Reports

Reports

Analysts’ Viewpoint on Textile Chemicals Market Scenario

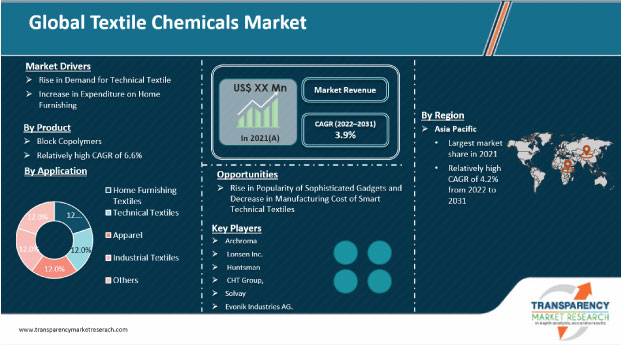

Demand for textiles and apparel is expected to increase during the forecast period owing to the rise in global population and increase in spending capacity of the people. Manufacturers in the global textile chemicals market are focusing on increasing the production of textile chemicals in Asia Pacific due to the abundant availability of raw materials and lower manufacturing costs in the region. The textile sector is highly fragmented, with the presence of small and medium sized enterprises. Manufacturers should target these enterprises for market development and diversification. Leading players should also focus on producing non-hazardous textile chemicals to gain lucrative opportunities in the market.

Textile chemicals are highly specialized chemicals that are used in different processes, including pre-treatment, dyeing, printing, and finishing, in the production of textiles. Chemicals used in the textile industry provide desirable properties to textiles. The global textile chemicals market is significantly driven by the rise in demand for apparel, growth in home furnishing activities, and lucrative presence of manufacturers of textile chemicals across the globe.

Based on application, the apparel segment dominated the global textile chemicals market with 42.2% share in 2021. Furthermore, the segment is projected to grow at a moderate CAGR of 3.7% during the forecast period. Apparel products include active wear, children and adult personal clothing, casual wear and formal wear, lingerie, undergarments, sportswear, and fashion accessories (scarfs, belts, socks, etc.). Demand for apparel products is rising at a rapid pace owing to the increase in population and rise in disposable income of the people across the globe.

Growth in awareness about health, hygiene, and safety is a key factor that is likely to propel the demand for apparel in the near future. China and India have been prominent markets for apparel production and usage. High economic growth is anticipated to be a major driver of the apparel market in both these countries during the forecast period. Growth of end-use industries is expected to lead to a trickle-down effect in the local manufacturing value chain, thus benefitting national manufacturers.

Home furnishing is a key application of textile chemicals. Advent of e-commerce in home furnishing is likely to propel the home furnishing segment. Rise in expenditure on home furnishing in developing economies such as India, China, and Thailand is expected to drive the textile chemicals market, as textile chemicals are widely used in the manufacture and spinning process of home textiles. North America and Europe are the prominent markets for home furnishing. Leading players such as IKEA and H&M Home are adopting expansion strategies to tap revenue opportunities in the home textile industry in Asia Pacific. Textile chemicals are also used in the manufacture of furniture upholstery. Increase in demand for new house construction and rise in urbanization are factors contributing to the rising demand for textile chemicals.

In terms of type, the global textile chemicals market has been classified into coating & sizing agents, dyes & dyestuff, finishing agents, surfactants, desizing agents, bleaching agents, yarn lubricants, antimicrobial agents, textile chemical dyes, and others. The coating & sizing agents segment accounted for major share of 30.1% of the global market in 2021. The segment is estimated to grow at a CAGR of 4.1% during the forecast period. Coating and sizing agents provide a uniform and consistent surface to yarn. Coating and textile sizing chemicals possess various properties such as excellent resistance, friction, and tension to yarn. They can reduce hairiness and increase smoothness. Textile auxiliaries are also widely used for washing and dying of yarns and fabrics.

In terms of volume, Asia Pacific held 65.3% share of the global textile chemicals market in 2021. The textile chemicals market in the region is anticipated to grow at a CAGR of 4.2% and 3.8% in terms of value and volume, respectively, during the forecast period. Abundant availability of raw materials, vast natural resources, and low-cost manufacturing are some of the key factors boosting the textile chemicals market in Asia Pacific. In terms of volume, Europe and North America were prominent regions of the global textile chemicals market, holding 18.4% and 13.3% share, respectively, in 2021.

