

Figure 254: Middle East and Africa Embedded System Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 255: Middle East and Africa Embedded System Market Value Share Analysis, by Component, 2025 and 2036

Figure 256: Middle East and Africa Embedded System Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 257: Middle East and Africa Embedded System Market Value Share Analysis, by System Type, 2025 and 2036

Figure 258: Middle East and Africa Embedded System Market Attractiveness Analysis, by System Type, 2026 to 2036

Figure 259: Middle East and Africa Embedded System Market Value Share Analysis, by System Size, 2025 and 2036

Figure 260: Middle East and Africa Embedded System Market Attractiveness Analysis, by System Size, 2026 to 2036

Figure 261: Middle East and Africa Embedded System Market Value Share Analysis, by End-Use Industry, 2025 and 2036

Figure 262: Middle East and Africa Embedded System Market Attractiveness Analysis, by End-Use Industry, 2026 to 2036

Figure 263: Middle East and Africa Embedded System Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 264: Middle East and Africa Embedded System Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 265: GCC Countries Embedded System Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 266: GCC Countries Embedded System Market Value Share Analysis, by Component, 2025 and 2036

Figure 267: GCC Countries Embedded System Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 268: GCC Countries Embedded System Market Value Share Analysis, by System Type, 2025 and 2036

Figure 269: GCC Countries Embedded System Market Attractiveness Analysis, by System Type, 2026 to 2036

Figure 270: GCC Countries Embedded System Market Value Share Analysis, by System Size, 2025 and 2036

Figure 271: GCC Countries Embedded System Market Attractiveness Analysis, by System Size, 2026 to 2036

Figure 272: GCC Countries Embedded System Market Value Share Analysis, by End-Use Industry, 2025 and 2036

Figure 273: GCC Countries Embedded System Market Attractiveness Analysis, by End-Use Industry, 2026 to 2036

Figure 274: South Africa Embedded System Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 275: South Africa Embedded System Market Value Share Analysis, by Component, 2025 and 2036

Figure 276: South Africa Embedded System Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 277: South Africa Embedded System Market Value Share Analysis, by System Type, 2025 and 2036

Figure 278: South Africa Embedded System Market Attractiveness Analysis, by System Type, 2026 to 2036

Figure 279: South Africa Embedded System Market Value Share Analysis, by System Size, 2025 and 2036

Figure 280: South Africa Embedded System Market Attractiveness Analysis, by System Size, 2026 to 2036

Figure 281: South Africa Embedded System Market Value Share Analysis, by End-Use Industry, 2025 and 2036

Figure 282: South Africa Embedded System Market Attractiveness Analysis, by End-Use Industry, 2026 to 2036

Figure 283: Rest of Middle East and Africa Embedded System Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 284: Rest of Middle East and Africa Embedded System Market Value Share Analysis, by Component, 2025 and 2036

Figure 285: Rest of Middle East and Africa Embedded System Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 286: Rest of Middle East and Africa Embedded System Market Value Share Analysis, by System Type, 2025 and 2036

Figure 287: Rest of Middle East and Africa Embedded System Market Attractiveness Analysis, by System Type, 2026 to 2036

Figure 288: Rest of Middle East and Africa Embedded System Market Value Share Analysis, by System Size, 2025 and 2036

Figure 289: Rest of Middle East and Africa Embedded System Market Attractiveness Analysis, by System Size, 2026 to 2036

Figure 290: Rest of Middle East and Africa Embedded System Market Value Share Analysis, by End-Use Industry, 2025 and 2036

Figure 291: Rest of Middle East and Africa Embedded System Market Attractiveness Analysis, by End-Use Industry, 2026 to 2036