The global textile chemicals market comprises several small and large-scale manufacturers and suppliers who control a majority of the share. Most of the firms are adopting new technologies and strategies with comprehensive research and development activities, primarily to expand their manufacturing operations. Growth of product portfolios and mergers and acquisitions are notable strategies adopted by key players. Lonsen Inc., Archroma, Huntsman International LLC, Solvay S.A., DyStar Singapore Pte Ltd, Huntsman International LLC, Covestro AG, Evonik Industries AG, The Lubrizol Corporation, OMNOVA Solutions Inc, Fibro Chem LLC, Tata Chemicals Ltd, The Dow Chemical Company, CHT Switzerland AG, and CHT Group are the prominent players operating in the textile chemicals market.

Each of these players has been profiled in the textile chemicals market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2021 | US$ 26.5 Bn |

| Market Forecast Value in 2031 | US$ 38.9 Bn |

| Growth Rate (CAGR) | 3.9% |

| Forecast Period | 2022-2031 |

| Historical Data Available for | 2020 |

| Quantitative Units | US$ Bn for Value and Kilo Tons for Volume |

| Market Analysis | It includes cross segment analysis at global as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The market stood at US$ 26.5 Bn in 2021

The market is expected to expand at a CAGR of 3.9% from 2022 to 2031

Rise in demand for technical textiles and increase in expenditure on home furnishing are key drivers of the textile chemicals market

Coating & sizing agents was the largest type segment that held 29.7% share in 2021

Asia Pacific was the most lucrative region of the textile chemicals market in 2021

Lonsen Inc., Archroma, Huntsman International LLC, Solvay S.A., DyStar Singapore Pte Ltd, Huntsman International LLC, Covestro AG, Evonik Industries AG, Solvay, The Lubrizol Corporation, OMNOVA Solutions Inc., OMNOVA Solutions Inc, Fibro Chem LLC, Tata Chemicals Ltd, The Dow Chemical Company, Lonsen Inc, CHT Switzerland AG, and CHT Group are the prominent entities operating in the market

1. Executive Summary

1.1. Textile Chemicals Market Snapshot

1.2. Key Market Trends

1.3. Current Market and Future Potential

1.4. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Market Indicators

2.3. Market Definitions

2.4. Market Dynamics

2.4.1. Drivers

2.4.2. Restraints

2.4.3. Opportunities

2.5. Porter’s Five Forces Analysis

2.6. Value Chain Analysis

2.6.1. List of Service Providers

2.6.2. List of Potential Customers

3. COVID-19 Impact Analysis

4. Global Textile Chemicals Market Analysis and Forecast, by Product, 2020-2031

4.1. Introduction and Definitions

4.2. Global Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

4.2.1. Coating & Sizing Chemicals

4.2.1.1. Wetting Agents

4.2.1.2. Defoamers

4.2.1.3. Others

4.3. Dyes & Dyestuff

4.3.1.1. Acid Dyes

4.3.1.2. Basic Dyes

4.3.1.3. Direct Dyes

4.3.1.4. Disperse Dyes

4.3.1.5. Reactive Dyes

4.3.1.6. Sulfur Dyes

4.3.1.7. Vat Dyes

4.3.1.8. Others

4.3.2. Finishing Agents

4.3.3. Surfactants

4.3.4. Desizing Agents

4.3.5. Bleaching Agents

4.3.6. Yarn Lubricants

4.3.7. Others

4.4. Global Textile Chemicals Market Attractiveness, by Product

5. Global Textile Chemicals Market Analysis and Forecast, by Application, 2020-2031

5.1. Introduction and Definitions

5.2. Global Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

5.2.1. Home Furnishing Textiles

5.2.1.1. Carpets & Rugs

5.2.1.2. Furniture

5.2.1.3. Others

5.2.2. Technical Textiles

5.2.2.1. Agrotech

5.2.2.2. Geotech

5.2.2.3. Meditech

5.2.3. Others

5.2.4. Apparel

5.2.5. Industrial Textiles

5.3. Global Textile Chemicals Market Attractiveness, by Application

6. Global Textile Chemicals Market Analysis and Forecast, by Region, 2020-2031

6.1. Key Findings

6.2. Global Textile Chemicals Market Value (US$ Bn) Forecast, by Region, 2020-2031

6.2.1. North America

6.2.2. Europe

6.2.3. Asia Pacific

6.2.4. Latin America

6.2.5. Middle East & Africa

6.3. Global Textile Chemicals Market Attractiveness, by Region

7. North America Textile Chemicals Market Analysis and Forecast, 2020-2031

7.1. Key Findings

7.2. North America Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

7.3. North America Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

7.4. North America Textile Chemicals Market Value (US$ Bn) Forecast, by Country, 2020-2031

7.4.1. U.S. Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

7.4.2. U.S. Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

7.4.3. Canada Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

7.4.4. Canada Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

7.5. North America Textile Chemicals Market Attractiveness Analysis

8. Europe Textile Chemicals Market Analysis and Forecast, 2020-2031

8.1. Key Findings

8.2. Europe Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

8.3. Europe Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

8.4. Europe Textile Chemicals Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

8.4.1. Germany Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

8.4.2. Germany Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

8.4.3. France Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

8.4.4. France Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

8.4.5. U.K. Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

8.4.6. U.K. Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

8.4.7. Italy Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

8.4.8. Italy. Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

8.4.9. Russia & CIS Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

8.4.10. Russia & CIS Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

8.4.11. Russia & CIS Textile Chemicals Market Value (US$ Bn) Forecast, by End-use, 2020-2031

8.4.12. Rest of Europe Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

8.4.13. Rest of Europe Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

8.5. Europe Textile Chemicals Market Attractiveness Analysis

9. Asia Pacific Textile Chemicals Market Analysis and Forecast, 2020-2031

9.1. Key Findings

9.2. Asia Pacific Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

9.3. Asia Pacific Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

9.4. Asia Pacific Textile Chemicals Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

9.4.1. China Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

9.4.2. China Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

9.4.3. Japan Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

9.4.4. Japan Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

9.4.5. India Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

9.4.6. India Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

9.4.7. ASEAN Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

9.4.8. ASEAN Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

9.4.9. Rest of Asia Pacific Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

9.4.10. Rest of Asia Pacific Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

9.5. Asia Pacific Textile Chemicals Market Attractiveness Analysis

10. Latin America Textile Chemicals Market Analysis and Forecast, 2020-2031

10.1. Key Findings

10.2. Latin America Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

10.3. Latin America Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

10.4. Latin America Textile Chemicals Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

10.4.1. Brazil Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

10.4.2. Brazil Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

10.4.3. Mexico Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

10.4.4. Mexico Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

10.4.5. Rest of Latin America Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

10.4.6. Rest of Latin America Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

10.5. Latin America Textile Chemicals Market Attractiveness Analysis

11. Middle East & Africa Textile Chemicals Market Analysis and Forecast, 2020-2031

11.1. Key Findings

11.2. Middle East & Africa Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

11.3. Middle East & Africa Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

11.4. Middle East & Africa Textile Chemicals Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

11.4.1. GCC Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

11.4.2. GCC Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

11.4.3. South Africa Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

11.4.4. South Africa Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

11.4.5. Rest of Middle East & Africa Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

11.4.6. Rest of Middle East & Africa Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

11.5. Middle East & Africa Textile Chemicals Market Attractiveness Analysis

12. Global Textile Chemicals Company Market Share Analysis, 2021

12.1. Competition Matrix

12.2. Market Footprint Analysis

12.2.1. By Product

12.2.2. By Application

12.3. Company Profiles (Details - Overview, Financials, Recent Developments, and Strategy)

12.3.1. Lonsen Inc

12.3.1.1. Company Description

12.3.1.2. Business Overview

12.3.1.3. Financial Overview

12.3.1.4. Strategic Overview

12.3.2. Archroma

12.3.2.1. Company Description

12.3.2.2. Business Overview

12.3.2.3. Financial Overview

12.3.2.4. Strategic Overview

12.3.3. Huntsman International LLC

12.3.1. Company Description

12.3.2. Business Overview

12.3.3. Financial Overview

12.3.4. Strategic Overview

12.3.4. AB Enzymes GmbH

12.3.4.1. Company Description

12.3.4.2. Business Overview

12.3.4.3. Financial Overview

12.3.4.4. Strategic Overview

12.3.5. Solvay S.A.

12.3.5.1. Company Description

12.3.5.2. Business Overview

12.3.5.3. Financial Overview

12.3.5.4. Strategic Overview

12.3.6. DyStar Singapore Pte Ltd

12.3.6.1. Company Description

12.3.6.2. Business Overview

12.3.6.3. Financial Overview

12.3.6.4. Strategic Overview

12.3.7. Huntsman International LLC

12.3.7.1. Company Description

12.3.7.2. Business Overview

12.3.7.3. Financial Overview

12.3.7.4. Strategic Overview

12.3.8. Covestro AG, Evonik Industries AG

12.3.8.1. Company Description

12.3.8.2. Business Overview

12.3.8.3. Financial Overview

12.3.8.4. Strategic Overview

12.3.9. Solvay, The Lubrizol Corporation

12.3.9.1. Company Description

12.3.9.2. Business Overview

12.3.9.3. Financial Overview

12.3.9.4. Strategic Overview

12.3.10. OMNOVA Solutions Inc.

12.3.10.1. Company Description

12.3.10.2. Business Overview

12.3.10.3. Financial Overview

12.3.10.4. Strategic Overview

12.3.11. Fibro Chem LLC

12.3.11.1. Company Description

12.3.11.2. Business Overview

12.3.11.3. Financial Overview

12.3.11.4. Strategic Overview

12.3.12. Amano Enzyme Inc Company Description

12.3.12.1. Business Overview

12.3.12.2. Financial Overview

12.3.12.3. Strategic Overview

12.3.13. Tata Chemicals Ltd Company Description

12.3.13.1. Business Overview

12.3.13.2. Financial Overview

12.3.13.3. Strategic Overview

12.3.14. The Dow Chemical Company

12.3.14.1. Company Description

12.3.14.2. Business Overview

12.3.14.3. Financial Overview

12.3.14.4. Strategic Overview

12.3.15. Specialty Enzymes & Probiotics

12.3.15.1. Company Description

12.3.15.2. Business Overview

12.3.15.3. Financial Overview

12.3.15.4. Strategic Overview

12.3.16. F. Lonsen Inc

12.3.16.1. Company Description

12.3.16.2. Business Overview

12.3.16.3. Financial Overview

12.3.16.4. Strategic Overview

12.3.17. CHT Switzerland AG

12.3.17.1. Company Description

12.3.17.2. Business Overview

12.3.17.3. Financial Overview

12.3.17.4. Strategic Overview

12.3.18. CHT Group

12.3.18.1. Company Description

12.3.18.2. Business Overview

12.3.18.3. Financial Overview

12.3.18.4. Strategic Overview

12.3.18.5. Others

13. Primary Research: Key Insights

14. Appendix

List of Tables

Table 1: Global Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

Table 2: Global Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 4: Global Textile Chemicals Market Value (US$ Bn) Forecast, by Region, 2020-2031

Table 5: North America Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

Table 6: North America Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 8: North America Textile Chemicals Market Value (US$ Bn) Forecast, by Country, 2020-2031

Table 9: U.S. Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

Table 10: U.S. Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 12: Canada Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

Table 13: Canada Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 15: Europe Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

Table 16: Europe Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 18: Europe Textile Chemicals Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

Table 19: Germany Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

Table 20: Germany Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 22: France Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

Table 23: France Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 25: U.K. Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

Table 26: U.K. Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 28: Italy Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

Table 29: Italy Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 30: Spain Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

Table 31: Spain Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 33: Russia & CIS Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

Table 34: Russia & CIS Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 36: Rest of Europe Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

Table 37: Rest of Europe Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 39: Asia Pacific Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

Table 40: Asia Pacific Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 42: Asia Pacific Textile Chemicals Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

Table 43: China Textile Chemicals Market Value (US$ Bn) Forecast, by Product 2020-2031

Table 44: China Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 46: Japan Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

Table 47: Japan Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 49: India Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

Table 50: India Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 52: ASEAN Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

Table 54: ASEAN Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 56: Rest of Asia Pacific Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

Table 57: Rest of Asia Pacific Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 59: Latin America Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

Table 60: Latin America Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 62: Latin America Textile Chemicals Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

Table 63: Brazil Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

Table 64: Brazil Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 66: Mexico Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

Table 67: Mexico Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 69: Rest of Latin America Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

Table 70: Rest of Latin America Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 72: Middle East & Africa Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

Table 73: Middle East & Africa Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 75: Middle East & Africa Textile Chemicals Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

Table 76: GCC Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

Table 77: GCC Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 79: South Africa Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

Table 80: South Africa Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

Table 82: Rest of Middle East & Africa Textile Chemicals Market Value (US$ Bn) Forecast, by Product, 2020-2031

Table 83: Rest of Middle East & Africa Textile Chemicals Market Value (US$ Bn) Forecast, by Application, 2020-2031

List of Figures

Figure 1: Global Textile Chemicals Market Attractiveness, by Product

Figure 2: Global Textile Chemicals Market Attractiveness, by Application

Figure 4: Global Textile Chemicals Market Attractiveness, by Region

Figure 5: North America Textile Chemicals Market Attractiveness, by Product

Figure 6: North America Textile Chemicals Market Attractiveness, by Application

Figure 8: North America Textile Chemicals Market Attractiveness, by Country

Figure 9: Europe Textile Chemicals Market Attractiveness, by Product

Figure 10: Europe Textile Chemicals Market Attractiveness, by Application

Figure 12: Europe Textile Chemicals Market Attractiveness, by Country and Sub-region

Figure 13: Asia Pacific Textile Chemicals Market Attractiveness, by Product

Figure 14: Asia Pacific Textile Chemicals Market Attractiveness, by Application

Figure 16: Asia Pacific Textile Chemicals Market Attractiveness, by Country and Sub-region

Figure 17: Latin America Textile Chemicals Market Attractiveness, by Product

Figure 18: Latin America Textile Chemicals Market Attractiveness, by Application

Figure 20: Latin America Textile Chemicals Market Attractiveness, by Country and Sub-region

Figure 21: Middle East & Africa Textile Chemicals Market Attractiveness, by Product

Figure 22: Middle East & Africa Textile Chemicals Market Attractiveness, by Application

Figure 24: Middle East & Africa Textile Chemicals Market Attractiveness, by Country and Sub-region